Key Insights

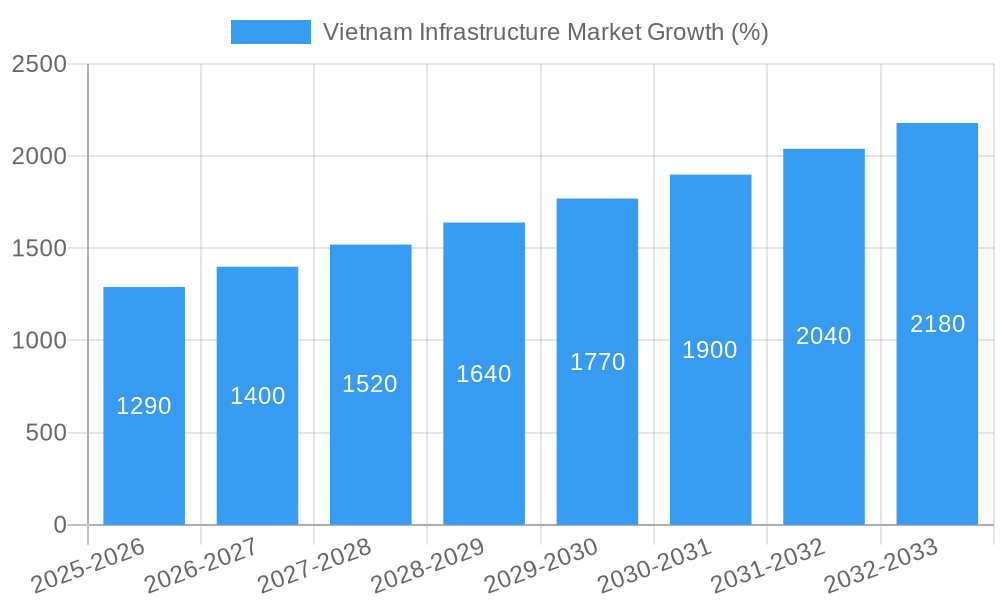

The Vietnam infrastructure market is experiencing robust growth, projected to reach $18.33 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by significant government investments in social infrastructure projects such as healthcare and education facilities, alongside substantial development in transportation infrastructure, including expressways and waterways. Increased urbanization, rising tourism, and the nation's commitment to improving connectivity are key drivers. The market is segmented across various infrastructure types, with social and transportation infrastructure representing the largest shares. Leading companies like Song Da Corporation, Hoa Binh Construction Group, and Coteccons Construction are actively shaping the market landscape, competing for large-scale projects. While challenges such as land acquisition and regulatory hurdles may present some constraints, the overall outlook remains positive, driven by sustained economic growth and government initiatives to modernize the country's infrastructure.

The forecast period (2025-2033) anticipates continued expansion, with the market size consistently increasing year-on-year. This positive trajectory is supported by the government's long-term infrastructure development plans and continued foreign investment in key sectors. The segments will likely see growth proportional to their current market share. While the exact contribution of each segment might fluctuate based on specific project implementations, the overall growth trend is expected to remain consistent, driven by the continuous demand for improved infrastructure across the country. Competition within the market is expected to intensify as both domestic and international players vie for contracts, leading to innovation and improved efficiency in project delivery.

Vietnam Infrastructure Market Report: 2019-2033 Forecast

Dive deep into the dynamic Vietnam infrastructure market with this comprehensive report, offering actionable insights for investors, businesses, and policymakers. This in-depth analysis covers the period from 2019 to 2033, with a focus on 2025, providing a clear understanding of market dynamics, key players, and future growth opportunities. The report utilizes a robust methodology incorporating extensive primary and secondary research, ensuring accurate and reliable data for informed decision-making. Expect detailed analysis across key infrastructure segments, including transportation, social infrastructure, waterways, and telecoms, with a projected market value exceeding xx Million by 2033.

Vietnam Infrastructure Market Market Dynamics & Concentration

The Vietnam infrastructure market exhibits a moderately concentrated landscape, with several large players holding significant market share. While precise market share data for individual companies remains proprietary, leading firms like Coteccons Construction Joint Stock Company and Hoa Binh Construction Group Joint Stock Company command substantial portions. The market's dynamics are shaped by a combination of factors, including government initiatives promoting infrastructure development (e.g., the national master plan), increasing urbanization and industrialization driving demand, and a supportive regulatory environment, although bureaucratic hurdles remain. However, the market is also characterized by intense competition, fostering innovation and efficiency improvements.

Key Market Drivers & Dynamics:

- Government Investments: Significant government spending on infrastructure projects is a major catalyst for market growth.

- Foreign Direct Investment (FDI): Significant FDI inflows fuel the development of large-scale projects.

- Technological Advancements: The adoption of new technologies like BIM (Building Information Modeling) and advanced construction techniques is increasing efficiency and project quality.

- Mergers & Acquisitions (M&A): The number of M&A deals in the sector has increased in recent years, driven by consolidation efforts and expansion strategies. The exact number of deals from 2019-2024 is xx.

- Regulatory Framework: Although generally supportive, inconsistent regulations and bureaucratic processes occasionally pose challenges.

- Product Substitutes: The availability of alternative materials and construction methods affects market competition.

Vietnam Infrastructure Market Industry Trends & Analysis

The Vietnam infrastructure market is experiencing robust growth, driven by sustained government investment in key sectors. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, indicating a healthy expansion trajectory. This growth is further fueled by increasing urbanization, industrialization, and rising disposable incomes, leading to greater demand for improved infrastructure. Technological disruptions, such as the adoption of prefabrication and digital technologies for project management, enhance efficiency and reduce construction timelines. Consumer preferences for sustainable and environmentally friendly infrastructure solutions are also impacting the market, pushing companies towards greener practices. The competitive landscape is highly dynamic, with established players facing increasing competition from smaller, agile firms embracing innovation. Market penetration of advanced construction materials and technologies remains relatively low, indicating significant growth potential.

Leading Markets & Segments in Vietnam Infrastructure Market

The transportation infrastructure segment currently dominates the Vietnam infrastructure market, accounting for the largest share of overall revenue due to extensive road and railway development projects and the expansion of seaports and airports. The social infrastructure segment, encompassing healthcare and education facilities, also shows significant potential for future growth, aligned with governmental initiatives.

Key Drivers of Segment Dominance:

- Transportation Infrastructure:

- Governmental focus on improving national connectivity.

- Expansion of urban transportation networks in major cities.

- Increased demand for efficient logistics solutions.

- Social Infrastructure:

- Growing emphasis on healthcare and education development.

- Rising population and urbanization demands.

- Increased government investment in improving living standards.

While other segments, such as waterways and telecoms infrastructure, are relatively smaller, they are expected to see steady growth in coming years, driven by technological advancements and rising demand.

Vietnam Infrastructure Market Product Developments

The Vietnam infrastructure market is witnessing significant advancements in product development, reflecting global trends in construction technology. Companies are increasingly incorporating prefabricated components, modular designs, and advanced materials to improve efficiency, reduce costs, and enhance sustainability. These innovations are improving project timelines, reducing waste, and enhancing the overall quality of infrastructure projects. Smart city initiatives are also driving the adoption of intelligent infrastructure solutions, focusing on improving resource management and service delivery. The market is further witnessing the use of more sustainable materials and construction processes.

Key Drivers of Vietnam Infrastructure Market Growth

The robust growth of the Vietnam infrastructure market is primarily driven by several key factors. Firstly, substantial government spending on infrastructure development plans fuels significant growth. Secondly, the expanding economy and rising urbanization create an increasing demand for new infrastructure. Finally, technological advancements, such as prefabrication and digital project management tools, improve project efficiency and accelerate development.

Challenges in the Vietnam Infrastructure Market Market

Several challenges hinder the growth of Vietnam’s infrastructure market. Bureaucratic complexities and delays in obtaining permits and approvals pose significant obstacles. Land acquisition issues also delay projects and increase costs. Furthermore, fluctuations in material prices and supply chain disruptions, particularly evident in the aftermath of recent global events, cause project cost overruns and delays. Finally, competition from both local and international firms creates intense competitive pressure.

Emerging Opportunities in Vietnam Infrastructure Market

The long-term growth of the Vietnam infrastructure market is fueled by several emerging opportunities. The government's continued investment in large-scale infrastructure projects presents considerable opportunities for businesses. Further advancements in construction technologies promise to enhance efficiency and sustainability. The development of smart city initiatives necessitates the implementation of advanced infrastructure solutions. These elements present immense opportunities for businesses that can meet this growing demand.

Leading Players in the Vietnam Infrastructure Market Sector

- Song Da Corporation - JSC

- Hoa Binh Construction Group Joint Stock Company

- Minh Duc Concrete and Construction Company Limited

- Nam Long Investment Corporation

- Cofico Construction

- Vietnam Expressway Corporation

- Civil Engineering Construction Corporation No. 1 - JSC

- Fecon Corporation

- Central Power Corporation

- Coteccons Construction Joint Stock Company

Key Milestones in Vietnam Infrastructure Market Industry

- 2020: Launch of several large-scale transportation infrastructure projects.

- 2021: Increased government investment in renewable energy infrastructure.

- 2022: Significant adoption of Building Information Modeling (BIM) technology.

- 2023: Several mergers and acquisitions among key players in the market. (Specific details are proprietary).

- 2024: Implementation of new regulations to promote sustainable infrastructure development.

Strategic Outlook for Vietnam Infrastructure Market Market

The Vietnam infrastructure market holds considerable promise for future growth, driven by sustained government investment, increasing urbanization, and technological advancements. Strategic partnerships between domestic and international firms will play a crucial role in developing advanced infrastructure solutions. Focusing on sustainable and resilient infrastructure, meeting rising environmental demands, will be key to long-term success. Companies that can effectively navigate the challenges posed by land acquisition, regulatory hurdles, and supply chain disruptions are well-positioned to capitalize on the substantial growth opportunities within the sector.

Vietnam Infrastructure Market Segmentation

-

1. Infrastructure segment

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Others

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission & Disribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

-

1.1. Social Infrastructure

Vietnam Infrastructure Market Segmentation By Geography

- 1. Vietnam

Vietnam Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in FDI in Vietnam boosting the market; Government has focused on developing infrastructure to underpin socio-economic development strategies

- 3.3. Market Restrains

- 3.3.1 The infrastructure sector in Vietnam is fragmented

- 3.3.2 which can affect its growth; Weak global demand can pose a challenge to the growth of Vietnam's construction industry

- 3.4. Market Trends

- 3.4.1. Foreign Direct Investment (FDI) Boosting the Vietnam Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Others

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission & Disribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Song da corporation - jsc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hoa binh construction group joint stock company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Minh duc concrete and construction company limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nam long investment corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cofico construction*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vietnam expressway corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Civil engineering construction corporation no1 - jsc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fecon corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Central power corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coteccons construction joint stock company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Song da corporation - jsc

List of Figures

- Figure 1: Vietnam Infrastructure Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Infrastructure Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Infrastructure Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 3: Vietnam Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Vietnam Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Vietnam Infrastructure Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 6: Vietnam Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Infrastructure Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Vietnam Infrastructure Market?

Key companies in the market include Song da corporation - jsc, Hoa binh construction group joint stock company, Minh duc concrete and construction company limited, Nam long investment corporation, Cofico construction*List Not Exhaustive, Vietnam expressway corporation, Civil engineering construction corporation no1 - jsc, Fecon corporation, Central power corporation, Coteccons construction joint stock company.

3. What are the main segments of the Vietnam Infrastructure Market?

The market segments include Infrastructure segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in FDI in Vietnam boosting the market; Government has focused on developing infrastructure to underpin socio-economic development strategies.

6. What are the notable trends driving market growth?

Foreign Direct Investment (FDI) Boosting the Vietnam Market.

7. Are there any restraints impacting market growth?

The infrastructure sector in Vietnam is fragmented. which can affect its growth; Weak global demand can pose a challenge to the growth of Vietnam's construction industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Infrastructure Market?

To stay informed about further developments, trends, and reports in the Vietnam Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence