Key Insights

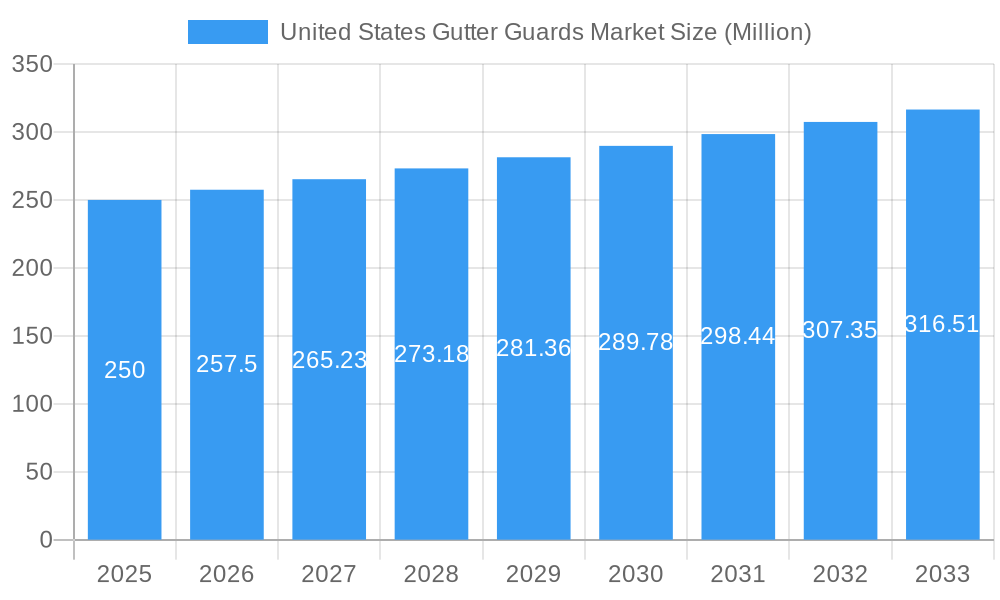

The United States gutter guard market is poised for significant expansion, propelled by heightened homeowner awareness of gutter protection benefits and a rise in extreme weather events. The market, valued at $2.88 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 2.2% through 2033. Key growth drivers include the increasing frequency of severe storms, which necessitates preventative gutter solutions to mitigate roof damage. The expanding availability of diverse gutter guard products, spanning various materials and styles, caters to a broad spectrum of consumer needs and budgets. Ongoing product innovation, focusing on advanced materials and installation techniques, is enhancing performance and durability. The residential sector leads market demand, driven by homeowner investment in water damage prevention. The commercial sector, including multi-family and commercial properties, presents substantial growth potential. Leading industry participants are actively employing strategic marketing and product line expansions to secure market share.

United States Gutter Guards Market Market Size (In Billion)

The competitive environment features both established market leaders and specialized smaller enterprises. Larger entities benefit from brand recognition and economies of scale, while smaller businesses often concentrate on niche offerings or localized customer service. Market dynamics are influenced by fluctuating raw material costs and intensifying competition. Nevertheless, sustained positive market momentum is anticipated, supported by favorable consumer trends and continuous industry innovation. Strategic alliances, product portfolio diversification, and focused marketing strategies are vital for sustained success. While detailed segment and regional data are not provided, significant market concentration is expected in the Northeast and Southeast United States due to prevalent weather patterns requiring robust gutter protection.

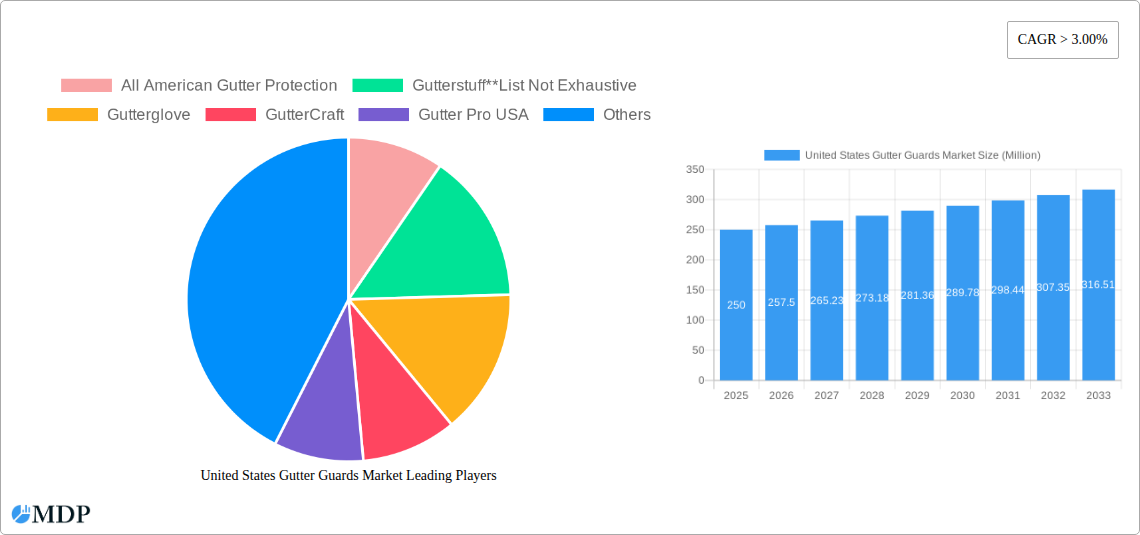

United States Gutter Guards Market Company Market Share

United States Gutter Guards Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States Gutter Guards market, offering invaluable insights for stakeholders across the industry. From market dynamics and leading players to emerging opportunities and future projections, this report covers all key aspects of this growing sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The market size is projected to reach xx Million by 2033.

United States Gutter Guards Market Market Dynamics & Concentration

The US Gutter Guards market exhibits a moderately concentrated landscape, with key players like All American Gutter Protection, Gutterstuff, Gutterglove, GutterCraft, Gutter Pro USA, Gutter Guards America, Raptor, Amerimax, Leaf Guard, and Homecraft Gutter Protection vying for market share. However, the market also accommodates several smaller, regional players. The market share of the top 5 players is estimated at xx%.

Market Concentration Metrics:

- Market Concentration Ratio (CR5): xx%

- Herfindahl-Hirschman Index (HHI): xx

Innovation Drivers:

- Development of durable, long-lasting materials.

- Integration of smart technologies for enhanced performance.

- Focus on eco-friendly and sustainable solutions.

Regulatory Frameworks:

- Building codes and regulations influencing product standards.

- Environmental regulations impacting material selection.

Product Substitutes:

- Traditional gutter cleaning methods.

- DIY gutter protection solutions.

End-User Trends:

- Growing demand from homeowners prioritizing maintenance-free solutions.

- Increasing adoption among commercial buildings for cost savings.

M&A Activities: The number of M&A deals in the US Gutter Guards market during the historical period (2019-2024) was approximately xx. Consolidation is expected to continue, driving market concentration.

United States Gutter Guards Market Industry Trends & Analysis

The US Gutter Guards market is experiencing robust growth, driven by several key factors. The market's CAGR during the forecast period (2025-2033) is projected to be xx%. Market penetration is currently estimated at xx% and is expected to reach xx% by 2033.

This growth is fueled by rising awareness of the benefits of gutter guards, including reduced maintenance, protection against water damage, and prevention of pest infestations. Technological advancements, such as the introduction of self-cleaning gutter guards and smart gutter systems, are further enhancing market appeal. Changing consumer preferences, particularly towards convenient and efficient solutions, also play a significant role. Competitive dynamics remain intense, with companies constantly striving to innovate and differentiate their offerings. The increasing prevalence of extreme weather events has also increased demand for effective gutter protection solutions.

Leading Markets & Segments in United States Gutter Guards Market

The residential segment dominates the US Gutter Guards market, accounting for approximately xx% of the total market value. Among product types, mesh and screen gutter guards enjoy the largest share, followed by hoods and covers. Metal gutter guards currently hold the leading position in terms of material type.

Key Drivers by Segment:

By Product:

- Meshes and Screens: Cost-effectiveness, ease of installation.

- Hoods and Covers: Superior protection against debris buildup.

- Plastic Frames and Bristles: Lightweight, affordability.

By Material Type:

- Metal: Durability, longevity.

- Plastic: Affordability, lightweight.

- Others: Niche applications, specialized features.

By End User:

- Residential: High demand driven by homeowner preference for maintenance-free solutions.

- Commercial: Cost savings, protection of building infrastructure.

Geographic Dominance: The Southeast and Northeast regions of the US exhibit the highest market demand owing to factors like high rainfall and prevalence of trees.

United States Gutter Guards Market Product Developments

Recent years have witnessed significant innovation in gutter guard technology, including the introduction of self-cleaning systems, smart gutter monitoring features, and improved material compositions. The focus is shifting towards eco-friendly options and improved aesthetics to better suit modern architectural designs. The development of UPVC nets (as seen with Leaf Guard's 2020 launch) represents a significant step toward maintenance-free gutter systems, addressing a crucial consumer need. This trend is likely to continue, with emphasis on materials which are robust enough to resist even the harshest weather conditions.

Key Drivers of United States Gutter Guards Market Growth

Several factors are contributing to the expansion of the US Gutter Guards market. Technological advancements, such as the development of self-cleaning and smart gutter guards, have enhanced functionality and user experience. Favorable economic conditions and increased homeowner disposable income support higher spending on home improvement projects. Lastly, stricter building codes and regulations in some regions are pushing adoption of gutter guards for improved water management and damage prevention.

Challenges in the United States Gutter Guards Market Market

The US Gutter Guards market faces challenges including intense competition, high installation costs that can deter some consumers, and the potential for supply chain disruptions impacting material availability and pricing. Regulatory hurdles in specific regions can also create obstacles for market expansion. These factors can influence market growth rates and profitability for individual companies.

Emerging Opportunities in United States Gutter Guards Market

The market presents significant opportunities for growth through strategic partnerships, mergers and acquisitions among existing players, and the entry of new players with innovative products. Technological breakthroughs, particularly in smart home integration and AI-powered gutter management, promise to unlock new market segments and enhance product appeal. Expansion into underserved markets and developing tailored solutions for specific geographic locations also holds considerable potential.

Leading Players in the United States Gutter Guards Market Sector

- All American Gutter Protection

- Gutterstuff

- Gutterglove

- GutterCraft

- Gutter Pro USA

- Gutter Guards America

- Raptor

- Amerimax

- Leaf Guard

- Homecraft Gutter Protection

Key Milestones in United States Gutter Guards Market Industry

- 2020: Leaf Guard launches a UPVC net for leaf-prone areas, enabling maintenance-free gutters. This significantly impacted market perception and demand.

Strategic Outlook for United States Gutter Guards Market Market

The US Gutter Guards market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and favorable economic conditions. Strategic opportunities exist for companies focusing on innovation, sustainable solutions, and targeted marketing efforts. The market’s future trajectory hinges on addressing ongoing challenges and capitalizing on emerging opportunities to maintain a competitive edge.

United States Gutter Guards Market Segmentation

-

1. Product

- 1.1. Meshes and Screens

- 1.2. Hoods and Covers

- 1.3. Plastic Frames and Bristles

-

2. Material Type

- 2.1. Metal

- 2.2. Plastic

- 2.3. Others

-

3. End User

- 3.1. Residential

- 3.2. Commercial

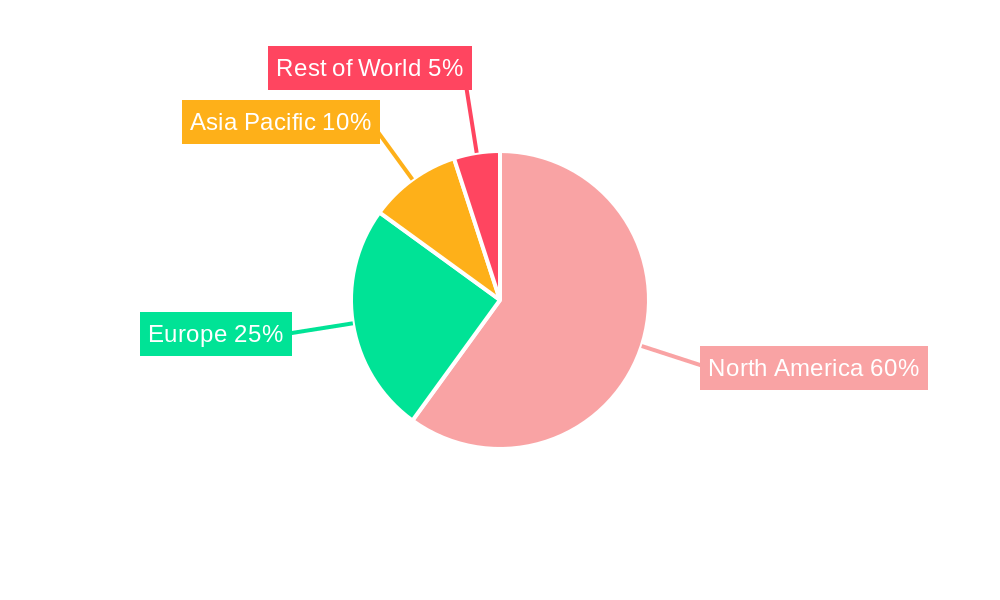

United States Gutter Guards Market Segmentation By Geography

- 1. United States

United States Gutter Guards Market Regional Market Share

Geographic Coverage of United States Gutter Guards Market

United States Gutter Guards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. The Aging US population is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Gutter Guards Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Meshes and Screens

- 5.1.2. Hoods and Covers

- 5.1.3. Plastic Frames and Bristles

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Metal

- 5.2.2. Plastic

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 All American Gutter Protection

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gutterstuff**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gutterglove

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GutterCraft

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gutter Pro USA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gutter Guards America

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raptor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amerimax

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Leaf Guard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Homecraft Gutter Protection

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 All American Gutter Protection

List of Figures

- Figure 1: United States Gutter Guards Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Gutter Guards Market Share (%) by Company 2025

List of Tables

- Table 1: United States Gutter Guards Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Gutter Guards Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: United States Gutter Guards Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Gutter Guards Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Gutter Guards Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Gutter Guards Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 7: United States Gutter Guards Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: United States Gutter Guards Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Gutter Guards Market?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the United States Gutter Guards Market?

Key companies in the market include All American Gutter Protection, Gutterstuff**List Not Exhaustive, Gutterglove, GutterCraft, Gutter Pro USA, Gutter Guards America, Raptor, Amerimax, Leaf Guard, Homecraft Gutter Protection.

3. What are the main segments of the United States Gutter Guards Market?

The market segments include Product, Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

The Aging US population is driving the market.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

In 2020, Leaf Guard launched a UPVC net which can be clipped to the gutter in leaf prone areas whereby the leaf will fall in the flat surface and could fly away. This has enabled a maintenance free gutter.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Gutter Guards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Gutter Guards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Gutter Guards Market?

To stay informed about further developments, trends, and reports in the United States Gutter Guards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence