Key Insights

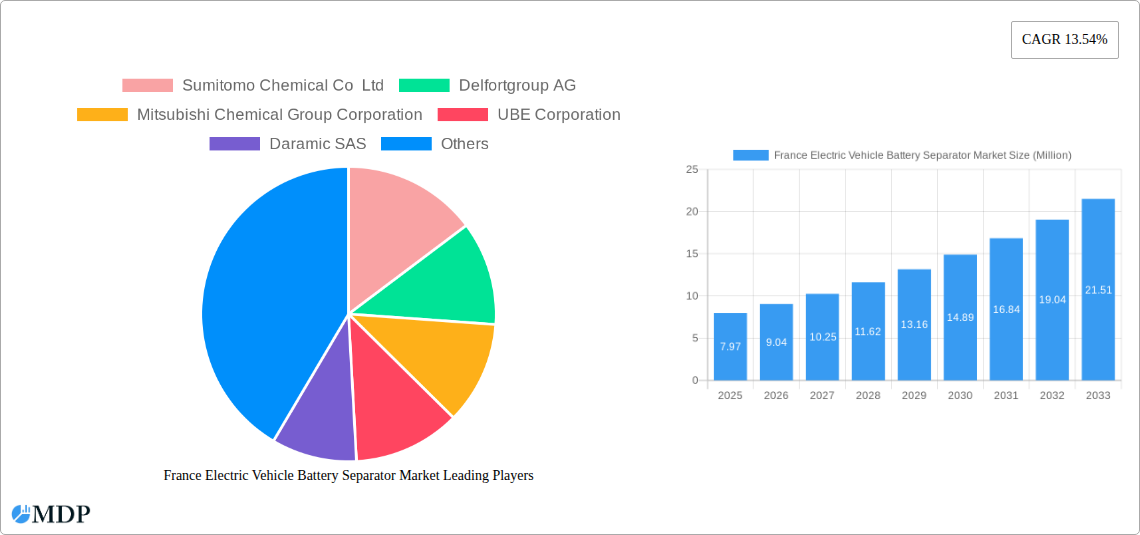

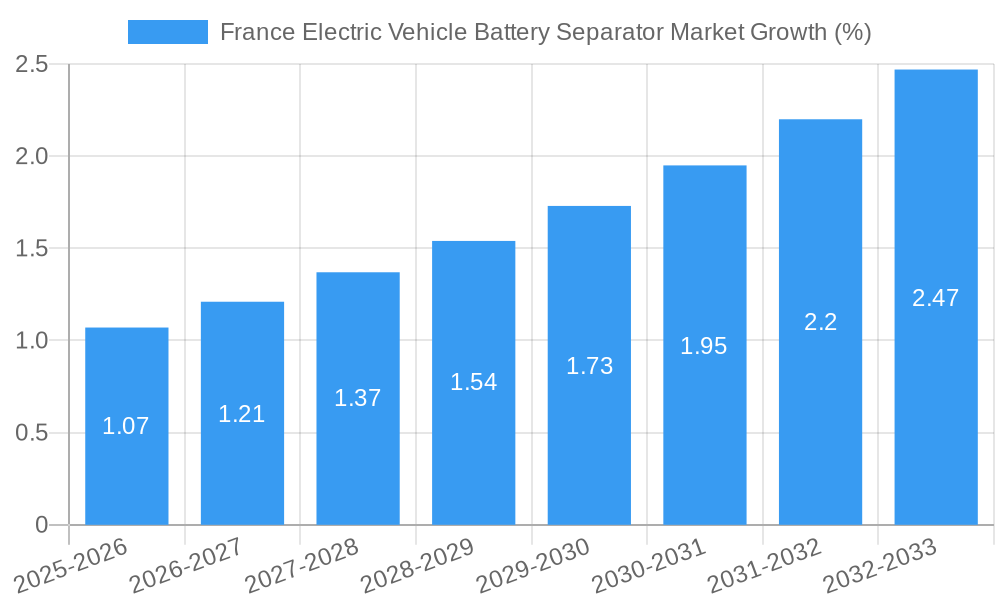

The France Electric Vehicle (EV) Battery Separator market, valued at €7.97 million in 2025, is projected to experience robust growth, driven by the burgeoning EV adoption in France and supportive government policies promoting electric mobility. A Compound Annual Growth Rate (CAGR) of 13.54% is anticipated from 2025 to 2033, indicating a significant market expansion. Key drivers include increasing demand for high-performance EV batteries, stringent emission regulations pushing towards EV adoption, and ongoing advancements in battery separator technology leading to enhanced energy density, safety, and lifespan. Market trends reveal a preference for separators with improved thermal stability and electrolyte compatibility, leading to increased adoption of advanced materials like ceramic coated separators and those featuring innovative designs to improve battery cell performance. While the market faces restraints such as the high cost of advanced separators and the potential for supply chain disruptions, the overall positive outlook is fueled by substantial investments in battery manufacturing facilities and continuous research and development efforts within the sector. Major players like Sumitomo Chemical Co Ltd, Delfortgroup AG, and Mitsubishi Chemical Group Corporation are strategically positioned to capitalize on this growth, focusing on product innovation and expansion of their manufacturing capabilities to meet the increasing demand. The market segmentation, while not explicitly provided, likely includes categories based on separator material type (e.g., polyethylene, polypropylene, ceramic-coated), battery chemistry (e.g., lithium-ion, solid-state), and vehicle type (e.g., passenger cars, commercial vehicles).

The significant growth forecast for the French EV battery separator market reflects the broader European trend toward electric vehicle adoption. The market's success is intrinsically linked to the overall success of the EV industry in France, highlighting the vital role battery separators play in the performance and safety of EV batteries. The competitive landscape includes both established international players and potentially smaller, specialized companies focusing on niche technologies. Future growth will depend on continued government support for electric mobility, the successful integration of battery separator technology improvements into next-generation batteries, and maintaining competitive pricing amidst fluctuating raw material costs. The market offers significant opportunities for companies focused on sustainable and cost-effective battery separator manufacturing, particularly those adept at responding to evolving regulatory requirements and technological advancements.

France Electric Vehicle Battery Separator Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Electric Vehicle (EV) Battery Separator Market, offering valuable insights for stakeholders across the automotive, energy, and materials sectors. With a detailed study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report covers market dynamics, industry trends, leading players, and emerging opportunities, providing actionable intelligence for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

France Electric Vehicle Battery Separator Market Market Dynamics & Concentration

This section analyzes the competitive landscape of the French EV battery separator market, examining factors driving market concentration, innovation, and growth. The market exhibits a moderately consolidated structure, with key players holding significant market share. However, the entry of new players with innovative technologies is expected to increase competition.

Market Concentration:

- The top five players, including Sumitomo Chemical Co Ltd, Delfortgroup AG, Mitsubishi Chemical Group Corporation, UBE Corporation, and Daramic SAS, collectively hold approximately xx% of the market share in 2025.

- The market exhibits moderate concentration, with several smaller players contributing significantly to the overall market volume.

Innovation Drivers: The demand for higher energy density, faster charging, improved safety, and cost reduction is driving innovation in battery separator technology.

Regulatory Frameworks: Government regulations and incentives promoting EV adoption in France significantly influence market growth. Stringent safety standards are also shaping technological advancements.

Product Substitutes: While currently limited, alternative separator materials and technologies are emerging, potentially impacting market dynamics in the long term.

End-User Trends: The growing demand for EVs, particularly in the passenger car segment, directly fuels the growth of the battery separator market.

M&A Activities: The number of mergers and acquisitions (M&A) in the battery separator industry in France remains relatively low, but strategic partnerships are becoming increasingly common. An estimated xx M&A deals were recorded between 2019 and 2024.

France Electric Vehicle Battery Separator Market Industry Trends & Analysis

The French EV battery separator market is experiencing robust growth, driven by several key factors. The increasing adoption of EVs fueled by government support for electric mobility and rising environmental awareness is a primary catalyst. Technological advancements in battery separator materials, leading to improved performance and safety, are further stimulating market expansion. Consumer preference for longer-range EVs and faster charging times is also positively impacting market demand. The competitive landscape is characterized by intense rivalry among established players and emerging entrants, leading to continuous product innovation and price competition.

The market is projected to grow at a CAGR of xx% from 2025 to 2033. Market penetration is expected to reach approximately xx% by 2033, indicating substantial growth potential.

Leading Markets & Segments in France Electric Vehicle Battery Separator Market

The dominant segment within the French EV battery separator market is currently the lithium-ion battery segment, driven by its widespread adoption in EVs. The Paris region and other major urban centers are key markets, reflecting the high concentration of EV adoption in these areas.

Key Drivers for Market Dominance:

- Government Policies: France's supportive policies towards EV adoption, including subsidies and tax incentives, are crucial drivers.

- Infrastructure Development: The growing network of EV charging stations further enhances market growth.

- Technological Advancements: The development of advanced battery separator technologies tailored to the demands of high-performance EVs contributes to segment dominance.

France Electric Vehicle Battery Separator Market Product Developments

Recent years have witnessed significant advancements in battery separator technology, focusing on improved safety, thermal stability, and electrochemical performance. New materials such as ceramic separators are gaining traction, offering superior performance compared to traditional polymers. These advancements address key challenges in EV batteries, such as thermal runaway and dendrite formation, leading to improved battery life and safety. The market is witnessing increasing adoption of separators with enhanced functionalities, including integrated sensors for monitoring battery health.

Key Drivers of France Electric Vehicle Battery Separator Market Growth

The growth of the French EV battery separator market is propelled by several factors:

- Government support for EV adoption: Substantial government funding and incentives are stimulating EV sales, consequently increasing demand for battery separators.

- Technological advancements: Innovations in battery separator materials and designs are enhancing performance and safety.

- Rising environmental concerns: Growing awareness of climate change is driving a shift towards cleaner transportation alternatives, boosting EV adoption.

Challenges in the France Electric Vehicle Battery Separator Market Market

The French EV battery separator market faces several challenges:

- Supply chain disruptions: Global supply chain issues can impact the availability of raw materials and components.

- High manufacturing costs: The production of advanced battery separators remains relatively expensive, potentially limiting market penetration.

- Competition: The intense competition among established and emerging players can put pressure on pricing and profitability.

Emerging Opportunities in France Electric Vehicle Battery Separator Market

Significant opportunities exist for growth within the French EV battery separator market:

- Development of next-generation battery technologies: Innovations in solid-state batteries and other advanced battery chemistries present considerable growth potential for specialized separators.

- Strategic partnerships and collaborations: Collaborations between battery manufacturers, separator producers, and automotive companies can accelerate market growth.

- Expansion into new applications: The application of battery separators beyond EVs, such as in energy storage systems, creates additional market opportunities.

Leading Players in the France Electric Vehicle Battery Separator Market Sector

- Sumitomo Chemical Co Ltd

- Delfortgroup AG

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Daramic SAS

- SK innovation Co Ltd

- Toray Industries Inc

- List Not Exhaustive

- 6 4 List of Other Prominent Companies

- 6 5 Market Ranking Analysis

Key Milestones in France Electric Vehicle Battery Separator Market Industry

- July 2024: ProLogium Technology Co. announces plans for a EUR 5.2 billion (USD 5.7 billion) battery factory in Dunkirk, France, signaling significant investment in the sector and highlighting the growing demand for advanced battery technologies. Production is slated to begin in 2027, with an initial output of 2-4 GWh and a planned increase to 8-16 GWh by 2030.

- January 2024: 24M introduces its 24M ImpervioTM battery separator, focusing on enhanced safety features to prevent catastrophic fires and recalls. This innovative technology underscores the ongoing pursuit of improved battery safety and reliability.

Strategic Outlook for France Electric Vehicle Battery Separator Market Market

The French EV battery separator market is poised for substantial growth, driven by supportive government policies, technological advancements, and rising environmental awareness. Strategic partnerships and investments in research and development will be crucial for players to capitalize on the market's long-term potential. The focus on improving battery performance, safety, and cost-effectiveness will shape future market dynamics. Expansion into new applications and regions will further contribute to the market's continued expansion.

France Electric Vehicle Battery Separator Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Other Battery Types

-

2. Material Type

- 2.1. Polypropylene

- 2.2. Polyethylene

- 2.3. Other Material Types

France Electric Vehicle Battery Separator Market Segmentation By Geography

- 1. France

France Electric Vehicle Battery Separator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Adoption of Electric Vehicles4.; Decreasing Price of Lithium-ion Batteries

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Adoption of Electric Vehicles4.; Decreasing Price of Lithium-ion Batteries

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment to be the Fastest Growing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Electric Vehicle Battery Separator Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Polypropylene

- 5.2.2. Polyethylene

- 5.2.3. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sumitomo Chemical Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delfortgroup AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Chemical Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UBE Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daramic SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SK innovation Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries Inc *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: France Electric Vehicle Battery Separator Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Electric Vehicle Battery Separator Market Share (%) by Company 2024

List of Tables

- Table 1: France Electric Vehicle Battery Separator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Electric Vehicle Battery Separator Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: France Electric Vehicle Battery Separator Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: France Electric Vehicle Battery Separator Market Volume Million Forecast, by Battery Type 2019 & 2032

- Table 5: France Electric Vehicle Battery Separator Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 6: France Electric Vehicle Battery Separator Market Volume Million Forecast, by Material Type 2019 & 2032

- Table 7: France Electric Vehicle Battery Separator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: France Electric Vehicle Battery Separator Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: France Electric Vehicle Battery Separator Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: France Electric Vehicle Battery Separator Market Volume Million Forecast, by Battery Type 2019 & 2032

- Table 11: France Electric Vehicle Battery Separator Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 12: France Electric Vehicle Battery Separator Market Volume Million Forecast, by Material Type 2019 & 2032

- Table 13: France Electric Vehicle Battery Separator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: France Electric Vehicle Battery Separator Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Electric Vehicle Battery Separator Market?

The projected CAGR is approximately 13.54%.

2. Which companies are prominent players in the France Electric Vehicle Battery Separator Market?

Key companies in the market include Sumitomo Chemical Co Ltd, Delfortgroup AG, Mitsubishi Chemical Group Corporation, UBE Corporation, Daramic SAS, SK innovation Co Ltd, Toray Industries Inc *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi.

3. What are the main segments of the France Electric Vehicle Battery Separator Market?

The market segments include Battery Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.97 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Adoption of Electric Vehicles4.; Decreasing Price of Lithium-ion Batteries.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment to be the Fastest Growing.

7. Are there any restraints impacting market growth?

4.; Growing Adoption of Electric Vehicles4.; Decreasing Price of Lithium-ion Batteries.

8. Can you provide examples of recent developments in the market?

July 2024: ProLogium Technology Co, a Taiwanese battery manufacturer, is set to scale up its EUR 5.2 billion (USD 5.7 billion) factory in Dunkirk, France. Despite a 12% dip in EU EV sales in May 2024, ProLogium, backed by Mercedes-Benz, remains optimistic about its next-generation technology. Construction is scheduled to start by late 2024 or early 2025, with production beginning in 2027. The factory's initial output will be 2-4 GWh, with plans to reach 8-16 GWh by 2030. ProLogium is confident that its innovative technology, featuring a ceramic separator, silicon anode, and nickel manganese cobalt (NMC) cathode, will be sought after for its rapid charging capabilities and high energy density.January 2024: 24M introduced its groundbreaking battery separator, 24M ImpervioTM, set to revolutionize battery safety across electric vehicles (EVs), energy storage systems (ESS), and consumer electronics. This proprietary technology marks a significant leap in safety for lithium-ion and lithium-metal batteries, aiming to avert catastrophic fires and extensive recalls typically triggered by issues like metallic dendrites, electrode misalignments, or lithium dendrites. 24M ImpervioTM not only blocks the formation of metallic dendrites but also monitors battery performance, allowing for early detection of potential faults.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Electric Vehicle Battery Separator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Electric Vehicle Battery Separator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Electric Vehicle Battery Separator Market?

To stay informed about further developments, trends, and reports in the France Electric Vehicle Battery Separator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence