Key Insights

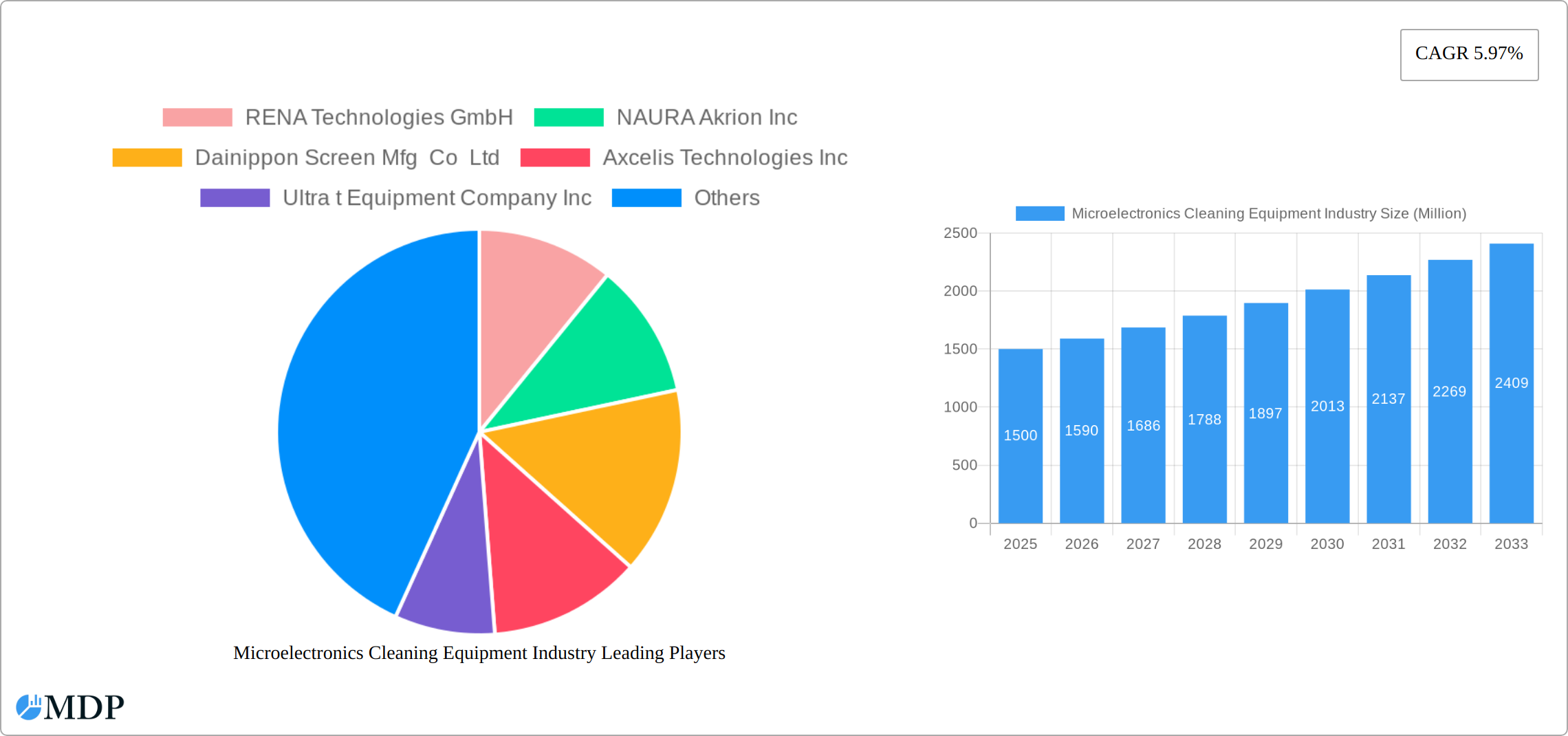

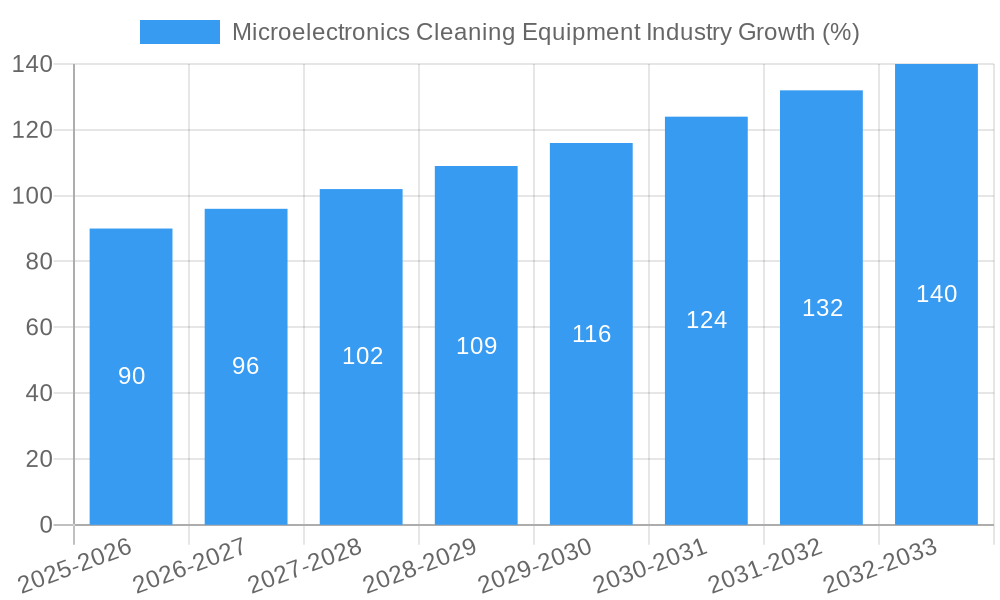

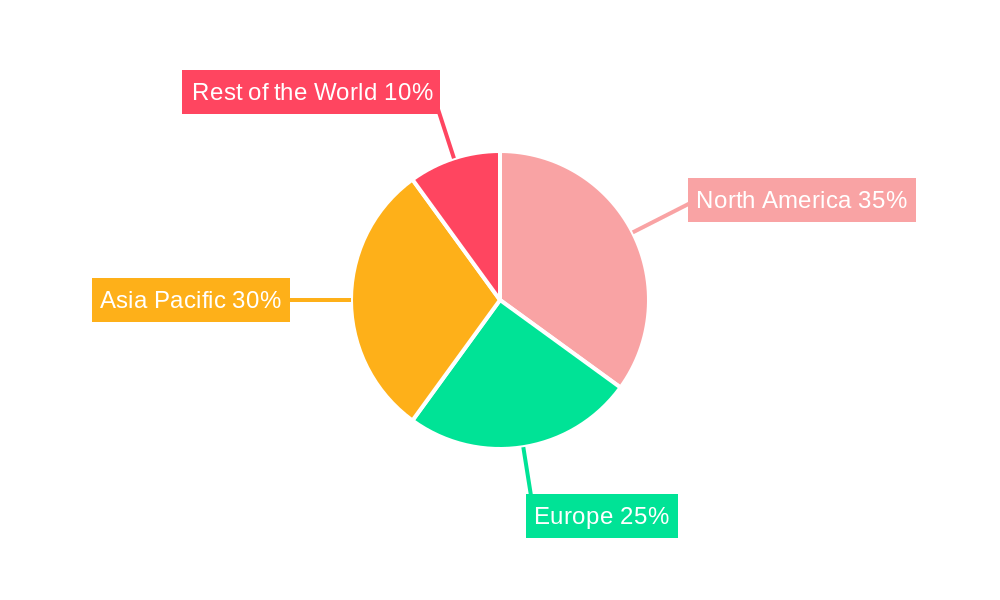

The microelectronics cleaning equipment market is experiencing robust growth, driven by the increasing demand for advanced semiconductor devices and the miniaturization of electronic components. The market's Compound Annual Growth Rate (CAGR) of 5.97% from 2019 to 2024 suggests a consistently expanding market, projected to continue its upward trajectory through 2033. Key drivers include the rising adoption of advanced packaging technologies in the integrated circuit (IC) and semiconductor industries, necessitating sophisticated and precise cleaning solutions. The proliferation of smartphones, wearables, and other consumer electronics fuels this demand, further complemented by the growth of the automotive and industrial automation sectors which increasingly rely on microelectronics. Technological advancements, such as the development of dry cleaning techniques like plasma cleaning, are also contributing to market expansion by offering superior cleaning efficiency and reduced environmental impact compared to traditional wet chemical methods. However, the high cost of advanced cleaning equipment and the stringent regulatory environment surrounding chemical waste disposal present notable restraints. The market is segmented by type (single system, single-wafer spray systems, batch systems), technology (wet, dry, plasma), and application (PCB, MEMS, ICs, displays, HDDs). The Asia Pacific region is expected to dominate the market due to its large concentration of semiconductor manufacturing facilities. Leading companies in this sector, including RENA Technologies, NAURA Akrion, and Dainippon Screen, are strategically investing in research and development to enhance cleaning technology and cater to the evolving needs of the microelectronics industry. Competition is intense, with companies focusing on innovation and providing customized solutions to maintain a competitive edge.

The forecast period of 2025-2033 anticipates continued growth, fueled by ongoing technological advancements and increasing demand from key application segments. The market is expected to see further consolidation as larger players acquire smaller companies with specialized technologies. While the high capital expenditure involved in acquiring new equipment could hinder some market segments, the overall positive outlook is expected to prevail, leading to substantial market expansion throughout the forecast period. Specific growth within sub-segments will be influenced by the adoption rates of new technologies and the evolving demands of the specific application areas, with the IC and MEMS segments anticipated to exhibit particularly strong growth due to their importance in modern electronics. Further research into specific regional dynamics and the performance of individual companies will provide a more granular understanding of the market's future trajectory.

Microelectronics Cleaning Equipment Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Microelectronics Cleaning Equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, technological advancements, and competitive landscapes to provide a robust understanding of this crucial sector. The global market value is projected to reach xx Million by 2033.

Microelectronics Cleaning Equipment Industry Market Dynamics & Concentration

The Microelectronics Cleaning Equipment market is characterized by moderate concentration, with several key players holding significant market share. RENA Technologies GmbH, NAURA Akrion Inc, and Dainippon Screen Mfg Co Ltd are among the leading companies, collectively accounting for an estimated xx% of the global market in 2025. Market concentration is influenced by factors such as technological advancements, regulatory compliance, and the ongoing consolidation through mergers and acquisitions (M&A). The historical period (2019-2024) witnessed approximately xx M&A deals, with a predicted increase in deal activity during the forecast period (2025-2033) driven by the need for enhanced technological capabilities and expansion into new geographical markets. Innovation is a key driver, with companies continuously investing in research and development to improve cleaning efficiency, reduce chemical usage, and meet the demands of increasingly complex microelectronic components. Stringent regulatory frameworks regarding chemical waste disposal and environmental concerns further shape the market landscape. The industry also faces pressures from substitute technologies, such as dry cleaning methods, which are gaining traction due to their environmental benefits. End-user trends, particularly the increasing demand for higher-performance and smaller microelectronic devices, are driving the market's growth.

Microelectronics Cleaning Equipment Industry Trends & Analysis

The Microelectronics Cleaning Equipment market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several factors, including the escalating demand for advanced microelectronic devices across various applications such as smartphones, computers, and automobiles. Technological disruptions, such as the adoption of advanced plasma cleaning and cryogenic cleaning solutions, are driving innovation and efficiency improvements. Consumer preferences for smaller, faster, and more energy-efficient devices further fuel the demand for sophisticated cleaning equipment capable of handling increasingly complex components. The market exhibits intense competitive dynamics, with established players focusing on product differentiation and innovation to maintain their market position. Market penetration of advanced cleaning technologies is gradually increasing, particularly in regions with robust semiconductor industries. The rising adoption of automation and smart manufacturing techniques also contributes significantly to market expansion.

Leading Markets & Segments in Microelectronics Cleaning Equipment Industry

The Integrated Circuit (IC) segment continues to be the powerhouse of the microelectronics cleaning equipment market, projected to command approximately 70-75% of the total market revenue by 2025. The Asia-Pacific region, spearheaded by semiconductor manufacturing hubs like South Korea, Taiwan, and China, will maintain its dominance. This sustained leadership is underpinned by the robust presence of advanced semiconductor fabrication plants and a proactive approach to technological adoption.

Key Market Drivers:

- Government Support & Investment: Favorable economic policies, including substantial government incentives and strategic investments in the semiconductor industry, are critical growth catalysts.

- Advanced Infrastructure & Talent Pool: The availability of cutting-edge infrastructure, coupled with a highly skilled and adaptable workforce, is essential for the expansion and innovation within the sector.

- Increasing Complexity of Semiconductor Devices: As semiconductor devices become more intricate and miniaturized, the demand for highly precise and contaminant-free cleaning processes intensifies.

- Growing Demand for High-Performance Electronics: The escalating global demand for advanced electronics across various sectors, including consumer electronics, automotive, and telecommunications, directly fuels the need for efficient microelectronics manufacturing and, consequently, specialized cleaning equipment.

Segment Analysis:

- By Type: While Single-Wafer Spray Systems are expected to lead due to their superior cleaning efficacy and suitability for cutting-edge IC manufacturing, Batch Systems will continue to hold a significant share, particularly for applications where cost-effectiveness is paramount. The market is witnessing a growing interest in advanced single-wafer technologies that offer enhanced throughput and precision.

- By Technology: Wet cleaning solutions currently represent the largest market share. However, dry cleaning technologies, prominently plasma-based and cryogenic solutions, are exhibiting substantial growth. This surge is driven by their eco-friendly attributes, reduced chemical usage, and exceptional ability to eliminate even the most challenging contaminants without damaging sensitive materials.

- By Application: The Integrated Circuit (IC) application segment is anticipated to remain the market leader, propelled by the relentless innovation and expansion of the semiconductor industry. Significant growth is also projected for other segments such as Micro-Electro-Mechanical Systems (MEMS) and Printed Circuit Boards (PCBs), albeit at a comparatively more moderate pace. The increasing integration of advanced packaging technologies also presents a growing demand for specialized cleaning processes.

Microelectronics Cleaning Equipment Industry Product Developments

Recent product innovations in the microelectronics cleaning equipment industry are intensely focused on elevating cleaning precision, minimizing chemical consumption through advanced dispensing and recycling technologies, and enhancing process control via sophisticated sensor integration and real-time monitoring. Manufacturers are increasingly embedding automation and advanced data analytics capabilities into their equipment to achieve optimal cleaning outcomes, predictive maintenance, and a reduction in overall operational expenditures. A significant trend is the development and adoption of environmentally conscious cleaning solutions, with cryogenic and plasma-based methods gaining considerable traction. These advanced systems not only offer superior contaminant removal but also align with the industry's stringent sustainability mandates and environmental regulations, providing manufacturers with a distinct competitive edge in a market increasingly prioritizing green manufacturing practices.

Key Drivers of Microelectronics Cleaning Equipment Growth

Several factors are driving the growth of the Microelectronics Cleaning Equipment industry. Technological advancements, leading to the development of more sophisticated and efficient cleaning systems, are a primary driver. The increasing demand for high-performance microelectronic devices across various applications fuels market growth. Furthermore, favorable government policies and incentives in key regions are supporting industry expansion. Stringent regulatory requirements for environmental protection are also promoting the adoption of eco-friendly cleaning technologies.

Challenges in the Microelectronics Cleaning Equipment Industry Market

The industry faces challenges such as high initial investment costs for advanced cleaning equipment, limiting entry for smaller players. Fluctuations in raw material prices and supply chain disruptions can impact profitability. Intense competition from established players and the emergence of new technologies pose significant competitive pressure. Regulatory compliance requirements and stringent environmental regulations can increase operational costs.

Emerging Opportunities in Microelectronics Cleaning Equipment Industry

The microelectronics cleaning equipment industry is on the cusp of significant expansion, driven by a confluence of emerging opportunities. The integration of artificial intelligence (AI) and machine learning (ML) is opening new frontiers for optimizing cleaning processes, enabling predictive analytics for equipment maintenance, and enhancing overall operational efficiency. Strategic alliances and collaborations between leading equipment manufacturers and semiconductor fabrication companies are becoming increasingly crucial. These partnerships facilitate the co-development of highly customized cleaning solutions tailored to specific advanced manufacturing needs and accelerate the product development lifecycle. Furthermore, the expansion into nascent geographical markets, particularly in rapidly developing economies with burgeoning semiconductor industries, presents substantial opportunities for market penetration and sustained growth.

Leading Players in the Microelectronics Cleaning Equipment Industry Sector

- RENA Technologies GmbH

- NAURA Akrion Inc.

- Dainippon Screen Mfg. Co., Ltd.

- Axcelis Technologies, Inc.

- Ultra t Equipment Company, Inc.

- Axus Technology LLC

- Speedline Technologies, Inc.

- Quantum Global Technologies LLC

- Tokyo Electron Limited (TEL FSI Inc.)

- Panasonic Corporation

Key Milestones in Microelectronics Cleaning Equipment Industry

- 2020: Introduction of a new generation of plasma cleaning systems by RENA Technologies GmbH, enhancing cleaning efficiency and reducing processing time.

- 2022: Acquisition of a smaller cleaning equipment manufacturer by Dainippon Screen Mfg Co Ltd, expanding its product portfolio and market reach.

- 2023: Launch of a sustainable and eco-friendly cryogenic cleaning solution by TEL FSI Inc.

- 2024: Implementation of advanced automation and AI features in cleaning equipment by several major players.

Strategic Outlook for Microelectronics Cleaning Equipment Market

The Microelectronics Cleaning Equipment market exhibits substantial growth potential driven by continuous technological advancements, increasing demand for higher-performance microelectronics, and the adoption of sustainable cleaning solutions. Strategic investments in R&D, focus on product innovation, strategic partnerships, and expansion into emerging markets will be critical for success. The focus on environmentally friendly and cost-effective solutions will shape the future landscape of this dynamic industry.

Microelectronics Cleaning Equipment Industry Segmentation

-

1. Type

-

1.1. Single System

- 1.1.1. Single-Wafer Cryogenic Systems

- 1.1.2. Single-Wafer Spray Systems

-

1.2. Batch System

- 1.2.1. Batch Immersion Cleaning Systems

- 1.2.2. Batch Spray Cleaning Systems

-

1.1. Single System

-

2. Technology (Qualitative Trend Analysis)

-

2.1. Wet

- 2.1.1. RCA Cleaning

- 2.1.2. Sulphuric Acid Solutions

- 2.1.3. HF Acid Solutions

-

2.2. Aqueous

- 2.2.1. FEOL Cleaning Solutions

- 2.2.2. BEOL Cleaning Solutions

- 2.2.3. Emerging Aqueous Solutions

- 2.2.4. Cryogenic Cleaning Solutions

-

2.3. Dry

- 2.3.1. Vapor-Phase Cleaning Solution

- 2.3.2. Plasma Cleaning Solution

-

2.4. Emerging Solutions

- 2.4.1. Laser Cleaning

- 2.4.2. Chemical Treatment Solutions

- 2.4.3. Dry Particle Solutions

- 2.4.4. Water Purity Solutions

-

2.1. Wet

-

3. Application

- 3.1. Printed Circuit Board (PCB)

- 3.2. Microelectromechanical Systems (MEMS)

- 3.3. Integrated Circuit (ICs)

- 3.4. Display

- 3.5. Hard Disk Drives (HDD)s

- 3.6. Others

Microelectronics Cleaning Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Microelectronics Cleaning Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in the Semiconductor Wafer Industry; Increasing use of MEMS; Increasing Demand for Smartphones & Tablets

- 3.3. Market Restrains

- 3.3.1. Growth in Gesture Recognition Market

- 3.4. Market Trends

- 3.4.1. Microelectromechanical Systems (MEMS) to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single System

- 5.1.1.1. Single-Wafer Cryogenic Systems

- 5.1.1.2. Single-Wafer Spray Systems

- 5.1.2. Batch System

- 5.1.2.1. Batch Immersion Cleaning Systems

- 5.1.2.2. Batch Spray Cleaning Systems

- 5.1.1. Single System

- 5.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 5.2.1. Wet

- 5.2.1.1. RCA Cleaning

- 5.2.1.2. Sulphuric Acid Solutions

- 5.2.1.3. HF Acid Solutions

- 5.2.2. Aqueous

- 5.2.2.1. FEOL Cleaning Solutions

- 5.2.2.2. BEOL Cleaning Solutions

- 5.2.2.3. Emerging Aqueous Solutions

- 5.2.2.4. Cryogenic Cleaning Solutions

- 5.2.3. Dry

- 5.2.3.1. Vapor-Phase Cleaning Solution

- 5.2.3.2. Plasma Cleaning Solution

- 5.2.4. Emerging Solutions

- 5.2.4.1. Laser Cleaning

- 5.2.4.2. Chemical Treatment Solutions

- 5.2.4.3. Dry Particle Solutions

- 5.2.4.4. Water Purity Solutions

- 5.2.1. Wet

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Printed Circuit Board (PCB)

- 5.3.2. Microelectromechanical Systems (MEMS)

- 5.3.3. Integrated Circuit (ICs)

- 5.3.4. Display

- 5.3.5. Hard Disk Drives (HDD)s

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single System

- 6.1.1.1. Single-Wafer Cryogenic Systems

- 6.1.1.2. Single-Wafer Spray Systems

- 6.1.2. Batch System

- 6.1.2.1. Batch Immersion Cleaning Systems

- 6.1.2.2. Batch Spray Cleaning Systems

- 6.1.1. Single System

- 6.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 6.2.1. Wet

- 6.2.1.1. RCA Cleaning

- 6.2.1.2. Sulphuric Acid Solutions

- 6.2.1.3. HF Acid Solutions

- 6.2.2. Aqueous

- 6.2.2.1. FEOL Cleaning Solutions

- 6.2.2.2. BEOL Cleaning Solutions

- 6.2.2.3. Emerging Aqueous Solutions

- 6.2.2.4. Cryogenic Cleaning Solutions

- 6.2.3. Dry

- 6.2.3.1. Vapor-Phase Cleaning Solution

- 6.2.3.2. Plasma Cleaning Solution

- 6.2.4. Emerging Solutions

- 6.2.4.1. Laser Cleaning

- 6.2.4.2. Chemical Treatment Solutions

- 6.2.4.3. Dry Particle Solutions

- 6.2.4.4. Water Purity Solutions

- 6.2.1. Wet

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Printed Circuit Board (PCB)

- 6.3.2. Microelectromechanical Systems (MEMS)

- 6.3.3. Integrated Circuit (ICs)

- 6.3.4. Display

- 6.3.5. Hard Disk Drives (HDD)s

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single System

- 7.1.1.1. Single-Wafer Cryogenic Systems

- 7.1.1.2. Single-Wafer Spray Systems

- 7.1.2. Batch System

- 7.1.2.1. Batch Immersion Cleaning Systems

- 7.1.2.2. Batch Spray Cleaning Systems

- 7.1.1. Single System

- 7.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 7.2.1. Wet

- 7.2.1.1. RCA Cleaning

- 7.2.1.2. Sulphuric Acid Solutions

- 7.2.1.3. HF Acid Solutions

- 7.2.2. Aqueous

- 7.2.2.1. FEOL Cleaning Solutions

- 7.2.2.2. BEOL Cleaning Solutions

- 7.2.2.3. Emerging Aqueous Solutions

- 7.2.2.4. Cryogenic Cleaning Solutions

- 7.2.3. Dry

- 7.2.3.1. Vapor-Phase Cleaning Solution

- 7.2.3.2. Plasma Cleaning Solution

- 7.2.4. Emerging Solutions

- 7.2.4.1. Laser Cleaning

- 7.2.4.2. Chemical Treatment Solutions

- 7.2.4.3. Dry Particle Solutions

- 7.2.4.4. Water Purity Solutions

- 7.2.1. Wet

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Printed Circuit Board (PCB)

- 7.3.2. Microelectromechanical Systems (MEMS)

- 7.3.3. Integrated Circuit (ICs)

- 7.3.4. Display

- 7.3.5. Hard Disk Drives (HDD)s

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single System

- 8.1.1.1. Single-Wafer Cryogenic Systems

- 8.1.1.2. Single-Wafer Spray Systems

- 8.1.2. Batch System

- 8.1.2.1. Batch Immersion Cleaning Systems

- 8.1.2.2. Batch Spray Cleaning Systems

- 8.1.1. Single System

- 8.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 8.2.1. Wet

- 8.2.1.1. RCA Cleaning

- 8.2.1.2. Sulphuric Acid Solutions

- 8.2.1.3. HF Acid Solutions

- 8.2.2. Aqueous

- 8.2.2.1. FEOL Cleaning Solutions

- 8.2.2.2. BEOL Cleaning Solutions

- 8.2.2.3. Emerging Aqueous Solutions

- 8.2.2.4. Cryogenic Cleaning Solutions

- 8.2.3. Dry

- 8.2.3.1. Vapor-Phase Cleaning Solution

- 8.2.3.2. Plasma Cleaning Solution

- 8.2.4. Emerging Solutions

- 8.2.4.1. Laser Cleaning

- 8.2.4.2. Chemical Treatment Solutions

- 8.2.4.3. Dry Particle Solutions

- 8.2.4.4. Water Purity Solutions

- 8.2.1. Wet

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Printed Circuit Board (PCB)

- 8.3.2. Microelectromechanical Systems (MEMS)

- 8.3.3. Integrated Circuit (ICs)

- 8.3.4. Display

- 8.3.5. Hard Disk Drives (HDD)s

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single System

- 9.1.1.1. Single-Wafer Cryogenic Systems

- 9.1.1.2. Single-Wafer Spray Systems

- 9.1.2. Batch System

- 9.1.2.1. Batch Immersion Cleaning Systems

- 9.1.2.2. Batch Spray Cleaning Systems

- 9.1.1. Single System

- 9.2. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 9.2.1. Wet

- 9.2.1.1. RCA Cleaning

- 9.2.1.2. Sulphuric Acid Solutions

- 9.2.1.3. HF Acid Solutions

- 9.2.2. Aqueous

- 9.2.2.1. FEOL Cleaning Solutions

- 9.2.2.2. BEOL Cleaning Solutions

- 9.2.2.3. Emerging Aqueous Solutions

- 9.2.2.4. Cryogenic Cleaning Solutions

- 9.2.3. Dry

- 9.2.3.1. Vapor-Phase Cleaning Solution

- 9.2.3.2. Plasma Cleaning Solution

- 9.2.4. Emerging Solutions

- 9.2.4.1. Laser Cleaning

- 9.2.4.2. Chemical Treatment Solutions

- 9.2.4.3. Dry Particle Solutions

- 9.2.4.4. Water Purity Solutions

- 9.2.1. Wet

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Printed Circuit Board (PCB)

- 9.3.2. Microelectromechanical Systems (MEMS)

- 9.3.3. Integrated Circuit (ICs)

- 9.3.4. Display

- 9.3.5. Hard Disk Drives (HDD)s

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Microelectronics Cleaning Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 RENA Technologies GmbH

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 NAURA Akrion Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Dainippon Screen Mfg Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Axcelis Technologies Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ultra t Equipment Company Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Axus Technology LL

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Speedline Technologies Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Quantum Global Technologies LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 TEL FSI Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Panasonic Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 RENA Technologies GmbH

List of Figures

- Figure 1: Global Microelectronics Cleaning Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 13: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 14: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 21: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 22: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 29: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 30: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 37: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Technology (Qualitative Trend Analysis) 2024 & 2032

- Figure 38: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World Microelectronics Cleaning Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Microelectronics Cleaning Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 4: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Microelectronics Cleaning Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 16: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 20: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 24: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2019 & 2032

- Table 28: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Microelectronics Cleaning Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microelectronics Cleaning Equipment Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Microelectronics Cleaning Equipment Industry?

Key companies in the market include RENA Technologies GmbH, NAURA Akrion Inc, Dainippon Screen Mfg Co Ltd, Axcelis Technologies Inc, Ultra t Equipment Company Inc, Axus Technology LL, Speedline Technologies Inc, Quantum Global Technologies LLC, TEL FSI Inc, Panasonic Corporation.

3. What are the main segments of the Microelectronics Cleaning Equipment Industry?

The market segments include Type, Technology (Qualitative Trend Analysis), Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in the Semiconductor Wafer Industry; Increasing use of MEMS; Increasing Demand for Smartphones & Tablets.

6. What are the notable trends driving market growth?

Microelectromechanical Systems (MEMS) to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Growth in Gesture Recognition Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microelectronics Cleaning Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microelectronics Cleaning Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microelectronics Cleaning Equipment Industry?

To stay informed about further developments, trends, and reports in the Microelectronics Cleaning Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence