Key Insights

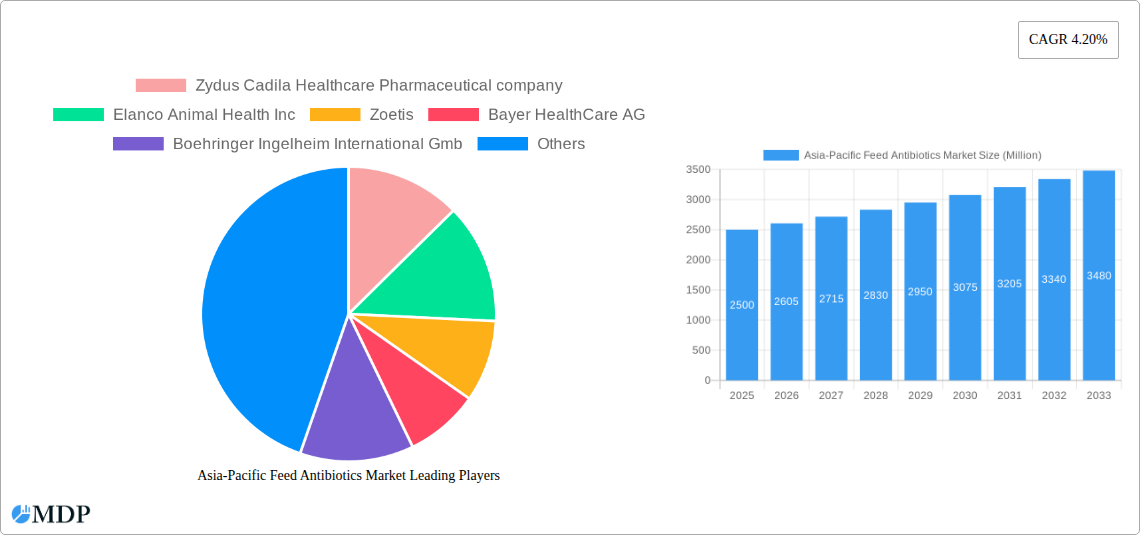

The Asia-Pacific feed antibiotics market, valued at $1.35 billion in 2025, is projected to achieve a compound annual growth rate (CAGR) of 4.2% through 2033. This growth is driven by escalating demand for animal protein, particularly in emerging economies, necessitating efficient livestock production through disease prevention and improved feed conversion. Technological advancements in antibiotic formulations and the development of novel, more effective antibiotics also contribute to market expansion. However, the rise of antibiotic-resistant bacteria presents a significant challenge, driving stricter regulations and a move towards alternative disease management solutions and antibiotic stewardship.

Asia-Pacific Feed Antibiotics Market Market Size (In Billion)

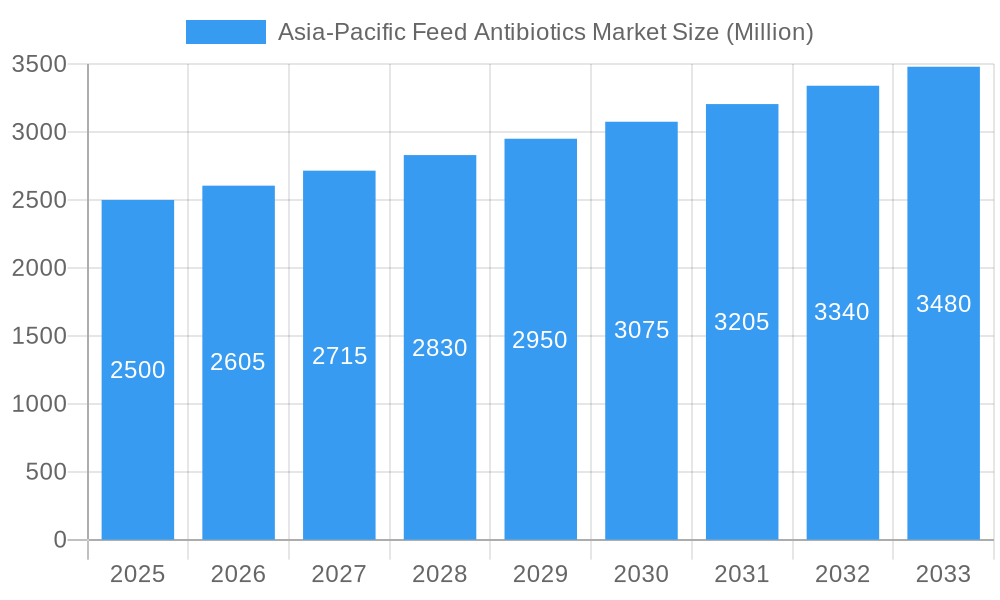

Market segmentation highlights significant consumption within ruminant and poultry sectors, with tetracyclines, penicillins, and sulfonamides as primary antibiotic classes. Intense competition prevails among key players like Zoetis, Elanco, and Bayer, who are actively pursuing R&D, strategic partnerships, and M&A to enhance their market standing. Growth is expected to be concentrated in regions with substantial livestock populations and developing agricultural industries.

Asia-Pacific Feed Antibiotics Market Company Market Share

Future market dynamics are influenced by rising animal protein demand counterbalanced by increasing regulatory oversight on antibiotic use in animal feed, fueled by concerns over residues and antibiotic resistance. The industry is responding by investing in alternatives such as probiotics, prebiotics, and immunostimulants. Furthermore, innovations in antibiotic delivery systems and a focus on sustainable animal farming practices are shaping the market's future. Success hinges on adaptability to evolving regulations and consumer preferences, while delivering cost-effective, safe, and effective products.

Asia-Pacific Feed Antibiotics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Feed Antibiotics Market, offering invaluable insights for stakeholders across the value chain. From market dynamics and leading players to emerging opportunities and future trends, this report equips you with the knowledge needed to navigate this dynamic sector. The study covers the period 2019-2033, with a focus on the 2025 estimated year and a forecast extending to 2033. The market is segmented by animal type (ruminant, poultry, swine, aquaculture, others) and antibiotic type (tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, cephalosporins, others). The report also features key players such as Zydus Cadila Healthcare Pharmaceutical company, Elanco Animal Health Inc, Zoetis, Bayer HealthCare AG, Boehringer Ingelheim International Gmb, Virbac Animal Health Pvt Ltd, and Merck Animal Health. Expect detailed analysis covering market size (in Millions), CAGR, and competitive landscape.

Asia-Pacific Feed Antibiotics Market Market Dynamics & Concentration

This section analyzes the market's competitive landscape, identifying key trends influencing market concentration. We explore innovation drivers, regulatory changes impacting the industry, the availability of product substitutes, evolving end-user preferences, and the impact of mergers and acquisitions (M&A) activities. The analysis includes:

- Market Concentration: The market exhibits a [xx]% concentration ratio, with the top 5 players holding an estimated [xx]% market share in 2025. This reflects [describe the nature of market concentration – e.g., a highly consolidated market dominated by a few large players or a more fragmented market].

- Innovation Drivers: [Describe specific technological advancements, such as new antibiotic formulations or delivery systems, driving market innovation. Quantify the impact where possible, e.g., "X% growth attributed to new formulation Y"].

- Regulatory Frameworks: [Discuss the impact of regional regulations on antibiotic use in animal feed. Mention specific regulations and their effects on market growth. E.g., "Stringent regulations in Country X have resulted in a Y% decrease in the use of antibiotic Z"].

- Product Substitutes: [Analyze the impact of alternative solutions, like probiotics or prebiotics, on antibiotic market share. Quantify the market share of these alternatives].

- End-User Trends: [Detail shifts in animal farming practices, such as the growth of intensive farming or organic farming, and their effects on antibiotic demand. Example: "The increasing adoption of intensive farming techniques is projected to boost demand for antibiotics by X%"].

- M&A Activities: [Discuss the number of M&A deals in the sector during the historical period (2019-2024) and their impact on market consolidation. E.g., "Over the period 2019-2024, there were xx M&A deals, resulting in [describe the consequences – e.g., increased market concentration or expanded product portfolios]"].

Asia-Pacific Feed Antibiotics Market Industry Trends & Analysis

This section provides a detailed analysis of the Asia-Pacific Feed Antibiotics Market's growth trajectory, exploring key industry trends and their impact on market dynamics. The analysis incorporates:

[This section requires 600 words of detailed analysis using the data available. It should analyze market growth drivers (e.g., rising livestock production, increasing awareness of animal health), technological disruptions (e.g., the development of novel antibiotic formulations), consumer preferences (e.g., demand for antibiotic-free meat), and competitive dynamics (e.g., pricing strategies, product differentiation). Include specific metrics such as CAGR and market penetration rates for different segments.]

Leading Markets & Segments in Asia-Pacific Feed Antibiotics Market

This section identifies the leading regions, countries, and segments within the Asia-Pacific Feed Antibiotics Market.

Dominant Segments:

- Animal Type: [Identify the dominant animal type (e.g., Poultry) and explain its dominance. Provide reasons for its dominance, such as high livestock population, intensive farming practices, and higher susceptibility to diseases. Quantify the market share of this segment].

- Antibiotic Type: [Identify the dominant antibiotic type (e.g., Tetracyclines) and explain its dominance. Provide reasons for its dominance, such as efficacy, cost-effectiveness, and widespread availability. Quantify the market share of this segment].

Key Drivers for Dominant Segments:

- [Region/Country]: Economic Policies: [Explain relevant policies, e.g., government subsidies for livestock farming]. Infrastructure: [Explain factors like efficient transportation networks facilitating the distribution of antibiotics].

- [Specific Segment]: High Prevalence of Diseases: [Explain the higher susceptibility of specific animal types to certain diseases, driving higher antibiotic usage]. Cost-Effectiveness: [Explain how cost-effective certain antibiotic types are compared to alternatives].

[This section requires a detailed dominance analysis (600 words) using bullet points and paragraphs. It should explain why specific segments are dominant, backed up with data and market insights.]

Asia-Pacific Feed Antibiotics Market Product Developments

Recent product innovations focus on [describe specific examples, e.g., improved formulations with enhanced efficacy and reduced side effects, novel delivery systems for targeted antibiotic release]. This is driven by [explain driving factors, e.g., the need for increased efficacy, minimizing environmental impact, and complying with stricter regulations]. These advancements offer [describe competitive advantages, e.g., improved animal health outcomes, reduced antibiotic usage, and enhanced profitability for farmers].

Key Drivers of Asia-Pacific Feed Antibiotics Market Growth

The Asia-Pacific Feed Antibiotics Market is propelled by several key factors: the rising demand for animal protein due to increasing population and changing dietary habits; the growth of intensive livestock farming, increasing the risk of disease outbreaks; and technological advancements leading to the development of more effective and targeted antibiotics. Further, supportive government policies in several countries within the region are stimulating market growth.

Challenges in the Asia-Pacific Feed Antibiotics Market Market

The market faces challenges including stringent regulations on antibiotic use aimed at curbing antimicrobial resistance; supply chain disruptions impacting the availability and cost of antibiotics; and increasing competition from alternative solutions such as probiotics and prebiotics. These factors contribute to [quantify the impact – e.g., xx% reduction in market growth, xx% increase in production costs].

Emerging Opportunities in the Asia-Pacific Feed Antibiotics Market

Long-term growth is driven by the ongoing development of novel antibiotic formulations with enhanced efficacy and reduced side effects; strategic partnerships between pharmaceutical companies and livestock producers; and the expansion into new markets driven by rising demand in developing economies. This creates opportunities for market players to capture significant growth.

Leading Players in the Asia-Pacific Feed Antibiotics Market Sector

Key Milestones in Asia-Pacific Feed Antibiotics Market Industry

- [List key milestones with year/month, e.g., "2022-Q3: Launch of new broad-spectrum antibiotic by Company X," "2023-Q1: Acquisition of Company Y by Company Z"]. Describe the impact of each milestone on the market.

Strategic Outlook for Asia-Pacific Feed Antibiotics Market Market

The Asia-Pacific Feed Antibiotics Market holds significant future potential, driven by factors such as increasing livestock production, growing demand for animal protein, and ongoing innovation in antibiotic development. Strategic partnerships, investments in research and development, and the adoption of sustainable practices will be crucial for market success. The market is projected to experience substantial growth in the forecast period (2025-2033), presenting lucrative opportunities for businesses with a strong strategic outlook.

Asia-Pacific Feed Antibiotics Market Segmentation

-

1. Type

- 1.1. Tetracyclines

- 1.2. Penicillins

- 1.3. Sulfonamides

- 1.4. Macrolides

- 1.5. Aminoglycosides

- 1.6. Cephalosporins

- 1.7. Others

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

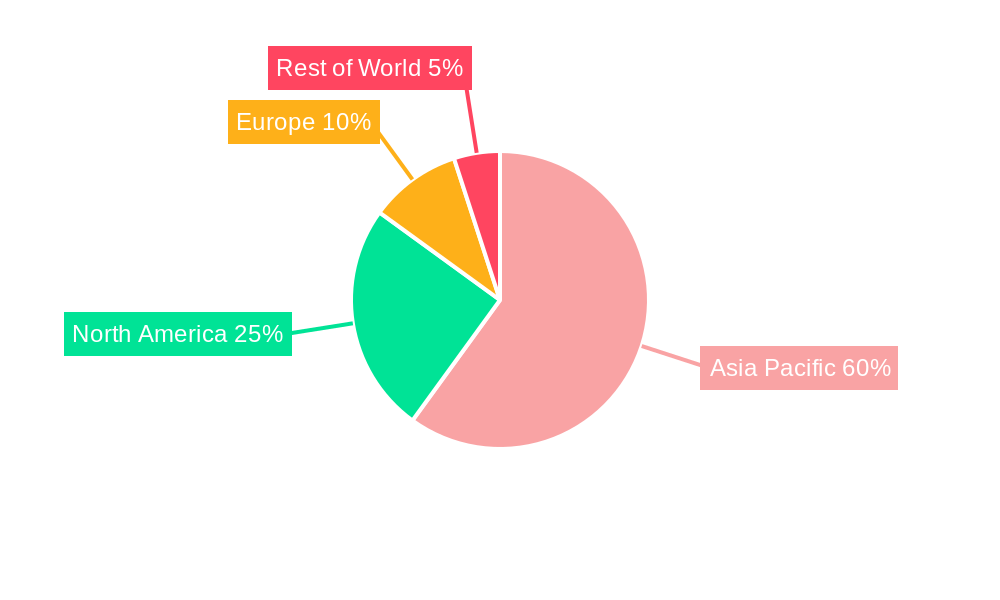

Asia-Pacific Feed Antibiotics Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Feed Antibiotics Market Regional Market Share

Geographic Coverage of Asia-Pacific Feed Antibiotics Market

Asia-Pacific Feed Antibiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Meat Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tetracyclines

- 5.1.2. Penicillins

- 5.1.3. Sulfonamides

- 5.1.4. Macrolides

- 5.1.5. Aminoglycosides

- 5.1.6. Cephalosporins

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tetracyclines

- 6.1.2. Penicillins

- 6.1.3. Sulfonamides

- 6.1.4. Macrolides

- 6.1.5. Aminoglycosides

- 6.1.6. Cephalosporins

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tetracyclines

- 7.1.2. Penicillins

- 7.1.3. Sulfonamides

- 7.1.4. Macrolides

- 7.1.5. Aminoglycosides

- 7.1.6. Cephalosporins

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tetracyclines

- 8.1.2. Penicillins

- 8.1.3. Sulfonamides

- 8.1.4. Macrolides

- 8.1.5. Aminoglycosides

- 8.1.6. Cephalosporins

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tetracyclines

- 9.1.2. Penicillins

- 9.1.3. Sulfonamides

- 9.1.4. Macrolides

- 9.1.5. Aminoglycosides

- 9.1.6. Cephalosporins

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Tetracyclines

- 10.1.2. Penicillins

- 10.1.3. Sulfonamides

- 10.1.4. Macrolides

- 10.1.5. Aminoglycosides

- 10.1.6. Cephalosporins

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zydus Cadila Healthcare Pharmaceutical company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elanco Animal Health Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zoetis

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer HealthCare AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Boehringer Ingelheim International Gmb

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Virbac Animal Health Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merck Animal Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Zydus Cadila Healthcare Pharmaceutical company

List of Figures

- Figure 1: Asia-Pacific Feed Antibiotics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Feed Antibiotics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 19: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Feed Antibiotics Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Asia-Pacific Feed Antibiotics Market?

Key companies in the market include Zydus Cadila Healthcare Pharmaceutical company, Elanco Animal Health Inc, Zoetis, Bayer HealthCare AG, Boehringer Ingelheim International Gmb, Virbac Animal Health Pvt Ltd, Merck Animal Health.

3. What are the main segments of the Asia-Pacific Feed Antibiotics Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Meat Consumption.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Feed Antibiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Feed Antibiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Feed Antibiotics Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Feed Antibiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence