Key Insights

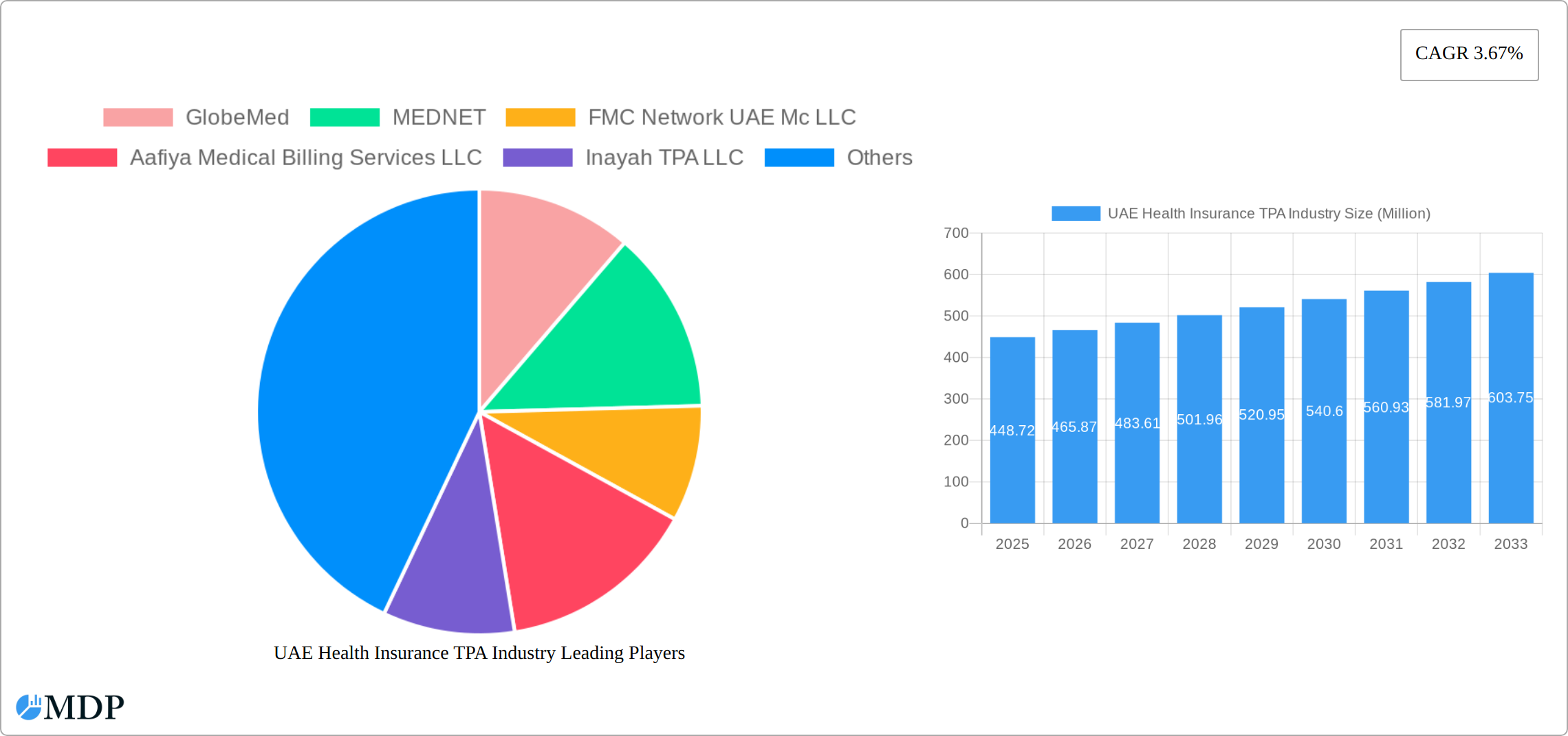

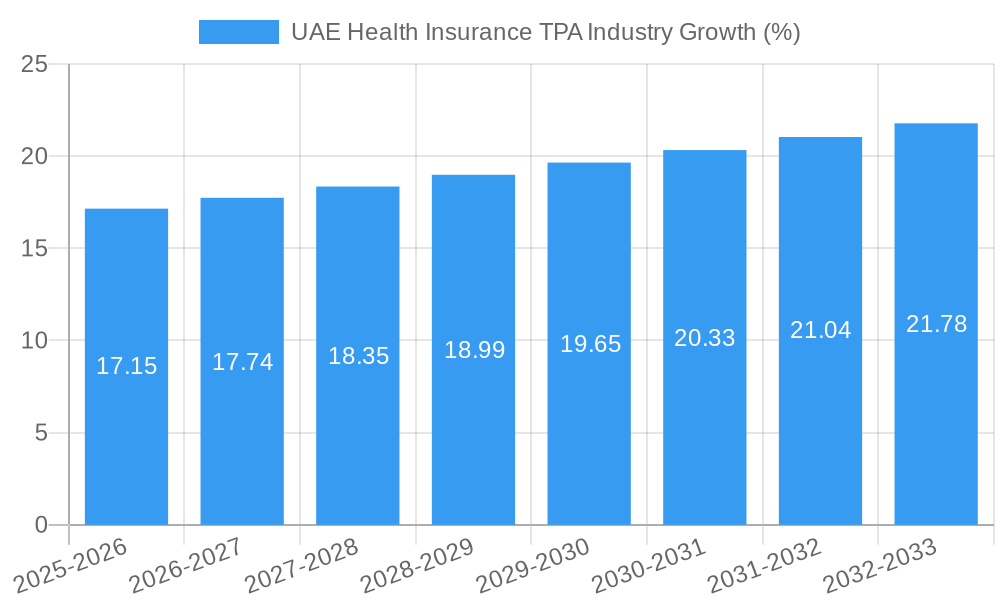

The UAE health insurance TPA (Third-Party Administrator) industry is experiencing robust growth, driven by the increasing adoption of health insurance, a burgeoning population, and government initiatives promoting healthcare accessibility. The market, valued at $448.72 million in 2025, is projected to expand at a CAGR of 3.67% from 2025 to 2033. This growth is fueled by several key factors. The rising prevalence of chronic diseases necessitates greater reliance on health insurance, boosting demand for TPA services. Furthermore, the UAE's focus on improving its healthcare infrastructure and attracting foreign investment is creating a favorable environment for TPA providers. The industry is segmented by product type (corporate, individual, and government health insurance), service type (claims processing, customer service, and fraud detection), and end-user (corporates, individuals, and government). The competitive landscape includes both established international players like Aetna Inc. and several local companies such as GlobeMed, MEDNET, and Aafiya Medical Billing Services LLC, suggesting a healthy mix of competition and innovation within the market. Increased demand for efficient claims processing and customer service solutions, coupled with the need to combat healthcare fraud, are key drivers shaping the TPA market’s trajectory.

The growth of the UAE health insurance TPA industry is not without challenges. Regulatory changes and the increasing complexity of healthcare systems can impact profitability. Furthermore, maintaining data security and complying with privacy regulations pose significant hurdles. Despite these challenges, the long-term outlook remains positive. The rising demand for health insurance, coupled with technological advancements in TPA services, such as AI-driven fraud detection and automated claims processing, will likely lead to continued market expansion. The focus on improving healthcare efficiency and cost-effectiveness will further fuel the demand for specialized TPA services in the coming years. The UAE’s strategic position as a regional hub for healthcare also promises to attract further investment and growth within the TPA sector.

UAE Health Insurance TPA Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UAE Health Insurance TPA industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. The report covers market dynamics, trends, leading players, and future opportunities, using data spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The market size is projected to reach xx Million by 2033.

UAE Health Insurance TPA Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the UAE Health Insurance TPA market, encompassing market concentration, innovation drivers, regulatory influences, and recent mergers and acquisitions (M&A) activities. The market is characterized by a moderate level of concentration, with several key players holding significant market share. However, the emergence of new entrants and technological advancements are reshaping the competitive dynamics.

Market Concentration: The top 5 TPAs hold an estimated 40% market share in 2025. This is driven by factors including established brand recognition and extensive network infrastructure. We project a slight decrease in concentration to approximately 35% by 2033 due to increased competition from smaller, specialized TPAs.

Innovation Drivers: The industry is experiencing significant innovation driven by the adoption of digital technologies, including AI-powered claims processing and blockchain for secure data management. These innovations are enhancing efficiency and transparency.

Regulatory Framework: The UAE's regulatory framework, while supportive of industry growth, presents challenges for smaller TPAs. Compliance with data privacy regulations and licensing requirements are significant factors influencing market dynamics.

Product Substitutes: The primary substitutes are in-house claims processing by insurance companies, although TPAs are gaining preference for their specialized expertise and cost-effectiveness.

End-User Trends: A growing preference for digital self-service platforms and enhanced customer support is driving the demand for sophisticated TPA services.

M&A Activities: In the historical period (2019-2024), approximately 5 M&A deals involving UAE Health Insurance TPAs were recorded. We anticipate an increase in M&A activity in the forecast period (2025-2033) as larger players seek to expand their market share and service offerings.

UAE Health Insurance TPA Industry Industry Trends & Analysis

This section offers a detailed examination of the UAE Health Insurance TPA market's growth trajectory, technological advancements, and evolving consumer preferences. The market is experiencing robust growth, fueled by factors like increasing health insurance penetration, government initiatives to expand health coverage, and the adoption of advanced technologies.

The UAE Health Insurance TPA industry demonstrates a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Several factors drive this growth, including:

- Rising Healthcare Expenditure: The increasing healthcare expenditure per capita in the UAE directly correlates to higher demand for TPA services.

- Government Initiatives: Government policies promoting health insurance coverage, particularly for the expat population, further stimulate market growth.

- Technological Advancements: The adoption of digital technologies enhances efficiency and reduces operational costs for TPAs.

- Growing Demand for Specialized Services: The need for specialized services, including fraud detection and customer service, contributes to market expansion.

Leading Markets & Segments in UAE Health Insurance TPA Industry

The Corporate Health Insurance segment currently holds the largest market share, driven by the substantial presence of multinational companies in the UAE. However, the Individual Health Insurance segment is projected to experience the highest growth rate during the forecast period.

Key Drivers:

- Economic Policies: Government initiatives promoting health insurance coverage contribute to the growth of all segments.

- Infrastructure: Well-developed healthcare infrastructure and a sophisticated insurance sector facilitate industry expansion.

Dominance Analysis:

- Product Type: Corporate Health Insurance dominates in terms of revenue, driven by the large number of multinational companies. However, Individual Health Insurance is the fastest-growing segment due to increasing awareness and affordability of health plans. Government Health Insurance also contributes significantly, though its growth is relatively steady.

- Service Type: Claims processing remains the largest service segment, while customer service and fraud detection are experiencing rapid growth due to increasing customer expectations and regulatory pressures.

- End-User: Corporate clients constitute the largest segment, while the individual and government segments are experiencing significant growth.

UAE Health Insurance TPA Industry Product Developments

The UAE Health Insurance TPA industry is witnessing significant product innovations, with a strong emphasis on digital solutions. This includes AI-driven claims processing, automated customer service portals, and advanced fraud detection systems. These innovations are enhancing efficiency, accuracy, and customer satisfaction, providing a competitive advantage in a rapidly evolving market. Integration with electronic health records (EHR) systems is also gaining traction.

Key Drivers of UAE Health Insurance TPA Industry Growth

Several key factors fuel the growth of the UAE Health Insurance TPA industry. These include:

- Technological advancements: AI-powered claims processing and digital platforms streamline operations and reduce costs.

- Economic growth: The robust UAE economy supports increased healthcare spending and insurance penetration.

- Favorable regulatory environment: Supportive government policies promoting health insurance coverage stimulate industry growth.

Challenges in the UAE Health Insurance TPA Industry Market

The UAE Health Insurance TPA market faces several challenges, including:

- Regulatory compliance: Maintaining compliance with evolving regulations and data privacy requirements presents a significant challenge.

- Competition: Intense competition from both established and emerging TPAs necessitates continuous innovation and differentiation.

- Cybersecurity threats: Protecting sensitive patient data requires robust cybersecurity measures and significant investment.

Emerging Opportunities in UAE Health Insurance TPA Industry

The UAE Health Insurance TPA industry presents several significant long-term growth opportunities. These include:

- Expansion into new technologies: The adoption of blockchain technology and big data analytics can improve efficiency and security.

- Strategic partnerships: Collaborations with healthcare providers and technology companies can expand service offerings.

- Market expansion: Targeting underserved segments, such as SMEs and individuals, can unlock new growth avenues.

Leading Players in the UAE Health Insurance TPA Industry Sector

- GlobeMed

- MEDNET

- FMC Network UAE Mc LLC

- Aafiya Medical Billing Services LLC

- Inayah TPA LLC

- Sehteq

- Nextcare

- E Care International Medical Billing Services Co LLC

- 247 Medical Billing Services LLC

- Aetna Inc

Key Milestones in UAE Health Insurance TPA Industry Industry

- September 2022: Dubai National Insurance (DNI) partnered with Al Madallah Healthcare Management to offer innovative medical claims management services, signaling a trend towards collaboration within the industry.

- April 2023: Aetna's partnership with Oshi Health highlights the growing adoption of value-based care models and the integration of telehealth services within the UAE's healthcare ecosystem. This signifies a shift towards proactive and patient-centric care delivery, influencing the demand for sophisticated TPA services capable of managing these new models.

Strategic Outlook for UAE Health Insurance TPA Industry Market

The UAE Health Insurance TPA market exhibits strong potential for continued growth, driven by technological innovation, increasing healthcare expenditure, and a supportive regulatory environment. Strategic opportunities lie in leveraging digital technologies, fostering strategic partnerships, and expanding into new market segments. The focus on value-based care and the integration of telehealth will further shape the industry's future.

UAE Health Insurance TPA Industry Segmentation

-

1. Geography

- 1.1. Dubai

- 1.2. Abu Dhabi

- 1.3. Other Cities

UAE Health Insurance TPA Industry Segmentation By Geography

- 1. Dubai

- 2. Abu Dhabi

- 3. Other Cities

UAE Health Insurance TPA Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Increasing Health Insurance Market in UAE

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Dubai

- 5.1.2. Abu Dhabi

- 5.1.3. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Dubai

- 5.2.2. Abu Dhabi

- 5.2.3. Other Cities

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Dubai UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Dubai

- 6.1.2. Abu Dhabi

- 6.1.3. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Abu Dhabi UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Dubai

- 7.1.2. Abu Dhabi

- 7.1.3. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Other Cities UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Dubai

- 8.1.2. Abu Dhabi

- 8.1.3. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Geography

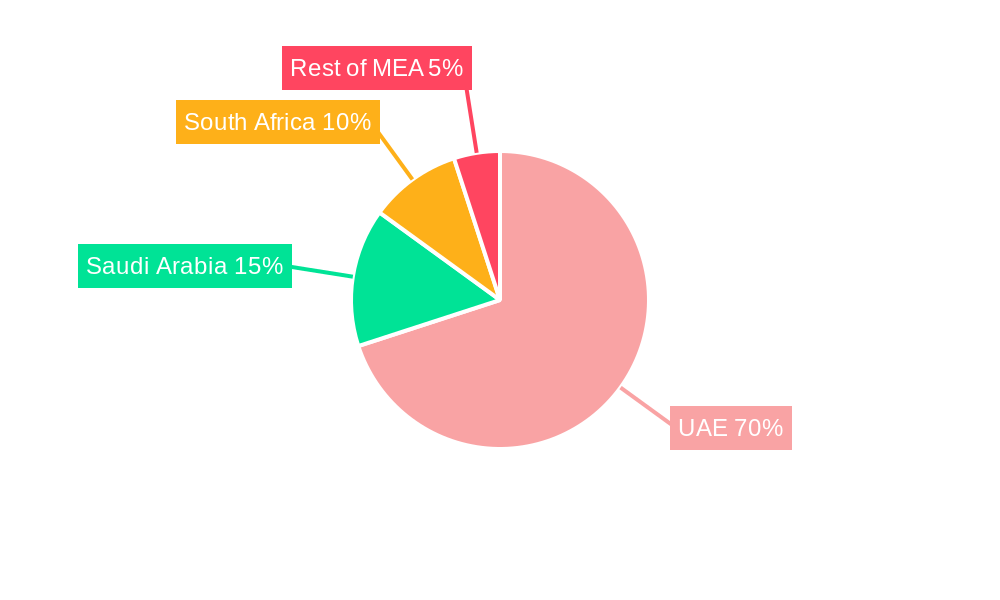

- 9. UAE UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 10. South Africa UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 11. Saudi Arabia UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of MEA UAE Health Insurance TPA Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 GlobeMed

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MEDNET

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 FMC Network UAE Mc LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aafiya Medical Billing Services LLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Inayah TPA LLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Sehteq

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nextcare

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 E Care International Medical Billing Services Co LLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 247 Medical Billing Services LLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Aetna Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 GlobeMed

List of Figures

- Figure 1: UAE Health Insurance TPA Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: UAE Health Insurance TPA Industry Share (%) by Company 2024

List of Tables

- Table 1: UAE Health Insurance TPA Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: UAE Health Insurance TPA Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 3: UAE Health Insurance TPA Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: UAE Health Insurance TPA Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: UAE UAE Health Insurance TPA Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South Africa UAE Health Insurance TPA Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia UAE Health Insurance TPA Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of MEA UAE Health Insurance TPA Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: UAE Health Insurance TPA Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: UAE Health Insurance TPA Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: UAE Health Insurance TPA Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: UAE Health Insurance TPA Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: UAE Health Insurance TPA Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: UAE Health Insurance TPA Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Health Insurance TPA Industry?

The projected CAGR is approximately 3.67%.

2. Which companies are prominent players in the UAE Health Insurance TPA Industry?

Key companies in the market include GlobeMed, MEDNET, FMC Network UAE Mc LLC, Aafiya Medical Billing Services LLC, Inayah TPA LLC, Sehteq, Nextcare, E Care International Medical Billing Services Co LLC, 247 Medical Billing Services LLC, Aetna Inc.

3. What are the main segments of the UAE Health Insurance TPA Industry?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 448.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Increasing Health Insurance Market in UAE.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

April 2023: Aetna, the insurer owned by CVS Health, and digital gastrointestinal care startup Oshi Health initiated a value-based care partnership. Oshi Health provides virtual access to a team of healthcare professionals, including a gastroenterologist, dietician, behavioral health doctor, and health coach, for patients dealing with digestive issues like Crohn's disease, ulcerative colitis, and irritable bowel syndrome (IBS). Additionally, patients can monitor their symptoms and engage in instant chat communication with their clinicians.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Health Insurance TPA Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Health Insurance TPA Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Health Insurance TPA Industry?

To stay informed about further developments, trends, and reports in the UAE Health Insurance TPA Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence