Key Insights

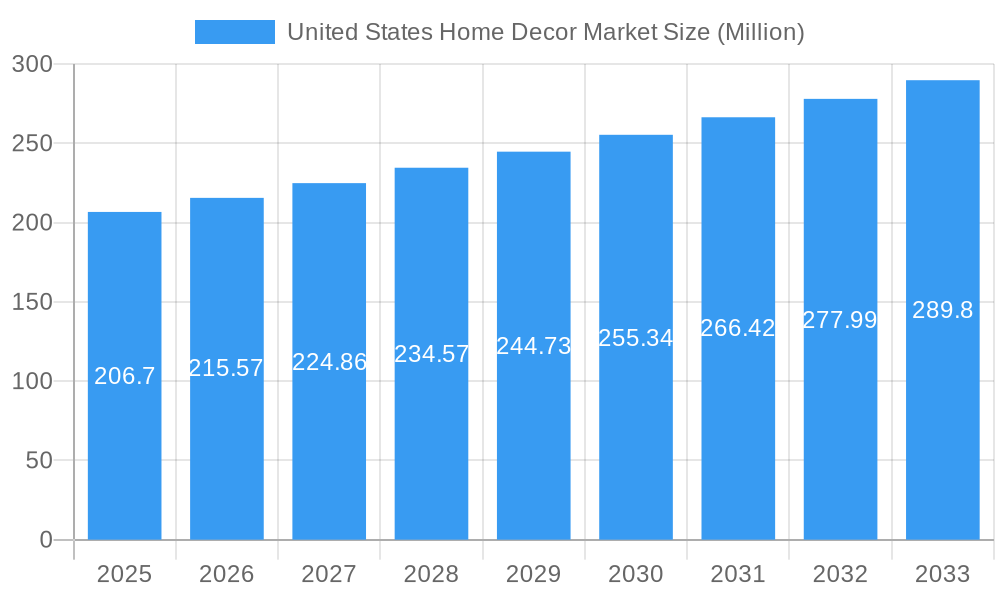

The United States home decor market, valued at $206.70 million in 2025, is projected to experience robust growth, driven by several key factors. A rising disposable income among millennials and Gen Z, coupled with an increasing focus on home improvement and personalization, fuels significant demand for aesthetically pleasing and functional home furnishings. The growing popularity of online shopping, offering convenience and a wider selection of products, further propels market expansion. The trend towards sustainable and eco-friendly home decor options also presents a lucrative segment for businesses committed to environmentally responsible practices. While supply chain disruptions and inflationary pressures might present challenges, the overall market outlook remains positive. The market is segmented by distribution channels (supermarkets/hypermarkets, specialty stores, online, and others) and product categories (home furniture, home textiles, flooring, wall decor, lighting, accessories, and others). Major players like IKEA, Ashley Furniture, and Shaw Industries are well-positioned to capitalize on these trends, but competition remains intense. The geographical segmentation across the US (Northeast, Southeast, Midwest, Southwest, West) reveals varying levels of market penetration and consumer preferences, influencing marketing strategies and product offerings. The continued CAGR of 4.11% suggests a steady expansion throughout the forecast period (2025-2033).

United States Home Decor Market Market Size (In Million)

The continued growth trajectory is expected to be influenced by several factors. Firstly, the increasing adoption of smart home technologies is likely to create opportunities for innovative home decor products. Secondly, the rising popularity of minimalist and Scandinavian design aesthetics is expected to shape consumer preferences. Lastly, the growth of the rental market and the demand for easily movable and adaptable furniture will influence the sales of certain product segments. Analyzing these aspects across various regions provides invaluable insights into tailoring specific strategies to maximize market share and cater to diverse consumer needs. Companies are expected to invest further in e-commerce infrastructure and improve their online presence to better reach the growing online consumer base. Innovation in product design and material sourcing will also be crucial for sustained market leadership.

United States Home Decor Market Company Market Share

United States Home Decor Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States home decor market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report delivers a holistic view of past performance, current trends, and future projections. The report leverages extensive data analysis, expert insights, and key industry developments to offer actionable recommendations. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, showcasing significant growth potential.

United States Home Decor Market Market Dynamics & Concentration

The U.S. home decor market displays a moderately consolidated structure, featuring a blend of major players and a substantial number of smaller businesses. While precise market share figures for 2025 are proprietary, analysis indicates that the top five companies command a significant portion of the overall revenue. Market dynamics are significantly shaped by innovation, fueled by advancements in materials science and manufacturing technologies. Stringent regulatory landscapes, encompassing product safety and environmental regulations, heavily influence manufacturers' operational strategies. A rising consumer preference for sustainable and ethically sourced products presents lucrative opportunities for eco-conscious brands. The market exhibits consistent merger and acquisition (M&A) activity, with a notable number of deals concluded in recent years, predominantly driven by consolidation strategies and expansion initiatives. The surge in home improvement and renovation projects significantly boosts demand for home decor products. However, the market faces competitive pressure from product substitutes, such as repurposed furniture and DIY decor options. A thorough understanding of evolving consumer preferences, encompassing shifting aesthetic trends and lifestyle changes, is crucial for predicting future demand accurately.

United States Home Decor Market Industry Trends & Analysis

The U.S. home decor market demonstrates a robust Compound Annual Growth Rate (CAGR) projected at [Insert Projected CAGR]% during the forecast period (2025-2033). Key growth catalysts include escalating disposable incomes, increasing urbanization rates, and a growing desire for personalized living spaces. Technological disruptions, such as the expansion of e-commerce and the adoption of 3D printing, are reshaping the industry landscape. These technologies offer greater personalization capabilities and improve operational efficiency. A notable shift in consumer preferences towards sustainable and eco-friendly products is influencing product design and material sourcing strategies. Online sales penetration is steadily rising, reaching [Insert Percentage]% in 2025. Competitive dynamics are characterized by intense competition among established players and the emergence of innovative startups. The market shows especially strong growth within the millennial and Gen Z demographics, who exhibit a higher propensity for home improvement projects.

Leading Markets & Segments in United States Home Decor Market

By Distribution Channel:

- Online: This segment holds market dominance, driven by the convenience and accessibility offered by e-commerce platforms. Growth is propelled by increasing internet penetration and the expansion of mobile commerce.

- Specialty Stores: Specialty stores maintain a significant presence, offering curated product selections and personalized customer service. Sustained market growth depends on their ability to effectively integrate online presence and offer unique value propositions.

- Supermarkets/Hypermarkets: This segment commands a substantial share, particularly for basic home decor items. Future growth hinges on strategic product placement and diversification efforts.

- Other Distribution Channels: This category encompasses direct-to-consumer sales and wholesale channels, which retain stable market shares.

By Product:

- Home Furniture: This segment constitutes a major portion of the market, fueled by continuous renovation and furnishing activities.

- Home Textiles: This segment showcases robust growth, influenced by evolving fashion trends and increased consumer spending on home textiles.

- Flooring: This remains a prominent segment, driven by the growth in residential construction and renovation projects.

- Wall Decor: This segment demonstrates significant market share, reflecting a growing interest in personalized wall aesthetics.

- Lighting and Lamps: This segment exhibits solid growth, propelled by trends toward smart lighting and innovative designs.

- Accessories: This segment maintains a stable market share due to the consistent demand for smaller home decor accessories.

The Southern and Western regions of the U.S. exhibit particularly strong growth potential, driven by factors such as population growth, economic strength, and robust consumer spending patterns. Government initiatives promoting home renovation projects further contribute to market expansion.

United States Home Decor Market Product Developments

Recent product innovations focus on sustainable materials, smart home integration, and personalized design options. Manufacturers are increasingly leveraging 3D printing and other advanced technologies to create bespoke products and enhance efficiency. These developments contribute to market differentiation and cater to the evolving needs and preferences of consumers seeking unique, functional, and environmentally conscious home decor items.

Key Drivers of United States Home Decor Market Growth

Several factors contribute to the growth of the US home decor market. These include rising disposable incomes, enabling increased spending on home improvements; increased urbanization, resulting in greater demand for aesthetically pleasing living spaces; and technological advancements, introducing innovative products and streamlining the purchasing process. Government initiatives promoting sustainable housing solutions further enhance the market's growth trajectory.

Challenges in the United States Home Decor Market Market

The market faces certain challenges, including supply chain disruptions, causing fluctuations in material costs and product availability; intense competition, with established and new market entrants vying for share; and regulatory changes, creating additional compliance requirements. The fluctuations in the raw material prices can also affect the market, causing price volatility.

Emerging Opportunities in United States Home Decor Market

The US home decor market offers several promising opportunities, including the growing popularity of smart home technology and smart home furnishings, presenting opportunities for product innovation and integration; the increasing demand for sustainable and eco-friendly products, creating opportunities for brands that prioritize environmental responsibility; and the potential for market expansion through strategic partnerships and collaborations, broadening reach and enhancing brand recognition.

Leading Players in the United States Home Decor Market Sector

- Ikea USA

- Shaw Industries Group

- Crane & Canopy Inc

- Mannington Mills Inc

- Herman Miller Inc

- Generation Lighting

- Ashley Furniture

- Mohawak Flooring

- Kimball International

- American Textile Systems

- Acuity Brands Lighting

Key Milestones in United States Home Decor Market Industry

- April 2023: IKEA announces a USD 2.2 billion investment to bolster its omnichannel expansion within the U.S. market.

- June 2023: Overstock.com acquires select intellectual property assets from Bed Bath & Beyond.

- August 2023: Overstock.com and Bed Bath & Beyond launch a unified online retail platform, BedBathandBeyond.com.

- [Add more recent milestones here with dates and brief descriptions]

Strategic Outlook for United States Home Decor Market Market

The U.S. home decor market presents considerable potential for sustained growth. Key strategic opportunities include leveraging technological innovations, prioritizing sustainability initiatives, and establishing strategic partnerships to broaden market reach and enhance customer engagement. Companies that successfully adapt to evolving consumer preferences and embrace innovative approaches are well-positioned to capture substantial market share in the coming years. Focus on personalization, omnichannel strategies, and data-driven decision making will be crucial for success.

United States Home Decor Market Segmentation

-

1. Product

- 1.1. Home Furniture

- 1.2. Home Textiles

- 1.3. Flooring

- 1.4. Wall Decor

- 1.5. Lighting and Lamps

- 1.6. Acessoriess

- 1.7. Other Home Decor Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

United States Home Decor Market Segmentation By Geography

- 1. United States

United States Home Decor Market Regional Market Share

Geographic Coverage of United States Home Decor Market

United States Home Decor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Demand for Home Decor Products is Surging as People are Inclined to Show their Creativity Through DIY Activities.

- 3.3. Market Restrains

- 3.3.1. The Price Fluctuations of Raw Materials can be a Challenge for the Home Decor Industry.; Lack of Skilled Labour who Design Home Decor Furniture

- 3.4. Market Trends

- 3.4.1. The Market is Being Fueled by the Growth of E-Commerce Distribution

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Home Decor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Home Furniture

- 5.1.2. Home Textiles

- 5.1.3. Flooring

- 5.1.4. Wall Decor

- 5.1.5. Lighting and Lamps

- 5.1.6. Acessoriess

- 5.1.7. Other Home Decor Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ikea USA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shaw Industries Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crane & Canopy Inc**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mannington Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Herman Miller Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Generation Lighting

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashley Furniture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawak Flooring

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kimball International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 American Textile Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Acuity Brands Lighting

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ikea USA

List of Figures

- Figure 1: United States Home Decor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Home Decor Market Share (%) by Company 2025

List of Tables

- Table 1: United States Home Decor Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Home Decor Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Home Decor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Home Decor Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: United States Home Decor Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Home Decor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Home Decor Market?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the United States Home Decor Market?

Key companies in the market include Ikea USA, Shaw Industries Group, Crane & Canopy Inc**List Not Exhaustive, Mannington Mills Inc, Herman Miller Inc, Generation Lighting, Ashley Furniture, Mohawak Flooring, Kimball International, American Textile Systems, Acuity Brands Lighting.

3. What are the main segments of the United States Home Decor Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 206.70 Million as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Home Decor Products is Surging as People are Inclined to Show their Creativity Through DIY Activities..

6. What are the notable trends driving market growth?

The Market is Being Fueled by the Growth of E-Commerce Distribution.

7. Are there any restraints impacting market growth?

The Price Fluctuations of Raw Materials can be a Challenge for the Home Decor Industry.; Lack of Skilled Labour who Design Home Decor Furniture.

8. Can you provide examples of recent developments in the market?

August 2023: Overstock.com Inc., in collaboration with Bed Bath & Beyond, unveiled BedBathandBeyond.com in the United States. This strategic move consolidates the strengths of both companies, creating a unified online retail platform operating exclusively as Bed Bath & Beyond.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Home Decor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Home Decor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Home Decor Market?

To stay informed about further developments, trends, and reports in the United States Home Decor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence