Key Insights

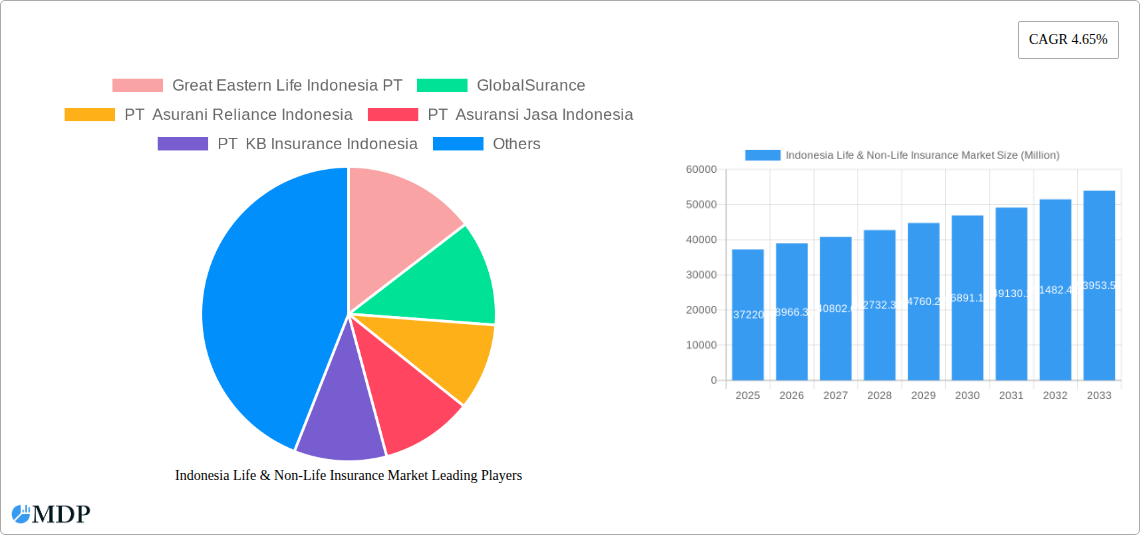

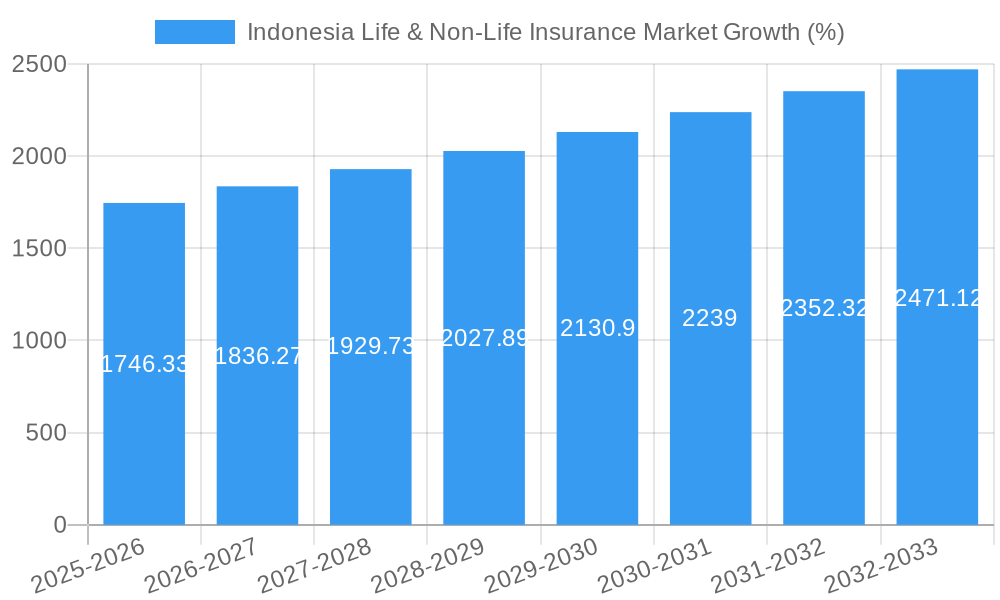

The Indonesian life and non-life insurance market presents a compelling growth opportunity, with a market size of $37.22 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 4.65% from 2025 to 2033. This expansion is driven by several key factors. Increasing awareness of insurance products, particularly among the growing middle class, fuels demand. Government initiatives promoting financial inclusion and insurance penetration further contribute to market growth. Furthermore, the rising prevalence of chronic diseases and the increasing need for healthcare coverage are boosting demand for health insurance products. Technological advancements, such as digital insurance platforms and mobile-based applications, are streamlining distribution and enhancing customer experience, accelerating market penetration. Competition is intensifying, with both domestic and international players vying for market share. Key players like Great Eastern Life Indonesia, GlobalSurance, and PT Asuransi Reliance Indonesia are actively involved in expanding their product offerings and distribution networks to cater to the evolving needs of the Indonesian population.

However, challenges remain. Limited financial literacy and trust in insurance products, particularly in rural areas, hinder wider adoption. Regulatory changes and infrastructural limitations also pose obstacles. The market is segmented by product type (life, health, non-life, etc.), distribution channels (online, agents, brokers), and geographic location. While precise segment-specific data is unavailable, it's evident that the life insurance segment likely holds a significant portion of the market due to cultural preferences and increasing awareness of retirement planning and wealth protection. To overcome these hurdles, insurers are investing heavily in digital technologies, financial literacy programs, and expanding their distribution networks to reach previously underserved populations. The long-term outlook for the Indonesian insurance market remains positive, anticipating robust growth driven by economic expansion and an evolving insurance landscape.

Indonesia Life & Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of Indonesia's dynamic life and non-life insurance market, covering the period 2019-2033. With a focus on market dynamics, industry trends, leading players, and future opportunities, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. We delve into market concentration, competitive landscapes, and growth drivers to offer actionable insights for navigating this rapidly evolving sector. The report uses 2025 as the base year, with forecasts extending to 2033. Key market segments are analyzed, along with the impact of recent mergers and acquisitions (M&A) and technological advancements. Expect detailed data and analysis, including CAGR projections and market penetration rates.

Indonesia Life & Non-Life Insurance Market Market Dynamics & Concentration

The Indonesian life and non-life insurance market exhibits a complex interplay of factors influencing its concentration and dynamism. The market share is currently dominated by a few large players, but a fragmented landscape also exists with numerous smaller insurers. While precise market share figures for each insurer require a deeper dive into the available data, xx% of the market is currently concentrated within the top 5 players. This is expected to see some consolidation with further M&A activity anticipated to occur in the next few years. Innovation drivers include increasing digitalization and the demand for tailored insurance products. The regulatory framework, while evolving, plays a crucial role in shaping market behavior. The emergence of alternative financial products acts as a substitute for traditional insurance solutions, adding a layer of complexity to the market’s evolution. Consumer preference shifts toward digital platforms and online transactions is significant.

Key Market Dynamics:

- Market Concentration: High concentration among top players, although smaller insurers make up a considerable part.

- Innovation Drivers: Digitalization, personalized products, and increasing financial literacy.

- Regulatory Framework: Evolving regulations influence market access and product offerings.

- Product Substitutes: Emergence of alternative financial services competes with traditional insurance.

- End-User Trends: Growing preference for digital channels and tailored solutions.

- M&A Activity: Significant M&A activity observed, potentially reshaping market dynamics and concentration in coming years (xx deals recorded between 2019-2024, xx anticipated for 2025-2033).

Indonesia Life & Non-Life Insurance Market Industry Trends & Analysis

The Indonesian life and non-life insurance market is experiencing robust growth, driven by several key factors. The rising middle class, expanding urbanization, and increasing awareness of risk management are significant contributors to this expansion. Technological advancements, particularly the proliferation of digital platforms and fintech solutions, are reshaping the market landscape. Consumer preferences are shifting toward customized products with streamlined digital access. Competitive dynamics are characterized by an increasing level of competition amongst existing players and the entry of new players into the market. The Compound Annual Growth Rate (CAGR) for the period 2019–2024 stood at xx%, and forecasts suggest a CAGR of xx% for 2025–2033. Market penetration continues to grow, with current penetration at xx% and projections reaching xx% by 2033. This robust growth is significantly influenced by improved financial inclusion in the country and a growing appetite for insurance as a risk management tool.

Leading Markets & Segments in Indonesia Life & Non-Life Insurance Market

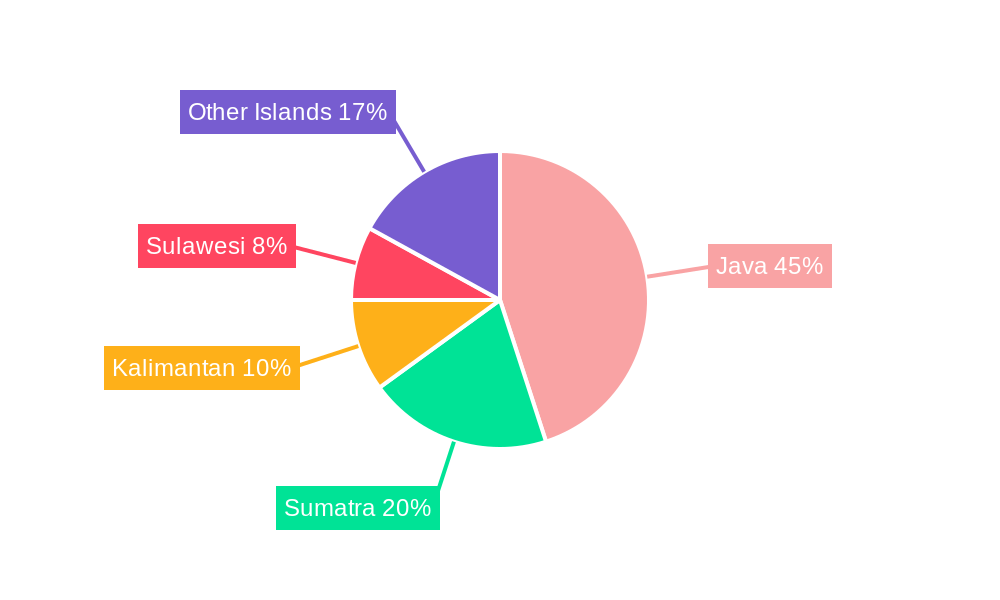

The Indonesian life and non-life insurance market shows a strong regional disparity. While detailed regional breakdown requires further research, the major cities like Jakarta, Surabaya, and Bandung exhibit higher market concentration due to higher population density, economic activity, and better infrastructure.

Key Drivers of Market Dominance:

- Economic Policies: Government initiatives supporting financial inclusion and insurance penetration.

- Infrastructure: Better infrastructure in urban areas facilitates better access to insurance services.

- Digital Penetration: Higher digital penetration in urban areas enhances market access through online platforms.

The dominance of urban centers is primarily due to higher income levels, better access to financial services, and greater awareness of insurance products within these densely populated areas. Further research is needed to provide a more detailed regional analysis and identification of segments which will yield the highest returns.

Indonesia Life & Non-Life Insurance Market Product Developments

Recent product innovations in the Indonesian insurance market reflect a strong focus on digitalization and customization. Insurers are increasingly leveraging technology to create user-friendly platforms, personalized products, and seamless customer journeys. The market is seeing an expansion of micro-insurance products, aimed at catering to the lower-income segments of the population. This highlights the market’s growing inclusivity and commitment to providing tailored financial solutions to all consumers.

Key Drivers of Indonesia Life & Non-Life Insurance Market Growth

Several factors are driving the growth of Indonesia's life and non-life insurance market: The burgeoning middle class represents a substantial increase in potential customers. Government initiatives promoting financial inclusion create a more conducive environment for insurance penetration. Technological advancements, including mobile penetration and digital payment systems, expand market accessibility. These factors collectively underpin the market's impressive growth trajectory.

Challenges in the Indonesia Life & Non-Life Insurance Market Market

The Indonesian insurance market faces challenges including limited insurance awareness in certain demographic groups, infrastructure gaps that hinder accessibility, especially in rural areas, and competition from informal insurance options. These factors present obstacles to wider penetration and sustainable market growth. The regulatory landscape, while evolving, requires more clarity and consistency for long term market stability. Addressing these factors is critical to maximizing the potential of this significant market.

Emerging Opportunities in Indonesia Life & Non-Life Insurance Market

Significant long-term growth opportunities exist in Indonesia's insurance sector, driven primarily by increasing digital financial literacy and the potential to expand into underserved market segments. Strategic partnerships between insurers and fintech companies unlock access to wider market reach, particularly in rural areas. The development of innovative insurance products tailored to specific consumer needs will further drive this expansion.

Leading Players in the Indonesia Life & Non-Life Insurance Market Sector

- Great Eastern Life Indonesia PT

- GlobalSurance

- PT Asurani Reliance Indonesia

- PT Asuransi Jasa Indonesia

- PT KB Insurance Indonesia

- PT Tokio Marine Life Insurance Indonesia

- PT Fistlight Indonesia

- Bank Negara Indonesia

- PT Tokio Marine

- Chubb Insurance

(List Not Exhaustive)

Key Milestones in Indonesia Life & Non-Life Insurance Market Industry

- April 2023: Hanwha Life acquires Lippo General Insurance, boosting its global presence and digital capabilities.

- January 2022: Great Eastern Life Indonesia launches the i-Great Heritage Assurance Service, partnering with Bank OCBC NISP's Sharia Business Unit.

Strategic Outlook for Indonesia Life & Non-Life Insurance Market Market

The Indonesian life and non-life insurance market presents a compelling long-term investment opportunity. Continued growth is anticipated, fueled by technological advancements, expanding financial inclusion, and increasing consumer awareness. Strategic partnerships and product innovation will be crucial for capitalizing on this potential, leading to significant market expansion in the coming years.

Indonesia Life & Non-Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non - Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Rest of Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Indonesia Life & Non-Life Insurance Market Segmentation By Geography

- 1. Indonesia

Indonesia Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Awareness of the Importance of Insurance

- 3.3. Market Restrains

- 3.3.1. The Growing Awareness of the Importance of Insurance

- 3.4. Market Trends

- 3.4.1. Life Insurance Holds the Largest Segment in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non - Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Rest of Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Great Eastern Life Indonesia PT

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GlobalSurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Asurani Reliance Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Asuransi Jasa Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT KB Insurance Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Tokio Marine Life Insurance Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Fistlight Indonesia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bank Negara Indonesia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Tokio Marine

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chubb Insurance**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Great Eastern Life Indonesia PT

List of Figures

- Figure 1: Indonesia Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 4: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Insurance Type 2019 & 2032

- Table 5: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 6: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Channel of Distribution 2019 & 2032

- Table 7: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 10: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Insurance Type 2019 & 2032

- Table 11: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 12: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Channel of Distribution 2019 & 2032

- Table 13: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Life & Non-Life Insurance Market?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Indonesia Life & Non-Life Insurance Market?

Key companies in the market include Great Eastern Life Indonesia PT, GlobalSurance, PT Asurani Reliance Indonesia, PT Asuransi Jasa Indonesia, PT KB Insurance Indonesia, PT Tokio Marine Life Insurance Indonesia, PT Fistlight Indonesia, Bank Negara Indonesia, PT Tokio Marine, Chubb Insurance**List Not Exhaustive.

3. What are the main segments of the Indonesia Life & Non-Life Insurance Market?

The market segments include Insurance Type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.22 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Awareness of the Importance of Insurance.

6. What are the notable trends driving market growth?

Life Insurance Holds the Largest Segment in the Market.

7. Are there any restraints impacting market growth?

The Growing Awareness of the Importance of Insurance.

8. Can you provide examples of recent developments in the market?

In April 2023, Hanwha Life acquired Lippo General Insurance to improve its global presence and digital capabilities. Hanwha Life plans to become a leading digital financial services provider by offering tailored financial solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Indonesia Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence