Key Insights

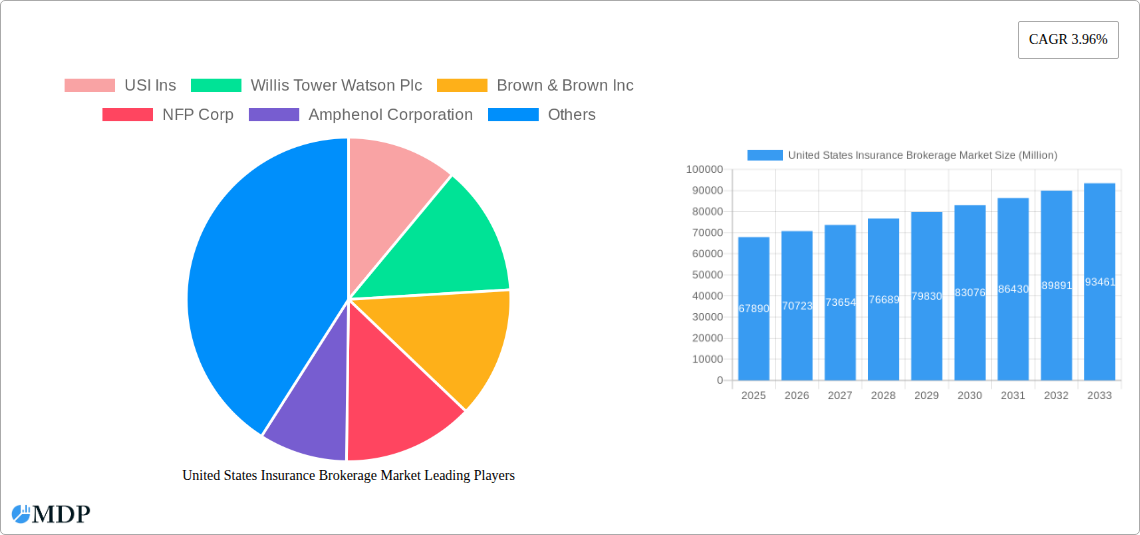

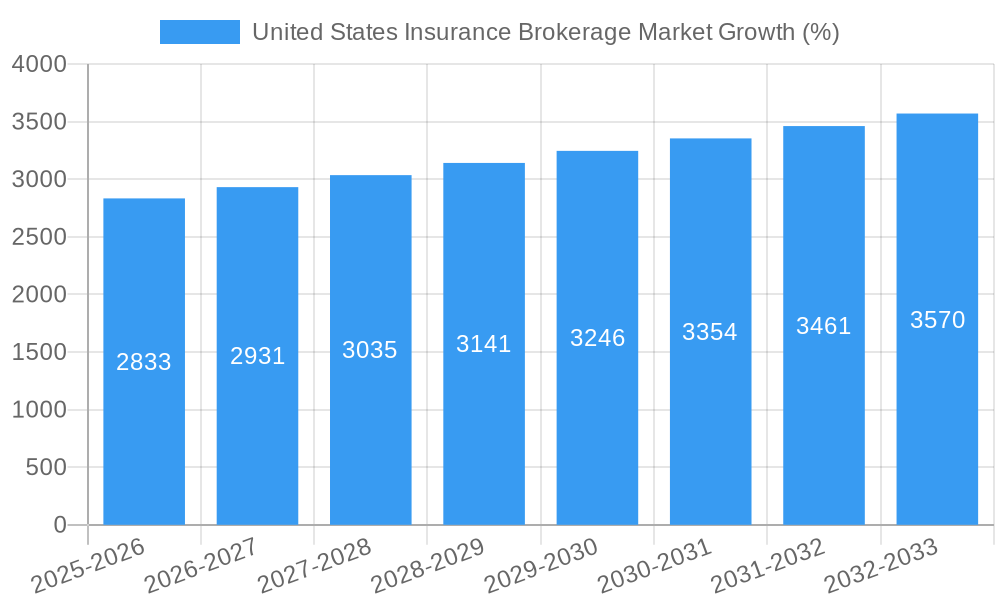

The United States insurance brokerage market, valued at $67.89 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing complexity of insurance products and the rising demand for specialized risk management solutions are fueling the need for professional brokerage services. Furthermore, the growing adoption of technology, such as Insurtech solutions and data analytics, is enhancing efficiency and improving customer experience, attracting more businesses and individuals to utilize brokerage services. Consolidation within the industry, with larger brokerages acquiring smaller firms, is also contributing to market growth, leading to increased market share for dominant players like Aon, Marsh & McLennan, and Willis Towers Watson. While regulatory changes and economic fluctuations pose potential restraints, the overall market outlook remains positive, supported by a consistent CAGR of 3.96% from 2025 to 2033. The market is segmented by insurance type (life insurance, property & casualty insurance) and brokerage type (retail, wholesale), offering diverse opportunities for growth across different niches. The strong presence of established players, alongside emerging Insurtech companies, signifies a dynamic and competitive market landscape.

The significant growth in the U.S. insurance brokerage market is further fueled by the increasing demand for tailored insurance solutions across various sectors. Businesses, particularly in high-risk industries, are increasingly relying on brokers to navigate complex insurance policies and secure optimal coverage. The rise of cyber risks and other emerging threats further necessitates the expertise of brokers in risk assessment and mitigation. Moreover, the shift towards digital channels and the increasing adoption of online platforms for insurance transactions are reshaping the brokerage landscape. Retail brokerage is experiencing significant growth due to direct customer interaction, while wholesale brokerage benefits from serving independent agents and insurers. This diverse segment composition contributes to the market's overall resilience and projected sustained expansion throughout the forecast period. Competition among established players and the emergence of new entrants will continue to drive innovation and enhance the quality of services available to consumers.

United States Insurance Brokerage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States insurance brokerage market, encompassing market dynamics, industry trends, leading segments, key players, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is essential for insurance professionals, investors, and stakeholders seeking actionable insights into this dynamic market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Insurance Brokerage Market Market Dynamics & Concentration

The US insurance brokerage market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is driven by strategic mergers and acquisitions (M&A) activities, as larger firms consolidate their position and expand their service offerings. Between 2019 and 2024, the market witnessed approximately xx M&A deals, with the top 5 players accounting for approximately xx% of the market share in 2024. Innovation is a key driver, with advancements in technology leading to improved risk assessment, claims processing, and customer service. Regulatory changes, particularly those impacting data privacy and cybersecurity, are also shaping market dynamics. The market faces competition from alternative risk transfer mechanisms and the increasing adoption of Insurtech solutions. End-user trends, including a growing demand for customized insurance solutions and digital platforms, further influence market growth.

- Market Share (2024): Top 5 players – xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: AI-powered risk assessment, digital distribution channels, personalized insurance products.

- Regulatory Landscape: Focus on data privacy (e.g., CCPA, GDPR implications), cybersecurity regulations.

United States Insurance Brokerage Market Industry Trends & Analysis

The US insurance brokerage market is experiencing robust growth, driven by several factors. The increasing prevalence of complex risks, coupled with the need for specialized insurance solutions, fuels demand for professional brokerage services. Technological disruptions, such as the rise of Insurtech firms and the adoption of digital platforms, are transforming the industry, improving efficiency and customer experience. Consumer preferences are shifting towards personalized and digital-first insurance solutions, demanding innovation from brokers. The competitive landscape is intensely competitive, with large global players and niche specialists vying for market share. The market exhibits significant growth potential due to factors such as the growing middle class, increasing awareness of risk management, and the expanding scope of insurance products.

- CAGR (2025-2033): xx%

- Market Penetration (2024): xx%

Leading Markets & Segments in United States Insurance Brokerage Market

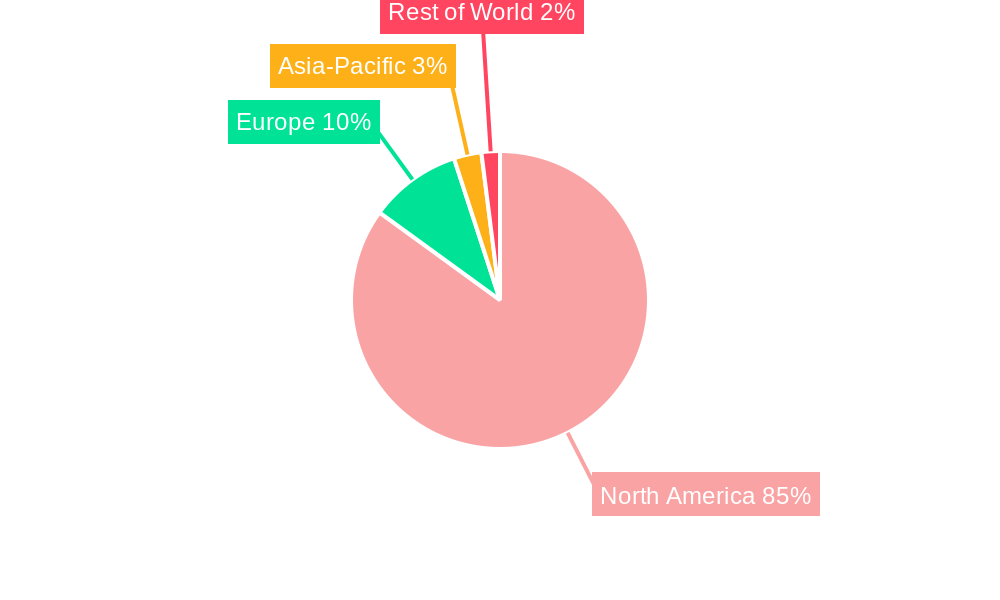

The Property & Casualty (P&C) insurance segment dominates the US insurance brokerage market, driven by the extensive need for coverage across various industries. The retail brokerage channel holds a larger market share than wholesale brokerage, reflecting the high demand for personalized insurance solutions from individual consumers and small businesses. Geographically, the market is concentrated in densely populated areas with robust economic activity.

Key Drivers by Segment:

- Property & Casualty Insurance: High demand for liability, commercial, and personal lines insurance.

- Life Insurance: Growing awareness of life insurance's financial protection benefits.

- Retail Brokerage: Demand for personalized services from individual customers and SMBs.

- Wholesale Brokerage: Focus on large corporate clients and complex risk management needs.

Dominance Analysis:

The dominance of the P&C segment reflects the breadth of risks faced by businesses and individuals in the US economy. Similarly, retail brokerage benefits from serving a vast customer base. The geographical concentration aligns with population density and economic activity.

United States Insurance Brokerage Market Product Developments

Recent product innovations in the US insurance brokerage market include the development of customized insurance solutions based on AI-powered risk assessment and the implementation of digital platforms that streamline insurance purchasing and claims management. These advancements are enabling brokers to cater to the evolving needs of consumers and businesses, leading to improved efficiency and better customer service. This allows brokers to differentiate themselves through improved customer experience and specialized service offerings.

Key Drivers of United States Insurance Brokerage Market Growth

Several factors are driving the growth of the US insurance brokerage market. Technological advancements like AI and machine learning enable more accurate risk assessment and personalized solutions. Economic factors, such as a growing middle class and increasing business activity, are driving demand for insurance coverage. A supportive regulatory environment, encouraging competition and innovation, also plays a role.

Challenges in the United States Insurance Brokerage Market Market

The US insurance brokerage market faces several challenges. Intense competition from established players and emerging Insurtech firms puts pressure on margins. Regulatory changes related to data privacy and cybersecurity pose compliance costs and operational complexities. Supply chain disruptions can impact the timely delivery of insurance services, potentially impacting customer satisfaction.

Emerging Opportunities in United States Insurance Brokerage Market

The market presents several opportunities. Strategic partnerships with Insurtech companies offer access to advanced technologies and expanded market reach. Expansion into underserved markets can create new revenue streams. The increasing adoption of digital platforms provides opportunities for brokers to enhance customer engagement and improve efficiency.

Leading Players in the United States Insurance Brokerage Market Sector

- USI Ins

- Willis Towers Watson Plc

- Brown & Brown Inc

- NFP Corp

- Amphenol Corporation

- Aon Plc

- Ameritrust Group Inc

- Arthur J Gallagher & Co

- Hub International Ltd

- Marsh & Mclennan Companies Inc

Key Milestones in United States Insurance Brokerage Market Industry

- June 2023: Marsh McLennan Agency acquires SOLV Risk Solutions, LLC, expanding its presence in Texas and enhancing its service offerings.

- March 2022: Aon Plc acquires Tyche, an actuarial software platform, enhancing its technological capabilities and client service.

Strategic Outlook for United States Insurance Brokerage Market Market

The US insurance brokerage market holds significant long-term growth potential. Strategic partnerships, technological innovation, and expansion into new markets will be crucial for success. Brokers who adapt to evolving consumer preferences, embrace technology, and effectively manage regulatory compliance will be best positioned to capitalize on future growth opportunities.

United States Insurance Brokerage Market Segmentation

-

1. Insurance Type

- 1.1. Life Insurance

- 1.2. Property & Casualty Insurance

-

2. Brokerage Type

- 2.1. Retail Brokerage

- 2.2. Wholesale Brokerage

United States Insurance Brokerage Market Segmentation By Geography

- 1. United States

United States Insurance Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Increasing Merger & Acquisition Deals in Insurance Brokerage Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Insurance Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.2. Property & Casualty Insurance

- 5.2. Market Analysis, Insights and Forecast - by Brokerage Type

- 5.2.1. Retail Brokerage

- 5.2.2. Wholesale Brokerage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 USI Ins

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Willis Tower Watson Plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Brown & Brown Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NFP Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amphenol Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aon Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ameritrust Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arthur J Gallagher & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hub International Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marsh & Mclennan Companies Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 USI Ins

List of Figures

- Figure 1: United States Insurance Brokerage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Insurance Brokerage Market Share (%) by Company 2024

List of Tables

- Table 1: United States Insurance Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Insurance Brokerage Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: United States Insurance Brokerage Market Revenue Million Forecast, by Brokerage Type 2019 & 2032

- Table 4: United States Insurance Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Insurance Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Insurance Brokerage Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 7: United States Insurance Brokerage Market Revenue Million Forecast, by Brokerage Type 2019 & 2032

- Table 8: United States Insurance Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Insurance Brokerage Market?

The projected CAGR is approximately 3.96%.

2. Which companies are prominent players in the United States Insurance Brokerage Market?

Key companies in the market include USI Ins, Willis Tower Watson Plc, Brown & Brown Inc, NFP Corp, Amphenol Corporation, Aon Plc, Ameritrust Group Inc, Arthur J Gallagher & Co, Hub International Ltd, Marsh & Mclennan Companies Inc.

3. What are the main segments of the United States Insurance Brokerage Market?

The market segments include Insurance Type, Brokerage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Merger & Acquisition Deals in Insurance Brokerage Market.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Marsh McLennan Agency, a subsidiary of Marsh, announced the acquisition of SOLV Risk Solutions, LLC, a leading independent agency based in Austin, Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Insurance Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Insurance Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Insurance Brokerage Market?

To stay informed about further developments, trends, and reports in the United States Insurance Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence