Key Insights

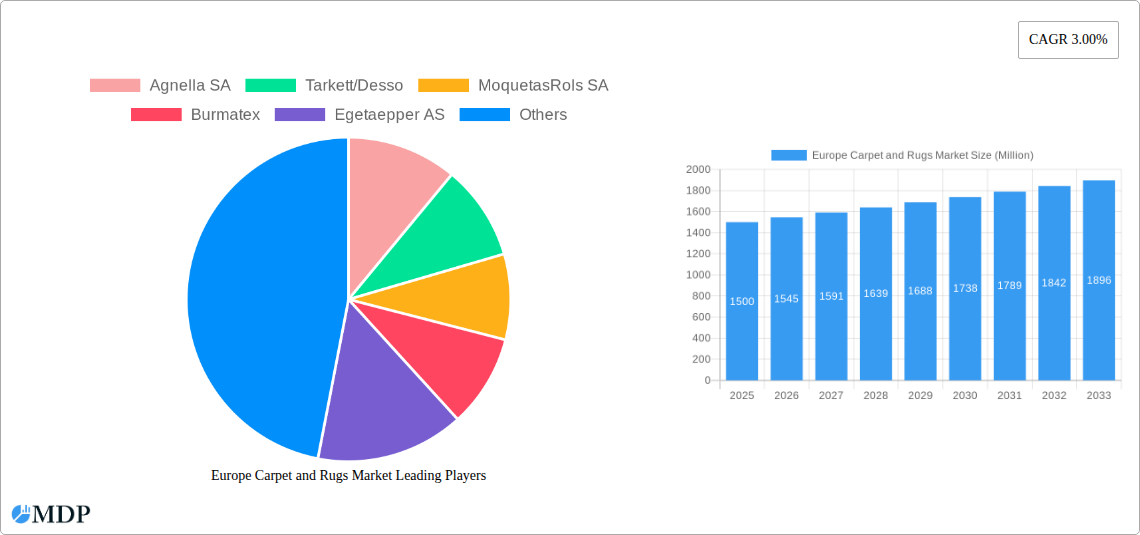

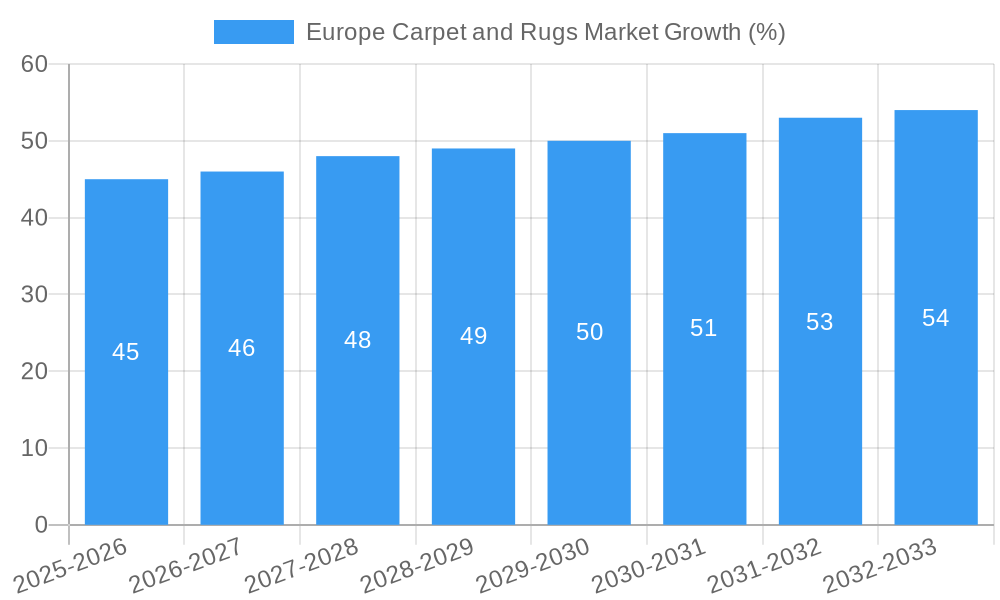

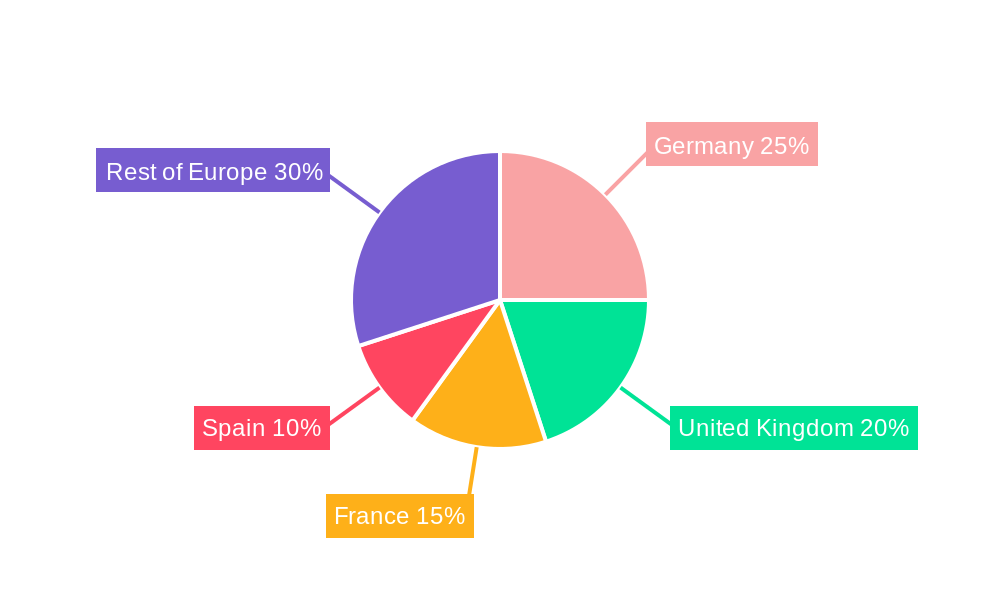

The European carpet and rugs market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.00% from 2025 to 2033. This growth is driven by several factors, including increasing disposable incomes across several European countries leading to higher spending on home improvements and renovations, a renewed focus on interior design and enhancing home comfort, and a resurgence of interest in traditional craftsmanship reflected in the demand for high-quality, handcrafted rugs. The market is segmented by product type (wall-to-wall tufted carpets, wall-to-wall woven carpets, and rugs), application (residential and commercial), and distribution channel (contractors, retail, and other channels). Germany, the United Kingdom, and France are expected to remain the largest national markets within Europe, driven by robust construction activity and a preference for carpeted floors in both residential and commercial spaces.

However, several restraints may impact the market's growth trajectory. These include fluctuating raw material prices (particularly wool and synthetic fibers), increased competition from alternative flooring solutions (such as vinyl and hardwood), and concerns regarding the environmental impact of carpet manufacturing and disposal. The market is witnessing a growing trend toward sustainable and eco-friendly carpet options, with manufacturers increasingly focusing on recycled materials and reduced carbon footprints to address these concerns. Further segmentation reveals a strong preference for wall-to-wall carpets in commercial settings and a growing demand for rugs in residential applications reflecting changing interior design preferences. The competitive landscape includes both established international players and smaller regional manufacturers, leading to a dynamic market environment characterized by innovation in design, materials, and manufacturing processes. The overall outlook for the European carpet and rugs market remains positive, albeit with a need for adaptation to evolving consumer preferences and environmental regulations.

Europe Carpet and Rugs Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe carpet and rugs market, offering actionable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a detailed understanding of market dynamics, trends, and future opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key players analyzed include Agnella SA, Tarkett/Desso, MoquetasRols SA, Burmatex, Egetaepper AS, Balsan, Milliken, Fletco Carpets AS, Creatuft NV, Associated Weavers, Brintons Carpets, Balta Group, and Royal Carpet SA. The report segments the market by type (Wall-to-Wall Tufted Carpets, Wall-to-Wall Woven Carpets, Rugs), application (Residential, Commercial), and distribution channel (Contractors, Retail, Other Distribution Channels), across key European countries: Germany, United Kingdom, France, Spain, and the Rest of Europe.

Europe Carpet and Rugs Market Market Dynamics & Concentration

The Europe carpet and rugs market exhibits a moderately consolidated structure, with several large players holding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic competitive landscape. Market concentration is influenced by factors such as economies of scale in manufacturing, brand recognition, and distribution network reach. Key innovation drivers include advancements in material science (e.g., sustainable and recycled materials), design aesthetics, and manufacturing technologies (e.g., digital printing, automated production). The regulatory landscape, including environmental regulations and safety standards, plays a crucial role in shaping market practices and product development. Product substitutes, such as hardwood flooring, vinyl, and laminate, pose a competitive challenge, necessitating continuous innovation to maintain market relevance. End-user trends towards sustainability, durability, and aesthetics significantly influence market demand.

Mergers and acquisitions (M&A) activity has been a noticeable trend, impacting market concentration and competitive dynamics. For example:

- High M&A Activity: The market has seen a significant number of M&A deals, reflecting consolidation and expansion strategies. The exact number of deals during the study period is xx.

- Market Share Dynamics: The top 5 players collectively hold an estimated xx% market share, highlighting the moderately consolidated nature of the market.

Europe Carpet and Rugs Market Industry Trends & Analysis

The Europe carpet and rugs market is witnessing significant growth driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for aesthetically pleasing and comfortable home environments. Technological disruptions, particularly in manufacturing processes and material innovation, are transforming the industry. Consumer preferences are shifting towards eco-friendly, durable, and stylish carpets and rugs, prompting manufacturers to adapt their offerings accordingly. The market is characterized by intense competition, with companies focusing on product differentiation, brand building, and efficient supply chain management. The market is experiencing a shift towards digitally printed carpets and rugs, enabling greater design flexibility and customization. The increasing focus on sustainability is driving the adoption of recycled and renewable materials, contributing to market growth. The CAGR for the period 2019-2024 was xx%, and the estimated market penetration rate in 2025 is xx%.

Leading Markets & Segments in Europe Carpet and Rugs Market

Germany, the United Kingdom, and France represent the leading national markets in Europe for carpets and rugs, driven by strong residential and commercial construction activity, and established distribution networks.

By Type:

- Wall-to-Wall Tufted Carpets: This segment maintains a significant market share, owing to its affordability and widespread applicability in residential settings.

- Wall-to-Wall Woven Carpets: This segment caters to the premium market segment, offering superior quality, durability, and aesthetics.

- Rugs: This segment demonstrates strong growth, driven by increasing consumer preference for flexibility and design diversity.

By Application:

- Residential: This segment constitutes the largest share, reflecting the importance of carpets and rugs in home décor and comfort.

- Commercial: This segment demonstrates steady growth, fueled by increasing demand from hotels, offices, and other commercial spaces.

By Distribution Channel:

- Contractors: This channel plays a crucial role in large-scale projects, such as hotels and office complexes.

- Retail: This channel caters to individual consumers and smaller projects, offering a broad range of products and designs.

Key Drivers:

- Strong economic growth in leading markets.

- Government initiatives supporting construction and infrastructure development.

Europe Carpet and Rugs Market Product Developments

Recent product innovations focus on incorporating sustainable materials, improving durability and performance, and offering greater design flexibility. Technological advancements, such as digital printing and 3D weaving, allow for the creation of highly customized and visually appealing carpets and rugs. This enhances the products' market fit by catering to evolving consumer preferences for unique and personalized home decor solutions. The use of innovative materials, such as recycled fibers and bio-based polymers, improves the environmental credentials of the products, boosting their appeal to environmentally conscious consumers.

Key Drivers of Europe Carpet and Rugs Market Growth

Several factors are driving the expansion of the European carpet and rugs market. These include:

- Technological advancements: Innovations in materials, manufacturing processes, and design are leading to high-quality, sustainable, and aesthetically appealing products.

- Economic growth: Rising disposable incomes and increased construction activity are fueling demand, particularly in the residential sector.

- Favorable regulatory environment: Government support for sustainable building practices and infrastructure development positively impacts market growth.

Challenges in the Europe Carpet and Rugs Market Market

The market faces challenges, including:

- Intense competition: The presence of numerous players, including both large multinational corporations and smaller niche businesses, creates a highly competitive landscape.

- Fluctuating raw material costs: The price volatility of raw materials, such as fibers and dyes, can impact production costs and profitability.

- Environmental regulations: Stringent environmental regulations necessitate the adoption of sustainable manufacturing practices, which can increase costs.

Emerging Opportunities in Europe Carpet and Rugs Market

The market presents several exciting opportunities for growth. The rising demand for sustainable and eco-friendly products presents a significant opportunity for companies that can offer carpets and rugs made from recycled or renewable materials. Strategic partnerships with interior designers and architects can help expand market reach and brand visibility. Expansion into new markets and product categories, such as specialized carpets for specific applications (e.g., healthcare, education), also presents growth potential.

Leading Players in the Europe Carpet and Rugs Market Sector

- Agnella SA

- Tarkett/Desso

- MoquetasRols SA

- Burmatex

- Egetaepper AS

- Balsan

- Milliken

- Fletco Carpets AS

- Creatuft NV

- Associated Weavers

- Brintons Carpets

- Balta Group

- Royal Carpet SA

Key Milestones in Europe Carpet and Rugs Market Industry

- November 2021: UK-based Victoria acquired the rugs division of Balta Group for GBP 117 million (around USD 141.5 million), significantly altering the market landscape.

- April 2022: Milliken & Company expanded its production capacity by 60% through the acquisition of Zebra-chem GmbH, enhancing its position in the market.

Strategic Outlook for Europe Carpet and Rugs Market Market

The future of the Europe carpet and rugs market appears promising, driven by sustained economic growth, increasing urbanization, and ongoing innovation in product design and materials. Companies that can effectively adapt to evolving consumer preferences, embrace sustainable practices, and leverage technological advancements will be best positioned for success. Strategic partnerships and market expansion into high-growth regions will also be crucial for achieving long-term growth.

Europe Carpet and Rugs Market Segmentation

-

1. Type

- 1.1. Wall to Wall Tufted Carpets

- 1.2. Wall to Wall Woven Carpets

- 1.3. Rugs

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Contractors

- 3.2. Retail

- 3.3. Other Distibution Channels

Europe Carpet and Rugs Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Carpet and Rugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances

- 3.3. Market Restrains

- 3.3.1. Changing Needs of Customers; Limited Usage of the Product

- 3.4. Market Trends

- 3.4.1. Germany Accounts for a Major Percentage of the Market Share in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall to Wall Tufted Carpets

- 5.1.2. Wall to Wall Woven Carpets

- 5.1.3. Rugs

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Contractors

- 5.3.2. Retail

- 5.3.3. Other Distibution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Agnella SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Tarkett/Desso

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 MoquetasRols SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Burmatex

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Egetaepper AS

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Balsan

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Milliken

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Fletco Carpets AS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Creatuft NV

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Associated Weavers

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Brintons Carpets

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Balta Group

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Royal Carpet SA

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Agnella SA

List of Figures

- Figure 1: Europe Carpet and Rugs Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Carpet and Rugs Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Carpet and Rugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Carpet and Rugs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Carpet and Rugs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Carpet and Rugs Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Europe Carpet and Rugs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Carpet and Rugs Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Europe Carpet and Rugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Europe Carpet and Rugs Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: Europe Carpet and Rugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Carpet and Rugs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe Carpet and Rugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Carpet and Rugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe Carpet and Rugs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Europe Carpet and Rugs Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 29: Europe Carpet and Rugs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Europe Carpet and Rugs Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 31: Europe Carpet and Rugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Europe Carpet and Rugs Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 33: Europe Carpet and Rugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Carpet and Rugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: United Kingdom Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Germany Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: France Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Italy Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Italy Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Spain Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Netherlands Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Netherlands Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Belgium Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Belgium Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Sweden Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Sweden Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Norway Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Norway Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Poland Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Poland Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Denmark Europe Carpet and Rugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Denmark Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Carpet and Rugs Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Europe Carpet and Rugs Market?

Key companies in the market include Agnella SA, Tarkett/Desso, MoquetasRols SA, Burmatex, Egetaepper AS, Balsan, Milliken, Fletco Carpets AS, Creatuft NV, Associated Weavers, Brintons Carpets, Balta Group, Royal Carpet SA.

3. What are the main segments of the Europe Carpet and Rugs Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances.

6. What are the notable trends driving market growth?

Germany Accounts for a Major Percentage of the Market Share in the Region.

7. Are there any restraints impacting market growth?

Changing Needs of Customers; Limited Usage of the Product.

8. Can you provide examples of recent developments in the market?

November 2021: UK-based Victoria, engaged in the manufacturing of carpets and floor coverings, acquired the rugs division of Balta Group for GBP 117 million (around USD 141.5 million). Balta Group is headquartered in Belgium and is the largest manufacturer of carpets in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Carpet and Rugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Carpet and Rugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Carpet and Rugs Market?

To stay informed about further developments, trends, and reports in the Europe Carpet and Rugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence