Key Insights

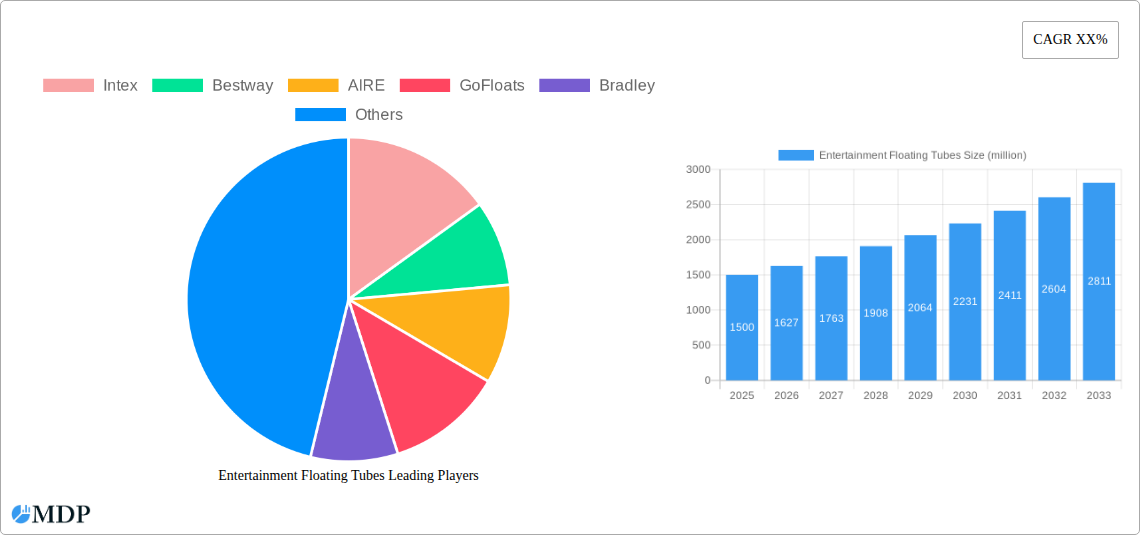

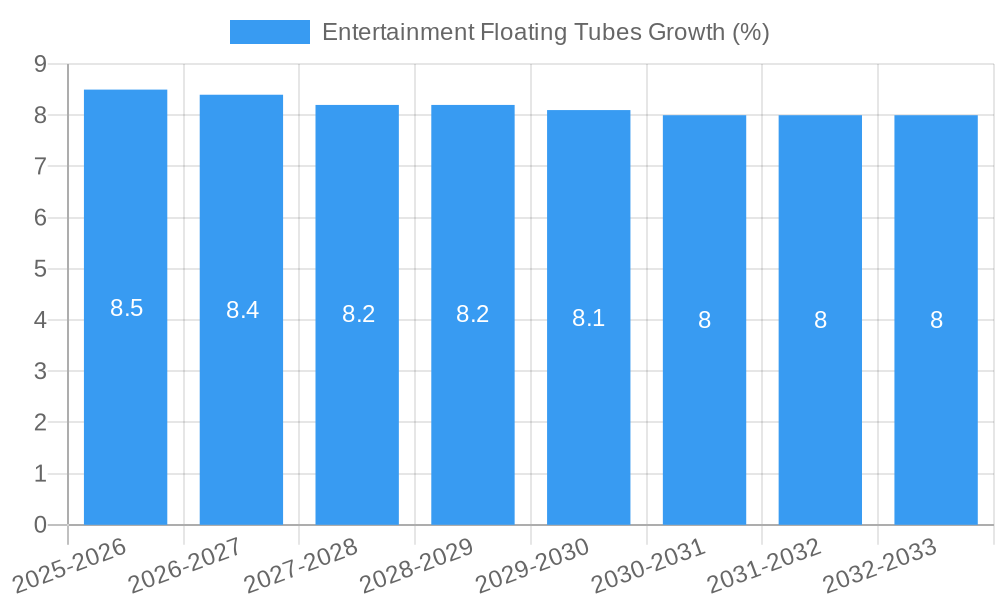

The global Entertainment Floating Tubes market is projected to reach a significant valuation by 2033, demonstrating robust growth driven by increasing consumer demand for recreational water activities and a rising disposable income in emerging economies. This market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, indicating a dynamic and expanding sector. Key growth drivers include the escalating popularity of pool parties, beach vacations, and river rafting, coupled with advancements in product design and material innovation leading to more durable, attractive, and feature-rich floating tubes. The growing emphasis on outdoor recreation and leisure activities, particularly among millennials and Gen Z, further fuels market expansion. Furthermore, the surge in tourism and the development of water-based amusement parks and resorts globally contribute to a consistent demand for a wide array of entertainment floating tubes, from individual inflatable rings to larger multi-person rafts.

The market segmentation reveals diverse application areas, with River and Lake applications likely leading in volume due to their natural appeal and accessibility for recreational purposes. Ocean applications also represent a substantial segment, especially in tourist-heavy coastal regions. Within product types, U-Shaped and V-Shaped designs are expected to dominate due to their ergonomic benefits and suitability for various water activities. Major players such as Intex and Bestway are poised to capitalize on market opportunities through product innovation, strategic marketing, and expanding distribution networks. However, the market may face certain restraints, including seasonal demand fluctuations in some regions and potential challenges related to environmental regulations concerning inflatable products and their disposal. Despite these, the overall outlook for the Entertainment Floating Tubes market remains highly optimistic, driven by evolving consumer lifestyles and a persistent desire for water-based entertainment.

Here's a comprehensive and SEO-optimized report description for Entertainment Floating Tubes, designed for maximum visibility and stakeholder engagement.

Entertainment Floating Tubes Market Dynamics & Concentration

The global Entertainment Floating Tubes market, valued at over xx million in 2025, is experiencing a dynamic blend of concentration and fragmentation. Market leaders such as Intex and Bestway command significant shares, estimated to be over 30 million and 25 million respectively in 2025, due to their established brand recognition and extensive distribution networks. However, the market also features a robust presence of specialized players like AIRE, GoFloats, Bradley, BigMouth, Lucky Bums, Tube Pro, and Tube In A Box, each catering to niche segments with innovative designs and targeted marketing. Innovation drivers are primarily fueled by the demand for enhanced user experience, durability, and safety features, leading to the development of advanced materials and ergonomic designs. Regulatory frameworks, particularly concerning safety standards and environmental impact, are becoming increasingly stringent, influencing product development and manufacturing processes. Product substitutes, including inflatable kayaks and paddleboards, present a moderate competitive threat, though floating tubes maintain a distinct appeal for recreational simplicity and accessibility. End-user trends indicate a growing preference for vibrant designs, larger capacities for group fun, and eco-friendly materials. Merger and acquisition activities are expected to remain moderate, with potential consolidations driven by the acquisition of innovative technologies or expansion into underserved geographical regions. The total number of M&A deals is projected to be around xx between 2025 and 2033.

Entertainment Floating Tubes Industry Trends & Analysis

The Entertainment Floating Tubes industry is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This expansion is propelled by a confluence of favorable market growth drivers, technological disruptions, evolving consumer preferences, and intensifying competitive dynamics. The increasing popularity of outdoor recreational activities, particularly among millennials and Gen Z, is a primary catalyst. As disposable incomes rise globally, consumers are allocating more resources towards leisure and travel, with water-based activities emerging as a significant focus. Technological advancements are continuously reshaping the industry, with innovations in material science leading to lighter, more durable, and puncture-resistant floating tubes. The integration of smart features, such as built-in cup holders and enhanced buoyancy systems, further elevates the consumer experience. Furthermore, advancements in manufacturing processes are enabling greater customization and cost-effectiveness, making these products more accessible to a broader market.

Consumer preferences are shifting towards aesthetically pleasing and functional designs. Bright colors, unique shapes (beyond the traditional circular), and themed tubes are gaining traction, reflecting a desire for personalized and Instagrammable experiences. The demand for tubes suitable for various aquatic environments – from calm pools and serene lakes to exhilarating rivers and even moderate ocean conditions – is driving product diversification. Market penetration is expected to deepen significantly, particularly in emerging economies in Asia-Pacific and Latin America, where the adoption of recreational water sports is still in its nascent stages but showing rapid acceleration. The competitive landscape is characterized by both established giants and agile startups. Companies are increasingly differentiating themselves through product quality, brand storytelling, and sustainable practices. The push towards eco-friendly materials and manufacturing processes is also becoming a key competitive advantage, resonating with environmentally conscious consumers. This multi-faceted growth trajectory underscores the robust health and promising future of the entertainment floating tubes market.

Leading Markets & Segments in Entertainment Floating Tubes

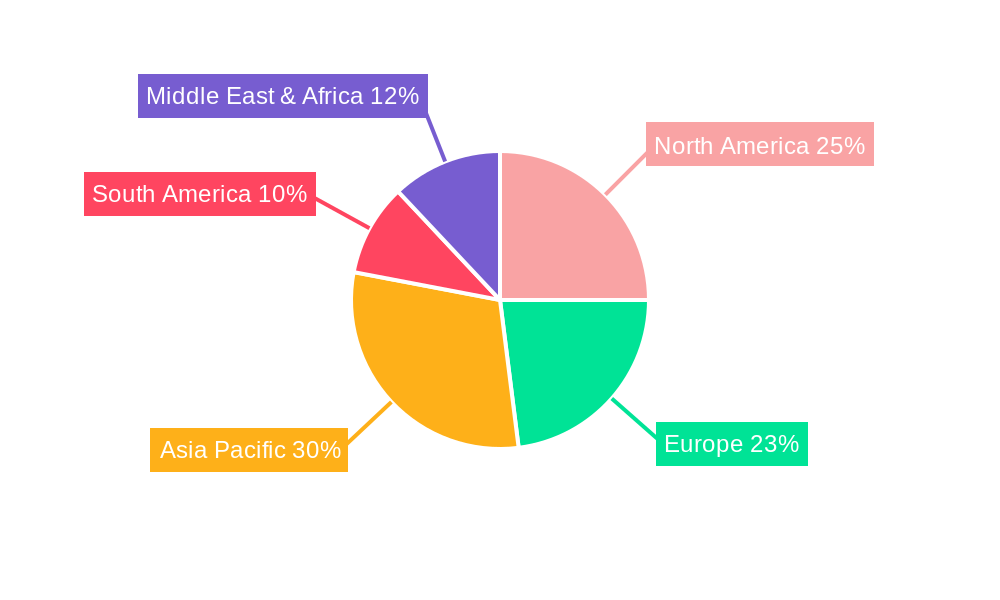

The global Entertainment Floating Tubes market exhibits distinct regional dominance and segment preferences, with North America currently holding the largest market share, projected to be over xx million in 2025. This supremacy is attributed to a mature outdoor recreation culture, high disposable incomes, and a well-developed infrastructure supporting water-based leisure activities. Within North America, the United States represents the most significant country-level market, driven by extensive coastlines, numerous lakes, and a strong emphasis on family-friendly entertainment.

Within the Application segment, River floating tubes are witnessing particularly strong growth, estimated at a CAGR of xx% between 2025 and 2033. This surge is fueled by the growing popularity of adventure tourism and river expeditions, where floating tubes offer an accessible and enjoyable way to experience natural waterways. Lake applications follow closely, with a consistent demand for leisurely floating and relaxation. Pool applications, while mature, continue to be a significant segment, driven by residential pools and commercial water parks. Ocean applications, though more niche due to safety considerations, are growing with the development of more robust and specialized tube designs. Others, encompassing diverse uses like water parks and private events, also contribute to the market's breadth.

In terms of Types, Circular-Shaped floating tubes remain the most prevalent due to their simplicity and widespread recognition. However, U-Shaped and V-Shaped designs are gaining considerable traction, particularly for river tubing, offering improved stability and maneuverability. These innovative shapes cater to the demand for a more dynamic and engaging tubing experience.

Key drivers for the dominance of these regions and segments include:

- Economic Policies: Favorable tourism policies and investments in recreational infrastructure in regions like North America and parts of Europe.

- Infrastructure Development: Availability of accessible rivers, lakes, and well-maintained public access points for water activities.

- Consumer Lifestyles: A cultural inclination towards outdoor adventures and water-based leisure as a primary form of recreation.

- Technological Advancements: Innovations in materials and designs that enhance safety, comfort, and usability across different water bodies.

The continued evolution of these factors will shape the future landscape of the entertainment floating tubes market, with emerging economies expected to play a more prominent role in the forecast period.

Entertainment Floating Tubes Product Developments

Product development in the Entertainment Floating Tubes sector is heavily focused on enhancing user experience and durability. Innovations include the incorporation of robust, puncture-resistant materials like heavy-duty PVC and reinforced seams, significantly extending product lifespan. Advanced valve systems for quicker inflation and deflation are becoming standard. Furthermore, ergonomic designs are a key trend, with U-shaped and V-shaped tubes offering improved stability and control, especially in river applications. Aesthetics also play a crucial role, with manufacturers introducing vibrant color palettes, unique graphics, and even licensed character designs to appeal to a younger demographic. Some products are integrating features like built-in coolers, mesh bottoms for drainage, and tow ropes for enhanced functionality and group enjoyment. These developments aim to provide greater comfort, safety, and a more engaging recreational experience, thereby securing competitive advantages.

Key Drivers of Entertainment Floating Tubes Growth

The Entertainment Floating Tubes market's growth is underpinned by several key drivers. A primary factor is the escalating global interest in outdoor recreational activities, amplified by a growing emphasis on leisure and wellness. Technological advancements in material science and manufacturing processes are leading to more durable, lightweight, and cost-effective floating tubes, making them more accessible. The increasing popularity of water sports and adventure tourism, particularly among younger demographics, is a significant demand generator. Furthermore, favorable government initiatives promoting tourism and outdoor recreation in various countries, alongside rising disposable incomes, contribute to increased consumer spending on leisure products. The growing trend of staycations and increased utilization of local natural resources also fuels demand.

Challenges in the Entertainment Floating Tubes Market

Despite its growth trajectory, the Entertainment Floating Tubes market faces several challenges. Regulatory hurdles, particularly concerning safety standards and environmental impact, can increase manufacturing costs and complexity, especially in certain regions. Supply chain disruptions, exacerbated by global events, can lead to material shortages and increased production expenses. Intense competition from established brands and emerging players, leading to price wars and margin pressures, is another significant challenge. The reliance on seasonal demand in many regions can also create inventory management complexities. Furthermore, the availability of product substitutes, such as inflatable kayaks and paddleboards, albeit with different use cases, presents an indirect competitive pressure.

Emerging Opportunities in Entertainment Floating Tubes

Emerging opportunities in the Entertainment Floating Tubes market are abundant, driven by ongoing innovation and evolving consumer behavior. The increasing demand for sustainable and eco-friendly products presents a significant avenue for growth, with companies investing in biodegradable materials and responsible manufacturing practices. The integration of smart technologies, such as Bluetooth speakers or even LED lighting for night-time use, offers novel product differentiation. Expansion into emerging markets in Asia-Pacific and Latin America, where the adoption of recreational water sports is rapidly growing, represents a substantial opportunity for market penetration. Strategic partnerships with tourism operators, water parks, and outdoor adventure retailers can create new distribution channels and boost brand visibility. The development of specialized tubes for specific niche activities, such as fishing or advanced river navigation, can also unlock new market segments.

Leading Players in the Entertainment Floating Tubes Sector

- Intex

- Bestway

- AIRE

- GoFloats

- Bradley

- BigMouth

- Lucky Bums

- Tube Pro

- Tube In A Box

Key Milestones in Entertainment Floating Tubes Industry

- 2019: Introduction of advanced UV-resistant coatings on floating tubes, significantly enhancing durability and color fastness.

- 2020: Increased consumer demand for larger, multi-person floating tubes driven by staycation trends and group outdoor activities.

- 2021: Launch of eco-friendly floating tubes made from recycled materials by select manufacturers, catering to growing environmental consciousness.

- 2022: Significant investment in R&D by major players focusing on ergonomic designs for improved stability and user comfort, particularly for river tubing.

- 2023: Growing adoption of online retail channels and direct-to-consumer (DTC) models by manufacturers to expand reach and customer engagement.

- 2024: Emergence of smart features, such as integrated cup holders and cooler compartments, as standard offerings in premium floating tube models.

Strategic Outlook for Entertainment Floating Tubes Market

The strategic outlook for the Entertainment Floating Tubes market is exceptionally positive, characterized by sustained growth accelerators and significant future potential. The continuous surge in demand for outdoor recreational activities, coupled with increasing disposable incomes globally, will continue to fuel market expansion. Strategic focus areas for stakeholders should include investing in sustainable product development to align with growing environmental concerns and capitalize on the "green" consumer trend. Further innovation in product design, emphasizing user comfort, safety, and novel functionalities, will be crucial for competitive differentiation. Expanding into untapped emerging markets, supported by targeted marketing campaigns and strategic distribution partnerships, presents a substantial opportunity for market share growth. The market is also poised for further consolidation and collaboration, fostering an environment of innovation and efficiency.

Entertainment Floating Tubes Segmentation

-

1. Application

- 1.1. River

- 1.2. Lake

- 1.3. Ocean

- 1.4. Pool

- 1.5. Others

-

2. Types

- 2.1. U-Shaped

- 2.2. V-Shaped

- 2.3. Circular-Shaped

Entertainment Floating Tubes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Entertainment Floating Tubes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Entertainment Floating Tubes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. River

- 5.1.2. Lake

- 5.1.3. Ocean

- 5.1.4. Pool

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. U-Shaped

- 5.2.2. V-Shaped

- 5.2.3. Circular-Shaped

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Entertainment Floating Tubes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. River

- 6.1.2. Lake

- 6.1.3. Ocean

- 6.1.4. Pool

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. U-Shaped

- 6.2.2. V-Shaped

- 6.2.3. Circular-Shaped

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Entertainment Floating Tubes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. River

- 7.1.2. Lake

- 7.1.3. Ocean

- 7.1.4. Pool

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. U-Shaped

- 7.2.2. V-Shaped

- 7.2.3. Circular-Shaped

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Entertainment Floating Tubes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. River

- 8.1.2. Lake

- 8.1.3. Ocean

- 8.1.4. Pool

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. U-Shaped

- 8.2.2. V-Shaped

- 8.2.3. Circular-Shaped

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Entertainment Floating Tubes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. River

- 9.1.2. Lake

- 9.1.3. Ocean

- 9.1.4. Pool

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. U-Shaped

- 9.2.2. V-Shaped

- 9.2.3. Circular-Shaped

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Entertainment Floating Tubes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. River

- 10.1.2. Lake

- 10.1.3. Ocean

- 10.1.4. Pool

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. U-Shaped

- 10.2.2. V-Shaped

- 10.2.3. Circular-Shaped

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intex

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bestway

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AIRE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GoFloats

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bradley

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BigMouth

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lucky Bums

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tube Pro

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tube In A Box

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Intex

List of Figures

- Figure 1: Global Entertainment Floating Tubes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Entertainment Floating Tubes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Entertainment Floating Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Entertainment Floating Tubes Revenue (million), by Types 2024 & 2032

- Figure 5: North America Entertainment Floating Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Entertainment Floating Tubes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Entertainment Floating Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Entertainment Floating Tubes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Entertainment Floating Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Entertainment Floating Tubes Revenue (million), by Types 2024 & 2032

- Figure 11: South America Entertainment Floating Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Entertainment Floating Tubes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Entertainment Floating Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Entertainment Floating Tubes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Entertainment Floating Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Entertainment Floating Tubes Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Entertainment Floating Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Entertainment Floating Tubes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Entertainment Floating Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Entertainment Floating Tubes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Entertainment Floating Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Entertainment Floating Tubes Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Entertainment Floating Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Entertainment Floating Tubes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Entertainment Floating Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Entertainment Floating Tubes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Entertainment Floating Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Entertainment Floating Tubes Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Entertainment Floating Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Entertainment Floating Tubes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Entertainment Floating Tubes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Entertainment Floating Tubes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Entertainment Floating Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Entertainment Floating Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Entertainment Floating Tubes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Entertainment Floating Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Entertainment Floating Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Entertainment Floating Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Entertainment Floating Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Entertainment Floating Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Entertainment Floating Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Entertainment Floating Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Entertainment Floating Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Entertainment Floating Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Entertainment Floating Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Entertainment Floating Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Entertainment Floating Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Entertainment Floating Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Entertainment Floating Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Entertainment Floating Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Entertainment Floating Tubes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Entertainment Floating Tubes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Entertainment Floating Tubes?

Key companies in the market include Intex, Bestway, AIRE, GoFloats, Bradley, BigMouth, Lucky Bums, Tube Pro, Tube In A Box.

3. What are the main segments of the Entertainment Floating Tubes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Entertainment Floating Tubes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Entertainment Floating Tubes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Entertainment Floating Tubes?

To stay informed about further developments, trends, and reports in the Entertainment Floating Tubes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence