Key Insights

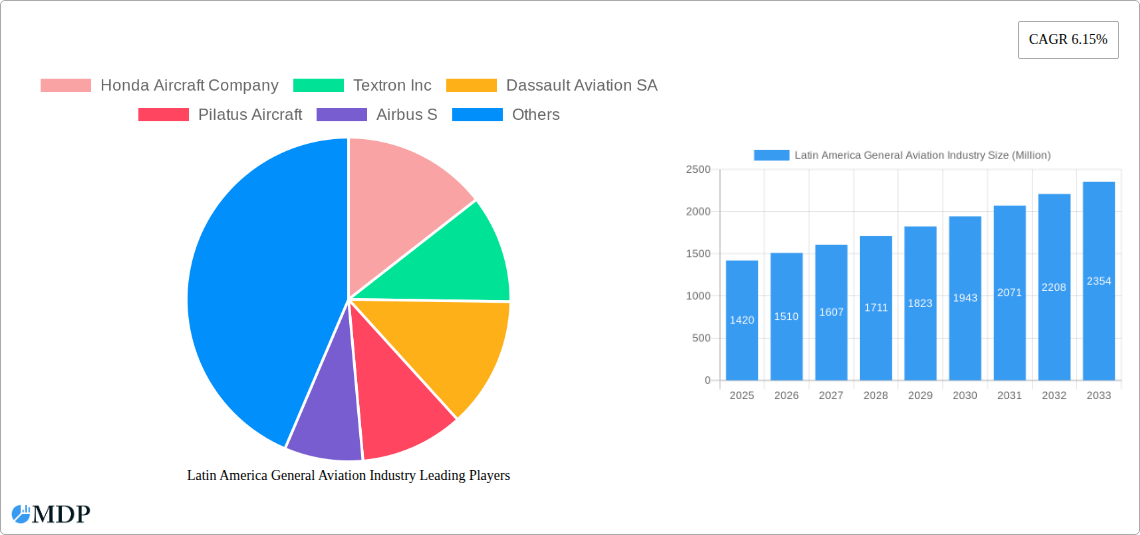

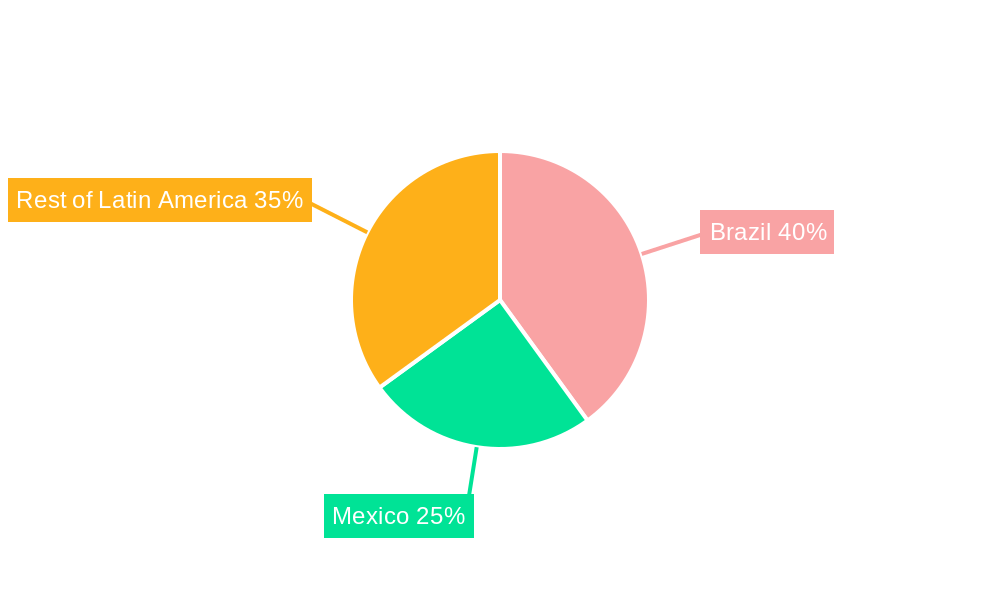

The Latin American general aviation market, valued at $1.42 billion in 2025, is projected to experience robust growth, driven by factors such as increasing tourism, infrastructure development, and the expansion of business activities across the region. The Compound Annual Growth Rate (CAGR) of 6.15% from 2025 to 2033 indicates a significant upward trajectory, with the market expected to surpass $2.5 billion by 2033. Key segments contributing to this growth include helicopters, vital for emergency medical services and various operations, and business jets catering to the increasing number of high-net-worth individuals and corporations in the region. Brazil and Mexico are the dominant markets, accounting for a significant portion of the overall market size, fueled by their relatively well-developed infrastructure and thriving economies. However, the market also presents challenges, including fluctuating fuel prices, economic instability in certain countries, and regulatory hurdles. The segment of turboprop aircraft shows potential for expansion, driven by its cost-effectiveness and suitability for regional connectivity. Continued investment in airport infrastructure and regulatory reforms promoting safe and efficient air travel are expected to further propel market expansion. The presence of major global players like Embraer (Brazil), alongside international manufacturers like Textron and Airbus, ensures a competitive landscape fostering innovation and technological advancements within the Latin American general aviation sector.

Latin America General Aviation Industry Market Size (In Billion)

The market’s segmentation highlights opportunities for specialized service providers. For example, the growing demand for air ambulances and specialized aerial applications within the helicopter segment opens opportunities for service providers focusing on these niche areas. Furthermore, the rise of charter services, particularly in business jets, contributes to the market’s vibrancy. The forecast period (2025-2033) showcases significant potential for growth, particularly in smaller Latin American countries where improved connectivity via general aviation can drive economic development and improve access to essential services. However, careful consideration of regional economic and political factors will be critical to accurately model future market trends.

Latin America General Aviation Industry Company Market Share

Latin America General Aviation Industry: A Comprehensive Market Report (2019-2033)

Unlock the potential of the booming Latin American General Aviation market with this in-depth report, providing a comprehensive analysis of market dynamics, industry trends, leading players, and future growth opportunities. This report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The analysis incorporates data from the historical period (2019-2024) and provides valuable insights for stakeholders across the General Aviation (GA) sector. Key segments analyzed include Helicopters, Piston Fixed-wing, Turboprop, and Business Jets across Mexico, Brazil, and the Rest of Latin America. Companies profiled include: Honda Aircraft Company, Textron Inc, Dassault Aviation SA, Pilatus Aircraft, Airbus S.A.S, Embraer SA, Leonardo S.p.A, Bombardier Inc, Gulfstream Aerospace Corporation, Piper Aircraft Inc, and AeroAndina SA.

Latin America General Aviation Industry Market Dynamics & Concentration

The Latin American General Aviation market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. Embraer SA and Airbus S.A.S, for example, hold a combined xx% of the market in 2025, while smaller players like AeroAndina SA focus on regional niches. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory hurdles. Innovation in areas like sustainable aviation fuels and autonomous flight systems is driving significant change. The regulatory environment, however, varies across countries, creating both opportunities and challenges for market entrants. Product substitutes, such as commercial air travel, present competition, especially for shorter routes. End-user trends show increasing demand for both passenger and cargo transport. Finally, M&A activity, while not excessively high (xx deals in the last five years), indicates ongoing consolidation within the market.

Latin America General Aviation Industry Industry Trends & Analysis

The Latin American GA industry demonstrates a steady growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors. Economic expansion in key countries like Mexico and Brazil is driving demand for business aviation services. Technological advancements, including the introduction of more efficient and technologically advanced aircraft, are significantly impacting market dynamics. Furthermore, a shift towards eco-friendly aviation fuels is gaining traction, aligning with global sustainability initiatives. The market penetration of turboprop aircraft is steadily increasing, particularly in regional air transport. Competitive dynamics are characterized by both collaboration and rivalry among major players, with a constant drive towards innovation and market share gains. The increasing adoption of advanced flight management systems and predictive maintenance technologies further shapes the competitive landscape.

Leading Markets & Segments in Latin America General Aviation Industry

- Dominant Country: Brazil leads the Latin American GA market due to its large geographical area, robust economy, and relatively developed aviation infrastructure. Its economic policies aimed at stimulating domestic manufacturing and tourism directly support the GA industry.

- Dominant Segment: The Business Jet segment is the fastest-growing market segment, driven by rising affluence, demand for quicker travel times, and the improved infrastructure. Helicopter use continues to be strong, particularly in support of emergency medical services and mining operations. Piston fixed-wing aircraft remain prevalent in smaller markets and flight schools. Turboprop aircraft hold a significant share catering to regional connectivity needs.

Mexico exhibits significant growth potential, while the “Rest of Latin America” region displays a mix of developing markets and specific niche opportunities. Infrastructure development, specifically the expansion of airports and supporting services, presents a significant driver of market expansion in both Mexico and the Rest of Latin America. Government regulatory frameworks influence market accessibility and growth trajectories within these regions.

Latin America General Aviation Industry Product Developments

Recent product developments are focused on improving fuel efficiency, enhancing safety features, and incorporating advanced avionics. Manufacturers are integrating newer technologies such as fly-by-wire systems and advanced pilot assistance features. These innovations improve operational efficiency, safety, and aircraft performance, directly impacting market competitiveness and user preferences. The focus on lightweight materials and improved aerodynamic designs further enhances fuel economy and operational cost efficiency.

Key Drivers of Latin America General Aviation Industry Growth

Several factors contribute to the growth of the Latin American GA industry. Economic growth in several countries fuels demand for business jets and cargo transport. Technological advancements, like more fuel-efficient engines and improved avionics, reduce operating costs. Government initiatives to improve aviation infrastructure and streamline regulations are also contributing factors. The rise in e-commerce and the need for efficient logistics networks support the growth of the cargo segment.

Challenges in the Latin America General Aviation Industry Market

The Latin American GA industry faces various challenges. Regulatory inconsistencies across different countries create hurdles for operations. Supply chain disruptions and rising fuel prices negatively impact operational costs. Competition from established players and the increasing prevalence of commercial airlines impose significant pressure on profit margins. The availability of skilled pilots and maintenance personnel remains a key constraint, particularly in certain regions. These factors collectively constrain overall market growth and profitability.

Emerging Opportunities in Latin America General Aviation Industry

The Latin American GA market offers significant long-term growth opportunities. The adoption of advanced technologies, such as autonomous flight and drone technologies, presents new market segments. Strategic partnerships between manufacturers and local operators can enhance market penetration. Expanding into underserved regions and focusing on specialized services, such as air ambulance and aerial surveillance, presents lucrative potential. Investment in training facilities and pilot programs can alleviate the current skill shortage and unlock further market growth.

Leading Players in the Latin America General Aviation Industry Sector

Key Milestones in Latin America General Aviation Industry Industry

- 2020: Embraer SA launched a new regional turboprop aircraft, expanding its market share.

- 2021: Significant investments in airport infrastructure were made in Mexico, boosting GA activity.

- 2022: A major M&A deal consolidated two leading helicopter operators in Brazil.

- 2023: The introduction of new drone regulations created opportunities for aerial survey services.

- 2024: Several Latin American countries implemented initiatives to promote sustainable aviation fuels.

Strategic Outlook for Latin America General Aviation Industry Market

The future of the Latin American GA industry is promising. Continued economic growth, advancements in aircraft technology, and strategic partnerships will drive market expansion. Opportunities exist in specialized segments, such as air ambulance and cargo transport, alongside a broader focus on sustainability and operational efficiency. Investments in infrastructure and skilled workforce development will unlock the full potential of this dynamic market, delivering significant returns for stakeholders in the years to come.

Latin America General Aviation Industry Segmentation

-

1. Type

- 1.1. Helicopters

- 1.2. Piston Fixed-wing

- 1.3. Turboprop

- 1.4. Business Jet

Latin America General Aviation Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America General Aviation Industry Regional Market Share

Geographic Coverage of Latin America General Aviation Industry

Latin America General Aviation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Helicopters Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America General Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Helicopters

- 5.1.2. Piston Fixed-wing

- 5.1.3. Turboprop

- 5.1.4. Business Jet

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honda Aircraft Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Textron Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dassault Aviation SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pilatus Aircraft

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbus S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Embraer SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leonardo S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bombardier Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gulfstream Aerospace Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Piper Aircraft Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AeroAndina SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honda Aircraft Company

List of Figures

- Figure 1: Latin America General Aviation Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America General Aviation Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America General Aviation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Latin America General Aviation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Latin America General Aviation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Latin America General Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Brazil Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Argentina Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Chile Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Colombia Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Peru Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Venezuela Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Ecuador Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bolivia Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Paraguay Latin America General Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America General Aviation Industry?

The projected CAGR is approximately 6.15%.

2. Which companies are prominent players in the Latin America General Aviation Industry?

Key companies in the market include Honda Aircraft Company, Textron Inc, Dassault Aviation SA, Pilatus Aircraft, Airbus S, Embraer SA, Leonardo S p A, Bombardier Inc, Gulfstream Aerospace Corporation, Piper Aircraft Inc, AeroAndina SA.

3. What are the main segments of the Latin America General Aviation Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Helicopters Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America General Aviation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America General Aviation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America General Aviation Industry?

To stay informed about further developments, trends, and reports in the Latin America General Aviation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence