Key Insights

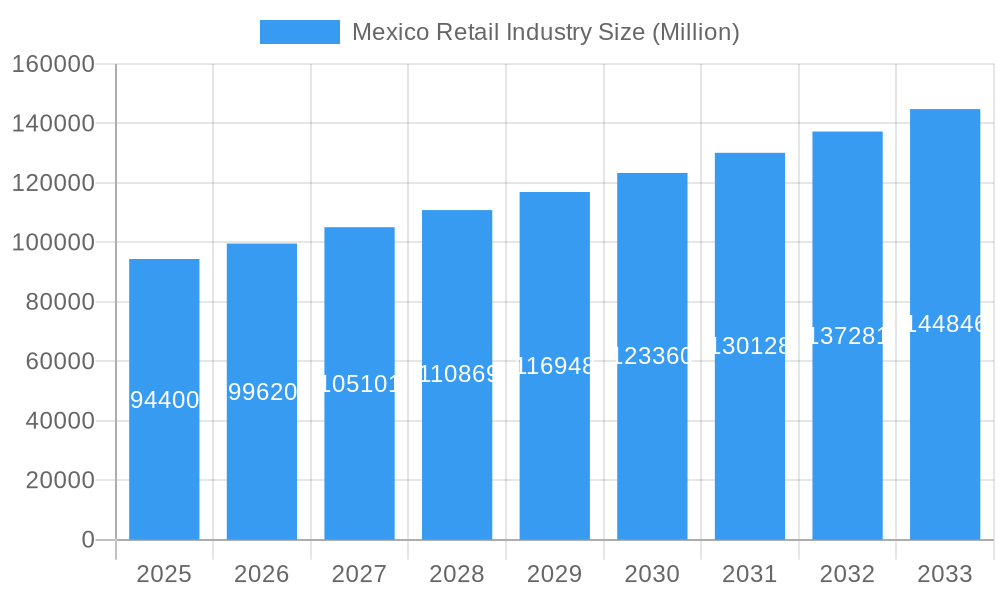

The Mexican retail industry, valued at $94.40 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increasing disposable income is a significant factor, driving demand for diverse retail offerings. E-commerce penetration is rapidly increasing, leading to innovative omnichannel strategies by established players and the emergence of new online retailers. Furthermore, Mexico's strategic location facilitates robust cross-border trade and foreign investment, further stimulating market growth. However, challenges remain. Economic volatility and fluctuations in the Mexican Peso can impact consumer spending. Intense competition among established players like Walmart, Soriana, and FEMSA Comercio, along with the rise of smaller, specialized retailers, creates a dynamic and competitive landscape. Regulatory changes and evolving consumer preferences also present ongoing adjustments for businesses to navigate.

Mexico Retail Industry Market Size (In Billion)

The industry segmentation likely includes diverse categories like grocery, apparel, electronics, home goods, and pharmaceuticals. The competitive landscape is characterized by a mix of large multinational corporations and established domestic players, indicating potential opportunities for both large-scale expansion and niche market penetration. Future growth will likely be driven by continuous technological advancements in e-commerce, personalized shopping experiences, and supply chain optimization. Companies will need to adapt to changing consumer expectations, particularly regarding sustainability and ethical sourcing, to maintain market share and attract new customers. Analyzing specific regional variations within Mexico will be crucial for effective market entry and expansion strategies. The forecast period of 2025-2033 presents a significant opportunity for strategic investment and growth in this dynamic market.

Mexico Retail Industry Company Market Share

Mexico Retail Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the dynamic Mexico retail industry, covering the period 2019-2033, with a focus on 2025. Uncover key trends, challenges, and opportunities shaping this lucrative market, including market size projections, leading players, and emerging technologies. This in-depth study is essential for investors, industry professionals, and strategic decision-makers seeking a clear understanding of the Mexican retail landscape.

Mexico Retail Industry Market Dynamics & Concentration

The Mexican retail market, valued at $XX Million in 2024, is characterized by a mix of established giants and emerging players. Market concentration is moderately high, with a few dominant players controlling a significant share. Innovation is driven by technological advancements, evolving consumer preferences, and increasing competition. A robust regulatory framework, while generally supportive, presents certain challenges. Product substitutes, particularly in the online retail space, are impacting traditional brick-and-mortar stores. M&A activity remains significant, with an estimated XX deals concluded in the historical period (2019-2024).

- Market Share: Walmart International holds the largest market share (estimated at XX%), followed by FEMSA Comercio SA (XX%), and Organization Soriana SA de (XX%). The remaining market share is distributed among numerous smaller players.

- M&A Activity: The number of M&A deals is expected to increase in the forecast period (2025-2033) driven by consolidation and expansion strategies.

- Regulatory Framework: The government's focus on consumer protection and fair competition influences market dynamics.

- End-User Trends: Growing online shopping penetration, increased demand for convenience, and a shift towards private labels are reshaping the landscape.

Mexico Retail Industry Industry Trends & Analysis

The Mexican retail industry is experiencing dynamic and sustained growth, fueled by a burgeoning middle class, increasing urbanization, and a favorable demographic landscape. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately XX% for the period 2025-2033, highlighting significant expansion potential. This evolution is profoundly shaped by technological advancements, with the rapid ascent of e-commerce and the strategic implementation of omnichannel approaches fundamentally altering business operations and consumer purchasing habits. Consumers are increasingly prioritizing personalized experiences, exceptional value for money, and products that demonstrate a commitment to sustainability. The competitive environment is exceptionally robust, compelling players to innovate and employ aggressive pricing strategies to capture and retain market share. By 2033, the penetration of online retail is anticipated to reach a substantial XX%, underscoring the digital transformation of the sector.

Leading Markets & Segments in Mexico Retail Industry

The Mexico City metropolitan area continues to assert its dominance as the premier retail market, propelled by its high population density, robust purchasing power, and sophisticated infrastructure. Alongside the capital, other significant urban centers such as Guadalajara, Monterrey, and Tijuana are pivotal contributors to the industry's overall performance.

- Key Drivers for Mexico City Dominance:

- Exceptional population density coupled with strong disposable income levels.

- Highly developed infrastructure that facilitates efficient logistics and retail operations.

- A concentrated presence of major retail conglomerates and established brands.

- Supportive government initiatives aimed at fostering economic expansion and attracting investment.

The grocery segment, encompassing a wide array of supermarkets, hypermarkets, and convenience stores, represents the largest and most significant sector within Mexican retail. Following closely are the apparel, electronics, and home goods categories, each presenting considerable market opportunities.

Mexico Retail Industry Product Developments

Recent product innovations are centered around enhanced customer experience through digital technologies such as mobile apps, loyalty programs, and personalized offers. Many retailers are focusing on private label brands to offer value-for-money propositions. Technological trends like AI-powered recommendation engines and advanced analytics are improving efficiency and personalization. This ensures better market fit and enhances customer engagement.

Key Drivers of Mexico Retail Industry Growth

Several factors contribute to the growth of the Mexican retail industry. A rising middle class with increasing disposable income is a key driver, along with continued urbanization and favorable demographics. Government initiatives promoting economic growth and investment also play a crucial role. Furthermore, technological advancements are enabling greater efficiency, personalization, and market expansion.

Challenges in the Mexico Retail Industry Market

The Mexican retail landscape is not without its formidable challenges. Intense competition, particularly from well-established international retailers, exerts considerable pressure on profit margins. Disruptions within supply chains and escalating logistics costs can significantly impact operational efficiency and profitability. Furthermore, navigating complex regulatory frameworks and the inherent volatility of economic conditions can hinder growth, potentially moderating the annual growth rate by approximately XX%.

Emerging Opportunities in Mexico Retail Industry

Significant opportunities exist for growth in the Mexican retail market. The expansion of e-commerce, particularly in underserved regions, presents a considerable opportunity. Strategic partnerships, such as collaborations between online and offline retailers, are facilitating growth. Innovation in logistics and supply chain management can unlock further efficiencies and enhance customer service. Focus on sustainability is creating new market opportunities.

Leading Players in the Mexico Retail Industry Sector

- Organization Soriana SA de CV

- FEMSA Comercio SA

- Coppel SA de CV

- El Puerto de Liverpool

- Walmart International

- El Palacio de Hierro

- Superama

- Sears Operadora Mexico SA De CV

- Auchan

- Carrefour

List Not Exhaustive

Key Milestones in Mexico Retail Industry Industry

- March 2023: Walmart opened 22 new stores in Nuevo Leon, showcasing significant investment in the region’s infrastructure.

- January 2023: FEMSA launched Andretti Drive, a new app-enabled drive-thru coffee shop concept, expanding its presence in the food and beverage sector.

Strategic Outlook for Mexico Retail Industry Market

The Mexican retail industry is strategically positioned for continued and robust growth. This optimistic outlook is underpinned by favorable demographic trends, an upward trajectory in consumer spending, and the transformative impact of technological innovation. Significant opportunities abound for businesses willing to embrace and leverage omnichannel strategies, expand their reach into previously underserved markets, and prioritize hyper-personalization to thrive in this dynamic environment. A steadfast commitment to operational efficiency, sustainable practices, and the cultivation of strategic partnerships will be paramount for achieving enduring success and market leadership.

Mexico Retail Industry Segmentation

-

1. Product

- 1.1. Food and Beverage and Tobacco Products

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

-

2. Distribution Channel

- 2.1. Hypermarkets

- 2.2. Supermarkets

- 2.3. Convenience Stores

- 2.4. Department Stores

- 2.5. Specialty Stores

Mexico Retail Industry Segmentation By Geography

- 1. Mexico

Mexico Retail Industry Regional Market Share

Geographic Coverage of Mexico Retail Industry

Mexico Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market

- 3.3. Market Restrains

- 3.3.1. Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market

- 3.4. Market Trends

- 3.4.1. Growth of E-commerce Sector Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage and Tobacco Products

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets

- 5.2.2. Supermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Department Stores

- 5.2.5. Specialty Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Organization Soriana SA de

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FEMSA Comercio SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coppel SA de CV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 El Puerto de Liverpool

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Walmart International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 El Palacio de Hierro

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Superama

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sears Operadora Mexico SA De CV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Auchan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carrefour**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Organization Soriana SA de

List of Figures

- Figure 1: Mexico Retail Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Retail Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Mexico Retail Industry Volume Billion Forecast, by Product 2020 & 2033

- Table 3: Mexico Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Mexico Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Mexico Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Mexico Retail Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Mexico Retail Industry Volume Billion Forecast, by Product 2020 & 2033

- Table 9: Mexico Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Mexico Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Mexico Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Retail Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Retail Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Mexico Retail Industry?

Key companies in the market include Organization Soriana SA de, FEMSA Comercio SA, Coppel SA de CV, El Puerto de Liverpool, Walmart International, El Palacio de Hierro, Superama, Sears Operadora Mexico SA De CV, Auchan, Carrefour**List Not Exhaustive.

3. What are the main segments of the Mexico Retail Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 94.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market.

6. What are the notable trends driving market growth?

Growth of E-commerce Sector Drives the Market.

7. Are there any restraints impacting market growth?

Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market.

8. Can you provide examples of recent developments in the market?

March 2023 - Walmart opened 22 new stores across the state of Nuevo Leon as a part of an investment in the region’s infrastructure. Walmart made the decision during its 12th anniversary in Monterrey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Retail Industry?

To stay informed about further developments, trends, and reports in the Mexico Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence