Key Insights

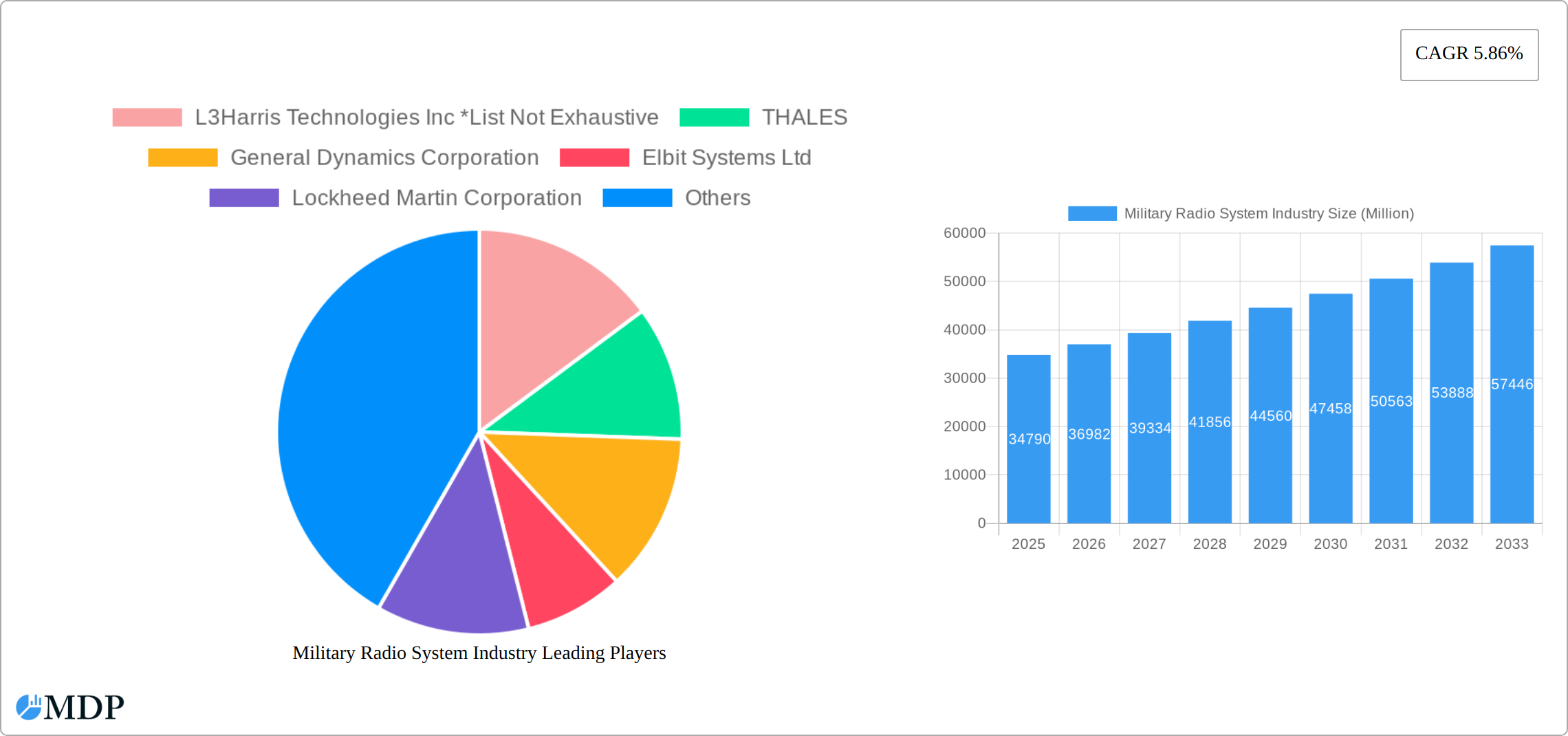

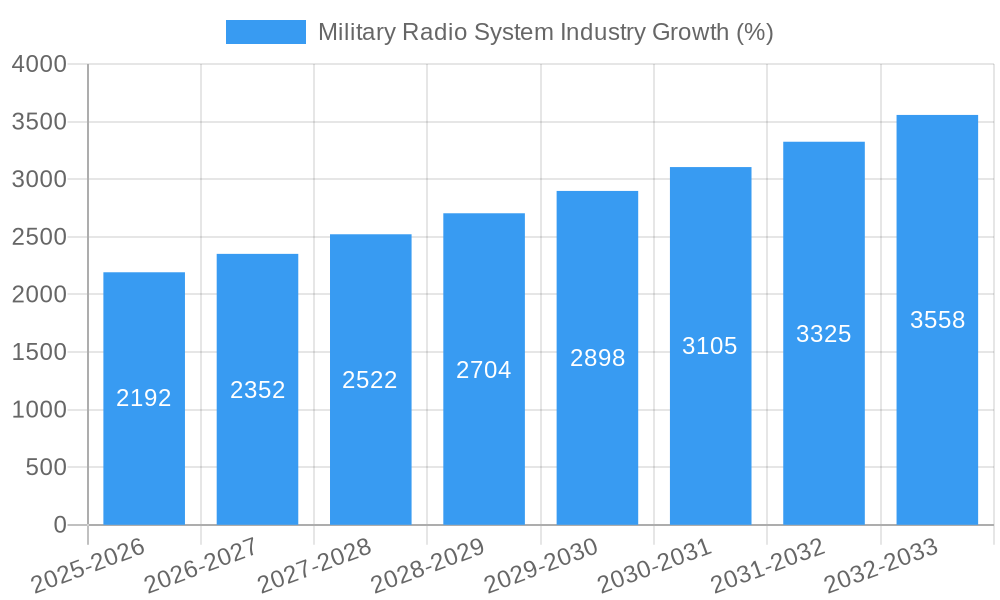

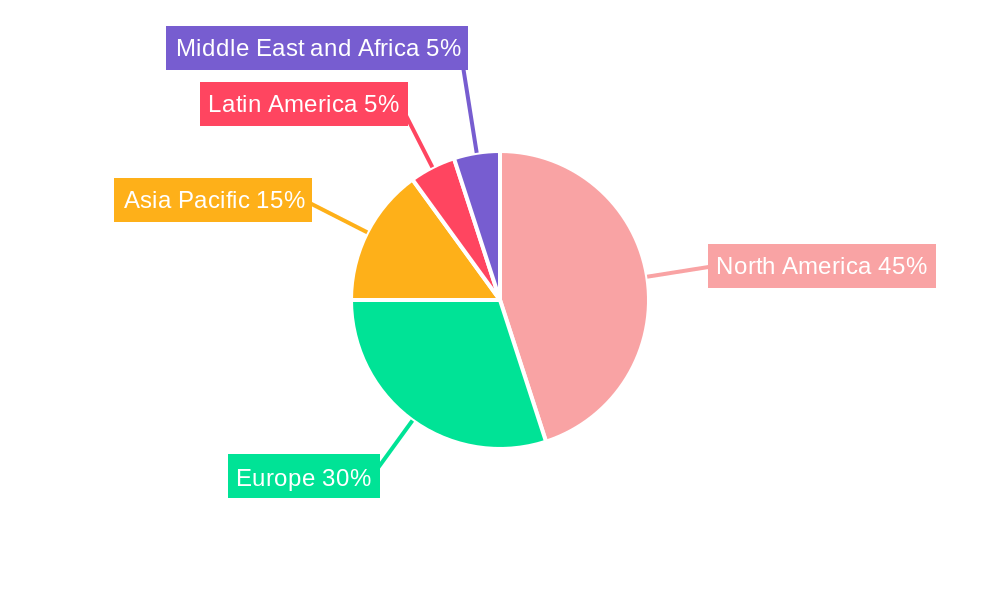

The Military Radio System market, valued at approximately $34.79 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, modernization initiatives across global militaries, and the increasing demand for secure and reliable communication in diverse operational environments. This growth is expected to continue at a Compound Annual Growth Rate (CAGR) of 5.86% from 2025 to 2033, reaching an estimated market size exceeding $60 billion by 2033. Key drivers include the integration of advanced technologies like Software Defined Radio (SDR), improved network centric warfare capabilities, and the rising adoption of high-frequency (HF) and very high frequency (VHF) radio systems for enhanced communication range and resilience. Furthermore, the increasing demand for specialized communication systems for various applications, such as command and control, situational awareness, and routine operations across different communication types (shipborne, ground-based, airborne, etc.), is fueling market expansion. The North American region, particularly the United States, is anticipated to dominate the market due to substantial defense spending and technological advancements, followed by Europe and the Asia-Pacific region.

Significant market trends include the miniaturization of military radio systems for improved portability and integration into smaller platforms, the increasing adoption of encrypted communication to enhance security against cyber threats and electronic warfare, and the development of more resilient and robust systems capable of operating under extreme conditions. While the market is characterized by a high degree of competition among major players like L3Harris Technologies, Thales, General Dynamics, and Lockheed Martin, opportunities remain for companies that offer innovative solutions addressing emerging needs in areas like secure communication over long distances, improved interoperability between different systems, and enhanced data analytics capabilities from collected communication data. Potential restraints include high initial investment costs, stringent regulatory requirements, and the continuous need for updates and upgrades to maintain technological superiority. The market is segmented by communication type, component, and application, allowing for targeted innovation and specialized product development across this diverse landscape.

Military Radio System Industry Market Report: 2019-2033

Dive deep into the dynamic world of military radio systems with this comprehensive market analysis, forecasting a robust growth trajectory from 2025 to 2033. This report provides in-depth insights into market size, growth drivers, technological advancements, leading players, and future opportunities within the Military Radio System Industry. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing the historical period of 2019-2024. This report is crucial for industry stakeholders, investors, and strategic decision-makers seeking a comprehensive understanding of this vital sector. The market value is predicted to reach xx Million by 2033.

Military Radio System Industry Market Dynamics & Concentration

The Military Radio System industry is characterized by a moderately concentrated market structure, dominated by established global leaders such as L3Harris Technologies Inc., Thales, General Dynamics Corporation, Elbit Systems Ltd., and Lockheed Martin Corporation, among other significant contributors. This concentration is a direct consequence of several pivotal factors: the relentless pace of technological advancements, the complex and stringent regulatory frameworks governing military communications, and the substantial capital investment essential for cutting-edge research and development. The industry thrives on continuous innovation, fueled by an insatiable demand for enhanced communication capabilities, robust security features, and increasingly miniaturized and ruggedized solutions. Regulatory mandates, particularly those emphasizing cybersecurity and seamless interoperability, play a crucial role in shaping industry practices and product design. While alternative communication technologies exist, the unique and often extreme operational requirements of military applications significantly limit the practicality and adoption of true product substitutes. Furthermore, end-user trends are intrinsically linked to evolving geopolitical dynamics and defense strategies, directly influencing market demand. The sector witnesses a dynamic landscape of Mergers and Acquisitions (M&A), reflecting strategic consolidation, capability enhancement, and market expansion initiatives. Between 2019 and 2024, an estimated xx M&A deals were completed, further solidifying the market positions of leading entities. The market share held by the top five players is projected to approximate xx% by 2025, underscoring the competitive intensity at the highest tiers.

Military Radio System Industry Industry Trends & Analysis

The Military Radio System market is experiencing robust growth, driven by several key factors. Increased defense spending globally, particularly in regions experiencing geopolitical instability, significantly fuels demand. Technological advancements, such as the integration of software-defined radios (SDRs), artificial intelligence (AI), and improved encryption technologies, enhance the capabilities and efficiency of military communication systems, leading to accelerated market penetration. The demand for secure and reliable communication in diverse operational environments is another primary driver. Consumer preferences, although indirectly influencing the industry, are manifested in the demand for advanced features like improved situational awareness and network-centric operations. The competitive landscape is marked by intense rivalry among established players and emerging entrants, resulting in product differentiation and continuous innovation. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, indicating substantial market expansion. Market penetration of advanced technologies like SDRs is projected to reach xx% by 2033.

Leading Markets & Segments in Military Radio System Industry

The North American region currently dominates the Military Radio System market, driven by substantial defense budgets and the presence of major industry players. However, Asia-Pacific is exhibiting the fastest growth rate, fueled by increasing defense modernization efforts in several countries within the region.

Key Drivers by Segment:

Communication Type:

- Airborne Communication: Driven by modernization of air forces and increasing demand for secure communication during aerial operations.

- Ground-based: Fueled by the need for robust and reliable communication networks for ground troops.

- Shipborne: Driven by naval modernization programs and the need for effective communication in maritime environments.

- Underwater Communication: Driven by the increasing adoption of autonomous underwater vehicles (AUVs) and the need for enhanced communication capabilities in submarine operations.

- Air-Ground Communication: Demand is driven by the need for seamless communication between airborne and ground assets.

Component:

- Military Radio Systems: Constitutes the largest segment due to the core role of radios in military communication.

- Military Satcom Systems: Growing rapidly due to the increasing reliance on satellite-based communication for broader coverage.

- Military Security Systems: Demand is fueled by the growing need for secure and encrypted communication to prevent interception and unauthorized access.

Application:

- Command and Control: A critical application, driving demand for reliable and secure communication systems for tactical decision-making.

- Routine Operations: This segment is driven by the continuous need for communication during routine military activities.

- Situational Awareness: The demand is growing with the adoption of advanced sensor technologies and the need for real-time information sharing.

- Other Applications: Includes various specialized applications such as intelligence gathering and surveillance.

The dominance of North America stems from robust defense budgets, a strong technological base, and the presence of major industry players. Asia-Pacific's rapid growth is attributed to substantial investments in defense modernization and increasing geopolitical tensions.

Military Radio System Industry Product Developments

Recent breakthroughs in Military Radio Systems are revolutionizing battlefield communication. A key development is the widespread integration of Software-Defined Radios (SDRs), offering unprecedented flexibility, adaptability, and reconfigurability to meet dynamic operational demands. Enhancements in advanced encryption algorithms are bolstering communication security against sophisticated threats. Furthermore, the incorporation of Artificial Intelligence (AI) is transforming signal processing, enabling smarter adaptive waveforms, proactive threat detection, and enhanced situational awareness for warfighters. These innovations are specifically engineered to address the evolving and complex needs of modern military operations, drastically improving interoperability and ensuring efficient, reliable communication in challenging and contested environments. The market is witnessing a strong emphasis on developing systems that are not only smaller and lighter but also boast extended battery life and superior ruggedness to withstand the harshest operating conditions.

Key Drivers of Military Radio System Industry Growth

The Military Radio System industry is propelled by a confluence of powerful growth drivers. Foremost among these are continuous technological advancements, particularly in areas like SDR technology, the integration of AI for intelligent communication, and the development of state-of-the-art encryption solutions. Global increasing defense budgets, especially in regions experiencing heightened geopolitical instability and strategic competition, are directly translating into increased procurement of advanced radio systems. Moreover, stringent regulatory frameworks that prioritize interoperability across different military branches and allied forces, alongside robust cybersecurity requirements, serve as significant catalysts for industry growth, compelling investment in compliant and advanced solutions.

Challenges in the Military Radio System Industry Market

The Military Radio System industry navigates a complex terrain of challenges. Stringent regulatory hurdles, encompassing critical areas like cybersecurity compliance and intricate export control regulations, can significantly impede market entry and extend product development timelines. Furthermore, supply chain disruptions, including the availability of specialized and critical components, pose a persistent risk to production capacity and timely delivery schedules. The market also contends with intense competition among established players, necessitating continuous innovation and relentless cost optimization strategies to preserve and grow market share. These collective challenges could potentially temper the market's growth trajectory, impacting it by approximately xx% by 2033.

Emerging Opportunities in Military Radio System Industry

Emerging opportunities lie in the integration of advanced technologies like 5G and IoT, creating more connected and intelligent communication systems. Strategic partnerships between defense contractors and technology companies will further fuel innovation and market expansion. Expanding into emerging markets with growing defense budgets also presents significant opportunities for growth.

Leading Players in the Military Radio System Industry Sector

- L3Harris Technologies Inc

- THALES

- General Dynamics Corporation

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Inmarsat Global Limited

- IAI

- RTX Corporation

- ASELSAN A S

- Leonardo S p A

- BAE Systems plc

- Northrop Grumman Corporation

Key Milestones in Military Radio System Industry Industry

- 2020: Introduction of a new generation of software-defined radios with enhanced security features by L3Harris Technologies.

- 2021: Successful testing of a new satellite communication system by Lockheed Martin for improved interoperability.

- 2022: Acquisition of a smaller competitor by Thales, strengthening its market position.

- 2023: Launch of a new military radio system with AI-powered signal processing capabilities by General Dynamics.

- 2024: Significant investment in R&D for advanced military communication systems by Elbit Systems.

Strategic Outlook for Military Radio System Industry Market

The Military Radio System market is strategically positioned for sustained and robust growth in the coming years. This optimistic outlook is underpinned by the ongoing acceleration of technological innovation, a consistent upward trend in global defense expenditure, and the persistent presence of geopolitical uncertainties that necessitate advanced communication capabilities. To thrive in this environment, companies must prioritize strategic partnerships and collaborations, alongside aggressive expansion into emerging markets and new defense procurement regions. Those entities that demonstrably focus on and excel in deploying advanced technologies such as AI-powered solutions and integrated 5G capabilities will be exceptionally well-positioned to capture significant market share and spearhead future industry advancements. The market is projected to experience a substantial xx% increase in value by 2033, signifying a period of significant opportunity and expansion.

Military Radio System Industry Segmentation

-

1. Communication Type

- 1.1. Shipborne

- 1.2. Ground-based

- 1.3. Underwater

- 1.4. Air-Ground

- 1.5. Airborne Communication

-

2. Component

- 2.1. Military Satcom Systems

- 2.2. Military Radio Systems

- 2.3. Military Security Systems

-

3. Application

- 3.1. Command and Control

- 3.2. Routine Operations

- 3.3. Situational Awareness

- 3.4. Other Applications

Military Radio System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Military Radio System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Ground-based systems Segment is Projected to Showcase the Fastest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Communication Type

- 5.1.1. Shipborne

- 5.1.2. Ground-based

- 5.1.3. Underwater

- 5.1.4. Air-Ground

- 5.1.5. Airborne Communication

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Military Satcom Systems

- 5.2.2. Military Radio Systems

- 5.2.3. Military Security Systems

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Command and Control

- 5.3.2. Routine Operations

- 5.3.3. Situational Awareness

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Communication Type

- 6. North America Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Communication Type

- 6.1.1. Shipborne

- 6.1.2. Ground-based

- 6.1.3. Underwater

- 6.1.4. Air-Ground

- 6.1.5. Airborne Communication

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Military Satcom Systems

- 6.2.2. Military Radio Systems

- 6.2.3. Military Security Systems

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Command and Control

- 6.3.2. Routine Operations

- 6.3.3. Situational Awareness

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Communication Type

- 7. Europe Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Communication Type

- 7.1.1. Shipborne

- 7.1.2. Ground-based

- 7.1.3. Underwater

- 7.1.4. Air-Ground

- 7.1.5. Airborne Communication

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Military Satcom Systems

- 7.2.2. Military Radio Systems

- 7.2.3. Military Security Systems

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Command and Control

- 7.3.2. Routine Operations

- 7.3.3. Situational Awareness

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Communication Type

- 8. Asia Pacific Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Communication Type

- 8.1.1. Shipborne

- 8.1.2. Ground-based

- 8.1.3. Underwater

- 8.1.4. Air-Ground

- 8.1.5. Airborne Communication

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Military Satcom Systems

- 8.2.2. Military Radio Systems

- 8.2.3. Military Security Systems

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Command and Control

- 8.3.2. Routine Operations

- 8.3.3. Situational Awareness

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Communication Type

- 9. Latin America Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Communication Type

- 9.1.1. Shipborne

- 9.1.2. Ground-based

- 9.1.3. Underwater

- 9.1.4. Air-Ground

- 9.1.5. Airborne Communication

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Military Satcom Systems

- 9.2.2. Military Radio Systems

- 9.2.3. Military Security Systems

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Command and Control

- 9.3.2. Routine Operations

- 9.3.3. Situational Awareness

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Communication Type

- 10. Middle East and Africa Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Communication Type

- 10.1.1. Shipborne

- 10.1.2. Ground-based

- 10.1.3. Underwater

- 10.1.4. Air-Ground

- 10.1.5. Airborne Communication

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Military Satcom Systems

- 10.2.2. Military Radio Systems

- 10.2.3. Military Security Systems

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Command and Control

- 10.3.2. Routine Operations

- 10.3.3. Situational Awareness

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Communication Type

- 11. North America Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Australia

- 13.1.6 Rest of Asia Pacific

- 14. Latin America Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Military Radio System Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 Egypt

- 15.1.3 Israel

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 L3Harris Technologies Inc *List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 THALES

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 General Dynamics Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Elbit Systems Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lockheed Martin Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Inmarsat Global Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 IAI

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 RTX Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 ASELSAN A S

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Leonardo S p A

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 BAE Systems plc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Northrop Grumman Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 L3Harris Technologies Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Military Radio System Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Military Radio System Industry Revenue (Million), by Communication Type 2024 & 2032

- Figure 13: North America Military Radio System Industry Revenue Share (%), by Communication Type 2024 & 2032

- Figure 14: North America Military Radio System Industry Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Military Radio System Industry Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Military Radio System Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Military Radio System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Military Radio System Industry Revenue (Million), by Communication Type 2024 & 2032

- Figure 21: Europe Military Radio System Industry Revenue Share (%), by Communication Type 2024 & 2032

- Figure 22: Europe Military Radio System Industry Revenue (Million), by Component 2024 & 2032

- Figure 23: Europe Military Radio System Industry Revenue Share (%), by Component 2024 & 2032

- Figure 24: Europe Military Radio System Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Military Radio System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Military Radio System Industry Revenue (Million), by Communication Type 2024 & 2032

- Figure 29: Asia Pacific Military Radio System Industry Revenue Share (%), by Communication Type 2024 & 2032

- Figure 30: Asia Pacific Military Radio System Industry Revenue (Million), by Component 2024 & 2032

- Figure 31: Asia Pacific Military Radio System Industry Revenue Share (%), by Component 2024 & 2032

- Figure 32: Asia Pacific Military Radio System Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Military Radio System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Military Radio System Industry Revenue (Million), by Communication Type 2024 & 2032

- Figure 37: Latin America Military Radio System Industry Revenue Share (%), by Communication Type 2024 & 2032

- Figure 38: Latin America Military Radio System Industry Revenue (Million), by Component 2024 & 2032

- Figure 39: Latin America Military Radio System Industry Revenue Share (%), by Component 2024 & 2032

- Figure 40: Latin America Military Radio System Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Military Radio System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Military Radio System Industry Revenue (Million), by Communication Type 2024 & 2032

- Figure 45: Middle East and Africa Military Radio System Industry Revenue Share (%), by Communication Type 2024 & 2032

- Figure 46: Middle East and Africa Military Radio System Industry Revenue (Million), by Component 2024 & 2032

- Figure 47: Middle East and Africa Military Radio System Industry Revenue Share (%), by Component 2024 & 2032

- Figure 48: Middle East and Africa Military Radio System Industry Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East and Africa Military Radio System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East and Africa Military Radio System Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Military Radio System Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Radio System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2019 & 2032

- Table 3: Global Military Radio System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Global Military Radio System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Military Radio System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Saudi Arabia Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Egypt Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2019 & 2032

- Table 32: Global Military Radio System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global Military Radio System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2019 & 2032

- Table 38: Global Military Radio System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 39: Global Military Radio System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Germany Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: France Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Russia Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2019 & 2032

- Table 47: Global Military Radio System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 48: Global Military Radio System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 49: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: India Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: China Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Japan Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Australia Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2019 & 2032

- Table 57: Global Military Radio System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 58: Global Military Radio System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Mexico Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Latin America Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Military Radio System Industry Revenue Million Forecast, by Communication Type 2019 & 2032

- Table 64: Global Military Radio System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 65: Global Military Radio System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 66: Global Military Radio System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Saudi Arabia Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Egypt Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Israel Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Middle East and Africa Military Radio System Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Radio System Industry?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the Military Radio System Industry?

Key companies in the market include L3Harris Technologies Inc *List Not Exhaustive, THALES, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, Inmarsat Global Limited, IAI, RTX Corporation, ASELSAN A S, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation.

3. What are the main segments of the Military Radio System Industry?

The market segments include Communication Type, Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.79 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Ground-based systems Segment is Projected to Showcase the Fastest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Radio System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Radio System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Radio System Industry?

To stay informed about further developments, trends, and reports in the Military Radio System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence