Key Insights

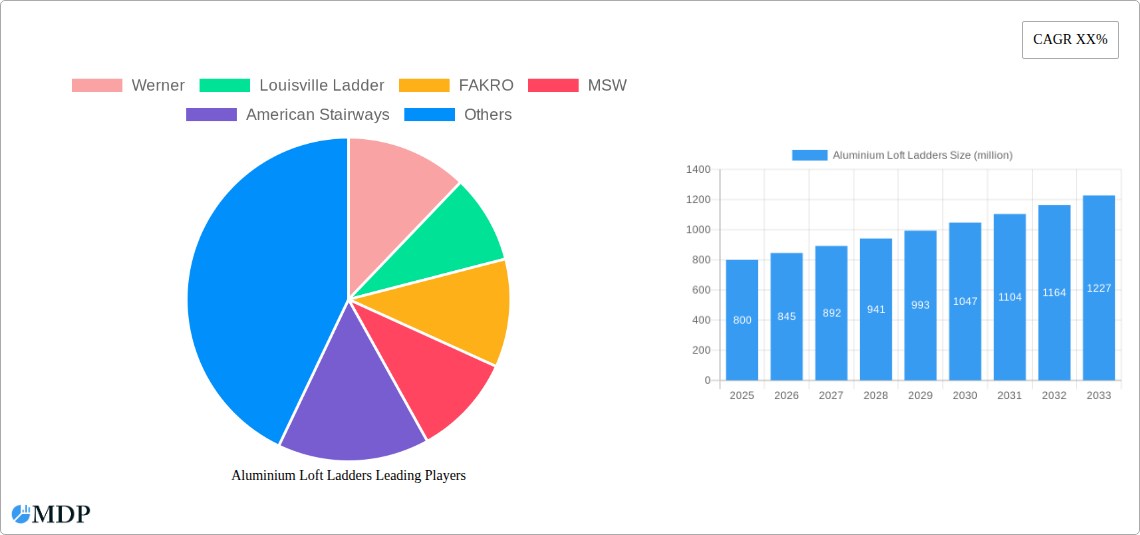

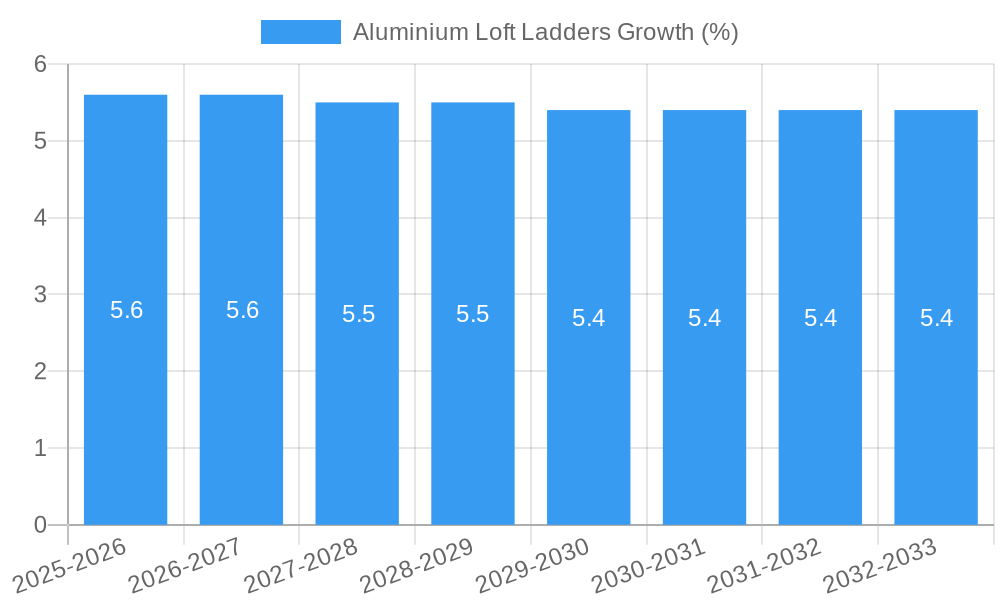

The global Aluminium Loft Ladder market is projected to experience robust growth, estimated at approximately $800 million in 2025, with a Compound Annual Growth Rate (CAGR) of around 5.5% anticipated through 2033. This expansion is primarily driven by the increasing demand for space optimization solutions in both residential and commercial sectors, fueled by urbanization and shrinking living spaces. The rising popularity of loft conversions and the need for accessible storage areas are significant contributors to this growth. Furthermore, the inherent benefits of aluminium, such as its lightweight nature, durability, and resistance to rust, make it a preferred material for loft ladders, especially in comparison to traditional wooden alternatives. The market is further buoyed by technological advancements leading to more user-friendly and aesthetically pleasing designs, including telescopic and folding loft ladders that offer convenience and minimal space impact.

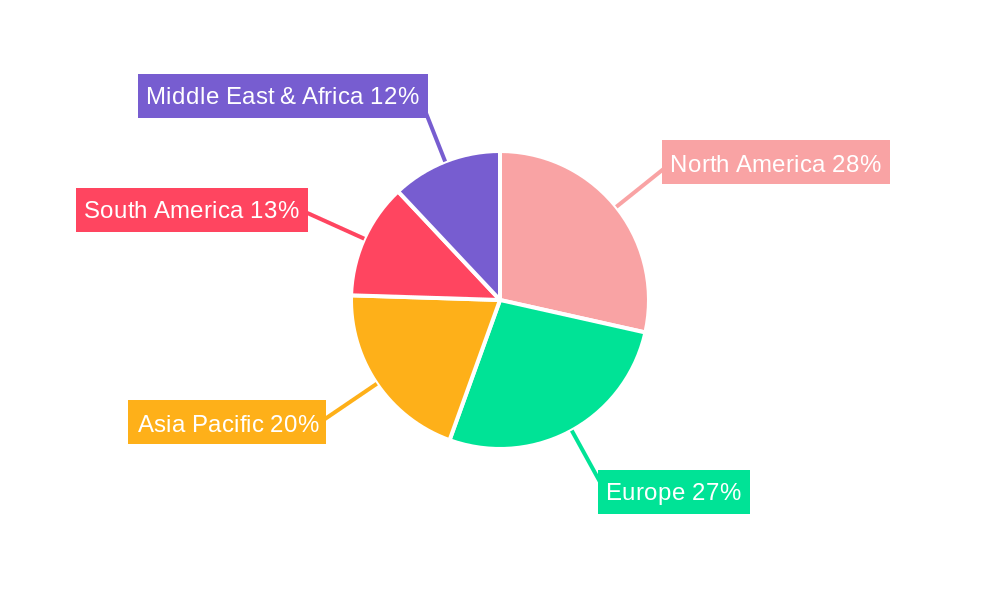

The market segmentation reveals a balanced demand across both residential and commercial applications, with the residential sector likely holding a slightly larger share due to home renovation trends and the desire for increased living space. In terms of type, the 3-section loft ladders are expected to dominate, offering a versatile solution for varying ceiling heights and accessibility needs, closely followed by 2-section models. Key players like Werner, Louisville Ladder, and FAKRO are expected to maintain a strong presence, leveraging their brand recognition and distribution networks. Geographically, North America and Europe are anticipated to lead the market, driven by established renovation markets and a high adoption rate of space-saving solutions. However, the Asia Pacific region presents a significant growth opportunity, with rapidly developing economies and increasing disposable incomes driving demand for home improvement products. Restraints such as the initial cost of premium aluminium models and potential competition from alternative space-saving solutions might temper growth in certain segments, but the overall outlook remains highly positive.

Aluminium Loft Ladders Market Dynamics & Concentration

The Aluminium Loft Ladders market is characterized by moderate concentration, with a handful of key players holding significant market share. Major companies such as Werner, Louisville Ladder, FAKRO, and MSW dominate the landscape, contributing to approximately 65% of the global market revenue. Innovation remains a crucial driver, with continuous advancements in material science, safety features, and ease of installation pushing the market forward. Regulatory frameworks, particularly concerning safety standards and building codes, play a vital role in shaping product development and market entry. Product substitutes, primarily wooden loft ladders and retractable attic stairs, present ongoing competition, though aluminium's durability and lightweight properties offer a competitive edge. End-user trends indicate a growing preference for space-saving solutions, increased DIY home improvement activities, and a demand for robust, long-lasting products. Merger and acquisition (M&A) activities, while not exceptionally high, have seen strategic consolidation aimed at expanding product portfolios and geographical reach. Over the historical period (2019-2024), an estimated 25 M&A deals were recorded, with an average deal value of xx million. The market share distribution for the top 5 companies hovers around 50 million.

Aluminium Loft Ladders Industry Trends & Analysis

The Aluminium Loft Ladders industry is poised for substantial growth, driven by a confluence of accelerating market growth drivers, transformative technological disruptions, evolving consumer preferences, and intensifying competitive dynamics. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from the base year of 2025, reaching an estimated market size of xx million by 2033. A key growth catalyst is the increasing global urbanization and the consequent rise in demand for efficient space utilization solutions in residential properties. As living spaces become more compact, the utility of loft spaces for storage and even as habitable areas is being redefined, directly boosting the need for accessible loft ladders. Technological advancements are at the forefront of industry evolution. Innovations in aluminium alloys are yielding lighter, yet stronger, loft ladders, enhancing user convenience and safety. The integration of smart features, such as automated deployment mechanisms and integrated lighting, is also an emerging trend, catering to a more tech-savvy consumer base. Consumer preferences are shifting towards products that offer durability, low maintenance, and aesthetic appeal, all of which aluminium loft ladders are increasingly meeting. The growing awareness among homeowners and builders regarding energy efficiency is also a significant factor, as well-sealed loft hatches connected to aluminium ladders can contribute to better insulation. Furthermore, the burgeoning DIY home improvement culture, amplified by online tutorials and readily available information, empowers consumers to undertake installation projects, thereby expanding the accessible market for these products. The competitive landscape is dynamic, with established players continually investing in research and development to maintain their market position and new entrants vying for market share through innovative offerings and competitive pricing. Market penetration is projected to increase from an estimated 30% in 2024 to over 45% by 2033 in developed economies, with emerging markets showing significant untapped potential.

Leading Markets & Segments in Aluminium Loft Ladders

The Residential segment is the dominant force within the Aluminium Loft Ladders market, projecting continued leadership through the forecast period of 2025–2033. This dominance is underscored by several key drivers, including the consistent demand for home renovation and expansion projects, the rising trend of converting unused attic spaces into functional living areas or storage solutions, and the increasing affordability and accessibility of loft ladders for individual homeowners. Within the Residential segment, the 2 Section loft ladder type exhibits the highest market penetration due to its versatility and ease of use in standard loft configurations. Countries like the United States, Germany, and the United Kingdom are leading the charge in this segment, fueled by robust housing markets and a strong culture of home improvement. Economic policies in these regions that support home ownership and renovation initiatives further bolster this trend.

The Commercial segment, while smaller, is exhibiting robust growth. This expansion is primarily driven by the need for access to storage areas, mechanical rooms, and mezzanines in various commercial establishments such as retail stores, warehouses, and office buildings. The increasing focus on optimizing operational space and improving workplace safety contributes significantly to the adoption of aluminium loft ladders in commercial settings. The 3 Section loft ladder type is gaining traction in the Commercial segment, offering greater reach and flexibility for taller ceiling heights or more complex access requirements. Infrastructure development, particularly in rapidly urbanizing developing nations, also presents a substantial opportunity for commercial applications of loft ladders. Regulatory frameworks mandating safe access to all operational areas within commercial premises are another crucial factor propelling this segment's growth.

Aluminium Loft Ladders Product Developments

Aluminium loft ladders are witnessing continuous innovation focused on enhanced user experience and safety. Developments include the introduction of lighter yet stronger alloys, improved sealing mechanisms for better thermal insulation, and user-friendly multi-section designs for greater versatility. Companies are also integrating features like non-slip treads, robust handrails, and smooth operating mechanisms to ensure secure and effortless access. These product developments directly address market demand for durable, safe, and space-efficient solutions, offering a distinct competitive advantage in an evolving market.

Key Drivers of Aluminium Loft Ladders Growth

The growth of the Aluminium Loft Ladders market is propelled by several key factors. Technologically, advancements in material science have led to the development of lighter, stronger, and more durable aluminium alloys, enhancing product performance and lifespan. Economically, the surge in home renovation and expansion projects, particularly the conversion of attics into usable living or storage spaces, is a primary demand driver. Regulatory frameworks that prioritize safety in access solutions and building codes encouraging energy-efficient designs also indirectly fuel market expansion by mandating or incentivizing the use of high-quality loft access systems.

Challenges in the Aluminium Loft Ladders Market

Despite robust growth, the Aluminium Loft Ladders market faces certain challenges. Regulatory hurdles, particularly variations in safety standards and building codes across different regions, can complicate product standardization and market entry. Supply chain issues, including fluctuations in raw material prices (aluminium) and logistical complexities, can impact production costs and lead times. Intense competitive pressures, with both established manufacturers and emerging players vying for market share, can lead to price wars and affect profit margins. The ongoing development of alternative access solutions also poses a competitive threat.

Emerging Opportunities in Aluminium Loft Ladders

Emerging opportunities in the Aluminium Loft Ladders market are centered on technological breakthroughs, strategic partnerships, and market expansion. The development of smart loft ladders with integrated sensors and automated features presents a significant avenue for innovation and premium product offerings. Strategic partnerships between manufacturers and home builders, or with online retail platforms, can enhance distribution channels and market reach. Furthermore, expanding into developing economies with increasing urbanization and a growing middle class, where the demand for space-saving solutions is on the rise, offers substantial long-term growth potential.

Leading Players in the Aluminium Loft Ladders Sector

- Werner

- Louisville Ladder

- FAKRO

- MSW

- American Stairways, Inc

- Dolle

- MARWIN

- Telesteps

- Duo-Safety Ladder Corporation

- Attic Ease

Key Milestones in Aluminium Loft Ladders Industry

- 2019: Introduction of enhanced safety locking mechanisms in leading models.

- 2020: Increased consumer adoption of DIY loft conversion projects.

- 2021: Launch of new lightweight aluminium alloy variants for improved portability.

- 2022: Growing emphasis on energy-efficient loft hatch designs and integrated insulation.

- 2023: Strategic acquisitions aimed at expanding product portfolios in niche markets.

- 2024: Introduction of smart features and automation in premium loft ladder models.

- 2025: Projected increase in the adoption of 3-section ladders for commercial applications.

- 2026: Anticipated rise in the demand for eco-friendly manufacturing processes.

- 2027: Potential for the emergence of modular loft ladder systems.

- 2028: Expected growth in smart home integration for loft access solutions.

- 2029: Forecast for increased market penetration in emerging economies.

- 2030: Continued innovation in user-friendly design and installation.

- 2031: Anticipated consolidation within the industry for competitive advantage.

- 2032: Focus on enhanced durability and maintenance-free operation.

- 2033: Projections for the widespread adoption of advanced safety features.

Strategic Outlook for Aluminium Loft Ladders Market

The strategic outlook for the Aluminium Loft Ladders market is overwhelmingly positive, fueled by continuous innovation and growing market demand. Key growth accelerators include the ongoing urbanization trend, the sustained interest in home renovation and space optimization, and the technological advancements in material science and smart features. The market is ripe for companies that can effectively cater to the evolving needs of both residential and commercial consumers by offering durable, safe, energy-efficient, and user-friendly loft access solutions. Strategic partnerships and market expansion into untapped geographical regions will be crucial for long-term success and sustained growth.

Aluminium Loft Ladders Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

-

2. Types

- 2.1. 2 Section

- 2.2. 3 Section

Aluminium Loft Ladders Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aluminium Loft Ladders REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aluminium Loft Ladders Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 2 Section

- 5.2.2. 3 Section

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aluminium Loft Ladders Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 2 Section

- 6.2.2. 3 Section

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aluminium Loft Ladders Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 2 Section

- 7.2.2. 3 Section

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aluminium Loft Ladders Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 2 Section

- 8.2.2. 3 Section

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aluminium Loft Ladders Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 2 Section

- 9.2.2. 3 Section

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aluminium Loft Ladders Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 2 Section

- 10.2.2. 3 Section

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Werner

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Louisville Ladder

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FAKRO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MSW

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Stairways

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dolle

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MARWIN

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Telesteps

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Duo-Safety Ladder Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Attic Ease

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Werner

List of Figures

- Figure 1: Global Aluminium Loft Ladders Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Aluminium Loft Ladders Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Aluminium Loft Ladders Revenue (million), by Application 2024 & 2032

- Figure 4: North America Aluminium Loft Ladders Volume (K), by Application 2024 & 2032

- Figure 5: North America Aluminium Loft Ladders Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Aluminium Loft Ladders Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Aluminium Loft Ladders Revenue (million), by Types 2024 & 2032

- Figure 8: North America Aluminium Loft Ladders Volume (K), by Types 2024 & 2032

- Figure 9: North America Aluminium Loft Ladders Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Aluminium Loft Ladders Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Aluminium Loft Ladders Revenue (million), by Country 2024 & 2032

- Figure 12: North America Aluminium Loft Ladders Volume (K), by Country 2024 & 2032

- Figure 13: North America Aluminium Loft Ladders Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Aluminium Loft Ladders Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Aluminium Loft Ladders Revenue (million), by Application 2024 & 2032

- Figure 16: South America Aluminium Loft Ladders Volume (K), by Application 2024 & 2032

- Figure 17: South America Aluminium Loft Ladders Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Aluminium Loft Ladders Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Aluminium Loft Ladders Revenue (million), by Types 2024 & 2032

- Figure 20: South America Aluminium Loft Ladders Volume (K), by Types 2024 & 2032

- Figure 21: South America Aluminium Loft Ladders Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Aluminium Loft Ladders Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Aluminium Loft Ladders Revenue (million), by Country 2024 & 2032

- Figure 24: South America Aluminium Loft Ladders Volume (K), by Country 2024 & 2032

- Figure 25: South America Aluminium Loft Ladders Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Aluminium Loft Ladders Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Aluminium Loft Ladders Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Aluminium Loft Ladders Volume (K), by Application 2024 & 2032

- Figure 29: Europe Aluminium Loft Ladders Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Aluminium Loft Ladders Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Aluminium Loft Ladders Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Aluminium Loft Ladders Volume (K), by Types 2024 & 2032

- Figure 33: Europe Aluminium Loft Ladders Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Aluminium Loft Ladders Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Aluminium Loft Ladders Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Aluminium Loft Ladders Volume (K), by Country 2024 & 2032

- Figure 37: Europe Aluminium Loft Ladders Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Aluminium Loft Ladders Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Aluminium Loft Ladders Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Aluminium Loft Ladders Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Aluminium Loft Ladders Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Aluminium Loft Ladders Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Aluminium Loft Ladders Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Aluminium Loft Ladders Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Aluminium Loft Ladders Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Aluminium Loft Ladders Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Aluminium Loft Ladders Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Aluminium Loft Ladders Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Aluminium Loft Ladders Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Aluminium Loft Ladders Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Aluminium Loft Ladders Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Aluminium Loft Ladders Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Aluminium Loft Ladders Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Aluminium Loft Ladders Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Aluminium Loft Ladders Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Aluminium Loft Ladders Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Aluminium Loft Ladders Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Aluminium Loft Ladders Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Aluminium Loft Ladders Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Aluminium Loft Ladders Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Aluminium Loft Ladders Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Aluminium Loft Ladders Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aluminium Loft Ladders Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aluminium Loft Ladders Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Aluminium Loft Ladders Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Aluminium Loft Ladders Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Aluminium Loft Ladders Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Aluminium Loft Ladders Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Aluminium Loft Ladders Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Aluminium Loft Ladders Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Aluminium Loft Ladders Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Aluminium Loft Ladders Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Aluminium Loft Ladders Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Aluminium Loft Ladders Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Aluminium Loft Ladders Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Aluminium Loft Ladders Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Aluminium Loft Ladders Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Aluminium Loft Ladders Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Aluminium Loft Ladders Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Aluminium Loft Ladders Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Aluminium Loft Ladders Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Aluminium Loft Ladders Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Aluminium Loft Ladders Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Aluminium Loft Ladders Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Aluminium Loft Ladders Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Aluminium Loft Ladders Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Aluminium Loft Ladders Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Aluminium Loft Ladders Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Aluminium Loft Ladders Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Aluminium Loft Ladders Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Aluminium Loft Ladders Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Aluminium Loft Ladders Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Aluminium Loft Ladders Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Aluminium Loft Ladders Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Aluminium Loft Ladders Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Aluminium Loft Ladders Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Aluminium Loft Ladders Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Aluminium Loft Ladders Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Aluminium Loft Ladders Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Aluminium Loft Ladders Volume K Forecast, by Country 2019 & 2032

- Table 81: China Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Aluminium Loft Ladders Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Aluminium Loft Ladders Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aluminium Loft Ladders?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Aluminium Loft Ladders?

Key companies in the market include Werner, Louisville Ladder, FAKRO, MSW, American Stairways, Inc, Dolle, MARWIN, Telesteps, Duo-Safety Ladder Corporation, Attic Ease.

3. What are the main segments of the Aluminium Loft Ladders?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aluminium Loft Ladders," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aluminium Loft Ladders report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aluminium Loft Ladders?

To stay informed about further developments, trends, and reports in the Aluminium Loft Ladders, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence