Key Insights

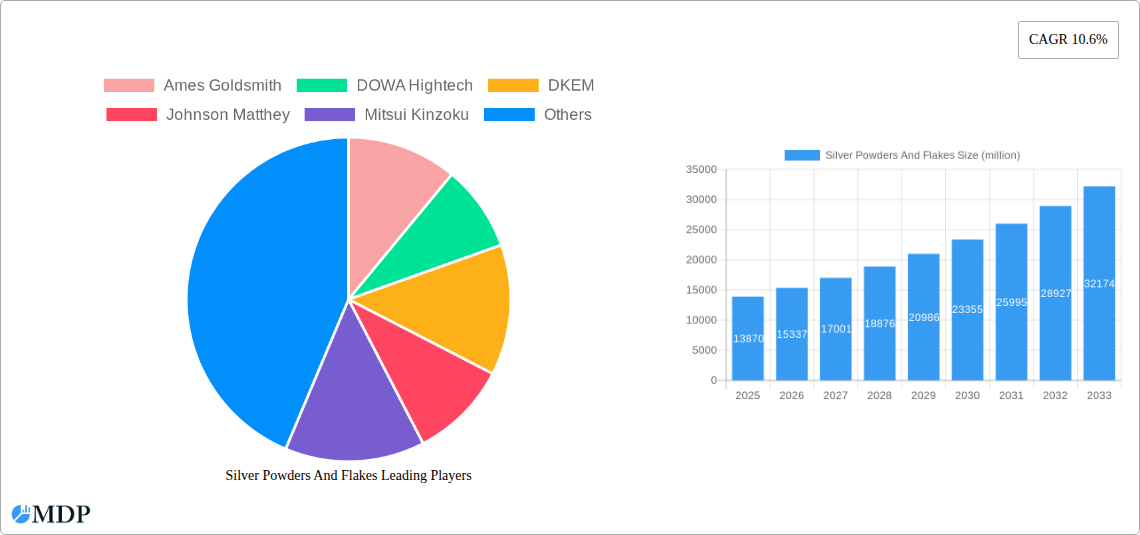

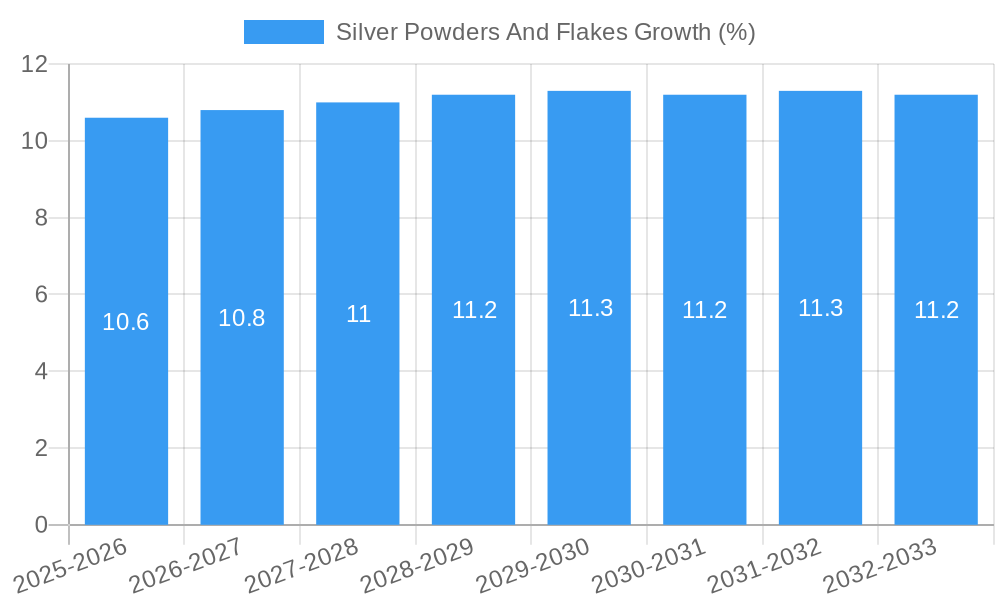

The global Silver Powders and Flakes market is poised for robust expansion, currently valued at an estimated $13,870 million. Driven by a strong Compound Annual Growth Rate (CAGR) of 10.6%, the market is projected to witness significant value appreciation over the forecast period of 2025-2033. This dynamic growth is primarily fueled by the escalating demand from the photovoltaic industry, where silver-based materials are indispensable for efficient solar cell manufacturing. The increasing global emphasis on renewable energy sources and government incentives for solar installations directly translate into a higher consumption of silver powders and flakes. Furthermore, the expanding applications in conductive pastes for electronics, printed circuit boards (PCBs), and advanced conductive glues are also contributing significantly to market momentum. As technology advances and the need for high-performance conductive materials grows across various sectors, the market for silver powders and flakes is expected to gain further traction.

Key drivers underpinning this growth include the inherent superior electrical conductivity of silver, its excellent reflectivity, and its antimicrobial properties, which are being leveraged in innovative applications. The burgeoning electronics sector, with its relentless pursuit of miniaturization and enhanced performance, presents a continuous demand for fine silver powders and flakes. Emerging trends such as the integration of silver into flexible electronics, wearable devices, and advanced sensor technologies are also opening new avenues for market expansion. While the high cost of silver can pose a restraint, ongoing research and development into optimizing its usage and exploring cost-effective alternatives are mitigating this challenge. The market exhibits a diverse segmentation by application, with Photovoltaic leading the charge, followed by Conductive Paste and Printed Circuit Board. By type, Silver Powders and Silver Flakes cater to distinct industrial requirements, with both segments expected to grow in tandem with their respective application areas. The competitive landscape is characterized by the presence of numerous global and regional players, indicating a healthy market with opportunities for both established and emerging companies.

Silver Powders And Flakes Market Analysis: Comprehensive Study 2019-2033 (Base Year 2025)

This in-depth market research report provides an exhaustive analysis of the global Silver Powders and Flakes market, covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033. Delving into critical aspects of market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook, this report is an indispensable resource for industry stakeholders. It incorporates high-traffic keywords to maximize search visibility and attract professionals and decision-makers across the value chain.

Silver Powders And Flakes Market Dynamics & Concentration

The Silver Powders and Flakes market exhibits a moderate to high concentration, with a significant share held by key players such as Ames Goldsmith, DOWA Hightech, DKEM, Johnson Matthey, Mitsui Kinzoku, Technic, Fukuda, Shoei Chemical, AG PRO Technology, MEPCO, Cermet, Yamamoto Precious Metal, TANAKA, Shin Nihon Kakin, Tokuriki Honten, Tongling Nonferrous Metals Group Holding, CNMC Ningxia Orient Group, Ningbo Jingxin Electronic Material, Kunming Noble Metal Electronic Materials, Nonfemet, RightSilver, Changgui Metal Powder, Yunnan Copper Science & Technology, Nippon Atomized Metal Powders, and Daiken Chemical. Innovation drivers, particularly in particle size control and morphology, are crucial for enhancing performance in applications like conductive pastes and photovoltaic cells. Regulatory frameworks, primarily focused on environmental safety and responsible sourcing of precious metals, influence manufacturing processes and product development. Product substitutes, while present in some lower-performance applications, are generally unable to match the superior conductivity and reliability offered by silver. End-user trends are increasingly demanding higher purity and tailored properties for advanced electronics. Merger and acquisition (M&A) activities are expected to remain active as companies seek to consolidate market share, acquire innovative technologies, and expand their geographic reach, with an estimated xx M&A deals projected during the forecast period.

Silver Powders And Flakes Industry Trends & Analysis

The Silver Powders and Flakes industry is poised for robust growth, driven by the insatiable demand for advanced electronic components and renewable energy solutions. The Compound Annual Growth Rate (CAGR) is projected to be a healthy xx% during the forecast period. Market penetration is deep within established sectors like printed circuit boards (PCBs) and conductive pastes, with significant expansion anticipated in emerging applications. Technological disruptions are a constant, with advancements in atomization techniques and nano-particle synthesis enabling the creation of silver powders and flakes with unprecedented conductivity, finer particle sizes, and improved dispersion characteristics. These innovations are directly responding to evolving consumer preferences for smaller, more powerful, and energy-efficient electronic devices. The competitive dynamics are characterized by a blend of established global manufacturers and emerging regional players, all vying for market share through product differentiation, cost-effectiveness, and strategic partnerships. The increasing adoption of electric vehicles (EVs), the burgeoning 5G infrastructure, and the continued global push towards solar energy are significant market growth drivers, creating a sustained demand for high-performance silver materials. Furthermore, the growing trend towards miniaturization in electronics necessitates the use of finer silver powders and flakes for intricate circuitry and advanced packaging solutions. The development of novel conductive adhesives and inks, leveraging the unique properties of silver, is also opening new avenues for market expansion, particularly in flexible electronics and wearable technology. The shift towards sustainable manufacturing practices and the exploration of recycled silver sources are also influencing industry trends, pushing for greater efficiency and reduced environmental impact.

Leading Markets & Segments in Silver Powders And Flakes

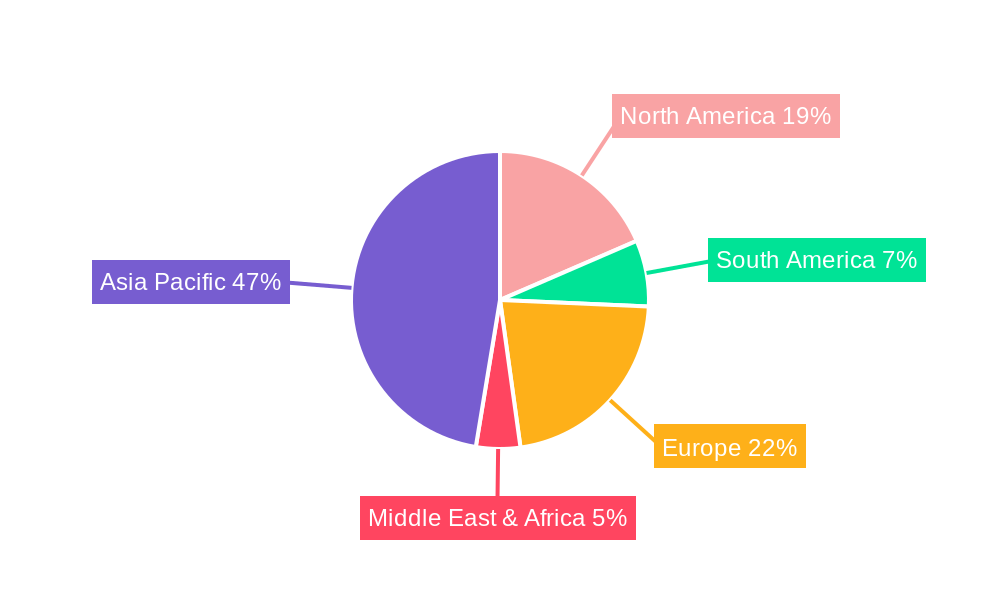

The global Silver Powders and Flakes market is dominated by Asia Pacific, driven by its robust manufacturing base for electronics and its significant investments in renewable energy. Within this region, China stands out as a leading country due to its extensive production capacity and high consumption of silver materials in the photovoltaic and printed circuit board industries.

Dominant Segments:

Application:

- Photovoltaic: This segment is experiencing exponential growth, fueled by government incentives and the global imperative to transition to clean energy. The demand for high-efficiency solar cells directly translates to a higher requirement for silver pastes, where silver powders and flakes are critical components. Economic policies supporting renewable energy deployment, coupled with significant infrastructure investments in solar farms, are key drivers.

- Conductive Paste: A cornerstone application, conductive pastes are vital for numerous electronic components, including resistors, capacitors, and sensors. The continuous miniaturization of electronic devices and the increasing complexity of circuitry amplify the demand for high-performance conductive pastes that rely heavily on silver powders and flakes.

- Printed Circuit Board (PCB): The ever-expanding electronics industry, from consumer gadgets to industrial automation, underpins the sustained demand for PCBs. Silver's superior conductivity makes it indispensable for high-density interconnects and complex PCB designs.

- Conductive Glue: The development of advanced conductive glues is opening new applications in electronics assembly and repair, offering flexibility and reliability where traditional soldering might be challenging.

- Others: This category encompasses niche but growing applications in areas like medical devices, conductive inks for flexible electronics, and specialized coatings.

Type:

- Silver Powders: Offering a wide range of particle sizes and morphologies, silver powders are fundamental to most applications, particularly conductive pastes and photovoltaic cells.

- Silver Flakes: Preferred for applications requiring excellent surface coverage and conductivity, silver flakes are crucial in certain conductive inks and coatings where thin film deposition is critical.

Silver Powders And Flakes Product Developments

Recent product developments in silver powders and flakes focus on achieving ultra-fine particle sizes, enhanced morphology control, and improved purity levels. Innovations in atomization and chemical synthesis processes are yielding materials with superior electrical conductivity, dispersion stability, and processability for demanding applications. These advancements enable the creation of next-generation conductive pastes for high-density interconnects, advanced solar cells with higher efficiency, and flexible electronic components with improved durability and performance. The competitive advantage lies in offering tailored solutions that meet the precise requirements of emerging technologies, thereby capturing market share in high-value segments.

Key Drivers of Silver Powders And Flakes Growth

The growth of the Silver Powders and Flakes market is propelled by several key factors. Technologically, the relentless pursuit of miniaturization and increased functionality in electronics necessitates materials with superior conductivity and finer particle sizes. Economically, the booming renewable energy sector, particularly solar power, represents a substantial growth engine, as silver is a critical component in photovoltaic cells. Regulatory support for clean energy and technological advancements in electronics manufacturing further bolsters demand.

Challenges in the Silver Powders And Flakes Market

Despite its strong growth trajectory, the Silver Powders and Flakes market faces several challenges. Fluctuations in the global price of silver can impact manufacturing costs and profitability. Stringent environmental regulations concerning the handling and disposal of precious metals can add to operational expenses. Furthermore, the development of alternative conductive materials, while not yet a significant threat in high-performance applications, poses a potential long-term challenge. Supply chain disruptions, as witnessed in recent global events, can also affect the availability and cost of raw materials.

Emerging Opportunities in Silver Powders And Flakes

Emerging opportunities for the Silver Powders and Flakes market lie in several promising areas. Technological breakthroughs in additive manufacturing (3D printing) for electronics are creating demand for specialized silver inks and pastes with precise rheological properties. Strategic partnerships between silver powder manufacturers and electronic component producers can accelerate the development and adoption of innovative solutions. Market expansion into rapidly developing economies with growing electronics manufacturing sectors and increasing renewable energy investments also presents significant growth potential. The development of novel applications in flexible electronics, wearable devices, and advanced sensors will further drive demand.

Leading Players in the Silver Powders And Flakes Sector

- Ames Goldsmith

- DOWA Hightech

- DKEM

- Johnson Matthey

- Mitsui Kinzoku

- Technic

- Fukuda

- Shoei Chemical

- AG PRO Technology

- MEPCO

- Cermet

- Yamamoto Precious Metal

- TANAKA

- Shin Nihon Kakin

- Tokuriki Honten

- Tongling Nonferrous Metals Group Holding

- CNMC Ningxia Orient Group

- Ningbo Jingxin Electronic Material

- Kunming Noble Metal Electronic Materials

- Nonfemet

- RightSilver

- Changgui Metal Powder

- Yunnan Copper Science & Technology

- Nippon Atomized Metal Powders

- Daiken Chemical

Key Milestones in Silver Powders And Flakes Industry

- 2020: Increased adoption of advanced sputtering techniques for producing high-purity silver films, impacting the demand for fine silver powders.

- 2021: Significant growth in the photovoltaic sector due to favorable government policies and declining solar panel costs, boosting demand for silver pastes.

- 2022: Launch of novel nano-silver powders with enhanced conductivity for flexible electronic applications.

- 2023: Increased focus on sustainable sourcing and recycling of silver, influencing manufacturing processes and material selection.

- 2024: Development of specialized silver flakes for high-frequency circuit applications, meeting the demands of 5G technology.

Strategic Outlook for Silver Powders And Flakes Market

The strategic outlook for the Silver Powders and Flakes market remains highly positive. Continued innovation in material science, particularly in tailoring particle size, shape, and purity, will be a key differentiator. Strategic collaborations and partnerships across the value chain, from raw material suppliers to end-product manufacturers, will accelerate market penetration into emerging applications. Companies that can offer cost-effective, high-performance solutions while adhering to stringent environmental standards will be best positioned for long-term success. The growing demand for advanced electronics and sustainable energy solutions ensures sustained growth and market potential for silver powders and flakes.

Silver Powders And Flakes Segmentation

-

1. Application

- 1.1. Photovoltaic

- 1.2. Conductive Paste

- 1.3. Printed Circuit Board

- 1.4. Conductive Glue

- 1.5. Others

-

2. Type

- 2.1. Silver Powders

- 2.2. Silver Flakes

Silver Powders And Flakes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Silver Powders And Flakes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silver Powders And Flakes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Photovoltaic

- 5.1.2. Conductive Paste

- 5.1.3. Printed Circuit Board

- 5.1.4. Conductive Glue

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Silver Powders

- 5.2.2. Silver Flakes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Silver Powders And Flakes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Photovoltaic

- 6.1.2. Conductive Paste

- 6.1.3. Printed Circuit Board

- 6.1.4. Conductive Glue

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Silver Powders

- 6.2.2. Silver Flakes

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Silver Powders And Flakes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Photovoltaic

- 7.1.2. Conductive Paste

- 7.1.3. Printed Circuit Board

- 7.1.4. Conductive Glue

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Silver Powders

- 7.2.2. Silver Flakes

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Silver Powders And Flakes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Photovoltaic

- 8.1.2. Conductive Paste

- 8.1.3. Printed Circuit Board

- 8.1.4. Conductive Glue

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Silver Powders

- 8.2.2. Silver Flakes

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Silver Powders And Flakes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Photovoltaic

- 9.1.2. Conductive Paste

- 9.1.3. Printed Circuit Board

- 9.1.4. Conductive Glue

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Silver Powders

- 9.2.2. Silver Flakes

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Silver Powders And Flakes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Photovoltaic

- 10.1.2. Conductive Paste

- 10.1.3. Printed Circuit Board

- 10.1.4. Conductive Glue

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Silver Powders

- 10.2.2. Silver Flakes

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ames Goldsmith

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DOWA Hightech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DKEM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Johnson Matthey

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsui Kinzoku

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Technic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fukuda

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shoei Chemical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AG PRO Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MEPCO

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cermet

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Yamamoto Precious Metal

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TANAKA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shin Nihon Kakin

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tokuriki Honten

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Tongling Nonferrous Metals Group Holding

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 CNMC Ningxia Orient Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ningbo Jingxin Electronic Material

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Kunming Noble Metal Electronic Materials

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Nonfemet

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 RightSilver

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Changgui Metal Powder

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Yunnan Copper Science & Technology

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Nippon Atomized Metal Powders

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Daiken Chemical

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Ames Goldsmith

List of Figures

- Figure 1: Global Silver Powders And Flakes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Silver Powders And Flakes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Silver Powders And Flakes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Silver Powders And Flakes Revenue (million), by Type 2024 & 2032

- Figure 5: North America Silver Powders And Flakes Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Silver Powders And Flakes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Silver Powders And Flakes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Silver Powders And Flakes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Silver Powders And Flakes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Silver Powders And Flakes Revenue (million), by Type 2024 & 2032

- Figure 11: South America Silver Powders And Flakes Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Silver Powders And Flakes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Silver Powders And Flakes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Silver Powders And Flakes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Silver Powders And Flakes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Silver Powders And Flakes Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Silver Powders And Flakes Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Silver Powders And Flakes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Silver Powders And Flakes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Silver Powders And Flakes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Silver Powders And Flakes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Silver Powders And Flakes Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Silver Powders And Flakes Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Silver Powders And Flakes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Silver Powders And Flakes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Silver Powders And Flakes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Silver Powders And Flakes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Silver Powders And Flakes Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Silver Powders And Flakes Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Silver Powders And Flakes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Silver Powders And Flakes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Silver Powders And Flakes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Silver Powders And Flakes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Silver Powders And Flakes Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Silver Powders And Flakes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Silver Powders And Flakes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Silver Powders And Flakes Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Silver Powders And Flakes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Silver Powders And Flakes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Silver Powders And Flakes Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Silver Powders And Flakes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Silver Powders And Flakes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Silver Powders And Flakes Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Silver Powders And Flakes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Silver Powders And Flakes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Silver Powders And Flakes Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Silver Powders And Flakes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Silver Powders And Flakes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Silver Powders And Flakes Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Silver Powders And Flakes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Silver Powders And Flakes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silver Powders And Flakes?

The projected CAGR is approximately 10.6%.

2. Which companies are prominent players in the Silver Powders And Flakes?

Key companies in the market include Ames Goldsmith, DOWA Hightech, DKEM, Johnson Matthey, Mitsui Kinzoku, Technic, Fukuda, Shoei Chemical, AG PRO Technology, MEPCO, Cermet, Yamamoto Precious Metal, TANAKA, Shin Nihon Kakin, Tokuriki Honten, Tongling Nonferrous Metals Group Holding, CNMC Ningxia Orient Group, Ningbo Jingxin Electronic Material, Kunming Noble Metal Electronic Materials, Nonfemet, RightSilver, Changgui Metal Powder, Yunnan Copper Science & Technology, Nippon Atomized Metal Powders, Daiken Chemical.

3. What are the main segments of the Silver Powders And Flakes?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13870 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silver Powders And Flakes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silver Powders And Flakes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silver Powders And Flakes?

To stay informed about further developments, trends, and reports in the Silver Powders And Flakes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence