Key Insights

The European small satellite market is poised for significant expansion, driven by escalating demand for affordable Earth observation, communication, and navigation solutions. Projections indicate a robust CAGR of 16.1%, with the market size expected to reach 1.33 billion by 2025. This growth trajectory is underpinned by several key catalysts. Technological innovations in miniaturization and propulsion, especially electric propulsion, are reducing launch expenses and enabling more frequent missions. Commercial entities are increasingly adopting small satellites for diverse applications such as IoT connectivity, environmental monitoring, and precision agriculture. Defense and government sectors also represent substantial end-users, utilizing small satellites for intelligence, surveillance, and reconnaissance (ISR). Germany, France, and the United Kingdom currently dominate the European market, supported by established space industries and governmental R&D initiatives. Emerging players like the Netherlands and Sweden are diversifying the market landscape. Intense competition from established companies, including Airbus SE and OHB SE, alongside innovative startups such as GomSpace ApS and Alba Orbital, is fostering innovation and competitive pricing.

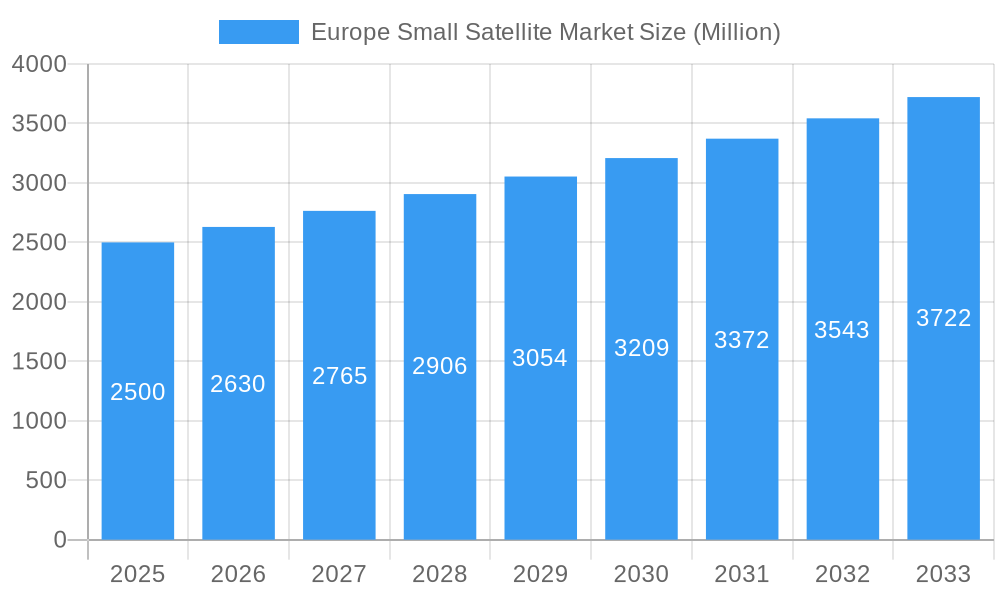

Europe Small Satellite Market Market Size (In Billion)

Despite a positive outlook, market participants face evolving regulatory frameworks for satellite launches and operations. Addressing space debris and ensuring the long-term sustainability of space operations remain critical concerns that may impact future market growth. Nevertheless, sustained expansion is anticipated, fueled by technological advancements, increasing cross-sector demand, and the emergence of new market entrants. Market segmentation by propulsion technology (electric, gas-based, liquid fuel), application (communication, Earth observation), orbit class (GEO, LEO, MEO), and end-user (commercial, military & government) offers a granular view of its diverse components and their contributions to overall market development, ensuring continued evolution and new opportunities.

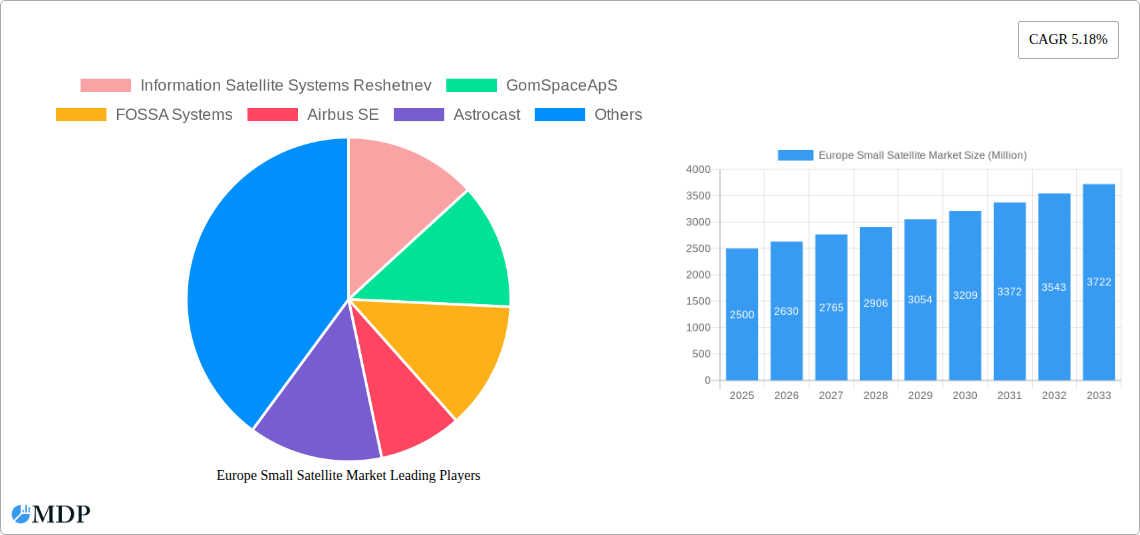

Europe Small Satellite Market Company Market Share

Europe Small Satellite Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the European small satellite market, covering the period 2019-2033. It offers invaluable insights into market dynamics, industry trends, leading players, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The market is segmented by propulsion technology (electric, gas-based, liquid fuel), application (communication, earth observation, navigation, space observation, others), orbit class (GEO, LEO, MEO), and end-user (commercial, military & government, other). Key players analyzed include Information Satellite Systems Reshetnev, GomSpace ApS, FOSSA Systems, Airbus SE, Astrocast, OHB SE, SatRev, Thale, and Alba Orbital. The total market size is predicted to reach xx Million by 2033.

Europe Small Satellite Market Market Dynamics & Concentration

The European small satellite market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is relatively moderate, with a few major players dominating specific segments while numerous smaller companies contribute to innovation and specialization. The market is driven by ongoing technological advancements, particularly in miniaturization and cost reduction, enabling easier access to space for various applications. Favorable regulatory frameworks, coupled with increasing government support for space exploration and commercialization, further stimulate market expansion. The substitution of traditional large satellites with smaller, more agile counterparts is also a significant driver. End-user trends are shifting towards increased demand for customized solutions, particularly in the commercial sector for applications like Earth observation and IoT connectivity.

Significant M&A activity has been observed, with larger companies acquiring smaller, specialized firms to expand their product portfolios and technological capabilities. The number of M&A deals increased from xx in 2019 to xx in 2024, indicating a consolidating market. Market share is spread across various players, with the top five companies holding approximately xx% of the market. Further consolidation is anticipated as companies seek to gain a larger share of the growing market.

Europe Small Satellite Market Industry Trends & Analysis

The European small satellite market exhibits robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends. Technological disruptions, such as advancements in electric propulsion and improved sensor technology, are continually reducing launch costs and enhancing satellite capabilities. Consumer preferences are shifting towards increased reliance on satellite-based services, driving demand for improved communication and Earth observation capabilities. The competitive landscape is dynamic, with new entrants constantly emerging, alongside established players expanding their offerings and geographic reach. Market penetration is increasing rapidly, particularly in the commercial sector, with various industries leveraging small satellite technology for data acquisition and communication. The market penetration is estimated at xx% in 2025, expected to rise to xx% by 2033.

Leading Markets & Segments in Europe Small Satellite Market

The LEO (Low Earth Orbit) segment dominates the European small satellite market due to its suitability for various applications, such as Earth observation and communication. The Commercial end-user sector is the largest segment, driven by growing demand for satellite-based services across multiple sectors, including telecommunications, agriculture, and environmental monitoring. The Earth observation application segment is also experiencing significant growth due to the increasing need for high-resolution imagery and data for various purposes.

- Key Drivers for LEO dominance: Lower launch costs, reduced development time, and improved accessibility.

- Key Drivers for Commercial sector dominance: Rising private investment in space-based solutions, increased adoption of IoT, and growth in data-driven applications.

- Key Drivers for Earth observation segment dominance: Growing demand for high-resolution imagery in agriculture, urban planning, environmental monitoring and disaster management.

Germany, France, and the UK are the leading national markets, benefiting from strong aerospace industries and government support for space research.

- Germany: Robust aerospace industry, favorable government policies.

- France: Strong R&D capabilities, involvement in large-scale space programs.

- UK: Growing private sector investment, focus on new space technologies.

Electric propulsion technology is gaining traction due to its efficiency and cost-effectiveness, contributing to the overall market expansion.

Europe Small Satellite Market Product Developments

Recent years have witnessed significant advancements in small satellite technology, focusing on miniaturization, improved payload capabilities, and enhanced power efficiency. Innovations in electric propulsion systems have led to longer operational lifetimes and reduced fuel costs. New applications are constantly emerging, particularly in the fields of IoT, remote sensing, and navigation. These advancements are creating a competitive landscape where companies strive to differentiate their offerings through innovative designs, advanced functionalities, and optimized cost structures. The market is witnessing increased focus on modular designs that allow for easier customization and integration, reducing development time and cost.

Key Drivers of Europe Small Satellite Market Growth

The European small satellite market is experiencing robust growth driven by a confluence of technological, economic, and regulatory factors. Technological advancements, such as miniaturization and the development of more efficient propulsion systems, have made small satellites more accessible and cost-effective. Economically, the decreasing cost of launching and operating small satellites has opened up new market opportunities for various industries. Favorable regulatory frameworks in several European countries have fostered a supportive environment for small satellite development and deployment. For example, the European Space Agency’s (ESA) initiatives and funding programs encourage innovation and collaboration.

Challenges in the Europe Small Satellite Market Market

Despite the promising outlook, the European small satellite market faces several challenges. Regulatory hurdles, particularly concerning licensing and spectrum allocation, can delay deployments and increase costs. Supply chain disruptions, particularly regarding essential components, can impact production schedules and overall market growth. Intense competition from both established and emerging players necessitates continuous innovation and adaptation to maintain market share. For example, the competition for launch services can cause delays and increase expenses.

Emerging Opportunities in Europe Small Satellite Market

The long-term growth of the European small satellite market is fueled by emerging opportunities arising from technological breakthroughs, strategic partnerships, and market expansion strategies. Advancements in artificial intelligence and machine learning are expected to significantly enhance satellite data processing and analytics. Collaborative efforts among government agencies, private companies, and research institutions foster innovation and create new opportunities. Expansion into new market segments, such as in-space servicing and debris removal, presents significant growth potential.

Leading Players in the Europe Small Satellite Market Sector

- Information Satellite Systems Reshetnev

- GomSpace ApS

- FOSSA Systems

- Airbus SE

- Astrocast

- OHB SE

- SatRev

- Thale

- Alba Orbital

Key Milestones in Europe Small Satellite Market Industry

- November 2021: FOSSA Systems partners with ienai SPACE for the use of electric thrusters in picosatellites, signifying a trend toward more efficient propulsion.

- January 2022: SatRevolution launched two satellites, STORK 3 (an Earth-imaging nanosatellite) and SteamSat 2, demonstrating the increasing accessibility of space for various applications.

- June 2022: Falcon 9 launched Globalstar FM15 to low-Earth orbit, highlighting the continued reliance on established launch providers and the growing demand for LEO constellations.

Strategic Outlook for Europe Small Satellite Market Market

The future of the European small satellite market is promising, with significant growth potential driven by continued technological advancements, increasing demand for satellite-based services, and supportive government policies. Strategic partnerships and collaborations will play a key role in driving innovation and market expansion. Companies that can effectively leverage technological breakthroughs, optimize their operational efficiency, and adapt to evolving market needs will be best positioned to capitalize on the vast opportunities presented by this dynamic sector. The market is poised for substantial growth, driven by emerging applications and new technological developments, reinforcing its position as a key component of the global space economy.

Europe Small Satellite Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Europe Small Satellite Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

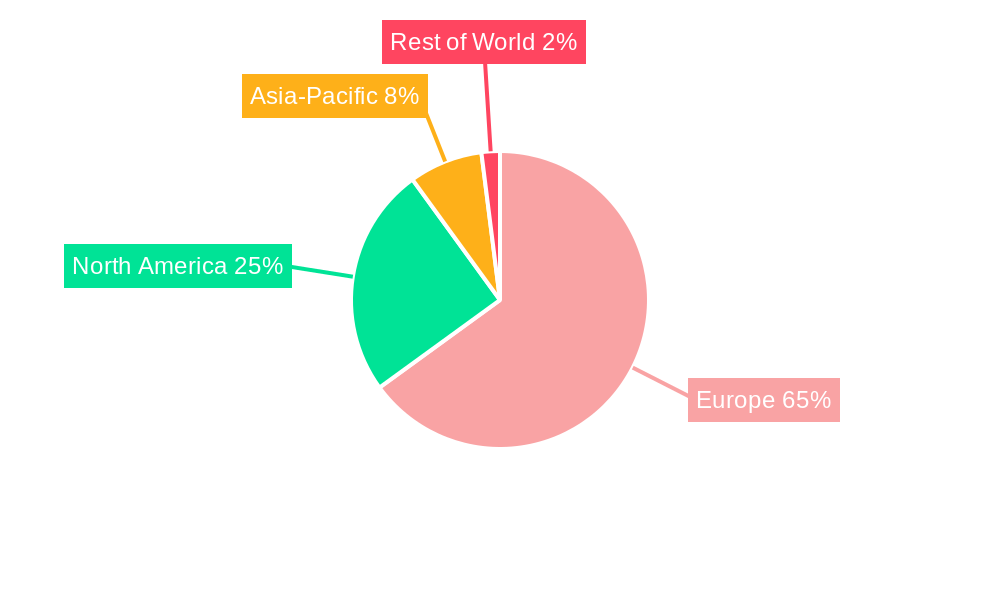

Europe Small Satellite Market Regional Market Share

Geographic Coverage of Europe Small Satellite Market

Europe Small Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Small Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Information Satellite Systems Reshetnev

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GomSpaceApS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FOSSA Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airbus SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astrocast

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OHB SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SatRev

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alba Orbital

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Information Satellite Systems Reshetnev

List of Figures

- Figure 1: Europe Small Satellite Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Small Satellite Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Small Satellite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Small Satellite Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Europe Small Satellite Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Small Satellite Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Europe Small Satellite Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Small Satellite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Small Satellite Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Europe Small Satellite Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Europe Small Satellite Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Europe Small Satellite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Small Satellite Market?

The projected CAGR is approximately 16.1%.

2. Which companies are prominent players in the Europe Small Satellite Market?

Key companies in the market include Information Satellite Systems Reshetnev, GomSpaceApS, FOSSA Systems, Airbus SE, Astrocast, OHB SE, SatRev, Thale, Alba Orbital.

3. What are the main segments of the Europe Small Satellite Market?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Falcon 9 launched Globalstar FM15 to low-Earth orbit from Space Launch Complex 40 (SLC-40) at Cape Canaveral Space Force Station in Florida.January 2022: SatRevolution launched two satellites STORK 3 and SteamSat 2. STORK 3 is an Earth-imaging nanosatellite.November 2021: FOSSA Systems partners with ienai SPACE for the use of electric thrusters in picosatellites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Small Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Small Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Small Satellite Market?

To stay informed about further developments, trends, and reports in the Europe Small Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence