Key Insights

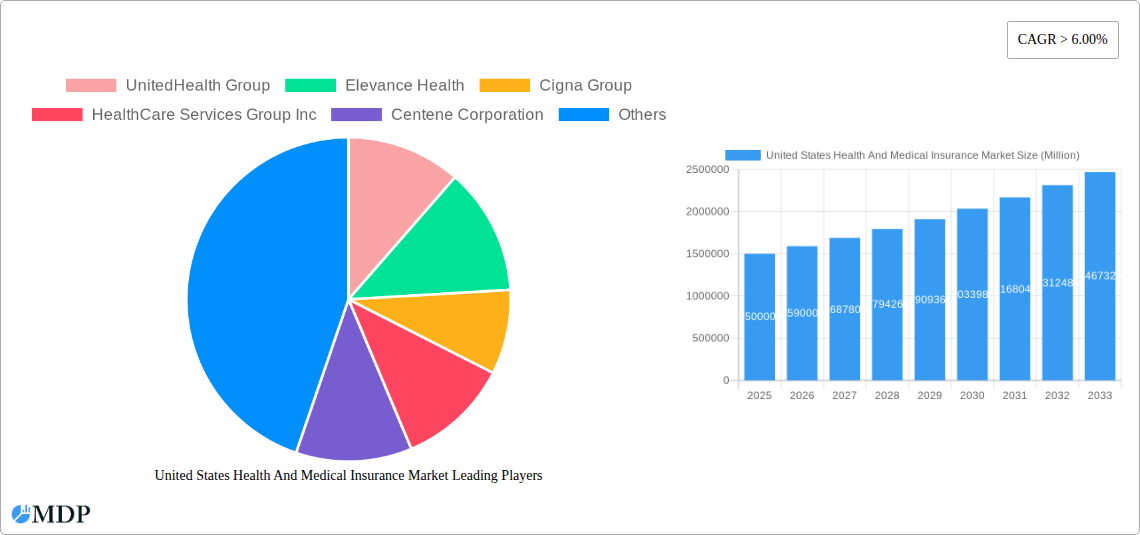

The United States Health and Medical Insurance Market, a substantial sector valued at $1.5 trillion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. The aging population, increasing prevalence of chronic diseases like diabetes and heart disease, and rising healthcare costs are significantly contributing factors. Furthermore, the growing adoption of technologically advanced healthcare solutions, such as telehealth and remote patient monitoring, is driving market growth. Government initiatives aimed at improving healthcare access and affordability, while complex and sometimes contradictory, also play a role in shaping the market. Increased consumer awareness of health and wellness and a greater demand for comprehensive coverage are also boosting market demand. However, the market faces constraints such as the high cost of premiums, limited insurance coverage for specific treatments, and regulatory complexities. The market is segmented based on various factors, including type of insurance (private vs. public), coverage type (individual vs. employer-sponsored), and service type (hospitalization, outpatient care, pharmaceuticals). Major players like UnitedHealth Group, Elevance Health, Cigna Group, and others fiercely compete within this lucrative landscape, constantly adapting to evolving market dynamics and consumer preferences.

United States Health And Medical Insurance Market Market Size (In Million)

The market's growth trajectory is expected to remain strong throughout the forecast period. The increasing emphasis on preventive healthcare and the expansion of value-based care models are likely to further propel market growth. However, potential future challenges include managing healthcare inflation, navigating evolving payment models, and ensuring equitable access to care for all segments of the population. Continued innovation in healthcare technology, coupled with effective policy reforms, will be crucial for ensuring the sustainable and inclusive growth of the US Health and Medical Insurance Market. Competition among existing players and potential entrants will intensify, necessitating strategic adjustments and a focus on delivering superior value and customer experience.

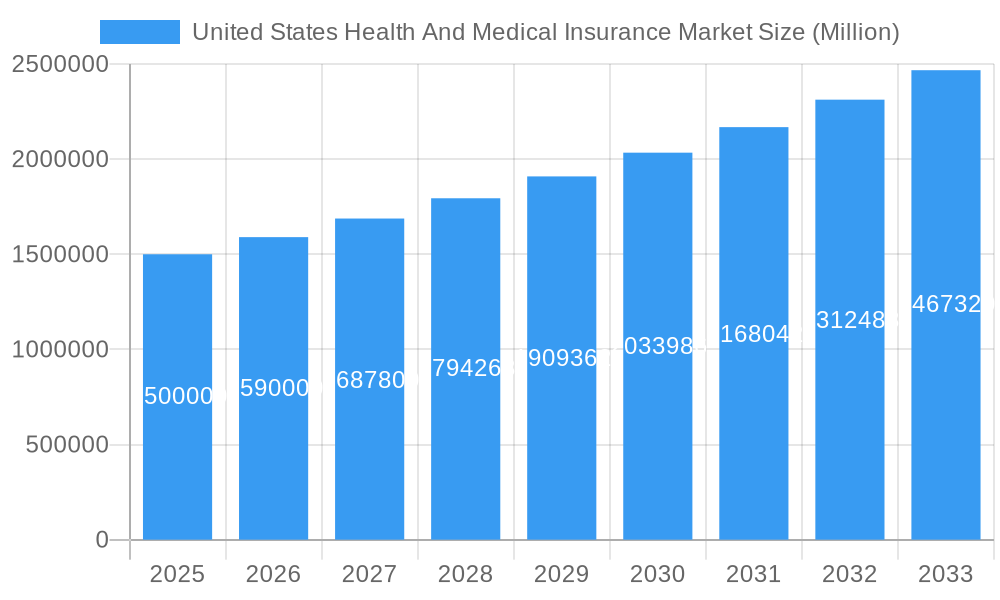

United States Health And Medical Insurance Market Company Market Share

Dive deep into the comprehensive analysis of the US Health & Medical Insurance Market, a multi-billion dollar industry poised for significant growth. This in-depth report provides a detailed examination of market dynamics, key players, emerging trends, and future opportunities from 2019 to 2033. Benefit from actionable insights to inform strategic decision-making and navigate the complexities of this dynamic sector.

United States Health And Medical Insurance Market Market Dynamics & Concentration

The US Health & Medical Insurance market, valued at $XX Million in 2024, is characterized by a moderately concentrated landscape. Key players such as UnitedHealth Group, Elevance Health, and Cigna Group hold significant market share, driving much of the innovation and consolidation. The market's dynamics are shaped by a complex interplay of factors:

- Market Concentration: The top five players control approximately XX% of the market, indicating a relatively high level of concentration. This concentration is expected to shift slightly over the forecast period due to mergers and acquisitions.

- Innovation Drivers: Technological advancements, such as telehealth and data analytics, are driving innovation and efficiency improvements. This leads to new product offerings and improved cost management for insurers.

- Regulatory Frameworks: The Affordable Care Act (ACA) and other regulations continue to shape market access, pricing, and coverage requirements, creating both challenges and opportunities for insurers.

- Product Substitutes: The emergence of alternative healthcare models, like direct primary care and concierge medicine, presents some level of competitive pressure to traditional insurance plans.

- End-User Trends: Increasing demand for personalized healthcare services and a focus on preventative care are influencing insurance product development and consumer choices.

- M&A Activities: The healthcare insurance sector is witnessing a significant rise in mergers and acquisitions. In 2024 alone, xx major M&A deals were recorded, demonstrating the ongoing consolidation in the industry. Examples include HCSC's acquisition of parts of Cigna's Medicare business and Elevance Health's acquisition of Paragon Healthcare Inc. This consolidation is expected to continue, further shaping the market's competitive landscape.

United States Health And Medical Insurance Market Industry Trends & Analysis

The US Health & Medical Insurance market is projected to experience a CAGR of XX% during the forecast period (2025-2033), driven by several key factors. Market penetration of various insurance products continues to evolve, particularly in segments like Medicare Advantage, which is experiencing rapid growth due to an aging population. Technological disruptions are significantly impacting the industry, with telehealth and digital health platforms gaining wider adoption. This increases access to care and reshapes delivery models. Consumer preferences are shifting toward value-based care and personalized plans, forcing insurers to adapt their offerings. Furthermore, competitive dynamics are intense, with major players constantly vying for market share through acquisitions, innovation, and strategic partnerships. The market is also characterized by a widening gap between pricing and accessibility depending on location and income brackets. The increasing awareness of chronic conditions and preventive care will continue to shape the market, with insurers developing targeted solutions and wellness programs. The market’s development is heavily influenced by governmental regulations and policies, such as changes to the ACA, influencing both opportunities and challenges for market players.

Leading Markets & Segments in United States Health And Medical Insurance Market

The market demonstrates strong regional variations in growth and penetration rates. While precise market share data requires further analysis, several key factors drive these differences:

- Key Drivers:

- Economic Policies: State-level variations in Medicaid expansion and healthcare subsidies significantly impact insurance coverage rates.

- Infrastructure: Access to healthcare facilities and technology infrastructure plays a crucial role in determining market penetration and growth rates.

- Demographic Factors: Regional variations in age distribution, population density, and health outcomes affect demand for specific insurance products.

Several segments, such as Medicare Advantage and Medicaid, exhibit above-average growth rates. These segments benefit from demographic trends (aging population) and government initiatives. The commercial insurance market also remains significant, driven by employer-sponsored plans. However, increasing costs and consumer dissatisfaction are contributing to challenges in growth in this segment. Competition in specific regional markets is also a major factor, impacting the dominance and growth of insurers within these regions.

United States Health And Medical Insurance Market Product Developments

Recent product innovations have focused on enhancing customer experience, improving access to care, and utilizing data analytics for more effective risk management. Insurers are increasingly integrating telehealth platforms into their plans, offering virtual consultations and remote monitoring. There is a growing focus on value-based care models that incentivize better health outcomes, aligning incentives between insurers and healthcare providers. These innovations are driven by both technological advancement and the changing preferences of consumers seeking more personalized and convenient care. The market is seeing a surge in tailored products aimed at various customer segments such as individuals with pre-existing conditions, specific age groups and lifestyle preferences.

Key Drivers of United States Health And Medical Insurance Market Growth

The US Health & Medical Insurance market is driven by a confluence of factors:

- Aging Population: The increasing number of elderly individuals necessitates greater demand for Medicare and supplemental insurance.

- Technological Advancements: Telehealth, remote patient monitoring, and big data analytics are improving access to care and driving efficiency.

- Government Regulations: Ongoing regulatory changes and initiatives aimed at expanding healthcare coverage continue to shape market growth.

- Rising Healthcare Costs: While a challenge, rising costs also stimulate greater demand for insurance coverage and cost-containment solutions.

Challenges in the United States Health And Medical Insurance Market Market

Several significant challenges hinder market growth:

- Rising Healthcare Costs: The ever-increasing costs of healthcare services pose a considerable challenge to both insurers and consumers. This directly impacts affordability and accessibility, limiting market expansion.

- Regulatory Uncertainty: Frequent changes in healthcare regulations create uncertainty and complexity for insurers, increasing compliance costs and administrative burdens.

- Competitive Pressures: Intense competition among major players necessitates a constant race for innovation and efficient operations to maintain market share.

- Fraud and Abuse: Combating fraudulent activities and ensuring proper compliance within the healthcare system remains a significant hurdle.

Emerging Opportunities in United States Health And Medical Insurance Market

Several factors present promising long-term growth opportunities:

- Expansion of Telehealth: The growing adoption of telehealth services expands access to care and creates new opportunities for innovative insurance product development.

- Focus on Preventative Care: A shift toward preventative care and wellness programs creates opportunities for insurers to offer tailored services and encourage healthier lifestyles.

- Data Analytics and AI: The application of advanced analytics and artificial intelligence can improve risk management, personalize care, and enhance customer experience.

- Strategic Partnerships: Collaboration with healthcare providers and technology companies unlocks synergistic opportunities and strengthens market position.

Leading Players in the United States Health And Medical Insurance Market Sector

- UnitedHealth Group

- Elevance Health

- Cigna Group

- HealthCare Services Group Inc

- Centene Corporation

- Aetna Inc

- Kaiser Foundation Group

- Independence Health Group

- Molina Healthcare

- Guidewell Mutual Holding

- Humana

- CVS Health (List Not Exhaustive)

Key Milestones in United States Health And Medical Insurance Market Industry

- January 2024: HCSC acquired Cigna's Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses, significantly expanding its presence in the Medicare market.

- January 2024: Elevance Health announced its acquisition of Paragon Healthcare Inc., strengthening its capabilities in infusible and injectable therapies.

Strategic Outlook for United States Health And Medical Insurance Market Market

The US Health & Medical Insurance market holds immense potential for future growth. Continued technological advancements, an aging population, and ongoing regulatory changes will shape the industry's trajectory. Insurers who can effectively leverage data analytics, embrace innovative care delivery models, and adapt to evolving consumer preferences are poised to capture significant market share. Strategic partnerships and acquisitions will continue to play a critical role in shaping the market landscape. The focus will remain on improving affordability, accessibility and overall value for consumers while maintaining profitability in a highly competitive environment.

United States Health And Medical Insurance Market Segmentation

-

1. Procurement Type

- 1.1. Directly/individually Purchased

-

1.2. Employer-Based

- 1.2.1. Small Group Market

- 1.2.2. Large Group Market

-

2. Products and Services Offered

- 2.1. Pharmacy Benefit Management

- 2.2. High Deductible Health Plans

- 2.3. Free-For-Service Plans

- 2.4. Managed Care Plans

-

3. Place of Purchase

- 3.1. On Exchange

- 3.2. Off Exchange

United States Health And Medical Insurance Market Segmentation By Geography

- 1. United States

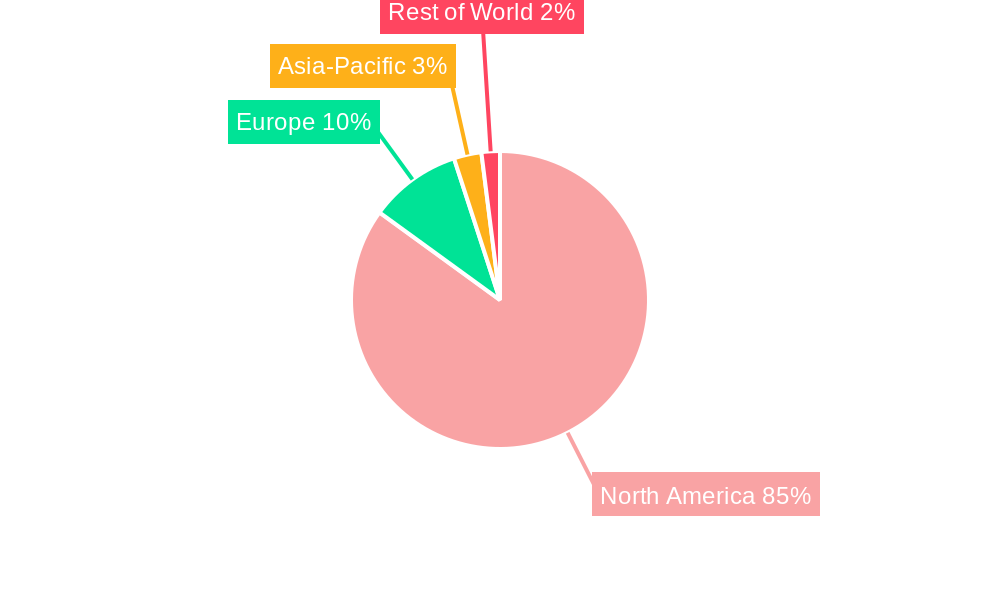

United States Health And Medical Insurance Market Regional Market Share

Geographic Coverage of United States Health And Medical Insurance Market

United States Health And Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs

- 3.3. Market Restrains

- 3.3.1. Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs

- 3.4. Market Trends

- 3.4.1. The Online Channel is Expected to Witness New Growth Avenues in the Coming Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Health And Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Procurement Type

- 5.1.1. Directly/individually Purchased

- 5.1.2. Employer-Based

- 5.1.2.1. Small Group Market

- 5.1.2.2. Large Group Market

- 5.2. Market Analysis, Insights and Forecast - by Products and Services Offered

- 5.2.1. Pharmacy Benefit Management

- 5.2.2. High Deductible Health Plans

- 5.2.3. Free-For-Service Plans

- 5.2.4. Managed Care Plans

- 5.3. Market Analysis, Insights and Forecast - by Place of Purchase

- 5.3.1. On Exchange

- 5.3.2. Off Exchange

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Procurement Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UnitedHealth Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elevance Health

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cigna Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HealthCare Services Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Centene Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aetna Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kaiser Foundation Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Independence Health Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Molina Healthcare

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Guidewell Mutual Holding

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Humana

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CVS Health**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 UnitedHealth Group

List of Figures

- Figure 1: United States Health And Medical Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Health And Medical Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: United States Health And Medical Insurance Market Revenue Million Forecast, by Procurement Type 2020 & 2033

- Table 2: United States Health And Medical Insurance Market Volume Trillion Forecast, by Procurement Type 2020 & 2033

- Table 3: United States Health And Medical Insurance Market Revenue Million Forecast, by Products and Services Offered 2020 & 2033

- Table 4: United States Health And Medical Insurance Market Volume Trillion Forecast, by Products and Services Offered 2020 & 2033

- Table 5: United States Health And Medical Insurance Market Revenue Million Forecast, by Place of Purchase 2020 & 2033

- Table 6: United States Health And Medical Insurance Market Volume Trillion Forecast, by Place of Purchase 2020 & 2033

- Table 7: United States Health And Medical Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Health And Medical Insurance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: United States Health And Medical Insurance Market Revenue Million Forecast, by Procurement Type 2020 & 2033

- Table 10: United States Health And Medical Insurance Market Volume Trillion Forecast, by Procurement Type 2020 & 2033

- Table 11: United States Health And Medical Insurance Market Revenue Million Forecast, by Products and Services Offered 2020 & 2033

- Table 12: United States Health And Medical Insurance Market Volume Trillion Forecast, by Products and Services Offered 2020 & 2033

- Table 13: United States Health And Medical Insurance Market Revenue Million Forecast, by Place of Purchase 2020 & 2033

- Table 14: United States Health And Medical Insurance Market Volume Trillion Forecast, by Place of Purchase 2020 & 2033

- Table 15: United States Health And Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Health And Medical Insurance Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Health And Medical Insurance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the United States Health And Medical Insurance Market?

Key companies in the market include UnitedHealth Group, Elevance Health, Cigna Group, HealthCare Services Group Inc, Centene Corporation, Aetna Inc, Kaiser Foundation Group, Independence Health Group, Molina Healthcare, Guidewell Mutual Holding, Humana, CVS Health**List Not Exhaustive.

3. What are the main segments of the United States Health And Medical Insurance Market?

The market segments include Procurement Type, Products and Services Offered, Place of Purchase.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs.

6. What are the notable trends driving market growth?

The Online Channel is Expected to Witness New Growth Avenues in the Coming Future.

7. Are there any restraints impacting market growth?

Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies; Aging Population in United States and increasing Healthcare Costs.

8. Can you provide examples of recent developments in the market?

January 2024: HCSC entered into a binding contract with The Cigna Group to purchase its Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. This acquisition will bring significant advantages to HCSC's existing and prospective members, as it will strengthen the company's capabilities and expand its presence, especially in the expanding Medicare sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Health And Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Health And Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Health And Medical Insurance Market?

To stay informed about further developments, trends, and reports in the United States Health And Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence