Key Insights

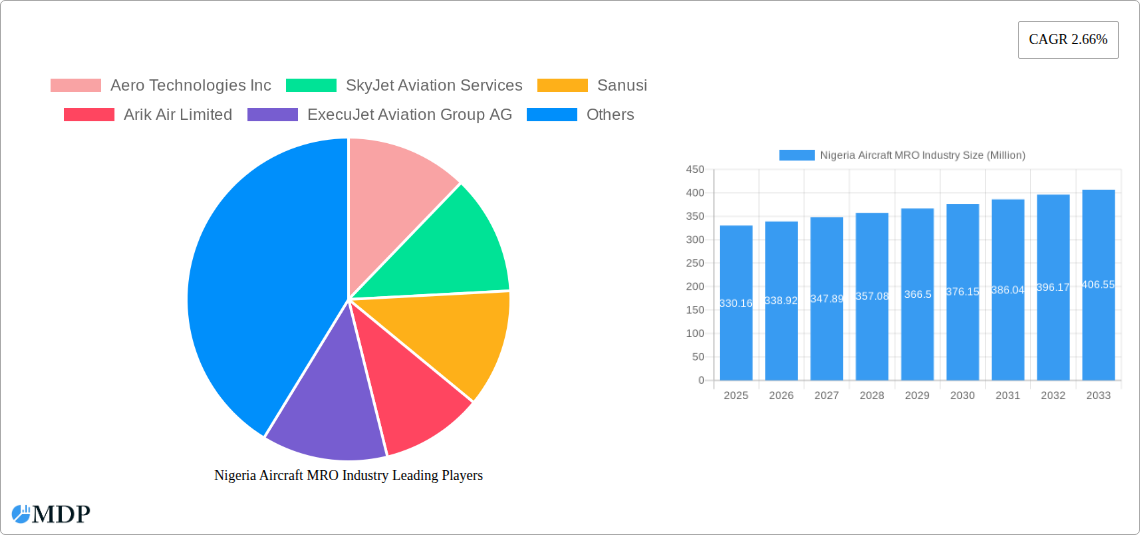

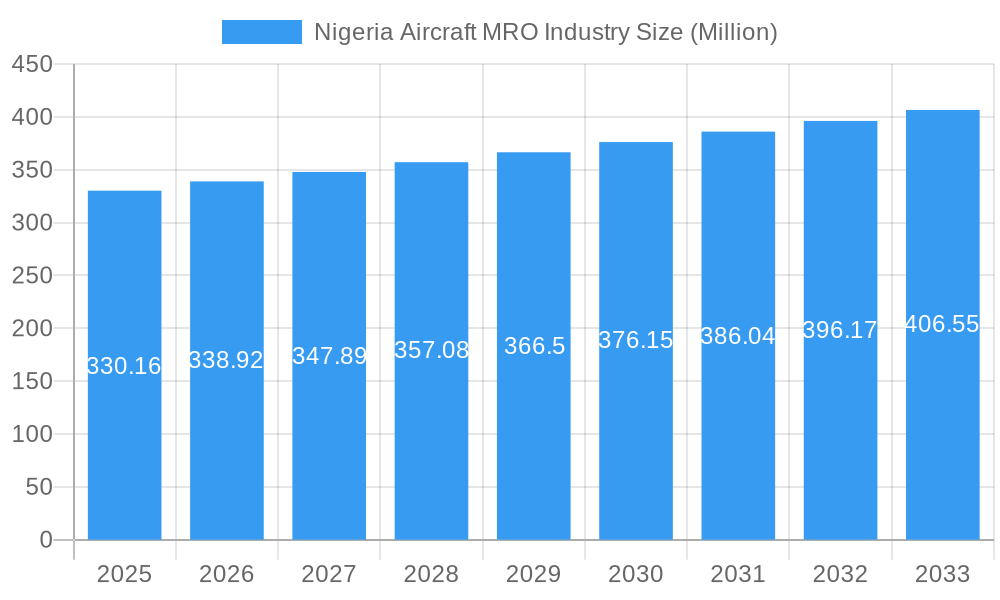

The Nigerian aircraft Maintenance, Repair, and Overhaul (MRO) market, valued at $330.16 million in 2025, is projected to experience steady growth, driven by a rising number of aircraft in operation within the country and the increasing demand for efficient and reliable maintenance services. This growth is further fueled by the expansion of the Nigerian aviation industry, government initiatives to improve aviation infrastructure, and a burgeoning domestic air travel market. Key segments within the industry, including engine maintenance, component overhaul, and airframe services, contribute significantly to the overall market value. While challenges such as a shortage of skilled technicians and the need for upgraded infrastructure exist, the long-term outlook remains positive. The presence of both international and domestic MRO providers indicates a competitive landscape, with companies like Aero Technologies Inc., SkyJet Aviation Services, and ExecuJet Aviation Group AG contributing to market growth through their expertise and service offerings. Focus on technological advancements, sustainable practices, and specialized maintenance capabilities will shape the industry's trajectory in the coming years.

Nigeria Aircraft MRO Industry Market Size (In Million)

The forecast period (2025-2033) anticipates a continued, albeit moderate, expansion of the Nigerian aircraft MRO market. A compound annual growth rate (CAGR) of 2.66% suggests a consistent, albeit not explosive, rise in market value. This growth is expected to be underpinned by the continuous development of the nation's aviation sector, investment in new aircraft acquisitions by domestic airlines, and a growing demand for improved aircraft safety and operational efficiency. Strategic partnerships between domestic and international players are likely to further accelerate market growth. However, the market’s future trajectory will depend heavily on macroeconomic conditions, regulatory policies, and the availability of skilled labor. The successful navigation of these factors will be key to unlocking the full potential of the Nigerian aircraft MRO market.

Nigeria Aircraft MRO Industry Company Market Share

Nigeria Aircraft MRO Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Nigerian Aircraft Maintenance, Repair, and Overhaul (MRO) industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, leading players, emerging trends, and future growth potential. The Nigerian MRO market, valued at XX Million in 2025, is projected to reach XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%.

Nigeria Aircraft MRO Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, regulatory environment, and market forces shaping the Nigerian Aircraft MRO industry. The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Aero Technologies Inc, for example, holds an estimated XX% market share in the engine segment, while Arik Air Limited accounts for approximately XX% in the airframe segment (2025 estimates). However, several smaller players contribute to a dynamic and evolving market.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Nigerian MRO market is estimated at XX in 2025, suggesting a moderately concentrated market.

- Innovation Drivers: Technological advancements in aircraft maintenance technologies, such as predictive maintenance and AI-powered diagnostics, are driving innovation.

- Regulatory Frameworks: Nigerian aviation regulations and safety standards significantly impact market operations and investment decisions. Compliance costs and bureaucratic processes present ongoing challenges.

- Product Substitutes: The lack of readily available substitutes for specialized MRO services limits the threat of substitution.

- End-User Trends: The increasing demand for air travel within Nigeria and across Africa fuels growth in the MRO sector, especially among low-cost carriers focused on fleet expansion.

- M&A Activities: The number of M&A transactions in the Nigerian MRO sector has been relatively low in recent years. However, strategic partnerships, like the Air Peace-Embraer collaboration, signal a potential surge in M&A activity. A total of XX M&A deals were recorded during the historical period (2019-2024).

Nigeria Aircraft MRO Industry Industry Trends & Analysis

This section delves into the overarching trends influencing the Nigerian MRO industry. Significant growth drivers include the expansion of the Nigerian airline fleet, increasing demand for air travel, and government initiatives promoting aviation infrastructure development. However, challenges such as economic instability, foreign exchange fluctuations, and infrastructural limitations pose significant headwinds. Technological advancements, like the adoption of digital tools for maintenance management and predictive analytics, are transforming operations and improving efficiency.

Market penetration of advanced MRO technologies remains relatively low compared to global standards. The industry continues to adopt more advanced maintenance technologies at a CAGR of approximately XX% during the forecast period (2025-2033). Consumer preferences lean towards reliable and cost-effective maintenance solutions, driving demand for both scheduled and unscheduled maintenance services. Competitive dynamics are marked by a mix of local and international players, fostering both cooperation and competition. The market is further segmented by aircraft type and MRO service type, creating opportunities for specialized service providers.

Leading Markets & Segments in Nigeria Aircraft MRO Industry

The Nigerian MRO market is predominantly concentrated in major urban centers with established airport infrastructure. Lagos and Abuja command the largest market share due to their high volume of air traffic and presence of major airlines. The engine segment currently leads in terms of revenue, followed by component and airframe maintenance. However, the field maintenance segment is witnessing rapid growth, driven by an increased focus on efficiency and cost optimization.

- Key Drivers:

- Economic Policies: Government initiatives promoting aviation infrastructure development and foreign investment in the sector are key drivers.

- Infrastructure: Availability of modern facilities and skilled workforce influences market development and concentration in specific locations.

- Regulatory Environment: Clear and stable regulatory frameworks attract investment and encourage the growth of the MRO sector.

- Dominance Analysis: The Lagos and Abuja regions dominate the market due to their superior infrastructure and concentration of airlines. The engine segment's dominance is attributed to the higher complexity and cost of engine maintenance.

Nigeria Aircraft MRO Industry Product Developments

Recent product innovations focus on leveraging technology to enhance efficiency and reduce downtime. This includes the adoption of predictive maintenance technologies, advanced diagnostic tools, and digital maintenance management systems. These innovations provide competitive advantages by improving operational efficiency, reducing maintenance costs, and enhancing aircraft safety. The market is seeing increased adoption of specialized software solutions for inventory management and maintenance scheduling.

Key Drivers of Nigeria Aircraft MRO Industry Growth

Several factors contribute to the growth of the Nigerian MRO industry. The expansion of the domestic airline fleet is a significant driver, creating increased demand for maintenance services. Government investments in aviation infrastructure and supportive regulatory policies also play a crucial role. Technological advancements in maintenance technologies enhance efficiency and reduce operating costs, while the growing regional aviation market presents opportunities for expansion beyond Nigeria.

Challenges in the Nigeria Aircraft MRO Industry Market

The Nigerian MRO industry faces several challenges. Regulatory hurdles and bureaucratic processes can hinder efficiency and investment. Supply chain issues, including difficulties in sourcing spare parts and specialized equipment, contribute to operational disruptions. Foreign exchange volatility and economic instability create uncertainty and impact investment decisions. Intense competition from both domestic and international players further intensifies the challenges in the market. These factors collectively restrain the growth potential of the sector.

Emerging Opportunities in Nigeria Aircraft MRO Industry

The Nigerian MRO market presents significant long-term growth opportunities. Technological breakthroughs in predictive maintenance and AI-powered diagnostics offer potential cost savings and enhanced safety. Strategic partnerships between local and international MRO providers can foster technology transfer and capacity building. Expansion into regional African markets provides significant untapped potential for Nigerian MRO providers to leverage their expertise and capabilities.

Leading Players in the Nigeria Aircraft MRO Industry Sector

- Aero Technologies Inc

- SkyJet Aviation Services

- Sanusi

- Arik Air Limited

- ExecuJet Aviation Group AG

- TekniTeed Nigeria Limited

- Onedot AG

- AJW

- Logos Aviation Inc

- JetMS (Avia Solutions Group)

Key Milestones in Nigeria Aircraft MRO Industry Industry

- September 2023: Dana Air strengthens its collaboration with Seven Star Global Hangar, enhancing MRO services and promoting capacity building within the Nigerian aviation industry.

- September 2023: Air Peace's agreement with Embraer Aerospace Corporation leads to the acquisition of 10 new aircraft and the establishment of a new state-of-the-art MRO facility in Nigeria, serving both domestic and international fleets. This marks a significant milestone in advancing Nigeria's aviation infrastructure and expertise.

Strategic Outlook for Nigeria Aircraft MRO Industry Market

The Nigerian MRO market holds significant potential for growth driven by increasing air travel demand, fleet expansion, and technological advancements. Strategic partnerships, investments in infrastructure, and supportive government policies will be crucial in unlocking this potential. The focus on developing local expertise and technological capabilities will be key to establishing Nigeria as a regional MRO hub. The market is poised for substantial expansion, particularly in the areas of digital maintenance solutions, specialized MRO services, and regional market penetration.

Nigeria Aircraft MRO Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Nigeria Aircraft MRO Industry Segmentation By Geography

- 1. Niger

Nigeria Aircraft MRO Industry Regional Market Share

Geographic Coverage of Nigeria Aircraft MRO Industry

Nigeria Aircraft MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Engine Segment to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Aircraft MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aero Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SkyJet Aviation Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanusi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arik Air Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExecuJet Aviation Group AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TekniTeed Nigeria Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Onedot AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AJW

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Logos Aviation Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JetMS (Avia Solutions Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aero Technologies Inc

List of Figures

- Figure 1: Nigeria Aircraft MRO Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria Aircraft MRO Industry Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Aircraft MRO Industry?

The projected CAGR is approximately 2.66%.

2. Which companies are prominent players in the Nigeria Aircraft MRO Industry?

Key companies in the market include Aero Technologies Inc, SkyJet Aviation Services, Sanusi, Arik Air Limited, ExecuJet Aviation Group AG, TekniTeed Nigeria Limited, Onedot AG, AJW, Logos Aviation Inc, JetMS (Avia Solutions Group).

3. What are the main segments of the Nigeria Aircraft MRO Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 330.16 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Engine Segment to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2023: Dana Air announced its commitment to fortify its collaboration with Seven Star Global Hangar, demonstrating a steadfast dedication to enhancing Maintenance, Repair, and Overhaul (MRO) services for Nigerian airlines. This strategic move underscores Dana Air's continuous endeavors to foster the expansion of the aviation industry, placing a strong emphasis on capacity building and fostering partnerships with local MRO entities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Aircraft MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Aircraft MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Aircraft MRO Industry?

To stay informed about further developments, trends, and reports in the Nigeria Aircraft MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence