Key Insights

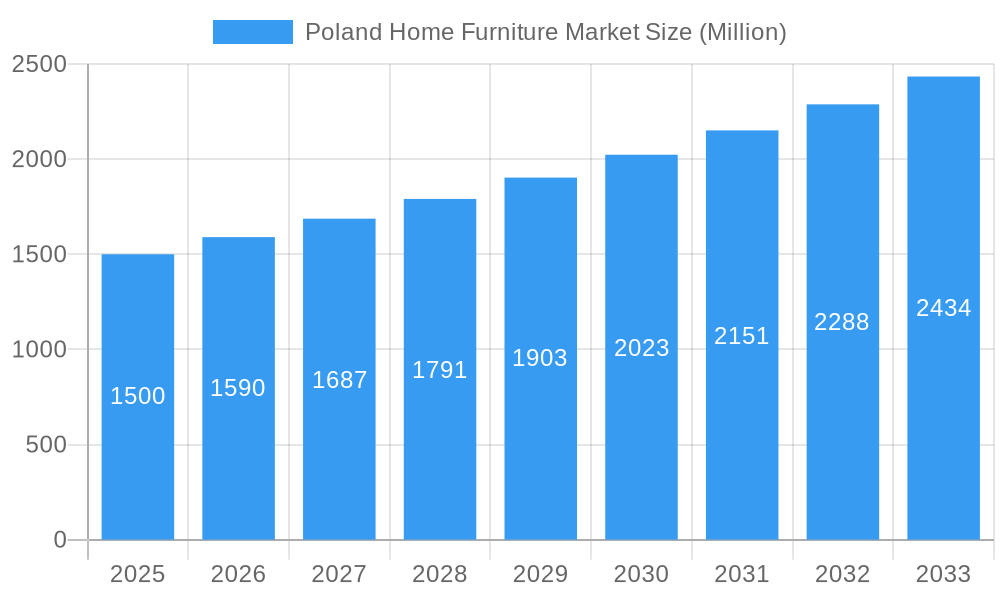

The Polish home furniture market, estimated at €7.81 billion in 2025, is poised for substantial expansion. Projections indicate a Compound Annual Growth Rate (CAGR) of 2.29% from 2025 to 2033. Key growth drivers include increasing household disposable incomes, a rising demand for contemporary home aesthetics, and a robust construction and renovation sector. E-commerce penetration further enhances accessibility to diverse furniture selections, bolstering market growth. While the market is segmented by material, type, and distribution channel, wood and kitchen furniture segments currently lead. The competitive landscape features major national and international players alongside specialized retailers. Potential challenges include raw material price volatility and economic slowdowns impacting discretionary spending. Emerging opportunities lie in niche products, alternative materials, and catering to the growing demand for sustainable and eco-friendly furniture. The forecast period anticipates sustained growth, influenced by macroeconomic factors. The trend towards multi-functional and space-saving furniture, particularly in urban environments, will drive product innovation. Strategic alliances and data-driven consumer insights will be critical for competitive advantage and market leadership in the evolving Polish home furniture sector.

Poland Home Furniture Market Market Size (In Billion)

Poland Home Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland home furniture market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a detailed examination of market dynamics, leading players, and future trends, this report offers a crucial roadmap for success in the Polish home furniture landscape. The report covers the period 2019-2033, with a focus on 2025, and leverages extensive market research to provide accurate forecasts and actionable intelligence. The market size is predicted to reach xx Million by 2025.

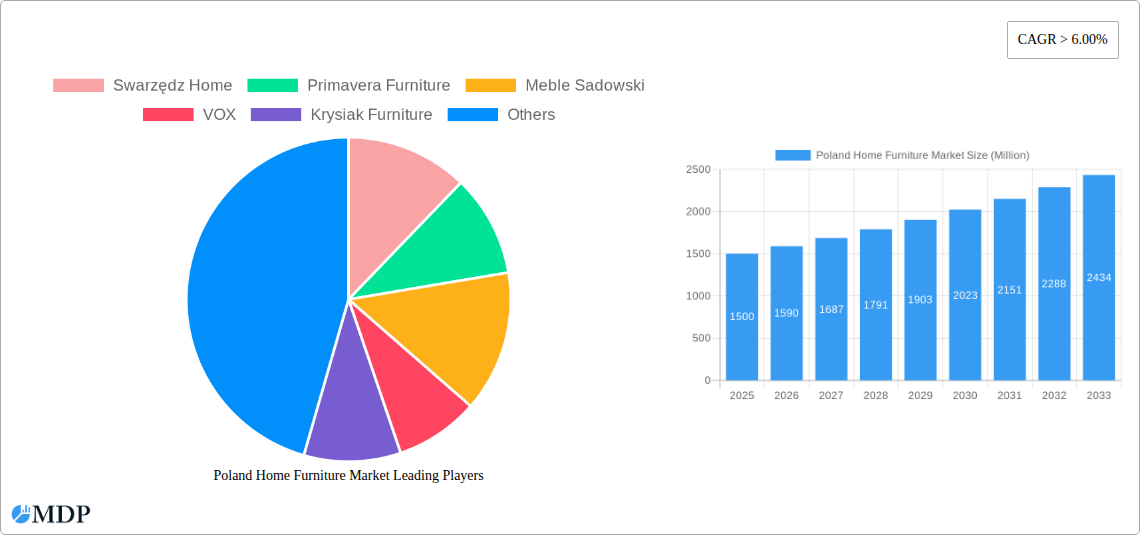

Poland Home Furniture Market Company Market Share

Poland Home Furniture Market Market Dynamics & Concentration

The Polish home furniture market exhibits a moderately concentrated structure, with key players like IKEA, VOX, and several prominent domestic brands holding significant market share. The market share of the top five players is estimated at 40% in 2025. Innovation is a key driver, with companies continuously introducing new designs, materials, and technologies to cater to evolving consumer preferences. The regulatory framework, including safety and environmental standards, influences product development and manufacturing processes. The market faces competition from substitute products such as modular furniture and customizable options. End-user trends, particularly a rising preference for sustainable and eco-friendly furniture, are shaping market demand. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately 5-7 M&A deals recorded annually between 2019-2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 40% market share in 2025.

- Innovation Drivers: New designs, materials (e.g., sustainable wood), and technological advancements (e.g., 3D rendering tools).

- Regulatory Framework: Compliance with safety and environmental regulations influences product development.

- Product Substitutes: Modular furniture, customizable options pose competitive threats.

- End-User Trends: Growing demand for sustainable and eco-friendly furniture.

- M&A Activity: Moderate, with approximately 5-7 deals annually (2019-2024).

Poland Home Furniture Market Industry Trends & Analysis

The Polish home furniture market is projected to experience steady growth throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. Key growth drivers include rising disposable incomes, increasing urbanization, and a growing preference for home improvement and renovation projects. Technological disruptions, such as the adoption of e-commerce and 3D design tools, are transforming the industry. Consumer preferences are shifting towards modern, functional, and sustainable designs. Competitive dynamics are characterized by both domestic and international players vying for market share, resulting in pricing pressure and a focus on product differentiation. Market penetration of online sales channels is expected to reach xx% by 2025.

Leading Markets & Segments in Poland Home Furniture Market

The market is dominated by urban areas, especially larger cities like Warsaw, Kraków, and Wrocław, due to higher purchasing power and greater concentration of consumers. Within the material segment, wood remains the leading material, accounting for approximately xx% of the market in 2025. Living Room and Dining Room furniture constitute the largest segment by type, driven by a growing emphasis on home aesthetics. Specialty stores remain the dominant distribution channel, although online sales are rapidly gaining traction.

Key Drivers for Dominant Segments:

- Wood: Traditional preference, aesthetic appeal, perceived durability.

- Living Room & Dining Room Furniture: Social focus on home entertaining and aesthetics.

- Specialty Stores: Established network, in-person experience, expert advice.

Regional Dominance: Urban areas, particularly Warsaw, Kraków, and Wrocław.

Poland Home Furniture Market Product Developments

Recent product innovations focus on incorporating sustainable materials, ergonomic designs, and smart features. Companies are increasingly offering customizable options and personalized services to enhance the customer experience. The focus on technological advancements such as 3D design tools enhances the customer experience and provides competitive advantage by offering tailored design solutions.

Key Drivers of Poland Home Furniture Market Growth

Key growth drivers include rising disposable incomes fueling higher spending on home furnishings, increasing urbanization driving demand for new homes and furniture, and a growing preference for home improvement projects. Government initiatives supporting sustainable manufacturing and design also contribute to market expansion.

Challenges in the Poland Home Furniture Market Market

Challenges include intense competition from both domestic and international brands, increasing raw material costs, and fluctuations in exchange rates impacting import-export activities. Supply chain disruptions and labor shortages have also posed difficulties for manufacturers.

Emerging Opportunities in Poland Home Furniture Market

Emerging opportunities include the expansion of e-commerce channels, the growth of the rental furniture market, and increased focus on sustainable and eco-friendly products. Strategic partnerships and collaborations can also unlock growth potential.

Leading Players in the Poland Home Furniture Market Sector

- Swarzędz Home

- Primavera Furniture

- Meble Sadowski

- VOX

- Krysiak Furniture

- IKEA

- Art Mebel

- Mebin Furniture

- BoConcept

- GiB MEBLE

- Meblomir

- MotivHome

- Halupczok

- DFM Sp zoo

Key Milestones in Poland Home Furniture Market Industry

- 2021: BoConcept launched a new store model featuring an elevated shopping experience with 3D rendering capabilities.

- 2021: IKEA Poland and Norway implemented successful circular economy initiatives focused on reusing spare parts.

Strategic Outlook for Poland Home Furniture Market Market

The Polish home furniture market presents significant long-term growth potential. Strategic opportunities exist in expanding e-commerce operations, investing in sustainable manufacturing practices, and developing innovative product lines tailored to evolving consumer preferences. Companies that can adapt to technological advancements and meet the growing demand for sustainable and customized furniture will be best positioned for success.

Poland Home Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Type

- 2.1. Kitchen Furniture

- 2.2. Living Room and Dining Room Furniture

- 2.3. Bedroom Furniture

- 2.4. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Poland Home Furniture Market Segmentation By Geography

- 1. Poland

Poland Home Furniture Market Regional Market Share

Geographic Coverage of Poland Home Furniture Market

Poland Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Technological Advancement of Smokeless Grilling

- 3.2.2 Infrared heating

- 3.2.3 others driving the market; Rising E-commerce driving sales of smokeless indoor grills

- 3.3. Market Restrains

- 3.3.1. Coal based grills having a significant share in the market; Rising price of electronic appliances with supply chain disruptions in market

- 3.4. Market Trends

- 3.4.1. Increasing Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Kitchen Furniture

- 5.2.2. Living Room and Dining Room Furniture

- 5.2.3. Bedroom Furniture

- 5.2.4. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Swarzędz Home

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Primavera Furniture

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meble Sadowski

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 VOX

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Krysiak Furniture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IKEA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Art Mebel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mebin Furniture

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BoConcept

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GiB MEBLE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Meblomir

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MotivHome

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Halupczok

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DFM Sp zoo

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Swarzędz Home

List of Figures

- Figure 1: Poland Home Furniture Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Home Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Home Furniture Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Poland Home Furniture Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 3: Poland Home Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Poland Home Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Poland Home Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Poland Home Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Poland Home Furniture Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Poland Home Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Poland Home Furniture Market Revenue billion Forecast, by Material 2020 & 2033

- Table 10: Poland Home Furniture Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 11: Poland Home Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Poland Home Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Poland Home Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Poland Home Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Poland Home Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Poland Home Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Home Furniture Market?

The projected CAGR is approximately 2.29%.

2. Which companies are prominent players in the Poland Home Furniture Market?

Key companies in the market include Swarzędz Home, Primavera Furniture, Meble Sadowski, VOX, Krysiak Furniture, IKEA, Art Mebel, Mebin Furniture, BoConcept, GiB MEBLE, Meblomir, MotivHome, Halupczok, DFM Sp zoo.

3. What are the main segments of the Poland Home Furniture Market?

The market segments include Material, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancement of Smokeless Grilling. Infrared heating. others driving the market; Rising E-commerce driving sales of smokeless indoor grills.

6. What are the notable trends driving market growth?

Increasing Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Coal based grills having a significant share in the market; Rising price of electronic appliances with supply chain disruptions in market.

8. Can you provide examples of recent developments in the market?

In 2021, BoConcept opened a new store model. The store featured a refreshed, evolved store concept that offers customers an elevated take on the shopping experience, including consultations and the ability to create a 3D rendering of the space the customer would like to design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Home Furniture Market?

To stay informed about further developments, trends, and reports in the Poland Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence