Key Insights

The Taiwan retail industry, encompassing both traditional brick-and-mortar establishments and rapidly expanding e-commerce channels, is a dynamic sector undergoing significant evolution. Factors such as increased disposable income, a growing middle class with enhanced purchasing power, and widespread adoption of digital technologies have fueled substantial growth. Based on an estimated compound annual growth rate (CAGR) of 4%, and a projected market size of $130 billion for the base year 2024, the industry demonstrates robust performance.

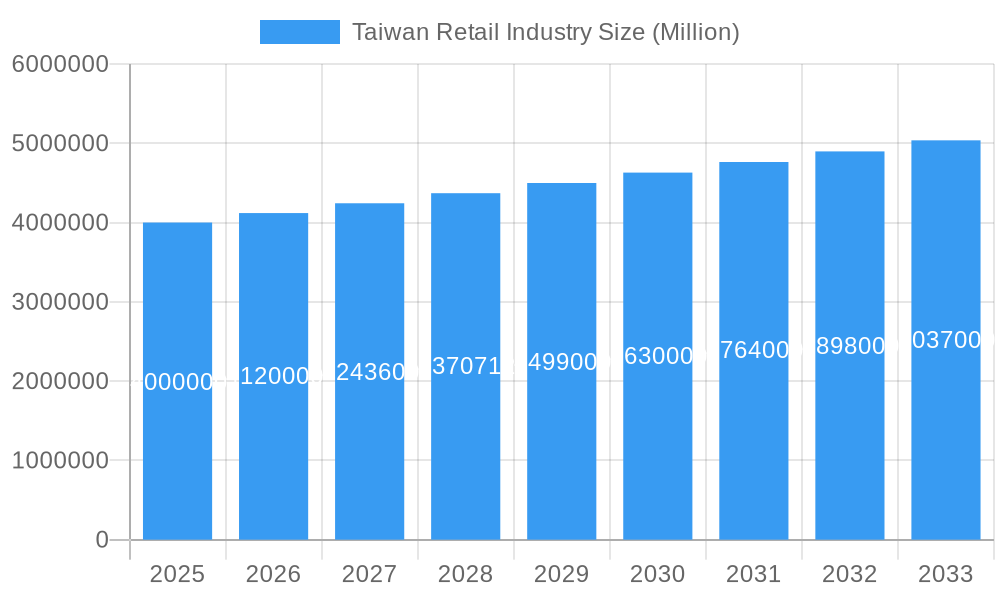

Taiwan Retail Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, influenced by evolving consumer preferences for experiences and sustainability, global economic uncertainties, and intensified competition. A projected CAGR of 3% for this period suggests a market size of approximately $130 billion by 2033. Growth drivers include the advancement of omnichannel strategies, the rising prevalence of mobile commerce, and a heightened emphasis on personalized customer engagement. Adaptability to shifting consumer behaviors and technological innovations will be critical for sustained success.

Taiwan Retail Industry Company Market Share

Taiwan Retail Industry: Market Report 2019-2033

Uncover the lucrative opportunities and challenges shaping Taiwan's dynamic retail landscape. This comprehensive report provides a deep dive into the Taiwan retail industry, analyzing market dynamics, competitive trends, and future growth prospects from 2019 to 2033. Benefit from detailed insights, market sizing, and forecasts to inform your strategic decisions. Ideal for investors, retailers, and industry professionals seeking a competitive edge in this thriving market.

Taiwan Retail Industry Market Dynamics & Concentration

The Taiwan retail market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape. President Chain Store Corp, Taiwan FamilyMart Co Ltd, and Carrefour hold significant market share, while numerous smaller players contribute to a vibrant competitive environment. Innovation is driven by increasing consumer demand for online convenience, omnichannel experiences, and personalized services. The regulatory framework, while generally supportive of business, undergoes periodic adjustments impacting operational efficiency and market entry. Product substitutes, including direct-to-consumer brands and e-commerce platforms, exert pressure on traditional brick-and-mortar stores. End-user trends show a growing preference for convenience, value, and personalized shopping experiences, particularly among younger demographics. M&A activity in the sector has seen xx deals in the past five years, largely driven by the need for expansion, enhanced supply chain capabilities, and technological integration.

- Market Concentration: Top 3 players hold approximately xx% market share.

- M&A Deal Count (2019-2024): xx

- Innovation Drivers: E-commerce integration, omnichannel strategies, personalization.

- Regulatory Impact: Ongoing adjustments to regulations affecting operational costs and market entry.

Taiwan Retail Industry Industry Trends & Analysis

The Taiwan retail industry is characterized by robust and dynamic growth, consistently demonstrating an upward trajectory. Fueled by factors such as a rising disposable income, an expanding middle-class demographic, and increasing urbanization, the sector has shown significant resilience. The landscape is undergoing a profound transformation driven by technological advancements, most notably the pervasive influence of e-commerce and the widespread adoption of mobile payment solutions. This necessitates a strategic pivot for retailers, compelling them to embrace digital innovation and adapt their business models. Consumer preferences are evolving towards greater demands for convenience, highly personalized shopping experiences, and seamless omnichannel integration, where physical and digital channels merge effortlessly. The competitive intensity is escalating, with both established local retailers and formidable international players actively vying for market dominance. The penetration of e-commerce is on a steady ascent, with projections indicating a significant market share by 2033, mirroring the growing embrace of omnichannel strategies across the industry.

Leading Markets & Segments in Taiwan Retail Industry

While the Taiwan retail market is relatively unified geographically, urban areas such as Taipei, Taichung, and Kaohsiung exhibit higher consumer spending and retail density. This dominance stems from higher population concentrations, robust infrastructure, and favorable economic conditions.

- Key Drivers of Urban Dominance:

- Higher population density

- Advanced infrastructure (transportation, logistics)

- Higher disposable incomes and consumer spending

- Concentrated business activity and commercial hubs

Taiwan Retail Industry Product Developments

Product innovation in the Taiwan retail sector is heavily geared towards elevating the customer experience through the strategic integration of technology. This includes the deployment of advanced personalized recommendation engines, the creation of fluid and uninterrupted omnichannel shopping journeys, and the development of sophisticated loyalty programs designed to foster customer retention. Convenience store chains are at the forefront of adapting to evolving consumer needs, evidenced by their expanding portfolios of high-quality ready-to-eat meals and their proactive adoption of technology to streamline checkout processes and facilitate mobile ordering. Department stores are increasingly focusing on creating immersive experiential retail environments and forging exclusive brand partnerships to draw in and engage customers. Furthermore, there is a discernible and growing trend towards the development and promotion of private label products, which not only enhances profitability but also strengthens the market share of established retailers.

Key Drivers of Taiwan Retail Industry Growth

The sustained growth of the Taiwan retail sector is propelled by a confluence of powerful factors. Technological advancements are playing a pivotal role in driving operational efficiencies and significantly enhancing the overall customer experience. Supportive government policies, including strategic investments in infrastructure development, provide a conducive environment that stimulates economic growth and bolsters consumer spending. A burgeoning middle class, characterized by increasing disposable income, directly fuels consumer demand. Moreover, the rapid expansion of e-commerce presents substantial opportunities for market reach and revenue generation.

Challenges in the Taiwan Retail Industry Market

The Taiwan retail market, while promising, is not without its hurdles. Retailers are grappling with the persistent challenge of rising labor costs, alongside intensified competition from both domestic and international entities. The imperative for continuous technological adaptation to meet evolving consumer expectations and market demands remains a critical concern. Supply chain disruptions, particularly those exacerbated by global geopolitical events and economic fluctuations, pose significant risks to inventory management and operational continuity. Consequently, maintaining profitability while navigating escalating operating expenses and intense competitive pressures presents an ongoing and complex challenge for a multitude of retailers.

Emerging Opportunities in Taiwan Retail Industry

Significant opportunities exist for players who can effectively leverage technological advancements, forge strategic partnerships, and capitalize on changing consumer preferences. Expansion into niche markets, leveraging omnichannel strategies, and focusing on sustainability are promising avenues for growth. Strategic partnerships with technology providers can unlock further innovations in personalized shopping experiences and supply chain optimization.

Leading Players in the Taiwan Retail Industry Sector

- President Chain Store Corp

- Taiwan FamilyMart Co Ltd

- Mercuries & Associates Holding Ltd

- Far Eastern Group

- POYA International Co Ltd

- The Eslite Corporation

- Sogo Department Stores Co Ltd

- Kayee International Group Co Ltd

- Carrefour

- RT-Mart

Key Milestones in Taiwan Retail Industry Industry

- November 2020: Foodpanda significantly expanded its e-commerce reach by establishing a strategic partnership with over 2,500 7-Eleven stores across Asia, including key operations in Taiwan, streamlining delivery and accessibility for a wide range of products.

- January 2021: Bolttech made its entry into the Taiwanese market by forging a device protection partnership with Samsung. This collaboration aimed to enhance the customer experience for Samsung device owners by offering comprehensive and accessible protection plans.

Strategic Outlook for Taiwan Retail Industry Market

The Taiwan retail market presents significant long-term growth potential, driven by technological innovation, evolving consumer preferences, and a supportive economic environment. Companies that can successfully integrate technology, personalize the customer experience, and optimize their supply chains will be best positioned to capitalize on the emerging opportunities in this dynamic market. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace compared to the historical period, necessitating agile strategies and continuous adaptation to market shifts.

Taiwan Retail Industry Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Hypermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Taiwan Retail Industry Segmentation By Geography

- 1. Taiwan

Taiwan Retail Industry Regional Market Share

Geographic Coverage of Taiwan Retail Industry

Taiwan Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Consumer Confidence to Strengthen on Minimum Wage Hike.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 President Chain Store Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Taiwan FamilyMart Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mercuries & Associates Holding Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Far Eastern Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 POYA International Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Eslite Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sogo Department Stores Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kayee International Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carrefour

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RT - Mart*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 President Chain Store Corp

List of Figures

- Figure 1: Taiwan Retail Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Taiwan Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Taiwan Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Taiwan Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Taiwan Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Taiwan Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Taiwan Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Retail Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Taiwan Retail Industry?

Key companies in the market include President Chain Store Corp, Taiwan FamilyMart Co Ltd, Mercuries & Associates Holding Ltd, Far Eastern Group, POYA International Co Ltd, The Eslite Corporation, Sogo Department Stores Co Ltd, Kayee International Group Co Ltd, Carrefour, RT - Mart*List Not Exhaustive.

3. What are the main segments of the Taiwan Retail Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 130 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Consumer Confidence to Strengthen on Minimum Wage Hike..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2021, Bolttech expanded in Taiwan via a device protection partnership with Samsung. Its latest partnership with Samsung in Taiwan includes arranging for mobile device protection to owners of new Samsung Galaxy smartphones and tablets through the Samsung Care+ program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Retail Industry?

To stay informed about further developments, trends, and reports in the Taiwan Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence