Key Insights

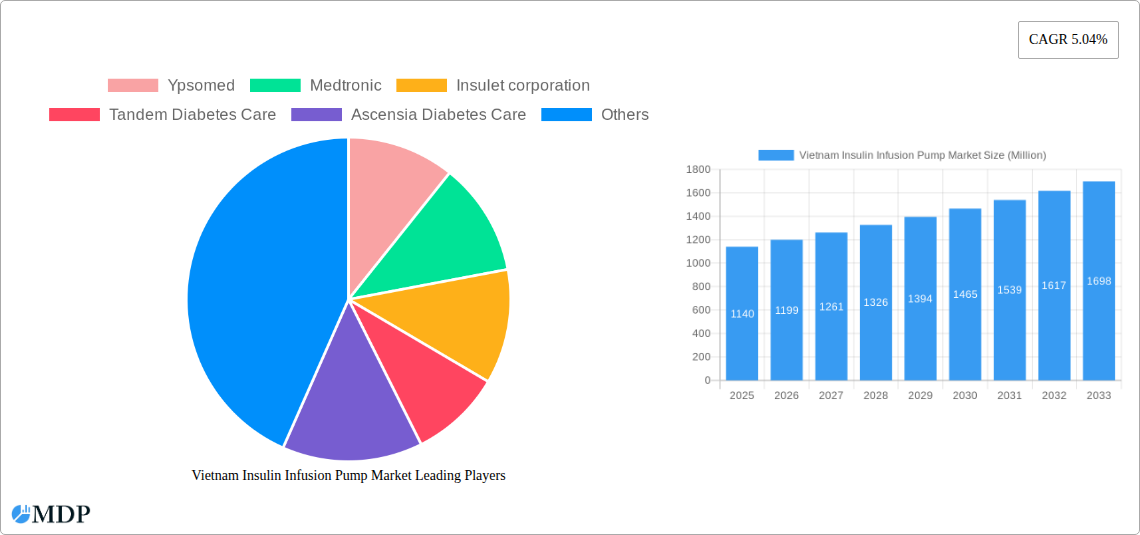

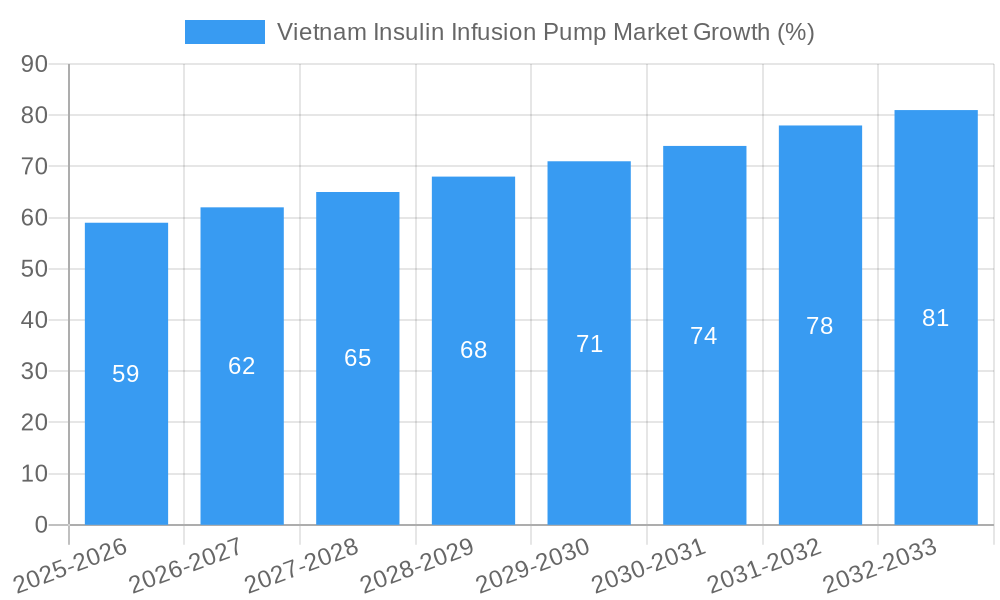

The Vietnam insulin infusion pump market, valued at $1.14 billion in 2025, is projected to experience robust growth, driven by rising diabetes prevalence, increasing healthcare expenditure, and growing awareness of advanced diabetes management techniques. The market's Compound Annual Growth Rate (CAGR) of 5.04% from 2019 to 2025 indicates a consistent upward trajectory. This growth is further fueled by the increasing adoption of insulin pumps as a preferred method of insulin delivery, particularly among patients requiring multiple daily injections or those with complex diabetes management needs. Technological advancements leading to smaller, more user-friendly, and connected devices are also contributing to market expansion. The market is segmented into insulin pump devices, infusion sets, and reservoirs, each exhibiting unique growth patterns based on technological innovation and consumer preference. Key players like Ypsomed, Medtronic, Insulet Corporation, Tandem Diabetes Care, and Ascensia Diabetes Care are actively competing to capture market share through product innovation, strategic partnerships, and expansion of their distribution networks. The increasing government initiatives focused on improving healthcare infrastructure and diabetes management programs are further bolstering market growth. However, the high cost of insulin infusion pumps and potential challenges related to insurance coverage could act as market restraints.

Looking ahead to 2033, the Vietnam insulin infusion pump market is poised for continued expansion. Factors such as the aging population, increasing urbanization, and rising disposable incomes will further contribute to market growth. The market's segmentation offers opportunities for specialized products catering to specific patient needs and preferences. Companies are likely to focus on developing innovative features such as improved accuracy, enhanced connectivity capabilities (e.g., integration with smartphone apps for remote monitoring), and smaller, more discreet pump designs. Continued focus on improving affordability and accessibility will be crucial for sustained market growth in Vietnam. Competitive landscape analysis reveals a dynamic market with players focusing on strategic partnerships, technological advancements, and targeted marketing campaigns to gain a competitive edge.

This in-depth report provides a comprehensive analysis of the Vietnam Insulin Infusion Pump Market, offering invaluable insights for stakeholders across the healthcare and medical device industries. With a detailed study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report unveils the market dynamics, growth drivers, and future potential of this vital sector. Discover key trends, leading players, and emerging opportunities within the Vietnamese insulin infusion pump market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Vietnam Insulin Infusion Pump Market Market Dynamics & Concentration

This section delves into the competitive landscape of the Vietnam insulin infusion pump market, analyzing market concentration, innovation drivers, regulatory frameworks, and market dynamics. We assess the influence of product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market concentration is currently estimated at xx%, with a predicted increase to xx% by 2033, driven by consolidation amongst key players.

Market Share: The top five players (Ypsomed, Medtronic, Insulet Corporation, Tandem Diabetes Care, Ascensia Diabetes Care) hold approximately xx% of the market share in 2025. This is expected to shift slightly by 2033, with some players potentially experiencing growth due to innovative product launches and market penetration strategies.

M&A Activity: The number of M&A deals within the Vietnam insulin infusion pump market has been relatively low in the historical period (2019-2024), with approximately xx deals recorded. However, we predict an increase in M&A activity in the forecast period (2025-2033), driven by the need for expansion and strategic partnerships.

Innovation Drivers: Technological advancements in pump design, connectivity, and data management are key innovation drivers. The increasing demand for sophisticated, user-friendly, and integrated systems pushes manufacturers to invest heavily in R&D.

Regulatory Landscape: The regulatory framework in Vietnam significantly influences market access and product approvals. Understanding the evolving regulations is crucial for market entry and sustained growth.

Product Substitutes: While insulin pens and syringes represent substitutes, the advantages of insulin infusion pumps in terms of accuracy and convenience are steadily driving adoption.

End-User Trends: The growing awareness of diabetes management and increasing adoption of advanced therapy options are contributing to market growth.

Vietnam Insulin Infusion Pump Market Industry Trends & Analysis

This section analyzes the market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics shaping the Vietnam insulin infusion pump market. The market has experienced a CAGR of xx% during the historical period (2019-2024). Market penetration is currently estimated at xx% with substantial growth potential in the forecast period. This growth is fueled by several factors, including rising diabetes prevalence, improving healthcare infrastructure, increasing government initiatives, and growing awareness of the benefits of insulin pump therapy. The technological disruptions, including the integration of continuous glucose monitoring (CGM) technology and the development of automated insulin delivery (AID) systems, are further accelerating this growth. Consumer preferences are shifting towards smaller, more user-friendly devices with advanced features and improved connectivity. Competitive dynamics are intense, with leading players actively engaged in product differentiation and market expansion strategies.

Leading Markets & Segments in Vietnam Insulin Infusion Pump Market

The most dominant segment within the Vietnam insulin infusion pump market is the Insulin Pump Device segment, driven primarily by increasing demand for automated insulin delivery systems. The key drivers of this dominance are outlined below:

Rising Prevalence of Diabetes: The increasing prevalence of type 1 and type 2 diabetes in Vietnam is a major driver, increasing the demand for effective insulin delivery solutions.

Government Initiatives: The government's focus on improving healthcare infrastructure and increasing access to diabetes management resources supports the sector's growth.

Economic Growth: Rising disposable incomes contribute to increased affordability of advanced diabetes management technologies, including insulin infusion pumps.

Dominance Analysis: The Insulin Pump Device segment holds the largest market share (xx%) within the insulin infusion pump market, followed by the Infusion Set (xx%) and Reservoir (xx%) segments. This dominance is expected to continue throughout the forecast period, driven by factors mentioned above. This segment demonstrates higher growth compared to the other segments and enjoys economies of scale.

Vietnam Insulin Infusion Pump Market Product Developments

Significant advancements in insulin infusion pump technology include the integration of CGM and AID systems, offering enhanced accuracy and convenience for users. These developments have revolutionized diabetes management by enabling automated insulin delivery, reducing the risk of hypoglycemia and improving overall glycemic control. The market is witnessing a trend toward smaller, more discreet devices with improved battery life and enhanced connectivity features, making them more user-friendly and accessible. These innovative products provide a significant competitive advantage, attracting a wider patient base and driving market expansion.

Key Drivers of Vietnam Insulin Infusion Pump Market Growth

Several factors contribute to the growth of the Vietnam insulin infusion pump market. Technological advancements, such as the development of smaller, smarter pumps with advanced features, along with increasing government initiatives to improve healthcare access and affordability are crucial. The rising prevalence of diabetes, particularly type 1 and type 2 diabetes, significantly contributes to the market's expansion.

Challenges in the Vietnam Insulin Infusion Pump Market

Despite the growth potential, several challenges hinder market expansion. High initial costs of insulin pumps and related supplies pose a significant barrier for many patients. The limited reimbursement coverage and insurance plans may reduce affordability and accessibility of these advanced technologies. Furthermore, the complexities of maintaining the devices and adhering to strict monitoring protocols represent challenges for some patients.

Emerging Opportunities in Vietnam Insulin Infusion Pump Market

The market presents substantial opportunities for growth, driven by ongoing technological advancements in insulin pump technology. Strategic partnerships between manufacturers, healthcare providers, and government agencies can expand market access and improve affordability. The continuous development of sophisticated, user-friendly devices and the increasing integration of CGM and AID systems are expanding market potential. Market expansion strategies focusing on patient education and awareness campaigns can further accelerate market growth.

Leading Players in the Vietnam Insulin Infusion Pump Market Sector

- Ypsomed

- Medtronic (Medtronic)

- Insulet corporation (Insulet Corporation)

- Tandem Diabetes Care (Tandem Diabetes Care)

- Ascensia Diabetes Care (Ascensia Diabetes Care)

Key Milestones in Vietnam Insulin Infusion Pump Market Industry

- March 2023: Defense Health Agency (DHA) officials announced that military family members with type-1 diabetes can now get Tricare coverage for the Omnipod 5 insulin pump. This expansion of insurance coverage is expected to significantly boost adoption rates.

- May 2023: The FDA cleared the Beta Bionics iLet ACE Pump and iLet Dosing Decision Software, creating the iLet Bionic Pancreas system for type-1 diabetes patients aged six and older. This technological advancement positions AID systems as a significant market driver in the near future.

Strategic Outlook for Vietnam Insulin Infusion Pump Market Market

The future of the Vietnam insulin infusion pump market is promising. Continued technological advancements, strategic partnerships, and increasing government support will drive market growth. The focus on improving affordability and accessibility, coupled with increasing patient awareness, will create a favorable environment for long-term market expansion. Companies investing in R&D, expanding distribution networks, and focusing on patient-centric solutions are well-positioned to capitalize on this significant growth opportunity.

Vietnam Insulin Infusion Pump Market Segmentation

-

1. Insulin Infusion Pump

- 1.1. Insulin Pump Device

- 1.2. Infusion Set

- 1.3. Reservoir

Vietnam Insulin Infusion Pump Market Segmentation By Geography

- 1. Vietnam

Vietnam Insulin Infusion Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques

- 3.3. Market Restrains

- 3.3.1. Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms

- 3.4. Market Trends

- 3.4.1. Insulin Pump is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 5.1.1. Insulin Pump Device

- 5.1.2. Infusion Set

- 5.1.3. Reservoir

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ypsomed

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Insulet corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tandem Diabetes Care

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascensia Diabetes Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ypsomed

List of Figures

- Figure 1: Vietnam Insulin Infusion Pump Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Insulin Infusion Pump Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Vietnam Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 4: Vietnam Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 5: Vietnam Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Vietnam Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Vietnam Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Vietnam Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 10: Vietnam Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 11: Vietnam Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Vietnam Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Insulin Infusion Pump Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Vietnam Insulin Infusion Pump Market?

Key companies in the market include Ypsomed, Medtronic, Insulet corporation, Tandem Diabetes Care, Ascensia Diabetes Care.

3. What are the main segments of the Vietnam Insulin Infusion Pump Market?

The market segments include Insulin Infusion Pump.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques.

6. What are the notable trends driving market growth?

Insulin Pump is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms.

8. Can you provide examples of recent developments in the market?

May 2023: The United States Food and Drug Administration (FDA) cleared the Beta Bionics iLet ACE Pump and the iLet Dosing Decision Software for people six years of age and older with type-1 diabetes. These two devices and a compatible FDA-cleared integrated continuous glucose monitor (iCGM) will form a new system called the iLet Bionic Pancreas. This new automated insulin dosing (AID) system uses an algorithm to determine and command insulin delivery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Insulin Infusion Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Insulin Infusion Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Insulin Infusion Pump Market?

To stay informed about further developments, trends, and reports in the Vietnam Insulin Infusion Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence