Key Insights

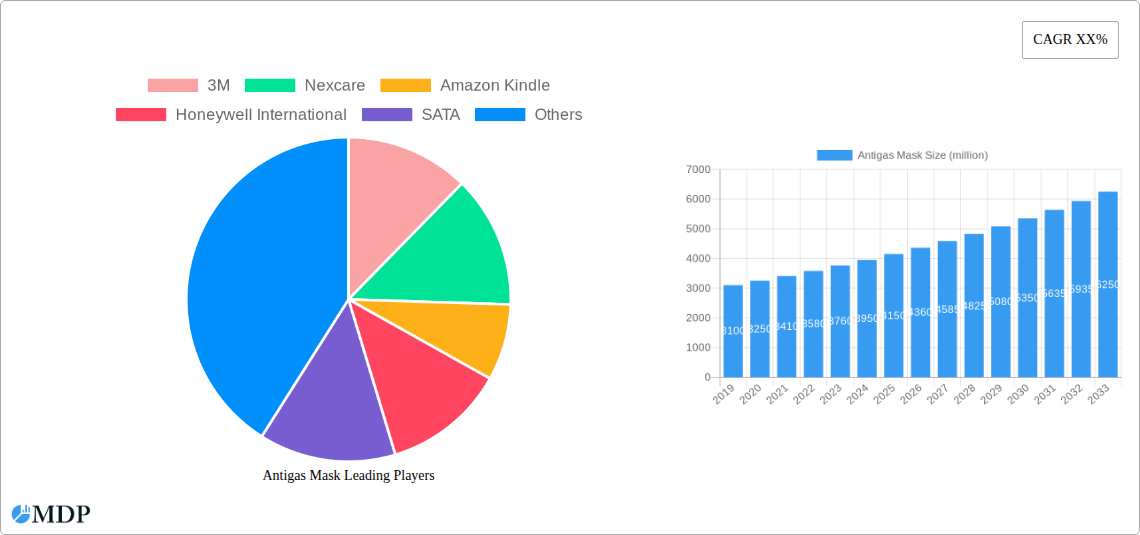

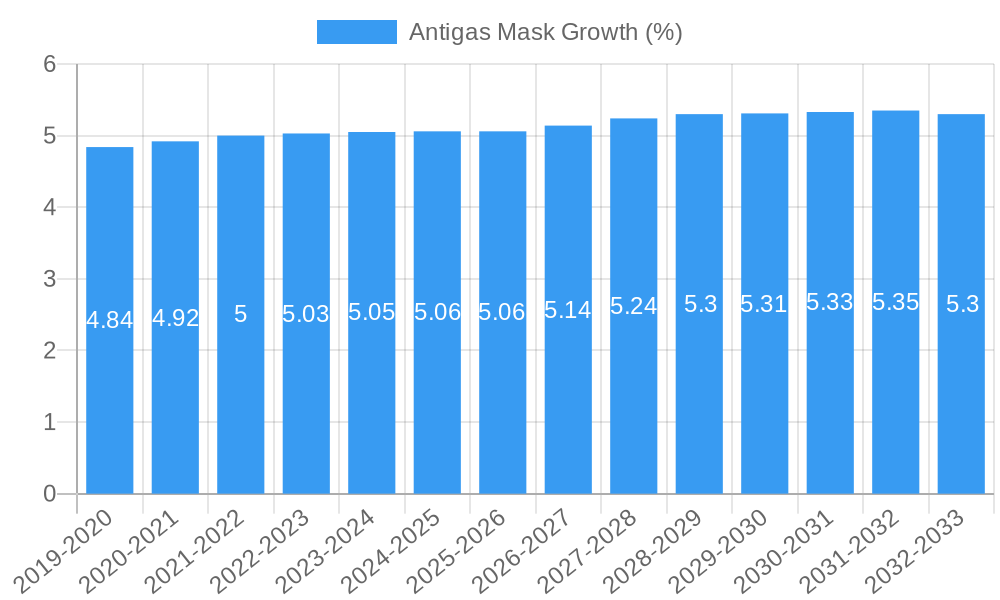

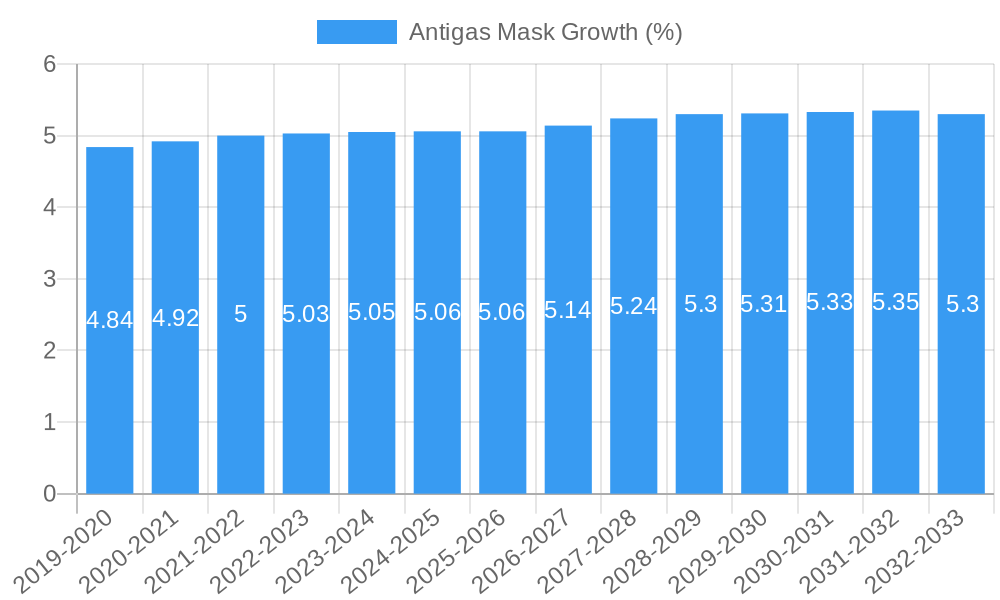

The global Antigas Mask market is poised for significant expansion, projected to reach a market size of approximately $6,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.5% from 2019 to 2033. This upward trajectory is primarily fueled by escalating safety regulations across various industries and a heightened global awareness of respiratory hazards. The petroleum and chemical industries, in particular, represent substantial application segments due to the inherent risks associated with handling volatile and toxic substances. Similarly, mining operations necessitate advanced respiratory protection to mitigate exposure to dust and harmful gases. The military sector's continuous demand for specialized protective gear, coupled with the increasing adoption of stringent workplace safety standards in manufacturing and construction, further underscores the market's growth potential. Innovations in mask design, including the development of lightweight materials, improved filtration technologies, and enhanced wearer comfort, are also contributing to market penetration, making antigas masks more accessible and appealing to a wider range of industrial users.

Looking ahead, the market's expansion will be further influenced by emerging trends such as the integration of smart technologies for real-time air quality monitoring and personalized fit solutions. The growing emphasis on occupational health and safety, driven by international bodies and national labor laws, will continue to be a primary market driver. However, the market may encounter restraints such as the high cost of advanced antigas mask technologies, particularly for smaller enterprises, and the challenges associated with counterfeit products that undermine the credibility of genuine safety equipment. Despite these hurdles, the overarching need for effective respiratory protection in an increasingly complex industrial landscape, coupled with advancements in product development, positions the antigas mask market for sustained and dynamic growth throughout the forecast period.

Antigas Mask Market Research Report: Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive Antigas Mask market research report offers an in-depth analysis of the global market landscape, providing invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report details market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and a strategic outlook. Leveraging high-traffic keywords such as "antigas mask," "respiratory protection," "PPE," "chemical industry safety," "petroleum safety," and "industrial hygiene," this report aims to maximize search visibility and attract professionals from across the safety, manufacturing, and regulatory sectors.

Antigas Mask Market Dynamics & Concentration

The global Antigas Mask market exhibits a moderate to high concentration, with a significant portion of the market share held by established players. Innovation drivers are primarily fueled by stringent safety regulations, advancements in filtration technologies, and the increasing demand for enhanced respiratory protection in hazardous environments. Regulatory frameworks globally, such as OSHA standards in the United States and REACH in Europe, play a pivotal role in shaping market access and product development. Product substitutes, while present in the form of basic respirators, often fall short in providing comprehensive protection against a wide spectrum of airborne contaminants, thus reinforcing the demand for advanced antigas masks. End-user trends indicate a growing preference for lightweight, ergonomic, and user-friendly designs with integrated communication systems. Mergers and acquisitions (M&A) activities are moderately prevalent as larger companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, there have been approximately 25 notable M&A deals in the past five years, consolidating market share and fostering innovation. Key market players are actively investing in research and development to enhance their competitive edge, with an estimated 15% of revenue reinvested annually. The overall market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% over the forecast period.

Antigas Mask Industry Trends & Analysis

The Antigas Mask industry is experiencing robust growth, driven by a confluence of factors including escalating industrialization, increasing awareness regarding occupational health and safety, and the persistent threat of airborne pollutants and hazardous substances. The global antigas mask market is projected to reach a valuation of over $7,000 million by 2033, exhibiting a steady CAGR of 6.5% during the forecast period (2025-2033). Technological disruptions are at the forefront of this expansion, with manufacturers investing heavily in the development of advanced filtration materials, smart sensor integration for real-time monitoring, and enhanced ergonomic designs for improved user comfort and compliance. The rise of the "Internet of Things" (IoT) is also influencing the market, paving the way for connected respiratory protection devices that can transmit data on air quality and user vital signs. Consumer preferences are shifting towards masks offering superior protection against specific contaminants, greater breathability, and extended operational lifespans. This is particularly evident in sectors like the chemical industry and petroleum exploration, where the need for reliable and effective antigas masks is paramount. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a growing emphasis on product differentiation. Market penetration for advanced antigas masks is steadily increasing, driven by stricter enforcement of safety regulations and a proactive approach to workplace hazard mitigation by employers. The demand for filter type antigas masks remains high due to their versatility and cost-effectiveness for a broad range of applications, while isolating antigas masks are gaining traction for environments with extreme hazards or unknown atmospheres. The market penetration for advanced antigas masks is estimated to grow from approximately 45% in 2024 to over 60% by 2033.

Leading Markets & Segments in Antigas Mask

The Petroleum and Chemical Industry segments collectively represent the largest and fastest-growing markets for antigas masks, driven by the inherent risks associated with handling volatile chemicals and hydrocarbons. These industries necessitate the highest standards of respiratory protection, contributing an estimated $2,500 million to the global market in the base year 2025.

Application Dominance:

- Petroleum: Critical for exploration, refining, and transportation, where exposure to toxic gases and vapors is a constant threat. Economic policies promoting energy independence and infrastructure development in this sector directly fuel antigas mask demand.

- Chemical Industry: Essential for manufacturing, handling, and research involving a wide array of hazardous chemicals. Stringent environmental and occupational safety regulations in this sector are primary growth accelerators.

- Mine: Provides protection against dust, silica, and hazardous gases encountered during extraction processes. Government initiatives focused on improving mining safety standards are significant drivers.

- Metallurgy: Offers protection against metal fumes, dust, and high temperatures prevalent in smelting and casting operations.

- Military: Crucial for protection against chemical, biological, radiological, and nuclear (CBRN) threats. Government defense spending and geopolitical stability influence demand.

- Fire Control: Vital for firefighters to breathe safely in smoke-filled environments containing toxic combustion byproducts. Increased investments in emergency response infrastructure boost this segment.

- Mechanics: Used in automotive repair and heavy machinery maintenance to protect against exhaust fumes and particulate matter.

- Others: Includes applications in healthcare, agriculture, and general industrial settings where air quality can be compromised.

Type Dominance:

- Filter type Antigas Mask: Dominates the market due to its widespread applicability and cost-effectiveness in environments with known contaminants. Its market share is projected to be around 70% in 2025.

- Isolating Antigas Mask: Crucial for highly hazardous or oxygen-deficient environments, offering superior protection. While a smaller segment, it is expected to witness higher growth rates due to increasing awareness of extreme risk mitigation.

Antigas Mask Product Developments

Recent product developments in the antigas mask market are focused on enhancing user experience and protection efficacy. Innovations include the integration of advanced multi-layer filtration systems capable of capturing an even wider range of particulate matter and gaseous contaminants, achieving over 99.9% filtration efficiency for specific threats. Lightweight composite materials are being utilized to reduce wearer fatigue during prolonged use, a key concern in sectors like Mechanics and Fire Control. Furthermore, smart antigas masks with integrated sensors are emerging, providing real-time air quality monitoring and communication capabilities, a significant competitive advantage in the Petroleum and Chemical Industry. These developments aim to meet evolving regulatory demands and improve overall occupational safety outcomes.

Key Drivers of Antigas Mask Growth

The antigas mask market's growth is propelled by a combination of critical factors.

- Stringent Regulatory Frameworks: Increasing government mandates and stricter enforcement of occupational health and safety standards worldwide, particularly in high-risk industries like Petroleum, Chemical Industry, and Mine, are primary drivers.

- Technological Advancements: Continuous innovation in filtration technologies, material science, and smart device integration leads to more effective and user-friendly antigas masks.

- Rising Industrialization & Urbanization: The expansion of industrial activities and growing urban populations often result in increased air pollution and a higher incidence of airborne hazards, boosting demand.

- Growing Awareness of Health Risks: Increased employer and employee awareness regarding the long-term health consequences of exposure to hazardous airborne substances fuels the adoption of superior respiratory protection.

- Defense and Security Needs: Growing geopolitical tensions and the need for protection against CBRN threats in Military applications contribute significantly to demand.

Challenges in the Antigas Mask Market

Despite robust growth, the antigas mask market faces several impediments.

- High Cost of Advanced Masks: Sophisticated antigas masks with cutting-edge technology can be prohibitively expensive for smaller businesses, limiting market penetration in certain segments.

- Counterfeit Products: The presence of low-quality counterfeit antigas masks in the market can undermine trust and pose significant safety risks, leading to potential regulatory crackdowns.

- User Compliance and Training: Ensuring proper fit, usage, and maintenance of antigas masks requires consistent training and adherence from end-users, which can be a challenge to achieve across diverse workforces.

- Supply Chain Disruptions: Global events and geopolitical instability can disrupt the supply chain for critical raw materials and components, impacting production and availability.

- Limited Awareness in Developing Economies: In some developing regions, awareness regarding the necessity of advanced respiratory protection remains relatively low, hindering market expansion.

Emerging Opportunities in Antigas Mask

The antigas mask sector is ripe with emerging opportunities for growth and innovation.

- Smart and Connected Respiratory Protection: The integration of IoT technology, sensors, and AI for real-time monitoring, predictive maintenance, and data analytics presents a significant growth avenue.

- Customization and Personalization: Developing antigas masks tailored to specific job roles, environmental conditions, and individual facial structures can cater to niche demands and improve user comfort.

- Expansion in Emerging Markets: Increasing industrialization and growing safety consciousness in developing economies offer substantial untapped market potential for affordable yet effective antigas masks.

- Focus on Sustainable Materials: The development and adoption of eco-friendly and sustainable materials in antigas mask manufacturing can appeal to environmentally conscious consumers and meet evolving regulatory demands.

- Strategic Partnerships and Collaborations: Collaborations between antigas mask manufacturers, technology providers, and end-user industries can accelerate product development and market penetration.

Leading Players in the Antigas Mask Sector

- 3M

- Nexcare

- Honeywell International

- SATA

- Deltaplus

- MSA

- Shigematsu

- Dräger

- Medtronic

- Moldex-Metric Inc.

- MSA Safety Inc.

- RPB Safety LLC

- Sundstrom Safety Inc.

- Qingdao Xinxin Sports Goods Co.,Ltd

- Guangzhou Powecom Labor Insurance Supplies Co.,Ltd

Key Milestones in Antigas Mask Industry

- 2019: Introduction of new CBRN filtration standards by regulatory bodies, driving demand for advanced military-grade antigas masks.

- 2020: Heightened global awareness of airborne pathogens leading to increased demand for high-efficiency particulate air (HEPA) filtration in general safety masks.

- 2021: Significant advancements in lightweight composite materials for respirator construction, enhancing comfort and durability.

- 2022: Increased investment in R&D for smart antigas masks with integrated IoT capabilities for real-time air quality monitoring.

- 2023: Several key players announce strategic partnerships to develop next-generation respiratory protection solutions for the Chemical Industry.

- 2024: Emergence of enhanced anti-fogging technologies for mask visors, improving visibility for users in demanding conditions.

Strategic Outlook for Antigas Mask Market

The strategic outlook for the antigas mask market remains exceptionally positive, characterized by sustained growth driven by an unwavering commitment to occupational safety and advancements in protective technologies. The market is poised for further expansion as industries increasingly prioritize worker well-being and regulatory bodies continue to tighten safety standards. Opportunities lie in leveraging smart technologies, exploring sustainable manufacturing practices, and expanding reach into emerging economies. Companies that can effectively innovate, adapt to evolving regulatory landscapes, and demonstrate superior product performance will be best positioned to capitalize on the significant market potential over the forecast period. The estimated market size is projected to exceed $7,000 million by 2033.

Antigas Mask Segmentation

-

1. Application

- 1.1. Petroleum

- 1.2. Chemical Industry

- 1.3. Mine

- 1.4. Metallurgy

- 1.5. Military

- 1.6. Fire Control

- 1.7. Mechanics

- 1.8. Others

-

2. Types

- 2.1. Filter type Antigas Mask

- 2.2. Isolating Antigas Mask

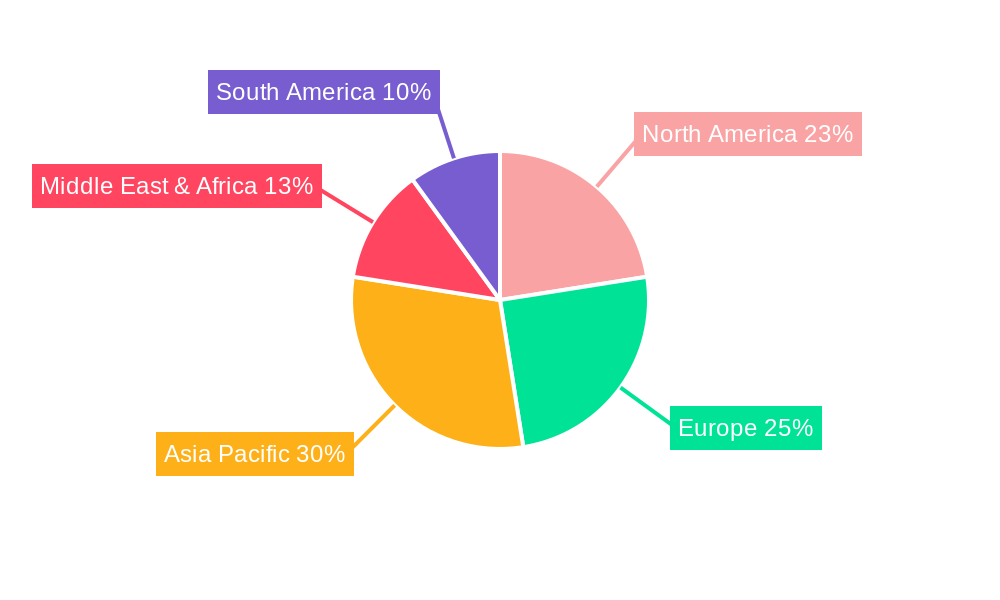

Antigas Mask Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Antigas Mask REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antigas Mask Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Petroleum

- 5.1.2. Chemical Industry

- 5.1.3. Mine

- 5.1.4. Metallurgy

- 5.1.5. Military

- 5.1.6. Fire Control

- 5.1.7. Mechanics

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Filter type Antigas Mask

- 5.2.2. Isolating Antigas Mask

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Antigas Mask Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Petroleum

- 6.1.2. Chemical Industry

- 6.1.3. Mine

- 6.1.4. Metallurgy

- 6.1.5. Military

- 6.1.6. Fire Control

- 6.1.7. Mechanics

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Filter type Antigas Mask

- 6.2.2. Isolating Antigas Mask

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Antigas Mask Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Petroleum

- 7.1.2. Chemical Industry

- 7.1.3. Mine

- 7.1.4. Metallurgy

- 7.1.5. Military

- 7.1.6. Fire Control

- 7.1.7. Mechanics

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Filter type Antigas Mask

- 7.2.2. Isolating Antigas Mask

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Antigas Mask Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Petroleum

- 8.1.2. Chemical Industry

- 8.1.3. Mine

- 8.1.4. Metallurgy

- 8.1.5. Military

- 8.1.6. Fire Control

- 8.1.7. Mechanics

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Filter type Antigas Mask

- 8.2.2. Isolating Antigas Mask

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Antigas Mask Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Petroleum

- 9.1.2. Chemical Industry

- 9.1.3. Mine

- 9.1.4. Metallurgy

- 9.1.5. Military

- 9.1.6. Fire Control

- 9.1.7. Mechanics

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Filter type Antigas Mask

- 9.2.2. Isolating Antigas Mask

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Antigas Mask Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Petroleum

- 10.1.2. Chemical Industry

- 10.1.3. Mine

- 10.1.4. Metallurgy

- 10.1.5. Military

- 10.1.6. Fire Control

- 10.1.7. Mechanics

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Filter type Antigas Mask

- 10.2.2. Isolating Antigas Mask

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nexcare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amazon Kindle

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SATA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deltaplus

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MSA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shigematsu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dräger

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Medtronic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Moldex-Metric Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MSA Safety Inc.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 RPB Safety LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sundstrom Safety Inc.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Qingdao Xinxin Sports Goods Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Guangzhou Powecom Labor Insurance Supplies Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Antigas Mask Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Antigas Mask Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Antigas Mask Revenue (million), by Application 2024 & 2032

- Figure 4: North America Antigas Mask Volume (K), by Application 2024 & 2032

- Figure 5: North America Antigas Mask Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Antigas Mask Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Antigas Mask Revenue (million), by Types 2024 & 2032

- Figure 8: North America Antigas Mask Volume (K), by Types 2024 & 2032

- Figure 9: North America Antigas Mask Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Antigas Mask Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Antigas Mask Revenue (million), by Country 2024 & 2032

- Figure 12: North America Antigas Mask Volume (K), by Country 2024 & 2032

- Figure 13: North America Antigas Mask Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Antigas Mask Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Antigas Mask Revenue (million), by Application 2024 & 2032

- Figure 16: South America Antigas Mask Volume (K), by Application 2024 & 2032

- Figure 17: South America Antigas Mask Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Antigas Mask Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Antigas Mask Revenue (million), by Types 2024 & 2032

- Figure 20: South America Antigas Mask Volume (K), by Types 2024 & 2032

- Figure 21: South America Antigas Mask Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Antigas Mask Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Antigas Mask Revenue (million), by Country 2024 & 2032

- Figure 24: South America Antigas Mask Volume (K), by Country 2024 & 2032

- Figure 25: South America Antigas Mask Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Antigas Mask Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Antigas Mask Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Antigas Mask Volume (K), by Application 2024 & 2032

- Figure 29: Europe Antigas Mask Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Antigas Mask Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Antigas Mask Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Antigas Mask Volume (K), by Types 2024 & 2032

- Figure 33: Europe Antigas Mask Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Antigas Mask Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Antigas Mask Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Antigas Mask Volume (K), by Country 2024 & 2032

- Figure 37: Europe Antigas Mask Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Antigas Mask Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Antigas Mask Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Antigas Mask Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Antigas Mask Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Antigas Mask Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Antigas Mask Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Antigas Mask Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Antigas Mask Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Antigas Mask Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Antigas Mask Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Antigas Mask Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Antigas Mask Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Antigas Mask Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Antigas Mask Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Antigas Mask Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Antigas Mask Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Antigas Mask Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Antigas Mask Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Antigas Mask Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Antigas Mask Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Antigas Mask Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Antigas Mask Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Antigas Mask Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Antigas Mask Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Antigas Mask Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Antigas Mask Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Antigas Mask Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Antigas Mask Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Antigas Mask Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Antigas Mask Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Antigas Mask Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Antigas Mask Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Antigas Mask Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Antigas Mask Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Antigas Mask Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Antigas Mask Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Antigas Mask Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Antigas Mask Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Antigas Mask Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Antigas Mask Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Antigas Mask Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Antigas Mask Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Antigas Mask Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Antigas Mask Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Antigas Mask Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Antigas Mask Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Antigas Mask Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Antigas Mask Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Antigas Mask Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Antigas Mask Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Antigas Mask Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Antigas Mask Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Antigas Mask Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Antigas Mask Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Antigas Mask Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Antigas Mask Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Antigas Mask Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Antigas Mask Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Antigas Mask Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Antigas Mask Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Antigas Mask Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Antigas Mask Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Antigas Mask Volume K Forecast, by Country 2019 & 2032

- Table 81: China Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Antigas Mask Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Antigas Mask Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antigas Mask?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Antigas Mask?

Key companies in the market include 3M, Nexcare, Amazon Kindle, Honeywell International, SATA, Deltaplus, MSA, Shigematsu, Dräger, Medtronic, Moldex-Metric Inc., MSA Safety Inc., RPB Safety LLC, Sundstrom Safety Inc., Qingdao Xinxin Sports Goods Co., Ltd, Guangzhou Powecom Labor Insurance Supplies Co., Ltd.

3. What are the main segments of the Antigas Mask?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antigas Mask," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antigas Mask report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antigas Mask?

To stay informed about further developments, trends, and reports in the Antigas Mask, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence