Key Insights

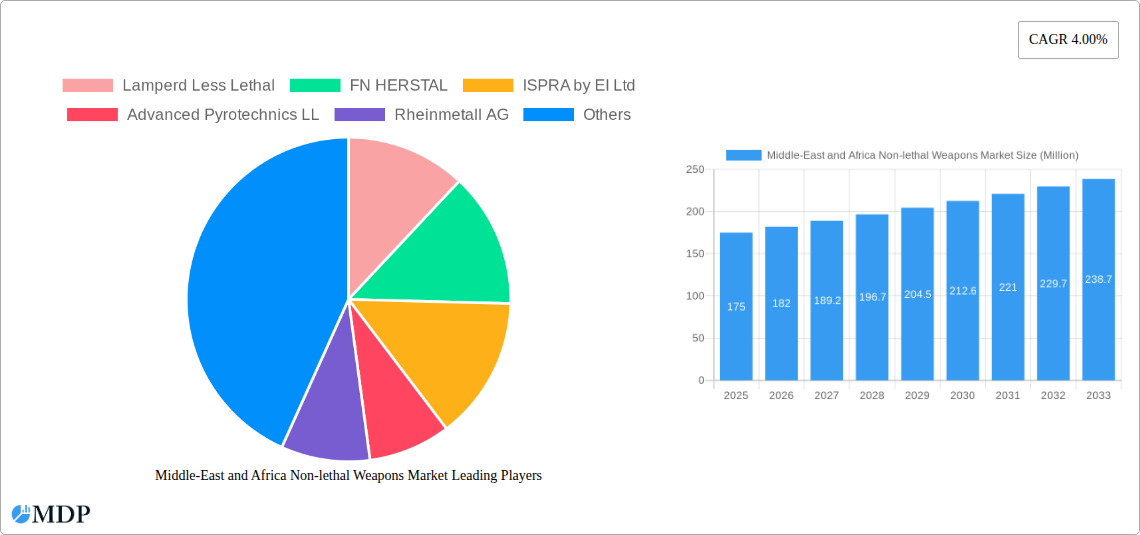

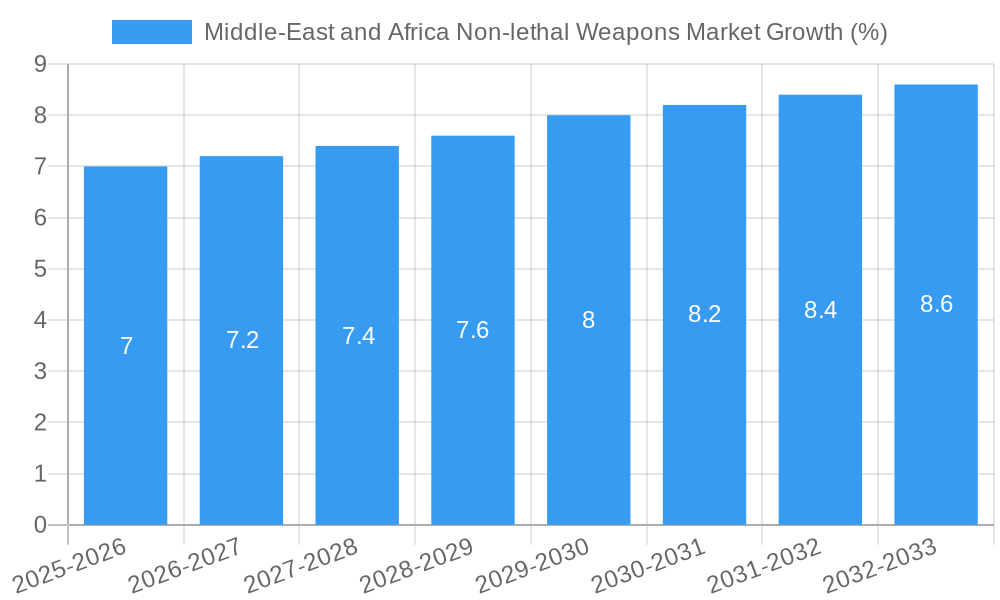

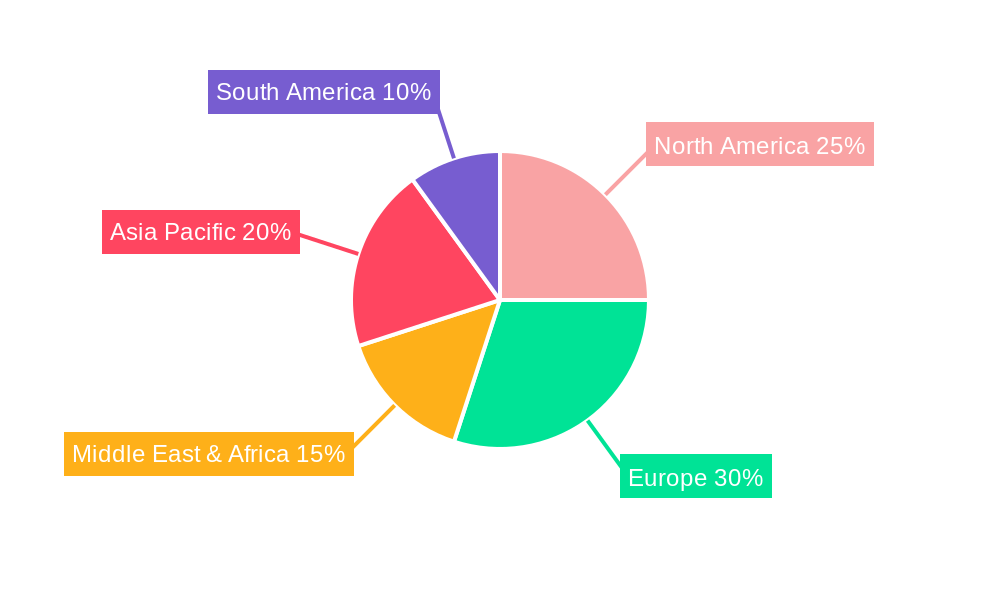

The Middle East and Africa (MEA) non-lethal weapons market is experiencing steady growth, driven by increasing demand for crowd control measures, enhanced security protocols, and the rising prevalence of civil unrest in several regions. The market's expansion is fueled by a growing focus on minimizing collateral damage and casualties during conflict resolution and law enforcement operations. Governmental investments in advanced security technologies and the increasing adoption of non-lethal weapons by law enforcement agencies are key contributors to this upward trend. Specific segments such as ammunition (including less-lethal rounds and tear gas canisters) and gases and sprays (pepper spray, tear gas) are experiencing particularly strong growth due to their widespread applicability across various sectors. While the market size for MEA in 2025 is not explicitly stated, considering the global CAGR of 4.00% and the significant security challenges faced in the region, a reasonable estimate would place it between $150 million and $200 million, given the estimated global market size (XX million) and the proportion of the MEA market within that global total. This estimate is further supported by considering the relatively high levels of conflict and civil unrest in parts of the region, driving a greater need for non-lethal crowd control solutions.

However, market growth is not without challenges. Political instability in certain MEA countries, fluctuating economic conditions, and potential budget constraints for security forces can act as restraints. Furthermore, the development and adoption of newer, more effective non-lethal technologies could disrupt the market share of existing product types. The market is also segmented by end-user (law enforcement, military) and by type of weapon, with ammunition and gases/sprays currently dominating. Key players, including Lamperd Less Lethal, FN Herstal, and others, are actively involved in developing and supplying these technologies to various government and security agencies across the region, adapting their offerings to meet the specific needs of the MEA market. The forecast period from 2025 to 2033 indicates a continued expansion, driven by ongoing security concerns and technological advancements in non-lethal weaponry.

Middle East & Africa Non-Lethal Weapons Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Non-Lethal Weapons Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Middle-East and Africa Non-lethal Weapons Market Market Dynamics & Concentration

The Middle East and Africa Non-Lethal Weapons market is characterized by moderate concentration, with a few dominant players and several regional specialists. Market share is largely influenced by technological innovation, regulatory compliance, and successful marketing strategies. The market's growth is driven by increasing demand for crowd control solutions, rising security concerns, and the need for less-lethal alternatives to traditional weaponry. However, stringent regulatory frameworks and varying levels of technological adoption across the region present challenges. Recent years have witnessed a moderate level of mergers and acquisitions (M&A) activity, primarily focused on expanding product portfolios and geographical reach. An estimated xx M&A deals occurred between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Drivers: Demand for advanced technologies like AI-powered crowd control systems and improved accuracy of non-lethal ammunition.

- Regulatory Frameworks: Varying regulations across different countries in the region create complexities for market entry and operations.

- Product Substitutes: Limited substitutes, but increased emphasis on less-harmful alternatives within the non-lethal category itself.

- End-User Trends: Growing demand from law enforcement agencies and military forces for improved crowd control and riot management capabilities.

- M&A Activities: Moderate level of M&A activity, driven by strategic expansion and technological acquisition.

Middle-East and Africa Non-lethal Weapons Market Industry Trends & Analysis

The Middle East and Africa Non-Lethal Weapons market is experiencing significant growth fueled by several key factors. The increasing prevalence of civil unrest and terrorist activities is driving demand for effective crowd control and riot management solutions. Governments in the region are investing heavily in modernizing their security forces, leading to increased procurement of non-lethal weapons. Technological advancements, particularly in AI-powered systems and precision ammunition, are transforming the market landscape, creating opportunities for new product development and market penetration. Competitive dynamics are shaped by technological innovation, pricing strategies, and the ability to meet specific regional needs. Market penetration for AI-integrated non-lethal weapons is currently estimated at xx%, projected to reach xx% by 2033.

Leading Markets & Segments in Middle-East and Africa Non-lethal Weapons Market

The Law Enforcement segment currently dominates the end-user market, driven by the need for effective crowd control and riot management solutions. Within product types, Gases and Sprays hold the largest market share due to their wide-ranging applications and relatively lower cost compared to other non-lethal options. Specific countries exhibiting high growth include [Insert specific countries with justification, e.g., "Israel, due to its ongoing security needs and technological advancements," and "Nigeria, due to increasing demands for internal security" ].

- Key Drivers for Law Enforcement Segment: Rising crime rates, need for effective riot control, and government initiatives to enhance security.

- Key Drivers for Military Segment: Demand for asymmetric warfare solutions and minimizing civilian casualties during operations.

- Key Drivers for Gases and Sprays Segment: Cost-effectiveness, wide range of applications, and readily available technology.

- Key Drivers for Ammunition Segment: Improved accuracy and reduced risk of serious injury.

- Dominance Analysis: Law Enforcement as the dominant end-user, driven by consistent demand for crowd control and security operations. Gases and Sprays dominate product type due to their cost effectiveness and established utility.

Middle-East and Africa Non-lethal Weapons Market Product Developments

Recent product developments focus on enhancing accuracy, minimizing collateral damage, and integrating advanced technologies such as AI for target tracking and improved situational awareness. Companies are also focusing on developing environmentally friendly and sustainable non-lethal weapons. The market is witnessing a shift towards less-lethal options that offer greater precision and minimize the risk of serious injury. This is leading to a rise in demand for smart non-lethal weapons systems.

Key Drivers of Middle-East and Africa Non-lethal Weapons Market Growth

Several key factors are driving growth in this market. Firstly, heightened security concerns across the region, including terrorism and civil unrest, are increasing the demand for effective crowd control and security solutions. Secondly, rising government spending on defense and security modernization programs is providing a significant boost to market growth. Finally, technological advancements in non-lethal weaponry, such as the incorporation of AI and improved accuracy, are creating new opportunities for market expansion.

Challenges in the Middle-East and Africa Non-lethal Weapons Market Market

The market faces several challenges, including stringent regulatory frameworks in some countries, which can hinder market entry and product approval. Supply chain disruptions and geopolitical instability in certain regions can also impact market dynamics, creating uncertainties in production and distribution. Furthermore, intense competition among established players and new entrants creates pricing pressures and limits profitability. These factors combined can significantly affect overall market growth and expansion.

Emerging Opportunities in Middle-East and Africa Non-lethal Weapons Market

Significant opportunities exist for long-term growth. Technological breakthroughs in AI, robotics, and advanced materials are likely to lead to the development of more sophisticated and effective non-lethal weapons. Strategic partnerships between technology providers and security agencies can accelerate product development and market penetration. Expanding into new markets within the region, particularly those with high security needs and increasing government spending, represents a considerable opportunity for market expansion.

Leading Players in the Middle-East and Africa Non-lethal Weapons Market Sector

- Lamperd Less Lethal

- FN HERSTAL

- Ispra by EI Ltd

- Advanced Pyrotechnics LL

- Rheinmetall AG

- Condor Non-Lethal Technologies

- Axon Enterprise Inc

- Genasys Inc

- Combined Systems Inc

- Pepperball (United Tactical Systems LLC)

- Safariland LLC

Key Milestones in Middle-East and Africa Non-lethal Weapons Market Industry

- May 2021: Israel announced the induction of the "Skunk," a malodorant for crowd control, signifying innovation in less-lethal deterrents.

- November 2022: Israel's deployment of AI-powered robotic weapons capable of firing tear gas, stun grenades, and sponge-tipped bullets marks a significant technological advancement in crowd control and tactical applications. This showcases the increasing integration of advanced technologies within the sector and the growing demand for precision non-lethal solutions.

Strategic Outlook for Middle-East and Africa Non-lethal Weapons Market Market

The Middle East and Africa Non-Lethal Weapons market holds substantial long-term growth potential. Continued technological innovation, increasing security concerns, and government investments in defense modernization will drive market expansion. Companies that can effectively adapt to evolving technological advancements, comply with regional regulations, and meet the specific needs of various end-users will be best positioned to capitalize on future growth opportunities. Strategic partnerships and regional expansion will also be crucial for achieving sustainable market success.

Middle-East and Africa Non-lethal Weapons Market Segmentation

-

1. Type

- 1.1. Ammunition

- 1.2. Explosives

- 1.3. Gases and Sprays

- 1.4. Other Types

-

2. End User

- 2.1. Law Enforcement

- 2.2. Military

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. United Arab Emirates

- 3.4. Qatar

- 3.5. Rest of Middle-East and Africa

Middle-East and Africa Non-lethal Weapons Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. United Arab Emirates

- 4. Qatar

- 5. Rest of Middle East and Africa

Middle-East and Africa Non-lethal Weapons Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Law Enforcement Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ammunition

- 5.1.2. Explosives

- 5.1.3. Gases and Sprays

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Law Enforcement

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. United Arab Emirates

- 5.3.4. Qatar

- 5.3.5. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. United Arab Emirates

- 5.4.4. Qatar

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ammunition

- 6.1.2. Explosives

- 6.1.3. Gases and Sprays

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Law Enforcement

- 6.2.2. Military

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. United Arab Emirates

- 6.3.4. Qatar

- 6.3.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ammunition

- 7.1.2. Explosives

- 7.1.3. Gases and Sprays

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Law Enforcement

- 7.2.2. Military

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. United Arab Emirates

- 7.3.4. Qatar

- 7.3.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Arab Emirates Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ammunition

- 8.1.2. Explosives

- 8.1.3. Gases and Sprays

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Law Enforcement

- 8.2.2. Military

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. United Arab Emirates

- 8.3.4. Qatar

- 8.3.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Qatar Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ammunition

- 9.1.2. Explosives

- 9.1.3. Gases and Sprays

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Law Enforcement

- 9.2.2. Military

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. United Arab Emirates

- 9.3.4. Qatar

- 9.3.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Middle East and Africa Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ammunition

- 10.1.2. Explosives

- 10.1.3. Gases and Sprays

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Law Enforcement

- 10.2.2. Military

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. South Africa

- 10.3.3. United Arab Emirates

- 10.3.4. Qatar

- 10.3.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Africa Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Middle-East and Africa Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Lamperd Less Lethal

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 FN HERSTAL

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 ISPRA by EI Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Advanced Pyrotechnics LL

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Rheinmetall AG

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Condor Non-Lethal Technologies

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Axon Enterprise Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Genasys Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Combined Systems Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Pepperball (United Tactical Systems LLC)

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Safariland LLC

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Lamperd Less Lethal

List of Figures

- Figure 1: Middle-East and Africa Non-lethal Weapons Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Non-lethal Weapons Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle-East and Africa Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle-East and Africa Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle-East and Africa Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle-East and Africa Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle-East and Africa Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle-East and Africa Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by End User 2019 & 2032

- Table 31: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle-East and Africa Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Non-lethal Weapons Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Middle-East and Africa Non-lethal Weapons Market?

Key companies in the market include Lamperd Less Lethal, FN HERSTAL, ISPRA by EI Ltd, Advanced Pyrotechnics LL, Rheinmetall AG, Condor Non-Lethal Technologies, Axon Enterprise Inc, Genasys Inc, Combined Systems Inc, Pepperball (United Tactical Systems LLC), Safariland LLC.

3. What are the main segments of the Middle-East and Africa Non-lethal Weapons Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Law Enforcement Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Israel announced the installation of robotic weapons that can fire tear gas, stun grenades, and sponge-tipped bullets. These weapons utilize artificial intelligence (AI) to track targets, making them even more effective for crowd control and other tactical purposes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Non-lethal Weapons Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Non-lethal Weapons Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Non-lethal Weapons Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Non-lethal Weapons Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence