Key Insights

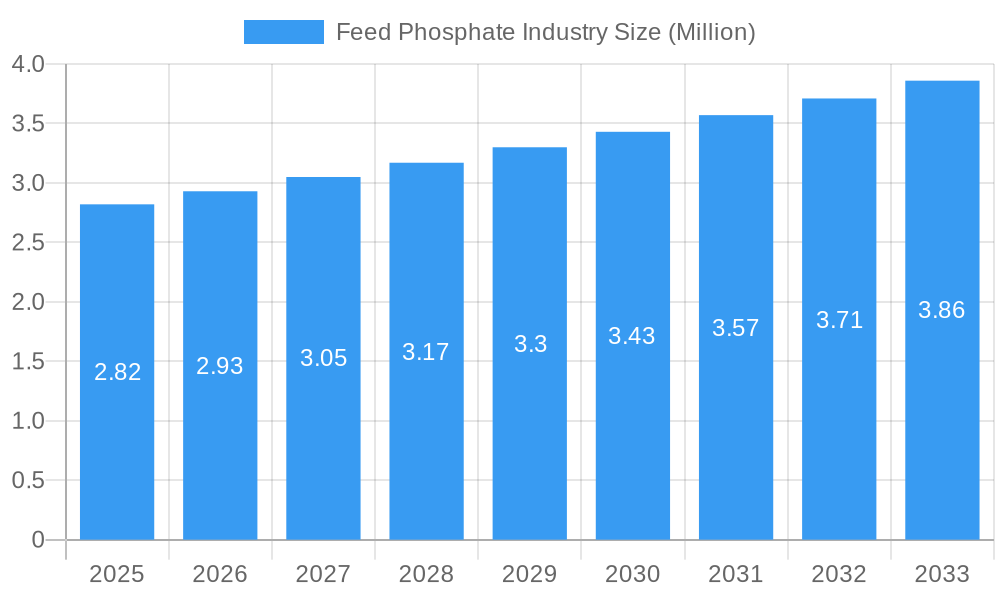

The global Feed Phosphate market is poised for robust expansion, projected to reach a significant size and experience steady growth driven by the escalating demand for animal protein and evolving animal nutrition practices. With a current market size of approximately USD 2.82 million and a projected Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033, this industry demonstrates strong underlying momentum. The primary drivers for this growth include the increasing global population, leading to a higher consumption of meat, dairy, and eggs, which in turn necessitates improved animal feed formulations. Furthermore, a growing awareness among livestock producers regarding the crucial role of essential minerals like phosphorus in animal health, growth performance, and overall productivity is fueling the adoption of high-quality feed phosphates. Innovations in feed processing and the development of more bioavailable phosphate sources are also contributing to market penetration. The poultry and swine segments are expected to remain dominant due to their high production volumes and the critical need for precise nutrient management in these species.

Feed Phosphate Industry Market Size (In Million)

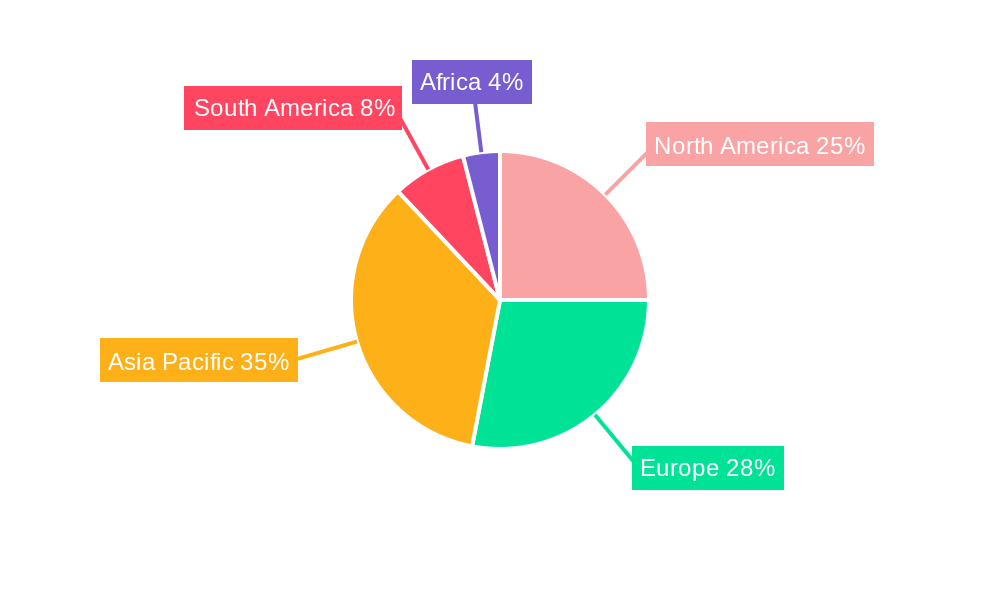

Despite the optimistic outlook, the Feed Phosphate market faces certain restraints. Fluctuations in raw material prices, particularly those associated with phosphate rock, can impact profitability and influence pricing strategies. Stringent environmental regulations concerning phosphate mining and its impact on water bodies, along with concerns over phosphorus runoff and eutrophication, could also pose challenges. However, the industry is actively responding to these concerns through the development of more sustainable production methods and the promotion of efficient nutrient utilization in animal diets. The Asia Pacific region, led by significant demand from India and China, is anticipated to be a key growth engine, driven by rapid industrialization of the livestock sector and a burgeoning middle class with increased purchasing power for animal-derived products. North America and Europe, with their established agricultural sectors and focus on animal welfare and efficiency, will continue to be significant markets, with ongoing innovation in feed additive technologies.

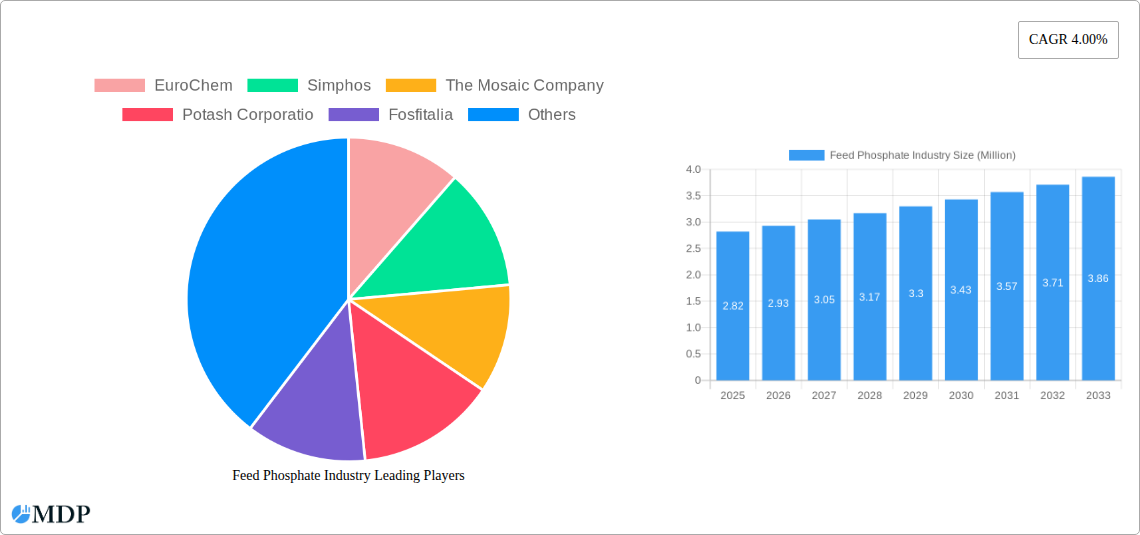

Feed Phosphate Industry Company Market Share

Feed Phosphate Industry Report: Global Market Analysis & Forecast (2019-2033)

Unlock the full potential of the global feed phosphate market with this comprehensive report. Analyze intricate market dynamics, identify growth catalysts, and navigate future opportunities within the animal nutrition sector. This in-depth analysis covers historical trends (2019-2024), the base year (2025), and provides a robust forecast through 2033. Discover key market segments, leading players, and pivotal industry developments shaping the future of feed phosphates. Gain actionable insights for strategic decision-making and competitive advantage.

Feed Phosphate Industry Market Dynamics & Concentration

The global feed phosphate market exhibits a moderately concentrated landscape, characterized by the strategic presence of key players and a growing emphasis on innovation. Market concentration is influenced by the significant capital investment required for phosphate rock mining and processing, alongside the intricate regulatory approvals for feed additives. Innovation drivers are primarily focused on enhancing phosphorus bioavailability, reducing environmental impact, and developing cost-effective solutions for animal nutrition. Regulatory frameworks, particularly concerning animal welfare and environmental sustainability, play a crucial role in shaping product development and market access. Product substitutes, such as organic phosphorus sources, are gaining traction but currently hold a smaller market share due to cost and efficacy considerations. End-user trends reveal a strong demand for feed phosphates that support improved animal growth, health, and reproductive performance, with a growing awareness of the link between animal nutrition and human health. Mergers and acquisition (M&A) activities, exemplified by a projected XX deal count over the forecast period, are expected to further consolidate the market, as larger players seek to expand their geographic reach and product portfolios. For instance, The Mosaic Company's acquisition of CF Industries' phosphate business significantly reshaped market share dynamics. The market share of major players like OCP Group and PhosAgro remains substantial, underscoring the competitive intensity.

Feed Phosphate Industry Industry Trends & Analysis

The feed phosphate industry is experiencing robust growth driven by several interconnected trends and technological disruptions. A primary growth driver is the escalating global demand for animal protein, fueled by a rising population and increasing disposable incomes in emerging economies. This necessitates greater efficiency in livestock farming, where feed phosphates are crucial for optimal animal growth, bone development, and overall health. Technological advancements are significantly impacting the industry, with a focus on developing highly digestible and bioavailable phosphorus forms. For example, advancements in granulation and coating technologies enhance product stability and delivery. Consumer preferences are increasingly leaning towards animal products raised with sustainable and welfare-conscious practices, which indirectly drives demand for high-quality feed ingredients that contribute to healthier animals and reduced environmental footprints. Competitive dynamics are intensifying, with companies investing heavily in research and development to differentiate their offerings. The market penetration of specialized feed phosphate products, designed for specific animal types and life stages, is on the rise. The projected Compound Annual Growth Rate (CAGR) for the feed phosphate market is estimated to be between 4.5% and 5.8% during the forecast period, reflecting this sustained growth trajectory. Innovations in precision nutrition, allowing for tailored feed formulations based on an animal's specific needs, are also influencing the demand for a wider range of feed phosphate products. The increasing scrutiny of antibiotic use in animal agriculture is another factor, pushing the demand for feed additives that promote animal health and immunity through improved nutrition.

Leading Markets & Segments in Feed Phosphate Industry

North America and Europe currently represent dominant regions in the feed phosphate market, largely due to well-established livestock industries and stringent regulations promoting animal health and feed quality. However, the Asia-Pacific region is emerging as a high-growth market, driven by rapid industrialization of animal agriculture and increasing per capita consumption of meat and dairy products. Within specific feed types, Monocalcium Phosphate (MCP) and Dicalcium Phosphate (DCP) hold significant market share due to their widespread use and high phosphorus bioavailability. The demand for MCP is particularly strong in poultry and swine diets due to its excellent absorption rates. Mono-Dicalcium Phosphate offers a balanced nutritional profile, finding applications across various livestock. Tricalcium Phosphate, while less digestible, is utilized in certain feed formulations where its calcium content is also beneficial. Defluorinated Phosphate is gaining importance as an environmentally friendly alternative.

Feed Type Dominance:

- Monocalcium Phosphate (MCP): Dominant due to high phosphorus bioavailability and cost-effectiveness in poultry and swine. Key drivers include the need for rapid growth and bone development in these species.

- Dicalcium Phosphate (DCP): Significant market presence, particularly in ruminant diets, offering a good balance of calcium and phosphorus. Economic policies supporting livestock farming are a key driver.

Livestock Type Dominance:

- Poultry: The largest segment, driven by the global demand for chicken meat and eggs. The rapid growth cycles of poultry necessitate efficient phosphorus utilization, making MCP a critical ingredient.

- Swine: The second-largest segment, with a growing demand for pork products. Similar to poultry, swine require adequate phosphorus for bone strength and muscle development.

- Cattle: While a mature market, demand for feed phosphates in cattle is sustained by the dairy and beef industries, particularly for young calves and growing animals.

- Aquatic Animals: This segment is experiencing rapid growth due to the expansion of aquaculture. Feed phosphates are essential for the growth and skeletal development of farmed fish and shrimp.

Feed Phosphate Industry Product Developments

Recent product developments in the feed phosphate industry are centered on enhancing phosphorus utilization and reducing environmental impact. Innovations like PHOSPHEA's HumIPHORA, a calcium humophosphate listed in the European Animal Feed Register, represent a significant advancement by offering high-quality phosphorus with improved nutrient absorption, particularly plant-based phosphorus. This innovation allows for reduced phosphate incorporation in feed formulations, contributing to sustainability. Furthermore, research into recovered phosphates, such as precipitated calcium phosphate (PCP) from sludge ash, demonstrates a commitment to circular economy principles and developing alternative, potentially more sustainable, feed ingredients. These developments aim to provide superior nutritional value and address growing environmental concerns within the animal feed sector.

Key Drivers of Feed Phosphate Industry Growth

The feed phosphate industry's growth is propelled by several critical factors.

- Rising Global Protein Demand: An expanding world population and increasing affluence drive the demand for meat, dairy, and eggs, necessitating efficient animal production, where phosphates are indispensable.

- Technological Advancements: Innovations in phosphorus processing, such as enhanced bioavailability techniques and novel phosphate sources, improve feed efficiency and animal health.

- Focus on Animal Health and Welfare: Growing awareness among consumers and regulators regarding animal well-being fuels the demand for high-quality feed ingredients that support optimal animal health, growth, and productivity.

- Sustainability Initiatives: The industry's push towards more sustainable practices, including the development of eco-friendly phosphate sources and efficient nutrient utilization, presents significant growth opportunities.

Challenges in the Feed Phosphate Industry Market

Despite its growth potential, the feed phosphate industry faces several challenges that can impact market dynamics.

- Volatile Raw Material Prices: Fluctuations in the prices of phosphate rock and energy, critical for production, can lead to price instability and impact profit margins.

- Environmental Regulations: Stricter environmental regulations concerning mining, processing, and the disposal of by-products can increase operational costs and limit market access in certain regions.

- Supply Chain Disruptions: Geopolitical instability, transportation issues, and natural disasters can disrupt the global supply chain of phosphate rock and finished feed phosphates, leading to shortages and price hikes.

- Competition from Alternative Feed Additives: The emergence of alternative nutrient sources and feed additives that claim to reduce phosphorus requirements or offer similar benefits can pose a competitive threat.

Emerging Opportunities in Feed Phosphate Industry

The feed phosphate industry is poised for significant long-term growth, catalyzed by several emerging opportunities.

- Sustainable and Circular Economy Solutions: The development and widespread adoption of feed phosphates derived from recycled materials or by-products present a substantial opportunity to enhance sustainability and reduce reliance on virgin resources.

- Precision Nutrition and Customization: Advances in animal nutrition science allow for the development of specialized feed phosphate products tailored to the specific needs of different animal species, breeds, and life stages, leading to improved feed conversion ratios and animal health.

- Emerging Markets Expansion: The rapid growth of livestock industries in developing countries, particularly in Asia and Africa, offers a vast untapped market for feed phosphate products.

- Innovation in Phosphorus Bioavailability: Continued research into enhancing phosphorus bioavailability and reducing its excretion into the environment will drive demand for next-generation feed phosphate solutions.

Leading Players in the Feed Phosphate Industry Sector

- EuroChem

- Simphos

- The Mosaic Company

- Potash Corporation

- Fosfitalia

- Timab Industries

- PhosAgro

- OCP Group

- Yara International ASA

Key Milestones in Feed Phosphate Industry Industry

- April 2022: PHOSPHEA announced the launch of HumIPHORA, a breakthrough innovation in the phosphate world. This calcium humophosphate is listed in the European Animal Feed Register (008979-EN). For the first time on the market, Phosphea offered a phosphate that provides high-quality phosphorus and contributes to better use of other nutrients, more specifically, plant-based phosphorus. HumIPHORA reduces the incorporation of phosphate in formulas compared to conventional sources on the market.

- February 2022: EuroChem Group completed the acquisition of the Serra do Salitre phosphate project in Brazil. This acquisition led to the increased development of phosphates, and it may increase the sales of animal feed phosphate in the coming years.

- February 2021: EasyMining, the Swedish University of Agricultural Sciences (SLU), and Lantmännen started an innovative project testing the precipitated calcium phosphate (PCP) recovered in the Ash2Phos-project as feed phosphate to poultry and pigs. The hypothesis is that recovered calcium phosphate from sludge ash has the same level of phosphorus digestibility as conventional monocalcium phosphate (MCP) in pigs and poultry.

Strategic Outlook for Feed Phosphate Industry Market

The strategic outlook for the feed phosphate industry remains highly positive, driven by a confluence of sustained demand for animal protein and an increasing emphasis on sustainable and efficient animal nutrition. Growth accelerators include the ongoing innovation in phosphorus bioavailability, the expansion of aquaculture, and the increasing adoption of precision nutrition technologies. Companies that invest in R&D for novel, environmentally friendly phosphate sources and forge strategic partnerships in emerging markets will be well-positioned to capitalize on future growth. The industry is expected to witness a continued trend towards consolidation and specialization, with a strong focus on meeting evolving regulatory requirements and consumer expectations for animal welfare and product safety. The successful integration of circular economy principles into phosphate production will be a key differentiator for market leaders.

Feed Phosphate Industry Segmentation

-

1. Feed Type

- 1.1. Monocalcium Phosphate

- 1.2. Dicalcium Phosphate

- 1.3. Mono-Dicalcium Phosphate

- 1.4. Tricalcium Phosphate

- 1.5. Defluorinated Phosphate

- 1.6. Other Feed Types

-

2. Livestock Type

- 2.1. Poultry

- 2.2. Swine

- 2.3. Cattle

- 2.4. Aquatic Animals

- 2.5. Other Livestock Types

Feed Phosphate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Feed Phosphate Industry Regional Market Share

Geographic Coverage of Feed Phosphate Industry

Feed Phosphate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Increasing Industrial Livestock Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Feed Phosphate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feed Type

- 5.1.1. Monocalcium Phosphate

- 5.1.2. Dicalcium Phosphate

- 5.1.3. Mono-Dicalcium Phosphate

- 5.1.4. Tricalcium Phosphate

- 5.1.5. Defluorinated Phosphate

- 5.1.6. Other Feed Types

- 5.2. Market Analysis, Insights and Forecast - by Livestock Type

- 5.2.1. Poultry

- 5.2.2. Swine

- 5.2.3. Cattle

- 5.2.4. Aquatic Animals

- 5.2.5. Other Livestock Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Feed Type

- 6. North America Feed Phosphate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feed Type

- 6.1.1. Monocalcium Phosphate

- 6.1.2. Dicalcium Phosphate

- 6.1.3. Mono-Dicalcium Phosphate

- 6.1.4. Tricalcium Phosphate

- 6.1.5. Defluorinated Phosphate

- 6.1.6. Other Feed Types

- 6.2. Market Analysis, Insights and Forecast - by Livestock Type

- 6.2.1. Poultry

- 6.2.2. Swine

- 6.2.3. Cattle

- 6.2.4. Aquatic Animals

- 6.2.5. Other Livestock Types

- 6.1. Market Analysis, Insights and Forecast - by Feed Type

- 7. Europe Feed Phosphate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feed Type

- 7.1.1. Monocalcium Phosphate

- 7.1.2. Dicalcium Phosphate

- 7.1.3. Mono-Dicalcium Phosphate

- 7.1.4. Tricalcium Phosphate

- 7.1.5. Defluorinated Phosphate

- 7.1.6. Other Feed Types

- 7.2. Market Analysis, Insights and Forecast - by Livestock Type

- 7.2.1. Poultry

- 7.2.2. Swine

- 7.2.3. Cattle

- 7.2.4. Aquatic Animals

- 7.2.5. Other Livestock Types

- 7.1. Market Analysis, Insights and Forecast - by Feed Type

- 8. Asia Pacific Feed Phosphate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feed Type

- 8.1.1. Monocalcium Phosphate

- 8.1.2. Dicalcium Phosphate

- 8.1.3. Mono-Dicalcium Phosphate

- 8.1.4. Tricalcium Phosphate

- 8.1.5. Defluorinated Phosphate

- 8.1.6. Other Feed Types

- 8.2. Market Analysis, Insights and Forecast - by Livestock Type

- 8.2.1. Poultry

- 8.2.2. Swine

- 8.2.3. Cattle

- 8.2.4. Aquatic Animals

- 8.2.5. Other Livestock Types

- 8.1. Market Analysis, Insights and Forecast - by Feed Type

- 9. South America Feed Phosphate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Feed Type

- 9.1.1. Monocalcium Phosphate

- 9.1.2. Dicalcium Phosphate

- 9.1.3. Mono-Dicalcium Phosphate

- 9.1.4. Tricalcium Phosphate

- 9.1.5. Defluorinated Phosphate

- 9.1.6. Other Feed Types

- 9.2. Market Analysis, Insights and Forecast - by Livestock Type

- 9.2.1. Poultry

- 9.2.2. Swine

- 9.2.3. Cattle

- 9.2.4. Aquatic Animals

- 9.2.5. Other Livestock Types

- 9.1. Market Analysis, Insights and Forecast - by Feed Type

- 10. Africa Feed Phosphate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Feed Type

- 10.1.1. Monocalcium Phosphate

- 10.1.2. Dicalcium Phosphate

- 10.1.3. Mono-Dicalcium Phosphate

- 10.1.4. Tricalcium Phosphate

- 10.1.5. Defluorinated Phosphate

- 10.1.6. Other Feed Types

- 10.2. Market Analysis, Insights and Forecast - by Livestock Type

- 10.2.1. Poultry

- 10.2.2. Swine

- 10.2.3. Cattle

- 10.2.4. Aquatic Animals

- 10.2.5. Other Livestock Types

- 10.1. Market Analysis, Insights and Forecast - by Feed Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 EuroChem

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Simphos

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Mosaic Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Potash Corporatio

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fosfitalia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Timab Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PhosAgro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OCP Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yara International ASA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 EuroChem

List of Figures

- Figure 1: Global Feed Phosphate Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Feed Phosphate Industry Revenue (Million), by Feed Type 2025 & 2033

- Figure 3: North America Feed Phosphate Industry Revenue Share (%), by Feed Type 2025 & 2033

- Figure 4: North America Feed Phosphate Industry Revenue (Million), by Livestock Type 2025 & 2033

- Figure 5: North America Feed Phosphate Industry Revenue Share (%), by Livestock Type 2025 & 2033

- Figure 6: North America Feed Phosphate Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Feed Phosphate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Feed Phosphate Industry Revenue (Million), by Feed Type 2025 & 2033

- Figure 9: Europe Feed Phosphate Industry Revenue Share (%), by Feed Type 2025 & 2033

- Figure 10: Europe Feed Phosphate Industry Revenue (Million), by Livestock Type 2025 & 2033

- Figure 11: Europe Feed Phosphate Industry Revenue Share (%), by Livestock Type 2025 & 2033

- Figure 12: Europe Feed Phosphate Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Feed Phosphate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Feed Phosphate Industry Revenue (Million), by Feed Type 2025 & 2033

- Figure 15: Asia Pacific Feed Phosphate Industry Revenue Share (%), by Feed Type 2025 & 2033

- Figure 16: Asia Pacific Feed Phosphate Industry Revenue (Million), by Livestock Type 2025 & 2033

- Figure 17: Asia Pacific Feed Phosphate Industry Revenue Share (%), by Livestock Type 2025 & 2033

- Figure 18: Asia Pacific Feed Phosphate Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Feed Phosphate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Feed Phosphate Industry Revenue (Million), by Feed Type 2025 & 2033

- Figure 21: South America Feed Phosphate Industry Revenue Share (%), by Feed Type 2025 & 2033

- Figure 22: South America Feed Phosphate Industry Revenue (Million), by Livestock Type 2025 & 2033

- Figure 23: South America Feed Phosphate Industry Revenue Share (%), by Livestock Type 2025 & 2033

- Figure 24: South America Feed Phosphate Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Feed Phosphate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Africa Feed Phosphate Industry Revenue (Million), by Feed Type 2025 & 2033

- Figure 27: Africa Feed Phosphate Industry Revenue Share (%), by Feed Type 2025 & 2033

- Figure 28: Africa Feed Phosphate Industry Revenue (Million), by Livestock Type 2025 & 2033

- Figure 29: Africa Feed Phosphate Industry Revenue Share (%), by Livestock Type 2025 & 2033

- Figure 30: Africa Feed Phosphate Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Africa Feed Phosphate Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Feed Phosphate Industry Revenue Million Forecast, by Feed Type 2020 & 2033

- Table 2: Global Feed Phosphate Industry Revenue Million Forecast, by Livestock Type 2020 & 2033

- Table 3: Global Feed Phosphate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Feed Phosphate Industry Revenue Million Forecast, by Feed Type 2020 & 2033

- Table 5: Global Feed Phosphate Industry Revenue Million Forecast, by Livestock Type 2020 & 2033

- Table 6: Global Feed Phosphate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Feed Phosphate Industry Revenue Million Forecast, by Feed Type 2020 & 2033

- Table 12: Global Feed Phosphate Industry Revenue Million Forecast, by Livestock Type 2020 & 2033

- Table 13: Global Feed Phosphate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Feed Phosphate Industry Revenue Million Forecast, by Feed Type 2020 & 2033

- Table 21: Global Feed Phosphate Industry Revenue Million Forecast, by Livestock Type 2020 & 2033

- Table 22: Global Feed Phosphate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: India Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: China Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Feed Phosphate Industry Revenue Million Forecast, by Feed Type 2020 & 2033

- Table 29: Global Feed Phosphate Industry Revenue Million Forecast, by Livestock Type 2020 & 2033

- Table 30: Global Feed Phosphate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Feed Phosphate Industry Revenue Million Forecast, by Feed Type 2020 & 2033

- Table 35: Global Feed Phosphate Industry Revenue Million Forecast, by Livestock Type 2020 & 2033

- Table 36: Global Feed Phosphate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South Africa Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Africa Feed Phosphate Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Feed Phosphate Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Feed Phosphate Industry?

Key companies in the market include EuroChem, Simphos, The Mosaic Company, Potash Corporatio, Fosfitalia, Timab Industries, PhosAgro, OCP Group, Yara International ASA.

3. What are the main segments of the Feed Phosphate Industry?

The market segments include Feed Type, Livestock Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Increasing Industrial Livestock Production.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

April 2022: PHOSPHEA announced the launch of HumIPHORA, a breakthrough innovation in the phosphate world. This calcium humophosphate is listed in the European Animal Feed Register (008979-EN). For the first time on the market, Phosphea offered a phosphate that provides high-quality phosphorus and contributes to better use of other nutrients, more specifically, plant-based phosphorus. HumIPHORA reduces the incorporation of phosphate in formulas compared to conventional sources on the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Feed Phosphate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Feed Phosphate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Feed Phosphate Industry?

To stay informed about further developments, trends, and reports in the Feed Phosphate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence