Key Insights

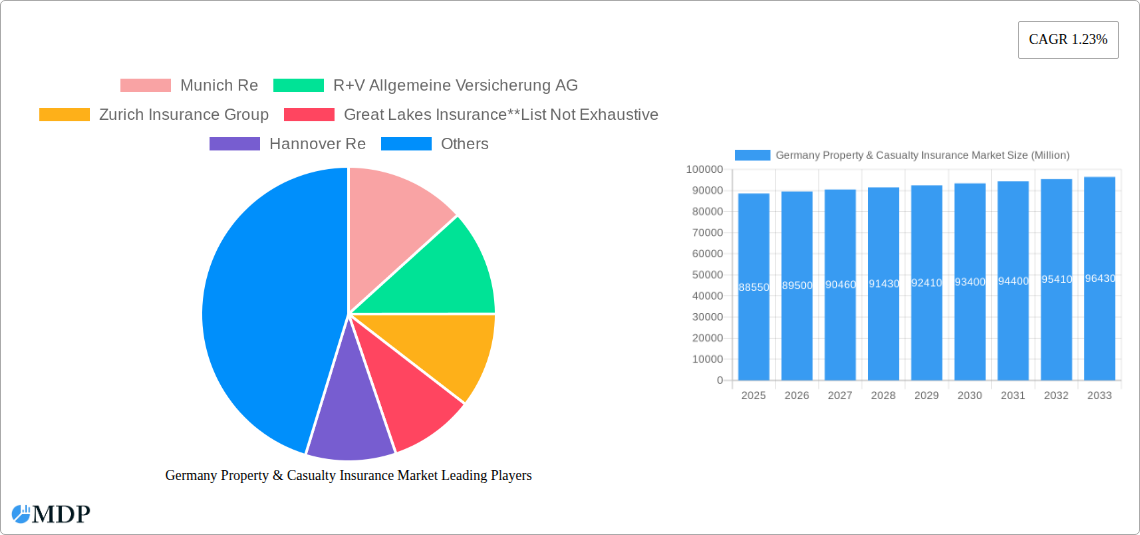

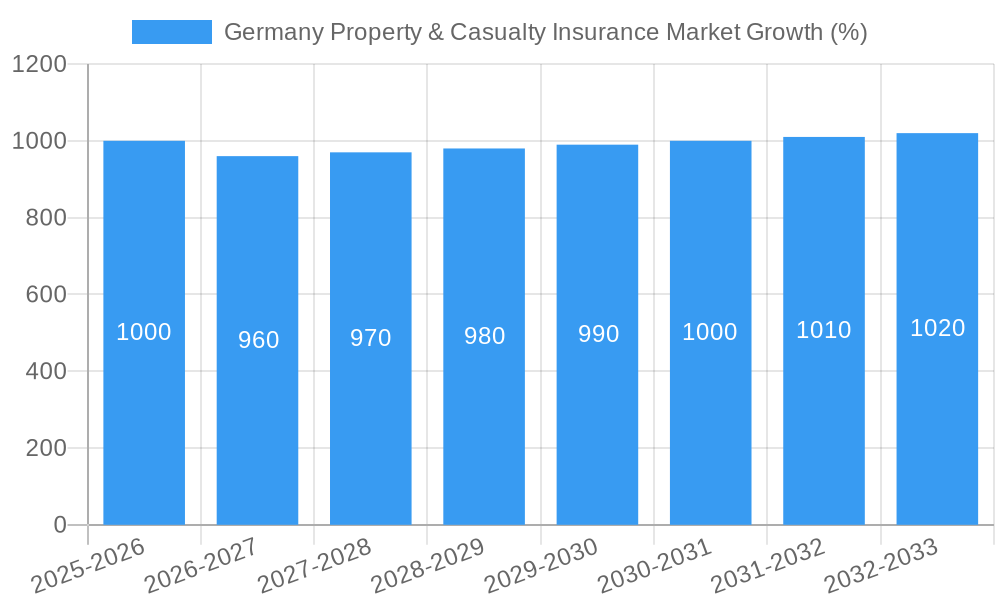

The German Property & Casualty (P&C) insurance market, valued at €88.55 billion in 2025, is projected to experience moderate growth over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 1.23% indicates a steady, albeit not explosive, expansion. This relatively low CAGR suggests a mature market with established players and a high level of insurance penetration. Driving market growth are factors such as increasing urbanization leading to higher property values and a growing awareness of the need for comprehensive insurance coverage against potential risks like natural disasters and cyber threats. Furthermore, the increasing adoption of digital technologies by insurance companies is streamlining operations, improving customer experience, and fostering greater efficiency, contributing to market expansion. Conversely, stringent regulatory oversight and intense competition amongst established insurers like Allianz, Munich Re, and Zurich Insurance Group, along with newer entrants, act as constraints on rapid growth. Market segmentation reveals significant contributions from auto and homeowners insurance, highlighting the dependence on personal lines for market stability. Growth in commercial property insurance will likely be driven by Germany's robust industrial and commercial sectors. The dominance of established distribution channels like agencies alongside the emerging influence of direct business and digital platforms reflects evolving consumer preferences.

The projected growth in the German P&C insurance market will likely be unevenly distributed across segments. While the auto and homeowners insurance segments will likely maintain a steady growth trajectory, driven by population growth and rising property values, commercial property insurance is expected to experience a slightly higher growth rate, reflecting the evolving economic landscape. The "Other Insurance Types" segment, including health and legal insurance, presents significant potential for future growth, fueled by increasing public awareness and government initiatives promoting insurance penetration. The ongoing digital transformation within the industry, while impacting market dynamics positively, requires careful attention to data security and customer privacy regulations. Strategic partnerships and mergers and acquisitions are expected to continue reshaping the competitive landscape, with large multinational players vying for market share against more agile, specialized competitors. Overall, the German P&C insurance market presents a stable investment opportunity, but profitability will depend on adapting to technological changes and effectively navigating the competitive landscape.

Germany Property & Casualty Insurance Market: 2019-2033 Forecast

Dive deep into the comprehensive analysis of the German Property & Casualty Insurance Market, providing invaluable insights for strategic decision-making. This report offers a detailed examination of market dynamics, key players, emerging trends, and future growth prospects from 2019 to 2033, with a focus on 2025. The study covers various insurance types (auto, homeowners, commercial property, fire, general liability, and others) and distribution channels (direct, agency, banks, and others), providing a holistic view of this dynamic market. This report is crucial for insurers, investors, and anyone seeking to understand the complexities and opportunities within the German P&C insurance landscape.

Germany Property & Casualty Insurance Market Market Dynamics & Concentration

The German property & casualty (P&C) insurance market is characterized by a high degree of concentration, with a few major players dominating the landscape. Market share analysis reveals that Allianz, Munich Re, and AXA collectively hold approximately XX% of the market in 2025. This concentration is driven by significant economies of scale, strong brand recognition, and extensive distribution networks. Innovation in the market is propelled by technological advancements, particularly in areas such as telematics, AI-driven risk assessment, and digital distribution channels. The regulatory framework, overseen by the BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), plays a crucial role in shaping market conduct, ensuring solvency, and promoting consumer protection. Substitute products, such as self-insurance and alternative risk transfer mechanisms, are present but haven't significantly eroded the market share of traditional insurers. End-user trends, including increasing demand for customized insurance products and digital customer experiences, are influencing the market's evolution. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately XX M&A deals recorded between 2019 and 2024. However, the increasing focus on digitalization and expansion into new insurance segments is expected to spur more consolidation in the years to come.

- Market Concentration: High, with top 3 players holding approximately XX% market share in 2025.

- Innovation Drivers: Technological advancements (telematics, AI), changing customer preferences.

- Regulatory Framework: Stringent regulations ensuring solvency and consumer protection, primarily by BaFin.

- M&A Activity: Approximately XX deals between 2019 and 2024, with an expected increase.

Germany Property & Casualty Insurance Market Industry Trends & Analysis

The German P&C insurance market demonstrates consistent growth, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) and a projected CAGR of XX% during the forecast period (2025-2033). Key growth drivers include rising disposable incomes, increasing awareness of insurance needs, and expanding coverage for various risks. Technological disruptions, such as the adoption of Insurtech solutions and the growing use of data analytics, are significantly impacting the industry, leading to improved efficiency, personalized products, and enhanced customer experiences. Consumer preferences are shifting towards digital-first interactions, demanding seamless online experiences, personalized offerings, and transparent pricing. Competitive dynamics are characterized by price competition, product innovation, and a continuous race towards digital transformation. Market penetration varies across segments, with auto insurance exhibiting the highest penetration rate due to mandatory coverage regulations. The ongoing focus on sustainable business practices within the insurance sector is also a contributing factor shaping the market trajectory.

Leading Markets & Segments in Germany Property & Casualty Insurance Market

The German P&C insurance market is geographically diverse, with no single dominant region. However, population density and economic activity are key indicators of segment performance.

By Insurance Type:

- Auto Insurance: Remains the largest segment, driven by mandatory coverage regulations and high car ownership.

- Homeowners Insurance: Steady growth fueled by increasing property values and homeowner awareness.

- Commercial Property Insurance: Shows substantial growth, mirroring developments in the German economy.

- Fire Insurance: A significant component of commercial and homeowners insurance, showing moderate growth in line with overall market trends.

- General Liability Insurance: Growing steadily due to increased legal and regulatory compliance requirements.

- Other Insurance Types (Health & Legal): Exhibit moderate growth with significant room for expansion.

By Distribution Channel:

- Agency: Remains the most prevalent distribution channel due to strong agent networks.

- Direct Business: Growing rapidly, driven by digitalization and online platforms.

- Banks: Significant players in distribution, primarily for bundled insurance products.

- Other Distribution Channels: A smaller but growing segment encompassing various partners.

Key Drivers: Strong economic fundamentals, a well-developed infrastructure, and a stable regulatory environment fuel overall market growth. Specific economic policies promoting homeownership and business investment contribute to the growth of individual segments.

Germany Property & Casualty Insurance Market Product Developments

Recent product innovations in the German P&C insurance market reflect a significant shift toward digitalization and personalization. Insurers are incorporating telematics data into auto insurance pricing, offering usage-based insurance (UBI) models. Homeowners insurance policies are incorporating smart home technology and IoT devices to improve risk assessment and prevention measures. The market is witnessing the development of modular insurance products that allow customers to customize their coverage. Furthermore, AI-powered risk assessment models are improving accuracy and efficiency in underwriting processes.

Key Drivers of Germany Property & Casualty Insurance Market Growth

The growth of the German P&C insurance market is fueled by several factors. Firstly, the robust German economy, with consistent GDP growth, drives increased demand for various insurance products. Secondly, increasing awareness of risk management among individuals and businesses leads to higher insurance uptake. Technological advancements, such as the adoption of Insurtech solutions, improve efficiency and create personalized insurance options, furthering market expansion. Finally, favorable regulatory policies encouraging insurance market development contribute significantly to the growth trajectory.

Challenges in the Germany Property & Casualty Insurance Market Market

The German P&C insurance market faces challenges, including intensifying competition among established players and new Insurtech entrants. This leads to price pressure and requires insurers to innovate constantly to remain competitive. Furthermore, regulatory changes and increasing compliance costs add to the operational burden. The increasing prevalence of cyber threats and data security concerns pose a significant challenge, requiring substantial investments in security measures. Finally, adjusting to evolving consumer expectations and technological advancements presents continuous adaptation challenges for traditional insurers.

Emerging Opportunities in Germany Property & Casualty Insurance Market

The German P&C insurance market presents substantial long-term growth opportunities. The increasing adoption of smart technologies creates possibilities for usage-based insurance and predictive risk modeling. Strategic partnerships between traditional insurers and technology companies can lead to innovative product offerings and improved customer experience. Expanding into niche insurance segments and focusing on underserved markets presents further growth potential. Lastly, a growing focus on sustainable and ESG-compliant insurance products can attract environmentally conscious customers.

Leading Players in the Germany Property & Casualty Insurance Market Sector

- Munich Re

- R+V Allgemeine Versicherung AG

- Zurich Insurance Group

- Great Lakes Insurance

- Hannover Re

- AXA

- Ergo Group AG

- HDI Global SE

- Allianz

- Generali

Key Milestones in Germany Property & Casualty Insurance Market Industry

- July 2022: Hanover Insurance introduced the Hanover i-on Sensor program to reduce business debt, showcasing technological innovation in risk management.

- December 2022: ERGO launched a new brand claim emphasizing ease of use, reflecting a focus on customer experience and digitalization.

Strategic Outlook for Germany Property & Casualty Insurance Market Market

The German P&C insurance market is poised for continued growth, driven by economic stability, technological advancements, and evolving consumer preferences. Strategic opportunities lie in embracing digital transformation, investing in data analytics, and fostering strategic partnerships. Insurers who successfully adapt to changing market dynamics, prioritize customer experience, and leverage technological innovations are likely to achieve significant success in the years to come. Focus on sustainable insurance practices and expanding into niche markets will further solidify market positioning and long-term growth.

Germany Property & Casualty Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Auto Insurance

- 1.2. Homeowners Insurance

- 1.3. Commercial Property Insurance

- 1.4. Fire Insurance

- 1.5. General Liability Insurance

- 1.6. Other In

-

2. Distribution Channel

- 2.1. Direct business

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels (Credit Institutions)

Germany Property & Casualty Insurance Market Segmentation By Geography

- 1. Germany

Germany Property & Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization of the Insurance Industry; Surge in Regulatory Reforms and Mandates

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns; Rising Multiple Sizable Natural Catastrophes

- 3.4. Market Trends

- 3.4.1. Increasing Insurance Contracts is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Auto Insurance

- 5.1.2. Homeowners Insurance

- 5.1.3. Commercial Property Insurance

- 5.1.4. Fire Insurance

- 5.1.5. General Liability Insurance

- 5.1.6. Other In

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct business

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels (Credit Institutions)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Germany Germany Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. France Germany Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Germany Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Germany Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Germany Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Germany Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Munich Re

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 R+V Allgemeine Versicherung AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Zurich Insurance Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Great Lakes Insurance**List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hannover Re

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AXA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ergo Group AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 HDI Global SE

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Allianz

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Generali

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Munich Re

List of Figures

- Figure 1: Germany Property & Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Property & Casualty Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Germany Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Germany Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Germany Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Germany Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Germany Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Germany Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 13: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Germany Property & Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Property & Casualty Insurance Market?

The projected CAGR is approximately 1.23%.

2. Which companies are prominent players in the Germany Property & Casualty Insurance Market?

Key companies in the market include Munich Re, R+V Allgemeine Versicherung AG, Zurich Insurance Group, Great Lakes Insurance**List Not Exhaustive, Hannover Re, AXA, Ergo Group AG, HDI Global SE, Allianz, Generali.

3. What are the main segments of the Germany Property & Casualty Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization of the Insurance Industry; Surge in Regulatory Reforms and Mandates.

6. What are the notable trends driving market growth?

Increasing Insurance Contracts is Driving the Market.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns; Rising Multiple Sizable Natural Catastrophes.

8. Can you provide examples of recent developments in the market?

December 2022: ERGO launched a new brand claim and accompanying product campaign focusing on 'Making Insurance Easier' in all its marketing and customer communications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Property & Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Property & Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Property & Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Germany Property & Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence