Key Insights

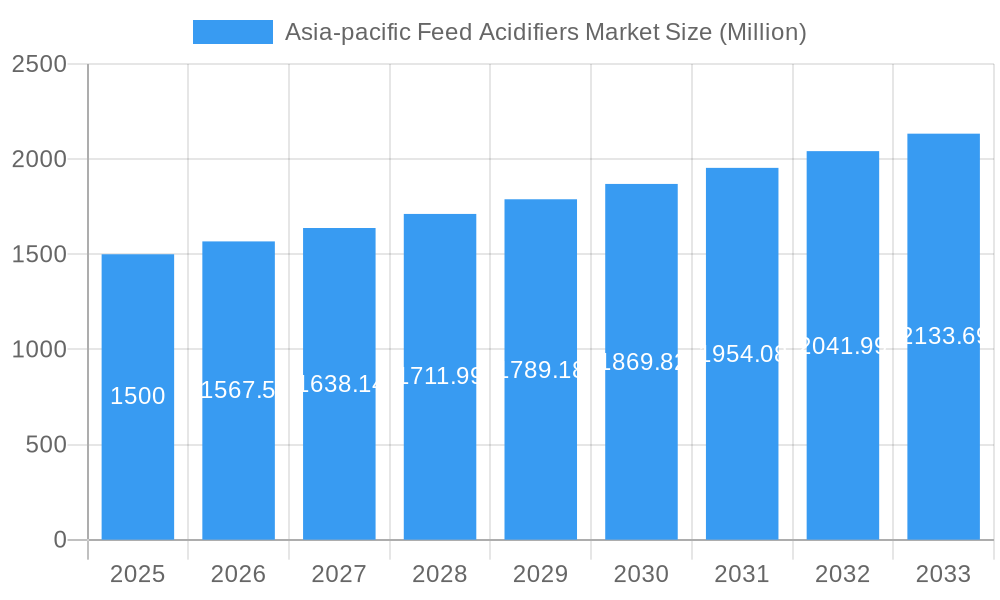

The Asia-Pacific feed acidifiers market, valued at approximately $17.56 billion in 2025, is projected for significant expansion, driven by a compound annual growth rate (CAGR) of 6.4% from 2025 to 2033. This growth is primarily attributed to the rising global demand for animal protein, especially in emerging economies across China, India, and Southeast Asia. Feed acidifiers are integral to improving feed digestibility, nutrient absorption, and gut health in livestock and aquaculture, thereby enhancing animal performance and productivity. Additionally, increasing consumer focus on food safety and the widespread adoption of sustainable farming practices are key drivers. The pursuit of high-quality animal products and a commitment to minimizing environmental impact encourage the use of acidifiers to optimize feed utilization and reduce waste. Aquaculture and swine farming segments are showing particularly strong growth within the region, mirroring the increased consumption of seafood and pork.

Asia-pacific Feed Acidifiers Market Market Size (In Billion)

Despite positive growth trends, the market faces challenges. Volatility in raw material pricing for key acidifier components can affect profitability and market stability. Furthermore, diverse and stringent regulatory frameworks for feed additives across various Asia-Pacific nations may present market expansion constraints. Nevertheless, the overall market outlook remains favorable, propelled by the sustained expansion of the animal agriculture sector and the increasing integration of advanced feed solutions incorporating acidifiers. The market is experiencing innovation with the introduction of novel acidifiers offering enhanced functionalities, attracting considerable investor interest. Leading companies such as SHV (Nutreco NV), Brenntag SE, and DSM are actively investing in research and development to broaden their product offerings and strengthen their market positions. The availability of a diverse range of acidifiers, including fumaric, lactic, and propionic acid, caters to specific animal and aquaculture requirements, fostering market diversification.

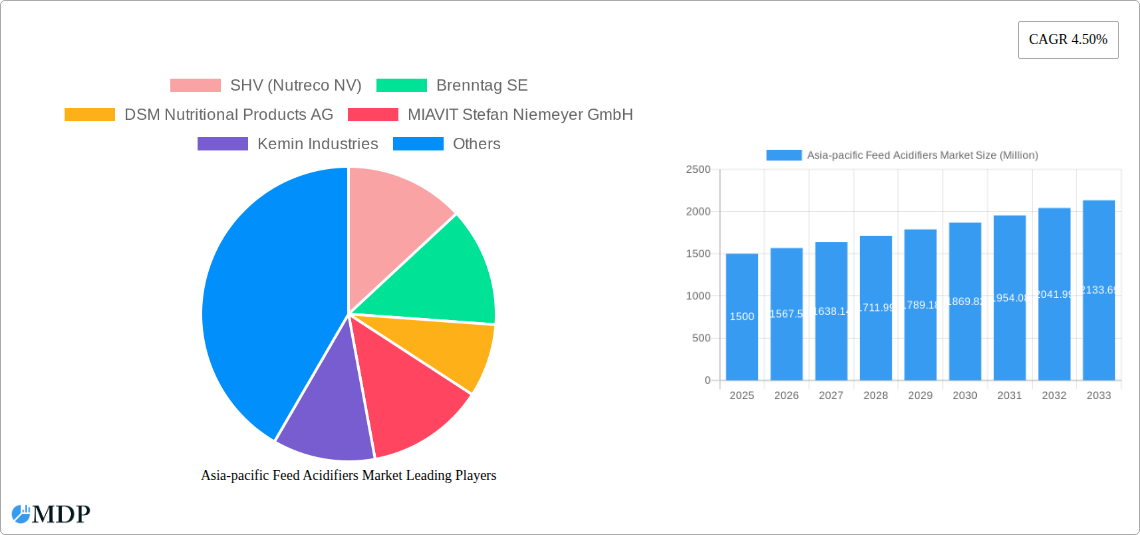

Asia-pacific Feed Acidifiers Market Company Market Share

Asia-Pacific Feed Acidifiers Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia-Pacific feed acidifiers market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report covers market dynamics, leading players, and future growth opportunities. The market is segmented by country (Australia, China, India, Indonesia, Japan, Philippines, South Korea, Thailand, Vietnam, and Rest of Asia-Pacific), sub-additive (Fumaric Acid, Lactic Acid, Propionic Acid, and Other Acidifiers), and animal type (Aquaculture, Other Ruminants, Swine, and Other Animals). The report's total market value is predicted to reach xx Million by 2033.

Asia-Pacific Feed Acidifiers Market Market Dynamics & Concentration

The Asia-Pacific feed acidifiers market is characterized by a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and strategic mergers and acquisitions (M&A). The region's robust animal husbandry and aquaculture sectors are major drivers of market growth, fueling demand for feed additives that enhance animal health and productivity. Stringent regulatory frameworks concerning feed safety and animal welfare are also shaping the market dynamics. The presence of substitute products, like alternative feed additives and natural feed supplements, creates a competitive landscape. However, the advantages of feed acidifiers in terms of cost-effectiveness and improved animal performance continue to ensure their relevance. Innovation in acidifier formulations, focusing on enhanced efficacy and reduced environmental impact, is a key factor shaping the market.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: The number of M&A deals in the Asia-Pacific feed acidifiers market averaged xx per year between 2019 and 2024.

- Innovation Drivers: Focus on sustainable and environmentally friendly acidifiers, improved efficacy formulations, and targeted product development for specific animal species.

- Regulatory Framework: Stringent regulations governing feed additives and animal health are expected to remain influential in shaping market growth.

Asia-Pacific Feed Acidifiers Market Industry Trends & Analysis

The Asia-Pacific feed acidifiers market is experiencing robust growth, driven by several key factors. The rising demand for animal protein in the region, coupled with intensifying aquaculture and livestock farming activities, has fueled the demand for feed acidifiers. Technological advancements in acidifier production and formulation have led to improved product efficacy and broader applications. Consumer preferences for high-quality, safe, and sustainably produced animal products are also influencing market trends. The competitive landscape is marked by both established multinational corporations and regional players, leading to intense competition in terms of pricing, product innovation, and market penetration. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing demand for efficient feed additives, sustainable agriculture, and technological advancements. Market penetration rates are expected to increase significantly, particularly in emerging economies within the region.

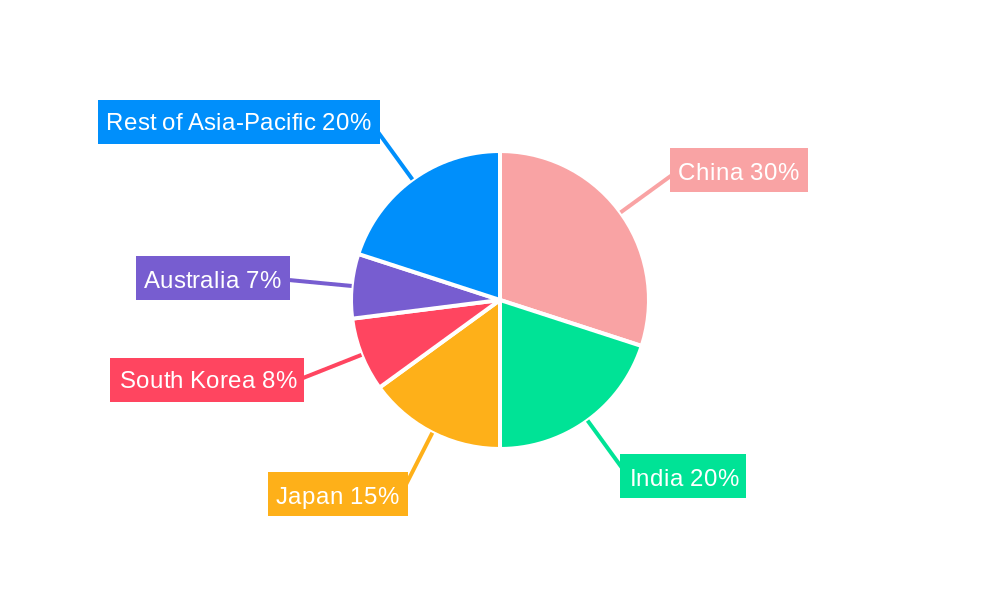

Leading Markets & Segments in Asia-Pacific Feed Acidifiers Market

China holds the dominant position in the Asia-Pacific feed acidifiers market, followed by India and other Southeast Asian nations, owing to their substantial animal feed industries. The Swine segment dominates animal type applications, while the Fumaric Acid segment leads in terms of sub-additives.

Key Drivers by Region:

- China: Rapid growth in livestock and aquaculture, government support for the agricultural sector, and expanding consumer demand for animal products.

- India: Growing poultry and dairy industries, increasing awareness of animal health and productivity, and government initiatives promoting agricultural development.

- Southeast Asia: Expansion of aquaculture, growing demand for meat, and increasing investment in livestock farming.

Dominance Analysis:

China's dominance stems from its large animal feed industry and substantial investments in agricultural infrastructure. India's growing livestock and poultry sectors are driving demand growth. Other Southeast Asian countries are experiencing expansion in aquaculture and livestock production, creating further growth opportunities.

Asia-Pacific Feed Acidifiers Market Product Developments

Recent product developments focus on delivering environmentally-friendly solutions with enhanced efficacy. Innovations include the introduction of encapsulated acidifiers which improve gut retention, optimizing animal digestion and nutrient utilization. The use of technologically advanced manufacturing processes has led to acidifiers with enhanced functionality, allowing for increased inclusion rates and ultimately improving the efficiency of the final product. Companies are also focusing on tailored product formulations for specific animal species and dietary requirements.

Key Drivers of Asia-Pacific Feed Acidifiers Market Growth

Several factors drive the growth of the Asia-Pacific feed acidifiers market. These include rising demand for animal protein, stringent regulations necessitating improved animal health and hygiene, rapid advancements in acidifier technologies leading to greater efficiency and improved efficacy, and strong government support for the development of the agricultural sector across the region. This includes financial incentives, infrastructural development, and research initiatives.

Challenges in the Asia-pacific Feed Acidifiers Market Market

The Asia-Pacific feed acidifiers market faces challenges such as fluctuations in raw material prices, stringent regulatory approvals, and intense competition among numerous players. Supply chain disruptions and the potential for counterfeit or substandard products also present obstacles. These factors can affect profitability and market stability. For example, the xx% increase in the price of lactic acid in 2022 impacted production costs for some manufacturers.

Emerging Opportunities in Asia-pacific Feed Acidifiers Market

The long-term growth of the Asia-Pacific feed acidifiers market is promising. Emerging opportunities include the development of novel, sustainable acidifiers, strategic partnerships to expand market reach, and the potential for market expansion into less-developed regions. Technological breakthroughs in acidifier formulation and delivery systems will further enhance market growth.

Leading Players in the Asia-Pacific Feed Acidifiers Market Sector

- SHV (Nutreco NV)

- Brenntag SE

- DSM Nutritional Products AG

- MIAVIT Stefan Niemeyer GmbH

- Kemin Industries

- BASF SE

- Cargill Inc

- EW Nutrition

- Adisseo

- Yara International AS

Key Milestones in Asia-Pacific Feed Acidifiers Market Industry

- December 2020: DSM's acquisition of Erber Group’s Biomin for approximately USD 1,046.1 Million significantly expanded its product portfolio and market presence.

- December 2021: Nutreco's partnership with Stellapps broadened its access to three million smallholder farmers, expanding its market reach.

- January 2022: The MoU between DSM and CPF to enhance animal protein production using DSM's Sustell technology highlights the growing focus on sustainable solutions.

Strategic Outlook for Asia-Pacific Feed Acidifiers Market Market

The Asia-Pacific feed acidifiers market presents significant growth potential due to the region's expanding animal husbandry sector and rising demand for animal protein. Strategic partnerships, investments in research and development, and a focus on sustainable and innovative acidifier solutions will be crucial for companies to capitalize on the long-term growth opportunities within this dynamic market. The market is poised for continued expansion driven by technological advancements, increasing consumer awareness of animal health and welfare, and the growing focus on sustainable agricultural practices.

Asia-pacific Feed Acidifiers Market Segmentation

-

1. Sub Additive

- 1.1. Fumaric Acid

- 1.2. Lactic Acid

- 1.3. Propionic Acid

- 1.4. Other Acidifiers

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

Asia-pacific Feed Acidifiers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-pacific Feed Acidifiers Market Regional Market Share

Geographic Coverage of Asia-pacific Feed Acidifiers Market

Asia-pacific Feed Acidifiers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-pacific Feed Acidifiers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Fumaric Acid

- 5.1.2. Lactic Acid

- 5.1.3. Propionic Acid

- 5.1.4. Other Acidifiers

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SHV (Nutreco NV)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brenntag SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DSM Nutritional Products AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MIAVIT Stefan Niemeyer GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kemin Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cargill Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EW Nutrition

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adisseo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yara International AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SHV (Nutreco NV)

List of Figures

- Figure 1: Asia-pacific Feed Acidifiers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-pacific Feed Acidifiers Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-pacific Feed Acidifiers Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 2: Asia-pacific Feed Acidifiers Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 3: Asia-pacific Feed Acidifiers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-pacific Feed Acidifiers Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 5: Asia-pacific Feed Acidifiers Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 6: Asia-pacific Feed Acidifiers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-pacific Feed Acidifiers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-pacific Feed Acidifiers Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Asia-pacific Feed Acidifiers Market?

Key companies in the market include SHV (Nutreco NV), Brenntag SE, DSM Nutritional Products AG, MIAVIT Stefan Niemeyer GmbH, Kemin Industries, BASF SE, Cargill Inc, EW Nutrition, Adisseo, Yara International AS.

3. What are the main segments of the Asia-pacific Feed Acidifiers Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

January 2022: DSM and CPF have agreed on a Memorandum of Understanding to enhance animal protein production by applying DSM's Intelligent Sustainability Service (Sustell).December 2021: Nutreco partnered with the tech start-up Stellapps. This will give accessibility for the company to sell feed products, premixes, and feed additives to three million smallholder farmers using Stellapps’ technology.December 2020: The acquisition of Erber Group’s Biomin further strengthens DSM's product portfolio by expanding its product offerings. The enterprise value of the combined company is about USD 1,046.1 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-pacific Feed Acidifiers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-pacific Feed Acidifiers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-pacific Feed Acidifiers Market?

To stay informed about further developments, trends, and reports in the Asia-pacific Feed Acidifiers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence