Key Insights

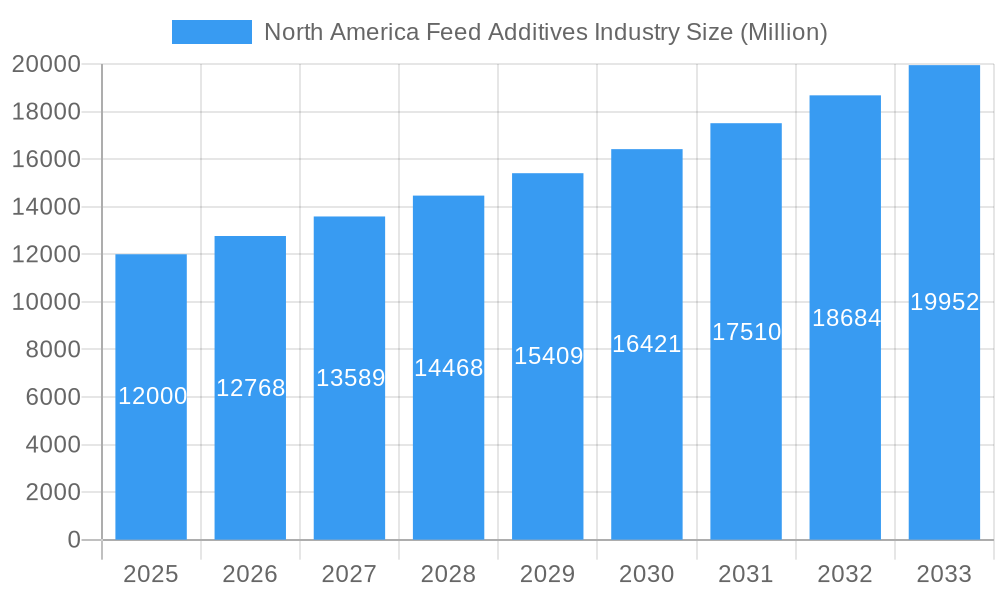

The North American feed additives market is poised for robust expansion, driven by an increasing demand for high-quality animal protein and a growing emphasis on animal health and welfare. With a projected market size of approximately USD 12,000 million in 2025, the industry is expected to witness a Compound Annual Growth Rate (CAGR) of 6.40% through 2033. This growth trajectory is significantly influenced by the expanding aquaculture and poultry sectors, which are adopting advanced feed formulations to enhance productivity and disease resistance. The rising consumer awareness regarding the safety and nutritional value of food products further bolsters the demand for feed additives that improve animal health and reduce the need for antibiotics. Technological advancements in feed formulation, coupled with an increasing focus on sustainable animal agriculture practices, are also key contributors to this positive market outlook.

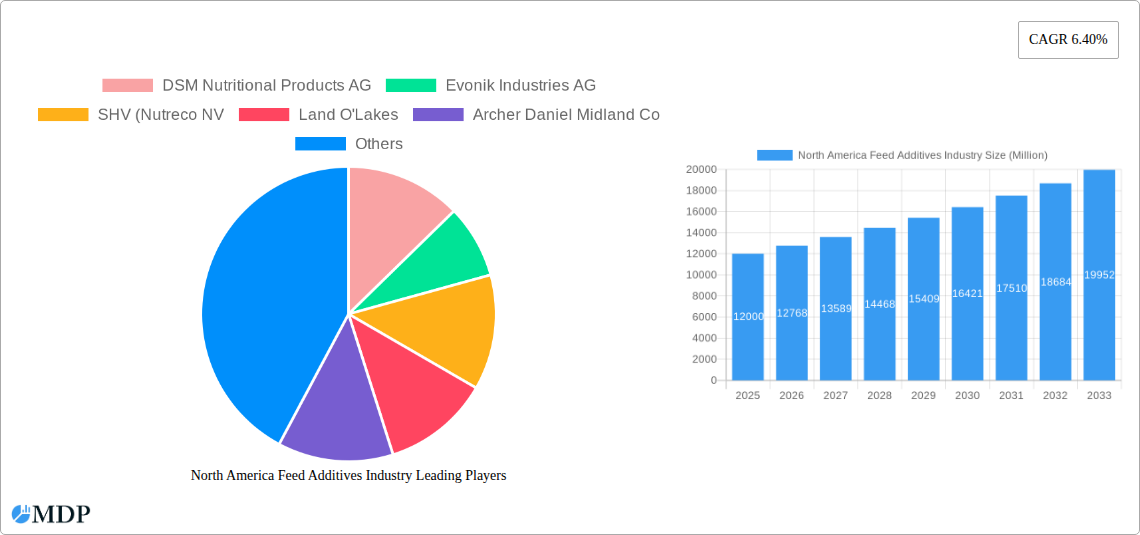

North America Feed Additives Industry Market Size (In Billion)

The market's dynamism is further shaped by a diverse range of segments, including essential vitamins, minerals, amino acids, enzymes, and probiotics, each playing a crucial role in optimizing animal nutrition and health. While the market benefits from strong growth drivers, certain restraints, such as stringent regulatory frameworks and the high cost of some advanced feed additives, require careful navigation. However, the pervasive trend towards antibiotic-free animal production is creating substantial opportunities for alternatives like phytogenics and prebiotics. Major players like DSM Nutritional Products AG, Evonik Industries AG, and BASF SE are actively investing in research and development to introduce innovative solutions, further accelerating market penetration and solidifying North America's position as a pivotal region in the global feed additives landscape.

North America Feed Additives Industry Company Market Share

North America Feed Additives Industry: Market Dynamics, Trends, and Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the North America Feed Additives Industry, covering market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the strategic outlook. With a study period spanning from 2019 to 2033, the report provides critical insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors, aiming to understand the market's current landscape and future trajectory. Leverage actionable intelligence on market concentration, innovation, regulatory frameworks, and competitive landscapes to inform your business strategy.

North America Feed Additives Industry Market Dynamics & Concentration

The North America Feed Additives Industry exhibits a moderate to high level of market concentration, with several key players dominating significant market share. Companies such as DSM Nutritional Products AG, Evonik Industries AG, and Cargill Inc. are recognized for their extensive product portfolios and strong market presence. Innovation drivers are primarily centered on enhancing animal health and productivity, reducing the environmental footprint of livestock farming, and meeting evolving consumer demands for safe and sustainable animal protein. Regulatory frameworks, including those set by the FDA in the United States and Health Canada, significantly influence product approval and market access, emphasizing safety and efficacy. Product substitutes, particularly in the realm of antibiotics, are increasingly sought, pushing innovation towards alternatives like probiotics and phytogenics. End-user trends reveal a growing demand for specialized additives that improve gut health, immune response, and nutrient utilization across various animal species. Mergers and acquisitions (M&A) activity is notable, driven by the pursuit of synergistic capabilities, expanded product offerings, and enhanced market reach. For instance, the Adisseo group's acquisition of Nor-Feed highlights a strategic move to bolster its botanical additive portfolio. M&A deal counts are expected to remain steady as companies seek to consolidate their market positions and acquire innovative technologies.

North America Feed Additives Industry Industry Trends & Analysis

The North America Feed Additives Industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This expansion is fueled by several interconnected trends. A primary market growth driver is the escalating global demand for animal protein, necessitating increased efficiency and productivity in livestock farming. This directly translates to a higher need for feed additives that optimize animal health, growth, and feed conversion ratios. Technological disruptions are playing a pivotal role, with advancements in biotechnology leading to the development of more effective and targeted enzymes, probiotics, and prebiotics. For instance, the development of novel enzyme formulations capable of breaking down complex carbohydrates or releasing bound nutrients is transforming feed efficiency. Consumer preferences are increasingly shifting towards antibiotic-free meat production and sustainable farming practices. This is a significant catalyst for the growth of non-antibiotic feed additives, such as phytogenics and organic acids, which support animal health without contributing to antimicrobial resistance. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on product differentiation. Companies are investing heavily in developing solutions that address specific animal health challenges, improve digestibility, and reduce environmental impact, such as methane emissions from ruminants. Market penetration of specialized additives, particularly those offering gut health benefits and immune support, is on an upward trajectory across poultry, swine, and ruminant sectors. The increasing emphasis on traceability and transparency in the food supply chain further supports the adoption of scientifically validated feed additives.

Leading Markets & Segments in North America Feed Additives Industry

The North America Feed Additives Industry is led by the United States, a major consumer of animal protein and a hub for feed production. Within the United States, poultry and swine segments represent the largest markets for feed additives, driven by the sheer volume of production and the economic imperative to maximize efficiency.

Dominant Additive Segments:

- Amino Acids: Lysine and Methionine are critical for optimizing protein synthesis and growth in poultry and swine, making them consistently high-volume additives. Their dominance is driven by their essential role in animal diets and the continuous need for precise formulation to achieve optimal growth rates and feed efficiency.

- Vitamins: Vitamins, particularly Vitamin A, Vitamin E, and B-complex vitamins, are indispensable for maintaining animal health, immune function, and reproductive performance across all livestock categories. Their widespread application and fundamental role in animal metabolism ensure sustained demand.

- Enzymes: Carbohydrases and Phytases are crucial for improving nutrient digestibility and reducing anti-nutritional factors in feed. The increasing adoption of enzyme technology to unlock the nutritional potential of alternative feed ingredients, especially in poultry and swine, contributes to their significant market share. Phytase enzymes, in particular, are vital for improving phosphorus utilization and reducing environmental phosphorus excretion.

- Probiotics & Prebiotics: These segments are experiencing rapid growth due to the growing consumer demand for antibiotic-free animal products and a heightened focus on gut health. They play a vital role in modulating the gut microbiome, enhancing nutrient absorption, and boosting immune responses in poultry, swine, and aquaculture.

- Minerals: Macrominerals (e.g., calcium, phosphorus) and Microminerals (e.g., zinc, copper, selenium) are essential for skeletal development, enzyme function, and overall metabolic health. Their foundational role in animal nutrition ensures consistent demand across all species.

Dominant Animal Segments:

- Poultry: Broilers and layers represent the largest animal segment. The high metabolic rate and rapid growth cycles of poultry necessitate precise nutrient management, making feed additives crucial for maximizing productivity and minimizing feed costs. The industry's focus on disease prevention and antibiotic reduction further fuels the demand for functional additives.

- Swine: The swine industry relies heavily on feed additives to enhance growth performance, improve gut health, and support immune function, especially during critical life stages such as weaning. The drive for efficient feed conversion and reduced environmental impact makes swine a significant market.

- Ruminants: While often characterized by longer growth cycles, ruminants, particularly dairy cattle, benefit significantly from additives that improve feed digestibility, milk production, and overall herd health. Enzymes, yeast additives, and minerals are key to optimizing their diets.

Key drivers for dominance in these segments include economic policies supporting livestock production, the technological infrastructure for feed manufacturing, and the continuous scientific research aimed at enhancing animal welfare and productivity.

North America Feed Additives Industry Product Developments

Product development in the North America Feed Additives Industry is characterized by a focus on efficacy, sustainability, and safety. Innovations are centered on creating multi-functional additives that address multiple animal health and performance challenges simultaneously. For instance, the development of synergistic blends of probiotics and prebiotics aims to optimize gut microbial balance and enhance nutrient absorption more effectively than single-ingredient approaches. Advances in encapsulation technologies are improving the stability and targeted delivery of active ingredients, such as vitamins and enzymes, ensuring their survival through the feed manufacturing process and optimal release in the animal's digestive tract. Furthermore, there is a significant push towards developing naturally derived additives, including novel phytogenic compounds and bio-based antioxidants, to meet the growing demand for clean-label and sustainable feed solutions. These developments offer competitive advantages by providing enhanced animal health outcomes, reduced environmental impact, and alignment with consumer preferences for responsible food production.

Key Drivers of North America Feed Additives Industry Growth

The North America Feed Additives Industry is experiencing significant growth propelled by several key factors. The escalating global demand for animal protein, driven by population growth and rising disposable incomes, necessitates increased efficiency and productivity in livestock farming, directly increasing the need for feed additives. Technological advancements in areas like enzyme technology and microbial fermentation are enabling the development of more effective and targeted feed additives, enhancing nutrient utilization and animal health. Regulatory shifts, particularly the global movement to reduce antibiotic use in animal agriculture, are creating substantial opportunities for antibiotic alternatives like probiotics, prebiotics, and phytogenics. Economic factors, including the optimization of feed costs and improvements in feed conversion ratios, make the adoption of performance-enhancing additives a financially sound decision for producers.

Challenges in the North America Feed Additives Industry Market

Despite robust growth, the North America Feed Additives Industry faces several significant challenges. Navigating complex and evolving regulatory landscapes across different countries and regions can be a hurdle, requiring extensive research, development, and compliance efforts. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can impact the availability and cost of raw materials and finished products. Intense competition among a growing number of players, including both established giants and emerging innovators, can lead to price pressures and the need for continuous product differentiation. The increasing demand for natural and sustainably sourced ingredients also presents a challenge, requiring investment in novel production methods and ingredient sourcing. Furthermore, the perceived cost of specialized additives can sometimes hinder adoption in price-sensitive markets.

Emerging Opportunities in North America Feed Additives Industry

Emerging opportunities within the North America Feed Additives Industry are largely driven by sustainability initiatives and technological innovation. The growing consumer and regulatory pressure to reduce the environmental footprint of animal agriculture is a major catalyst for growth in additives that mitigate greenhouse gas emissions, improve nutrient efficiency, and reduce waste. Technological breakthroughs in areas such as precision nutrition, utilizing artificial intelligence and big data analytics, offer opportunities to develop highly customized feed additive solutions tailored to specific animal needs and production systems. Strategic partnerships between feed additive manufacturers, technology providers, and academic institutions are crucial for accelerating the development and commercialization of novel solutions. Market expansion strategies focused on underpenetrated segments, such as aquaculture and specialty animal production, also present significant growth potential.

Leading Players in the North America Feed Additives Industry Sector

- DSM Nutritional Products AG

- Evonik Industries AG

- SHV (Nutreco NV)

- Land O'Lakes

- Archer Daniel Midland Co

- BASF SE

- Alltech Inc

- Cargill Inc

- IFF (Danisco Animal Nutrition)

- Adisseo

Key Milestones in North America Feed Additives Industry Industry

- December 2022: Adisseo group acquired Nor-Feed and its subsidiaries to develop and register botanical additives for use in animal feed, strengthening its portfolio of natural solutions.

- October 2022: Evonik and BASF entered into a partnership, granting Evonik certain non-exclusive licensing rights to Opteinics™, a digital solution aimed at improving comprehension and reducing the environmental impact of the animal protein and feed industries.

- June 2022: Delacon and Cargill collaborated to establish a global plant-based phytogenic feed additives business, leveraging extensive feed additives expertise and increasing global presence for enhanced animal nutrition.

Strategic Outlook for North America Feed Additives Industry Market

The strategic outlook for the North America Feed Additives Industry remains exceptionally positive, driven by an undeniable synergy between market demand and technological advancement. The increasing global population and its demand for animal protein will continue to be a fundamental growth accelerator. Coupled with this is the accelerating shift towards sustainable and antibiotic-free animal agriculture, which significantly bolsters the market for natural and functional feed additives such as probiotics, prebiotics, and phytogenics. Investment in research and development will be critical for companies seeking to innovate and gain a competitive edge, particularly in areas like precision nutrition and gut health optimization. Strategic partnerships and acquisitions will continue to play a vital role in expanding market reach, acquiring new technologies, and consolidating market share. The industry is poised for sustained growth, with a clear trajectory towards more science-backed, sustainable, and health-focused feed additive solutions.

North America Feed Additives Industry Segmentation

-

1. Additive

-

1.1. Acidifiers

-

1.1.1. By Sub Additive

- 1.1.1.1. Fumaric Acid

- 1.1.1.2. Lactic Acid

- 1.1.1.3. Propionic Acid

- 1.1.1.4. Other Acidifiers

-

1.1.1. By Sub Additive

-

1.2. Amino Acids

- 1.2.1. Lysine

- 1.2.2. Methionine

- 1.2.3. Threonine

- 1.2.4. Tryptophan

- 1.2.5. Other Amino Acids

-

1.3. Antibiotics

- 1.3.1. Bacitracin

- 1.3.2. Penicillins

- 1.3.3. Tetracyclines

- 1.3.4. Tylosin

- 1.3.5. Other Antibiotics

-

1.4. Antioxidants

- 1.4.1. Butylated Hydroxyanisole (BHA)

- 1.4.2. Butylated Hydroxytoluene (BHT)

- 1.4.3. Citric Acid

- 1.4.4. Ethoxyquin

- 1.4.5. Propyl Gallate

- 1.4.6. Tocopherols

- 1.4.7. Other Antioxidants

-

1.5. Binders

- 1.5.1. Natural Binders

- 1.5.2. Synthetic Binders

-

1.6. Enzymes

- 1.6.1. Carbohydrases

- 1.6.2. Phytases

- 1.6.3. Other Enzymes

- 1.7. Flavors & Sweeteners

-

1.8. Minerals

- 1.8.1. Macrominerals

- 1.8.2. Microminerals

-

1.9. Mycotoxin Detoxifiers

- 1.9.1. Biotransformers

-

1.10. Phytogenics

- 1.10.1. Essential Oil

- 1.10.2. Herbs & Spices

- 1.10.3. Other Phytogenics

-

1.11. Pigments

- 1.11.1. Carotenoids

- 1.11.2. Curcumin & Spirulina

-

1.12. Prebiotics

- 1.12.1. Fructo Oligosaccharides

- 1.12.2. Galacto Oligosaccharides

- 1.12.3. Inulin

- 1.12.4. Lactulose

- 1.12.5. Mannan Oligosaccharides

- 1.12.6. Xylo Oligosaccharides

- 1.12.7. Other Prebiotics

-

1.13. Probiotics

- 1.13.1. Bifidobacteria

- 1.13.2. Enterococcus

- 1.13.3. Lactobacilli

- 1.13.4. Pediococcus

- 1.13.5. Streptococcus

- 1.13.6. Other Probiotics

-

1.14. Vitamins

- 1.14.1. Vitamin A

- 1.14.2. Vitamin B

- 1.14.3. Vitamin C

- 1.14.4. Vitamin E

- 1.14.5. Other Vitamins

-

1.15. Yeast

- 1.15.1. Live Yeast

- 1.15.2. Selenium Yeast

- 1.15.3. Spent Yeast

- 1.15.4. Torula Dried Yeast

- 1.15.5. Whey Yeast

- 1.15.6. Yeast Derivatives

-

1.1. Acidifiers

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

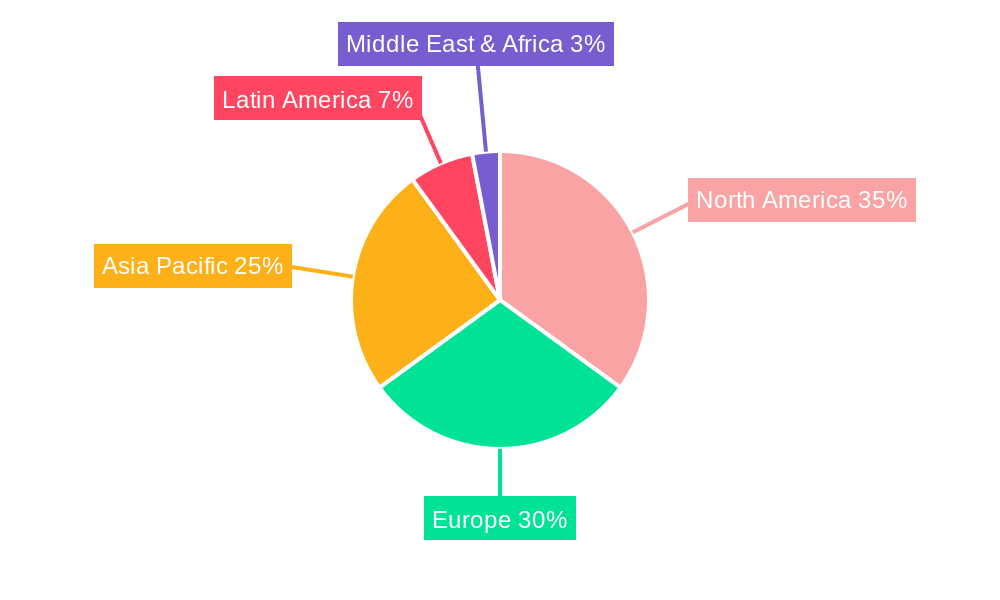

North America Feed Additives Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Feed Additives Industry Regional Market Share

Geographic Coverage of North America Feed Additives Industry

North America Feed Additives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Feed Additives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Additive

- 5.1.1. Acidifiers

- 5.1.1.1. By Sub Additive

- 5.1.1.1.1. Fumaric Acid

- 5.1.1.1.2. Lactic Acid

- 5.1.1.1.3. Propionic Acid

- 5.1.1.1.4. Other Acidifiers

- 5.1.1.1. By Sub Additive

- 5.1.2. Amino Acids

- 5.1.2.1. Lysine

- 5.1.2.2. Methionine

- 5.1.2.3. Threonine

- 5.1.2.4. Tryptophan

- 5.1.2.5. Other Amino Acids

- 5.1.3. Antibiotics

- 5.1.3.1. Bacitracin

- 5.1.3.2. Penicillins

- 5.1.3.3. Tetracyclines

- 5.1.3.4. Tylosin

- 5.1.3.5. Other Antibiotics

- 5.1.4. Antioxidants

- 5.1.4.1. Butylated Hydroxyanisole (BHA)

- 5.1.4.2. Butylated Hydroxytoluene (BHT)

- 5.1.4.3. Citric Acid

- 5.1.4.4. Ethoxyquin

- 5.1.4.5. Propyl Gallate

- 5.1.4.6. Tocopherols

- 5.1.4.7. Other Antioxidants

- 5.1.5. Binders

- 5.1.5.1. Natural Binders

- 5.1.5.2. Synthetic Binders

- 5.1.6. Enzymes

- 5.1.6.1. Carbohydrases

- 5.1.6.2. Phytases

- 5.1.6.3. Other Enzymes

- 5.1.7. Flavors & Sweeteners

- 5.1.8. Minerals

- 5.1.8.1. Macrominerals

- 5.1.8.2. Microminerals

- 5.1.9. Mycotoxin Detoxifiers

- 5.1.9.1. Biotransformers

- 5.1.10. Phytogenics

- 5.1.10.1. Essential Oil

- 5.1.10.2. Herbs & Spices

- 5.1.10.3. Other Phytogenics

- 5.1.11. Pigments

- 5.1.11.1. Carotenoids

- 5.1.11.2. Curcumin & Spirulina

- 5.1.12. Prebiotics

- 5.1.12.1. Fructo Oligosaccharides

- 5.1.12.2. Galacto Oligosaccharides

- 5.1.12.3. Inulin

- 5.1.12.4. Lactulose

- 5.1.12.5. Mannan Oligosaccharides

- 5.1.12.6. Xylo Oligosaccharides

- 5.1.12.7. Other Prebiotics

- 5.1.13. Probiotics

- 5.1.13.1. Bifidobacteria

- 5.1.13.2. Enterococcus

- 5.1.13.3. Lactobacilli

- 5.1.13.4. Pediococcus

- 5.1.13.5. Streptococcus

- 5.1.13.6. Other Probiotics

- 5.1.14. Vitamins

- 5.1.14.1. Vitamin A

- 5.1.14.2. Vitamin B

- 5.1.14.3. Vitamin C

- 5.1.14.4. Vitamin E

- 5.1.14.5. Other Vitamins

- 5.1.15. Yeast

- 5.1.15.1. Live Yeast

- 5.1.15.2. Selenium Yeast

- 5.1.15.3. Spent Yeast

- 5.1.15.4. Torula Dried Yeast

- 5.1.15.5. Whey Yeast

- 5.1.15.6. Yeast Derivatives

- 5.1.1. Acidifiers

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DSM Nutritional Products AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Evonik Industries AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SHV (Nutreco NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Land O'Lakes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniel Midland Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alltech Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cargill Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DSM Nutritional Products AG

List of Figures

- Figure 1: North America Feed Additives Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Feed Additives Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Feed Additives Industry Revenue Million Forecast, by Additive 2020 & 2033

- Table 2: North America Feed Additives Industry Revenue Million Forecast, by Animal 2020 & 2033

- Table 3: North America Feed Additives Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Feed Additives Industry Revenue Million Forecast, by Additive 2020 & 2033

- Table 5: North America Feed Additives Industry Revenue Million Forecast, by Animal 2020 & 2033

- Table 6: North America Feed Additives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Feed Additives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Feed Additives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Feed Additives Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Feed Additives Industry?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the North America Feed Additives Industry?

Key companies in the market include DSM Nutritional Products AG, Evonik Industries AG, SHV (Nutreco NV, Land O'Lakes, Archer Daniel Midland Co, BASF SE, Alltech Inc, Cargill Inc, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the North America Feed Additives Industry?

The market segments include Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

December 2022: Adisseo group had agreed to acquire Nor-Feed and its subsidiaries to develop and register botanical additives for use in animal feed.October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.June 2022: Delacon and Cargill collaborated to establish a global plant-based phytogenic feed additives business for enhanced animal nutrition. The partnership has helped in extensive feed additives expertise as well as an increase in the global presence.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Feed Additives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Feed Additives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Feed Additives Industry?

To stay informed about further developments, trends, and reports in the North America Feed Additives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence