Key Insights

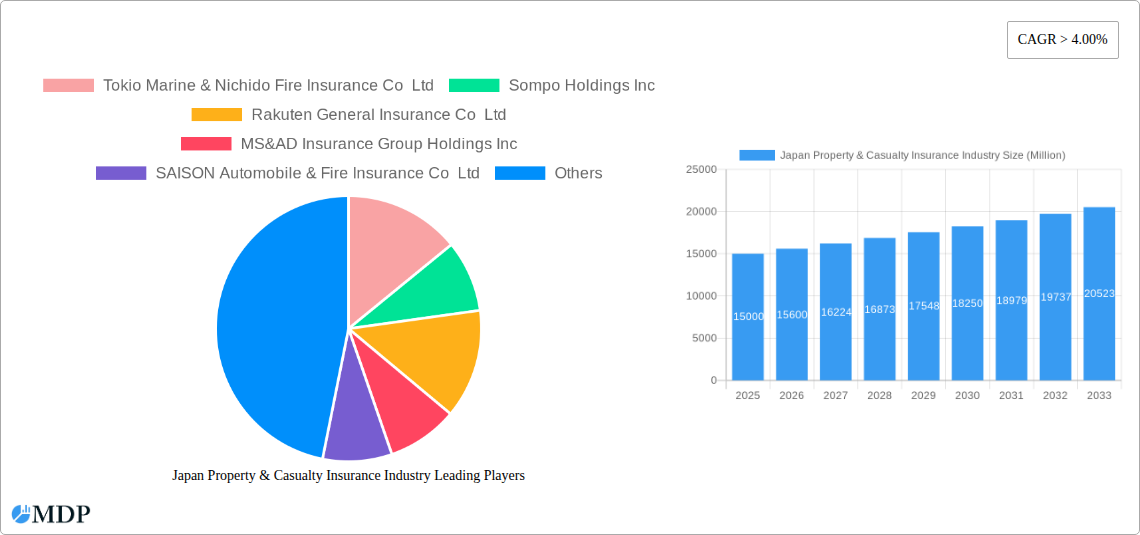

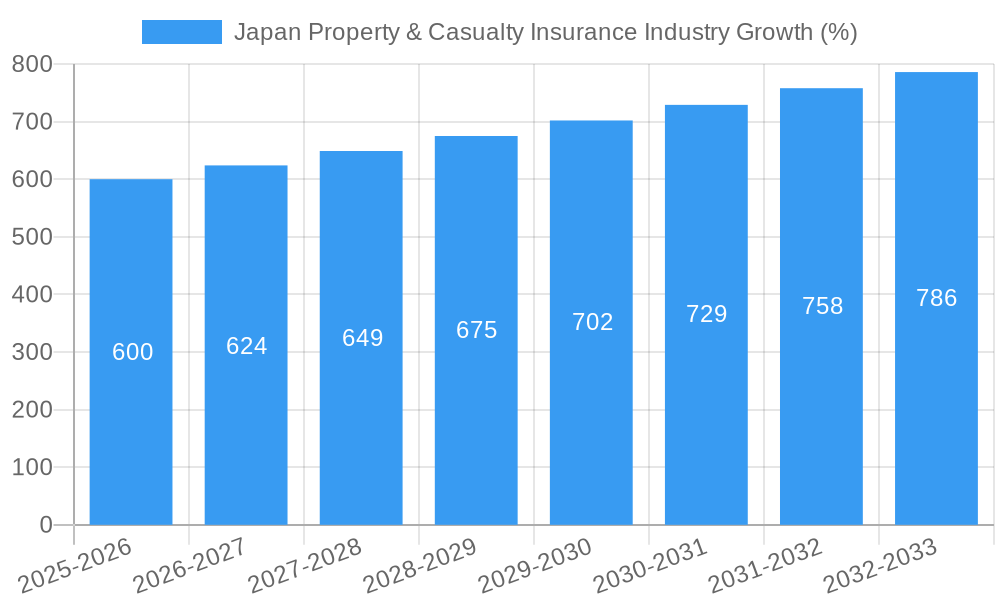

The Japan Property & Casualty (P&C) insurance market presents a compelling investment opportunity, exhibiting robust growth fueled by several key factors. The market, currently estimated at approximately ¥15 trillion (assuming a reasonable market size based on comparable developed economies and the provided CAGR), is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This growth is primarily driven by increasing urbanization, leading to higher property values and a greater demand for insurance coverage. Furthermore, heightened awareness of natural disaster risks, including earthquakes and typhoons, is prompting more individuals and businesses to secure comprehensive insurance policies. Government initiatives promoting financial security and resilience also contribute to market expansion. The competitive landscape is characterized by established players like Tokio Marine & Nichido Fire Insurance, Sompo Holdings, and MS&AD Insurance Group Holdings, alongside smaller, more specialized insurers. These companies are increasingly leveraging technology, particularly digital platforms and data analytics, to enhance customer experience, streamline operations, and develop innovative insurance products tailored to specific market needs.

However, market growth faces certain challenges. Regulatory changes, economic fluctuations, and intense competition could impact profitability. The aging population of Japan presents a demographic challenge, potentially affecting both the demand for and affordability of insurance products. While the market is resilient, insurers must adapt to evolving customer preferences, increasing digitalization, and the emergence of Insurtech companies to maintain a strong competitive edge. The segmentation of the market likely includes various product types (homeowners, auto, commercial, etc.), catering to diverse customer needs and risk profiles. Growth in specific segments, such as those focusing on cyber security and climate-related risks, is expected to be particularly strong in the forecast period. Strategic partnerships, mergers, and acquisitions are likely to shape the competitive landscape further.

Japan Property & Casualty Insurance Industry: Market Analysis & Forecast 2019-2033

This comprehensive report delivers an in-depth analysis of the Japan Property & Casualty Insurance industry, providing critical insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with a base and estimated year of 2025. This report is essential for investors, insurers, and industry professionals seeking actionable intelligence to drive strategic decision-making.

Japan Property & Casualty Insurance Industry Market Dynamics & Concentration

The Japanese Property & Casualty (P&C) insurance market, valued at xx Million in 2024, exhibits a moderately concentrated landscape. A few major players, including Tokio Marine & Nichido Fire Insurance Co Ltd, Sompo Holdings Inc, and MS&AD Insurance Group Holdings Inc, command significant market share, estimated at a combined xx%. However, the presence of numerous smaller insurers indicates scope for increased competition.

Market concentration is influenced by several factors:

- Stringent Regulatory Framework: Japan's regulatory environment shapes market entry and operational dynamics, impacting the overall level of concentration.

- Innovation Drivers: Technological advancements like AI and big data analytics are driving innovation, potentially disrupting existing market structures. This includes the development of more accurate risk assessment models and personalized insurance products.

- Product Substitutes: The emergence of alternative risk management solutions, such as self-insurance or micro-insurance schemes, exerts pressure on traditional P&C insurers.

- End-User Trends: Shifting consumer preferences toward digital channels and personalized coverage influence insurers' strategies and the overall market structure.

- M&A Activities: The past five years have witnessed xx M&A deals in the Japanese P&C insurance sector, impacting market consolidation and player rankings. These deals often involve smaller insurers being acquired by larger players, leading to further market consolidation. The average deal size has been around xx Million.

Japan Property & Casualty Insurance Industry Industry Trends & Analysis

The Japanese P&C insurance market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by several key trends:

- Increasing Insurance Penetration: Rising awareness of insurance benefits and the growing middle class are driving higher insurance penetration rates.

- Technological Disruption: Digitalization is transforming the industry, offering opportunities for enhanced customer experience, efficient claims processing, and improved risk management. Telematics and AI-powered fraud detection are key examples.

- Evolving Consumer Preferences: Customers are increasingly seeking personalized insurance products and digital-first interactions. This requires insurers to adapt their service models and product offerings.

- Intensifying Competition: Competition within the market is fierce, with both established players and new entrants vying for market share, leading to innovative product offerings and competitive pricing.

- Government Initiatives: Government policies related to disaster preparedness and insurance regulations are also influencing market dynamics. For example, government support for initiatives in disaster-prone regions might increase demand for particular types of coverage. Market penetration of specific product types (e.g., earthquake insurance) could be identified here, along with numerical data if available.

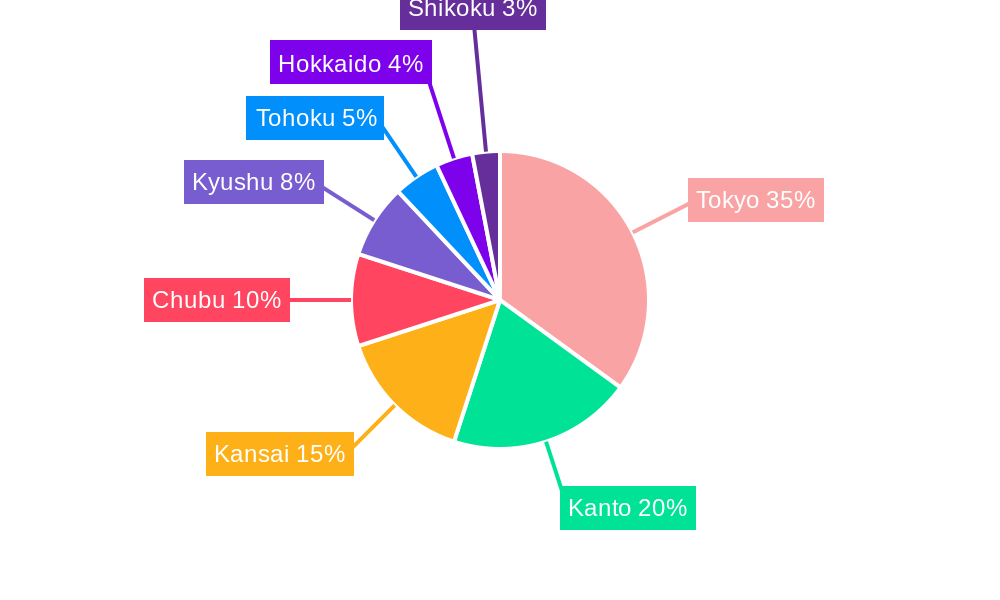

Leading Markets & Segments in Japan Property & Casualty Insurance Industry

The Japanese P&C insurance market is predominantly driven by the urban centers, particularly the Kanto region, owing to higher population density and economic activity. The Tokyo metropolitan area alone contributes a substantial portion of the overall market revenue.

- Key Drivers of Regional Dominance:

- High Population Density

- Robust Economic Activity

- Developed Infrastructure

- Higher Awareness of Insurance Benefits

Detailed dominance analysis would require further segmentation data on specific geographical areas. Further analysis of specific segments (e.g., motor insurance, property insurance, liability insurance) would reveal specific market share data and growth factors for each.

Japan Property & Casualty Insurance Industry Product Developments

The industry is witnessing a wave of product innovation, driven by technological advancements and evolving customer needs. Insurers are leveraging AI, IoT, and big data to offer personalized products with improved risk assessment and pricing models. Products incorporating telematics for automotive insurance and smart home technologies for property insurance are gaining traction. These innovations offer competitive advantages by enhancing customer experiences and improving operational efficiency.

Key Drivers of Japan Property & Casualty Insurance Industry Growth

Several factors contribute to the projected growth of the Japanese P&C insurance market:

- Technological Advancements: AI, IoT, and big data analytics are creating opportunities for improved risk management, fraud detection, and customer service.

- Economic Growth: Continued economic growth, although slow, contributes to increased disposable incomes and insurance spending.

- Government Regulations: Government initiatives related to disaster preparedness and insurance penetration are expected to influence demand.

Challenges in the Japan Property & Casualty Insurance Industry Market

The Japanese P&C insurance market faces several challenges:

- Low Interest Rates: Persistently low interest rates compress investment income for insurers.

- Natural Disasters: Japan's susceptibility to earthquakes and typhoons poses significant risk and impacts profitability. The financial impact of major events in the historical period could be quantified here.

- Intense Competition: The competitive landscape makes it challenging to maintain profitability and market share.

Emerging Opportunities in Japan Property & Casualty Insurance Industry

The Japanese P&C insurance market presents several growth opportunities:

- Expansion of Insurtech: Collaboration with fintech companies can enhance customer engagement, reduce operational costs, and provide innovative product offerings.

- Growth of Specialized Products: The demand for specialized insurance products catering to niche markets will continue to increase.

- Market Expansion: Growing awareness and increasing penetration in underserved segments provide potential for expansion.

Leading Players in the Japan Property & Casualty Insurance Industry Sector

- Tokio Marine & Nichido Fire Insurance Co Ltd

- Sompo Holdings Inc

- Rakuten General Insurance Co Ltd

- MS&AD Insurance Group Holdings Inc

- SAISON Automobile & Fire Insurance Co Ltd

- SECOM General Insurance Co Ltd

- Hitachi Capital Insurance Corporation

- Nisshin Fire & Marine Insurance Co Ltd

- Kyoei Fire & Marine Insurance Co Ltd

- Mitsui Direct General Insurance Co Ltd

List Not Exhaustive

Key Milestones in Japan Property & Casualty Insurance Industry Industry

- July 2021: Sompo International Holdings Ltd launched the Sompo Women in Insurance Management (SWIM) program, focusing on leadership development. This initiative reflects the industry's commitment to diversity and inclusion.

- July 2021: Sompo International Holdings Ltd expanded its global product capabilities with the formation of Sompo Global Risk Solutions (GRS) Asia-Pacific, signifying its strategic focus on the Asian market.

Strategic Outlook for Japan Property & Casualty Insurance Industry Market

The Japanese P&C insurance market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and government initiatives. Strategic partnerships, product diversification, and a focus on digital transformation will be key to success. The market's resilience to economic fluctuations, coupled with opportunities in emerging segments, presents significant long-term potential.

Japan Property & Casualty Insurance Industry Segmentation

-

1. Insurance Type

- 1.1. Property

- 1.2. Auto

- 1.3. Other Insurance Types

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Other Distribution Channels

Japan Property & Casualty Insurance Industry Segmentation By Geography

- 1. Japan

Japan Property & Casualty Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Status of Automobile Insurance in Japan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Property & Casualty Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Property

- 5.1.2. Auto

- 5.1.3. Other Insurance Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tokio Marine & Nichido Fire Insurance Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sompo Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rakuten General Insurance Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MS&AD Insurance Group Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAISON Automobile & Fire Insurance Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SECOM General Insurance Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hitachi Capital Insurance Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nisshin Fire & Marine Insurance Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kyoei Fire & Marine Insurance Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsui Direct General Insurance Co Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tokio Marine & Nichido Fire Insurance Co Ltd

List of Figures

- Figure 1: Japan Property & Casualty Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Property & Casualty Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Property & Casualty Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Property & Casualty Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Japan Property & Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Japan Property & Casualty Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Property & Casualty Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 6: Japan Property & Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Japan Property & Casualty Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Property & Casualty Insurance Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Japan Property & Casualty Insurance Industry?

Key companies in the market include Tokio Marine & Nichido Fire Insurance Co Ltd, Sompo Holdings Inc, Rakuten General Insurance Co Ltd, MS&AD Insurance Group Holdings Inc, SAISON Automobile & Fire Insurance Co Ltd, SECOM General Insurance Co Ltd, Hitachi Capital Insurance Corporation, Nisshin Fire & Marine Insurance Co Ltd, Kyoei Fire & Marine Insurance Co Ltd, Mitsui Direct General Insurance Co Ltd **List Not Exhaustive.

3. What are the main segments of the Japan Property & Casualty Insurance Industry?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Status of Automobile Insurance in Japan.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2021 - Sompo International Holdings Ltd, a global, Bermuda-based specialty provider of property and casualty insurance and reinsurance, announced the launch of its Sompo Women in Insurance Management (SWIM) program, which aims to better prepare young women to assume future leadership roles at Sompo International. The initial program will begin in the United States in collaboration with High Point University located in High Point, North Carolina, to ultimately expand the program and approach to additional universities in the U.S. and internationally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Property & Casualty Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Property & Casualty Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Property & Casualty Insurance Industry?

To stay informed about further developments, trends, and reports in the Japan Property & Casualty Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence