Key Insights

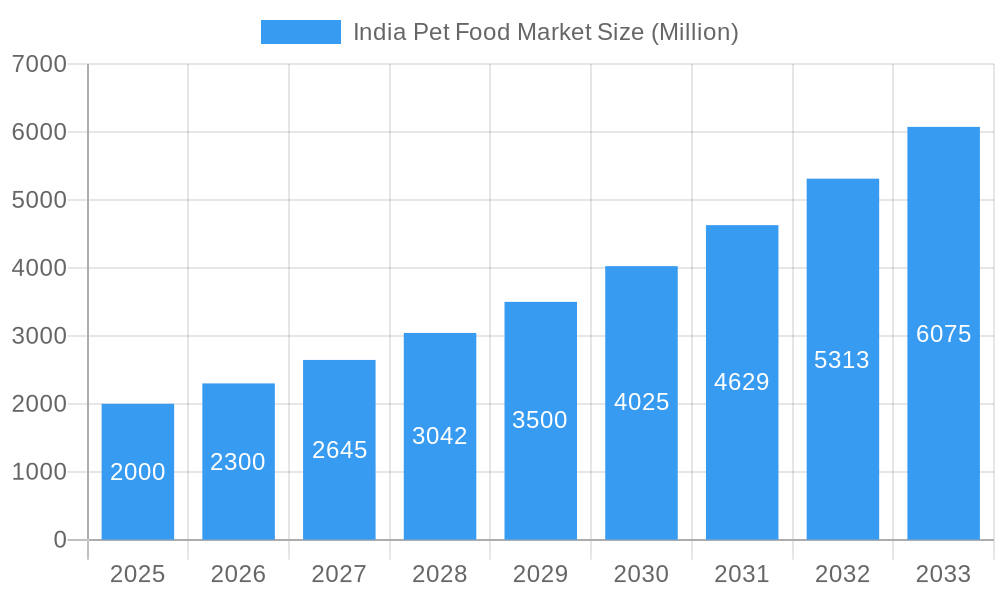

The Indian pet food market is exhibiting strong expansion, driven by rising pet ownership, increasing disposable incomes, and a significant trend towards premiumization. The market, valued at $973.6 million in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 15.37% from 2025 to 2033. This growth is underpinned by several key factors, including the growing perception of pets as family members, leading to elevated spending on their care. Enhanced awareness of pet nutrition and health is compelling owners to seek superior quality, specialized pet foods. The premiumization trend, encompassing grain-free diets, functional foods addressing specific health concerns, and organic options, is a primary catalyst for market growth. Challenges include consumer price sensitivity and persistent competition from the unorganized sector offering lower-cost alternatives.

India Pet Food Market Market Size (In Million)

Despite these hurdles, the long-term forecast for the Indian pet food sector remains optimistic. An expanding pet owner demographic, coupled with greater access to information on pet nutrition and the availability of diverse premium product offerings, will continue to fuel market expansion. Leading industry players are actively investing in the Indian market, fostering innovation and intensifying competition. Market segmentation spans various pet types, product categories (dry, wet, treats), and price points, presenting extensive opportunities across the value chain. Future growth trajectories will be shaped by evolving consumer preferences, technological advancements in pet food production, and the prevailing regulatory environment.

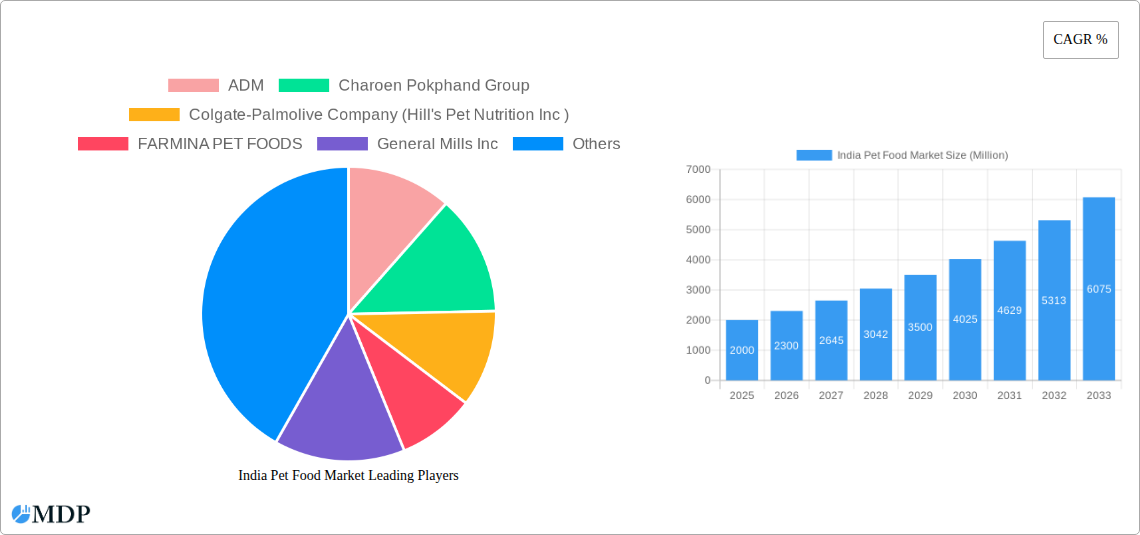

India Pet Food Market Company Market Share

India Pet Food Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Pet Food Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The market size is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx% during the forecast period.

India Pet Food Market Market Dynamics & Concentration

The India Pet Food Market is experiencing robust growth, driven by rising pet ownership, increasing disposable incomes, and a shift towards premium pet food products. Market concentration is moderately high, with a few dominant players holding significant market share. However, the market also presents opportunities for smaller players specializing in niche segments like organic or specialized pet diets. Innovation in pet food formulations, such as the inclusion of functional ingredients and novel protein sources, fuels market expansion. The regulatory framework, while evolving, plays a crucial role in ensuring product safety and quality. The presence of substitute products, such as homemade pet food, poses a challenge, but premiumization trends are mitigating this. End-user trends show a clear preference for convenient and healthy options. The market has witnessed a moderate number of M&A activities (xx deals in the past 5 years), indicating strategic consolidation and expansion efforts by key players.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Activity: An average of xx M&A deals per year were recorded between 2019 and 2024.

- Innovation Drivers: Growing consumer awareness of pet health and nutrition, technological advancements in pet food manufacturing, and increasing demand for specialized pet food products.

- Regulatory Framework: The Food Safety and Standards Authority of India (FSSAI) plays a key role in regulating the pet food industry.

India Pet Food Market Industry Trends & Analysis

The India Pet Food Market demonstrates impressive growth, fueled by several key factors. Rising pet ownership, particularly in urban areas, is a primary driver. The increasing disposable incomes of the Indian middle class enables pet owners to spend more on premium pet food. A burgeoning trend towards humanization of pets contributes to greater spending on pet food and healthcare. Technological advancements, such as improved manufacturing processes and innovative product formulations, are transforming the industry. Consumer preferences are shifting towards functional foods, focusing on specific health benefits, like improved digestion or enhanced immunity. The competitive landscape is dynamic, with both established international players and domestic companies vying for market share. The market exhibits a strong CAGR of xx%, with market penetration gradually increasing in smaller cities and towns.

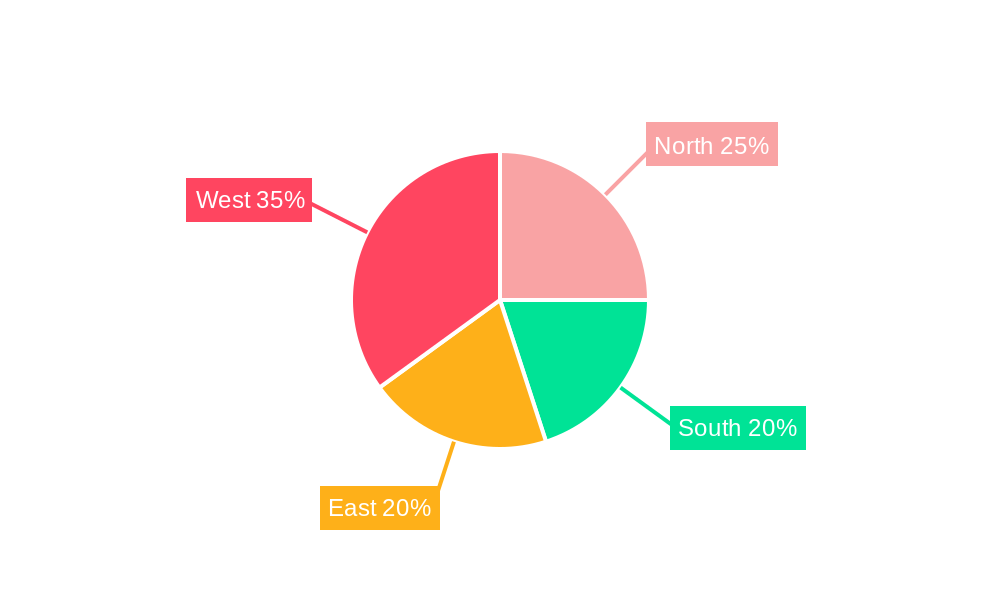

Leading Markets & Segments in India Pet Food Market

The Indian pet food market shows strong growth across various regions, with urban centers leading the charge. The premium segment is experiencing significant expansion due to increased spending power and health-conscious pet owners.

- Key Drivers for Dominant Regions:

- Urban Areas: Higher pet ownership, increased disposable incomes, and greater awareness of pet health.

- Tier 1 & Tier 2 Cities: Rapid economic growth, changing lifestyles, and rising pet adoption rates.

- Dominance Analysis: The premium segment has a commanding position, reflecting the growing demand for high-quality pet food products. This segment's growth is projected to significantly outpace that of the economy segment in the coming years.

India Pet Food Market Product Developments

Recent product innovations have focused on enhanced nutritional profiles, functional ingredients to cater to specific pet health needs, and convenient packaging options. The integration of novel protein sources and technologically advanced processing methods continues to improve the quality and palatability of pet food. These advancements are shaping competitive advantages by catering to specific pet owner demands and driving market growth.

Key Drivers of India Pet Food Market Growth

Several factors are fueling the expansion of the Indian pet food market. The rising number of pet adoptions, particularly dogs and cats, contributes significantly to this growth. Increased disposable incomes among urban households directly translate into higher spending on pet food and accessories. Furthermore, growing awareness of pet nutrition and health, coupled with a shift toward premium and specialized pet food, further enhances market growth. The government's focus on animal welfare also positively influences the market.

Challenges in the India Pet Food Market Market

The Indian pet food market faces certain challenges, including the prevalence of counterfeit products, supply chain inconsistencies affecting the consistent availability of raw materials, and intense competition from both established and new market entrants, creating pricing pressures. Regulatory changes and compliance requirements can also impact the market. The fragmented distribution network can impact efficiency and accessibility in remote areas.

Emerging Opportunities in India Pet Food Market

The Indian pet food market presents substantial long-term opportunities. Technological advancements in pet food formulation and production are opening up new avenues for innovation. Strategic alliances between domestic and international players are creating synergies that boost market penetration. Expanding into untapped markets and focusing on niche segments with specialized pet food offers immense growth potential.

Leading Players in the India Pet Food Market Sector

- ADM

- Charoen Pokphand Group

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc)

- FARMINA PET FOODS

- General Mills Inc

- IB Group (Drools Pet Food Pvt Ltd)

- Mars Incorporated

- Nestle (Purina)

- Schell & Kampeter Inc (Diamond Pet Foods)

- Virba

Key Milestones in India Pet Food Market Industry

- July 2023: Hill's Pet Nutrition launched MSC-certified pollock and insect protein pet food.

- May 2023: Nestle Purina introduced new Friskies Playfuls cat treats.

- April 2023: Mars Incorporated opened its first APAC pet food R&D center.

Strategic Outlook for India Pet Food Market Market

The India Pet Food Market is poised for sustained growth, driven by increasing pet ownership, rising disposable incomes, and evolving consumer preferences. Strategic partnerships, product diversification, and technological innovation will be critical for success. Focusing on premium and specialized pet food segments, coupled with robust distribution networks, will unlock significant market opportunities. The market's future growth trajectory is exceptionally promising.

India Pet Food Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Pet Food Market Segmentation By Geography

- 1. India

India Pet Food Market Regional Market Share

Geographic Coverage of India Pet Food Market

India Pet Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Pet Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Charoen Pokphand Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FARMINA PET FOODS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Mills Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IB Group (Drools Pet Food Pvt Ltd )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mars Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nestle (Purina)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schell & Kampeter Inc (Diamond Pet Foods)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virba

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: India Pet Food Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Pet Food Market Share (%) by Company 2025

List of Tables

- Table 1: India Pet Food Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Pet Food Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Pet Food Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Pet Food Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Pet Food Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Pet Food Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: India Pet Food Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Pet Food Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Pet Food Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Pet Food Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Pet Food Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Pet Food Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Pet Food Market?

The projected CAGR is approximately 15.37%.

2. Which companies are prominent players in the India Pet Food Market?

Key companies in the market include ADM, Charoen Pokphand Group, Colgate-Palmolive Company (Hill's Pet Nutrition Inc ), FARMINA PET FOODS, General Mills Inc, IB Group (Drools Pet Food Pvt Ltd ), Mars Incorporated, Nestle (Purina), Schell & Kampeter Inc (Diamond Pet Foods), Virba.

3. What are the main segments of the India Pet Food Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 973.6 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2023: Hill's Pet Nutrition introduced its new MSC (Marine Stewardship Council) certified pollock and insect protein products for pets with sensitive stomachs and skin lines. They contain vitamins, omega-3 fatty acids, and antioxidants.May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific. This new facility, called the APAC pet center, will support the company's product development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Pet Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Pet Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Pet Food Market?

To stay informed about further developments, trends, and reports in the India Pet Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence