Key Insights

The Business Aviation MRO (Maintenance, Repair, and Overhaul) market is projected to reach $90.85 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.75% from a base year of 2024. This growth is propelled by an expanding global business jet fleet and the aging of existing aircraft, which necessitates more frequent and comprehensive maintenance, repair, and overhaul services. Key market segments include engine, component, interior, airframe, and field maintenance. Engine MRO is anticipated to lead due to the inherent complexity and cost of engine upkeep, driven by advancements in engine technology and the pursuit of optimal performance. Component MRO, covering a vast array of parts and systems, will also be a significant contributor. Interior and airframe MRO services will benefit from an increasing demand for refurbishments and upgrades. The field maintenance segment is set to expand in tandem with the growing business aviation fleet, offering convenient on-site solutions. The competitive landscape is characterized by the presence of major global players such as Rolls-Royce and Pratt & Whitney, alongside specialized MRO providers. Strategic alliances, innovation in MRO technologies, and geographic expansion are vital for sustained market penetration and success.

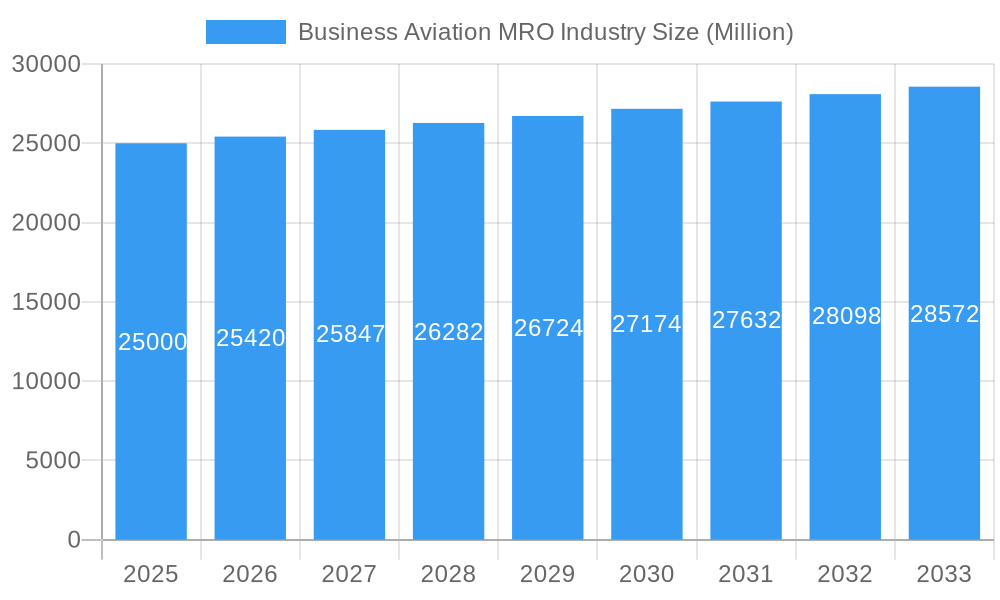

Business Aviation MRO Industry Market Size (In Billion)

Geographically, North America and Europe dominate the Business Aviation MRO market, reflecting the high concentration of business jet operations in these regions. However, the Asia-Pacific region is poised for the most rapid expansion, fueled by increasing disposable incomes, robust business growth, and a rising demand for air travel. Key market challenges include the volatility of fuel prices, potential economic downturns impacting business travel expenditure, and the unwavering requirement for stringent safety and regulatory adherence. Furthermore, the growing emphasis on sustainability and environmental compliance will drive MRO providers to adopt greener operational practices. Despite these challenges, the Business Aviation MRO market offers a resilient investment prospect with predictable growth trajectories.

Business Aviation MRO Industry Company Market Share

Business Aviation MRO Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Business Aviation MRO (Maintenance, Repair, and Overhaul) industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data and actionable strategies for success. The global Business Aviation MRO market is projected to reach xx Million by 2033, demonstrating significant growth potential.

Business Aviation MRO Industry Market Dynamics & Concentration

The Business Aviation MRO market is characterized by a dynamic and evolving landscape, exhibiting moderate concentration. It features a blend of established, large-scale MRO providers alongside a vibrant ecosystem of numerous specialized and agile smaller firms. Market leadership is consistently influenced by a combination of factors, including cutting-edge technological capabilities, the breadth and depth of service portfolios (encompassing Engine MRO, Component MRO, Interior MRO, Airframe MRO, and comprehensive Field Maintenance solutions), expansive geographic coverage, and the cultivation of robust, long-term client relationships.

The market's inherent dynamics are significantly shaped by the following critical influences:

- Innovation Drivers: The relentless pursuit of technological advancements is a pivotal force. This includes the integration of sophisticated predictive maintenance algorithms, the widespread adoption of digital solutions for streamlined operations and enhanced data analysis, and the growing imperative for sustainable MRO practices, all of which are fundamentally reshaping the industry's operational paradigms.

- Regulatory Frameworks: The business aviation sector operates under exceptionally stringent safety regulations and demanding compliance requirements. These frameworks not only dictate operational procedures but also have a direct impact on operational expenditures and the very nature of service delivery.

- Product Substitutes & Innovations: The ongoing development of novel materials, advanced repair methodologies, and innovative service solutions continuously presents both significant opportunities for differentiation and potential challenges to traditional MRO provider models.

- End-User Trends: A pronounced and growing demand for MRO services characterized by exceptional quality, enhanced operational efficiency, and a keen focus on cost-effectiveness is a primary catalyst for market expansion. Furthermore, the increasing prevalence of fractional ownership models and the sustained growth of charter services are key indicators of evolving end-user preferences that fuel MRO demand.

- M&A Activities: Strategic consolidation through mergers and acquisitions remains a prevalent and effective strategy for expanding market share, diversifying service capabilities, and achieving economies of scale. Over the historical period from 2019 to 2024, an estimated xx M&A deals were recorded, contributing to an approximate xx% increase in overall market concentration.

Business Aviation MRO Industry Industry Trends & Analysis

The Business Aviation MRO industry is currently experiencing a phase of robust and sustained growth, propelled by a confluence of interconnected factors. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the comprehensive forecast period spanning from 2025 to 2033. A detailed analysis reveals several pivotal trends that are actively shaping the trajectory of this industry:

- Market Growth Drivers: The escalating number of business jets actively in operation worldwide, coupled with the inherent maintenance needs of an aging global fleet that necessitates more frequent and intensive upkeep, stands as a primary engine of market growth. Concurrently, continuous technological advancements are instrumental in augmenting operational efficiency and significantly reducing aircraft downtime. The global market size was valued at an estimated xx Million in 2025.

- Technological Disruptions: The proactive and increasing adoption of transformative digital technologies, most notably AI-powered predictive maintenance systems, is revolutionizing operational efficiency and driving substantial cost optimization. This technological infusion is leading to palpable improvements in inventory management, a marked reduction in maintenance-related delays, and a heightened level of overall safety. The market penetration of these advanced technologies is experiencing an impressive annual growth rate of approximately xx%.

- Consumer Preferences: Aircraft operators are placing an ever-increasing premium on services that offer faster turnaround times, demonstrably higher quality repairs, and demonstrably cost-effective solutions. This persistent demand is a powerful impetus for ongoing innovation within MRO service offerings and the development of highly specialized, tailored solutions.

- Competitive Dynamics: The industry is presently characterized by an intensification of competitive pressures. This heightened competition is compelling MRO providers to strategically invest in state-of-the-art technologies, proactively expand their service portfolios to meet diverse client needs, and forge strategic partnerships to not only maintain but also enhance their competitive positioning in the market.

Leading Markets & Segments in Business Aviation MRO Industry

The North American region holds the dominant position in the Business Aviation MRO market, accounting for xx% of the global market share in 2025. This dominance is attributed to several factors:

- Key Drivers in North America:

- Large business jet fleet size.

- Well-established MRO infrastructure.

- Stringent regulatory environment fostering high-quality services.

- Favorable economic conditions.

While North America leads, the Asia-Pacific region is experiencing the fastest growth, driven by increasing business jet ownership and economic expansion. In terms of MRO types:

- Engine MRO: High maintenance costs and specialized expertise make it a significant segment.

- Airframe MRO: Significant revenue contributor due to the complexity of airframe maintenance.

- Component MRO: Growing in importance due to the increasing reliance on sophisticated avionics and systems.

- Interior MRO: A high-value segment driven by customization and refurbishment demands.

- Field Maintenance: Becoming more sophisticated with the introduction of mobile maintenance units and advanced diagnostic tools.

The detailed dominance analysis reveals a clear trend toward regional specialization. For example, while North America excels in all segments, the Asia-Pacific region shows faster growth primarily in Component and Engine MRO.

Business Aviation MRO Industry Product Developments

Significant innovations are transforming the Business Aviation MRO landscape. This includes the deployment of advanced diagnostics, predictive maintenance analytics, and the integration of IoT devices to monitor aircraft health in real-time. These advancements result in improved maintenance efficiency, reduced downtime, and enhanced operational safety, giving companies a competitive advantage in securing contracts and attracting customers. The adoption of sustainable practices is also gaining traction.

Key Drivers of Business Aviation MRO Industry Growth

The sustained and significant growth observed within the Business Aviation MRO industry can be attributed to a multifaceted array of key drivers:

- Continuous technological advancements, particularly in the realms of predictive maintenance analytics and sophisticated digital solutions that enhance operational visibility and control.

- The progressively aging global fleet of business aviation aircraft, which inherently necessitates more frequent and comprehensive maintenance interventions.

- A burgeoning demand from operators for MRO services that deliver superior quality, significantly reduced turnaround times, and increasingly specialized and customized solutions.

- Favorable economic conditions prevalent in key global markets, which stimulate increased business jet sales and consequently, higher utilization rates, leading to greater MRO demand.

- The ever-evolving landscape of regulatory requirements, which consistently drives the demand for MRO services that ensure strict adherence to all safety and operational compliance standards.

Challenges in the Business Aviation MRO Industry Market

The industry faces various challenges:

- Regulatory Hurdles: Compliance with stringent safety regulations and evolving certification processes can increase operational costs.

- Supply Chain Issues: Disruptions in the global supply chain impact the availability of parts and materials, leading to delays and increased costs.

- Competitive Pressures: Intense competition drives down pricing and necessitates continuous investments in technology and expertise to maintain competitiveness. This has led to a xx% decrease in average profit margins over the last 5 years.

Emerging Opportunities in Business Aviation MRO Industry

The long-term growth trajectory of the Business Aviation MRO industry is being significantly propelled by a range of exciting emerging opportunities:

The widespread adoption of advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) is proving to be a game-changer, enabling highly accurate predictive maintenance and substantially improving operational efficiency while minimizing costly downtime. Furthermore, the cultivation of strategic partnerships between MRO providers and original aircraft manufacturers (OEMs) is facilitating a more seamless and integrated deployment of new technologies and a broader spectrum of services. The strategic expansion into nascent and rapidly growing emerging markets, characterized by expanding business aviation fleets, presents substantial untapped growth potential for forward-thinking MRO organizations.

Leading Players in the Business Aviation MRO Industry Sector

- Western Aircraft Inc

- Rolls-Royce plc

- General Dynamics Corporation

- Pratt & Whitney (Raytheon Technologies Corporation)

- Atlas Air Service AG

- ExecuJet Aviation Group AG

- Lufthansa Technik AG

- DC Aviation GmbH

- Bombardier Inc

- Flying Colours Corp

- Constant Aviation LLC

- Comlux Aviation Services LLC

Key Milestones in Business Aviation MRO Industry Industry

- December 2022: Embraer-X partnered with Pulse Aviation for Beacon, a maintenance coordination platform improving aircraft return-to-service times. This showcases the industry's shift towards digital solutions.

- March 2022: Embraer's service agreement with Avantto highlights the growing importance of comprehensive maintenance programs for predictable budgeting.

- December 2021: ExecuJet's new MRO facility in Malaysia signals expansion in the Asia-Pacific region, signifying growth in this key market.

Strategic Outlook for Business Aviation MRO Industry Market

The Business Aviation MRO market is strategically positioned for continued and robust growth, primarily fueled by the synergistic forces of relentless technological innovation, the formation of impactful strategic partnerships, and the proactive expansion into new and developing market territories. The accelerating adoption of digital technologies, coupled with a pronounced emphasis on environmentally sustainable practices and the implementation of highly efficient maintenance solutions, will undoubtedly create significant and valuable opportunities for MRO providers. These opportunities will empower them to not only elevate their existing service offerings but also to solidify and expand their competitive advantages. The long-term growth prospects for the industry remain exceptionally strong, with particular optimism surrounding regions experiencing rapid economic expansion and a corresponding increase in the size and operational tempo of their business jet fleets.

Business Aviation MRO Industry Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Component MRO

- 1.3. Interior MRO

- 1.4. Airframe MRO

- 1.5. Field Maintenance

Business Aviation MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Business Aviation MRO Industry Regional Market Share

Geographic Coverage of Business Aviation MRO Industry

Business Aviation MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Components MRO Segment of the Market is Expected to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Component MRO

- 5.1.3. Interior MRO

- 5.1.4. Airframe MRO

- 5.1.5. Field Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Component MRO

- 6.1.3. Interior MRO

- 6.1.4. Airframe MRO

- 6.1.5. Field Maintenance

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Component MRO

- 7.1.3. Interior MRO

- 7.1.4. Airframe MRO

- 7.1.5. Field Maintenance

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Component MRO

- 8.1.3. Interior MRO

- 8.1.4. Airframe MRO

- 8.1.5. Field Maintenance

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Component MRO

- 9.1.3. Interior MRO

- 9.1.4. Airframe MRO

- 9.1.5. Field Maintenance

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Component MRO

- 10.1.3. Interior MRO

- 10.1.4. Airframe MRO

- 10.1.5. Field Maintenance

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Western Aircraft Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rolls-Royce pl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pratt & Whitney (Raytheon Technologies Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atlas Air Service AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ExecuJet Aviation Group AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lufthansa Technik AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DC Aviation GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flying Colours Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Constant Aviation LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Comlux Aviation Services LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Western Aircraft Inc

List of Figures

- Figure 1: Global Business Aviation MRO Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 3: North America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 4: North America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 7: Europe Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 8: Europe Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 11: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 12: Asia Pacific Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 15: Latin America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 16: Latin America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 19: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 20: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Global Business Aviation MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 4: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 8: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 10: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 12: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Aviation MRO Industry?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Business Aviation MRO Industry?

Key companies in the market include Western Aircraft Inc, Rolls-Royce pl, General Dynamics Corporation, Pratt & Whitney (Raytheon Technologies Corporation), Atlas Air Service AG, ExecuJet Aviation Group AG, Lufthansa Technik AG, DC Aviation GmbH, Bombardier Inc, Flying Colours Corp, Constant Aviation LLC, Comlux Aviation Services LLC.

3. What are the main segments of the Business Aviation MRO Industry?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.85 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Components MRO Segment of the Market is Expected to Witness Highest Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Embraer-X signed a contract with Pulse Aviation for the use of Beacon, the maintenance coordination platform connecting resources and professionals for faster return-to-service aircraft. Pulse Aviation, a Florida-based business aviation company that offers MRO services, will use Beacon to improve maintenance coordination, make it easier to communicate about maintenance events involving all different types of aircraft models, foster teamwork, enhance knowledge sharing, and speed up workflows related to maintenance events.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Aviation MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Aviation MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Aviation MRO Industry?

To stay informed about further developments, trends, and reports in the Business Aviation MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence