Key Insights

The Russia laundry appliances market, valued at approximately $11.12 billion in the base year 2025, is poised for sustained expansion. This growth is fueled by rising disposable incomes, increasing urbanization, and a growing consumer preference for contemporary, convenient home appliances. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1%. Key segments encompass freestanding and built-in washing machines and dryers, electric smoothing irons, and ancillary laundry devices. Automatic washing machines are expected to lead the technology segment, driven by consumer demand for time-efficient and effective laundry solutions. Leading manufacturers, including LG, Samsung, Bosch, and Electrolux, are actively competing through product innovation, strategic alliances, and robust distribution networks spanning online and offline retail. Western Russia is anticipated to exhibit stronger growth due to higher disposable incomes and advanced infrastructure. While economic volatility and supply chain disruptions present challenges, the long-term outlook remains optimistic, bolstered by a growing middle class and ongoing modernization initiatives.

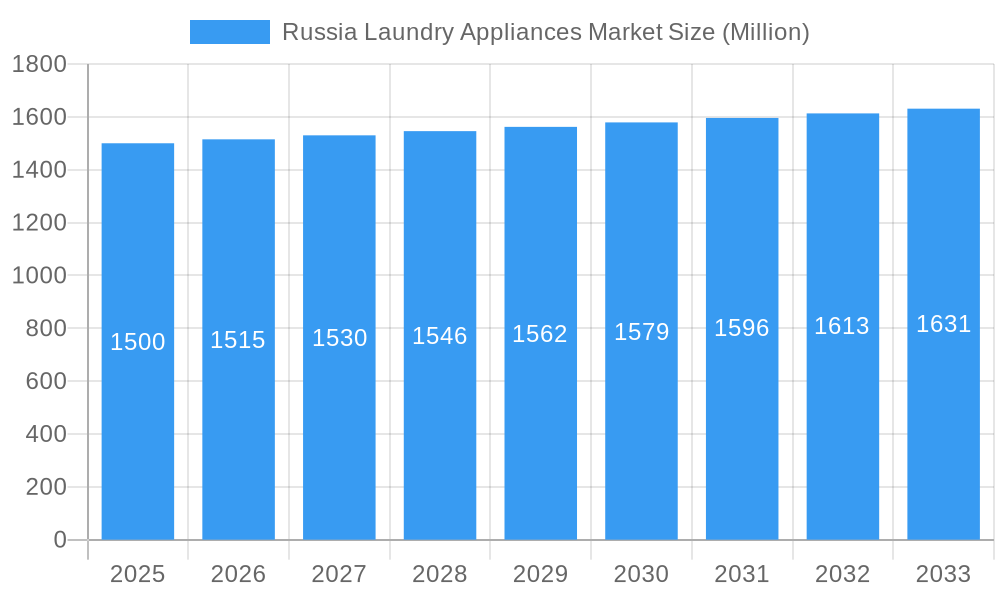

Russia Laundry Appliances Market Market Size (In Billion)

The forecast period, 2025-2033, anticipates a steady increase in market size. This expansion will be influenced by a higher adoption rate of automatic washing machines, progressively replacing semi-automatic and manual models. The e-commerce sector is expected to play an increasingly significant role in driving sales. Furthermore, manufacturers’ emphasis on energy-efficient and smart appliances will be a key sales driver. However, economic conditions and geopolitical factors will continue to significantly influence market performance. Competitive strategies from established brands and the emergence of new market entrants will also shape the landscape. A thorough understanding of these dynamics is essential for businesses aiming for success in this evolving market.

Russia Laundry Appliances Market Company Market Share

Russia Laundry Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia laundry appliances market, covering the period 2019-2033. It offers valuable insights into market dynamics, leading players, key trends, and future growth prospects, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. Market values are expressed in Millions.

Russia Laundry Appliances Market Market Dynamics & Concentration

The Russia laundry appliances market exhibits a moderately concentrated structure, with key players like LG, Candy, Atlant, Indesit, Hotpoint, Electrolux, Haier, Beko, Gorenje, Bosch, and Samsung vying for market share. Market concentration is influenced by factors such as brand recognition, product differentiation, distribution networks, and pricing strategies. Innovation, primarily driven by technological advancements in energy efficiency and smart features, plays a significant role in shaping market dynamics. Regulatory frameworks, including energy efficiency standards and safety regulations, impact product design and market access. Substitute products, such as traditional laundry methods, exert limited competitive pressure. Consumer preferences are shifting towards energy-efficient, technologically advanced appliances, reflecting an evolving focus on convenience and sustainability. The market has witnessed a moderate level of M&A activity, with strategic acquisitions aimed at expanding market reach and technological capabilities. For example, LG’s acquisition of AppleMango in 2022 reflects a broader trend towards strategic investments in related technologies, although not directly within the laundry appliance sector itself. Overall, the market exhibits a complex interplay of competitive forces and technological advancements, contributing to its dynamic nature.

- Market Share: The market share of the top 5 players is estimated at xx%.

- M&A Deal Count: The number of M&A deals in the last 5 years is estimated at xx.

Russia Laundry Appliances Market Industry Trends & Analysis

The Russia laundry appliances market is experiencing steady growth, driven by several key factors. Rising disposable incomes and urbanization are contributing to increased demand for modern, convenient household appliances. Technological advancements, such as the introduction of smart appliances with connectivity features and improved energy efficiency, are shaping consumer preferences. The market is witnessing a gradual shift from semi-automatic to fully automatic washing machines and dryers, reflecting increasing consumer preference for convenience and time-saving solutions. Competitive dynamics are intense, with manufacturers focusing on product differentiation, innovation, and strategic pricing to gain market share. Consumer preferences for specific features vary across regions, impacting product design and marketing strategies. The market's CAGR during the historical period (2019-2024) is estimated at xx%, with market penetration of automatic washing machines exceeding xx% in urban areas. The forecast period (2025-2033) projects a continued, albeit moderated, growth trajectory due to the ongoing geopolitical context and economic fluctuations.

Leading Markets & Segments in Russia Laundry Appliances Market

The largest segment within the Russia laundry appliances market is washing machines, followed by dryers and electric smoothing irons. Within washing machine types, freestanding models maintain a significant market share compared to built-in options, driven by affordability and adaptability to various living spaces. The automatic technology segment dominates the washing machine market, reflecting the increasing demand for ease of use and efficiency. Multi-brand stores constitute the leading distribution channel, offering wide product availability and reach.

- Key Drivers for Washing Machines: Affordability, energy efficiency improvements, and increased availability in multi-brand stores.

- Key Drivers for Dryers: Rising disposable incomes and preference for convenient clothes drying solutions.

- Key Drivers for Multi-Brand Stores: Wider product reach, competitive pricing, and established consumer trust.

Regional variations exist within Russia, with larger urban centers exhibiting higher market penetration due to higher disposable income and improved infrastructure.

Russia Laundry Appliances Market Product Developments

Recent product innovations focus on enhanced energy efficiency, smart connectivity features, and improved cleaning performance. Manufacturers are incorporating advanced technologies, such as AI-powered washing programs and steam cleaning capabilities, to enhance user experience and meet evolving consumer demands. These developments contribute to improved product differentiation and competitive advantage, influencing the overall market landscape and consumer choices.

Key Drivers of Russia Laundry Appliances Market Growth

Growth is primarily driven by rising disposable incomes and the increasing preference for convenient, energy-efficient appliances among urban households. Technological advancements in features such as smart connectivity and improved cleaning efficacy further stimulate demand. Government initiatives promoting energy efficiency and sustainable consumption play a supporting role, although their direct impact is comparatively less compared to consumer demand and income levels.

Challenges in the Russia Laundry Appliances Market Market

Economic fluctuations and geopolitical instability pose significant challenges to market growth. Supply chain disruptions caused by global events can impact product availability and pricing. Intense competition and pricing pressures create difficulties for manufacturers in maintaining profitability and market share.

Emerging Opportunities in Russia Laundry Appliances Market

Expansion into rural markets through improved distribution networks presents a significant opportunity for growth. The increasing adoption of online shopping offers avenues for manufacturers to increase reach and access new customer segments. Strategic partnerships and collaborations between manufacturers and retailers can enhance market penetration and consumer access.

Key Milestones in Russia Laundry Appliances Market Industry

- June 2022: LG Electronics' acquisition of AppleMango, while not directly impacting the laundry appliance market, signals the company's investment in related technologies and potential future applications in home appliances.

- February 2022: Bosch's investment in Autozilla Solutions demonstrates the company's broader strategic focus, with indirect implications for supply chain management and technological integration within the wider appliance sector.

Strategic Outlook for Russia Laundry Appliances Market Market

The Russia laundry appliances market presents substantial long-term growth potential, driven by increasing urbanization, rising disposable incomes, and the ongoing demand for convenient and energy-efficient appliances. Strategic opportunities lie in expanding into underserved markets, leveraging technological advancements, and forming strategic partnerships to enhance market penetration and brand visibility. Manufacturers need to adapt to shifting consumer preferences, manage supply chain challenges effectively and navigate the complexities of the evolving geopolitical landscape.

Russia Laundry Appliances Market Segmentation

-

1. Type

- 1.1. Freestanding

- 1.2. Built-in

-

2. Product

- 2.1. Washing Machines

- 2.2. Dryers

- 2.3. Electric Smoothing Irons

- 2.4. Other Products

-

3. Technology

- 3.1. Automatic

- 3.2. Semi-Automatic/ Manual

- 3.3. Other Technologies

-

4. Distribution Channel

- 4.1. Multi-Brand Stores

- 4.2. Exclusive Stores

- 4.3. Online

- 4.4. Other Distribution Channels

Russia Laundry Appliances Market Segmentation By Geography

- 1. Russia

Russia Laundry Appliances Market Regional Market Share

Geographic Coverage of Russia Laundry Appliances Market

Russia Laundry Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. The Washing Machine Segment Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Laundry Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Freestanding

- 5.1.2. Built-in

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Washing Machines

- 5.2.2. Dryers

- 5.2.3. Electric Smoothing Irons

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Automatic

- 5.3.2. Semi-Automatic/ Manual

- 5.3.3. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Multi-Brand Stores

- 5.4.2. Exclusive Stores

- 5.4.3. Online

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Candy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Atlant

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indesit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hotpoint

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Electrolux

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haier**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beko

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gorenje

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bosch

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Samsung

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: Russia Laundry Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Laundry Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russia Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Russia Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Russia Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Russia Laundry Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Russia Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Russia Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Russia Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 9: Russia Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Russia Laundry Appliances Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Laundry Appliances Market?

The projected CAGR is approximately 1%.

2. Which companies are prominent players in the Russia Laundry Appliances Market?

Key companies in the market include LG, Candy, Atlant, Indesit, Hotpoint, Electrolux, Haier**List Not Exhaustive, Beko, Gorenje, Bosch, Samsung.

3. What are the main segments of the Russia Laundry Appliances Market?

The market segments include Type, Product, Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

The Washing Machine Segment Dominates the Market.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

June 2022: LG Electronics announced the acquisition of the South Korean EV charger solutions provider, AppleMango, jointly with GS Energy and GS Neotek. The acquisition is expected to accelerate the growth of LG's EV charging solution business and enable the company to take advantage of future business opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Laundry Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Laundry Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Laundry Appliances Market?

To stay informed about further developments, trends, and reports in the Russia Laundry Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence