Key Insights

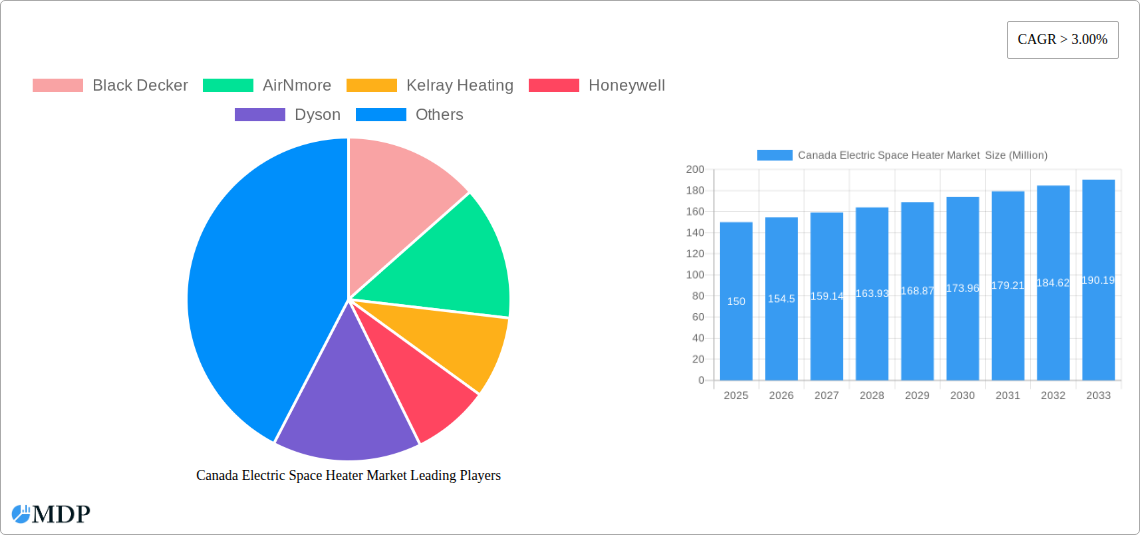

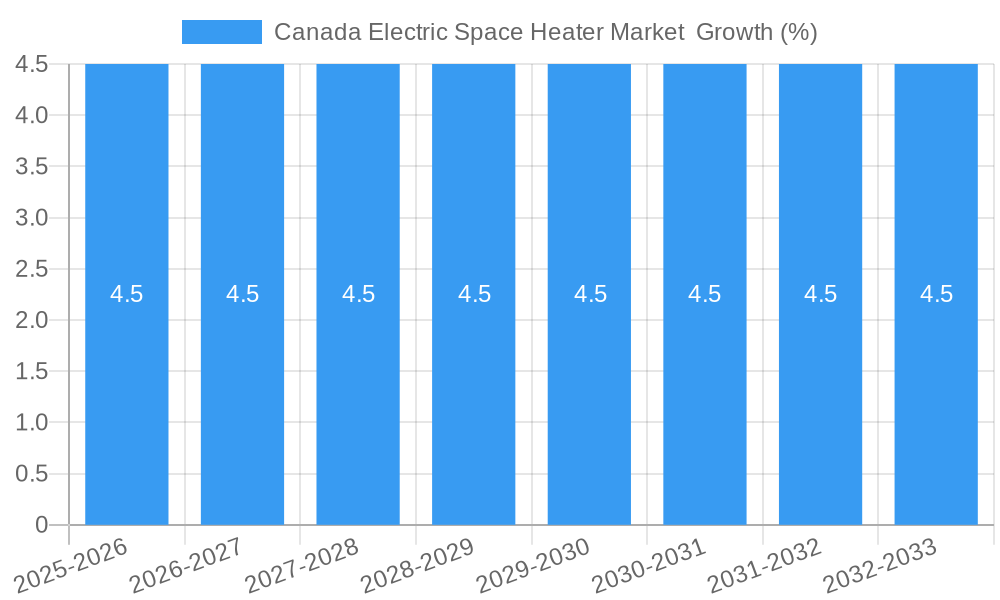

The Canadian electric space heater market, valued at approximately $150 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 3% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing energy costs and concerns about climate change are prompting homeowners and businesses to seek efficient supplemental heating solutions, leading to higher demand for electric space heaters. The growing popularity of smart home technology is also contributing to market growth, with consumers increasingly adopting smart, energy-efficient models offering features like programmable thermostats and remote control capabilities. Furthermore, the market is segmented by heater type (convector, radiant), application (residential, commercial), and distribution channel (online, offline), presenting diverse opportunities for manufacturers. The rise of e-commerce further boosts the online segment's expansion. However, the market faces challenges, including potential competition from other heating systems (natural gas, heat pumps) and concerns about energy consumption. Nevertheless, the market is anticipated to maintain a positive trajectory, driven by technological advancements, increasing awareness of energy efficiency, and the expanding smart home market.

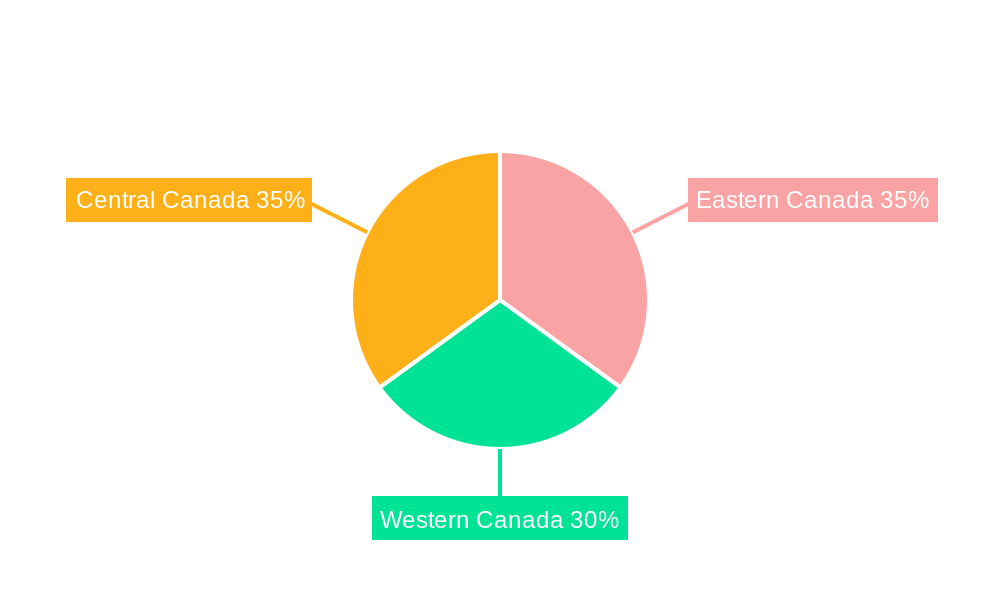

Regional variations exist within Canada, with higher adoption rates expected in regions with colder climates, such as Eastern and Western Canada. The presence of established players like Black+Decker, Honeywell, and Dyson, alongside emerging brands, indicates a competitive yet dynamic landscape. Convector heaters are likely to maintain a dominant market share owing to their affordability and widespread availability. However, the increasing demand for energy efficiency could lead to the higher adoption of radiant heaters in the coming years. The market's growth trajectory is projected to be influenced by factors including government incentives for energy-efficient heating, technological innovations in heater design, and changes in consumer preferences for smart home devices. The continued expansion of online retail channels will also contribute significantly to the market's future growth and accessibility across all regions of Canada.

Canada Electric Space Heater Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada electric space heater market, offering valuable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future growth potential. The report covers key segments including convector and radiant heaters, residential and commercial applications, and online and offline distribution channels. Leading players such as Black Decker, AirNmore, Kelray Heating, Honeywell, Dyson, Envi Heater, Brant Radiant Heaters Limited, Veito, Ouellet Canada, and ICON are analyzed, revealing market share, competitive strategies, and growth trajectories. Download this essential resource to gain a competitive edge in this dynamic market.

Canada Electric Space Heater Market Market Dynamics & Concentration

The Canadian electric space heater market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors such as brand recognition, distribution network strength, and technological innovation. The market is experiencing a wave of innovation, driven by the demand for energy-efficient and smart heating solutions. Regulatory frameworks, such as energy efficiency standards, play a crucial role in shaping market dynamics. Product substitutes, including gas heaters and heat pumps, present competitive pressure. However, the growing preference for convenient and cost-effective electric heating solutions fuels market growth. End-user trends, notably a preference for smart home technology and eco-friendly products, influence product development and marketing strategies. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with approximately xx M&A deals recorded between 2019 and 2024. This resulted in a xx% change in market concentration. The market share of the top 5 players is estimated at xx% in 2025.

Canada Electric Space Heater Market Industry Trends & Analysis

The Canada electric space heater market is projected to witness a CAGR of xx% during the forecast period (2025-2033), driven by several key factors. Increasing urbanization and rising disposable incomes are boosting demand for comfortable home environments. Technological advancements, particularly in smart heating technology, are creating opportunities for innovative product offerings. Consumer preferences are shifting towards energy-efficient and user-friendly heaters. The market penetration of smart electric heaters is expected to reach xx% by 2033, compared to xx% in 2025. This growth is fueled by the integration of smart home features and voice control capabilities, enhancing convenience and energy management. However, intense competition among established and emerging players is creating pressure on pricing and profit margins. The market is also influenced by fluctuating energy prices and government policies aimed at promoting energy efficiency.

Leading Markets & Segments in Canada Electric Space Heater Market

The residential segment dominates the Canada electric space heater market, accounting for approximately xx% of total sales in 2025. This is primarily driven by the increasing number of households and the rising demand for efficient and affordable heating solutions in residential settings. The convector heater type holds a larger market share compared to radiant heaters, due to its affordability and widespread availability. Online distribution channels are experiencing rapid growth, facilitated by the increasing popularity of e-commerce.

Key Drivers for Residential Segment:

- Growing urbanization and household formations.

- Rising disposable incomes.

- Preference for convenient and energy-efficient heating solutions.

Key Drivers for Convector Heaters:

- Lower cost compared to radiant heaters.

- Wider availability across various retail channels.

Key Drivers for Online Distribution:

- Convenience and ease of purchase.

- Wider product selection and competitive pricing.

Ontario and Quebec are the leading provinces for electric space heater sales, driven by factors such as higher population density, colder climates, and strong residential construction activity. The commercial segment is also showing potential, driven by the demand for energy-efficient heating solutions in offices, retail spaces, and other commercial establishments.

Canada Electric Space Heater Market Product Developments

Recent years have witnessed significant innovation in electric space heater technology. The introduction of smart heaters with app-based controls, voice assistant integration (e.g., Alexa and Google Home compatibility), and energy-monitoring features is transforming the market. Manufacturers are also focusing on enhancing energy efficiency through advancements in heating element technology and improved thermal insulation. These innovations are catering to the growing consumer preference for smart home technology and energy-conscious products, leading to improved market fit and competitive advantages. The emphasis on energy efficiency aligns with government regulations promoting sustainable practices.

Key Drivers of Canada Electric Space Heater Market Growth

The growth of the Canada electric space heater market is fueled by several key factors. Rising energy costs are driving the adoption of energy-efficient models. Government initiatives aimed at improving energy efficiency are also creating a conducive market environment. Technological advancements, particularly in smart heating technology, are leading to increased product innovation and consumer demand. Furthermore, increasing urbanization and a growing middle class are boosting the overall demand for comfortable and affordable heating solutions.

Challenges in the Canada Electric Space Heater Market Market

The market faces several challenges, including increasing competition from alternative heating technologies such as heat pumps and gas heaters. Supply chain disruptions caused by global events can lead to price volatility and product shortages. Stringent energy efficiency standards can increase manufacturing costs and restrict product availability. Fluctuations in energy prices impact consumer purchasing decisions and affect overall market demand.

Emerging Opportunities in Canada Electric Space Heater Market

The integration of smart technology, including AI and IoT capabilities, presents significant opportunities for market expansion. Strategic partnerships between manufacturers and smart home technology providers can enhance market reach and product innovation. Expanding into niche markets such as commercial spaces and specialized heating applications, like outdoor heaters, also offers growth potential.

Leading Players in the Canada Electric Space Heater Market Sector

- Black Decker

- AirNmore

- Kelray Heating

- Honeywell

- Dyson

- Envi Heater

- Brant Radiant Heaters Limited

- Veito

- Ouellet Canada

- ICON

Key Milestones in Canada Electric Space Heater Market Industry

- January 2022: Kelray Heating, an Auckland-based infrared heater manufacturer, expanded its operations into Canada. This expansion broadened product availability and increased competition.

- September 2023: Envi Heater Inc. launched the Smart Envi, an app-controlled electric panel heater. This highlights the increasing adoption of smart home technologies in the space heater market.

Strategic Outlook for Canada Electric Space Heater Market Market

The Canada electric space heater market presents significant growth potential driven by technological innovation, rising energy costs, and a growing focus on energy efficiency. Strategic partnerships, product diversification, and investments in research and development will be crucial for sustained growth. Manufacturers should prioritize energy efficiency, smart home integration, and affordability to appeal to environmentally conscious consumers. Expanding into new segments and exploring export opportunities can further enhance market reach and profitability.

Canada Electric Space Heater Market Segmentation

-

1. Types

- 1.1. Convector Heater

- 1.2. Radiant Heater

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution

- 3.1. Online

- 3.2. Offline

Canada Electric Space Heater Market Segmentation By Geography

- 1. Canada

Canada Electric Space Heater Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electric space heaters are often preferred over other heating methods due to their lack of emissions and improved indoor air quality. This awareness is contributing to the growing adoption of electric heaters in residential and commercial settings.

- 3.3. Market Restrains

- 3.3.1 The market for electric space heaters faces competition from alternative heating solutions

- 3.3.2 such as natural gas heaters

- 3.3.3 propane heaters

- 3.3.4 and oil heaters. These alternatives may offer lower operating costs in some regions

- 3.4. Market Trends

- 3.4.1 The trend towards smart home technology is influencing the electric space heater market. Smart electric heaters with features such as Wi-Fi connectivity

- 3.4.2 remote control

- 3.4.3 and integration with home automation systems are becoming increasingly popular.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Electric Space Heater Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Convector Heater

- 5.1.2. Radiant Heater

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Eastern Canada Canada Electric Space Heater Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Electric Space Heater Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Electric Space Heater Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Black Decker

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 AirNmore

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kelray Heating

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Honeywell

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Dyson

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Envi Heater

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Brant Radiant Heaters Limited

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Veito

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ouellet Canada

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 ICON

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Black Decker

List of Figures

- Figure 1: Canada Electric Space Heater Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Electric Space Heater Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Electric Space Heater Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Electric Space Heater Market Revenue Million Forecast, by Types 2019 & 2032

- Table 3: Canada Electric Space Heater Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Canada Electric Space Heater Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 5: Canada Electric Space Heater Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Electric Space Heater Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Electric Space Heater Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Electric Space Heater Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Electric Space Heater Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Electric Space Heater Market Revenue Million Forecast, by Types 2019 & 2032

- Table 11: Canada Electric Space Heater Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Canada Electric Space Heater Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 13: Canada Electric Space Heater Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Electric Space Heater Market ?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Canada Electric Space Heater Market ?

Key companies in the market include Black Decker, AirNmore, Kelray Heating, Honeywell, Dyson, Envi Heater, Brant Radiant Heaters Limited, Veito, Ouellet Canada, ICON.

3. What are the main segments of the Canada Electric Space Heater Market ?

The market segments include Types, Application, Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Electric space heaters are often preferred over other heating methods due to their lack of emissions and improved indoor air quality. This awareness is contributing to the growing adoption of electric heaters in residential and commercial settings..

6. What are the notable trends driving market growth?

The trend towards smart home technology is influencing the electric space heater market. Smart electric heaters with features such as Wi-Fi connectivity. remote control. and integration with home automation systems are becoming increasingly popular..

7. Are there any restraints impacting market growth?

The market for electric space heaters faces competition from alternative heating solutions. such as natural gas heaters. propane heaters. and oil heaters. These alternatives may offer lower operating costs in some regions.

8. Can you provide examples of recent developments in the market?

January 2022: Auckland infrared heater manufacturer Kelray Heating expanded its operations into Canada. Kelray has been supplying Kiwi home and business owners with heating solutions for the past three decades. The heaters were to be manufactured in New Zealand and assembled in Canada and are covered by a five-year warranty for an outdoor electric infrared heater.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Electric Space Heater Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Electric Space Heater Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Electric Space Heater Market ?

To stay informed about further developments, trends, and reports in the Canada Electric Space Heater Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence