Key Insights

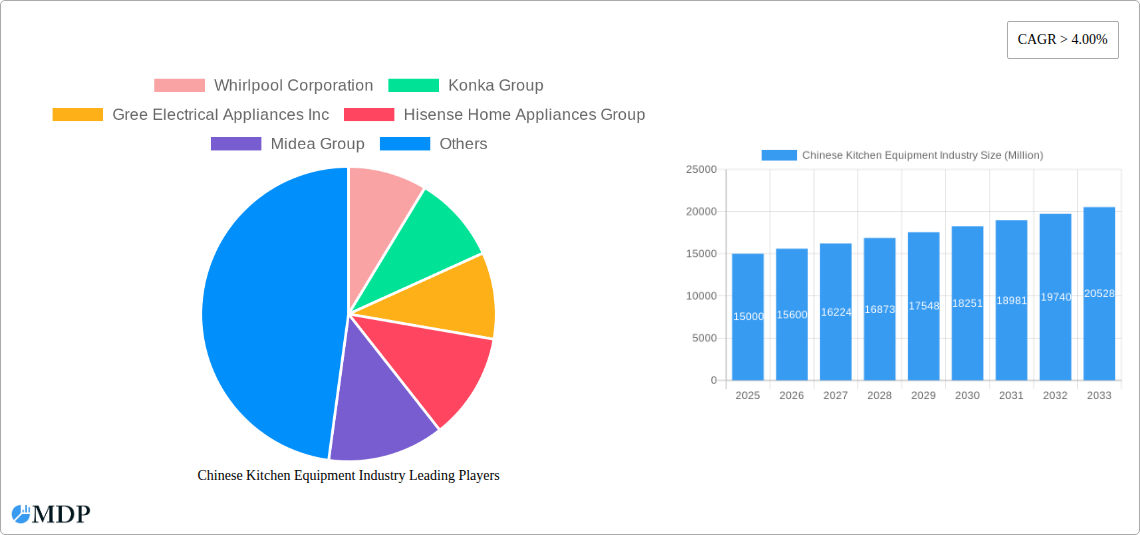

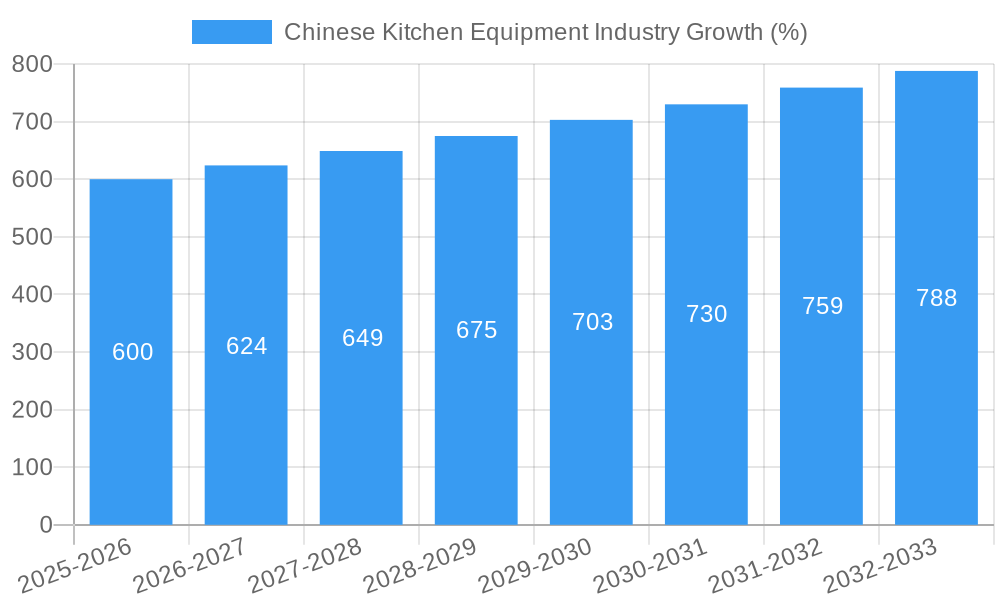

The Chinese kitchen equipment market, currently experiencing robust growth with a CAGR exceeding 4%, presents a significant opportunity for both domestic and international players. Driven by rising disposable incomes, urbanization, and a growing preference for modern, convenient kitchens, the market is projected to reach substantial value in the coming years. Key segments contributing to this growth include refrigerators and freezers, dishwashers, and microwave ovens, fueled by increasing demand from residential consumers in burgeoning urban centers. The market's expansion is further bolstered by the increasing popularity of online sales channels, providing greater accessibility and convenience to a wider consumer base. While challenges remain, such as potential supply chain disruptions and intense competition, the long-term outlook for the Chinese kitchen equipment market remains positive. Government initiatives promoting smart home technologies and energy efficiency are also expected to stimulate demand for advanced and technologically integrated appliances. The dominance of established brands like Haier, Midea, and Whirlpool, alongside the rapid ascent of emerging domestic players, suggests a dynamic and competitive landscape.

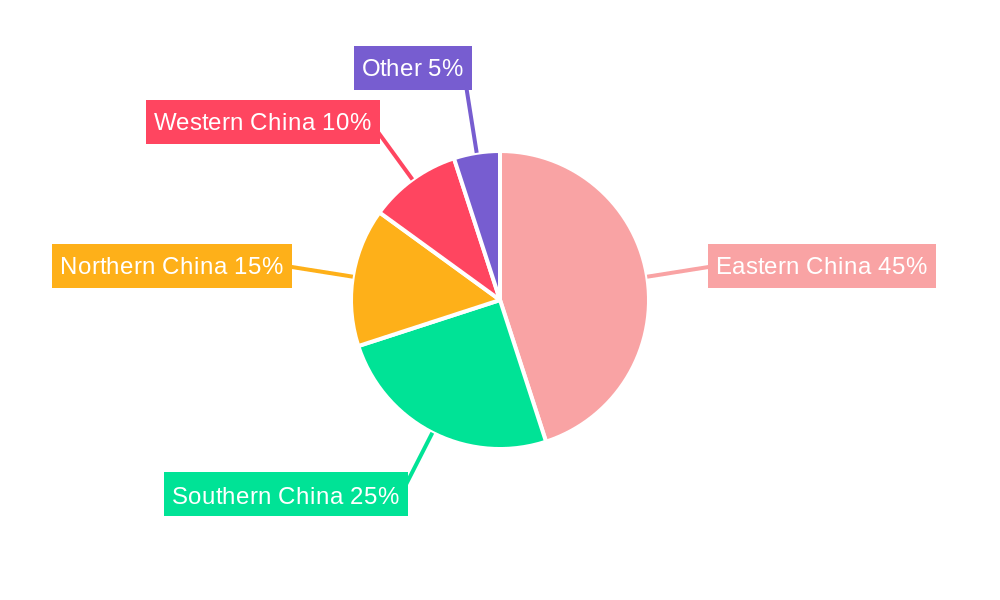

The regional distribution of the market reveals strong growth across major Chinese cities and provinces. While the North and South regions might experience slightly slower growth in comparison to the eastern coastal areas due to existing infrastructure and market saturation, the overall trend signifies a nationwide expansion of kitchen appliance ownership. Commercial segments, including restaurants and hotels, are also contributing significantly to market growth, driven by expanding hospitality and food service industries. The strategic focus on product innovation, particularly incorporating smart features and energy-efficient technologies, is proving to be a key competitive advantage, enabling manufacturers to command premium pricing and capture significant market share. Further expansion will be influenced by government policies related to energy consumption, consumer spending habits, and the evolving technological landscape of smart home integration.

Chinese Kitchen Equipment Industry Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Chinese kitchen equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report projects a market worth xx Million by 2033, revealing key trends, opportunities, and challenges shaping this dynamic sector.

Chinese Kitchen Equipment Industry Market Dynamics & Concentration

The Chinese kitchen equipment market exhibits a moderately concentrated structure, with several leading players like Midea Group, Haier Smart Home, and Whirlpool Corporation holding significant market share. However, the presence of numerous smaller players and emerging brands creates a competitive landscape. Innovation is a primary driver, fueled by advancements in smart home technology, energy efficiency, and consumer demand for convenience. The regulatory framework, including standards for safety and energy consumption, significantly influences market dynamics. Product substitutes, such as traditional cooking methods, continue to compete, particularly in lower-income segments. End-user trends show a shift toward premium appliances with smart functionalities and health-conscious features. M&A activity in the sector has been moderate in recent years, with xx major deals recorded between 2019 and 2024, mostly focused on strategic acquisitions to expand product lines or geographical reach.

- Market Concentration: Midea Group and Haier Smart Home hold an estimated combined market share of xx%, with Whirlpool Corporation at approximately xx%.

- Innovation Drivers: Smart technology integration, energy efficiency improvements, and health-focused features.

- Regulatory Framework: Stringent safety and energy efficiency standards influence product design and manufacturing.

- M&A Activity: An estimated xx major mergers and acquisitions occurred from 2019-2024.

Chinese Kitchen Equipment Industry Industry Trends & Analysis

The Chinese kitchen equipment market is experiencing robust growth, driven by rising disposable incomes, urbanization, and a growing preference for modern, convenient kitchen appliances. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033), with market penetration increasing steadily, particularly in rural areas. Technological disruptions, including the integration of AI, IoT, and cloud connectivity, are transforming the industry, creating opportunities for smart kitchen appliances with enhanced features and user experience. Consumer preferences are shifting towards energy-efficient, multi-functional appliances with advanced technologies and aesthetically pleasing designs. Competitive dynamics are characterized by intense rivalry, with established players focusing on innovation and brand building, while new entrants leverage e-commerce and direct-to-consumer strategies.

Leading Markets & Segments in Chinese Kitchen Equipment Industry

The residential segment dominates the market, accounting for approximately xx% of total sales. Within product segments, refrigerators and freezers maintain the largest share, followed by dishwashers and microwave ovens. Online distribution channels are growing rapidly, with e-commerce platforms playing a crucial role.

- Dominant Region: Eastern China demonstrates the highest market share due to higher disposable incomes and urbanization.

- Leading Product Segment: Refrigerators and Freezers, driven by increasing demand for larger capacity and advanced features.

- Key Drivers for Residential Segment: Rising disposable incomes, increased urbanization, and a preference for convenience.

- Key Drivers for Online Distribution: The rapid expansion of e-commerce and its convenience for consumers.

Chinese Kitchen Equipment Industry Product Developments

Recent years have witnessed significant product innovation, with the integration of smart technology, such as Wi-Fi connectivity, voice control, and app-based control, becoming prevalent. Energy-efficient designs, coupled with improved functionality and aesthetics, are gaining traction. The market is also witnessing a rise in multi-functional appliances that combine various functions into a single unit, catering to space constraints and consumer preferences for convenience. The introduction of air fryers with advanced features like ingredient viewing windows and precise temperature control reflects the trend towards healthy cooking. This trend reflects market demand for healthier and more convenient cooking methods.

Key Drivers of Chinese Kitchen Equipment Industry Growth

Several factors contribute to the growth of the Chinese kitchen equipment industry:

- Rising Disposable Incomes: Increased purchasing power allows consumers to invest in premium kitchen appliances.

- Technological Advancements: Smart home integration and innovative features drive demand.

- Government Initiatives: Policies promoting energy efficiency and smart home technologies support the sector's growth.

Challenges in the Chinese Kitchen Equipment Industry Market

The Chinese kitchen equipment industry faces certain challenges:

- Intense Competition: The presence of numerous players creates a competitive landscape.

- Supply Chain Disruptions: Global supply chain volatility can impact production and pricing.

- Fluctuating Raw Material Costs: Changes in raw material prices affect production costs and profitability.

Emerging Opportunities in Chinese Kitchen Equipment Industry

The Chinese kitchen equipment market presents promising opportunities for growth. The adoption of smart kitchen technologies is expected to accelerate, driving demand for interconnected appliances and sophisticated software solutions. Strategic partnerships between manufacturers and technology companies can unlock innovative solutions and create new market segments. Expansion into rural areas and untapped markets presents significant growth potential.

Leading Players in the Chinese Kitchen Equipment Industry Sector

- Whirlpool Corporation

- Konka Group

- Gree Electrical Appliances Inc

- Hisense Home Appliances Group

- Midea Group

- TCL Corporation

- Haier Smart Home

- Xiaomi Smart Home

- Hangzhou Miyoung Smart Home Co Ltd

- LG Electronics

Key Milestones in Chinese Kitchen Equipment Industry Industry

- September 2022: Xiaomi launched the MIJIA Cooking Robot, introducing multi-functional smart cooking capabilities.

- August 2023: Xiaomi launched the Mijia 5.5L Visual Air Fryer, showcasing advanced features and health-conscious design.

Strategic Outlook for Chinese Kitchen Equipment Industry Market

The Chinese kitchen equipment market is poised for sustained growth, driven by technological innovation, rising consumer demand, and favorable government policies. Strategic partnerships, investments in R&D, and expansion into new markets will be crucial for success. The focus on smart, energy-efficient, and health-conscious appliances will define future market trends.

Chinese Kitchen Equipment Industry Segmentation

-

1. Product

- 1.1. Refrigerators and Freezers

- 1.2. Dishwashers

- 1.3. Mixers and Grinders

- 1.4. Microwave Ovens

- 1.5. Grills and Roasters

- 1.6. Water Purifiers

- 1.7. Other Kitchen Appliances

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Multi- Brand Stores

- 3.2. Exclusive Stores

- 3.3. Online

- 3.4. Other Distribution Channel

Chinese Kitchen Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Kitchen Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances

- 3.3. Market Restrains

- 3.3.1. High power consumption from smart home appliances; Limited spaces in households for appliances

- 3.4. Market Trends

- 3.4.1. Smart Kitchen Appliances are driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators and Freezers

- 5.1.2. Dishwashers

- 5.1.3. Mixers and Grinders

- 5.1.4. Microwave Ovens

- 5.1.5. Grills and Roasters

- 5.1.6. Water Purifiers

- 5.1.7. Other Kitchen Appliances

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi- Brand Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Refrigerators and Freezers

- 6.1.2. Dishwashers

- 6.1.3. Mixers and Grinders

- 6.1.4. Microwave Ovens

- 6.1.5. Grills and Roasters

- 6.1.6. Water Purifiers

- 6.1.7. Other Kitchen Appliances

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Multi- Brand Stores

- 6.3.2. Exclusive Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Refrigerators and Freezers

- 7.1.2. Dishwashers

- 7.1.3. Mixers and Grinders

- 7.1.4. Microwave Ovens

- 7.1.5. Grills and Roasters

- 7.1.6. Water Purifiers

- 7.1.7. Other Kitchen Appliances

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Multi- Brand Stores

- 7.3.2. Exclusive Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Refrigerators and Freezers

- 8.1.2. Dishwashers

- 8.1.3. Mixers and Grinders

- 8.1.4. Microwave Ovens

- 8.1.5. Grills and Roasters

- 8.1.6. Water Purifiers

- 8.1.7. Other Kitchen Appliances

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Multi- Brand Stores

- 8.3.2. Exclusive Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Refrigerators and Freezers

- 9.1.2. Dishwashers

- 9.1.3. Mixers and Grinders

- 9.1.4. Microwave Ovens

- 9.1.5. Grills and Roasters

- 9.1.6. Water Purifiers

- 9.1.7. Other Kitchen Appliances

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Multi- Brand Stores

- 9.3.2. Exclusive Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Refrigerators and Freezers

- 10.1.2. Dishwashers

- 10.1.3. Mixers and Grinders

- 10.1.4. Microwave Ovens

- 10.1.5. Grills and Roasters

- 10.1.6. Water Purifiers

- 10.1.7. Other Kitchen Appliances

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Multi- Brand Stores

- 10.3.2. Exclusive Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 USA

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 France

- 12.1.3 Italy

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Australia

- 13.1.4 India

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Saudi Arabia

- 14.1.2 Egypt

- 14.1.3 UAE

- 14.1.4 Rest of Middle East and Africa

- 15. South America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Argentina

- 15.1.2 Colombia

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Whirlpool Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Konka Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Gree Electrical Appliances Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Hisense Home Appliances Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Midea Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 TCL Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Haier Smart Home

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Xiaomi Smart Home

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Hangzhou Miyoung Smart Home Co Ltd*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 LG Electronics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global Chinese Kitchen Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: North America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 21: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 22: South America Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 23: South America Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 24: South America Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: South America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 29: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 30: Europe Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 31: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 32: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 45: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 46: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 47: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 48: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 49: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 50: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: USA Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Egypt Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: UAE Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Argentina Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 34: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Brazil Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Argentina Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of South America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 47: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 49: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: United Kingdom Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Germany Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Spain Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Russia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Benelux Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Nordics Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 61: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 62: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Turkey Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: GCC Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: North Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: South Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 70: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 71: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 72: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 73: China Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: India Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Japan Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: South Korea Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: ASEAN Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Oceania Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Rest of Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Kitchen Equipment Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Chinese Kitchen Equipment Industry?

Key companies in the market include Whirlpool Corporation, Konka Group, Gree Electrical Appliances Inc, Hisense Home Appliances Group, Midea Group, TCL Corporation, Haier Smart Home, Xiaomi Smart Home, Hangzhou Miyoung Smart Home Co Ltd*List Not Exhaustive, LG Electronics.

3. What are the main segments of the Chinese Kitchen Equipment Industry?

The market segments include Product, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances.

6. What are the notable trends driving market growth?

Smart Kitchen Appliances are driving the growth of the market.

7. Are there any restraints impacting market growth?

High power consumption from smart home appliances; Limited spaces in households for appliances.

8. Can you provide examples of recent developments in the market?

August 2023: Xiamoi launched The Mijia 5.5L Visual Air Fryer, which comes with a host of features designed to elevate the cooking experience. Its standout feature is the 6.8-inch ingredient viewing window, allowing users to monitor their dishes without interrupting the cooking process. The appliance supports efficient oil removal and no-flip cooking techniques, ensuring convenient and healthier meals. The device also features a circular OLED display, which shows the temperature, timer, and different modes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Kitchen Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Kitchen Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Kitchen Equipment Industry?

To stay informed about further developments, trends, and reports in the Chinese Kitchen Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence