Key Insights

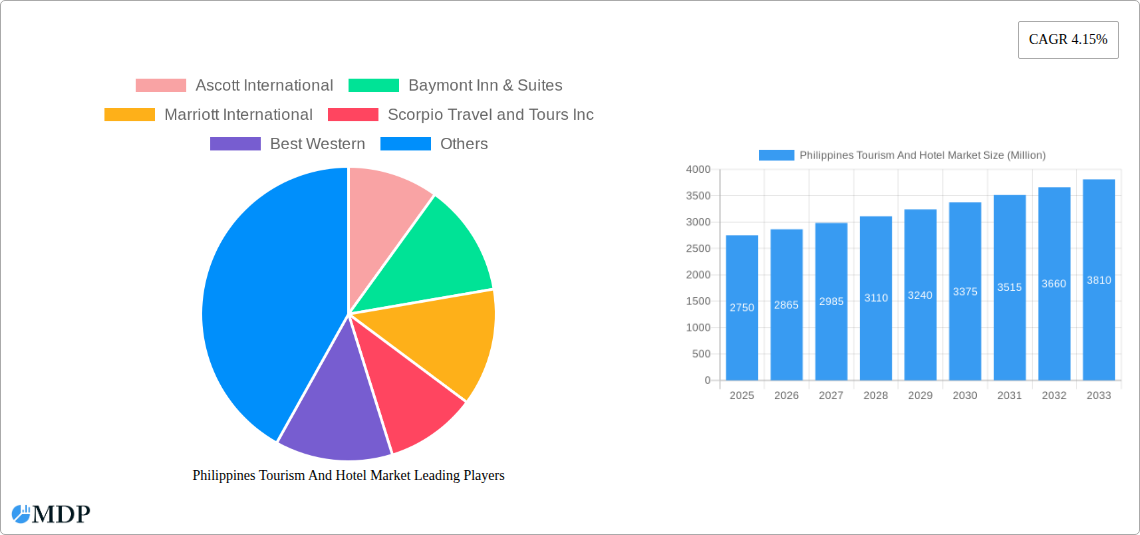

The Philippines tourism and hotel market, valued at $2.75 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.15% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of the Philippines as a unique travel destination, boasting diverse landscapes ranging from pristine beaches to lush rice terraces and vibrant cities, attracts both domestic and international tourists. The rise of budget-friendly accommodations and the increasing accessibility of online booking platforms have broadened the market's reach, making travel more affordable and convenient. Furthermore, strategic government initiatives promoting sustainable tourism and infrastructure development are playing a crucial role in boosting the sector's growth. The market segmentation reveals a strong presence of both business and leisure travelers, with a growing interest in eco-tourism and cultural experiences. This diversified demand fuels competition among various hotel chains and travel agencies, leading to continuous innovation in service offerings and pricing strategies. While challenges remain, such as infrastructure limitations in certain areas and seasonal variations in tourist arrivals, the overall outlook for the Philippines tourism and hotel market remains positive, showcasing significant potential for growth in the coming years.

Philippines Tourism And Hotel Market Market Size (In Billion)

The market's segmentation provides a granular understanding of its dynamics. The domestic tourism segment likely constitutes a significant portion of the market, owing to the growing middle class and increased disposable income within the Philippines. International tourism, however, is predicted to drive considerable growth, fueled by global marketing campaigns highlighting the country's unique attractions. The shift towards online booking channels reflects broader global trends, further contributing to market growth and transparency. While business tourism remains a significant segment, the increasing appeal of diverse tourism types, including eco-tourism, cultural tourism, and adventure tourism, showcases a broadening appeal, promising a more resilient and sustainable future for the sector. Competition within the market is fierce, with established international chains vying for market share alongside local players, resulting in continuous improvement in service quality and guest experience. The continued investment in infrastructure and sustainable tourism practices will prove crucial in further strengthening the long-term growth trajectory of the Philippine tourism and hotel sector.

Philippines Tourism And Hotel Market Company Market Share

Philippines Tourism and Hotel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Philippines tourism and hotel market, offering valuable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, growth drivers, challenges, and emerging opportunities within this vibrant sector. The report projects a market value of xx Million by 2033, showcasing significant growth potential.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Philippines Tourism And Hotel Market Market Dynamics & Concentration

The Philippines tourism and hotel market exhibits a dynamic landscape shaped by several key factors. Market concentration is moderate, with a mix of international chains and local players. Innovation, driven by technological advancements and evolving consumer preferences, is a major driver. The regulatory framework, while generally supportive of tourism, faces ongoing refinement. Product substitutes, such as alternative accommodation options like Airbnb, exert competitive pressure. End-user trends increasingly favor sustainable and experiential tourism. M&A activity has been steadily increasing, with approximately xx M&A deals recorded in the historical period, indicating a push for consolidation and expansion within the sector. Major players such as Marriott International and Best Western hold significant market share, estimated at xx% and xx% respectively in 2025. Smaller players, including numerous local hotels and travel agencies like Scorpio Travel and Tours Inc and Vansol Travel & Tours, contribute to the market’s overall competitiveness.

- Market Concentration: Moderate, with a blend of international and domestic players.

- Innovation Drivers: Technological advancements, evolving consumer preferences, sustainable tourism initiatives.

- Regulatory Framework: Supportive, with ongoing refinements.

- Product Substitutes: Airbnb and other alternative accommodations.

- M&A Activity: xx deals in the historical period (2019-2024), indicating consolidation and expansion.

Philippines Tourism And Hotel Market Industry Trends & Analysis

The Philippines tourism and hotel market is experiencing robust growth, driven by factors such as increasing disposable incomes, improved infrastructure, and government initiatives promoting tourism. The market is witnessing a shift towards online booking platforms, impacting traditional booking channels. Technological disruptions, including the rise of online travel agents (OTAs) and mobile booking apps, are transforming the industry. Consumer preferences increasingly lean towards personalized experiences, sustainable tourism options, and unique cultural immersions. The CAGR for the market from 2025 to 2033 is estimated to be xx%, with a market penetration rate of xx% by 2033. Competitive dynamics are characterized by a mix of price competition and differentiation strategies based on unique offerings and targeted customer segments. The market is projected to reach xx Million in revenue by 2033.

Leading Markets & Segments in Philippines Tourism And Hotel Market

The domestic tourism segment dominates the market, accounting for approximately xx% of total revenue in 2025. However, the international tourism segment is experiencing significant growth potential. Online booking channels are rapidly gaining popularity, surpassing phone and in-person bookings. Vacation tourism constitutes the largest segment by type, followed by Business and Cultural Tourism.

- By Tourists:

- Domestic: Dominates the market due to strong local demand and affordability. Key drivers: Growing middle class, increased disposable income.

- International: Significant growth potential due to the Philippines' attractive destinations and improving infrastructure. Key drivers: Increased global air connectivity, effective marketing campaigns.

- By Booking Channel:

- Online Booking: Rapidly growing segment due to convenience and wider reach. Key drivers: Increased internet penetration, mobile usage, and user-friendly platforms.

- Phone Booking: Still significant but declining. Key drivers: Traditional preference for certain demographics.

- In-Person Booking: Declining but still significant for some segments. Key drivers: Personal interaction and customized services.

- By Type:

- Vacation Tourism: Largest segment driven by the country's beautiful beaches and diverse attractions.

- Business Tourism: Growing due to increased economic activity and MICE events. Key drivers: Improved business infrastructure, increased FDI.

- Eco-Tourism: Growing segment with considerable potential due to environmental conservation efforts and increased awareness.

- Cultural Tourism: Significant segment due to rich history and cultural heritage. Key drivers: Preservation of cultural sites and immersive experiences.

- Adventure Tourism: Growing segment benefiting from stunning natural landscapes. Key drivers: Development of adventure activities and infrastructure.

- Event Tourism: Driven by MICE events and festivals. Key drivers: Government support for tourism events.

Philippines Tourism And Hotel Market Product Developments

The Philippines tourism and hotel market is witnessing significant product innovations, focusing on enhanced guest experiences and technological integrations. Smart hotel technology, personalized services, and sustainable practices are gaining prominence. The market is increasingly focused on niche tourism segments, with hotels and resorts offering specialized experiences tailored to specific interests like eco-tourism, adventure tourism, and cultural immersion. These developments reflect a wider shift towards experiential travel and a focus on fulfilling the diverse needs of a discerning tourism market.

Key Drivers of Philippines Tourism And Hotel Market Growth

Several factors fuel the growth of the Philippines tourism and hotel market:

- Technological Advancements: Online booking platforms, mobile apps, and smart hotel technologies enhance efficiency and customer experience.

- Economic Growth: Rising disposable incomes and a growing middle class are boosting domestic tourism.

- Government Initiatives: Government support for tourism infrastructure and marketing campaigns attracts both domestic and international tourists.

Challenges in the Philippines Tourism And Hotel Market Market

The market faces challenges including:

- Infrastructure limitations: While improvements are being made, infrastructure development in certain areas still lags.

- Seasonality: Tourism is heavily seasonal, impacting revenue streams throughout the year. This seasonality impacts profitability significantly.

- Competition: Intense competition from both established and emerging players.

Emerging Opportunities in Philippines Tourism And Hotel Market

The Philippines tourism and hotel market holds significant long-term growth potential, driven by:

- Sustainable tourism: Growing demand for eco-friendly options presents opportunities for hotels and resorts.

- Niche tourism: Targeting specific interests, such as adventure tourism or cultural immersion, offers opportunities for differentiation.

- Strategic partnerships: Collaborations with airlines, tour operators, and technology providers can expand market reach.

Leading Players in the Philippines Tourism And Hotel Market Sector

- Ascott International

- Baymont Inn & Suites

- Marriott International

- Scorpio Travel and Tours Inc

- Best Western

- Crown Regency Hotels & Resorts

- Vansol Travel & Tours

- GoldenSky Travel and Tours

- Baron Travel

- Citadines

Key Milestones in Philippines Tourism And Hotel Market Industry

- March 2023: Wyndham Hotels & Resorts partnered with Groups360, enabling online multi-room bookings, enhancing booking efficiency and accessibility.

- June 2023: BWH Hotels expanded globally, including new locations in Asia, significantly increasing the availability of its hotel offerings in the region. This expansion directly impacts market competition and consumer choices.

Strategic Outlook for Philippines Tourism And Hotel Market Market

The Philippines tourism and hotel market is poised for sustained growth, driven by ongoing infrastructure development, government support, and the increasing popularity of the country as a tourist destination. Strategic partnerships, investments in sustainable tourism initiatives, and the adoption of innovative technologies will be critical for sustained success in this dynamic and competitive market. The focus on niche tourism segments and the enhancement of the digital guest experience will be key factors in capturing the growing market share.

Philippines Tourism And Hotel Market Segmentation

-

1. Type

- 1.1. Business Tourism

- 1.2. Vacation Tourism

- 1.3. Eco-tourism

- 1.4. Cultural Tourism

- 1.5. Adventure Tourism

- 1.6. Event Tourism

-

2. Tourist

- 2.1. Domestic

- 2.2. International

-

3. Booking Channel

- 3.1. Phone Booking

- 3.2. In-person Booking

- 3.3. Online Booking

Philippines Tourism And Hotel Market Segmentation By Geography

- 1. Philippines

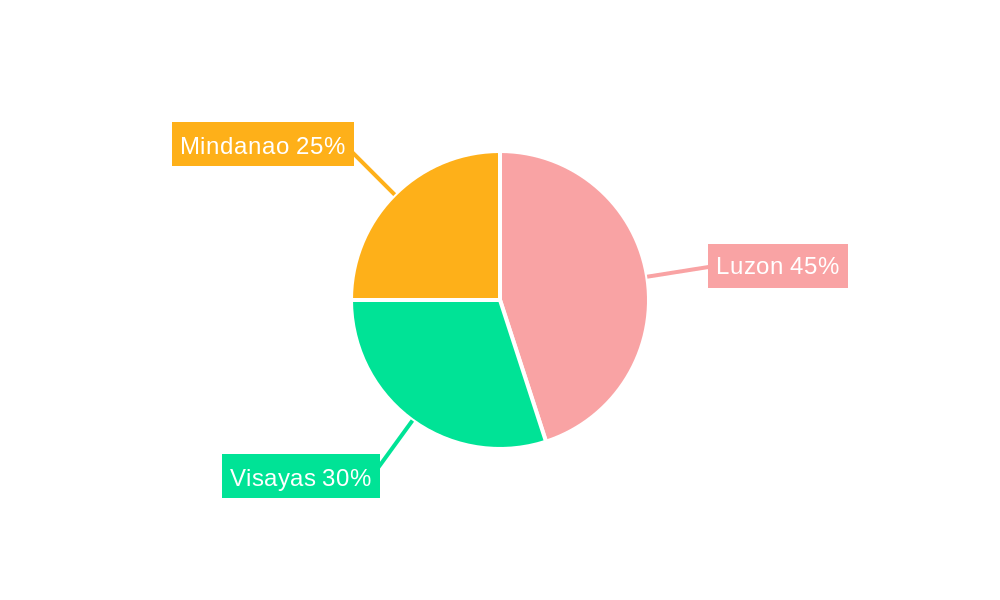

Philippines Tourism And Hotel Market Regional Market Share

Geographic Coverage of Philippines Tourism And Hotel Market

Philippines Tourism And Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Social Media Influencers is Driving the Growth in the Market; Increasing the Recreational Activities Boost the Tourism Industry

- 3.3. Market Restrains

- 3.3.1. Language Barriers for International Tourists; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Expanding Airways Network in Philippines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Tourism And Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business Tourism

- 5.1.2. Vacation Tourism

- 5.1.3. Eco-tourism

- 5.1.4. Cultural Tourism

- 5.1.5. Adventure Tourism

- 5.1.6. Event Tourism

- 5.2. Market Analysis, Insights and Forecast - by Tourist

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Booking Channel

- 5.3.1. Phone Booking

- 5.3.2. In-person Booking

- 5.3.3. Online Booking

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ascott International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Baymont Inn & Suites

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marriott International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scorpio Travel and Tours Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Best Western

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Regency Hotels & Resorts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vansol Travel & Tours

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GoldenSky Travel and Tours**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baron Travel

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Citadines

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ascott International

List of Figures

- Figure 1: Philippines Tourism And Hotel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Tourism And Hotel Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Philippines Tourism And Hotel Market Revenue Million Forecast, by Tourist 2020 & 2033

- Table 3: Philippines Tourism And Hotel Market Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 4: Philippines Tourism And Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Philippines Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Philippines Tourism And Hotel Market Revenue Million Forecast, by Tourist 2020 & 2033

- Table 7: Philippines Tourism And Hotel Market Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 8: Philippines Tourism And Hotel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Tourism And Hotel Market?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Philippines Tourism And Hotel Market?

Key companies in the market include Ascott International, Baymont Inn & Suites, Marriott International, Scorpio Travel and Tours Inc, Best Western, Crown Regency Hotels & Resorts, Vansol Travel & Tours, GoldenSky Travel and Tours**List Not Exhaustive, Baron Travel, Citadines.

3. What are the main segments of the Philippines Tourism And Hotel Market?

The market segments include Type, Tourist, Booking Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Social Media Influencers is Driving the Growth in the Market; Increasing the Recreational Activities Boost the Tourism Industry.

6. What are the notable trends driving market growth?

Expanding Airways Network in Philippines.

7. Are there any restraints impacting market growth?

Language Barriers for International Tourists; Labor Shortages.

8. Can you provide examples of recent developments in the market?

June 2023: BWH Hotels expanded its presence in North America and Europe, as well as in Africa and Asia. The BWH hotels are now available in Austria, Canada, Dubai, the United Arab Emirates, Ethiopia, France, India, Japan, the Netherlands, Saudi Arabia, Sweden, Tanzania, and the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Tourism And Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Tourism And Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Tourism And Hotel Market?

To stay informed about further developments, trends, and reports in the Philippines Tourism And Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence