Key Insights

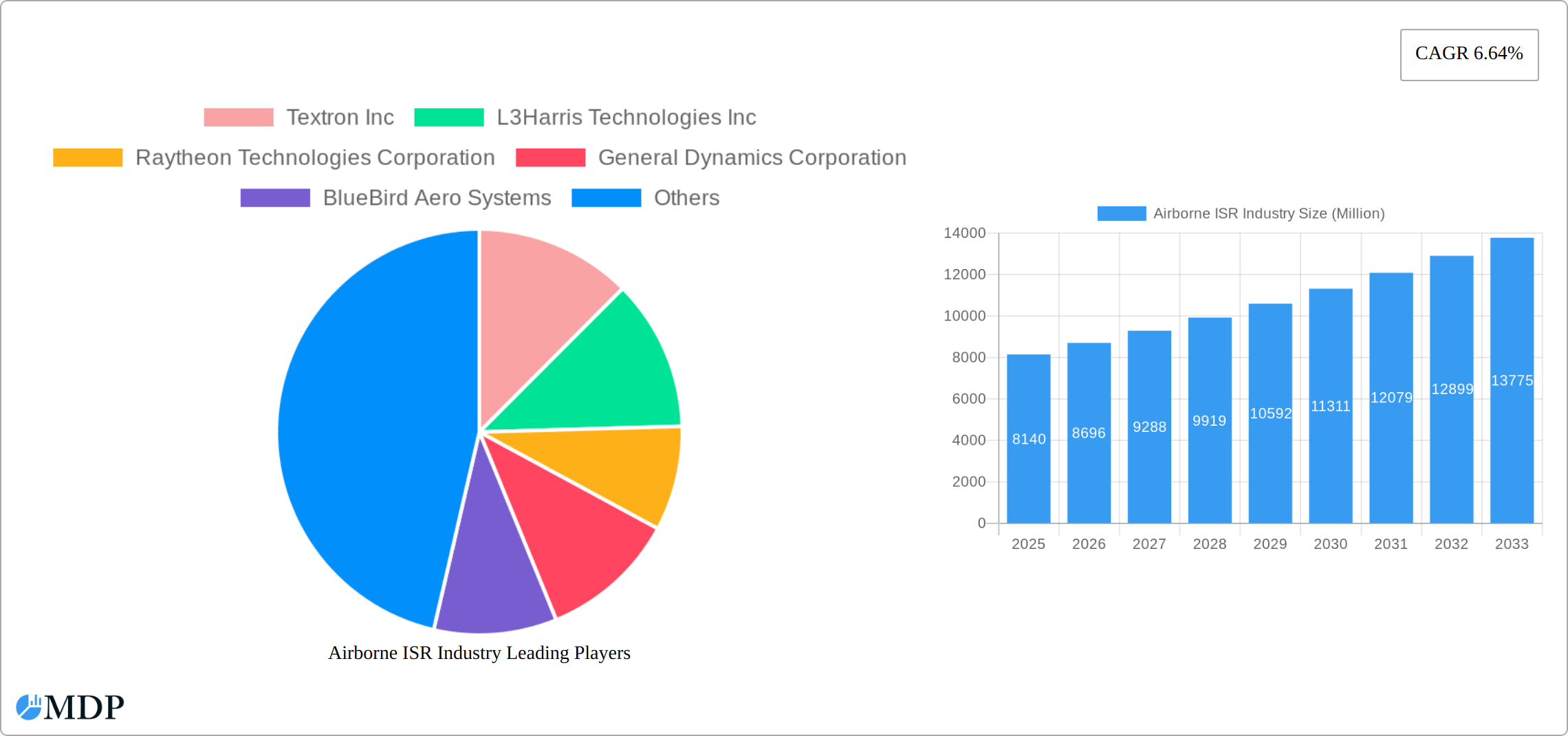

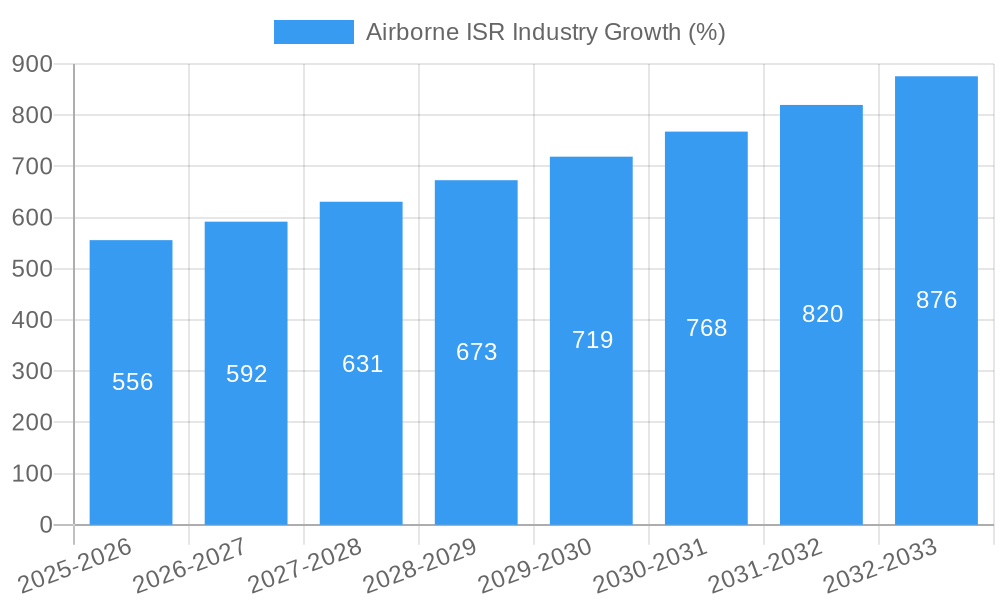

The Airborne Intelligence, Surveillance, and Reconnaissance (ISR) industry is experiencing robust growth, projected to reach a market size of $8.14 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.64% from 2025 to 2033. This expansion is driven by escalating geopolitical tensions, the increasing need for enhanced border security, and the growing demand for real-time intelligence gathering across diverse sectors like defense and homeland security. Technological advancements, including the integration of artificial intelligence (AI) and machine learning (ML) in ISR systems, along with the development of miniaturized sensors and improved data analytics capabilities, further fuel market growth. The unmanned segment is poised for significant expansion, driven by cost-effectiveness and reduced operational risks compared to manned systems. Key applications such as maritime patrol, airborne ground surveillance (AGS), airborne early warnings (AEW), and signals intelligence (SIGINT) are witnessing high demand, particularly in regions experiencing heightened security concerns.

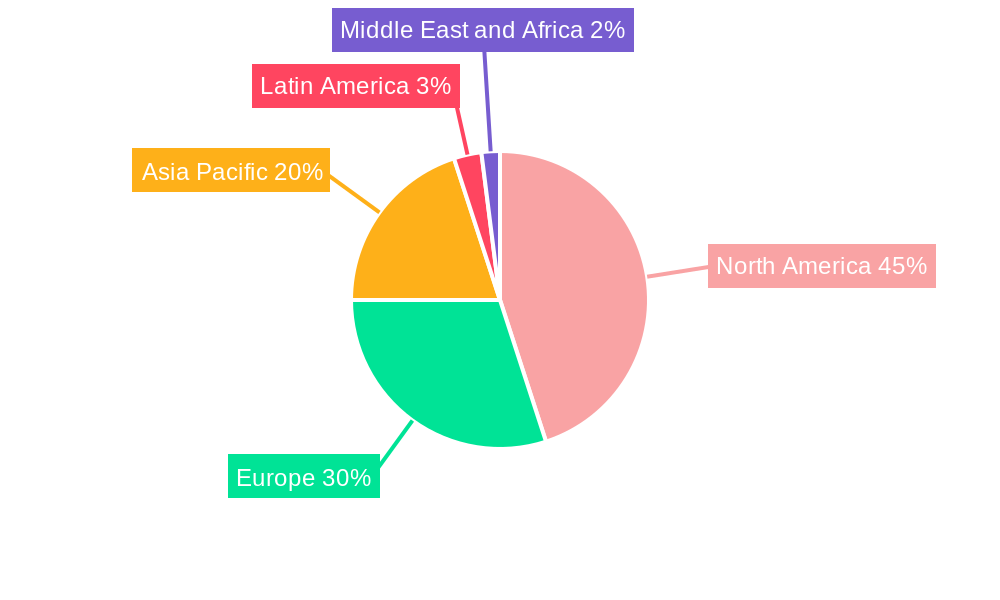

The market's regional distribution reveals a significant share held by North America, fueled by substantial defense budgets and technological innovation. Europe and Asia Pacific also exhibit strong growth potential, driven by increasing investments in defense modernization and national security. However, regulatory hurdles related to airspace usage and data privacy, along with the high initial investment costs associated with advanced ISR systems, pose significant restraints on market growth. The competitive landscape is marked by the presence of established players like Textron, L3Harris, Raytheon, and Lockheed Martin, alongside emerging technology companies. These companies are focusing on strategic partnerships, mergers and acquisitions, and continuous product innovation to maintain their market position and capitalize on the growing demand for sophisticated Airborne ISR solutions. The forecast period (2025-2033) anticipates a steady rise in market value, driven by the factors mentioned above, creating promising opportunities for both established industry giants and innovative newcomers.

Airborne ISR Industry Market Report: 2019-2033 Forecast

Dive deep into the lucrative Airborne ISR market with this comprehensive report, offering actionable insights for strategic decision-making. This in-depth analysis covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Expect detailed breakdowns of market dynamics, leading players, technological advancements, and emerging opportunities within the Manned and Unmanned segments, across key applications like Maritime Patrol, Airborne Ground Surveillance (AGS), Airborne Early Warnings (AEW), and Signals Intelligence (SIGNIT). The report reveals a market valued at $xx Million in 2025, projected to reach $xx Million by 2033, exhibiting a compelling CAGR of xx%.

Airborne ISR Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Airborne ISR industry, examining market concentration, innovation drivers, regulatory influences, and market trends from 2019 to 2033. We delve into the impact of mergers and acquisitions (M&A) activity, providing a detailed overview of market share distribution among key players.

- Market Concentration: The Airborne ISR market exhibits a moderately concentrated structure, with the top 5 players—Textron Inc, L3Harris Technologies Inc, Raytheon Technologies Corporation, General Dynamics Corporation, and Lockheed Martin Corporation—holding approximately xx% of the market share in 2025. Smaller players like BlueBird Aero Systems and Elbit Systems Ltd. are actively seeking market expansion through innovation and strategic partnerships.

- Innovation Drivers: Continuous advancements in sensor technology, AI-powered analytics, and unmanned aerial vehicle (UAV) capabilities are driving significant innovation. The demand for enhanced situational awareness and real-time intelligence gathering fuels investments in cutting-edge ISR solutions.

- Regulatory Frameworks: Stringent export controls and data privacy regulations significantly impact market growth, especially in international markets. Compliance with these regulations is crucial for companies operating in this sector.

- Product Substitutes: While Airborne ISR systems are unique in their capabilities, competing technologies like satellite imagery and ground-based intelligence systems present some degree of substitution.

- End-User Trends: The increasing demand for advanced surveillance and reconnaissance capabilities by defense and security agencies globally is the primary driver of market expansion. Growing adoption of ISR technology by commercial entities for applications like environmental monitoring and disaster relief is also contributing to growth.

- M&A Activities: The Airborne ISR market has witnessed a significant number of M&A transactions in recent years (xx deals between 2019 and 2024). These acquisitions have broadened the product portfolios and expanded the geographic reach of larger players.

Airborne ISR Industry Industry Trends & Analysis

This section provides a comprehensive analysis of Airborne ISR industry trends, focusing on market growth drivers, technological advancements, and competitive dynamics. We examine market penetration rates and Compound Annual Growth Rates (CAGR) for different segments to deliver a clear picture of market evolution between 2019 and 2033. The increasing integration of AI and machine learning in ISR systems has significantly improved data processing and analysis capabilities. This has translated into a higher demand for sophisticated ISR platforms equipped with advanced sensors and communication systems. Furthermore, the growing adoption of cloud-based solutions for data storage and analysis has significantly enhanced the accessibility and efficiency of ISR operations. The increasing adoption of unmanned aerial systems (UAS) for ISR applications is another significant trend. UAS offer several advantages over traditional manned platforms, including cost-effectiveness, reduced risk to human personnel, and greater flexibility in deployment.

Leading Markets & Segments in Airborne ISR Industry

This section delves into the leading markets and segments within the Airborne ISR industry, providing an in-depth analysis of the pivotal growth drivers shaping its trajectory.

- Dominant Region: North America continues to command the largest market share, propelled by substantial defense expenditures and pioneering technological advancements. Europe and the Asia-Pacific region are experiencing robust expansion, fueled by escalating geopolitical tensions and the imperative modernization of defense forces.

- Dominant Segment (Platform Type): The Unmanned segment is exhibiting a significantly faster growth rate compared to its manned counterpart. This surge is attributed to the compelling advantages of cost-effectiveness, enhanced operational capabilities, and the mitigation of inherent operational risks.

- Dominant Segment (Application): Airborne Ground Surveillance (AGS) represents a substantial portion of the market. This dominance is driven by the escalating demand for superior battlefield awareness and robust border security. Maritime Patrol is another segment demonstrating remarkable and rapid growth.

- Key Growth Catalysts:

- North America: Characterized by substantial defense budgets, a highly developed technological infrastructure, and unwavering governmental support.

- Europe: Influenced by increasing geopolitical instability, a concerted effort towards defense force modernization, and a proliferation of collaborative research and development initiatives.

- Asia-Pacific: Marked by rising defense budgets, ongoing territorial disputes, and an insatiable demand for cutting-edge surveillance systems.

Airborne ISR Industry Product Developments

Recent product innovations in the Airborne ISR industry are redefining operational capabilities. These advancements include the miniaturization of sensors, leading to lighter and more versatile deployment options; the enhancement of data fusion capabilities, enabling a more comprehensive and actionable understanding of the operational environment; and the pioneering development of autonomous ISR systems. These autonomous systems are designed to operate effectively without continuous direct human intervention, thereby improving image clarity, significantly enhancing target identification accuracy, and drastically reducing the reliance on human operators in potentially hazardous or inaccessible environments. These innovations collectively strengthen the market fit for a wide spectrum of critical defense applications.

Key Drivers of Airborne ISR Industry Growth

The Airborne ISR industry's growth is fundamentally propelled by a confluence of factors: rapid technological advancements that continually enhance system performance and intelligence-gathering potential; escalating global defense budgets, indicating a sustained investment in national security; and a palpable increase in geopolitical instability, which necessitates more sophisticated and responsive surveillance and reconnaissance capabilities. The amplified demand for enhanced situational awareness and the critical need for real-time intelligence gathering are further fueling the widespread adoption and integration of advanced ISR systems across various defense and security operations.

Challenges in the Airborne ISR Industry Market

The Airborne ISR industry market faces several significant challenges that influence its growth trajectory. Foremost among these are the inherently high development costs associated with sophisticated ISR technologies, the complex and time-consuming nature of stringent regulatory approvals, and the ever-present and evolving threat landscape of cybersecurity. Furthermore, the industry grapples with the consistent need for highly skilled personnel capable of operating and maintaining these advanced systems. Compounding these issues are potential supply chain disruptions, particularly concerning the acquisition of critical, specialized components, which can impede timely production and deployment.

Emerging Opportunities in Airborne ISR Industry

The integration of AI and machine learning, expanding commercial applications, and the development of hybrid ISR platforms present promising opportunities. Strategic partnerships between technology providers and defense contractors are also expected to fuel growth.

Leading Players in the Airborne ISR Industry Sector

- Textron Inc

- L3Harris Technologies Inc

- Raytheon Technologies Corporation

- General Dynamics Corporation

- BlueBird Aero Systems

- Leonardo SpA

- Aeronautics Group

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Airbus SE

- Safran SA

- General Atomics

- AeroVironment Inc

- BAE Systems PLC

- Israel Aerospace Industries (IAI)

- 3 Other Companies

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

- Teledyne FLIR LLC

Key Milestones in Airborne ISR Industry Industry

- 2020: Increased investment in AI-powered ISR solutions.

- 2021: Launch of several new unmanned aerial vehicles (UAVs) with enhanced capabilities.

- 2022: Significant M&A activity, consolidating market share.

- 2023: Development of advanced sensor technologies improving image clarity and target identification.

- 2024: Growing adoption of cloud-based solutions for data storage and analysis.

Strategic Outlook for Airborne ISR Industry Market

The Airborne ISR market is strategically positioned for substantial and sustained growth. This expansion is primarily driven by the relentless pace of technological innovation, a consistent rise in global defense spending, and the ever-increasing imperative for superior situational awareness and intelligence gathering. To maintain a competitive edge in this dynamic and rapidly evolving market, strategic partnerships and significant investment in research and development will be paramount. The ongoing trend towards the miniaturization of sensors, coupled with the seamless integration of Artificial Intelligence (AI) capabilities, will undoubtedly catalyze the development of even more advanced, cost-effective, and highly capable ISR solutions, further shaping the future of airborne intelligence.

Airborne ISR Industry Segmentation

-

1. Type

- 1.1. Manned

- 1.2. Unmanned

-

2. Application

- 2.1. Maritime Patrol

- 2.2. Airborne Ground Surveillance (AGS)

- 2.3. Airborne Early Warnings (AEW)

- 2.4. Signals Intelligence (SIGINT)

Airborne ISR Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Airborne ISR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Unmanned Segment to Experience Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Manned

- 5.1.2. Unmanned

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Maritime Patrol

- 5.2.2. Airborne Ground Surveillance (AGS)

- 5.2.3. Airborne Early Warnings (AEW)

- 5.2.4. Signals Intelligence (SIGINT)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Manned

- 6.1.2. Unmanned

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Maritime Patrol

- 6.2.2. Airborne Ground Surveillance (AGS)

- 6.2.3. Airborne Early Warnings (AEW)

- 6.2.4. Signals Intelligence (SIGINT)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Manned

- 7.1.2. Unmanned

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Maritime Patrol

- 7.2.2. Airborne Ground Surveillance (AGS)

- 7.2.3. Airborne Early Warnings (AEW)

- 7.2.4. Signals Intelligence (SIGINT)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Manned

- 8.1.2. Unmanned

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Maritime Patrol

- 8.2.2. Airborne Ground Surveillance (AGS)

- 8.2.3. Airborne Early Warnings (AEW)

- 8.2.4. Signals Intelligence (SIGINT)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Manned

- 9.1.2. Unmanned

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Maritime Patrol

- 9.2.2. Airborne Ground Surveillance (AGS)

- 9.2.3. Airborne Early Warnings (AEW)

- 9.2.4. Signals Intelligence (SIGINT)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Manned

- 10.1.2. Unmanned

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Maritime Patrol

- 10.2.2. Airborne Ground Surveillance (AGS)

- 10.2.3. Airborne Early Warnings (AEW)

- 10.2.4. Signals Intelligence (SIGINT)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. US

- 12. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. Canada

- 13. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Europe Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. United Kingdom

- 15. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. France

- 16. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. Gemany

- 17. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1. Russia

- 18. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1. Rest of Europe

- 19. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1.

- 20. Asia Pacific Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 20.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 20.1.1. China

- 21. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 21.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 21.1.1. India

- 22. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 22.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 22.1.1. Japan

- 23. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 23.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 23.1.1. South Korea

- 24. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 24.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 24.1.1. Rest of Asia Pacific

- 25. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 25.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 25.1.1.

- 26. Latin America Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 26.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 26.1.1. Brazil

- 27. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 27.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 27.1.1. Rest of Latin America

- 28. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 28.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 28.1.1.

- 29. Middle East and Africa Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 29.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 29.1.1. Saudi Arabia

- 30. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 30.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 30.1.1. United Arab Emirates

- 31. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 31.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 31.1.1. Rest of Middle East and Africa

- 32. By Type Airborne ISR Industry Analysis, Insights and Forecast, 2019-2031

- 32.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 32.1.1.

- 33. Competitive Analysis

- 33.1. Global Market Share Analysis 2024

- 33.2. Company Profiles

- 33.2.1 Textron Inc

- 33.2.1.1. Overview

- 33.2.1.2. Products

- 33.2.1.3. SWOT Analysis

- 33.2.1.4. Recent Developments

- 33.2.1.5. Financials (Based on Availability)

- 33.2.2 L3Harris Technologies Inc

- 33.2.2.1. Overview

- 33.2.2.2. Products

- 33.2.2.3. SWOT Analysis

- 33.2.2.4. Recent Developments

- 33.2.2.5. Financials (Based on Availability)

- 33.2.3 Raytheon Technologies Corporation

- 33.2.3.1. Overview

- 33.2.3.2. Products

- 33.2.3.3. SWOT Analysis

- 33.2.3.4. Recent Developments

- 33.2.3.5. Financials (Based on Availability)

- 33.2.4 General Dynamics Corporation

- 33.2.4.1. Overview

- 33.2.4.2. Products

- 33.2.4.3. SWOT Analysis

- 33.2.4.4. Recent Developments

- 33.2.4.5. Financials (Based on Availability)

- 33.2.5 BlueBird Aero Systems

- 33.2.5.1. Overview

- 33.2.5.2. Products

- 33.2.5.3. SWOT Analysis

- 33.2.5.4. Recent Developments

- 33.2.5.5. Financials (Based on Availability)

- 33.2.6 Leonardo SpA

- 33.2.6.1. Overview

- 33.2.6.2. Products

- 33.2.6.3. SWOT Analysis

- 33.2.6.4. Recent Developments

- 33.2.6.5. Financials (Based on Availability)

- 33.2.7 Aeronautics Grou

- 33.2.7.1. Overview

- 33.2.7.2. Products

- 33.2.7.3. SWOT Analysis

- 33.2.7.4. Recent Developments

- 33.2.7.5. Financials (Based on Availability)

- 33.2.8 Elbit Systems Ltd

- 33.2.8.1. Overview

- 33.2.8.2. Products

- 33.2.8.3. SWOT Analysis

- 33.2.8.4. Recent Developments

- 33.2.8.5. Financials (Based on Availability)

- 33.2.9 Lockheed Martin Corporation

- 33.2.9.1. Overview

- 33.2.9.2. Products

- 33.2.9.3. SWOT Analysis

- 33.2.9.4. Recent Developments

- 33.2.9.5. Financials (Based on Availability)

- 33.2.10 Airbus SE

- 33.2.10.1. Overview

- 33.2.10.2. Products

- 33.2.10.3. SWOT Analysis

- 33.2.10.4. Recent Developments

- 33.2.10.5. Financials (Based on Availability)

- 33.2.11 Safran SA

- 33.2.11.1. Overview

- 33.2.11.2. Products

- 33.2.11.3. SWOT Analysis

- 33.2.11.4. Recent Developments

- 33.2.11.5. Financials (Based on Availability)

- 33.2.12 General Atomics

- 33.2.12.1. Overview

- 33.2.12.2. Products

- 33.2.12.3. SWOT Analysis

- 33.2.12.4. Recent Developments

- 33.2.12.5. Financials (Based on Availability)

- 33.2.13 AeroVironment Inc

- 33.2.13.1. Overview

- 33.2.13.2. Products

- 33.2.13.3. SWOT Analysis

- 33.2.13.4. Recent Developments

- 33.2.13.5. Financials (Based on Availability)

- 33.2.14 BAE Systems PLC

- 33.2.14.1. Overview

- 33.2.14.2. Products

- 33.2.14.3. SWOT Analysis

- 33.2.14.4. Recent Developments

- 33.2.14.5. Financials (Based on Availability)

- 33.2.15 Israel Aerospace Industries (IAI)6 3 Other Companies

- 33.2.15.1. Overview

- 33.2.15.2. Products

- 33.2.15.3. SWOT Analysis

- 33.2.15.4. Recent Developments

- 33.2.15.5. Financials (Based on Availability)

- 33.2.16 Northrop Grumman Corporation

- 33.2.16.1. Overview

- 33.2.16.2. Products

- 33.2.16.3. SWOT Analysis

- 33.2.16.4. Recent Developments

- 33.2.16.5. Financials (Based on Availability)

- 33.2.17 Saab AB

- 33.2.17.1. Overview

- 33.2.17.2. Products

- 33.2.17.3. SWOT Analysis

- 33.2.17.4. Recent Developments

- 33.2.17.5. Financials (Based on Availability)

- 33.2.18 The Boeing Company

- 33.2.18.1. Overview

- 33.2.18.2. Products

- 33.2.18.3. SWOT Analysis

- 33.2.18.4. Recent Developments

- 33.2.18.5. Financials (Based on Availability)

- 33.2.19 Teledyne FLIR LLC

- 33.2.19.1. Overview

- 33.2.19.2. Products

- 33.2.19.3. SWOT Analysis

- 33.2.19.4. Recent Developments

- 33.2.19.5. Financials (Based on Availability)

- 33.2.1 Textron Inc

List of Figures

- Figure 1: Global Airborne ISR Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Europe Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Europe Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Middle East and Africa Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: By Type Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: By Type Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: North America Airborne ISR Industry Revenue (Million), by Type 2024 & 2032

- Figure 47: North America Airborne ISR Industry Revenue Share (%), by Type 2024 & 2032

- Figure 48: North America Airborne ISR Industry Revenue (Million), by Application 2024 & 2032

- Figure 49: North America Airborne ISR Industry Revenue Share (%), by Application 2024 & 2032

- Figure 50: North America Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: North America Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Europe Airborne ISR Industry Revenue (Million), by Type 2024 & 2032

- Figure 53: Europe Airborne ISR Industry Revenue Share (%), by Type 2024 & 2032

- Figure 54: Europe Airborne ISR Industry Revenue (Million), by Application 2024 & 2032

- Figure 55: Europe Airborne ISR Industry Revenue Share (%), by Application 2024 & 2032

- Figure 56: Europe Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 57: Europe Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific Airborne ISR Industry Revenue (Million), by Type 2024 & 2032

- Figure 59: Asia Pacific Airborne ISR Industry Revenue Share (%), by Type 2024 & 2032

- Figure 60: Asia Pacific Airborne ISR Industry Revenue (Million), by Application 2024 & 2032

- Figure 61: Asia Pacific Airborne ISR Industry Revenue Share (%), by Application 2024 & 2032

- Figure 62: Asia Pacific Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 63: Asia Pacific Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 64: Latin America Airborne ISR Industry Revenue (Million), by Type 2024 & 2032

- Figure 65: Latin America Airborne ISR Industry Revenue Share (%), by Type 2024 & 2032

- Figure 66: Latin America Airborne ISR Industry Revenue (Million), by Application 2024 & 2032

- Figure 67: Latin America Airborne ISR Industry Revenue Share (%), by Application 2024 & 2032

- Figure 68: Latin America Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 69: Latin America Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Middle East and Africa Airborne ISR Industry Revenue (Million), by Type 2024 & 2032

- Figure 71: Middle East and Africa Airborne ISR Industry Revenue Share (%), by Type 2024 & 2032

- Figure 72: Middle East and Africa Airborne ISR Industry Revenue (Million), by Application 2024 & 2032

- Figure 73: Middle East and Africa Airborne ISR Industry Revenue Share (%), by Application 2024 & 2032

- Figure 74: Middle East and Africa Airborne ISR Industry Revenue (Million), by Country 2024 & 2032

- Figure 75: Middle East and Africa Airborne ISR Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Airborne ISR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Airborne ISR Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Airborne ISR Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Airborne ISR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: US Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Canada Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: France Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Gemany Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Russia Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Rest of Europe Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: China Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: India Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Japan Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: South Korea Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Rest of Asia Pacific Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Brazil Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Rest of Latin America Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Saudi Arabia Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: United Arab Emirates Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Rest of Middle East and Africa Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Airborne ISR Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Airborne ISR Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: United States Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Canada Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Airborne ISR Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 55: Global Airborne ISR Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: United Kingdom Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: France Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Germany Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Russia Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Europe Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Global Airborne ISR Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Airborne ISR Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: China Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: India Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Japan Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Korea Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Rest of Asia Pacific Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Global Airborne ISR Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 71: Global Airborne ISR Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 72: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 73: Brazil Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Latin America Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Global Airborne ISR Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 76: Global Airborne ISR Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 77: Global Airborne ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Saudi Arabia Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: United Arab Emirates Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of Middle East and Africa Airborne ISR Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airborne ISR Industry?

The projected CAGR is approximately 6.64%.

2. Which companies are prominent players in the Airborne ISR Industry?

Key companies in the market include Textron Inc, L3Harris Technologies Inc, Raytheon Technologies Corporation, General Dynamics Corporation, BlueBird Aero Systems, Leonardo SpA, Aeronautics Grou, Elbit Systems Ltd, Lockheed Martin Corporation, Airbus SE, Safran SA, General Atomics, AeroVironment Inc, BAE Systems PLC, Israel Aerospace Industries (IAI)6 3 Other Companies, Northrop Grumman Corporation, Saab AB, The Boeing Company, Teledyne FLIR LLC.

3. What are the main segments of the Airborne ISR Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Unmanned Segment to Experience Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airborne ISR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airborne ISR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airborne ISR Industry?

To stay informed about further developments, trends, and reports in the Airborne ISR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence