Key Insights

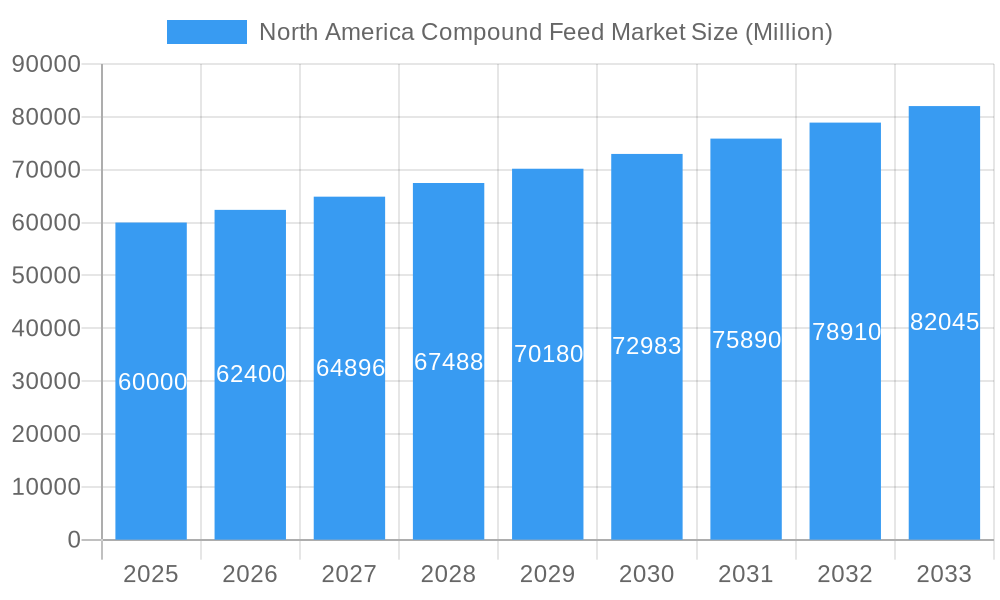

The North America Compound Feed Market is poised for robust growth, projected to reach a substantial market size of approximately USD 60,000 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.00% anticipated through 2033. This expansion is primarily fueled by the escalating global demand for animal protein, driven by a growing population and evolving dietary preferences. Advancements in animal nutrition science, leading to the development of more efficient and specialized feed formulations, are also key enablers. The increasing adoption of modern farming practices, emphasis on animal health and welfare, and the need to optimize livestock productivity are further bolstering market penetration. The market's segmentation highlights the dominance of poultry and ruminant feed, reflecting their significant contribution to overall meat and dairy production. Cereals and cakes & meals constitute the largest ingredient categories, underscoring their role as foundational components of compound feeds, while the growing awareness of gut health and immunity is driving the demand for supplements like prebiotics, probiotics, and enzymes.

North America Compound Feed Market Market Size (In Billion)

Despite the optimistic outlook, the market faces certain restraints, including the fluctuating prices of raw materials, particularly grains, which directly impact feed production costs. Stringent regulations concerning feed safety, animal welfare, and environmental impact, while essential for industry sustainability, can also pose challenges in terms of compliance and investment. Furthermore, the susceptibility of animal agriculture to disease outbreaks can lead to supply chain disruptions and a temporary decline in demand. Nonetheless, the North American market is characterized by significant investment in research and development for innovative feed solutions, including the exploration of alternative protein sources and precision nutrition. Companies are actively focusing on expanding their product portfolios, enhancing distribution networks, and embracing digitalization to improve operational efficiency and cater to the diverse needs of the animal husbandry sector across the United States, Canada, and Mexico.

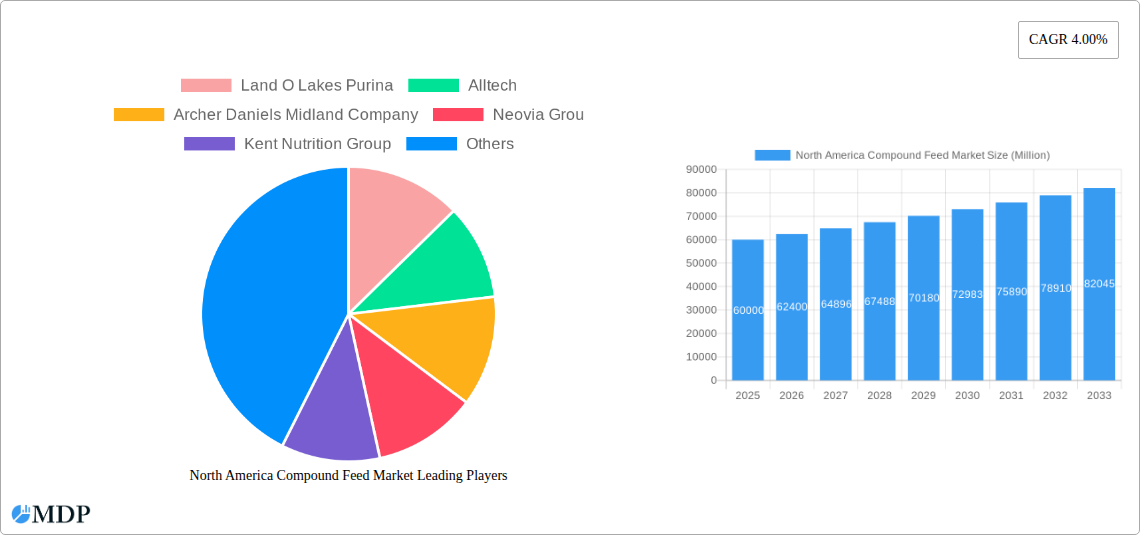

North America Compound Feed Market Company Market Share

North America Compound Feed Market: Comprehensive Growth Insights & Forecast (2019-2033)

Unlock critical insights into the dynamic North America Compound Feed Market with this in-depth report. Spanning the historical period of 2019-2024, the base year of 2025, and extending through a robust forecast period of 2025-2033, this analysis provides a definitive roadmap for industry stakeholders. Delve into market concentration, innovation drivers, evolving regulatory landscapes, and the competitive dynamics shaping the future of animal nutrition across the United States, Canada, and Mexico. This report is an indispensable resource for understanding market growth, technological advancements, consumer preferences, and strategic opportunities within the multi-billion dollar North American compound feed industry.

North America Compound Feed Market Market Dynamics & Concentration

The North America Compound Feed Market exhibits a moderately concentrated landscape, characterized by the presence of several large, integrated players alongside a spectrum of regional and specialized manufacturers. Key innovation drivers include advancements in feed formulation, precision nutrition, the utilization of novel ingredients, and the integration of digital technologies for enhanced farm management. Regulatory frameworks, such as those set by the FDA in the U.S. and Health Canada, play a crucial role in ensuring feed safety, efficacy, and labeling standards, influencing product development and market access. Product substitutes, while limited in the context of compound feeds, can emerge from changes in farming practices or the availability of alternative feed sources. End-user trends are heavily influenced by consumer demand for sustainably produced animal protein, leading to a greater emphasis on feed efficiency, animal welfare, and reduced environmental impact. Mergers and acquisitions (M&A) activities remain a significant feature, with estimated M&A deal counts of 15-20 annually over the past five years, aimed at consolidating market share, acquiring technological capabilities, and expanding geographic reach. For instance, Land O'Lakes Purina's strategic acquisitions have bolstered its presence across various animal segments. The market share of the top 5 players is estimated to be between 50-60%, highlighting the ongoing consolidation efforts.

North America Compound Feed Market Industry Trends & Analysis

The North America Compound Feed Market is poised for significant expansion, driven by a confluence of escalating global demand for animal protein, increasing livestock populations, and a growing awareness of the critical role of nutrition in animal health and productivity. The Compound Feed Market in North America is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.2% during the forecast period. This growth is underpinned by several key trends. Firstly, the Poultry segment continues to be a dominant force, fueled by its cost-effectiveness, rapid growth cycles, and widespread consumer acceptance. Secondly, technological disruptions are revolutionizing feed manufacturing, with advancements in ingredient processing, extrusion technologies, and the development of functional feeds incorporating prebiotics, probiotics, and enzymes to enhance gut health and nutrient absorption. The integration of data analytics and artificial intelligence in feed formulation optimizes nutrient delivery, minimizes waste, and improves overall farm profitability. Consumer preferences for ethically raised and sustainably produced meat and dairy products are directly impacting the demand for high-quality, traceable compound feeds that contribute to animal welfare and reduce the environmental footprint of livestock operations. Competitive dynamics are intensifying, with companies investing heavily in research and development to differentiate their product portfolios and secure market share. The market penetration of specialized and performance-enhancing feed additives is also on the rise, indicating a shift towards more sophisticated animal nutrition solutions. The projected market size for North America Compound Feed is estimated to reach USD 85 Billion by 2033, a substantial increase from its current valuation.

Leading Markets & Segments in North America Compound Feed Market

The United States stands as the largest and most influential market within the North America Compound Feed sector, driven by its substantial livestock population, advanced agricultural infrastructure, and high adoption rates of innovative feed technologies. Within the United States, the Poultry segment consistently demonstrates the highest market share, accounting for an estimated 40% of the total compound feed consumption. This dominance is attributed to the sheer volume of chicken and turkey production for both domestic and export markets, coupled with efficient production cycles that necessitate consistent and high-quality feed. Key drivers for the poultry segment's growth include favorable economic policies supporting agricultural production, a well-developed supply chain infrastructure, and ongoing consumer demand for affordable protein sources.

The Ingredient landscape is led by Cereals, primarily corn and soybeans, which form the fundamental energy and protein base of most compound feeds. Their widespread availability and cost-effectiveness make them indispensable. However, there is a discernible growth trend in the Supplements category, particularly in Amino Acids, Vitamins, and Enzymes, reflecting a growing focus on precision nutrition and performance enhancement. These supplements enable targeted improvements in feed conversion ratios, animal health, and product quality.

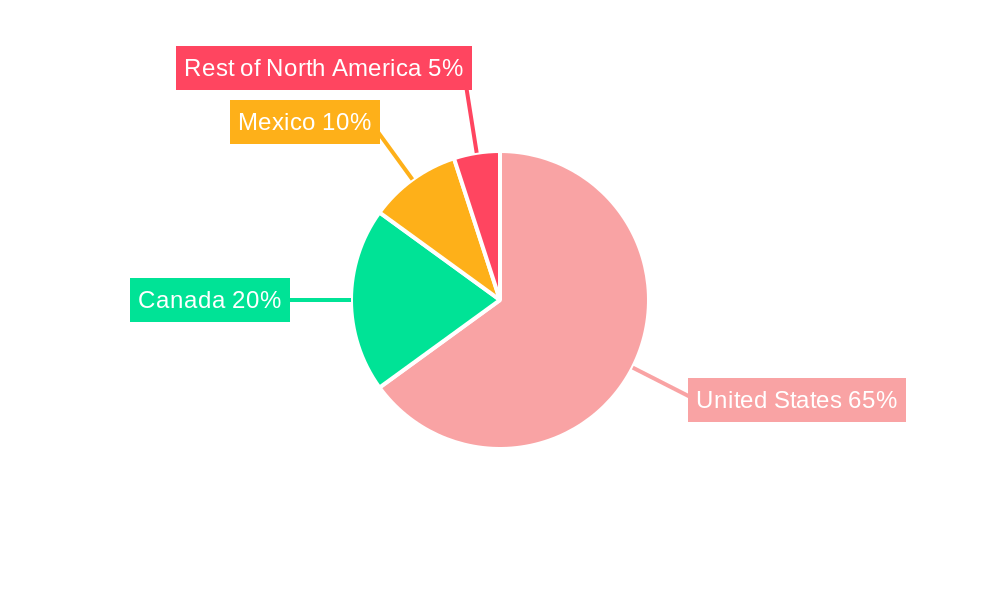

Geographically, while the United States leads, Canada and Mexico represent significant and growing markets. Mexico's expanding population and increasing per capita consumption of animal protein are key growth accelerators, supported by investments in its agricultural sector. Canada, with its strong Ruminant and Swine industries, also contributes substantially to the overall market value. The Rest of North America, though smaller in scale, is observing niche growth opportunities, particularly in specialized aquaculture and pet food segments.

Within Animal Types, following Poultry, the Ruminants segment, encompassing cattle and dairy cows, holds a substantial market share, driven by the dairy and beef industries. The increasing adoption of advanced feed management practices and the demand for specialized feeds to optimize milk production and meat quality are key factors. The Swine segment is also a significant contributor, with continuous efforts to improve feed efficiency and reduce mortality rates through fortified compound feeds. The Aquaculture segment, while smaller, is exhibiting the highest growth potential, driven by the increasing demand for sustainable seafood and the expansion of fish farming operations across the region.

North America Compound Feed Market Product Developments

Product innovation in the North America Compound Feed Market is largely centered on enhancing animal health, optimizing nutrient utilization, and improving feed efficiency. Companies are actively developing specialized feeds incorporating advanced supplements like prebiotics and probiotics for improved gut health, enzymes to boost nutrient digestibility, and targeted amino acid profiles to reduce nitrogen excretion. These developments offer competitive advantages by enabling livestock producers to achieve better growth rates, reduce feed conversion ratios, and minimize their environmental impact. Technological advancements in feed processing and formulation are also leading to more palatable and digestible feed options tailored to specific animal life stages and production goals.

Key Drivers of North America Compound Feed Market Growth

Several key drivers are propelling the North America Compound Feed Market forward. The increasing global demand for animal protein, particularly meat, poultry, and dairy products, necessitates a robust compound feed industry to support livestock production. Technological advancements in animal nutrition science, including the development of precision feeding strategies and the incorporation of functional feed additives like enzymes and probiotics, are enhancing feed efficiency and animal health. Furthermore, rising disposable incomes and growing populations in developing North American economies are boosting per capita consumption of animal-derived products. Government initiatives aimed at promoting sustainable agriculture and improving food security also indirectly support the compound feed market.

Challenges in the North America Compound Feed Market Market

Despite robust growth prospects, the North America Compound Feed Market faces several challenges. Fluctuations in raw material prices, particularly for grains and oilseeds, can significantly impact production costs and profitability. Stringent regulatory requirements regarding feed safety, labeling, and the use of certain additives can also pose compliance hurdles and necessitate substantial investment in research and development. The growing consumer concern over antibiotic use in livestock production is driving demand for antibiotic-free feed solutions, requiring manufacturers to reformulate their products and invest in alternative growth promoters. Supply chain disruptions, as evidenced by recent global events, can also impact the availability and cost of essential feed ingredients.

Emerging Opportunities in North America Compound Feed Market

Emerging opportunities within the North America Compound Feed Market are largely driven by innovation and sustainability initiatives. The burgeoning demand for plant-based protein sources and the exploration of alternative protein ingredients, such as insect meal and algae, present significant avenues for market expansion and product differentiation. The continued development and adoption of precision nutrition technologies, leveraging data analytics and AI, offer opportunities to create highly customized feed solutions that maximize animal performance and minimize environmental impact. Furthermore, the increasing focus on animal welfare and the demand for traceability in the food supply chain are creating opportunities for compound feed manufacturers to develop and market specialized, ethically produced feed products. Strategic partnerships between feed manufacturers, technology providers, and livestock producers will be crucial for unlocking these opportunities.

Leading Players in the North America Compound Feed Market Sector

- Land O Lakes Purina

- Alltech

- Archer Daniels Midland Company

- Neovia Group

- Kent Nutrition Group

- Nutreco N V (Trouw Nutrition)

- Cargill Inc

- Hi-Pro Feeds

Key Milestones in North America Compound Feed Market Industry

- 2020: Increased investment in research and development of microbiome-enhancing feed additives (probiotics and prebiotics).

- 2021: Significant M&A activity focused on consolidating market share and acquiring specialized feed technology.

- 2022: Growing emphasis on sustainable sourcing of raw materials and reduced environmental footprint of feed production.

- 2023: Advancements in precision nutrition technologies and the integration of AI in feed formulation gaining traction.

- 2024: Increased demand for antibiotic-free and hormone-free compound feed solutions across all animal segments.

Strategic Outlook for North America Compound Feed Market Market

The strategic outlook for the North America Compound Feed Market is one of sustained growth and innovation. Future growth will be accelerated by a continued focus on precision nutrition, the development of sustainable and alternative protein ingredients, and the integration of digital technologies for enhanced farm management. Companies that prioritize R&D, invest in sustainable practices, and adapt to evolving consumer preferences will be best positioned for success. Strategic collaborations and targeted acquisitions will likely continue to shape the market landscape. The increasing emphasis on animal health and welfare, coupled with regulatory support for sustainable agriculture, presents a promising future for the compound feed industry in North America.

North America Compound Feed Market Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

-

2.4. Supplements

- 2.4.1. Vitamins

- 2.4.2. Amino Acid

- 2.4.3. Enzymes

- 2.4.4. Prebiotics and Probiotics

- 2.4.5. Acidifiers

- 2.4.6. Other Supplements

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Compound Feed Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Compound Feed Market Regional Market Share

Geographic Coverage of North America Compound Feed Market

North America Compound Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Animal based Products is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.2.4.1. Vitamins

- 5.2.4.2. Amino Acid

- 5.2.4.3. Enzymes

- 5.2.4.4. Prebiotics and Probiotics

- 5.2.4.5. Acidifiers

- 5.2.4.6. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United States North America Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.2.4.1. Vitamins

- 6.2.4.2. Amino Acid

- 6.2.4.3. Enzymes

- 6.2.4.4. Prebiotics and Probiotics

- 6.2.4.5. Acidifiers

- 6.2.4.6. Other Supplements

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Canada North America Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.2.4.1. Vitamins

- 7.2.4.2. Amino Acid

- 7.2.4.3. Enzymes

- 7.2.4.4. Prebiotics and Probiotics

- 7.2.4.5. Acidifiers

- 7.2.4.6. Other Supplements

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Mexico North America Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.2.4.1. Vitamins

- 8.2.4.2. Amino Acid

- 8.2.4.3. Enzymes

- 8.2.4.4. Prebiotics and Probiotics

- 8.2.4.5. Acidifiers

- 8.2.4.6. Other Supplements

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Rest of North America North America Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.2.4.1. Vitamins

- 9.2.4.2. Amino Acid

- 9.2.4.3. Enzymes

- 9.2.4.4. Prebiotics and Probiotics

- 9.2.4.5. Acidifiers

- 9.2.4.6. Other Supplements

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Land O Lakes Purina

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alltech

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Archer Daniels Midland Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Neovia Grou

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kent Nutrition Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nutreco N V (trouw nutrition)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cargill Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hi-Pro Feeds

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Land O Lakes Purina

List of Figures

- Figure 1: North America Compound Feed Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Compound Feed Market Share (%) by Company 2025

List of Tables

- Table 1: North America Compound Feed Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 2: North America Compound Feed Market Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 3: North America Compound Feed Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Compound Feed Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Compound Feed Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: North America Compound Feed Market Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 7: North America Compound Feed Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Compound Feed Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Compound Feed Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 10: North America Compound Feed Market Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 11: North America Compound Feed Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Compound Feed Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Compound Feed Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 14: North America Compound Feed Market Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 15: North America Compound Feed Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Compound Feed Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: North America Compound Feed Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 18: North America Compound Feed Market Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 19: North America Compound Feed Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Compound Feed Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Compound Feed Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the North America Compound Feed Market?

Key companies in the market include Land O Lakes Purina, Alltech, Archer Daniels Midland Company, Neovia Grou, Kent Nutrition Group, Nutreco N V (trouw nutrition), Cargill Inc, Hi-Pro Feeds.

3. What are the main segments of the North America Compound Feed Market?

The market segments include Animal Type, Ingredient, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Growing Demand for Animal based Products is Driving the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Compound Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Compound Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Compound Feed Market?

To stay informed about further developments, trends, and reports in the North America Compound Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence