Key Insights

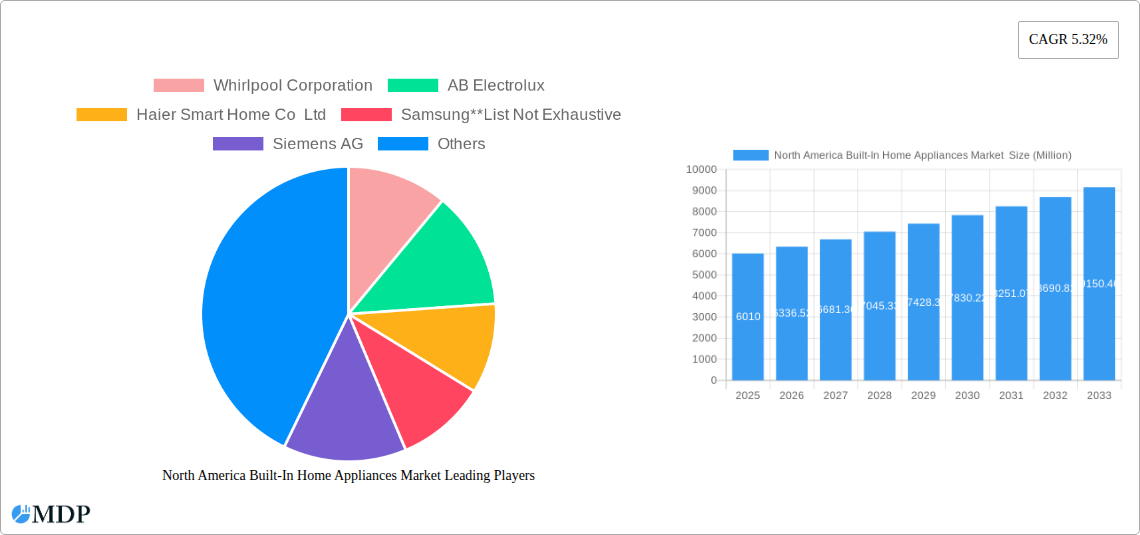

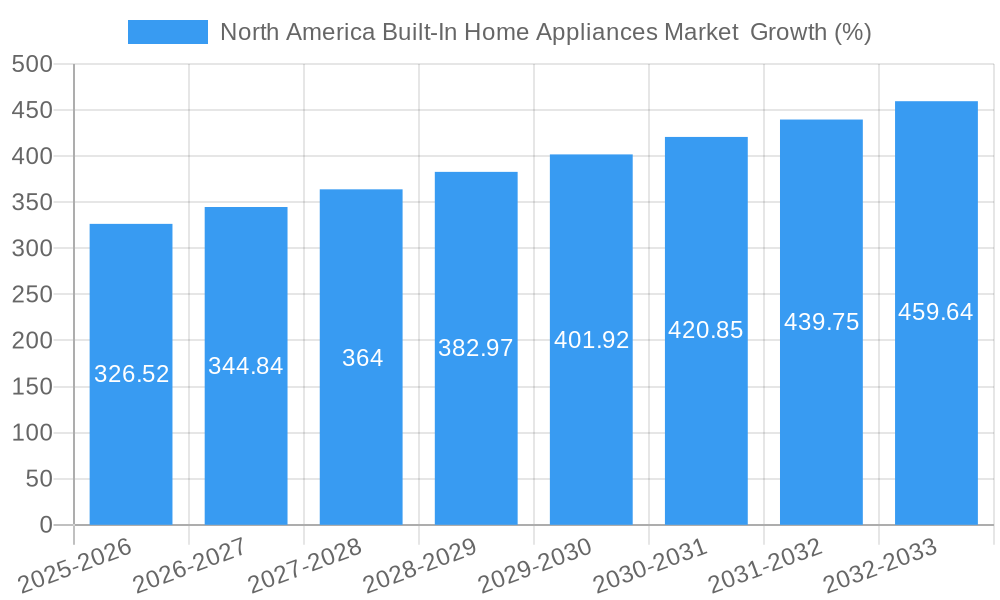

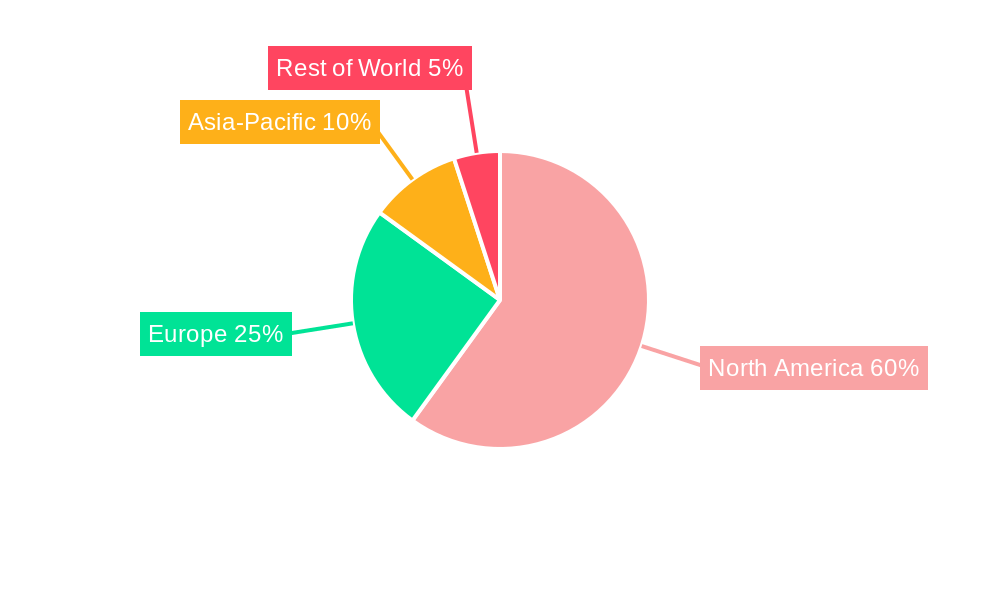

The North America built-in home appliances market, valued at $6.01 billion in 2025, is projected to experience robust growth, driven by a rising preference for modern, space-saving kitchen designs and increasing disposable incomes among consumers. The market's Compound Annual Growth Rate (CAGR) of 5.32% from 2025 to 2033 indicates a significant expansion opportunity. Key growth drivers include the increasing popularity of luxury kitchen renovations, a surge in new home constructions, and the growing demand for smart home appliances offering enhanced convenience and energy efficiency. The built-in refrigerator segment currently dominates, followed by built-in ovens and microwaves. However, the built-in hob and hood segments are poised for substantial growth, fueled by the adoption of sleek, integrated kitchen designs. Distribution channels like e-commerce are gaining traction, offering consumers greater convenience and access to a wider product range. Leading brands such as Whirlpool, Electrolux, Haier, Samsung, and Bosch are aggressively competing through product innovation, strategic partnerships, and brand building activities to secure a larger market share.

The market's growth is not without challenges. Rising raw material costs and supply chain disruptions could impact profitability. Furthermore, economic downturns could potentially dampen consumer demand for premium appliances. To mitigate these risks, manufacturers are focusing on cost optimization strategies, diversifying supply chains, and introducing more affordable built-in appliance models. The segment's future hinges on its ability to cater to evolving consumer preferences, incorporate smart technology seamlessly, and enhance product durability and energy efficiency to sustain long-term growth. The North American market, specifically the United States and Canada, will likely continue to lead in market share due to high consumer spending power and technological advancements.

North America Built-In Home Appliances Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America built-in home appliances market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report delves into market dynamics, trends, leading players, and future opportunities. The market is segmented by product type (built-in ovens and microwaves, built-in refrigerators, built-in hob, built-in hoods), end-user, and distribution channel (supermarkets/hypermarkets, specialty stores, e-commerce stores). Key players analyzed include Whirlpool Corporation, AB Electrolux, Haier Smart Home Co Ltd, Samsung, Siemens AG, Danby, Robert Bosch GmbH, IFB Appliances, LG Electronics, and Panasonic Holdings Corporation (list not exhaustive).

North America Built-In Home Appliances Market Dynamics & Concentration

The North American built-in home appliance market is characterized by a moderate level of concentration, with several major players holding significant market share. Market share data for 2024 indicates Whirlpool Corporation holds approximately xx%, followed by AB Electrolux at xx%, and Samsung at xx%. The remaining market share is distributed among other key players and smaller regional manufacturers. Innovation plays a crucial role, driven by consumer demand for smart appliances, energy efficiency, and aesthetically pleasing designs. Stringent regulatory frameworks regarding energy consumption and safety standards further shape market dynamics. Product substitutes, such as standalone appliances, exert competitive pressure, although built-in appliances maintain their premium positioning. The market also witnesses considerable end-user trends, with a growing preference for customized kitchens and smart home integration. M&A activity in the sector is relatively frequent, with an estimated xx M&A deals in the past five years (2019-2024), predominantly focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated with several dominant players.

- Innovation Drivers: Smart home integration, energy efficiency, design aesthetics.

- Regulatory Frameworks: Stringent energy and safety standards influence product development.

- Product Substitutes: Standalone appliances present some competition.

- End-User Trends: Growing preference for customized kitchens and smart homes.

- M&A Activity: Significant activity with approximately xx deals (2019-2024).

North America Built-In Home Appliances Market Industry Trends & Analysis

The North America built-in home appliances market exhibits a robust growth trajectory, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by rising disposable incomes, increasing urbanization, and a shift towards modern and convenient kitchen designs. Technological advancements, particularly in smart appliances and connected devices, are driving significant market penetration. Consumer preferences are shifting towards energy-efficient, aesthetically pleasing, and technologically advanced appliances, influencing product development strategies. Competitive dynamics are intense, with key players focusing on innovation, brand building, and strategic partnerships to gain market share. Market penetration of smart built-in appliances is estimated to reach xx% by 2033, compared to xx% in 2024. The market is witnessing a significant increase in demand for premium and luxury built-in appliances, creating new opportunities for high-end manufacturers.

Leading Markets & Segments in North America Built-In Home Appliances Market

The United States represents the largest market within North America for built-in home appliances, driven by high consumer spending and a preference for advanced kitchen solutions. Within product segments, built-in refrigerators and ovens and microwaves command the largest market share, reflecting their necessity in modern kitchens. The e-commerce channel is experiencing rapid growth, contributing to overall market expansion.

- Dominant Region: United States

- Leading Product Segments: Built-in Refrigerators and Built-in Ovens & Microwaves

- Fastest-Growing Channel: E-commerce

- Key Drivers (US Market): High disposable income, preference for modern kitchens, technological advancements.

By Product Type: Built-in refrigerators command the largest segment, followed by built-in ovens and microwaves. The growth of built-in hob and hood segments is also significant, driven by the rising trend of integrated kitchen designs.

By End User: Residential consumers form the largest end-user segment, with a growing demand for smart and energy-efficient appliances. The hospitality sector is witnessing a gradual increase in the adoption of built-in appliances for enhanced kitchen efficiency.

By Distribution Channel: Supermarkets/hypermarkets maintain a significant share, while e-commerce is rapidly expanding, offering convenience and a wider product selection to consumers. Specialty stores also cater to high-end consumers looking for customized solutions.

North America Built-In Home Appliances Market Product Developments

Recent product innovations emphasize smart features, energy efficiency, and enhanced user experience. Manufacturers are integrating smart technology to allow for remote control, customized cooking settings, and appliance diagnostics. Energy-efficient models are gaining popularity due to increasing environmental awareness and rising electricity costs. Manufacturers are also focusing on sleek designs and space-saving solutions to meet evolving consumer preferences. This focus on improved functionality and aesthetics positions these products to compete effectively within the market.

Key Drivers of North America Built-In Home Appliances Market Growth

Several factors fuel the market's growth, including: (1) increasing disposable incomes and urbanization, driving demand for modern, premium appliances; (2) technological advancements in smart appliances and IoT integration, enhancing convenience and user experience; and (3) supportive government policies promoting energy-efficient products. These factors contribute to a positive outlook for market expansion.

Challenges in the North America Built-In Home Appliances Market

The market faces challenges such as: (1) fluctuating raw material prices impacting production costs; (2) intense competition from established players and new entrants; and (3) potential supply chain disruptions impacting product availability. These factors pose some risk to market growth.

Emerging Opportunities in North America Built-In Home Appliances Market

The integration of Artificial Intelligence (AI) and machine learning in built-in appliances presents a major opportunity, creating appliances capable of learning user preferences and optimizing performance. Strategic partnerships between appliance manufacturers and technology companies offer opportunities to introduce innovative solutions. Expanding into niche markets, such as luxury or specialized built-in appliance options for small spaces, is another potential growth catalyst.

Leading Players in the North America Built-In Home Appliances Market Sector

- Whirlpool Corporation

- AB Electrolux

- Haier Smart Home Co Ltd

- Samsung

- Siemens AG

- Danby

- Robert Bosch GmbH

- IFB Appliances

- LG Electronics

- Panasonic Holdings Corporation

Key Milestones in North America Built-In Home Appliances Market Industry

- September 2023: Samsung launched a new oven with internal temperature monitoring and customizable notifications, enhancing user convenience and driving sales.

- August 2023: LG Electronics introduced a new built-in kitchen package at IFA 2023, strengthening its premium product portfolio and market position.

Strategic Outlook for North America Built-In Home Appliances Market

The North American built-in home appliance market holds significant potential for continued growth, driven by evolving consumer preferences, technological advancements, and strategic initiatives by key players. Focusing on innovation, particularly in smart home integration and energy efficiency, will be crucial for maintaining a competitive edge. Expanding into niche segments and exploring new distribution channels will be vital for long-term success. The market is expected to experience steady expansion throughout the forecast period.

North America Built-In Home Appliances Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Built-In Home Appliances Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Built-In Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Household Disposable Income Drives the Market; Changing Lifestyles Drives the Market

- 3.3. Market Restrains

- 3.3.1. Repairing Challenges; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1. United States Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Built-In Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Whirlpool Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AB Electrolux

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Haier Smart Home Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung**List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Danby

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IFB Appliances

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 LG Electronics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Holdings Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Whirlpool Corporation

List of Figures

- Figure 1: North America Built-In Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Built-In Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: North America Built-In Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Built-In Home Appliances Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Built-In Home Appliances Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Built-In Home Appliances Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Built-In Home Appliances Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Built-In Home Appliances Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Built-In Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Built-In Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Built-In Home Appliances Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Built-In Home Appliances Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Built-In Home Appliances Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Built-In Home Appliances Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Built-In Home Appliances Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Built-In Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Built-In Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Built-In Home Appliances Market ?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the North America Built-In Home Appliances Market ?

Key companies in the market include Whirlpool Corporation, AB Electrolux, Haier Smart Home Co Ltd, Samsung**List Not Exhaustive, Siemens AG, Danby, Robert Bosch GmbH, IFB Appliances, LG Electronics, Panasonic Holdings Corporation.

3. What are the main segments of the North America Built-In Home Appliances Market ?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Household Disposable Income Drives the Market; Changing Lifestyles Drives the Market.

6. What are the notable trends driving market growth?

United States Dominates the Market.

7. Are there any restraints impacting market growth?

Repairing Challenges; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

September 2023: Samsung launched a new oven that enables consumers to monitor internal temperature and set notifications at various cooking stages, which provides convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Built-In Home Appliances Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Built-In Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Built-In Home Appliances Market ?

To stay informed about further developments, trends, and reports in the North America Built-In Home Appliances Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence