Key Insights

The Vietnam aquafeed market, projected at 2.63 billion in 2025, is poised for substantial expansion driven by the nation's thriving aquaculture industry. Forecasted to grow at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033, the market is expected to reach significant valuations. Key growth catalysts include escalating seafood consumption, government support for sustainable aquaculture, and technological innovations that boost feed efficiency and minimize environmental impact. Rising demand for shrimp and fish, especially for export, and the adoption of intensive farming methods are primary drivers. The market is segmented by feed type and species, with strong demand for feeds for shrimp, catfish, and other prevalent aquaculture species. Leading entities such as Charoen Pokphand Group and Archer Daniels Midland Co. are active participants in this dynamic sector, leveraging their formulation expertise and distribution networks. While challenges like raw material price volatility and environmental concerns exist, the market's overall growth trend remains positive.

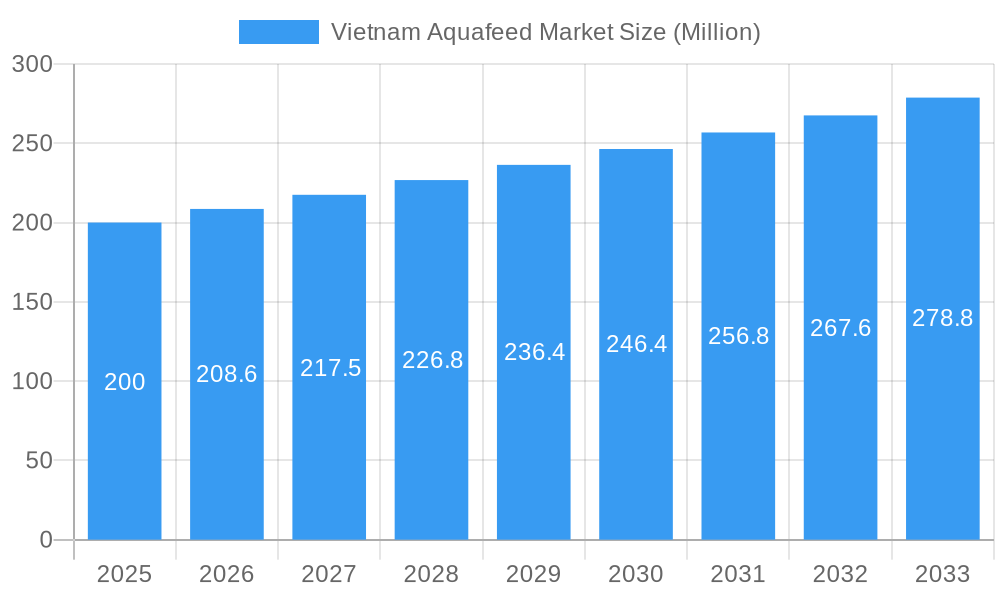

Vietnam Aquafeed Market Market Size (In Billion)

The competitive arena features both global corporations and domestic enterprises. International firms contribute advanced technology and know-how, while local companies offer deep insights into the Vietnamese market. Future expansion will be shaped by regulatory policies, industry sustainability efforts, and evolving consumer preferences for ethically sourced seafood. Strategic alliances and M&A activities are anticipated to influence market structure. Regional economic factors within Vietnam may also dictate varying growth rates. Consequently, the Vietnam aquafeed market presents considerable opportunities, establishing it as a significant contributor to the global aquaculture landscape. Detailed analysis of specific species and feed types is recommended for a more granular market understanding.

Vietnam Aquafeed Market Company Market Share

Vietnam Aquafeed Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Vietnam aquafeed market, covering market dynamics, industry trends, leading segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders seeking to navigate this rapidly evolving market. The report projects a market valued at xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Vietnam Aquafeed Market Market Dynamics & Concentration

The Vietnam aquafeed market is characterized by a moderately concentrated landscape, with several large multinational corporations and domestic players competing for market share. Market concentration is estimated at xx% in 2025, driven by the presence of major players like Charoen Pokphand Group and Cargill Inc. Innovation is a key driver, with companies investing in sustainable and high-performance feed formulations to meet evolving consumer demand and regulatory requirements. The regulatory framework, while evolving, is geared towards promoting sustainable aquaculture practices, influencing the adoption of environmentally friendly feed technologies. Product substitutes, such as alternative protein sources, are emerging but have not yet significantly impacted the market. End-user trends are shifting towards higher-value, specialized feeds tailored to specific species and farming practices. M&A activities have been relatively modest in recent years, with an estimated xx M&A deals recorded between 2019 and 2024, indicating a potential for increased consolidation in the future.

- Market Share (2025): Top 5 players account for xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Sustainable feed formulations, precision nutrition, disease prevention

- Regulatory Focus: Sustainable aquaculture practices, environmental impact

Vietnam Aquafeed Market Industry Trends & Analysis

The Vietnam aquafeed market is experiencing robust and dynamic growth, propelled by a confluence of evolving consumer demands, technological innovations, and supportive governmental policies. The escalating global and domestic appetite for seafood, driven by a burgeoning population and a discernible rise in disposable incomes, stands as a primary catalyst. Concurrently, significant strides in feed formulation and production technologies are revolutionizing aquaculture. These advancements are yielding aquafeed with enhanced nutritional profiles and superior digestibility, directly translating into improved feed conversion ratios and accelerated aquaculture yields. Furthermore, a pronounced global shift towards sustainably sourced seafood is reshaping consumer preferences, creating a burgeoning demand for aquafeed solutions that demonstrably minimize environmental footprints. The competitive landscape is characterized by its intensity, compelling market players to vigorously pursue product differentiation, cultivate strong brand identities, and forge strategic alliances to capture and expand market share. The market exhibits substantial growth potential, projected to witness a compound annual growth rate (CAGR) of approximately [Insert Specific CAGR for 2019-2024]% from 2019 to 2024, and an even more impressive CAGR of [Insert Specific CAGR for 2025-2033]% from 2025 to 2033. The penetration of specialized and functional aquafeeds remains relatively nascent, indicating considerable untapped potential in niche segments such as high-performance feeds, species-specific formulations, and nutraceutical-enhanced feeds.

Leading Markets & Segments in Vietnam Aquafeed Market

The Mekong Delta region unequivocally anchors the Vietnam aquafeed market, commanding an estimated [Insert Specific % for Mekong Delta Consumption]% of total consumption in 2025. This regional dominance is intrinsically linked to its unparalleled concentration of aquaculture operations and its highly favorable climatic conditions, which are optimally suited for diverse aquaculture practices. Within the species segmentation, shrimp feed reigns supreme, capturing a significant [Insert Specific % for Shrimp Feed]% market share, closely followed by catfish feed at [Insert Specific % for Catfish Feed]% and tilapia feed at [Insert Specific % for Tilapia Feed]%. The enduring strength of these dominant segments is underpinned by several critical factors:

- Supportive Economic Policies: Robust government initiatives, including substantial financial incentives, preferential lending schemes, and strategic investments in aquaculture infrastructure, provide a conducive environment for market expansion.

- Developed Infrastructure: The presence of a well-established aquaculture ecosystem, encompassing advanced farming facilities, efficient processing plants, and sophisticated logistics and supply chain networks, facilitates seamless market operations.

- Favorable Climate: The region's naturally advantageous climate, characterized by consistent temperatures and ample water resources, creates an ideal setting for year-round aquaculture production, thereby driving sustained demand for aquafeed.

The preeminence of shrimp feed is a direct reflection of Vietnam's formidable shrimp production capabilities and its strong standing in international export markets. The continued growth of this segment is further amplified by ongoing advancements in feed technology, which are instrumental in enhancing feed utilization efficiency and promoting accelerated shrimp growth rates.

Vietnam Aquafeed Market Product Developments

Recent product innovations focus on enhancing feed efficiency, improving nutritional value, and reducing the environmental footprint of aquafeed. Companies are investing in sustainable feed ingredients, such as insect meal and single-cell protein, and developing specialized feeds tailored to specific species and farming practices. These innovations aim to address consumer demand for sustainably produced seafood and improve the overall profitability of aquaculture operations. Technological advancements in feed processing and formulation, including automated systems and advanced analytical techniques, are enhancing production efficiency and product quality.

Key Drivers of Vietnam Aquafeed Market Growth

The robust upward trajectory of the Vietnam aquafeed market is propelled by a synergistic interplay of key drivers. Foremost among these is the unwavering commitment of the Vietnamese government to foster the growth of its aquaculture sector through targeted financial support, investment in critical infrastructure development, and the implementation of policies that encourage innovation. The escalating domestic consumption of seafood, coupled with sustained demand from international markets, provides a powerful impetus for market expansion. Simultaneously, continuous technological advancements in aquafeed production methodologies are not only improving the efficiency and quality of feed but also enhancing the overall sustainability of aquaculture operations. Furthermore, a growing global and national consciousness regarding the importance of sustainable aquaculture practices is fostering a greater adoption of environmentally responsible aquafeed solutions, thereby contributing significantly to market expansion and the development of a more resilient aquaculture industry.

Challenges in the Vietnam Aquafeed Market Market

The Vietnam aquafeed market faces various challenges. Fluctuations in raw material prices and supply chain disruptions can impact profitability. Intense competition from both domestic and international players puts pressure on margins. Regulatory hurdles and evolving environmental regulations demand continuous adaptation. The impact of these challenges can be seen in the relatively low profit margins observed within the sector (xx%).

Emerging Opportunities in Vietnam Aquafeed Market

The long-term outlook for the Vietnam aquafeed market is exceedingly optimistic, brimming with opportunities for forward-thinking enterprises. Breakthroughs in feed technology, including the research and development of novel, sustainable feed ingredients (such as insect meal and microalgae) and cutting-edge feed processing techniques, present significant avenues for market differentiation and growth. The strategic formation of partnerships between aquafeed manufacturers and aquaculture farms is poised to foster deeper value chain integration, leading to enhanced operational efficiencies and improved profitability for all stakeholders. Moreover, opportunities abound for market expansion into less developed regions within Vietnam and for the diversification of product portfolios to include a wider array of species-specific feeds, catering to the unique nutritional requirements of a broader spectrum of farmed aquatic organisms. The increasing focus on traceable and premium aquafeed products also presents a substantial growth avenue.

Leading Players in the Vietnam Aquafeed Market Sector

- Charoen Pokphand Group

- Archer Daniels Midland Co

- Biomin GmbH

- Lallemand Vietnam

- Aller Aqua

- Nutreco NV

- BASF SE

- De Heus LLC

- Altech Inc

- Cargill Inc

- INVE Aquaculture Inc

Key Milestones in Vietnam Aquafeed Market Industry

- September 2021: Vietnam's Ministry of Agriculture and Rural Development launched a USD 149 Million initiative to develop the aquaculture sector in the Mekong Delta, boosting investment and growth prospects.

- June 2022: Vietnam-based Sheng Long Group opened a new aquafeed mill, increasing domestic production capacity and competition.

- November 2022: Skretting opened its new fish feed factory, Lotus II, in Vietnam, adding 100,000 tons of annual production capacity, significantly impacting the supply of high-quality fish feed.

Strategic Outlook for Vietnam Aquafeed Market Market

The Vietnam aquafeed market is poised for substantial and sustained long-term growth. Continued strategic investments in modernizing aquaculture infrastructure, coupled with the relentless pursuit of technological advancements in feed production and the widespread adoption of sustainable aquaculture practices, will be instrumental in driving further market expansion. The competitive landscape is likely to witness significant evolution, with anticipated consolidation through strategic partnerships and mergers and acquisitions (M&A) activities. This will foster an environment of increased innovation and operational efficiency. The paramount importance of sustainable and high-performance aquafeeds will continue to shape market dynamics, creating lucrative opportunities for companies that proactively adapt to the evolving needs of the aquaculture industry and the increasing global demand for responsibly produced seafood. Companies focusing on digitalization, traceability, and customized feed solutions are well-positioned for future success.

Vietnam Aquafeed Market Segmentation

-

1. Feed Type

-

1.1. Species

- 1.1.1. White Leg Shrimp (Litopenaeus vannamei)

- 1.1.2. Giant Tiger Prawn (Penaeus Monodon)

- 1.1.3. Pangasius

- 1.1.4. Carp

- 1.1.5. Catfish

- 1.1.6. Tilapia

- 1.1.7. Other Species

-

1.1. Species

Vietnam Aquafeed Market Segmentation By Geography

- 1. Vietnam

Vietnam Aquafeed Market Regional Market Share

Geographic Coverage of Vietnam Aquafeed Market

Vietnam Aquafeed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Export Demand for Aquaculture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Aquafeed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feed Type

- 5.1.1. Species

- 5.1.1.1. White Leg Shrimp (Litopenaeus vannamei)

- 5.1.1.2. Giant Tiger Prawn (Penaeus Monodon)

- 5.1.1.3. Pangasius

- 5.1.1.4. Carp

- 5.1.1.5. Catfish

- 5.1.1.6. Tilapia

- 5.1.1.7. Other Species

- 5.1.1. Species

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Feed Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Charoen Pokphand Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Archer Daniels Midland Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biomin GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lallemand Vietna

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aller Aqua

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutreco NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 De Heus LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Altech Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargill Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 INVE Aquaculture Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Charoen Pokphand Group

List of Figures

- Figure 1: Vietnam Aquafeed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Vietnam Aquafeed Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Aquafeed Market Revenue billion Forecast, by Feed Type 2020 & 2033

- Table 2: Vietnam Aquafeed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Vietnam Aquafeed Market Revenue billion Forecast, by Feed Type 2020 & 2033

- Table 4: Vietnam Aquafeed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Aquafeed Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Vietnam Aquafeed Market?

Key companies in the market include Charoen Pokphand Group, Archer Daniels Midland Co, Biomin GmbH, Lallemand Vietna, Aller Aqua, Nutreco NV, BASF SE, De Heus LLC, Altech Inc, Cargill Inc, INVE Aquaculture Inc.

3. What are the main segments of the Vietnam Aquafeed Market?

The market segments include Feed Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increase in Export Demand for Aquaculture Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Skretting opened its new fish feed factory, Lotus II, in Vietnam. The fish feed factory consists of two independent lines with a production capacity of 100,000 tons per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Aquafeed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Aquafeed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Aquafeed Market?

To stay informed about further developments, trends, and reports in the Vietnam Aquafeed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence