Key Insights

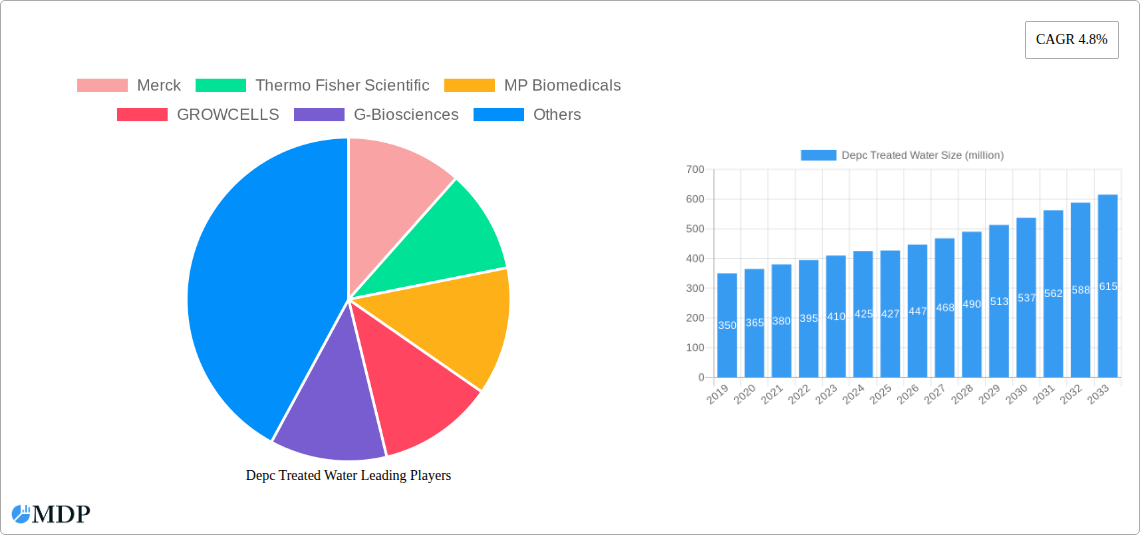

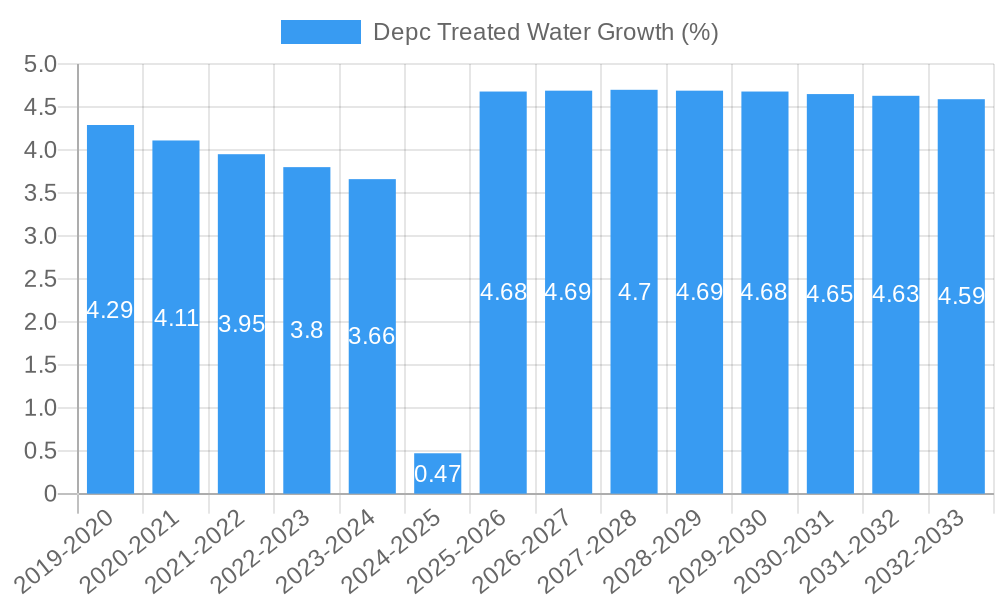

The global market for DEPC-treated water is poised for robust expansion, projected to reach an estimated value of USD 427 million in 2025 and demonstrating a significant Compound Annual Growth Rate (CAGR) of 4.8% over the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand in critical life science applications such as molecular biology and genomics, where the purity and nuclease-free nature of DEPC-treated water are paramount for accurate experimental outcomes. The increasing investment in research and development within academic institutions and pharmaceutical companies, coupled with the rising prevalence of genetic research and the development of novel therapeutic approaches, are key drivers propelling this market forward. Furthermore, the growing adoption of advanced laboratory techniques and the continuous innovation in molecular diagnostics are contributing to a sustained demand for high-quality reagents like DEPC-treated water.

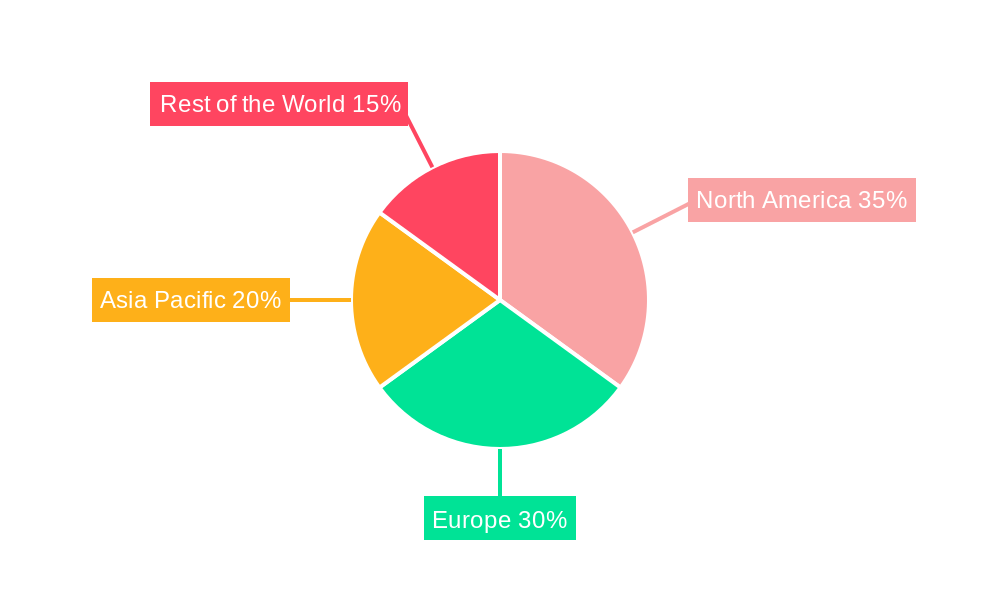

The market is characterized by a dynamic landscape with key players like Merck, Thermo Fisher Scientific, and Bio-Rad leading the charge in providing premium DEPC-treated water solutions. The market is segmented based on application, with Molecular Biology and Genomics representing the dominant segments due to their extensive reliance on sterile and nuclease-free water. In terms of type, ddH₂O and Milli-Q Water are the prevalent offerings. Geographically, North America and Europe currently hold substantial market shares, driven by their well-established research infrastructure and significant funding for life sciences. However, the Asia Pacific region is anticipated to exhibit the highest growth rate in the coming years, propelled by burgeoning economies, increasing R&D investments, and a growing pool of skilled researchers in countries like China and India. Emerging trends include the development of more efficient and cost-effective DEPC treatment methods and a greater emphasis on sustainable manufacturing processes within the industry.

Here's the SEO-optimized report description for Depc Treated Water, incorporating your specifications and high-traffic keywords.

Report Title: Global DEPC Treated Water Market Analysis: Trends, Opportunities, and Forecast (2019–2033)

Report Description:

Dive deep into the rapidly evolving global DEPC Treated Water market with this comprehensive analysis. Spanning a study period from 2019 to 2033, this report provides unparalleled insights into market dynamics, technological advancements, and growth trajectories for one of the most critical reagents in molecular biology and genomics. We project the market to reach XXX million by 2025, with a robust CAGR driving substantial expansion throughout the forecast period. This in-depth report is essential for stakeholders seeking to understand the competitive landscape, identify emerging opportunities, and strategize for success in the DEPC treated water market, molecular biology reagents market, and genomics research market.

Depc Treated Water Market Dynamics & Concentration

The DEPC Treated Water market exhibits a dynamic and moderately concentrated landscape. Innovation drivers are primarily fueled by the escalating demand for ultrapure water in sensitive biological applications, pushing manufacturers to enhance purification technologies and quality control. Regulatory frameworks, while generally supportive of high-purity standards, can vary regionally, influencing product certifications and market access. Product substitutes, though less common for critical research applications, might include alternative sterilization methods or lower-grade purified water for non-critical uses. End-user trends reveal a strong preference for consistent quality, lot-to-lot reproducibility, and readily available technical support. Mergers and acquisitions (M&A) activities, while not pervasive, indicate strategic consolidation to broaden product portfolios and gain market share. Estimated M&A deal counts are in the range of XX annually. Major players are strategically acquiring smaller entities to enhance their offerings. The market share distribution is concentrated among the top X companies, holding an estimated XX% of the global market.

Depc Treated Water Industry Trends & Analysis

The global DEPC Treated Water market is on a robust growth trajectory, driven by an insatiable demand from the life sciences sector. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This significant growth is primarily propelled by the accelerating pace of research and development in molecular biology, genomics, and biotechnology. The increasing prevalence of chronic diseases and the growing need for accurate diagnostic tools are further bolstering the demand for high-purity reagents like DEPC treated water. Technological disruptions are constantly reshaping the market, with advancements in water purification technologies, such as improved filtration membranes and advanced sterilization techniques, enhancing product efficacy and reducing contamination risks. Consumer preferences are leaning towards suppliers offering superior quality assurance, validated certifications, and exceptional customer support, with a keen eye on the environmental impact of production processes. Market penetration of DEPC treated water is expanding beyond traditional research institutions into industrial applications requiring stringent purity standards. Competitive dynamics are characterized by intense innovation, with established players continually investing in R&D to maintain their market leadership and new entrants striving to carve out niches through specialized offerings. The growing emphasis on personalized medicine and gene therapy further amplifies the need for reliable and ultrapure water solutions, making DEPC treated water an indispensable component in these advanced fields. The market penetration is currently estimated at XX% globally, with significant potential for growth in emerging economies.

Leading Markets & Segments in Depc Treated Water

The DEPC Treated Water market is dominated by the Molecular Biology application segment, which consistently drives demand due to the critical need for nuclease-free and sterile water in DNA/RNA extraction, PCR, and other sensitive molecular techniques. Within this application, ddH₂O (double-distilled deionized water) represents the most prevalent type, closely followed by Milli-Q Water, renowned for its exceptional purity and reliability. Geographically, North America, particularly the United States, stands as the leading market, fueled by extensive government funding for life science research, a thriving biotechnology industry, and the presence of major research institutions.

- Application Dominance (Molecular Biology):

- Key Drivers: The burgeoning field of genomics and proteomics, the increasing investment in gene editing technologies like CRISPR, and the expanding use of molecular diagnostic tests are primary catalysts for the high demand in molecular biology.

- Detailed Dominance Analysis: Research laboratories in universities, pharmaceutical companies, and contract research organizations (CROs) rely heavily on DEPC treated water for a wide array of experiments. The stringent requirements for preventing RNA degradation necessitate the use of DEPC treated water to ensure accurate and reproducible results.

- Type Dominance (ddH₂O & Milli-Q Water):

- Key Drivers: The inherent purity and proven efficacy of double-distilled deionized water and Milli-Q water systems make them the preferred choice. Manufacturers continuously refine their purification processes to meet and exceed industry standards.

- Detailed Dominance Analysis: ddH₂O, often produced through multi-stage distillation and deionization, offers a cost-effective yet highly pure solution. Milli-Q water, generated by advanced purification systems, provides a higher level of assurance for ultra-sensitive applications, making it a benchmark for quality.

- Regional Dominance (North America):

- Key Drivers: Robust funding for scientific research from agencies like the National Institutes of Health (NIH), a well-established pharmaceutical and biotechnology ecosystem, and a high concentration of leading academic institutions contribute to North America's market leadership.

- Detailed Dominance Analysis: The region's commitment to innovation and its early adoption of advanced research technologies ensure a sustained and growing demand for high-quality DEPC treated water.

Depc Treated Water Product Developments

Recent product developments in the DEPC treated water sector focus on enhancing purity levels, ensuring nuclease-free environments, and offering convenient packaging solutions. Innovations include improved multi-stage purification processes that guarantee ultra-low levels of contaminants and RNase/DNase activity, crucial for sensitive molecular biology applications. Manufacturers are also developing specialized formulations and advanced sterilization techniques to meet the evolving needs of genomics research, cell culture, and diagnostics. Competitive advantages are being gained through superior quality control, extended shelf-life, and adherence to strict regulatory compliance, ensuring lot-to-lot consistency and reliability for critical laboratory workflows.

Key Drivers of Depc Treated Water Growth

The DEPC treated water market is propelled by several key growth drivers. Foremost is the escalating global investment in life sciences research and development, particularly in areas like genomics, proteomics, and drug discovery. The increasing demand for accurate and reliable diagnostic tools, from infectious disease testing to cancer screening, directly fuels the need for ultrapure water in laboratory procedures. Furthermore, technological advancements in molecular biology techniques, such as PCR and next-generation sequencing, necessitate the use of high-purity reagents. Favorable government initiatives and funding for scientific research in various countries also contribute significantly to market expansion.

Challenges in the Depc Treated Water Market

Despite its strong growth prospects, the DEPC treated water market faces certain challenges. Stringent quality control requirements and the need for continuous investment in advanced purification technologies can lead to higher production costs. Regulatory hurdles and varying purity standards across different regions can also pose barriers to market entry and expansion. Supply chain complexities, especially for specialized reagents, and the potential for price volatility of raw materials can impact profitability. Moreover, intense competition among numerous players can lead to price pressures, necessitating a constant focus on differentiation through quality and service.

Emerging Opportunities in Depc Treated Water

Emerging opportunities in the DEPC treated water market are predominantly driven by the rapid expansion of personalized medicine and the growing adoption of advanced biotechnologies. The surge in demand for mRNA vaccines and therapies, a field heavily reliant on nuclease-free environments, presents a significant growth catalyst. Furthermore, the increasing use of DEPC treated water in industrial cell culture for biopharmaceutical production offers a lucrative avenue. Strategic partnerships between DEPC treated water manufacturers and biotechnology firms, as well as expansion into emerging economies with growing research infrastructure, are key strategies for tapping into these future growth potentials.

Leading Players in the Depc Treated Water Sector

- Merck

- Thermo Fisher Scientific

- MP Biomedicals

- GROWCELLS

- G-Biosciences

- SRL

- Alkali Scientific

- NZYtech

- Qiagen

- Promega Corporation

- Bio-Rad

- New England Biolabs (NEB)

- Takara Bio

- Nacalai Tesque

- NCM Biotech

- Beyotime

- Yeasen

- Maokangbio

- Biorigin

- Condice Chem

Key Milestones in Depc Treated Water Industry

- 2019: Increased focus on ultra-pure water for gene therapy research drives new product development.

- 2020: Global pandemic spurs demand for molecular diagnostic reagents, including DEPC treated water.

- 2021: Advancements in sterilization technologies lead to longer shelf-life DEPC treated water products.

- 2022: Expansion of biopharmaceutical manufacturing boosts industrial demand for high-purity water.

- 2023: Emerging economies show significant growth in research infrastructure, increasing regional demand.

- 2024: Development of more sustainable DEPC treated water production methods gains traction.

Strategic Outlook for Depc Treated Water Market

The strategic outlook for the DEPC treated water market is exceptionally bright, propelled by sustained innovation and expanding applications. The continued growth in genomics, personalized medicine, and the biopharmaceutical sector will act as significant growth accelerators. Manufacturers are expected to focus on developing next-generation DEPC treated water with enhanced purity, improved nuclease-free properties, and tailored formulations for specific research needs. Strategic collaborations with leading research institutions and biotechnology companies will be crucial for product development and market penetration. Furthermore, the expansion into untapped geographical markets and the adoption of advanced digital solutions for supply chain management will be key to capitalizing on the market's considerable future potential.

Depc Treated Water Segmentation

-

1. Application

- 1.1. Molecular Biology

- 1.2. Genomics

-

2. Type

- 2.1. ddH₂O

- 2.2. Milli-Q Water

Depc Treated Water Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Depc Treated Water REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Depc Treated Water Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Molecular Biology

- 5.1.2. Genomics

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. ddH₂O

- 5.2.2. Milli-Q Water

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Depc Treated Water Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Molecular Biology

- 6.1.2. Genomics

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. ddH₂O

- 6.2.2. Milli-Q Water

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Depc Treated Water Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Molecular Biology

- 7.1.2. Genomics

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. ddH₂O

- 7.2.2. Milli-Q Water

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Depc Treated Water Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Molecular Biology

- 8.1.2. Genomics

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. ddH₂O

- 8.2.2. Milli-Q Water

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Depc Treated Water Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Molecular Biology

- 9.1.2. Genomics

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. ddH₂O

- 9.2.2. Milli-Q Water

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Depc Treated Water Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Molecular Biology

- 10.1.2. Genomics

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. ddH₂O

- 10.2.2. Milli-Q Water

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Merck

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MP Biomedicals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GROWCELLS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G-Biosciences

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SRL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alkali Scientific

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NZYtech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qiagen

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Promega Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bio-Rad

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 New England Biolabs (NEB)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Takara Bio

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nacalai Tesque

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NCM Biotech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Beyotime

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Yeasen

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Maokangbio

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Biorigin

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Condice Chem

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Merck

List of Figures

- Figure 1: Global Depc Treated Water Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Depc Treated Water Revenue (million), by Application 2024 & 2032

- Figure 3: North America Depc Treated Water Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Depc Treated Water Revenue (million), by Type 2024 & 2032

- Figure 5: North America Depc Treated Water Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Depc Treated Water Revenue (million), by Country 2024 & 2032

- Figure 7: North America Depc Treated Water Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Depc Treated Water Revenue (million), by Application 2024 & 2032

- Figure 9: South America Depc Treated Water Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Depc Treated Water Revenue (million), by Type 2024 & 2032

- Figure 11: South America Depc Treated Water Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Depc Treated Water Revenue (million), by Country 2024 & 2032

- Figure 13: South America Depc Treated Water Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Depc Treated Water Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Depc Treated Water Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Depc Treated Water Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Depc Treated Water Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Depc Treated Water Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Depc Treated Water Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Depc Treated Water Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Depc Treated Water Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Depc Treated Water Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Depc Treated Water Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Depc Treated Water Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Depc Treated Water Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Depc Treated Water Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Depc Treated Water Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Depc Treated Water Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Depc Treated Water Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Depc Treated Water Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Depc Treated Water Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Depc Treated Water Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Depc Treated Water Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Depc Treated Water Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Depc Treated Water Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Depc Treated Water Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Depc Treated Water Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Depc Treated Water Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Depc Treated Water Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Depc Treated Water Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Depc Treated Water Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Depc Treated Water Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Depc Treated Water Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Depc Treated Water Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Depc Treated Water Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Depc Treated Water Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Depc Treated Water Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Depc Treated Water Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Depc Treated Water Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Depc Treated Water Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Depc Treated Water Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Depc Treated Water?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Depc Treated Water?

Key companies in the market include Merck, Thermo Fisher Scientific, MP Biomedicals, GROWCELLS, G-Biosciences, SRL, Alkali Scientific, NZYtech, Qiagen, Promega Corporation, Bio-Rad, New England Biolabs (NEB), Takara Bio, Nacalai Tesque, NCM Biotech, Beyotime, Yeasen, Maokangbio, Biorigin, Condice Chem.

3. What are the main segments of the Depc Treated Water?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 427 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Depc Treated Water," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Depc Treated Water report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Depc Treated Water?

To stay informed about further developments, trends, and reports in the Depc Treated Water, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence