Key Insights

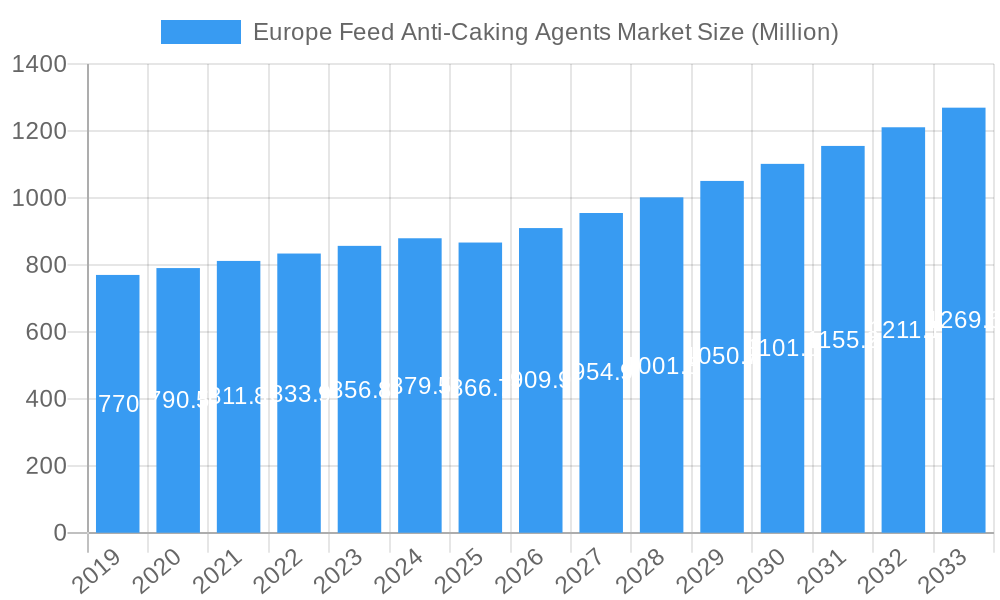

The European Feed Anti-Caking Agents Market is poised for significant expansion, with an estimated market size of $866.7 million in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% through 2033. This robust growth is primarily fueled by the increasing demand for high-quality animal feed, driven by the expanding global population and a corresponding rise in protein consumption. Modern livestock farming practices emphasize feed efficiency and palatability, making anti-caking agents indispensable for maintaining feed flowability, preventing clumping, and ensuring uniform nutrient delivery. The market's expansion is further bolstered by advancements in chemical formulations, leading to more effective and sustainable anti-caking solutions.

Europe Feed Anti-Caking Agents Market Market Size (In Million)

Key market drivers include the growing focus on animal health and welfare, which necessitates improved feed quality. The poultry and ruminant segments are expected to lead demand, given their significant contribution to overall meat and dairy production in Europe. Innovations in silicon-based and sodium-based anti-caking agents, offering superior performance and cost-effectiveness, are also contributing to market buoyancy. While market growth is generally strong, potential restraints such as stringent regulatory requirements for feed additives and price volatility of raw materials could pose challenges. Nevertheless, the overall outlook remains highly positive, with a strong emphasis on research and development to introduce novel solutions that address evolving industry needs and environmental considerations.

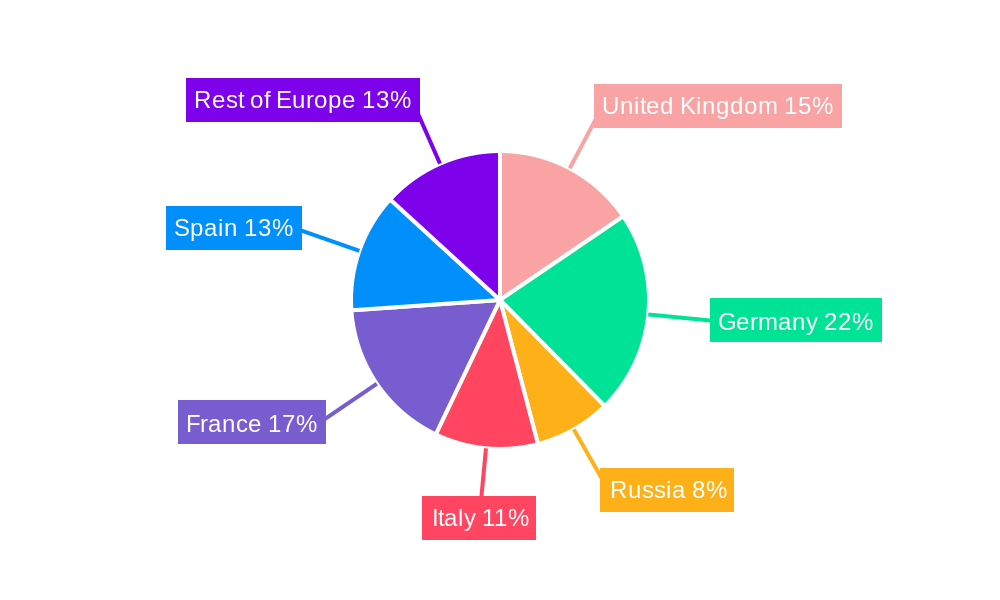

Europe Feed Anti-Caking Agents Market Company Market Share

Europe Feed Anti-Caking Agents Market: Comprehensive Market Analysis and Strategic Outlook (2019–2033)

Unlock the immense potential of the Europe Feed Anti-Caking Agents market with this in-depth report. Spanning from 2019 to 2033, this study provides critical insights into market dynamics, growth drivers, leading segments, and key players. Forecasted to reach an estimated value of XX million by 2025, with a projected CAGR of XX% during the forecast period (2025–2033), this report is an indispensable resource for stakeholders seeking to capitalize on the evolving landscape of animal feed additives.

Discover the intricate web of factors shaping the Europe feed anti-caking agents market, from evolving regulatory frameworks and technological innovations to shifting end-user preferences. This comprehensive analysis delves into the market's structure, identifying key players and their strategic moves, while also examining the impact of product substitutes and the increasing demand for high-quality animal feed solutions. With a deep dive into historical trends (2019–2024) and future projections, this report equips you with the knowledge to navigate this dynamic sector.

Europe Feed Anti-Caking Agents Market Market Dynamics & Concentration

The Europe Feed Anti-Caking Agents market is characterized by a moderate to high concentration, with key players like Ecolab, Archer Daniels Midland Co, W R Grace & Co* (List Not Exhaustive), PPG Industries Inc, NOVUS INTERNATIONAL, BASF SE, Kemin Industries Inc, Kao Corporation, and Evonik Industries holding significant market shares. Innovation is a primary driver, fueled by the continuous demand for improved feed quality, reduced waste, and enhanced animal health. Manufacturers are actively investing in research and development to create more effective, cost-efficient, and environmentally friendly anti-caking agents. Regulatory frameworks, particularly those from the European Food Safety Authority (EFSA), play a crucial role in shaping product development and market access, emphasizing safety and efficacy. While product substitutes exist in the form of alternative feed processing techniques, the cost-effectiveness and proven benefits of dedicated anti-caking agents maintain their dominance. End-user trends are shifting towards specialized solutions for different animal types and feed formulations, driven by growing awareness of animal nutrition and welfare. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to expand their product portfolios, geographical reach, and technological capabilities, with an estimated XX M&A deals expected within the forecast period, further consolidating the market.

Europe Feed Anti-Caking Agents Market Industry Trends & Analysis

The Europe Feed Anti-Caking Agents market is experiencing robust growth, propelled by a confluence of compelling industry trends. A primary growth driver is the escalating demand for high-quality animal feed, necessitated by the expansion of the global livestock industry and the increasing consumer preference for ethically sourced and sustainably produced animal products. This heightened focus on feed quality directly translates to a greater need for anti-caking agents to prevent clumping, improve flowability, and ensure uniform nutrient distribution, thereby optimizing animal health and productivity. Technological disruptions are playing a pivotal role, with ongoing research and development leading to the introduction of advanced anti-caking agents that offer enhanced efficacy, longer shelf-life, and improved environmental profiles. For instance, the development of bio-based anti-caking agents is gaining traction, aligning with the industry's sustainability goals. Consumer preferences are also subtly influencing the market; while not directly interacting with end-consumers, feed producers are increasingly prioritizing ingredients that contribute to overall animal well-being and reduce feed spoilage. This translates to a demand for anti-caking agents that are not only functional but also safe and contribute to a healthier digestive system. Competitive dynamics within the market are intensifying, with established global players vying for market share against emerging regional manufacturers. Companies are differentiating themselves through product innovation, strategic partnerships, and a focus on customer-centric solutions. The market penetration of advanced anti-caking agents is expected to rise significantly, driven by their proven benefits in reducing feed wastage and improving operational efficiency for feed manufacturers. The overall market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033), indicating a strong upward trajectory. This growth is underpinned by an estimated market value of XX million by the base year 2025. The increasing adoption of pelletized and pelleted feed formulations across various animal husbandry sectors further accentuates the need for effective anti-caking agents to maintain the integrity and palatability of these feed forms. The market’s evolution is also being shaped by the growing awareness of the economic impact of feed spoilage and handling inefficiencies, making anti-caking agents a crucial investment for livestock producers and feed mills alike.

Leading Markets & Segments in Europe Feed Anti-Caking Agents Market

The Silicon-based segment is currently dominating the Europe Feed Anti-Caking Agents market, driven by its exceptional efficacy in absorbing moisture and preventing particle aggregation across a wide range of feed types and environmental conditions. Its versatility and cost-effectiveness make it a preferred choice for numerous applications within the animal feed industry. Within the broader European landscape, Germany stands out as a leading market due to its significant agricultural output, large-scale livestock operations, and a strong emphasis on feed quality and animal health. The country’s robust economy and proactive approach to adopting new feed technologies further bolster the demand for advanced anti-caking agents.

Key Drivers of Dominance:

Technological Superiority of Silicon-based Agents:

- High moisture absorption capacity, crucial for preventing caking in humid environments.

- Excellent flowability enhancement properties, ensuring smooth feed handling and processing.

- Inert nature, posing no risk of adverse reactions with other feed ingredients.

- Cost-effectiveness relative to performance, making it an economical choice for feed producers.

Economic Policies and Agricultural Subsidies in Germany:

- Government initiatives supporting modern farming practices and investment in feed technology.

- Subsidies that encourage the adoption of high-quality feed additives for improved livestock productivity.

- Strict quality control measures on animal feed, necessitating the use of effective anti-caking agents.

Infrastructure and Logistics:

- Well-developed transportation networks in Germany facilitate efficient distribution of feed additives across the country and to other European nations.

- Presence of major feed manufacturers and distributors in Germany, creating a strong demand hub.

Dominance Analysis:

The dominance of Silicon-based anti-caking agents is further amplified by their suitability for a broad spectrum of animal types, including Poultry and Swine, which represent significant portions of Europe's livestock population. These animals often consume pelleted or mash feed where maintaining consistent particle size and preventing segregation is critical for balanced nutrition. The increasing trend towards intensive farming practices, particularly for poultry and swine, necessitates efficient feed management solutions, where anti-caking agents play a vital role. While other chemical types like Sodium-based and Calcium-based agents cater to specific needs, Silicon-based agents offer a more generalized yet highly effective solution. The strategic importance of Germany as a major agricultural producer and consumer of animal feed products solidifies its position as a key market, where the demand for advanced feed ingredients, including high-performance anti-caking agents, remains consistently high.

Europe Feed Anti-Caking Agents Market Product Developments

The Europe Feed Anti-Caking Agents market is witnessing a surge in product innovation focused on enhancing efficacy and sustainability. Manufacturers are developing advanced formulations that offer superior moisture management and improved flowability, catering to the evolving needs of feed producers. Emerging trends include the development of nano-particle anti-caking agents that provide enhanced surface area for moisture absorption and the integration of functional additives, such as prebiotics and probiotics, into anti-caking agents to offer dual benefits for animal health. Companies are also investing in research for more eco-friendly alternatives, exploring plant-derived or biodegradable anti-caking agents to align with growing environmental consciousness. These product developments aim to not only prevent caking but also contribute to overall feed quality, palatability, and digestive health, thereby providing a competitive edge in the market.

Key Drivers of Europe Feed Anti-Caking Agents Market Growth

Several key drivers are propelling the growth of the Europe Feed Anti-Caking Agents market. Firstly, the increasing demand for high-quality animal feed, driven by the expansion of the global meat, dairy, and egg industries, necessitates effective solutions to maintain feed integrity and nutritional value. Secondly, technological advancements in feed processing and manufacturing are creating a need for sophisticated anti-caking agents that can withstand these processes and ensure optimal feed flow. Thirdly, a growing awareness among feed producers and livestock farmers about the economic benefits of preventing feed spoilage, improving handling efficiency, and optimizing animal health is a significant catalyst. Finally, stringent regulatory frameworks emphasizing feed safety and quality are indirectly promoting the adoption of effective anti-caking agents that contribute to overall feed hygiene.

Challenges in the Europe Feed Anti-Caking Agents Market Market

Despite the positive growth trajectory, the Europe Feed Anti-Caking Agents market faces several challenges. Stringent and evolving regulatory landscapes, particularly concerning the approval and usage of feed additives, can pose significant hurdles for market entry and product development, potentially increasing R&D and compliance costs. Supply chain disruptions, exacerbated by global events, can impact the availability and price volatility of key raw materials, affecting production costs and profit margins. Furthermore, intense competition from both established players and emerging manufacturers can lead to price pressures and necessitate continuous innovation to maintain market share. The perception among some end-users regarding the necessity and cost-effectiveness of certain specialized anti-caking agents can also present a barrier to wider adoption, requiring focused educational initiatives and demonstration of tangible ROI.

Emerging Opportunities in Europe Feed Anti-Caking Agents Market

The Europe Feed Anti-Caking Agents market presents numerous emerging opportunities for growth and expansion. The increasing focus on sustainability and circular economy principles is creating a demand for eco-friendly and bio-based anti-caking agents, offering a niche for companies investing in green technologies. Technological breakthroughs in material science are paving the way for the development of advanced anti-caking agents with enhanced functionalities, such as improved nutrient delivery or pathogen inhibition, creating opportunities for value-added products. Strategic partnerships between anti-caking agent manufacturers and feed formulation companies can foster co-innovation and streamline the introduction of tailored solutions. Moreover, the growing demand for specialized feed additives in niche animal segments like aquaculture and exotic livestock presents untapped market potential for customized anti-caking agent solutions.

Leading Players in the Europe Feed Anti-Caking Agents Market Sector

- Ecolab

- Archer Daniels Midland Co

- W R Grace & Co

- PPG Industries Inc

- NOVUS INTERNATIONAL

- BASF SE

- Kemin Industries Inc

- Kao Corporation

- Evonik Industries

Key Milestones in Europe Feed Anti-Caking Agents Market Industry

- 2019: Increased regulatory scrutiny on feed additive safety by EFSA, prompting manufacturers to invest in enhanced product testing and compliance.

- 2020: Growing awareness of supply chain vulnerabilities due to global events, leading some companies to diversify raw material sourcing.

- 2021: Launch of new generation silicon-based anti-caking agents with improved moisture control capabilities.

- 2022: Expansion of product portfolios by key players to include calcium-based and other specialized anti-caking agents.

- 2023: Growing industry interest in sustainable and bio-based feed additive solutions, spurring R&D in this area.

Strategic Outlook for Europe Feed Anti-Caking Agents Market Market

The strategic outlook for the Europe Feed Anti-Caking Agents market is highly promising, characterized by sustained growth driven by innovation and evolving industry demands. Future success will hinge on a strategic focus on developing advanced, sustainable, and cost-effective anti-caking solutions that address the specific needs of diverse animal types and feed formulations. Companies that invest in cutting-edge research and development, particularly in areas like nanotechnology and bio-based alternatives, will be well-positioned to capture market share. Furthermore, fostering strategic collaborations with feed manufacturers and adopting a customer-centric approach to product development will be crucial for creating tailored solutions and strengthening market presence. Proactive engagement with regulatory bodies and a commitment to product safety and efficacy will remain paramount in navigating the competitive landscape and ensuring long-term market leadership.

Europe Feed Anti-Caking Agents Market Segmentation

-

1. Chemical Type

- 1.1. Silicon-based

- 1.2. Sodium-based

- 1.3. Calcium-based

- 1.4. Potassium-based

- 1.5. Other Chemical Types

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

Europe Feed Anti-Caking Agents Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Russia

- 4. Italy

- 5. France

- 6. Spain

- 7. Rest of Europe

Europe Feed Anti-Caking Agents Market Regional Market Share

Geographic Coverage of Europe Feed Anti-Caking Agents Market

Europe Feed Anti-Caking Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Need for Enhancing the Performance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Silicon-based

- 5.1.2. Sodium-based

- 5.1.3. Calcium-based

- 5.1.4. Potassium-based

- 5.1.5. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Russia

- 5.3.4. Italy

- 5.3.5. France

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. United Kingdom Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Silicon-based

- 6.1.2. Sodium-based

- 6.1.3. Calcium-based

- 6.1.4. Potassium-based

- 6.1.5. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. Germany Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Silicon-based

- 7.1.2. Sodium-based

- 7.1.3. Calcium-based

- 7.1.4. Potassium-based

- 7.1.5. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Russia Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Silicon-based

- 8.1.2. Sodium-based

- 8.1.3. Calcium-based

- 8.1.4. Potassium-based

- 8.1.5. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Italy Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Silicon-based

- 9.1.2. Sodium-based

- 9.1.3. Calcium-based

- 9.1.4. Potassium-based

- 9.1.5. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. France Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Silicon-based

- 10.1.2. Sodium-based

- 10.1.3. Calcium-based

- 10.1.4. Potassium-based

- 10.1.5. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminants

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Spain Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Silicon-based

- 11.1.2. Sodium-based

- 11.1.3. Calcium-based

- 11.1.4. Potassium-based

- 11.1.5. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Ruminants

- 11.2.2. Poultry

- 11.2.3. Swine

- 11.2.4. Aquaculture

- 11.2.5. Other Animal Types

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Rest of Europe Europe Feed Anti-Caking Agents Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12.1.1. Silicon-based

- 12.1.2. Sodium-based

- 12.1.3. Calcium-based

- 12.1.4. Potassium-based

- 12.1.5. Other Chemical Types

- 12.2. Market Analysis, Insights and Forecast - by Animal Type

- 12.2.1. Ruminants

- 12.2.2. Poultry

- 12.2.3. Swine

- 12.2.4. Aquaculture

- 12.2.5. Other Animal Types

- 12.1. Market Analysis, Insights and Forecast - by Chemical Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Ecolab

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Archer Daniels Midland Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 W R Grace & Co*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PPG Industries Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 NOVUS INTERNATIONAL

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BASF SE

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kemin Industries Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kao Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Evonik Industries

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Ecolab

List of Figures

- Figure 1: Europe Feed Anti-Caking Agents Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Feed Anti-Caking Agents Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 5: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 8: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 9: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 11: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 12: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 14: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 17: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 18: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 20: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 21: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 23: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 24: Europe Feed Anti-Caking Agents Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Feed Anti-Caking Agents Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Europe Feed Anti-Caking Agents Market?

Key companies in the market include Ecolab, Archer Daniels Midland Co, W R Grace & Co*List Not Exhaustive, PPG Industries Inc, NOVUS INTERNATIONAL, BASF SE, Kemin Industries Inc, Kao Corporation, Evonik Industries.

3. What are the main segments of the Europe Feed Anti-Caking Agents Market?

The market segments include Chemical Type, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Need for Enhancing the Performance.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Feed Anti-Caking Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Feed Anti-Caking Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Feed Anti-Caking Agents Market?

To stay informed about further developments, trends, and reports in the Europe Feed Anti-Caking Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence