Key Insights

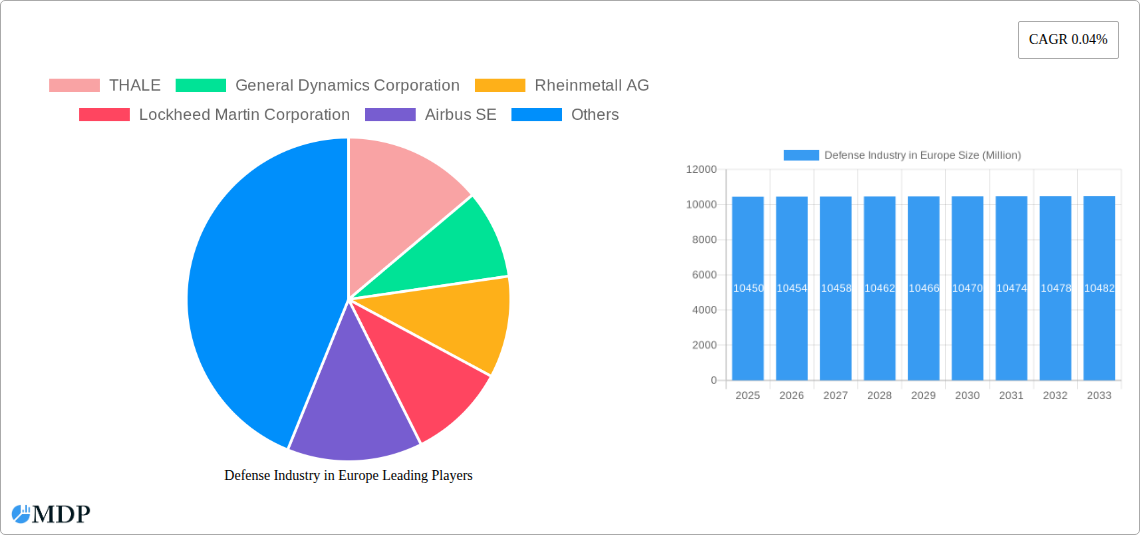

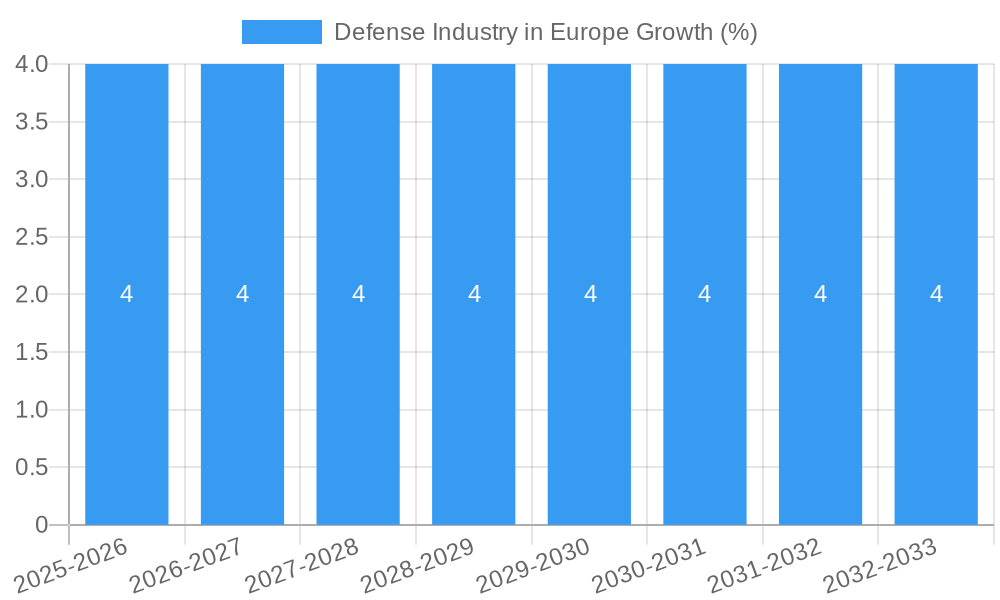

The European defense industry, valued at €10.45 billion in 2025, is projected to experience modest growth over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 0.04% indicates a relatively stable market, influenced by several factors. Geopolitical instability, particularly the ongoing conflict in Ukraine, is a significant driver, pushing nations to increase defense spending on advanced weaponry, cybersecurity enhancements, and personnel training. Technological advancements in areas like artificial intelligence (AI) and autonomous systems are also shaping the market, driving demand for sophisticated equipment and necessitating substantial investment in research and development. However, budgetary constraints within some European nations and the fluctuating global economic climate pose significant restraints on market expansion. The market is segmented by equipment type (personnel training & protection, communication, armament, transport) and platform (terrestrial, aerial, naval), with significant activity across major European countries including the United Kingdom, Germany, France, Russia, Italy, Spain, and Greece. Competition is fierce amongst major players such as Thales, General Dynamics, Rheinmetall, Lockheed Martin, Airbus, and BAE Systems, driving innovation and the constant improvement of military capabilities.

The market's relatively low CAGR reflects a mature industry characterized by ongoing modernization rather than rapid expansion. The segment focusing on personnel training and protection is likely to demonstrate stronger growth due to an increasing focus on cybersecurity and personnel readiness. The aerial and naval platforms segments are expected to maintain significant market share, driven by investments in advanced aircraft and naval vessels. Regional variations will likely persist, with countries experiencing heightened geopolitical pressures exhibiting above-average growth rates. The future trajectory of the European defense industry is intricately linked to evolving geopolitical landscapes, technological innovation, and the individual defense spending policies of European nations. Continued geopolitical uncertainty suggests that the market, while experiencing slow growth, will remain a significant area of economic and strategic investment.

Defense Industry in Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European defense industry, offering invaluable insights for stakeholders across the value chain. With a focus on market dynamics, key players, and future trends, this report is essential for strategic decision-making in this rapidly evolving sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Defense Industry in Europe Market Dynamics & Concentration

The European defense industry is characterized by a complex interplay of factors influencing market concentration, innovation, and growth. Market consolidation through mergers and acquisitions (M&A) is a significant trend, with xx Million deals recorded between 2019 and 2024. This has led to increased market share for major players like Airbus SE, BAE Systems plc, and Leonardo S p A, who collectively hold an estimated xx% market share in 2025. Innovation drivers include the ongoing need for advanced technologies in areas such as electronic warfare, cybersecurity, and unmanned systems. Stringent regulatory frameworks, including EU defense procurement directives, impact market access and competition. Furthermore, the industry faces pressure from product substitutes, necessitating continuous technological advancements and strategic partnerships. End-user trends, particularly increased defense budgets across several European nations, are key growth drivers.

- Market Concentration: Highly concentrated, with top 5 players holding xx% market share in 2025.

- M&A Activity: xx Million deals between 2019 and 2024, indicating consolidation.

- Innovation Drivers: Electronic warfare, cybersecurity, unmanned systems.

- Regulatory Frameworks: EU defense procurement directives impact market access.

- Product Substitutes: Pressure from emerging technologies and alternative solutions.

- End-User Trends: Increased defense spending in several European countries.

Defense Industry in Europe Industry Trends & Analysis

The European defense market is experiencing robust growth, driven by geopolitical instability, increased defense budgets, and modernization initiatives across multiple nations. The Compound Annual Growth Rate (CAGR) is estimated at xx% from 2025 to 2033, driven by significant investments in advanced defense systems. Technological disruptions, such as the increasing adoption of artificial intelligence (AI) and autonomous systems, are reshaping the competitive landscape. Consumer preferences are shifting towards more agile, adaptable, and networked defense solutions. Competitive dynamics are intense, with companies focusing on strategic partnerships, technology acquisitions, and product differentiation to maintain a leading edge. Market penetration of advanced technologies remains relatively low, with opportunities for growth in areas like AI and cyber defense.

Leading Markets & Segments in Defense Industry in Europe

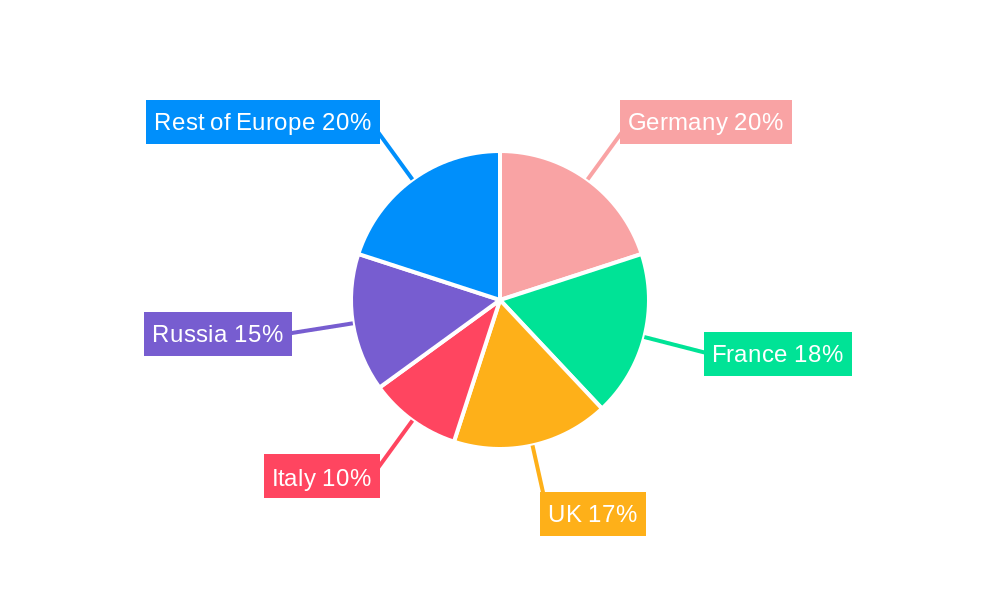

The United Kingdom, Germany, and France represent the largest national markets within the European defense industry, driven by their substantial defense budgets and robust indigenous industrial bases. The Aerial segment holds the largest market share within the Platform category, driven by investments in advanced fighter jets and unmanned aerial vehicles (UAVs). Within Equipment Types, Armament consistently demonstrates strong growth, fueled by ongoing modernization programs and the increasing demand for advanced weaponry.

- Dominant Regions: United Kingdom, Germany, France.

- Key Drivers (UK): High defense spending, strong domestic industry.

- Key Drivers (Germany): Increased defense budget, focus on modernization.

- Key Drivers (France): Significant military exports, technological advancements.

- Dominant Segment (Platform): Aerial, due to fighter jet and UAV investments.

- Dominant Segment (Equipment Type): Armament, fueled by modernization & demand.

Defense Industry in Europe Product Developments

Recent product innovations focus on enhancing lethality, survivability, and network-centric capabilities. This includes advanced sensors, AI-powered targeting systems, and improved communication networks. Competitive advantages are increasingly derived from superior technological integration and interoperability. The market favors systems with adaptability, modularity, and enhanced cyber resilience.

Key Drivers of Defense Industry in Europe Growth

Several factors fuel the growth of the European defense industry. Firstly, increasing geopolitical tensions and security concerns across the continent are driving increased defense budgets. Secondly, technological advancements, particularly in areas such as AI, robotics, and cyber warfare, are creating new market opportunities. Finally, a renewed emphasis on European defense cooperation and collaborative procurement initiatives are stimulating growth within the industry.

Challenges in the Defense Industry in Europe Market

The European defense industry faces various challenges, including stringent regulatory compliance requirements which can hinder innovation and market access. Supply chain disruptions, particularly in the wake of geopolitical events, also pose a considerable threat to timely project delivery and production. Furthermore, intense competition from both domestic and international players places pressure on profit margins and necessitates constant innovation. These factors collectively restrict the market growth.

Emerging Opportunities in Defense Industry in Europe

Significant opportunities exist for growth. The expanding use of AI and autonomous systems in defense applications presents a substantial avenue for innovation and expansion. Strategic partnerships between European nations and defense companies are opening up new avenues for collaboration and shared technology development. Finally, expanding into new markets, particularly in regions facing similar security challenges, offers avenues for expansion.

Leading Players in the Defense Industry in Europe Sector

- THALES

- General Dynamics Corporation

- Rheinmetall AG

- Lockheed Martin Corporation

- Airbus SE

- Rostec State Corporation

- RTX Corporation

- United Aircraft Corporation (PJSC UAC)

- UkrOboronProm

- Leonardo S p A

- BAE Systems plc

- Indra Sistemas S A

- Northrop Grumman Corporation

- Saab AB

Key Milestones in Defense Industry in Europe Industry

- September 2023: Indra Sistemas S.A. leads a consortium launching the REACT (Responsive Electronic Attack for Cooperative Tasks) program for EU electronic warfare capabilities against missile attacks.

- June 2023: The UK Royal Air Force receives two F-35B Lightning II aircraft from Lockheed Martin, part of a 48-aircraft order, alongside a USD 225 Million support agreement.

Strategic Outlook for Defense Industry in Europe Market

The European defense industry is poised for sustained growth driven by geopolitical instability, technological innovation, and increased defense spending. Strategic opportunities lie in developing and deploying advanced technologies, fostering international collaborations, and capitalizing on emerging market needs. The future success of industry players will hinge on adaptability, innovation, and strategic partnerships.

Defense Industry in Europe Segmentation

-

1. Equipment Type

- 1.1. Personnel Training and Protection

- 1.2. Communication

- 1.3. Armament

- 1.4. Transport

-

2. Platform

- 2.1. Terrestrial

- 2.2. Aerial

- 2.3. Naval

Defense Industry in Europe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Defense Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Naval Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Personnel Training and Protection

- 5.1.2. Communication

- 5.1.3. Armament

- 5.1.4. Transport

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Terrestrial

- 5.2.2. Aerial

- 5.2.3. Naval

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Personnel Training and Protection

- 6.1.2. Communication

- 6.1.3. Armament

- 6.1.4. Transport

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Terrestrial

- 6.2.2. Aerial

- 6.2.3. Naval

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. South America Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Personnel Training and Protection

- 7.1.2. Communication

- 7.1.3. Armament

- 7.1.4. Transport

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Terrestrial

- 7.2.2. Aerial

- 7.2.3. Naval

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Europe Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Personnel Training and Protection

- 8.1.2. Communication

- 8.1.3. Armament

- 8.1.4. Transport

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Terrestrial

- 8.2.2. Aerial

- 8.2.3. Naval

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Middle East & Africa Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Personnel Training and Protection

- 9.1.2. Communication

- 9.1.3. Armament

- 9.1.4. Transport

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Terrestrial

- 9.2.2. Aerial

- 9.2.3. Naval

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Asia Pacific Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10.1.1. Personnel Training and Protection

- 10.1.2. Communication

- 10.1.3. Armament

- 10.1.4. Transport

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Terrestrial

- 10.2.2. Aerial

- 10.2.3. Naval

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11. Germany Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 12. France Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. Italy Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Defense Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 THALE

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 General Dynamics Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Rheinmetall AG

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Lockheed Martin Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Airbus SE

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Rostec State Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 RTX Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 United Aircraft Corporation (PJSC UAC)

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 UkrOboronProm

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Leonardo S p A

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 BAE Systems plc

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Indra Sistemas S A

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Northrop Grumman Corporation

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Saab AB

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 THALE

List of Figures

- Figure 1: Global Defense Industry in Europe Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Europe Defense Industry in Europe Revenue (Million), by Country 2024 & 2032

- Figure 3: Europe Defense Industry in Europe Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Defense Industry in Europe Revenue (Million), by Equipment Type 2024 & 2032

- Figure 5: North America Defense Industry in Europe Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 6: North America Defense Industry in Europe Revenue (Million), by Platform 2024 & 2032

- Figure 7: North America Defense Industry in Europe Revenue Share (%), by Platform 2024 & 2032

- Figure 8: North America Defense Industry in Europe Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Defense Industry in Europe Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Defense Industry in Europe Revenue (Million), by Equipment Type 2024 & 2032

- Figure 11: South America Defense Industry in Europe Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 12: South America Defense Industry in Europe Revenue (Million), by Platform 2024 & 2032

- Figure 13: South America Defense Industry in Europe Revenue Share (%), by Platform 2024 & 2032

- Figure 14: South America Defense Industry in Europe Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Defense Industry in Europe Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Defense Industry in Europe Revenue (Million), by Equipment Type 2024 & 2032

- Figure 17: Europe Defense Industry in Europe Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 18: Europe Defense Industry in Europe Revenue (Million), by Platform 2024 & 2032

- Figure 19: Europe Defense Industry in Europe Revenue Share (%), by Platform 2024 & 2032

- Figure 20: Europe Defense Industry in Europe Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Defense Industry in Europe Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Defense Industry in Europe Revenue (Million), by Equipment Type 2024 & 2032

- Figure 23: Middle East & Africa Defense Industry in Europe Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 24: Middle East & Africa Defense Industry in Europe Revenue (Million), by Platform 2024 & 2032

- Figure 25: Middle East & Africa Defense Industry in Europe Revenue Share (%), by Platform 2024 & 2032

- Figure 26: Middle East & Africa Defense Industry in Europe Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Defense Industry in Europe Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Defense Industry in Europe Revenue (Million), by Equipment Type 2024 & 2032

- Figure 29: Asia Pacific Defense Industry in Europe Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 30: Asia Pacific Defense Industry in Europe Revenue (Million), by Platform 2024 & 2032

- Figure 31: Asia Pacific Defense Industry in Europe Revenue Share (%), by Platform 2024 & 2032

- Figure 32: Asia Pacific Defense Industry in Europe Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Defense Industry in Europe Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Defense Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Defense Industry in Europe Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 3: Global Defense Industry in Europe Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: Global Defense Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Defense Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Defense Industry in Europe Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 14: Global Defense Industry in Europe Revenue Million Forecast, by Platform 2019 & 2032

- Table 15: Global Defense Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Defense Industry in Europe Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 20: Global Defense Industry in Europe Revenue Million Forecast, by Platform 2019 & 2032

- Table 21: Global Defense Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Defense Industry in Europe Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 26: Global Defense Industry in Europe Revenue Million Forecast, by Platform 2019 & 2032

- Table 27: Global Defense Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Defense Industry in Europe Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 38: Global Defense Industry in Europe Revenue Million Forecast, by Platform 2019 & 2032

- Table 39: Global Defense Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Turkey Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Israel Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: GCC Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: North Africa Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East & Africa Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Defense Industry in Europe Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 47: Global Defense Industry in Europe Revenue Million Forecast, by Platform 2019 & 2032

- Table 48: Global Defense Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: ASEAN Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Oceania Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Defense Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defense Industry in Europe?

The projected CAGR is approximately 0.04%.

2. Which companies are prominent players in the Defense Industry in Europe?

Key companies in the market include THALE, General Dynamics Corporation, Rheinmetall AG, Lockheed Martin Corporation, Airbus SE, Rostec State Corporation, RTX Corporation, United Aircraft Corporation (PJSC UAC), UkrOboronProm, Leonardo S p A, BAE Systems plc, Indra Sistemas S A, Northrop Grumman Corporation, Saab AB.

3. What are the main segments of the Defense Industry in Europe?

The market segments include Equipment Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.45 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Naval Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2023: A consortium of European defense manufacturers led by Indra Sistemas S.A. launched work on an electronic warfare capability for the European Union to protect friendly aircraft against missile attacks. According to a European Defence Fund fact sheet, the Responsive Electronic Attack for Cooperative Tasks (REACT) program is intended to develop a system capable of jamming any signals used for targeting European aircraft while being able to turn off adversary electronic warfare emitters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defense Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defense Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defense Industry in Europe?

To stay informed about further developments, trends, and reports in the Defense Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence