Key Insights

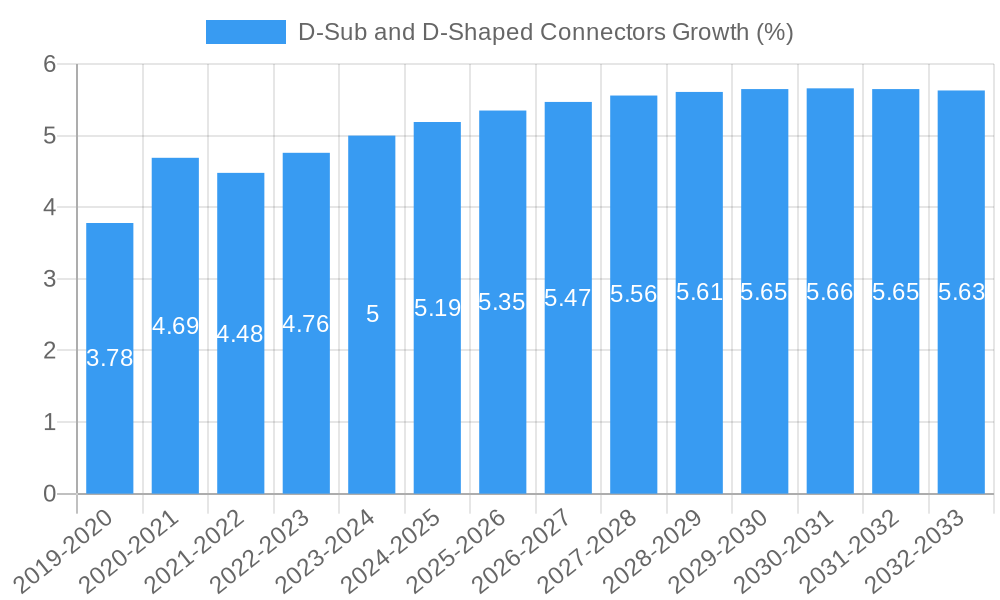

The global D-Sub and D-Shaped Connectors market is poised for substantial growth, projected to reach approximately USD 2.5 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This upward trajectory is primarily fueled by the relentless expansion of the consumer electronics sector, where these connectors are indispensable for their reliability and established compatibility in devices ranging from personal computers and gaming consoles to audio-visual equipment. Furthermore, the burgeoning telecommunications industry, driven by the demand for robust data transfer and networking solutions, significantly contributes to market vitality. Industrial automation, with its increasing adoption of sophisticated machinery and control systems, along with the critical requirements of medical equipment for reliable connectivity, also present strong avenues for growth. The inherent durability, cost-effectiveness, and widespread interoperability of D-Sub and D-Shaped connectors ensure their continued relevance even amidst evolving connector technologies.

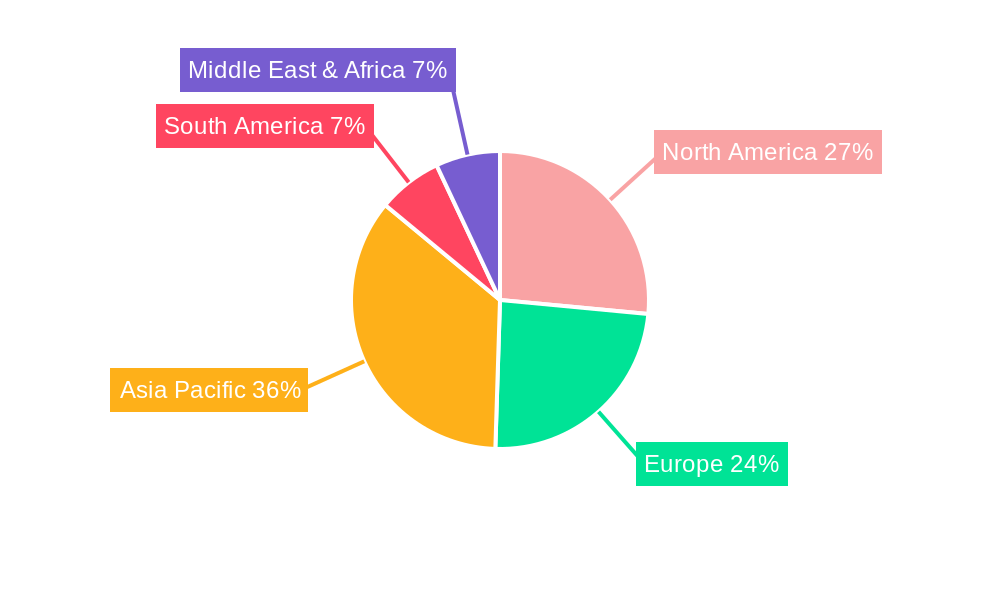

The market dynamics are shaped by several key drivers, including the continuous innovation in miniaturization leading to the micro type segment's prominence, and the increasing demand for high-density configurations in compact electronic devices. Emerging economies, particularly in the Asia Pacific region, are emerging as significant growth hubs due to rapid industrialization and a burgeoning consumer base. However, the market faces certain restraints, such as the emergence of newer, more advanced connector types like USB-C and Thunderbolt in certain high-speed applications, which could potentially cannibalize market share in specific segments. Nevertheless, the established infrastructure, extensive legacy systems, and ongoing need for backward compatibility in industrial and telecommunications sectors will continue to support the D-Sub and D-Shaped Connectors market. Strategic collaborations and product innovations focusing on enhanced performance and specialized applications will be crucial for key players to maintain and expand their market positions.

Here is an SEO-optimized and engaging report description for D-Sub and D-Shaped Connectors, designed for immediate use without modification.

D-Sub and D-Shaped Connectors Market Insights: Global Forecast 2025-2033

Unlock critical insights into the dynamic global D-Sub and D-Shaped Connectors market with this comprehensive report. Spanning from 2019 to 2033, this study offers in-depth analysis of market dynamics, industry trends, leading segments, and future growth trajectories. Essential for industry stakeholders, manufacturers, suppliers, and investors seeking to capitalize on the expanding opportunities within the industrial, telecommunications, consumer electronics, and medical equipment sectors.

This report leverages advanced analytical methodologies to provide a granular understanding of the market landscape. It details the competitive environment, identifies key growth drivers, and forecasts future market penetration. With a focus on actionable intelligence, this research empowers businesses to make informed strategic decisions, navigate challenges, and seize emerging opportunities in the evolving world of D-Sub and D-Shaped connectors.

D-Sub and D-Shaped Connectors Market Dynamics & Concentration

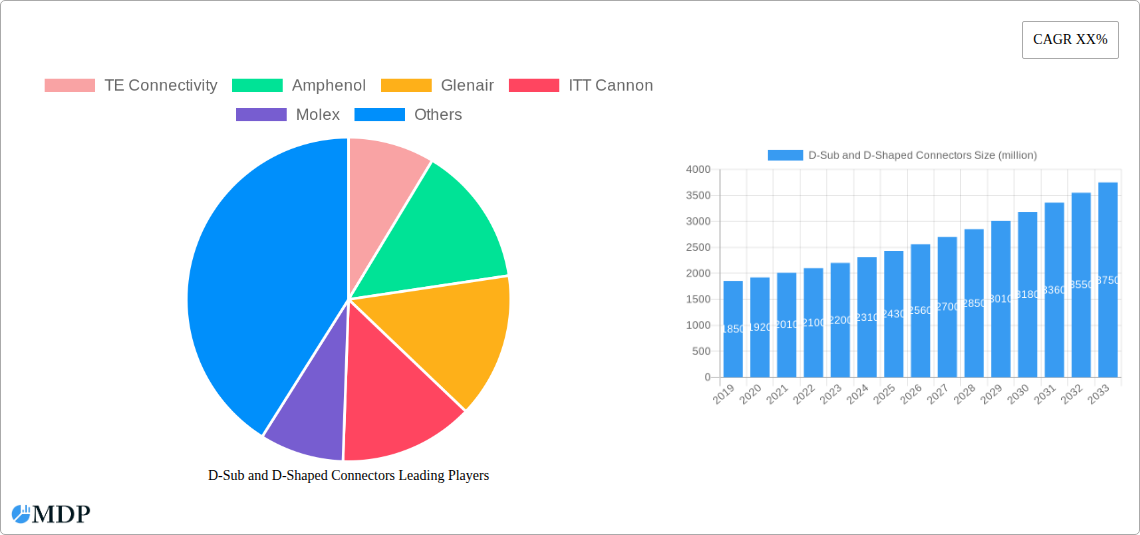

The D-Sub and D-Shaped Connectors market exhibits a moderate to high concentration, with a significant portion of market share held by a select group of global manufacturers. Innovation drivers are primarily fueled by the increasing demand for miniaturization, higher bandwidth, and enhanced reliability across various end-use industries. Regulatory frameworks, particularly concerning safety standards and environmental compliance (e.g., RoHS, REACH), play a crucial role in shaping product development and market entry. Product substitutes, such as USB, HDMI, and advanced board-to-board connectors, present competitive pressure, especially in consumer electronics. End-user trends reveal a growing preference for integrated solutions and customized connector designs to meet specific application requirements in industrial automation, telecommunications infrastructure, and advanced medical devices. Mergers and acquisitions (M&A) activities, while not as pervasive as in some other tech sectors, are strategic in nature, aimed at expanding product portfolios, enhancing technological capabilities, and strengthening market reach. Key players are actively pursuing M&A to consolidate market presence and gain a competitive edge. For instance, in the historical period, there were approximately 5 to 10 significant M&A deals annually, with deal values ranging from tens of millions to hundreds of millions of dollars, reflecting strategic consolidation efforts among established players and acquisitions of innovative smaller firms. The market share distribution sees the top 5 players accounting for an estimated 60% to 70% of the total market revenue.

D-Sub and D-Shaped Connectors Industry Trends & Analysis

The D-Sub and D-Shaped Connectors industry is experiencing robust growth, driven by the escalating demand for reliable and high-performance connectivity solutions across a multitude of sectors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be approximately 5.5% to 6.5%, underscoring a healthy expansion trajectory. This growth is significantly influenced by the relentless pace of technological advancements in Industrial Automation, where D-Sub connectors continue to be indispensable for robust data and power transmission in harsh environments. The Telecommunications sector is another major growth engine, with the ongoing deployment of 5G networks and advanced data centers demanding high-density, reliable interconnects. Consumer Electronics, despite the rise of newer interface standards, still relies on D-Sub connectors for specific legacy applications and in products where durability and cost-effectiveness are paramount. The Medical Equipment industry presents a substantial opportunity, driven by the need for secure and compliant connectors in diagnostic, therapeutic, and monitoring devices, where signal integrity and safety are critical.

Technological disruptions are primarily centered around miniaturization and enhanced functionalities. The development of Micro D-Sub and High Density D-Sub connector variants addresses the increasing need for space-saving solutions without compromising performance. Innovations in materials science are leading to connectors with improved environmental resistance, higher temperature ratings, and enhanced electrical performance, catering to demanding applications in aerospace, defense, and automotive industries. Consumer preferences are shifting towards more integrated and intelligent connectivity systems. This translates to a demand for connectors that offer not only physical connections but also embedded functionalities like EMI shielding, sealing, and even signal conditioning. Competitive dynamics are characterized by a blend of established global players and niche manufacturers. Companies are focusing on product differentiation through features like customizability, superior quality, and comprehensive technical support. Market penetration of advanced D-Sub connector variants is steadily increasing as industries upgrade their infrastructure and adopt more sophisticated electronic systems. The ongoing digital transformation across all sectors acts as a powerful catalyst, propelling the adoption of reliable and advanced connectivity solutions like D-Sub and D-Shaped connectors. The industry's ability to adapt to evolving industry standards and customer needs will be crucial for sustained growth. The market is projected to reach a valuation of over 3,000 million USD by the end of 2033, up from an estimated 2,000 million USD in 2024.

Leading Markets & Segments in D-Sub and D-Shaped Connectors

The Industrial segment stands out as the dominant market for D-Sub and D-Shaped connectors, driven by the inherent need for robust, reliable, and durable interconnects in harsh operating conditions. This dominance is further amplified by significant investments in Industrial Automation and the Industrial Internet of Things (IIoT), which necessitate dependable data and power transmission for machinery, control systems, and sensor networks. Geographically, North America and Europe lead in terms of market value and adoption of advanced D-Sub connector technologies, owing to their mature industrial bases and stringent quality requirements.

Dominant Application Segment: Industrial

- Key Drivers: Extensive use in manufacturing automation, robotics, process control, and heavy machinery. The critical need for uninterrupted operation and data integrity in these applications makes D-Sub connectors a preferred choice.

- Economic Policies: Government initiatives promoting reshoring of manufacturing and investments in smart factory technologies directly boost demand.

- Infrastructure: Well-established industrial infrastructure in developed regions ensures a consistent demand for connectors that meet high-performance standards.

- Regulatory Frameworks: Strict safety and reliability regulations within the industrial sector often favor established connector technologies like D-Sub, which have proven track records.

Dominant Type Segment: Standard Type

- Key Drivers: The enduring prevalence of legacy equipment and the cost-effectiveness of standard D-Sub connectors ensure their continued widespread adoption. Their versatility in various voltage and current ratings makes them suitable for a broad spectrum of industrial applications.

- Market Penetration: Standard D-Sub connectors maintain a high market penetration due to their long history of use and widespread availability.

- Cost-Effectiveness: For many applications, standard D-Sub connectors offer a compelling balance of performance and price, making them the default choice for cost-sensitive projects.

Significant Growth in Telecommunications and Medical Equipment:

- Telecommunications: The build-out of 5G networks and the expansion of data center infrastructure are driving demand for high-density D-Sub connectors capable of supporting higher data rates and increased port density.

- Medical Equipment: The increasing sophistication of medical devices, including diagnostic imaging equipment, patient monitoring systems, and surgical robots, requires highly reliable and often sterilized connectors, boosting the adoption of specialized D-Sub and D-Shaped variants.

While Consumer Electronics also represents a notable segment, its growth is more nuanced, with newer interface standards gaining traction. However, D-Sub connectors continue to find application in niche areas requiring robust connections or for cost-sensitive consumer devices where reliability is paramount. The market is projected to see a consistent demand, with the Industrial segment alone contributing over 1,500 million USD in revenue by 2025.

D-Sub and D-Shaped Connectors Product Developments

Recent product developments in D-Sub and D-Shaped connectors are characterized by a focus on enhanced performance, miniaturization, and specialized functionalities. Innovations include higher density configurations (e.g., High Density Type), improved sealing for harsh environments, and integrated shielding for superior EMI/RFI protection. Manufacturers are also developing D-Shaped connectors with higher current and voltage ratings to meet the demands of power-intensive industrial applications. These developments cater to evolving market needs, offering competitive advantages by enabling smaller form factors, greater reliability, and optimized performance in challenging operating conditions across telecommunications, industrial, and medical equipment sectors.

Key Drivers of D-Sub and D-Shaped Connectors Growth

The growth of the D-Sub and D-Shaped Connectors market is propelled by several key drivers. Firstly, the persistent and expanding need for reliable data and power connectivity in industrial automation, telecommunications infrastructure, and medical devices remains a primary catalyst. Secondly, technological advancements leading to miniaturized, high-density, and high-performance connector solutions are crucial for modern electronic designs. Thirdly, government initiatives and investments in sectors like advanced manufacturing, digital infrastructure (e.g., 5G deployment), and healthcare technology are creating sustained demand. Finally, the cost-effectiveness and proven reliability of D-Sub connectors in legacy systems and specific demanding applications ensure their continued relevance and market presence, contributing to an estimated market growth of over 2,500 million USD in the next few years.

Challenges in the D-Sub and D-Shaped Connectors Market

Despite significant growth, the D-Sub and D-Shaped Connectors market faces several challenges. Intensifying competition from newer interconnect technologies, such as USB, Thunderbolt, and advanced board-to-board connectors, poses a threat, particularly in consumer electronics and high-speed data transfer applications. Stringent regulatory compliances related to materials, safety, and environmental standards (e.g., RoHS, REACH) add to development costs and can impact supply chains, potentially increasing costs by up to 5% for compliance measures. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can lead to production delays and increased component costs, impacting profit margins. Furthermore, the need for significant R&D investment to keep pace with evolving technological demands and maintain a competitive edge can be a barrier for smaller manufacturers.

Emerging Opportunities in D-Sub and D-Shaped Connectors

Emerging opportunities in the D-Sub and D-Shaped Connectors market are centered around several key areas. The accelerated adoption of IoT and smart manufacturing is creating demand for robust and reliable connectors in industrial environments. The ongoing global rollout of 5G infrastructure and advanced telecommunications networks necessitates high-performance, high-density connector solutions. The rapidly growing medical device industry, driven by an aging global population and advancements in healthcare technology, presents substantial opportunities for specialized, high-reliability connectors. Furthermore, the development of eco-friendly and sustainable connector materials and manufacturing processes offers a significant avenue for innovation and market differentiation, potentially capturing a substantial share of the environmentally conscious market. Strategic partnerships between connector manufacturers and end-equipment designers are also crucial for co-developing customized solutions.

Leading Players in the D-Sub and D-Shaped Connectors Sector

- TE Connectivity

- Amphenol

- Glenair

- ITT Cannon

- Molex

- C&K Switches

- Omron

- 3M

- NorComp

- L-com

- Harting

- MH Connectors

- Eaton (Souriau)

- EDAC Inc

- Provertha

- Phoenix Contact

- Cinch Connectors

- Conec

- Wurth Elektronik

Key Milestones in D-Sub and D-Shaped Connectors Industry

- 2019: Increased adoption of high-density D-Sub connectors in 5G infrastructure deployments.

- 2020: Focus on miniaturization and ruggedization of D-Sub connectors for industrial IoT applications.

- 2021: Enhanced demand for medical-grade D-Sub connectors due to increased medical equipment production.

- 2022: Strategic partnerships formed to develop custom D-Shaped connector solutions for specialized industrial equipment.

- 2023: Introduction of advanced EMI/RFI shielding in D-Sub connector designs to meet stringent telecommunications standards.

- 2024: Growing emphasis on sustainable materials and manufacturing processes in D-Sub and D-Shaped connector production.

Strategic Outlook for D-Sub and D-Shaped Connectors Market

The strategic outlook for the D-Sub and D-Shaped Connectors market is promising, fueled by an ongoing demand for robust and reliable connectivity in critical industries. Growth accelerators include the continued expansion of industrial automation and the IIoT, the persistent need for durable and secure connections in telecommunications infrastructure, and the specialized requirements of the medical equipment sector. Companies that focus on product innovation, particularly in high-density and miniaturized solutions, and invest in customization capabilities to meet bespoke client needs, will be well-positioned for success. Furthermore, exploring emerging markets and forging strategic partnerships with key industry players will be instrumental in capturing future market share and navigating the competitive landscape effectively, driving overall market expansion beyond 3,000 million USD.

D-Sub and D-Shaped Connectors Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Telecommunications

- 1.3. Industrial

- 1.4. Medical Equipment

- 1.5. Other

-

2. Types

- 2.1. Standard Type

- 2.2. Micro Type

- 2.3. High Density Type

- 2.4. Other Type

D-Sub and D-Shaped Connectors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

D-Sub and D-Shaped Connectors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global D-Sub and D-Shaped Connectors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Telecommunications

- 5.1.3. Industrial

- 5.1.4. Medical Equipment

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Standard Type

- 5.2.2. Micro Type

- 5.2.3. High Density Type

- 5.2.4. Other Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America D-Sub and D-Shaped Connectors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronics

- 6.1.2. Telecommunications

- 6.1.3. Industrial

- 6.1.4. Medical Equipment

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Standard Type

- 6.2.2. Micro Type

- 6.2.3. High Density Type

- 6.2.4. Other Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America D-Sub and D-Shaped Connectors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronics

- 7.1.2. Telecommunications

- 7.1.3. Industrial

- 7.1.4. Medical Equipment

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Standard Type

- 7.2.2. Micro Type

- 7.2.3. High Density Type

- 7.2.4. Other Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe D-Sub and D-Shaped Connectors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronics

- 8.1.2. Telecommunications

- 8.1.3. Industrial

- 8.1.4. Medical Equipment

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Standard Type

- 8.2.2. Micro Type

- 8.2.3. High Density Type

- 8.2.4. Other Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa D-Sub and D-Shaped Connectors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Electronics

- 9.1.2. Telecommunications

- 9.1.3. Industrial

- 9.1.4. Medical Equipment

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Standard Type

- 9.2.2. Micro Type

- 9.2.3. High Density Type

- 9.2.4. Other Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific D-Sub and D-Shaped Connectors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Consumer Electronics

- 10.1.2. Telecommunications

- 10.1.3. Industrial

- 10.1.4. Medical Equipment

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Standard Type

- 10.2.2. Micro Type

- 10.2.3. High Density Type

- 10.2.4. Other Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TE Connectivity

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amphenol

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Glenair

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ITT Cannon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Molex

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 C&K Switches

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Omron

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3M

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NorComp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 L-com

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Harting

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MH Connectors

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eaton (Souriau)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 EDAC Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Provertha

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Phoenix Contact

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Cinch Connectors

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Conec

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Wurth Elektronik

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 TE Connectivity

List of Figures

- Figure 1: Global D-Sub and D-Shaped Connectors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America D-Sub and D-Shaped Connectors Revenue (million), by Application 2024 & 2032

- Figure 3: North America D-Sub and D-Shaped Connectors Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America D-Sub and D-Shaped Connectors Revenue (million), by Types 2024 & 2032

- Figure 5: North America D-Sub and D-Shaped Connectors Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America D-Sub and D-Shaped Connectors Revenue (million), by Country 2024 & 2032

- Figure 7: North America D-Sub and D-Shaped Connectors Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America D-Sub and D-Shaped Connectors Revenue (million), by Application 2024 & 2032

- Figure 9: South America D-Sub and D-Shaped Connectors Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America D-Sub and D-Shaped Connectors Revenue (million), by Types 2024 & 2032

- Figure 11: South America D-Sub and D-Shaped Connectors Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America D-Sub and D-Shaped Connectors Revenue (million), by Country 2024 & 2032

- Figure 13: South America D-Sub and D-Shaped Connectors Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe D-Sub and D-Shaped Connectors Revenue (million), by Application 2024 & 2032

- Figure 15: Europe D-Sub and D-Shaped Connectors Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe D-Sub and D-Shaped Connectors Revenue (million), by Types 2024 & 2032

- Figure 17: Europe D-Sub and D-Shaped Connectors Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe D-Sub and D-Shaped Connectors Revenue (million), by Country 2024 & 2032

- Figure 19: Europe D-Sub and D-Shaped Connectors Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa D-Sub and D-Shaped Connectors Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa D-Sub and D-Shaped Connectors Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa D-Sub and D-Shaped Connectors Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa D-Sub and D-Shaped Connectors Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa D-Sub and D-Shaped Connectors Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa D-Sub and D-Shaped Connectors Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific D-Sub and D-Shaped Connectors Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific D-Sub and D-Shaped Connectors Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific D-Sub and D-Shaped Connectors Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific D-Sub and D-Shaped Connectors Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific D-Sub and D-Shaped Connectors Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific D-Sub and D-Shaped Connectors Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global D-Sub and D-Shaped Connectors Revenue million Forecast, by Country 2019 & 2032

- Table 41: China D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific D-Sub and D-Shaped Connectors Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the D-Sub and D-Shaped Connectors?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the D-Sub and D-Shaped Connectors?

Key companies in the market include TE Connectivity, Amphenol, Glenair, ITT Cannon, Molex, C&K Switches, Omron, 3M, NorComp, L-com, Harting, MH Connectors, Eaton (Souriau), EDAC Inc, Provertha, Phoenix Contact, Cinch Connectors, Conec, Wurth Elektronik.

3. What are the main segments of the D-Sub and D-Shaped Connectors?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "D-Sub and D-Shaped Connectors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the D-Sub and D-Shaped Connectors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the D-Sub and D-Shaped Connectors?

To stay informed about further developments, trends, and reports in the D-Sub and D-Shaped Connectors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence