Key Insights

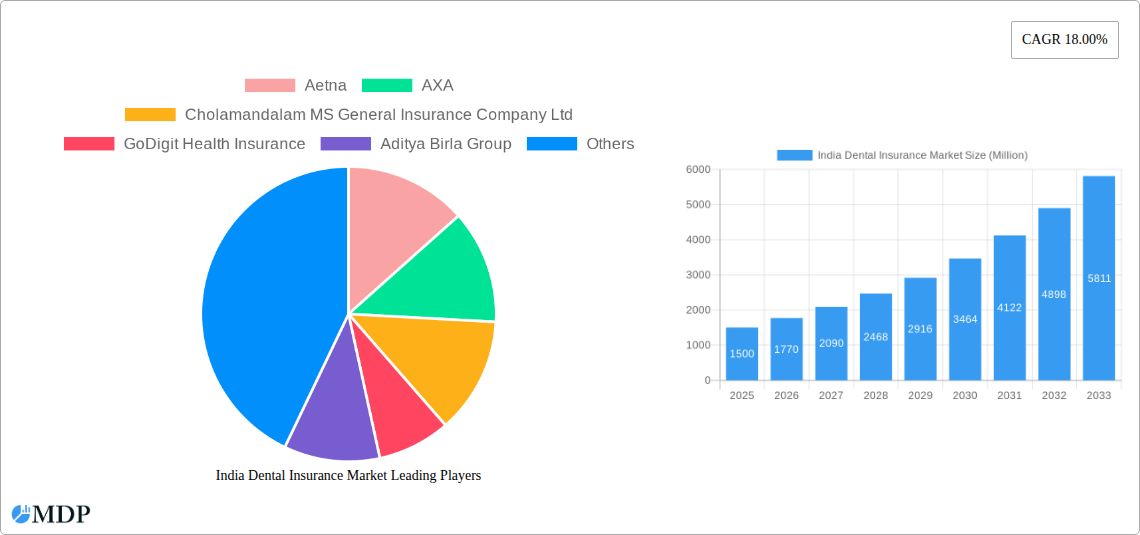

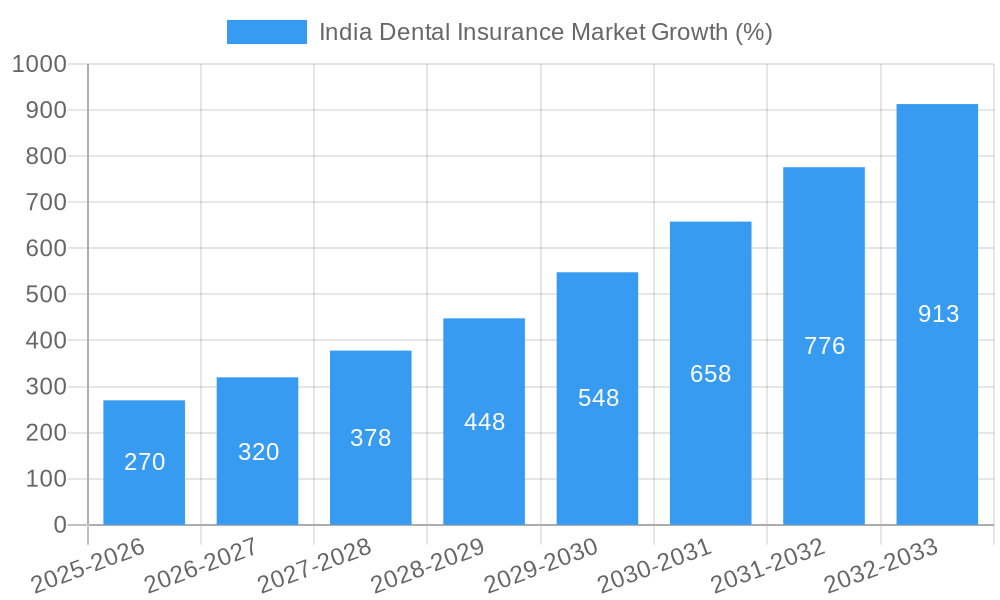

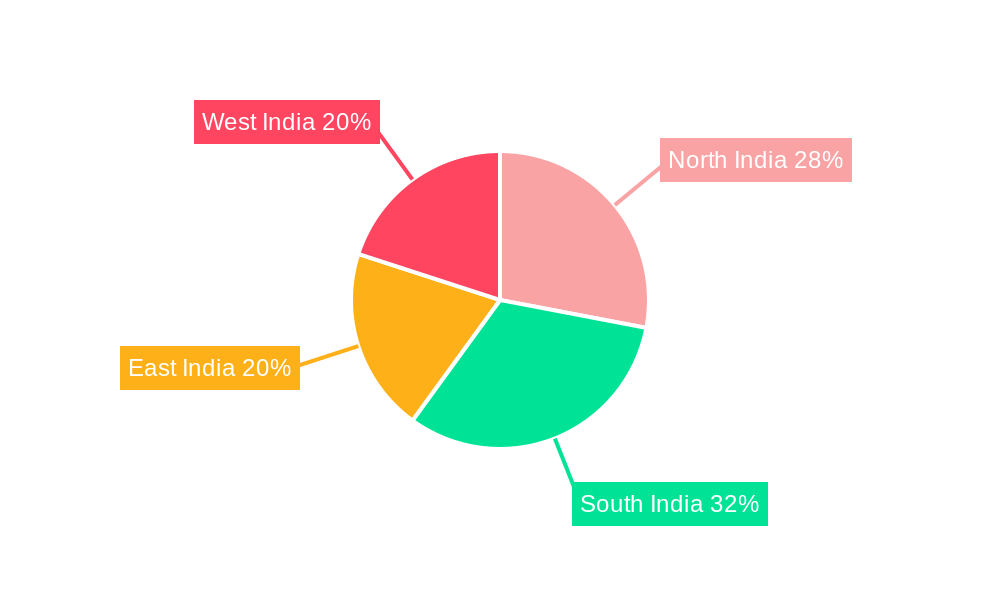

The Indian dental insurance market is experiencing robust growth, projected to reach a substantial size with a Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2033. This expansion is fueled by several key factors. Rising dental awareness among the population, particularly within the growing middle class, is driving demand for preventative and comprehensive dental care. An aging population, increasing prevalence of dental diseases, and a shift towards a more health-conscious lifestyle all contribute to higher insurance uptake. Furthermore, the expansion of dental insurance coverage through various plans such as Dental Health Maintenance Organizations (DHMOs), Dental Preferred Provider Organizations (DPPOs), and Dental Indemnity Plans (DIPs) is broadening market accessibility. The market is segmented by procedure type (preventive, major, basic), end-user (individuals, corporates), demographics (senior citizens, minors, other), and coverage type (DHMO, DPPO, DIP, Dental Point of Service (DPS)). Key players like Aetna, AXA, Cholamandalam MS General Insurance, GoDigit Health Insurance, Aditya Birla Group, Delta Dental, Star Health & Allied Insurance, Policy Bazaar, and Allianz are actively shaping the market landscape through innovative product offerings and expansion strategies. The regional distribution across North, South, East, and West India reflects varying levels of awareness and penetration, presenting further opportunities for growth.

The market's growth trajectory is expected to remain strong throughout the forecast period. However, challenges such as high out-of-pocket expenses for dental procedures and limited insurance coverage in certain regions present potential restraints. Government initiatives promoting dental health awareness and affordable healthcare could significantly influence market dynamics. Furthermore, the increasing adoption of digital technologies in the insurance sector, including online platforms and tele-dentistry, will likely streamline access and enhance customer experience. The competitive landscape will likely intensify as more players enter the market, leading to product innovation and price optimization. Strategic partnerships between insurers and dental providers will be crucial in driving market penetration and fostering customer loyalty.

India Dental Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning India Dental Insurance Market, offering invaluable insights for stakeholders including insurers, investors, and healthcare professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities. The market is projected to reach xx Million by 2033, showcasing significant growth potential. This report delves into market dynamics, leading players, segment analysis, and future outlook, equipping readers with actionable intelligence to navigate this expanding sector.

India Dental Insurance Market Dynamics & Concentration

The Indian dental insurance market exhibits a dynamic landscape characterized by increasing market concentration among established players and the emergence of niche players. Innovation, driven by technological advancements and evolving consumer preferences, is a key driver. Regulatory frameworks, including recent relaxations by IRDAI, significantly influence market participation and expansion. Product substitutes, such as individual savings plans, pose a challenge. The market is experiencing notable M&A activity, though the exact number of deals remains at xx in 2024.

- Market Share: Aetna, AXA, and Cholamandalam MS General Insurance Company Ltd currently hold a significant market share, with smaller players vying for a larger piece of the pie. Exact figures are unavailable but are estimated to be xx%, xx%, and xx% respectively in 2024.

- M&A Activity: The number of M&A deals in the Indian dental insurance market increased to xx in 2024, primarily driven by consolidation and expansion strategies amongst key players.

- Regulatory Framework: The IRDAI's recent relaxations on market-linked products and promoter share dilution significantly impact the market, fostering growth and attracting new entrants.

- End-User Trends: A growing awareness of dental health and rising disposable incomes are fueling demand for dental insurance amongst individuals and corporates.

India Dental Insurance Market Industry Trends & Analysis

The Indian dental insurance market is experiencing robust growth, with a CAGR of xx% from 2025 to 2033. This growth is fueled by several factors, including increasing dental awareness, rising healthcare costs, and favorable government initiatives. Technological advancements, such as tele-dentistry and digital platforms, are disrupting traditional service delivery models. Consumer preferences are shifting toward comprehensive coverage and convenient access to dental services. Competitive dynamics are intensifying, with established players facing pressure from new entrants offering niche products and services. Market penetration remains relatively low, offering significant growth potential. The increasing prevalence of dental diseases, coupled with rising healthcare costs, is driving demand for comprehensive dental insurance coverage.

Leading Markets & Segments in India Dental Insurance Market

While data on regional dominance is limited, the urban areas are predicted to show the highest growth. The individual segment currently dominates the end-user market, followed by corporate segments. Within procedures, preventive care is gaining traction, while major procedures represent a substantial portion of claims.

- Key Drivers:

- Economic Growth: Rising disposable incomes and increased health consciousness among the population are boosting demand.

- Technological Advancements: Tele-dentistry and digital platforms are enhancing accessibility and convenience.

- Government Initiatives: Government regulations and policies focusing on affordable healthcare are facilitating market expansion.

- Dominant Segments:

- End-User: Individuals represent the largest segment, driven by increasing awareness and affordability concerns.

- Procedure: Preventive dental care is gaining traction, indicating a positive trend towards proactive health management.

India Dental Insurance Market Product Developments

Recent product innovations in the Indian dental insurance market center around enhanced coverage options, including digital platforms for claims processing and telehealth integration. Insurers are incorporating innovative features like preventive care programs and partnerships with dental clinics to provide comprehensive services. These innovations are designed to improve accessibility, affordability, and customer experience, ultimately driving market growth and establishing a competitive advantage.

Key Drivers of India Dental Insurance Market Growth

Several factors contribute to the growth of the India Dental Insurance Market:

- Rising Healthcare Costs: The increasing cost of dental treatments is driving the demand for insurance coverage.

- Growing Awareness of Dental Health: Increased public awareness about oral hygiene and the importance of preventive dental care is boosting demand.

- Technological Advancements: The use of tele-dentistry and digital platforms is making dental care more accessible and convenient.

- Favorable Regulatory Environment: The recent relaxation of regulations by IRDAI is further propelling market growth.

Challenges in the India Dental Insurance Market Market

The market faces challenges such as low awareness levels in rural areas and high treatment costs, limiting accessibility for a significant portion of the population. The fragmented nature of the dental healthcare sector also presents logistical difficulties. The relatively low penetration rate underscores the need for effective marketing and outreach strategies to reach underserved populations.

Emerging Opportunities in India Dental Insurance Market

The Indian dental insurance market presents significant long-term growth opportunities. Strategic partnerships between insurers and dental clinics, along with expansion into rural areas through innovative distribution channels and digital platforms, hold immense potential. Technological advancements, such as AI-powered diagnostic tools, will likely shape future offerings.

Leading Players in the India Dental Insurance Market Sector

- Aetna

- AXA

- Cholamandalam MS General Insurance Company Ltd

- GoDigit Health Insurance

- Aditya Birla Group

- Delta Dental

- Star Health & Allied Insurance

- Policy bazaar

- Allianz

- Humana Dental Insurance

Key Milestones in India Dental Insurance Market Industry

- November 2022: IRDAI relaxed regulations on market-linked products, increased data transparency, and allowed for more tie-ups for corporate agents, boosting the market's potential.

- November 2022: IRDAI allowed for greater promoter share dilution, enabling smaller insurers to raise capital and expand their reach in the market.

- 2018: IRDAI's decision to promote dental insurance as a standalone product led to the emergence of specialized offerings from several insurers.

Strategic Outlook for India Dental Insurance Market Market

The India Dental Insurance Market is poised for significant expansion, driven by rising healthcare costs, increased dental awareness, and technological advancements. Strategic partnerships, expansion into untapped markets, and product innovation will be key to capturing market share and achieving long-term growth. Focusing on preventive care and utilizing digital technologies will be crucial for success.

India Dental Insurance Market Segmentation

-

1. Coverage

- 1.1. Dental Health Maintenance Organizations(DHMO)

- 1.2. Dental Preferred Provider Organization(DEPO)

- 1.3. Dental Indemnity Plan(DIP)

- 1.4. Dental Point of Service(DPS)

-

2. Procedure

- 2.1. Preventive

- 2.2. Major

- 2.3. Basic

-

3. End User

- 3.1. Individual

- 3.2. Corporates

-

4. Demographics

- 4.1. Senior Citizen

- 4.2. Minors

- 4.3. Other Demographics

India Dental Insurance Market Segmentation By Geography

- 1. India

India Dental Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate

- 3.3. Market Restrains

- 3.3.1. Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 3.4. Market Trends

- 3.4.1 Changing eating habits affecting dental insurance market

- 3.4.2 because of early tooth diseases.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Dental Health Maintenance Organizations(DHMO)

- 5.1.2. Dental Preferred Provider Organization(DEPO)

- 5.1.3. Dental Indemnity Plan(DIP)

- 5.1.4. Dental Point of Service(DPS)

- 5.2. Market Analysis, Insights and Forecast - by Procedure

- 5.2.1. Preventive

- 5.2.2. Major

- 5.2.3. Basic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Individual

- 5.3.2. Corporates

- 5.4. Market Analysis, Insights and Forecast - by Demographics

- 5.4.1. Senior Citizen

- 5.4.2. Minors

- 5.4.3. Other Demographics

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. North India India Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Aetna

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AXA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cholamandalam MS General Insurance Company Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GoDigit Health Insurance

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Aditya Birla Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Delta Dental

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Star Health & Allied Insurance**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Policy bazaar

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Allianz

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Humana Dental Insurance

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Aetna

List of Figures

- Figure 1: India Dental Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Dental Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: India Dental Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 3: India Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 4: India Dental Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: India Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 6: India Dental Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: India Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North India India Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South India India Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: East India India Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West India India Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 13: India Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 14: India Dental Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: India Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 16: India Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Dental Insurance Market?

The projected CAGR is approximately 18.00%.

2. Which companies are prominent players in the India Dental Insurance Market?

Key companies in the market include Aetna, AXA, Cholamandalam MS General Insurance Company Ltd, GoDigit Health Insurance, Aditya Birla Group, Delta Dental, Star Health & Allied Insurance**List Not Exhaustive, Policy bazaar, Allianz, Humana Dental Insurance.

3. What are the main segments of the India Dental Insurance Market?

The market segments include Coverage, Procedure, End User, Demographics.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate.

6. What are the notable trends driving market growth?

Changing eating habits affecting dental insurance market. because of early tooth diseases..

7. Are there any restraints impacting market growth?

Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards..

8. Can you provide examples of recent developments in the market?

On 25 November 2022, IRDAI relaxed regulations related to market-linked products, increased transparency of data with account aggregators, and increased the maximum number of tie-ups from 6 to 9 for corporate agents and IMFs. These relaxations shall increase the scope for small insurers to expand in India with niche offerings such as dental insurance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Dental Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Dental Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Dental Insurance Market?

To stay informed about further developments, trends, and reports in the India Dental Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence