Key Insights

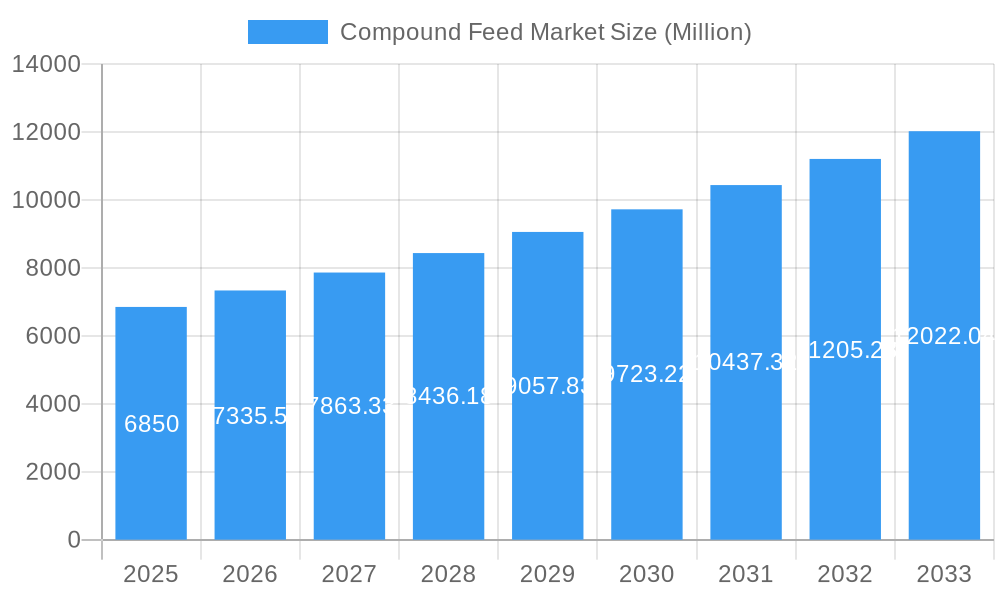

The GCC compound feed market, valued at $6.85 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by several key factors. The region's burgeoning livestock and poultry industries, particularly in Saudi Arabia and the UAE, are significantly increasing demand for efficient and high-quality compound feed. Growing consumer demand for animal protein sources is further bolstering market growth. Furthermore, advancements in feed formulation technologies, incorporating nutritional supplements to enhance animal health and productivity, contribute to market expansion. The increasing adoption of sustainable farming practices, aiming to improve feed efficiency and reduce environmental impact, also presents opportunities for specialized compound feed products. While challenges exist, such as fluctuations in raw material prices and potential regulatory changes, the overall outlook remains positive, suggesting a considerable market expansion throughout the forecast period.

Compound Feed Market Market Size (In Billion)

Segmentation within the market reveals diverse opportunities. Ruminants, poultry, and swine represent significant segments, with ruminant feed likely dominating due to the considerable size of the GCC's dairy and meat industries. Ingredient-wise, cereals, cakes & meals remain prevalent, while the growing awareness of animal nutrition is driving increased demand for specialized supplements. Key players like Parabel, Al-Sayer Group, and Agthia are well-positioned to capitalize on this growth, leveraging their established distribution networks and brand recognition. Regional variations exist, with the UAE and Saudi Arabia expected to lead market share due to their larger livestock populations and higher per capita income. However, other GCC countries will also see considerable growth driven by increasing investments in their respective agricultural sectors. The market's future hinges on continued economic growth, technological advancements, and the implementation of supportive government policies promoting sustainable agriculture and food security within the region.

Compound Feed Market Company Market Share

Compound Feed Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Compound Feed Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth opportunities. The global Compound Feed Market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Compound Feed Market Market Dynamics & Concentration

The Compound Feed Market is characterized by a moderately concentrated landscape, with key players like Parabel, Al-Sayer Group, and Agthia holding significant market share. Market concentration is influenced by factors such as economies of scale in production, access to raw materials, and strong distribution networks. Innovation, particularly in feed formulations to enhance animal health and productivity, is a key driver. Stringent regulatory frameworks regarding feed safety and composition influence market dynamics, while the availability of substitute feed ingredients impacts pricing and competitiveness. End-user trends, such as the increasing demand for sustainably produced animal protein, are shaping market demand. The historical period (2019-2024) witnessed xx M&A deals, contributing to market consolidation. The estimated market share of the top 5 players in 2025 is xx%.

- Key Factors: Economies of scale, raw material access, distribution networks, regulatory frameworks, product substitutes, and consumer preferences.

- Mergers & Acquisitions (M&A): xx M&A deals were recorded between 2019 and 2024. The forecast period (2025-2033) is expected to see xx additional deals.

Compound Feed Market Industry Trends & Analysis

The Compound Feed Market is experiencing robust growth driven by factors like rising global meat consumption, increasing demand for animal protein, and advancements in animal feed technology. Technological disruptions, such as precision feeding and the use of data analytics, are transforming the industry. Consumer preferences for ethically and sustainably sourced animal products are also influencing the market. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants. Market penetration of advanced feed technologies, such as probiotics and prebiotics, is increasing steadily. The market experienced a CAGR of xx% during the historical period (2019-2024). The estimated market size in 2025 is xx Million.

Leading Markets & Segments in Compound Feed Market

The global compound feed market is characterized by distinct regional and segment leadership. Within the Animal Type category, the Poultry segment stands out as the dominant force, fueled by the ever-increasing worldwide demand for poultry meat and eggs. This segment's growth is further propelled by advancements in poultry farming efficiency and favorable consumer preferences for protein sources. Geographically, the Asia-Pacific region commands the leading position. This is attributed to its substantial livestock population, coupled with a rapidly expanding middle class and accelerating urbanization, which collectively drive a significant surge in meat consumption and, consequently, the demand for compound feed.

- Dominant Animal Type Segment: Poultry, driven by high global demand for poultry meat and eggs. The poultry segment is projected to hold an estimated XX% market share in 2025, reflecting its unparalleled importance.

- Dominant Ingredient Segment: Cereals continue to be the cornerstone ingredient in compound feed formulations, owing to their cost-effectiveness and essential nutritional contributions. This segment is anticipated to account for an estimated XX% market share in 2025.

- Key Drivers for Poultry Dominance: The sustained dominance of the poultry segment is underpinned by robust consumer demand for affordable protein, relatively short production cycles that offer quicker returns, and the widespread adoption of efficient and scalable farming practices.

- Key Drivers for Asia-Pacific Dominance: The unparalleled growth in the Asia-Pacific region is a direct consequence of rapid economic development, the burgeoning purchasing power of an expanding middle class, and increasing urbanization, all of which contribute to a heightened demand for protein-rich diets.

Compound Feed Market Product Developments

Recent product innovations focus on improving feed efficiency, enhancing animal health, and reducing environmental impact. New feed formulations incorporate advanced ingredients like probiotics and prebiotics to enhance gut health and immunity. Companies are also developing sustainable and traceable feed solutions to meet growing consumer demand for ethically sourced animal products. These innovations offer competitive advantages by improving animal performance and reducing production costs. The market is also seeing the adoption of smart feeding technologies to optimize feed utilization and reduce waste.

Key Drivers of Compound Feed Market Growth

The Compound Feed Market is fueled by several key drivers. Firstly, the global increase in meat consumption drives the demand for animal feed. Secondly, technological advancements in feed formulation and processing enhance feed efficiency and animal productivity. Lastly, government support for the livestock industry and supportive regulatory frameworks play a crucial role.

Challenges in the Compound Feed Market Market

The compound feed market, while experiencing robust growth, is not without its hurdles. Fluctuations in raw material prices, often dictated by global agricultural yields and geopolitical factors, directly impact production costs and subsequently affect manufacturer profitability. Furthermore, the increasing global emphasis on environmental stewardship translates into stricter environmental regulations, compelling feed manufacturers to invest in and adopt more sustainable production practices and ingredients. The market also faces intense increasing competition among a growing number of feed manufacturers, which inherently puts downward pressure on pricing and necessitates a focus on cost optimization and value-added products. These interconnected challenges collectively influence the overall trajectory and growth potential of the market.

Emerging Opportunities in Compound Feed Market

Significant opportunities exist in the Compound Feed Market. The growing adoption of precision feeding technologies offers potential for enhanced feed efficiency and reduced waste. Strategic partnerships between feed manufacturers and technology providers can drive innovation. Expansion into emerging markets with high growth potential offers significant long-term growth prospects.

Leading Players in the Compound Feed Market Sector

- Parabel

- Al-Sayer Group

- Agthia

- Al Ghurair Foods Llc

- Oman Flour Mills Company

- Omani National Livestock Development Co

- Fujairah Feed Factor

- Arasco

- Delmon Poultry Company

- IFFCO

- Trouw Nutrition

Key Milestones in Compound Feed Market Industry

- 2020: Parabel revolutionized feed formulations with the introduction of a new product boasting significantly improved digestibility, enhancing nutrient absorption for livestock.

- 2022: Al-Sayer Group demonstrated its commitment to expanding its market reach and production capacity with a substantial expansion of its manufacturing facility in the strategically important Middle East region.

- 2023: Arasco proactively addressed the growing demand for eco-conscious solutions by launching a pioneering sustainable feed product line, emphasizing reduced environmental impact.

- 2024: A significant consolidation occurred with the merger of two smaller but agile feed companies, resulting in a strengthened entity with an increased collective market share and enhanced operational synergies.

Strategic Outlook for Compound Feed Market Market

The compound feed market is poised for a bright and dynamic future, offering substantial opportunities for growth and innovation. Continued technological advancements in feed formulation, production processes, and nutritional science will be pivotal in driving efficiency and developing specialized feeds. Strategic alliances and strategic partnerships, both within the supply chain and with research institutions, will foster collaboration and accelerate the development of novel solutions. Furthermore, expansion into emerging and underserved markets will unlock new revenue streams and broaden the global footprint of leading players. Companies that demonstrably prioritize sustainability through responsible sourcing, reduced environmental impact, and ethical practices, alongside a commitment to continuous innovation in product development and service delivery, are exceptionally well-positioned to capture significant and enduring market share. The market's long-term potential remains exceptionally strong, fundamentally driven by the unyielding and increasing global demand for safe, accessible, and nutritious animal protein.

Compound Feed Market Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

- 2.4. Supplements

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Oman

- 3.4. Bahrain

- 3.5. Kuwait

- 3.6. Rest of GCC Countries

Compound Feed Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Oman

- 4. Bahrain

- 5. Kuwait

- 6. Rest of GCC Countries

Compound Feed Market Regional Market Share

Geographic Coverage of Compound Feed Market

Compound Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Poultry Feed Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Oman

- 5.3.4. Bahrain

- 5.3.5. Kuwait

- 5.3.6. Rest of GCC Countries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Oman

- 5.4.4. Bahrain

- 5.4.5. Kuwait

- 5.4.6. Rest of GCC Countries

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United Arab Emirates Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. Oman

- 6.3.4. Bahrain

- 6.3.5. Kuwait

- 6.3.6. Rest of GCC Countries

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Saudi Arabia Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. Oman

- 7.3.4. Bahrain

- 7.3.5. Kuwait

- 7.3.6. Rest of GCC Countries

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Oman Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. Oman

- 8.3.4. Bahrain

- 8.3.5. Kuwait

- 8.3.6. Rest of GCC Countries

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Bahrain Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. Oman

- 9.3.4. Bahrain

- 9.3.5. Kuwait

- 9.3.6. Rest of GCC Countries

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Kuwait Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes & Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. Oman

- 10.3.4. Bahrain

- 10.3.5. Kuwait

- 10.3.6. Rest of GCC Countries

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Rest of GCC Countries Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Ruminants

- 11.1.2. Poultry

- 11.1.3. Swine

- 11.1.4. Aquaculture

- 11.1.5. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Ingredient

- 11.2.1. Cereals

- 11.2.2. Cakes & Meals

- 11.2.3. By-products

- 11.2.4. Supplements

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. United Arab Emirates

- 11.3.2. Saudi Arabia

- 11.3.3. Oman

- 11.3.4. Bahrain

- 11.3.5. Kuwait

- 11.3.6. Rest of GCC Countries

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Parabel

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Al-Sayer Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Agthia

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Al Ghurair Foods Llc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Oman Flour Mills Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Omani National Livestock Development Co

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fujairah Feed Factor

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Arasco

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Delmon Poultry Compan

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 IFFCO

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Trouw Nutrition

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Parabel

List of Figures

- Figure 1: Global Compound Feed Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United Arab Emirates Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: United Arab Emirates Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: United Arab Emirates Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 5: United Arab Emirates Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: United Arab Emirates Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: United Arab Emirates Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United Arab Emirates Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 9: United Arab Emirates Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Saudi Arabia Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: Saudi Arabia Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Saudi Arabia Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 13: Saudi Arabia Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 14: Saudi Arabia Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: Saudi Arabia Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Saudi Arabia Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Saudi Arabia Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Oman Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 19: Oman Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 20: Oman Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 21: Oman Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 22: Oman Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Oman Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Oman Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Oman Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Bahrain Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 27: Bahrain Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Bahrain Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 29: Bahrain Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Bahrain Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 31: Bahrain Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Bahrain Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Bahrain Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Kuwait Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 35: Kuwait Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 36: Kuwait Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 37: Kuwait Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 38: Kuwait Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Kuwait Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Kuwait Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Kuwait Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of GCC Countries Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 43: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 44: Rest of GCC Countries Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 45: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 46: Rest of GCC Countries Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 47: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of GCC Countries Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Compound Feed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 7: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 10: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 11: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 14: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 15: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 19: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 22: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 23: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 26: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 27: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compound Feed Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Compound Feed Market?

Key companies in the market include Parabel, Al-Sayer Group, Agthia, Al Ghurair Foods Llc, Oman Flour Mills Company, Omani National Livestock Development Co, Fujairah Feed Factor, Arasco, Delmon Poultry Compan, IFFCO, Trouw Nutrition.

3. What are the main segments of the Compound Feed Market?

The market segments include Animal Type, Ingredient, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Poultry Feed Dominates the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compound Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compound Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compound Feed Market?

To stay informed about further developments, trends, and reports in the Compound Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence