Key Insights

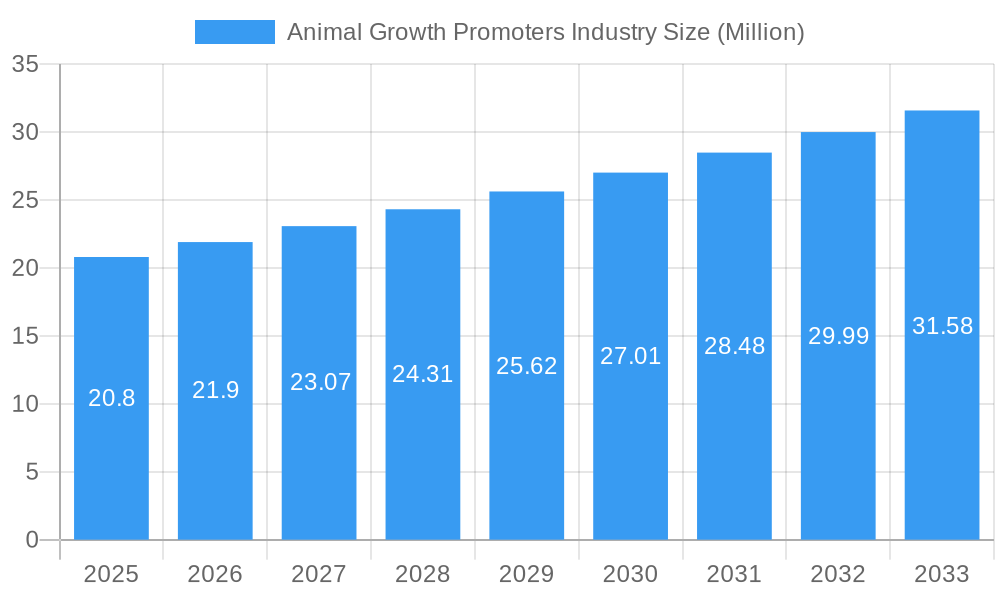

The global Animal Growth Promoters market is poised for significant expansion, with a current market size estimated at USD 20.80 Million and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 5.30%. This upward trajectory is largely fueled by the escalating global demand for animal protein, driven by a growing population and increasing disposable incomes, particularly in emerging economies. Farmers are increasingly adopting advanced feed additives to enhance animal health, improve feed conversion ratios, and ultimately boost productivity and profitability. This shift is further encouraged by the need to meet stringent food safety regulations and consumer preferences for efficiently produced, high-quality animal products. Key market drivers include technological advancements in feed formulation, the continuous development of novel growth-promoting ingredients with improved efficacy and safety profiles, and a greater understanding of animal gut health and nutrition.

Animal Growth Promoters Industry Market Size (In Million)

The market segmentation reveals a dynamic landscape with distinct growth patterns across various product types and animal categories. Probiotics and prebiotics are expected to witness substantial growth due to their proven benefits in improving gut microbiome health and immunity. Phytogenics are also gaining traction as natural alternatives to conventional growth promoters. In terms of animal types, the poultry and swine segments are anticipated to lead the market, owing to their high-volume production and the intensive farming practices prevalent in these sectors. Aquaculture also presents a rapidly growing segment as the industry expands to meet seafood demand. While the market is characterized by strong growth, potential restraints include evolving regulatory landscapes concerning the use of certain growth promoters, concerns about antibiotic resistance, and the fluctuating costs of raw materials. However, ongoing research and development efforts by leading companies, including Bluestar Adisseo, Kemin Industries, and DSM, are focused on developing sustainable and effective solutions, ensuring continued market vitality.

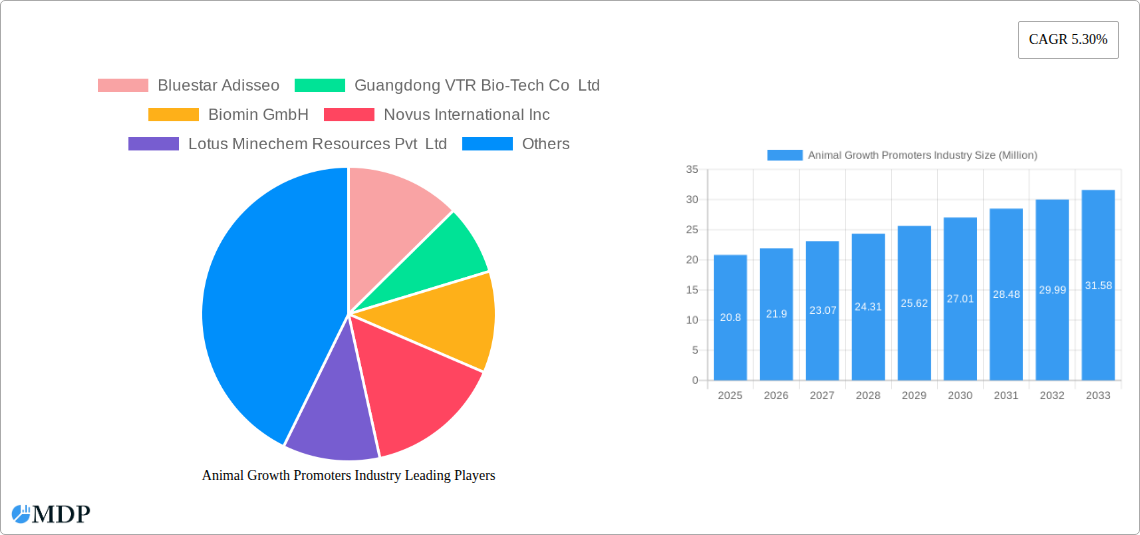

Animal Growth Promoters Industry Company Market Share

Here's an SEO-optimized and engaging report description for the Animal Growth Promoters Industry:

Report Title: Global Animal Growth Promoters Market: Dynamics, Trends, and Forecast 2019–2033

Report Description:

Dive deep into the dynamic Animal Growth Promoters Market with our comprehensive report. This analysis explores the evolving landscape of animal nutrition, feed additives, and livestock health, projecting a robust growth trajectory driven by increasing global protein demand and a shift towards sustainable farming practices. Discover key insights into the probiotics for animals, prebiotics in animal feed, phytogenics for livestock, and acidifiers for animal growth segments. We meticulously analyze the impact of poultry growth promoters, swine feed additives, ruminant nutrition enhancers, and aquaculture feed supplements. This report is an essential resource for animal health companies, feed manufacturers, veterinary professionals, and investors seeking to capitalize on the burgeoning animal growth promoters industry. With a detailed market analysis, CAGR projections, and identification of leading animal growth promoters companies, this study provides actionable intelligence for strategic decision-making.

Animal Growth Promoters Industry Market Dynamics & Concentration

The Animal Growth Promoters Market is characterized by moderate to high concentration, with key players like Bluestar Adisseo, Guangdong VTR Bio-Tech Co Ltd, Biomin GmbH, Novus International Inc, and Kemin Industries holding significant market share. Innovation remains a primary driver, fueled by extensive R&D into novel feed additives that enhance animal health and productivity while minimizing environmental impact. Regulatory frameworks are increasingly stringent, particularly concerning the phased ban of antibiotic growth promoters in many regions, pushing the industry towards safer alternatives. Product substitutes, including improved farm management practices and advanced genetics, pose a growing challenge. End-user trends favor solutions that improve gut health, reduce disease incidence, and enhance feed conversion ratios. Mergers and acquisitions (M&A) activity, with an estimated XX M&A deals recorded in the historical period, continues to shape the competitive landscape as companies seek to expand their product portfolios and geographic reach. Market share distribution shows leading players controlling approximately XX% of the global market, with emerging companies vying for niche segments.

Animal Growth Promoters Industry Industry Trends & Analysis

The global Animal Growth Promoters Market is poised for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is propelled by a confluence of factors, including the escalating global demand for animal protein, driven by a rising population and increasing disposable incomes in developing economies. The growing consumer awareness regarding food safety and animal welfare is a pivotal trend, leading to a decreased reliance on traditional antibiotic growth promoters (AGPs) and a surge in demand for natural and scientifically validated alternatives. This shift has created substantial market penetration opportunities for probiotics, prebiotics, and phytogenics. Technological disruptions, such as advancements in feed formulation, precision nutrition, and the application of artificial intelligence in livestock management, are further optimizing the efficacy of growth promoters. Consumer preferences are increasingly leaning towards products that offer traceability and sustainability throughout the animal production value chain. Competitive dynamics are intensifying, with established players investing heavily in research and development to introduce innovative solutions and gain a competitive edge. The market penetration for non-antibiotic growth promoters is projected to reach XX% by 2033. Economic factors, including rising feed costs, also necessitate the adoption of efficient growth promoters to improve feed conversion ratios and profitability for farmers. Furthermore, government initiatives aimed at promoting animal health and productivity in key agricultural nations are indirectly boosting the market. The forecasted market size for the Animal Growth Promoters Industry is projected to reach XX Million by 2033.

Leading Markets & Segments in Animal Growth Promoters Industry

The Poultry segment is the dominant force in the Animal Growth Promoters Industry, accounting for an estimated XX% of the global market share in 2025. This dominance is attributed to the high efficiency of poultry in converting feed into protein, coupled with the rapid growth cycles that benefit significantly from optimized nutrition. Furthermore, the global demand for chicken meat continues to surge, making poultry farming a cornerstone of food security. Within the poultry segment, probiotics and phytogenics are experiencing exceptional growth, driven by their perceived safety and efficacy in improving gut health, boosting immunity, and enhancing feed utilization, thereby replacing antibiotic growth promoters.

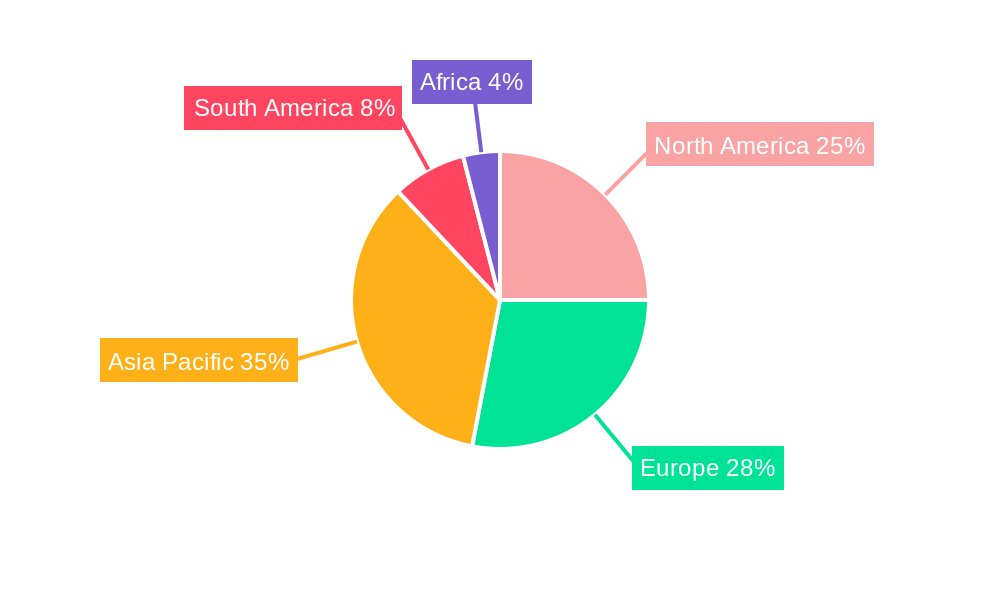

- Dominant Region: North America currently holds a significant market share due to its advanced agricultural infrastructure and high adoption rates of innovative feed additives. However, the Asia-Pacific region is projected to witness the fastest growth, fueled by expanding livestock production and increasing investments in animal husbandry.

- Key Country: The United States, with its large-scale livestock operations and stringent quality control measures, represents a major market. China and India are anticipated to exhibit the highest growth rates due to their vast agricultural bases and increasing domestic consumption of animal products.

- Dominant Type: Probiotics are leading the market, followed closely by prebiotics, which are gaining traction for their synergistic effects with probiotics in enhancing gut microbiota. Phytogenics are emerging as a strong contender due to their natural origin and multifaceted benefits, including antimicrobial and anti-inflammatory properties. Acidifiers continue to play a crucial role in maintaining gut pH and preventing the proliferation of pathogenic bacteria, particularly in young animals.

- Dominant Animal Type: While Poultry leads, Swine and Ruminant segments are also substantial contributors, with a growing interest in specialized growth promoters for these animal types to address specific health challenges and improve production efficiency. Aquaculture is an emerging segment with significant growth potential as aquaculture production expands globally.

- Key Drivers for Poultry Dominance:

- High feed conversion efficiency.

- Rapid growth cycles.

- Global demand for chicken meat.

- Technological advancements in poultry farming.

- Consumer preference for lean protein.

Animal Growth Promoters Industry Product Developments

Product innovation in the Animal Growth Promoters Industry is intensely focused on developing naturally derived and highly effective feed additives. Companies are investing in research to enhance the efficacy of probiotics and prebiotics through advanced strain selection and fermentation techniques, targeting specific gut health benefits and immune modulation. The development of novel phytogenic blends with synergistic antimicrobial and antioxidant properties is a key trend, offering safer alternatives to antibiotics. Furthermore, innovations in acidifiers are focusing on encapsulation technologies for improved stability and controlled release. These developments aim to provide enhanced feed conversion ratios, improved animal health, and reduced environmental impact, offering significant competitive advantages in a market increasingly driven by sustainability and safety concerns.

Key Drivers of Animal Growth Promoters Industry Growth

The Animal Growth Promoters Industry is experiencing robust growth, primarily driven by the escalating global demand for animal protein, fueled by a growing population and increasing disposable incomes. The significant shift away from antibiotic growth promoters (AGPs) due to regulatory pressures and consumer health concerns is a major catalyst, propelling the adoption of natural alternatives like probiotics, prebiotics, and phytogenics. Technological advancements in feed formulation and animal nutrition research are continuously introducing more effective and targeted growth promotion solutions. Furthermore, increasing awareness among farmers about the economic benefits of improved feed conversion ratios and reduced disease incidence in livestock directly contributes to market expansion.

Challenges in the Animal Growth Promoters Industry Market

The Animal Growth Promoters Industry faces several significant challenges. Stringent and evolving regulatory frameworks across different regions, particularly regarding the approval and labeling of feed additives, can create market access hurdles. Supply chain disruptions, exacerbated by geopolitical events and climate change, can impact the availability and cost of raw materials. Intense competition from both established players and new entrants, coupled with the high cost of research and development for innovative products, puts pressure on profit margins. Additionally, farmer education and the adoption of new technologies, especially in developing economies, can be slow, limiting the widespread implementation of advanced growth promotion strategies.

Emerging Opportunities in Animal Growth Promoters Industry

Emerging opportunities in the Animal Growth Promoters Industry are abundant, particularly in the development of next-generation probiotics, prebiotics, and phytogenics that offer enhanced efficacy and specific health benefits. Strategic partnerships between feed additive manufacturers, research institutions, and livestock producers are crucial for accelerating product development and market penetration. The growing demand for sustainable and ethically produced animal protein presents a significant opportunity for companies offering environmentally friendly growth promotion solutions. Furthermore, the expansion of aquaculture globally, coupled with increasing awareness of its nutritional benefits, opens new avenues for specialized feed additives. Technological breakthroughs in precision nutrition and gut microbiome analysis will enable the creation of highly customized growth promotion strategies, driving long-term growth.

Leading Players in the Animal Growth Promoters Industry Sector

- Bluestar Adisseo

- Guangdong VTR Bio-Tech Co Ltd

- Biomin GmbH

- Novus International Inc

- Lotus Minechem Resources Pvt Ltd

- Kemin Industries

- Chr Hansen A/S

- BASF SE

- DSM

- Alltech Inc

- Dupont De Nemours Inc

- Cargill Inc

- Novozymes A/S

- Elanco Animal Health Incorporated

- Zoetis Inc

Key Milestones in Animal Growth Promoters Industry Industry

- 2019: Increased global regulatory focus on reducing antibiotic use in livestock farming.

- 2020: Significant rise in R&D investment for non-antibiotic growth promoters.

- 2021: Launch of novel probiotic strains with enhanced gut health benefits.

- 2022: Growing adoption of phytogenic feed additives across Europe and North America.

- 2023: Partnerships formed to develop precision nutrition solutions for improved feed efficiency.

- 2024: Emerging markets show increased interest in adopting advanced feed additive technologies.

Strategic Outlook for Animal Growth Promoters Industry Market

The strategic outlook for the Animal Growth Promoters Industry is highly optimistic, driven by the sustained global demand for animal protein and the ongoing transition towards sustainable and antibiotic-free livestock production. Key growth accelerators include continued innovation in probiotics, prebiotics, and phytogenics, alongside advancements in precision nutrition and gut health management. Companies that focus on developing scientifically validated, safe, and environmentally friendly solutions will be well-positioned for success. Strategic expansions into high-growth emerging markets and strategic collaborations will further fuel market penetration and revenue generation. The industry is expected to witness increased consolidation as players seek to strengthen their market positions and diversify their product offerings.

Animal Growth Promoters Industry Segmentation

-

1. Type

- 1.1. Probiotics

- 1.2. Prebiotics

- 1.3. Phytogenics

- 1.4. Acidifiers

- 1.5. Other Types

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

Animal Growth Promoters Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Animal Growth Promoters Industry Regional Market Share

Geographic Coverage of Animal Growth Promoters Industry

Animal Growth Promoters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. The Rise in Demand for Meat Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Growth Promoters Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Probiotics

- 5.1.2. Prebiotics

- 5.1.3. Phytogenics

- 5.1.4. Acidifiers

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Animal Growth Promoters Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Probiotics

- 6.1.2. Prebiotics

- 6.1.3. Phytogenics

- 6.1.4. Acidifiers

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Animal Growth Promoters Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Probiotics

- 7.1.2. Prebiotics

- 7.1.3. Phytogenics

- 7.1.4. Acidifiers

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Animal Growth Promoters Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Probiotics

- 8.1.2. Prebiotics

- 8.1.3. Phytogenics

- 8.1.4. Acidifiers

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Animal Growth Promoters Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Probiotics

- 9.1.2. Prebiotics

- 9.1.3. Phytogenics

- 9.1.4. Acidifiers

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa Animal Growth Promoters Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Probiotics

- 10.1.2. Prebiotics

- 10.1.3. Phytogenics

- 10.1.4. Acidifiers

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bluestar Adisseo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Guangdong VTR Bio-Tech Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biomin GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Novus International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lotus Minechem Resources Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kemin Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chr Hansen A/

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DSM

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alltech Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dupont De Nemours Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cargill Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Novozymes A/S

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Elanco Animal Health Incorporated

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zoetis Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Bluestar Adisseo

List of Figures

- Figure 1: Global Animal Growth Promoters Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Animal Growth Promoters Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Animal Growth Promoters Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Animal Growth Promoters Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 5: North America Animal Growth Promoters Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Animal Growth Promoters Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Animal Growth Promoters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Animal Growth Promoters Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Animal Growth Promoters Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Animal Growth Promoters Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: Europe Animal Growth Promoters Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Europe Animal Growth Promoters Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Animal Growth Promoters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Animal Growth Promoters Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Animal Growth Promoters Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Animal Growth Promoters Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 17: Asia Pacific Animal Growth Promoters Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Asia Pacific Animal Growth Promoters Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Animal Growth Promoters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Animal Growth Promoters Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Animal Growth Promoters Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Animal Growth Promoters Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: South America Animal Growth Promoters Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: South America Animal Growth Promoters Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Animal Growth Promoters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Africa Animal Growth Promoters Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Africa Animal Growth Promoters Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Africa Animal Growth Promoters Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 29: Africa Animal Growth Promoters Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Africa Animal Growth Promoters Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Africa Animal Growth Promoters Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Growth Promoters Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Animal Growth Promoters Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Global Animal Growth Promoters Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Animal Growth Promoters Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Animal Growth Promoters Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Animal Growth Promoters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Animal Growth Promoters Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Animal Growth Promoters Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 13: Global Animal Growth Promoters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Animal Growth Promoters Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Animal Growth Promoters Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 22: Global Animal Growth Promoters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Animal Growth Promoters Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Animal Growth Promoters Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 30: Global Animal Growth Promoters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Animal Growth Promoters Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Animal Growth Promoters Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 36: Global Animal Growth Promoters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South Africa Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Africa Animal Growth Promoters Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Growth Promoters Industry?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Animal Growth Promoters Industry?

Key companies in the market include Bluestar Adisseo, Guangdong VTR Bio-Tech Co Ltd, Biomin GmbH, Novus International Inc, Lotus Minechem Resources Pvt Ltd, Kemin Industries, Chr Hansen A/, BASF SE, DSM, Alltech Inc, Dupont De Nemours Inc, Cargill Inc, Novozymes A/S, Elanco Animal Health Incorporated, Zoetis Inc.

3. What are the main segments of the Animal Growth Promoters Industry?

The market segments include Type, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

The Rise in Demand for Meat Boosting the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Growth Promoters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Growth Promoters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Growth Promoters Industry?

To stay informed about further developments, trends, and reports in the Animal Growth Promoters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence