Key Insights

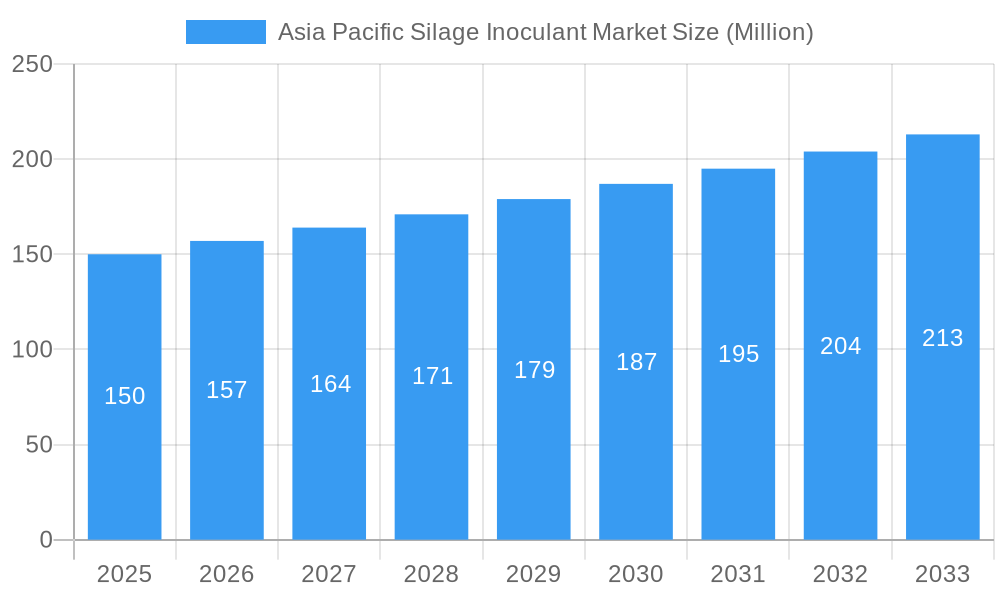

The Asia-Pacific silage inoculant market, valued at approximately $150 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.60% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for high-quality animal feed, particularly in rapidly developing economies like China and India, is boosting silage production. Improved livestock farming practices and a focus on enhancing feed efficiency are driving adoption of silage inoculants. Secondly, the growing awareness among farmers regarding the benefits of improved silage fermentation – leading to enhanced nutrient preservation and reduced spoilage – is further stimulating market growth. The shift towards sustainable and efficient agricultural practices aligns perfectly with the functionality of silage inoculants, contributing to their rising popularity. Finally, technological advancements in inoculant formulations, including the development of multi-strain inoculants tailored to specific crop types and regional climates, are enhancing their efficacy and expanding their application across various segments within the market, such as cereals and pulses.

Asia Pacific Silage Inoculant Market Market Size (In Million)

However, market growth is not without its challenges. The price volatility of raw materials used in inoculant production and potential fluctuations in agricultural commodity prices pose some restraints. Furthermore, a lack of awareness about the benefits of silage inoculants in certain regions of the Asia-Pacific market, particularly among smallholder farmers, presents an opportunity for targeted education and outreach programs. The market is segmented by inoculant type (homo-fermenter and hetero-fermenter), product form (wet and dry), and application (cereals, pulses, and other crops). Major players, including Mole Valley Farmers Ltd, Nutrec, Biomin, DuPont, Cargill Inc, and others, are actively competing to capture market share through product innovation and strategic partnerships. The significant growth potential of this market in the Asia-Pacific region, particularly in countries with expanding livestock industries, promises attractive opportunities for both established players and emerging businesses.

Asia Pacific Silage Inoculant Market Company Market Share

Asia Pacific Silage Inoculant Market Report: 2019-2033

Uncover lucrative growth opportunities in the booming Asia Pacific silage inoculant market. This comprehensive report provides an in-depth analysis of market dynamics, trends, leading players, and future prospects from 2019 to 2033. Benefit from actionable insights to navigate this dynamic sector and make informed strategic decisions. This report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Asia Pacific Silage Inoculant Market Dynamics & Concentration

The Asia Pacific silage inoculant market is experiencing moderate concentration, with key players holding significant market share. Mole Valley Farmers Ltd, Nutrec, Biomin, DuPont, Cargill Inc, Micron Bio-Systems, Lallemand Animal Nutrition, Volac International Limited, ADM Animal Nutrition, and Pearce Group of Companies are shaping the competitive landscape. Innovation in inoculant formulations, driven by advancements in microbial technology and enhanced preservation, is a major growth driver. Stringent regulatory frameworks concerning feed safety and quality are also influencing market dynamics. Product substitutes, such as chemical preservatives, pose a challenge, though the growing preference for natural and sustainable feed solutions favors silage inoculants. End-user trends reveal a shift towards improved feed efficiency and animal health, boosting market demand. M&A activity has been moderate, with approximately xx deals recorded between 2019 and 2024, resulting in a shifting market share distribution among key players. Market share data for the top five players in 2025 is estimated as follows:

- Mole Valley Farmers Ltd: xx%

- Nutrec: xx%

- Biomin: xx%

- DuPont: xx%

- Cargill Inc: xx%

Asia Pacific Silage Inoculant Market Industry Trends & Analysis

The Asia Pacific silage inoculant market is experiencing significant growth, propelled by several key factors. Rising livestock populations, particularly in rapidly developing economies, are driving increased demand for high-quality silage. Technological advancements leading to improved inoculant efficacy, enhanced preservation, and better nutrient utilization are also contributing to market expansion. Consumer preferences are increasingly shifting towards natural and sustainable feed solutions, benefiting the adoption of silage inoculants over chemical alternatives. The competitive landscape is dynamic, with companies focusing on product innovation, strategic partnerships, and geographic expansion to gain a competitive edge. The market is further segmented by type (homo-fermenter and hetero-fermenter), product form (wet and dry), and application (cereals, pulses, and other crops). The market is expected to grow at a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Technological disruptions, such as the use of advanced microbial strains and precision fermentation techniques, are further accelerating market growth.

Leading Markets & Segments in Asia Pacific Silage Inoculant Market

Within the Asia Pacific region, [Country X] is currently the dominant market for silage inoculants, driven by factors such as:

- High livestock density: The region possesses a significantly large livestock population.

- Government support for agriculture: Favorable agricultural policies support silage production.

- Favorable climatic conditions: Suitable conditions for silage production in specific regions.

The analysis further highlights the dominance of the Homo-fermenter type of silage inoculant, owing to its established effectiveness and widespread acceptance among farmers. In terms of product form, dry silage inoculants hold a larger market share due to their convenient storage and handling characteristics. Finally, Cereals constitute the primary application segment for silage inoculants, reflective of the predominant crop cultivation patterns in the region. The detailed dominance analysis reveals a strong correlation between livestock density, agricultural policies, and market share across different segments. For instance, countries with robust policies promoting sustainable agriculture exhibit a higher market penetration rate for silage inoculants.

Asia Pacific Silage Inoculant Market Product Developments

Recent product developments are focused on enhancing the efficacy of silage inoculants. This involves the development of advanced microbial strains with improved fermentation characteristics, resulting in better silage quality and enhanced nutrient preservation. The use of advanced technologies like precision fermentation is also emerging as a significant trend. These new inoculants offer enhanced performance, improved shelf life, and tailored solutions for different crop types, ultimately improving the overall market fit.

Key Drivers of Asia Pacific Silage Inoculant Market Growth

Several key drivers are propelling the growth of the Asia Pacific silage inoculant market. Firstly, the rising livestock population and growing demand for high-quality feed are major contributors. Secondly, the increasing awareness among farmers regarding the benefits of improved silage quality, such as enhanced feed efficiency and reduced feed wastage, is fueling market expansion. Technological advancements resulting in the development of more efficient and effective inoculant formulations further contribute to market growth. Lastly, supportive government policies promoting sustainable agriculture and livestock farming are creating a favorable environment for the wider adoption of silage inoculants.

Challenges in the Asia Pacific Silage Inoculant Market

Despite its growth potential, the Asia Pacific silage inoculant market faces several challenges. The fluctuating prices of raw materials impact production costs, affecting market profitability. Limited awareness among farmers in some regions regarding the benefits of silage inoculants also hinders market penetration. Further, the presence of substitute products, such as chemical preservatives, creates competition. These factors, combined with complex regulatory hurdles and inconsistent supply chains in certain regions, contribute to a less than optimal market scenario. These challenges collectively result in an estimated xx% reduction in market potential each year.

Emerging Opportunities in Asia Pacific Silage Inoculant Market

The Asia Pacific silage inoculant market presents promising opportunities for long-term growth. Expanding into untapped markets, strategic partnerships with agricultural companies and farmers, and developing customized inoculants to address specific crop and climate conditions are crucial. Investing in research and development to enhance inoculant efficacy and sustainability further provides significant growth prospects. The development and adoption of new technologies such as precision fermentation will offer even greater efficiency and effectiveness of inoculants in the future.

Leading Players in the Asia Pacific Silage Inoculant Market Sector

Key Milestones in Asia Pacific Silage Inoculant Market Industry

- 2020: Launch of a new homo-fermenter inoculant by [Company Name], significantly improving silage fermentation efficiency.

- 2022: Acquisition of [Company A] by [Company B], expanding market reach and product portfolio.

- 2023: Introduction of a novel dry inoculant formulation with enhanced shelf life by [Company Name], improving product accessibility for farmers.

- 2024: [Country X] government implements new regulations regarding feed safety standards, impacting market dynamics.

Strategic Outlook for Asia Pacific Silage Inoculant Market

The Asia Pacific silage inoculant market is poised for substantial growth over the next decade. Continued innovation in inoculant formulations, coupled with increasing awareness among farmers regarding the benefits of improved silage quality, will be key drivers. Expansion into untapped markets, strategic alliances, and the development of tailor-made solutions are crucial for capturing market share. Investing in research and development to ensure sustainability and enhance inoculant efficiency will further strengthen market positioning. The future looks bright for companies that proactively adapt to the changing market dynamics and capitalize on the growing demand for high-quality animal feed.

Asia Pacific Silage Inoculant Market Segmentation

-

1. Type

- 1.1. Homo-fermenter

- 1.2. Hetero-fermenter

-

2. Product Form

- 2.1. Wet

- 2.2. Dry

-

3. Application

- 3.1. Cereals

- 3.2. Pulses

- 3.3. Other Crops

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Australia

- 4.5. Rest of Asia Pacific

Asia Pacific Silage Inoculant Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Silage Inoculant Market Regional Market Share

Geographic Coverage of Asia Pacific Silage Inoculant Market

Asia Pacific Silage Inoculant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Livestock Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Homo-fermenter

- 5.1.2. Hetero-fermenter

- 5.2. Market Analysis, Insights and Forecast - by Product Form

- 5.2.1. Wet

- 5.2.2. Dry

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Cereals

- 5.3.2. Pulses

- 5.3.3. Other Crops

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Homo-fermenter

- 6.1.2. Hetero-fermenter

- 6.2. Market Analysis, Insights and Forecast - by Product Form

- 6.2.1. Wet

- 6.2.2. Dry

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Cereals

- 6.3.2. Pulses

- 6.3.3. Other Crops

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Homo-fermenter

- 7.1.2. Hetero-fermenter

- 7.2. Market Analysis, Insights and Forecast - by Product Form

- 7.2.1. Wet

- 7.2.2. Dry

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Cereals

- 7.3.2. Pulses

- 7.3.3. Other Crops

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Homo-fermenter

- 8.1.2. Hetero-fermenter

- 8.2. Market Analysis, Insights and Forecast - by Product Form

- 8.2.1. Wet

- 8.2.2. Dry

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Cereals

- 8.3.2. Pulses

- 8.3.3. Other Crops

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia Pacific Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Homo-fermenter

- 9.1.2. Hetero-fermenter

- 9.2. Market Analysis, Insights and Forecast - by Product Form

- 9.2.1. Wet

- 9.2.2. Dry

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Cereals

- 9.3.2. Pulses

- 9.3.3. Other Crops

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Homo-fermenter

- 10.1.2. Hetero-fermenter

- 10.2. Market Analysis, Insights and Forecast - by Product Form

- 10.2.1. Wet

- 10.2.2. Dry

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Cereals

- 10.3.2. Pulses

- 10.3.3. Other Crops

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mole Valley Farmers Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nutrec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biomin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cargill Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Micron Bio-Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lallemand Animal Nutrition

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Volac International Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ADM Animal Nutrition

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pearce Group of Companies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mole Valley Farmers Ltd

List of Figures

- Figure 1: Asia Pacific Silage Inoculant Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Silage Inoculant Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 3: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 8: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 13: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 18: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 23: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Product Form 2020 & 2033

- Table 28: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Silage Inoculant Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Silage Inoculant Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Asia Pacific Silage Inoculant Market?

Key companies in the market include Mole Valley Farmers Ltd, Nutrec, Biomin, DuPont, Cargill Inc, Micron Bio-Systems, Lallemand Animal Nutrition, Volac International Limited, ADM Animal Nutrition, Pearce Group of Companies.

3. What are the main segments of the Asia Pacific Silage Inoculant Market?

The market segments include Type, Product Form, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Livestock Production.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Silage Inoculant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Silage Inoculant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Silage Inoculant Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Silage Inoculant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence