Key Insights

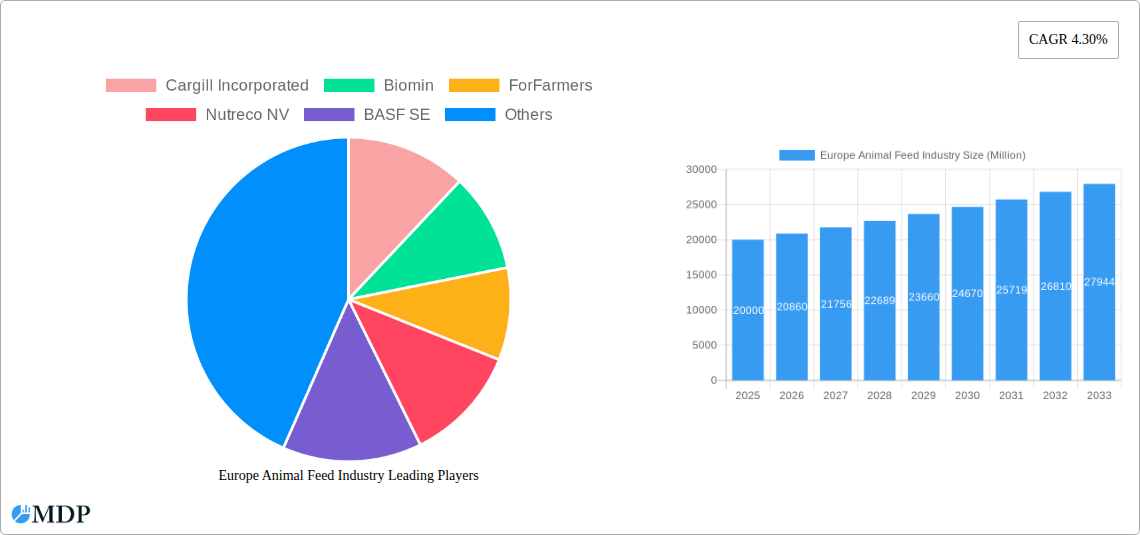

The European animal feed market is projected for robust growth, estimated at 158.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.3% from 2025 to 2033. This expansion is propelled by rising demand for animal protein sources like poultry and swine, driven by population increases and higher meat and dairy consumption. Innovations in feed formulation, focusing on enhanced animal health, nutritional optimization, and sustainable practices, are significant growth catalysts. The integration of novel ingredients, including functional supplements and by-products, further bolsters efficiency and animal welfare. Key challenges include raw material price volatility, stringent environmental regulations, and evolving concerns around feed additives.

Europe Animal Feed Industry Market Size (In Billion)

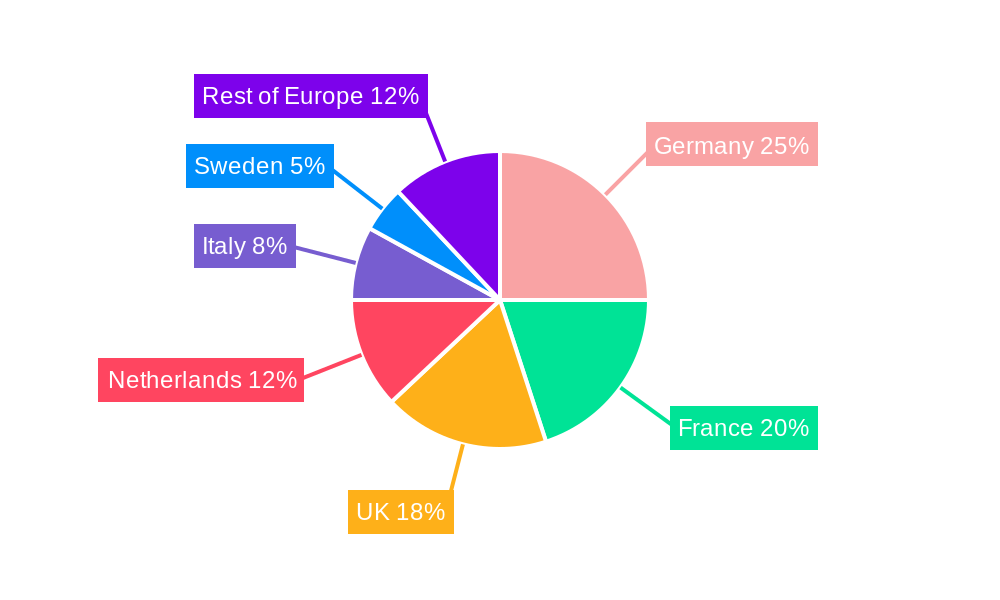

Market segmentation highlights strong performance in ruminant and poultry feed, with substantial growth observed in swine and aquaculture sectors. While cereals and oilseed meals dominate ingredient usage, specialized supplements and by-products with enhanced nutritional and functional properties are gaining traction. Geographically, Germany, France, the United Kingdom, and the Netherlands are leading markets due to substantial livestock populations and well-established feed industries. The competitive landscape features major multinational corporations such as Cargill, Biomin, and Nutreco, alongside regional specialists, all actively investing in R&D for sustainable feed solutions.

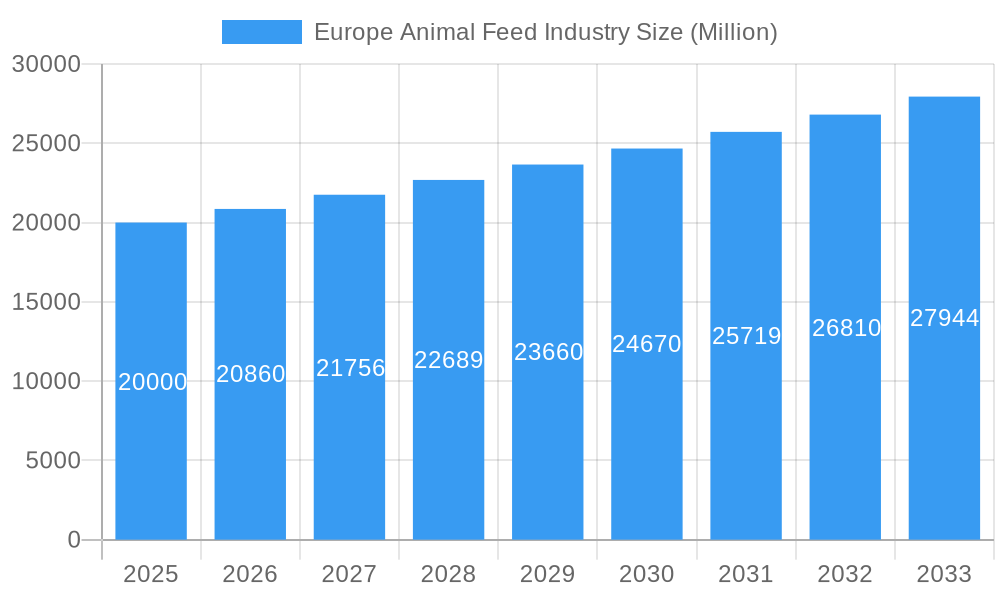

Europe Animal Feed Industry Company Market Share

This report offers a comprehensive analysis of the European animal feed sector, detailing market dynamics, key players, emerging trends, and future growth trajectories. Spanning a study period from 2019 to 2033, with a base year of 2025, this research provides actionable insights for stakeholders, investors, and strategic decision-makers, leveraging historical data to forecast future opportunities.

Europe Animal Feed Industry Market Dynamics & Concentration

The European animal feed industry is a highly consolidated market, with a few major players controlling a significant market share. In 2024, the top five companies held an estimated xx% market share, reflecting a trend towards consolidation driven by economies of scale and global expansion strategies. Innovation is a key driver, with companies investing heavily in research and development to improve feed efficiency, enhance animal health, and meet evolving consumer demands for sustainable and traceable products. Stringent regulatory frameworks concerning animal welfare, feed safety, and environmental sustainability significantly influence industry practices. Substitute products, such as insect-based protein, are emerging, posing both challenges and opportunities for traditional players. End-user trends, particularly increasing demand for high-quality, specialized feeds for specific animal types and production systems, are shaping product development and marketing strategies. The industry has witnessed a significant number of mergers and acquisitions (M&A) in recent years, further consolidating market power and expanding product portfolios. The number of M&A deals between 2019 and 2024 is estimated at xx.

- Market Concentration: Top 5 players hold xx% market share (2024 est.).

- Innovation Drivers: R&D investments in feed efficiency, animal health, and sustainability.

- Regulatory Frameworks: Stringent regulations on feed safety, animal welfare, and environmental impact.

- Product Substitutes: Emergence of alternative protein sources (e.g., insect meal).

- End-User Trends: Growing demand for specialized feeds tailored to specific animal needs and production systems.

- M&A Activity: xx M&A deals (2019-2024), driving consolidation and expansion.

Europe Animal Feed Industry Industry Trends & Analysis

The European animal feed market is experiencing significant growth, driven by factors such as increasing demand for animal protein, rising incomes in developing economies, and the expansion of the aquaculture sector. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%. Technological advancements, particularly in feed formulation, precision feeding, and data analytics, are improving efficiency and sustainability. Consumer preferences are shifting towards sustainably produced animal products, leading to increased demand for feeds made from responsibly sourced ingredients. The competitive landscape is characterized by intense rivalry among major players, necessitating continuous innovation and strategic partnerships to maintain market share. Market penetration of specialized feeds, such as functional feeds and organic feeds, is steadily increasing, reflecting growing consumer awareness and demand for higher-value products.

Leading Markets & Segments in Europe Animal Feed Industry

The European animal feed market is geographically diverse, with significant variations in consumption patterns and market dynamics across different regions and countries. While precise market share breakdowns require detailed proprietary data, several factors indicate key regional and segmental dominance:

Animal Type:

- Poultry: Poultry feed dominates the market due to high consumption of poultry meat and eggs across Europe. Key drivers include strong demand for affordable protein sources and efficient poultry production systems.

- Swine: Swine feed represents a substantial segment, driven by significant pork consumption. Market growth is influenced by factors like regional dietary preferences and consumer demand for specific pork cuts.

- Ruminants: Ruminant feed (cattle, sheep) constitutes a significant part of the market. Market trends are influenced by meat consumption patterns, dairy production levels, and government policies supporting livestock farming.

- Aquaculture: The aquaculture sector is experiencing rapid growth, driving demand for specialized feeds. Sustainability concerns are influencing the adoption of innovative feed formulations and farming practices.

- Other Animal Types: This segment includes feeds for horses, pets, and other livestock, exhibiting growth driven by specialized dietary needs and increasing pet ownership.

Ingredient:

- Cereals: Cereals remain the dominant ingredient due to cost-effectiveness and availability. Market trends are shaped by cereal prices, crop yields, and government policies related to agricultural production.

- Cakes & Meals: These ingredients represent significant segments, influenced by availability, price, and nutritional composition. Market growth is tied to the availability of by-products from food processing industries.

- By-products: Efficient utilization of by-products from food processing is gaining importance, driven by sustainability concerns and cost-efficiency. Market dynamics are closely linked to agricultural and food processing activities.

- Supplements: The demand for supplements is increasing, driven by the focus on enhancing animal health, productivity, and feed efficiency. Market trends are affected by advancements in nutritional science and consumer demands for high-quality animal products.

Europe Animal Feed Industry Product Developments

Recent product innovations focus on improving feed efficiency, enhancing animal health, and reducing environmental impact. This includes the development of functional feeds enriched with specific nutrients to boost immunity and productivity, precision feeding systems utilizing data analytics to optimize feed allocation, and the incorporation of alternative protein sources, such as insect meal, to reduce reliance on traditional sources. These innovations are designed to meet the evolving needs of producers and consumers, ensuring a sustainable and efficient animal feed supply.

Key Drivers of Europe Animal Feed Industry Growth

Growth in the European animal feed industry is propelled by several key factors. Increasing demand for animal protein globally fuels production, while rising disposable incomes in many European countries drive consumption. Technological advancements in feed formulation and production increase efficiency and reduce costs. Favorable government policies supporting livestock farming and aquaculture further stimulate growth. Finally, the growing emphasis on sustainability encourages innovation in feed production and sourcing.

Challenges in the Europe Animal Feed Industry Market

The European animal feed industry faces various challenges. Fluctuating raw material prices and supply chain disruptions impact profitability and production. Stringent regulatory requirements on feed safety and environmental impact increase production costs. Intense competition among major players necessitates continuous innovation and cost optimization to maintain market share. These factors combined can significantly influence market stability and growth.

Emerging Opportunities in Europe Animal Feed Industry

Long-term growth opportunities abound for innovative companies. Technological advancements in precision feeding and data analytics offer significant potential for optimizing feed efficiency and resource utilization. Strategic partnerships between feed companies and technology providers can create innovative solutions to meet the evolving needs of the industry. Furthermore, expansion into emerging markets and diversification of product portfolios provide avenues for future growth and profitability.

Leading Players in the Europe Animal Feed Industry Sector

Key Milestones in Europe Animal Feed Industry Industry

- February 2021: The Pavo (ForFarmers) acquired Mühldorfer Pferdefutter, increasing German turnover by over 40% and expanding into the horse feed market.

- November 2021: ADM acquired Sojaprotein, strengthening its plant-based protein capabilities in animal nutrition.

- April 2022: Cargill invested USD 50 Million in R&D for animal nutrition and feeds in China, Minnesota, and the Netherlands.

Strategic Outlook for Europe Animal Feed Industry Market

The future of the European animal feed industry is promising, driven by technological advancements, evolving consumer preferences, and a growing global demand for animal protein. Strategic opportunities lie in developing sustainable and innovative feed solutions, leveraging data analytics to optimize production, and forming strategic partnerships to enhance market reach and efficiency. Companies that embrace innovation and adapt to changing market dynamics will be well-positioned to capitalize on the significant growth potential within this dynamic sector.

Europe Animal Feed Industry Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

-

2.4. Supplements

- 2.4.1. Vitamins

- 2.4.2. Amino Acid

- 2.4.3. Enzymes

- 2.4.4. Prebiotics and Probiotics

- 2.4.5. Acidifiers

- 2.4.6. Other Supplements

Europe Animal Feed Industry Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Animal Feed Industry Regional Market Share

Geographic Coverage of Europe Animal Feed Industry

Europe Animal Feed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. Growing Demand for Meat and Aquaculture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.2.4.1. Vitamins

- 5.2.4.2. Amino Acid

- 5.2.4.3. Enzymes

- 5.2.4.4. Prebiotics and Probiotics

- 5.2.4.5. Acidifiers

- 5.2.4.6. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Germany

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. Spain Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.2.4.1. Vitamins

- 6.2.4.2. Amino Acid

- 6.2.4.3. Enzymes

- 6.2.4.4. Prebiotics and Probiotics

- 6.2.4.5. Acidifiers

- 6.2.4.6. Other Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. United Kingdom Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.2.4.1. Vitamins

- 7.2.4.2. Amino Acid

- 7.2.4.3. Enzymes

- 7.2.4.4. Prebiotics and Probiotics

- 7.2.4.5. Acidifiers

- 7.2.4.6. Other Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. France Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.2.4.1. Vitamins

- 8.2.4.2. Amino Acid

- 8.2.4.3. Enzymes

- 8.2.4.4. Prebiotics and Probiotics

- 8.2.4.5. Acidifiers

- 8.2.4.6. Other Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Germany Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.2.4.1. Vitamins

- 9.2.4.2. Amino Acid

- 9.2.4.3. Enzymes

- 9.2.4.4. Prebiotics and Probiotics

- 9.2.4.5. Acidifiers

- 9.2.4.6. Other Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Russia Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes & Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.2.4.1. Vitamins

- 10.2.4.2. Amino Acid

- 10.2.4.3. Enzymes

- 10.2.4.4. Prebiotics and Probiotics

- 10.2.4.5. Acidifiers

- 10.2.4.6. Other Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Italy Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Ruminants

- 11.1.2. Poultry

- 11.1.3. Swine

- 11.1.4. Aquaculture

- 11.1.5. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Ingredient

- 11.2.1. Cereals

- 11.2.2. Cakes & Meals

- 11.2.3. By-products

- 11.2.4. Supplements

- 11.2.4.1. Vitamins

- 11.2.4.2. Amino Acid

- 11.2.4.3. Enzymes

- 11.2.4.4. Prebiotics and Probiotics

- 11.2.4.5. Acidifiers

- 11.2.4.6. Other Supplements

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Rest of Europe Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 12.1.1. Ruminants

- 12.1.2. Poultry

- 12.1.3. Swine

- 12.1.4. Aquaculture

- 12.1.5. Other Animal Types

- 12.2. Market Analysis, Insights and Forecast - by Ingredient

- 12.2.1. Cereals

- 12.2.2. Cakes & Meals

- 12.2.3. By-products

- 12.2.4. Supplements

- 12.2.4.1. Vitamins

- 12.2.4.2. Amino Acid

- 12.2.4.3. Enzymes

- 12.2.4.4. Prebiotics and Probiotics

- 12.2.4.5. Acidifiers

- 12.2.4.6. Other Supplements

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Cargill Incorporated

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Biomin

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 ForFarmers

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Nutreco NV

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BASF SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Altech

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kemin Industries Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yara International AS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ADM Animal Nutrition

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Animal Feed Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Animal Feed Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 2: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 3: Europe Animal Feed Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 5: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 6: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 8: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 9: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 12: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 14: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 15: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 17: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 18: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 20: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 21: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 24: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Animal Feed Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Europe Animal Feed Industry?

Key companies in the market include Cargill Incorporated, Biomin, ForFarmers, Nutreco NV, BASF SE, Altech, Kemin Industries Inc, Yara International AS, ADM Animal Nutrition.

3. What are the main segments of the Europe Animal Feed Industry?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 158.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

Growing Demand for Meat and Aquaculture Products.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

April 2022: Cargill invested USD 50 million towards developing R&D in China, near Elk River, Minnesota, and a facility in the Netherlands, Europe, to research and develop animal nutrition and feeds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Animal Feed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Animal Feed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Animal Feed Industry?

To stay informed about further developments, trends, and reports in the Europe Animal Feed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence