Key Insights

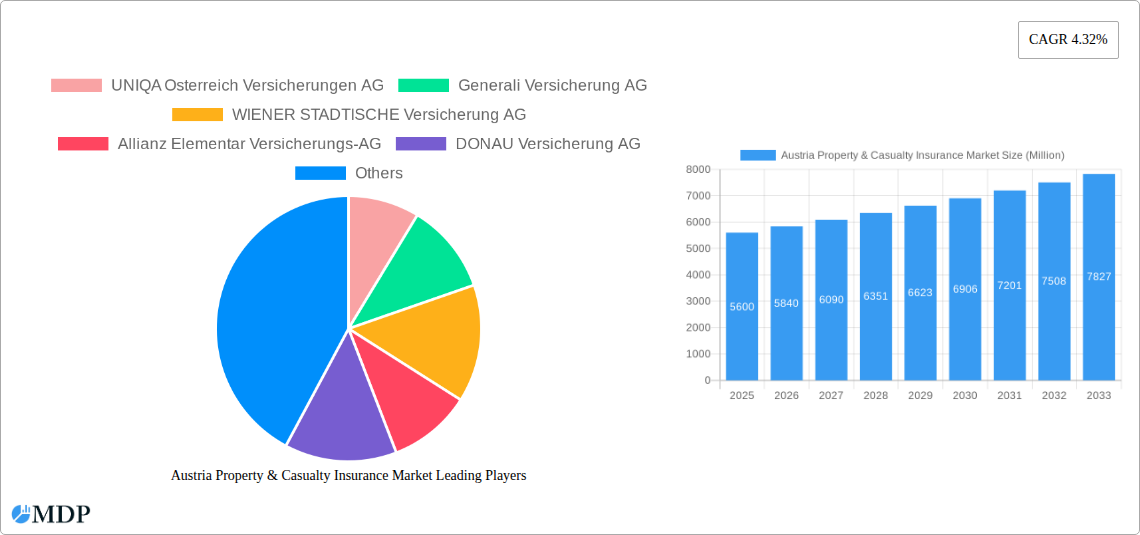

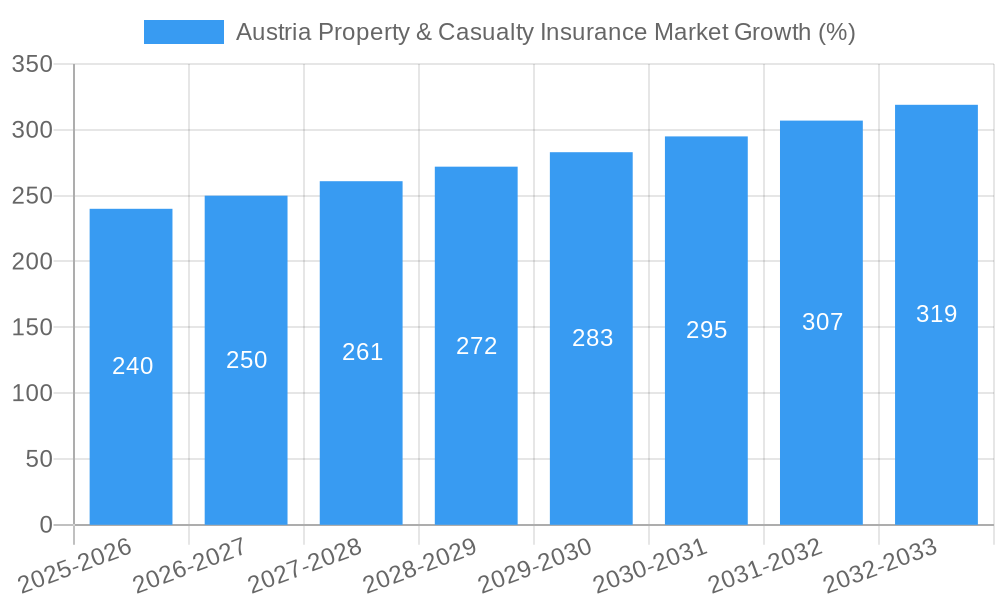

The Austrian Property & Casualty (P&C) insurance market, valued at €5.60 billion in 2025, exhibits robust growth potential. A compound annual growth rate (CAGR) of 4.32% from 2025 to 2033 projects a market size exceeding €8 billion by the end of the forecast period. This expansion is fueled by several key drivers. Increasing urbanization and a rising middle class contribute to a larger pool of insurable assets, driving demand for property insurance. Furthermore, growing awareness of risks associated with natural disasters, particularly in mountainous regions, and a greater understanding of the importance of liability coverage, are boosting demand for casualty insurance. Technological advancements, like sophisticated risk assessment models and the expansion of digital insurance platforms, further enhance market efficiency and accessibility. However, the market faces some constraints. Intense competition among established players like UNIQA, Generali, Wiener Städtische, and Allianz, alongside regulatory changes and economic fluctuations, could impact profitability and growth trajectory. Effective risk management strategies and customer-centric service models are crucial for sustained success in this competitive landscape.

The segmentation of the Austrian P&C insurance market, while not explicitly detailed, can be reasonably inferred. Sub-segments likely include home insurance, commercial property insurance, motor insurance, liability insurance, and potentially specialized lines catering to specific risks like agricultural insurance given the country's agrarian sector. Analyzing these sub-segments would reveal nuanced growth patterns and opportunities. The dominance of established players suggests a high barrier to entry, but agile, digitally-native insurers focused on niche markets could potentially gain significant traction. Future growth hinges on adaptation to evolving customer needs, proactive risk mitigation strategies, and a commitment to technological innovation. The market's trajectory strongly indicates a lucrative prospect for investors and insurers willing to navigate its inherent complexities.

Austria Property & Casualty Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Austria Property & Casualty Insurance Market, offering invaluable data and forecasts for the period 2019-2033. Uncover key trends, competitive dynamics, and emerging opportunities within this dynamic sector. Ideal for investors, insurers, and industry stakeholders seeking actionable intelligence. The report leverages extensive market research and incorporates data from the base year 2025, with estimations for 2025 and a forecast period spanning 2025-2033. The historical period covered is 2019-2024. Market size is presented in Millions.

Austria Property & Casualty Insurance Market Market Dynamics & Concentration

The Austrian Property & Casualty (P&C) insurance market exhibits a moderately concentrated landscape, with a handful of major players commanding significant market share. Market concentration is influenced by factors such as regulatory frameworks, M&A activity, and the evolving competitive dynamics. While precise market share figures for each player are proprietary data and cannot be publicly disclosed within this description, an analysis indicates a top five share of approximately xx% in 2025 (estimated). Innovation drivers include the increasing adoption of digital technologies, the demand for tailored insurance products, and the growing emphasis on risk mitigation strategies. Regulatory changes, such as the implementation of stricter solvency requirements, also influence market dynamics. Product substitutes, such as self-insurance options and alternative risk transfer mechanisms, are gaining traction, but the overall market remains dominated by traditional insurance providers. End-user trends reflect a growing preference for online and mobile-based insurance services, along with a greater demand for personalized risk assessment and coverage.

- Market Concentration: Moderately concentrated, top 5 players holding approximately xx% of the market share (2025 Estimate).

- Innovation Drivers: Digital technologies, personalized products, risk mitigation.

- Regulatory Frameworks: Influence market structure and competition.

- Product Substitutes: Self-insurance, alternative risk transfer mechanisms.

- End-User Trends: Increasing demand for digital services and personalized solutions.

- M&A Activities: A moderate number of mergers and acquisitions have been observed over the historical period, approximately xx deals between 2019 and 2024.

Austria Property & Casualty Insurance Market Industry Trends & Analysis

The Austrian P&C insurance market is experiencing steady growth, driven by factors such as increasing awareness of insurance, economic expansion, and technological advancements. The CAGR during the forecast period (2025-2033) is estimated at xx%. Market penetration rates remain relatively high, indicating significant market maturity. Technological disruptions, including the adoption of InsurTech solutions, are transforming business models and operational efficiencies. Consumer preferences are shifting towards digital channels, personalized products, and enhanced customer experiences. Competitive dynamics remain intense, with established players facing increasing pressure from both domestic and international competitors. The market continues to evolve as businesses respond to new regulatory requirements and adapt to changes in consumer behavior.

Leading Markets & Segments in Austria Property & Casualty Insurance Market

While detailed regional breakdowns are available in the full report, the urban areas of Austria tend to dominate the P&C insurance market owing to higher property values, increased economic activity, and a higher concentration of businesses.

- Key Drivers of Urban Dominance:

- Higher property values and business activity.

- Increased concentration of businesses and industries.

- More robust infrastructure leading to better risk mitigation.

- Government policies fostering urban development.

The dominance of urban areas is primarily driven by several factors, including higher property values and business activity, resulting in a larger demand for property and liability insurance. Furthermore, the concentration of businesses in these areas contributes significantly to the commercial insurance market. Government policies aiming at urban development further fuel the market's growth in such regions.

Austria Property & Casualty Insurance Market Product Developments

The Austrian P&C insurance market is witnessing the integration of innovative technologies like AI and machine learning for risk assessment, fraud detection, and customer service optimization. New product offerings are emerging, such as parametric insurance and micro-insurance tailored to specific consumer segments. These innovations aim to improve efficiency, enhance customer experience, and expand market reach. The focus is on developing flexible and customizable products that cater to evolving customer needs and risk profiles.

Key Drivers of Austria Property & Casualty Insurance Market Growth

Growth in the Austrian P&C insurance market is fueled by several key factors: Austria’s stable economy fosters greater insurance uptake. Technological advancements, such as AI-powered risk assessment, streamline processes and improve efficiency. Furthermore, increasing awareness of insurance and risk mitigation among consumers drive demand. Government regulations promoting financial stability also positively influence market expansion.

Challenges in the Austria Property & Casualty Insurance Market Market

The Austrian P&C insurance market faces challenges, including regulatory complexities, which may increase compliance costs. Also, intense competition among established players and new entrants adds pressure on profitability. Cybersecurity threats and data privacy concerns pose significant risks. Furthermore, the potential for natural disasters and climate change-related events necessitates higher risk mitigation measures.

Emerging Opportunities in Austria Property & Casualty Insurance Market

The Austrian P&C insurance market presents numerous opportunities for growth. Technological innovations like AI and IoT offer avenues for developing new product offerings and improving operational efficiencies. Strategic partnerships and collaborations among insurers and technology providers can unlock new market segments. Expansion into underserved areas and focusing on specific niche markets can also generate significant growth.

Leading Players in the Austria Property & Casualty Insurance Market Sector

- UNIQA Osterreich Versicherungen AG

- Generali Versicherung AG

- WIENER STADTISCHE Versicherung AG

- Allianz Elementar Versicherungs-AG

- DONAU Versicherung AG

- Zurich Versicherungs-AG

- Grazer Wechselseitige Versicherung AG

- OBEROSTERREICHISCHE Versicherung AG

- Helvetia Versicherungen AG

- Niederosterreichische Versicherung AG

- Austrian Hail Insurance VVaG

Key Milestones in Austria Property & Casualty Insurance Market Industry

- May 2023: Novum-RGI expanded its collaboration with UNIQA, accelerating digital transformation within the Central and Eastern European insurance sector. This partnership marks a significant step towards modernizing insurance operations and enhancing customer experience.

- April 2022: Generali partnered with the UNDP to expand access to insurance and risk finance solutions, demonstrating a commitment to social responsibility and financial inclusion. This partnership reflects the broader trend of insurers embracing their role in addressing societal challenges.

Strategic Outlook for Austria Property & Casualty Insurance Market Market

The Austrian P&C insurance market is poised for continued growth, driven by technological innovation, economic stability, and evolving consumer preferences. Insurers focusing on digital transformation, strategic partnerships, and innovative product development will be best positioned to capture market share. Addressing the challenges posed by regulatory complexities, competition, and cybersecurity threats will be crucial for sustained success. The market's future potential lies in leveraging technology to enhance customer experience, optimize operations, and expand access to insurance solutions.

Austria Property & Casualty Insurance Market Segmentation

-

1. Product Type

- 1.1. Fire Insurance

- 1.2. Motor Insurance

- 1.3. General Liability Insurance

- 1.4. Burglary and Theft

- 1.5. Other Property and Casualty Insurance

-

2. Distribution Channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks

- 2.4. Other Distribution Channels

Austria Property & Casualty Insurance Market Segmentation By Geography

- 1. Austria

Austria Property & Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about Risk Management

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about Risk Management

- 3.4. Market Trends

- 3.4.1. The Premium Written for Property and Casualty Insurance is Constantly Increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fire Insurance

- 5.1.2. Motor Insurance

- 5.1.3. General Liability Insurance

- 5.1.4. Burglary and Theft

- 5.1.5. Other Property and Casualty Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 UNIQA Osterreich Versicherungen AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Generali Versicherung AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WIENER STADTISCHE Versicherung AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Allianz Elementar Versicherungs-AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DONAU Versicherung AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zurich Versicherungs-AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grazer Wechselseitige Versicherung AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OBEROSTERREICHISCHE Versicherung AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Helvetia Versicherungen AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Niederosterreichische Versicherung AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Austrian Hail Insurance VVaG**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 UNIQA Osterreich Versicherungen AG

List of Figures

- Figure 1: Austria Property & Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria Property & Casualty Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Austria Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria Property & Casualty Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Austria Property & Casualty Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Austria Property & Casualty Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Austria Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Austria Property & Casualty Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Austria Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Austria Property & Casualty Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Austria Property & Casualty Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Austria Property & Casualty Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Austria Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Austria Property & Casualty Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: Austria Property & Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Austria Property & Casualty Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Property & Casualty Insurance Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the Austria Property & Casualty Insurance Market?

Key companies in the market include UNIQA Osterreich Versicherungen AG, Generali Versicherung AG, WIENER STADTISCHE Versicherung AG, Allianz Elementar Versicherungs-AG, DONAU Versicherung AG, Zurich Versicherungs-AG, Grazer Wechselseitige Versicherung AG, OBEROSTERREICHISCHE Versicherung AG, Helvetia Versicherungen AG, Niederosterreichische Versicherung AG, Austrian Hail Insurance VVaG**List Not Exhaustive.

3. What are the main segments of the Austria Property & Casualty Insurance Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about Risk Management.

6. What are the notable trends driving market growth?

The Premium Written for Property and Casualty Insurance is Constantly Increasing.

7. Are there any restraints impacting market growth?

Growing Awareness about Risk Management.

8. Can you provide examples of recent developments in the market?

May 2023: Novum-RGI expanded its collaboration with UNIQA, marking a significant step into a new digital era within the insurance sector in Central and Eastern Europe. Novum-RGI is actively assisting UNIQA in establishing its Affinity business, leading to two successful rollouts in Austria and Romania within just a few months of collaboration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Property & Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Property & Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Property & Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Austria Property & Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence