Key Insights

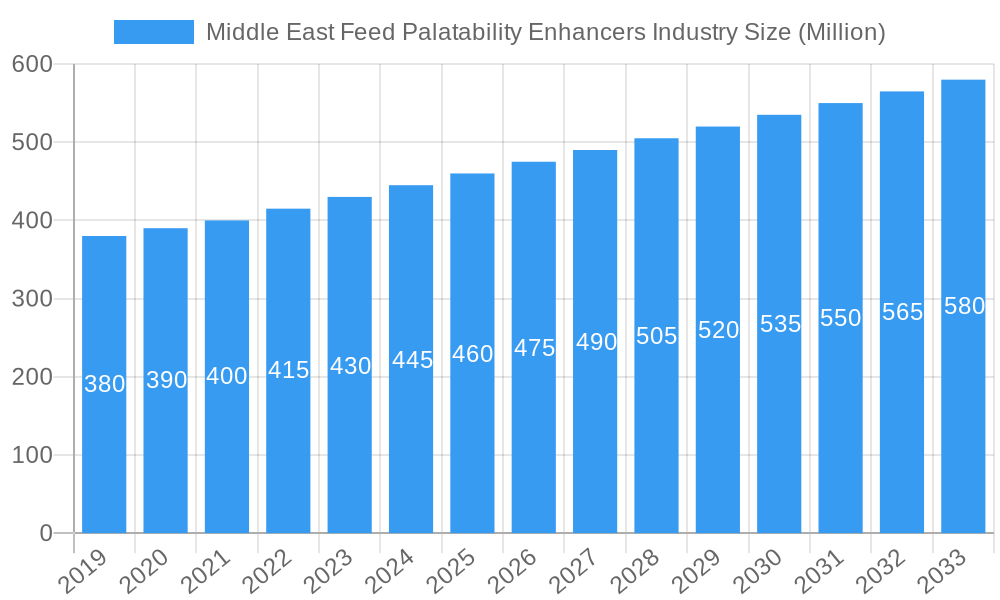

The Middle East Feed Palatability Enhancers Market is projected for significant expansion, forecasting a market size of 6.54 billion by 2024, with an anticipated Compound Annual Growth Rate (CAGR) of 3.18% through 2033. This growth is propelled by increasing demand for premium animal protein, advancements in animal nutrition, and a heightened focus on optimizing feed conversion ratios and animal health across the region. Key drivers include a rising livestock population, particularly in Saudi Arabia and Egypt, and the adoption of modern, feed-efficient farming practices. The demand for feed palatability enhancers is further strengthened by the necessity to enhance feed's sensory appeal, ensuring improved intake and nutrient absorption, thereby boosting farmer profitability. Evolving consumer preferences for safer, sustainably produced animal products also encourage feed manufacturers to integrate advanced solutions.

Middle East Feed Palatability Enhancers Industry Market Size (In Billion)

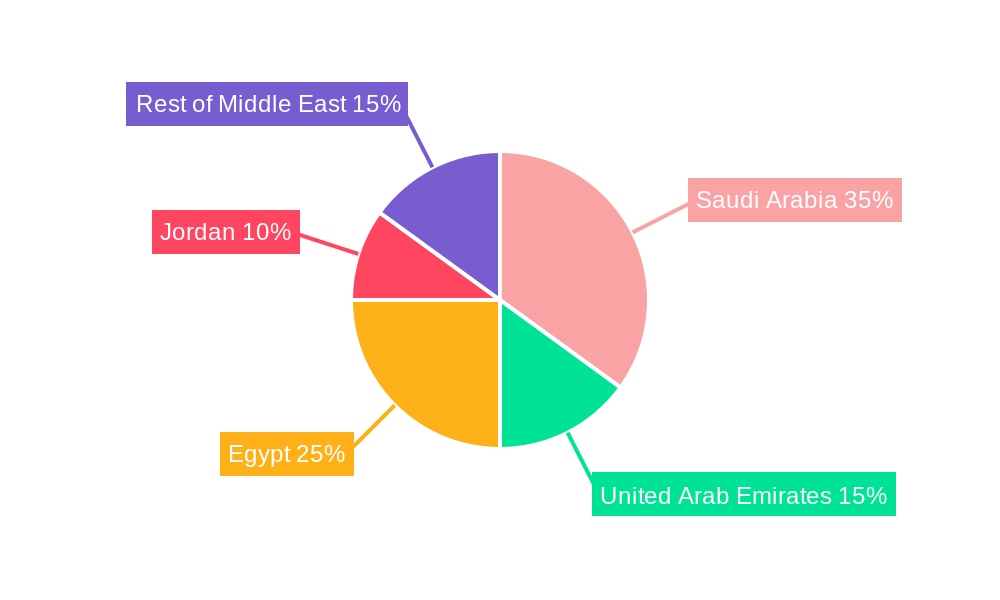

Market segmentation reveals diverse growth prospects, with Flavors and Sweeteners expected to lead demand due to their direct influence on animal feed acceptance. Aroma enhancers are also critical for masking off-flavors and stimulating appetite, especially in compound feeds. Geographically, Saudi Arabia is anticipated to be the dominant market, followed by Egypt, driven by their substantial and expanding livestock sectors. The United Arab Emirates and Jordan are also showing steady growth, supported by investments in agriculture and a commitment to food security. While the outlook is positive, potential restraints include fluctuating raw material costs and regulatory challenges for novel ingredients. However, continuous innovation from key players such as E I Dupont, Diana Group, and Kerry Group, alongside strategic partnerships and product development, is expected to overcome these obstacles and sustain the robust growth of the Middle East Feed Palatability Enhancers Market.

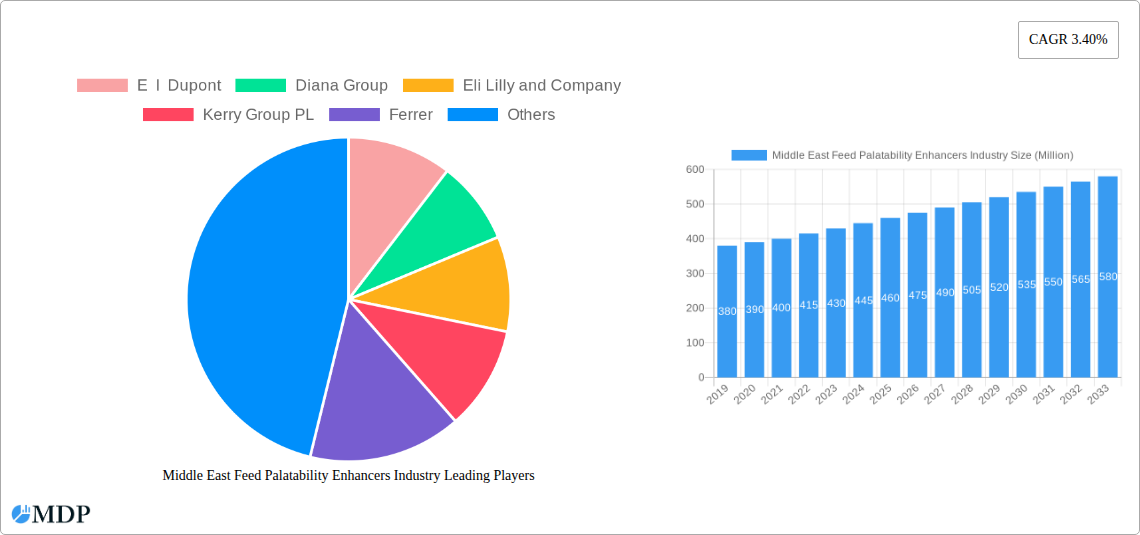

Middle East Feed Palatability Enhancers Industry Company Market Share

Unlocking Growth: Middle East Feed Palatability Enhancers Market Report (2019-2033)

Gain unparalleled insights into the burgeoning Middle East Feed Palatability Enhancers industry with our comprehensive market analysis. This report delves deep into market dynamics, key trends, leading segments, and future opportunities, providing actionable intelligence for stakeholders seeking to capitalize on this rapidly expanding sector.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Keywords: Feed Palatability Enhancers, Middle East Feed Additives, Animal Feed Ingredients, Poultry Feed Enhancers, Swine Feed Additives, Ruminant Feed Solutions, Saudi Arabia Feed Market, UAE Feed Industry, Egypt Animal Nutrition, Jordan Feed Market, Flavors for Feed, Sweeteners for Feed, Aroma Enhancers for Animals, Animal Feed Innovation, Livestock Nutrition, Feed Efficiency, Sustainable Feed, Animal Welfare, Feed Manufacturers Middle East, Feed Millers, Agri-business Middle East, Feed Additive Suppliers.

Middle East Feed Palatability Enhancers Industry Market Dynamics & Concentration

The Middle East Feed Palatability Enhancers market is characterized by a moderate to high concentration, with key players like E I Dupont, Diana Group, Eli Lilly and Company, Kerry Group PL, Ferrer, Associated British Foods PLC, Kent Feeds Inc, and Kemin Europa significantly influencing its trajectory. Innovation drivers are primarily centered around improving animal health and feed conversion ratios, responding to growing demand for cost-effective animal protein. Regulatory frameworks, while evolving, are increasingly focused on animal welfare and feed safety standards, impacting product development and market entry. Product substitutes, such as alternative feed formulations and improved feeding management practices, exist but often fall short of the precise benefits offered by specialized palatability enhancers. End-user trends highlight a growing preference for natural and sustainable feed ingredients, coupled with a demand for solutions that optimize nutrient utilization. Merger and acquisition (M&A) activities, though not at peak levels, are strategically undertaken to expand product portfolios and geographical reach. Several M&A deals have been observed in the historical period, with an estimated xx number of significant transactions, contributing to market consolidation and the diffusion of innovative technologies. The market share of the top five players is estimated to be around xx%, indicating a competitive landscape with room for agile new entrants.

Middle East Feed Palatability Enhancers Industry Industry Trends & Analysis

The Middle East Feed Palatability Enhancers industry is poised for robust growth, driven by several interconnected trends. A primary growth driver is the escalating demand for animal protein across the region, fueled by a growing population and increasing disposable incomes. This necessitates higher animal production efficiency, making feed palatability enhancers crucial for maximizing feed intake and conversion rates. Technological disruptions are playing a significant role, with advancements in encapsulation technologies and the development of novel flavoring compounds enhancing the efficacy and longevity of these additives. The industry is witnessing a shift towards more natural and sustainable ingredients, driven by both consumer preferences and regulatory pressures. Companies are investing in research and development to offer bio-based and environmentally friendly palatability enhancers. Consumer preferences are increasingly leaning towards ethically produced meat and dairy products, which indirectly influences the demand for feed additives that promote animal health and well-being. The competitive dynamics are intensifying, with both established global players and emerging regional manufacturers vying for market share. Strategic partnerships and collaborations are becoming more common as companies seek to leverage each other's expertise and expand their distribution networks. Market penetration for feed palatability enhancers is steadily increasing, particularly within the poultry and swine segments, which are the largest consumers of feed additives. The Compound Annual Growth Rate (CAGR) for the Middle East Feed Palatability Enhancers market is projected to be around xx% over the forecast period, reflecting sustained demand and industry expansion. This growth is underpinned by ongoing investments in the livestock sector, government initiatives to enhance food security, and the continuous pursuit of optimal animal nutrition by feed producers. The adoption of advanced analytical techniques for evaluating feed intake and animal performance is also contributing to a better understanding and utilization of palatability enhancers, further solidifying their importance in the feed industry.

Leading Markets & Segments in Middle East Feed Palatability Enhancers Industry

The Middle East Feed Palatability Enhancers market exhibits distinct leadership across its geographical and sectoral segments. Saudi Arabia is emerging as a dominant region, driven by significant government investments in its Vision 2030 to diversify the economy and bolster its domestic livestock and poultry industries. This translates into substantial demand for advanced feed solutions, including palatability enhancers.

- Key Drivers for Saudi Arabia's Dominance:

- Government Initiatives: Strong support for agricultural modernization and self-sufficiency in food production.

- Infrastructure Development: Expansion of modern feed milling facilities and integrated livestock operations.

- Growing Consumer Demand: Increasing consumption of poultry, red meat, and dairy products.

- Technological Adoption: Openness to incorporating advanced feed technologies to improve efficiency.

In terms of animal types, the Poultry segment leads the market significantly. The region's high per capita consumption of poultry, coupled with the inherent efficiency of poultry farming, makes it a prime target for feed palatability enhancer solutions.

- Dominance of the Poultry Segment:

- High Volume Consumption: Poultry is the most widely consumed meat source, necessitating large-scale production.

- Fast Growth Cycles: Shorter growth cycles in poultry require optimized feed intake for rapid development.

- Cost-Effectiveness: Palatability enhancers help improve feed conversion ratios, directly impacting the profitability of poultry operations.

- Disease Prevention: Enhanced feed intake supports stronger immune systems, reducing the reliance on antibiotics.

From the product type perspective, Flavors represent the largest and most influential segment. The ability of specific flavors to mask unpalatable ingredients, stimulate appetite, and encourage consistent feed intake makes them indispensable for feed manufacturers.

- Dominance of Flavors:

- Broad Application: Flavors are versatile and can be tailored to different animal species and feed formulations.

- Masking Undesirable Tastes: Essential for incorporating novel or less palatable ingredients into feed.

- Stimulating Natural Feeding Behavior: Mimicking natural food sources to encourage consumption.

- Brand Differentiation: Unique flavor profiles can differentiate feed products in a competitive market.

The United Arab Emirates and Egypt follow closely as significant markets, with growing livestock sectors and a focus on improving feed efficiency. Jordan and the Rest of the Middle East, while smaller individually, collectively represent a growing market with increasing adoption of modern feed technologies. The Swine segment, though smaller in certain markets due to cultural and religious reasons, represents a niche with high potential for specialized palatability solutions where permitted. Ruminant feed palatability enhancers are also gaining traction as the region seeks to enhance the efficiency of dairy and beef production. Other Animal Types, including aquaculture, are also beginning to show interest in palatability enhancers as the focus on diversified protein sources intensifies.

Middle East Feed Palatability Enhancers Industry Product Developments

Product development in the Middle East Feed Palatability Enhancers industry is intensely focused on enhancing efficacy, safety, and sustainability. Manufacturers are innovating with natural flavorings derived from plant extracts and essential oils, appealing to the growing demand for organic and natural feed ingredients. Advancements in microencapsulation technologies are leading to products with improved stability and controlled release, ensuring optimal palatability throughout the feed's shelf life and within the animal's digestive tract. The development of synergistic blends of flavors, sweeteners, and aroma enhancers is another key trend, designed to provide a more comprehensive appetite stimulation and feed acceptance. Companies are also investing in research to develop region-specific flavor profiles that resonate with local livestock preferences and common feed ingredients, offering a competitive advantage.

Key Drivers of Middle East Feed Palatability Enhancers Industry Growth

The growth of the Middle East Feed Palatability Enhancers industry is propelled by several critical factors. Firstly, the escalating demand for animal protein due to population growth and rising living standards necessitates increased livestock production efficiency. Secondly, technological advancements in feed formulation and ingredient processing are creating a need for sophisticated additives that enhance feed intake and nutrient utilization. Government initiatives aimed at boosting food security and developing the agricultural sector further incentivize the adoption of feed enhancers. Additionally, growing awareness among feed manufacturers and farmers about the economic benefits of improved feed conversion ratios and reduced wastage is a significant catalyst. The increasing focus on animal welfare and the reduction of antibiotic use also drives demand for palatability enhancers that promote healthy growth and reduce stress.

Challenges in the Middle East Feed Palatability Enhancers Industry Market

Despite the promising growth, the Middle East Feed Palatability Enhancers market faces several challenges. Stringent and evolving regulatory frameworks regarding feed additives can create hurdles for new product introductions and market access. Fluctuations in the prices of raw materials, including natural flavorants and sweeteners, can impact profitability and pricing strategies. Supply chain disruptions, particularly for imported ingredients, can affect product availability and lead times. Intense competition from both global and local players can lead to price pressures and necessitate continuous innovation to maintain market share. Furthermore, a lack of awareness or understanding of the full benefits of advanced palatability enhancers among some smaller feed producers can hinder widespread adoption.

Emerging Opportunities in Middle East Feed Palatability Enhancers Industry

Significant opportunities exist for growth and innovation within the Middle East Feed Palatability Enhancers market. The increasing emphasis on sustainable and natural feed solutions presents a prime avenue for the development and marketing of bio-based and organic palatability enhancers. Strategic partnerships between ingredient suppliers and major feed manufacturers can unlock new markets and facilitate the co-development of tailored solutions. Expansion into the aquaculture segment, which is rapidly growing in the region, offers a substantial untapped market for specialized palatability enhancers. Furthermore, the ongoing digitalization of the agriculture sector presents opportunities for data-driven solutions that optimize the application and efficacy of feed additives, providing measurable ROI for end-users.

Leading Players in the Middle East Feed Palatability Enhancers Industry Sector

- E I Dupont

- Diana Group

- Eli Lilly and Company

- Kerry Group PL

- Ferrer

- Associated British Foods PLC

- Kent Feeds Inc

- Kemin Europa

Key Milestones in Middle East Feed Palatability Enhancers Industry Industry

- 2019: Increased investment in R&D for natural feed additives in response to growing consumer demand for cleaner labels.

- 2020: Introduction of advanced encapsulation technologies for sustained release of flavorants.

- 2021: Several regional feed manufacturers establish strategic partnerships for ingredient sourcing and product development.

- 2022: Growing adoption of aroma enhancers to improve animal comfort and reduce stress in intensive farming.

- 2023: Increased regulatory scrutiny on feed additive safety and efficacy across key Middle Eastern markets.

- 2024: Emergence of aquaculture as a significant growth segment for feed palatability enhancers.

Strategic Outlook for Middle East Feed Palatability Enhancers Market

The strategic outlook for the Middle East Feed Palatability Enhancers market is exceptionally positive, driven by sustained demand for efficient animal protein production and an increasing appreciation for advanced feed solutions. Future growth will be accelerated by a focus on innovation in natural and sustainable ingredients, alongside the development of region-specific formulations. Strategic alliances and collaborations will be crucial for expanding market reach and enhancing product portfolios. Investments in R&D to address the unique challenges and opportunities within the diverse animal types and geographies of the Middle East will be a key differentiator. The market is poised for continued expansion, with an emphasis on delivering measurable economic benefits and contributing to food security in the region.

Middle East Feed Palatability Enhancers Industry Segmentation

-

1. Type

- 1.1. Flavors

- 1.2. Sweeteners

- 1.3. Aroma Enhancers

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Other Animal Types

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Egypt

- 3.4. Jordan

- 3.5. Rest of Middle east

Middle East Feed Palatability Enhancers Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Egypt

- 4. Jordan

- 5. Rest of Middle east

Middle East Feed Palatability Enhancers Industry Regional Market Share

Geographic Coverage of Middle East Feed Palatability Enhancers Industry

Middle East Feed Palatability Enhancers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Industrial Livestock Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Feed Palatability Enhancers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.2. Sweeteners

- 5.1.3. Aroma Enhancers

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Egypt

- 5.3.4. Jordan

- 5.3.5. Rest of Middle east

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Egypt

- 5.4.4. Jordan

- 5.4.5. Rest of Middle east

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East Feed Palatability Enhancers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flavors

- 6.1.2. Sweeteners

- 6.1.3. Aroma Enhancers

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Egypt

- 6.3.4. Jordan

- 6.3.5. Rest of Middle east

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East Feed Palatability Enhancers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flavors

- 7.1.2. Sweeteners

- 7.1.3. Aroma Enhancers

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Egypt

- 7.3.4. Jordan

- 7.3.5. Rest of Middle east

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Egypt Middle East Feed Palatability Enhancers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flavors

- 8.1.2. Sweeteners

- 8.1.3. Aroma Enhancers

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Egypt

- 8.3.4. Jordan

- 8.3.5. Rest of Middle east

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Jordan Middle East Feed Palatability Enhancers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flavors

- 9.1.2. Sweeteners

- 9.1.3. Aroma Enhancers

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Other Animal Types

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Egypt

- 9.3.4. Jordan

- 9.3.5. Rest of Middle east

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Middle east Middle East Feed Palatability Enhancers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Flavors

- 10.1.2. Sweeteners

- 10.1.3. Aroma Enhancers

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Other Animal Types

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Egypt

- 10.3.4. Jordan

- 10.3.5. Rest of Middle east

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 E I Dupont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Diana Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eli Lilly and Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kerry Group PL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ferrer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Associated British Foods PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kent Feeds Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kemin Europa

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 E I Dupont

List of Figures

- Figure 1: Middle East Feed Palatability Enhancers Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East Feed Palatability Enhancers Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 19: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Middle East Feed Palatability Enhancers Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Feed Palatability Enhancers Industry?

The projected CAGR is approximately 3.18%.

2. Which companies are prominent players in the Middle East Feed Palatability Enhancers Industry?

Key companies in the market include E I Dupont, Diana Group, Eli Lilly and Company, Kerry Group PL, Ferrer, Associated British Foods PLC, Kent Feeds Inc, Kemin Europa.

3. What are the main segments of the Middle East Feed Palatability Enhancers Industry?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Industrial Livestock Production.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Feed Palatability Enhancers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Feed Palatability Enhancers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Feed Palatability Enhancers Industry?

To stay informed about further developments, trends, and reports in the Middle East Feed Palatability Enhancers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence